Professional Documents

Culture Documents

Ch02 Test Bank

Ch02 Test Bank

Uploaded by

renn billCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch02 Test Bank

Ch02 Test Bank

Uploaded by

renn billCopyright:

Available Formats

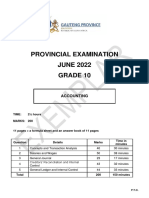

Test Bank

Chapter 2

The Accounting Cycle

Name: _______________________________________

Class: _______________________________________

Date: _______________________________________

True/False Questions

1. A check written to a supplier is an example of a source document.

a. True

b. False

2. The cost principle states that a business may record the current market price if it is greater than

the amount listed on an invoice.

a. True

b. False

3. The matching principle states that expenses must be matched with their appropriate source

document.

a. True

b. False

4. After completing all postings an unadjusted trial balance is prepared.

a. True

b. False

5. The cash basis of accounting is the same as the accrual basis of accounting except for accounting

periods.

a. True

b. False

6. A net income is reported on both the income statement and statement of owner’s equity.

a. True

b. False

7. The financial statement that displays all assets, liabilities, and owner’s equity is the statement of

owner’s equity.

a. True

b. False

Accounting Basics: An Introduction for Non-Accounting Majors Page 1

Test Bank

8. The final stage in the accounting cycle is the preparation of closing entries.

a. True

b. False

9. Permanent accounts are closed to the owner’s capital account.

a. True

b. False

10. Rent expense and owner’s drawing are examples of temporary accounts.

a. True

b. False

Multiple Choice Questions

11. Which of the following is not a source document for a business?

a. A check from a customer.

b. An invoice sent to a customer.

c. An employment contract.

d. An employee time card.

12. Which of the following is not a Generally Accepted Accounting Principle (GAAP)?

a. Revenue principle

b. Expense spending principle

c. Matching principle

d. Time-period principle

13. What is the first step in the accounting cycle?

a. Post journal entries.

b. Prepare financial statements.

c. Analyze business transactions.

d. Prepare the unadjusted trial balance.

14. Revenue is recognized under the accrual basis of accounting when:

a. cash is received.

b. services are rendered.

c. it (revenue) is earned.

d. None of the above.

15. Which of the following is not a financial statement?

a. A bank statement.

b. An income statement.

c. A balance sheet.

d. A statement of cash flows.

Accounting Basics: An Introduction for Non-Accounting Majors Page 2

Test Bank

16. Which of the following is an example of a permanent account?

a. Rent expense

b. Owner’s draw

c. Unearned revenue

d. Rent revenue

Matching Questions

17. Match each of the following as appropriate:

A Check A document sent to a company that outlines business

activities for a given month.

B Source document A document that provides information regarding payment

received from a customer or made to a supplier.

C Invoice A document that provides information regarding one or

more transactions, and which can take different forms.

D Bank statement A bill for goods or services.

18. Match each of the following principles as appropriate:

A Cost principle

B Matching principle

C Time-period principle

D Revenue principle

E Monetary unit principle

F Full disclosure principle

The amount recorded in the financial records reflecting the cost paid.

States that a public company must report all pertinent information about

company activities.

Accounting activity must be reported over specific periods.

Expenses must be recorded in the same time period as the revenues that they

generated.

Revenues are recorded when earned regardless of when cash exchanges hands.

Expressing amounts in a consistent currency (U.S. Dollars).

19. Match each of the following as appropriate:

A Unadjusted trial balance Expenses are recorded when they are incurred,

B Accrual basis of accounting Designed to summarize all account balances in one

location.

C Cash basis of accounting Revenues are recorded when cash is received.

Accounting Basics: An Introduction for Non-Accounting Majors Page 3

Test Bank

20. Match each of the following as appropriate:

A Income statement Reports net income and owner drawing.

B Statement of owner’s equity Reports revenue, expenses, and net income.

C Balance sheet Illustrates the accounting equation: assets = liabilities

plus owner’s equity.

D Statement of cash flows Summarizes activities that lead to a company’s ending

cash balance.

21. Match each of the following aspects that pertain to closing a company’s books:

A Temporary account Revenue, expenses, and drawing.

B Permanent account The last step in the accounting cycle.

C Post-closing trial balance The act of re-setting certain accounts to zero.

D Closing process Accounts that remain after the closing process concludes.

Fill-in-the-Blank Questions

22. A __________ __________ provides information regarding the details of a transaction.

23. GAAP stands for __________ __________ __________ __________.

24. The __________ principle states that expenses must be recorded in the same period as the

revenues.

25. Under the __________ basis of accounting revenues are recorded when they are earned, and

expenses are recorded when they are incurred, regardless of when cash changes hands.

26. The final figure within the income statement is __________ __________.

27. Revenue is an example of a __________ account, whereas cash is an example of a __________

account.

Accounting Basics: An Introduction for Non-Accounting Majors Page 4

You might also like

- CAT L1 Assessment Exam (Batch May 2022) - 1Document9 pagesCAT L1 Assessment Exam (Batch May 2022) - 1Sofia Mae AlbercaNo ratings yet

- Wrap Up Part 2 - Financial Accounting and ReportingDocument14 pagesWrap Up Part 2 - Financial Accounting and ReportingShaimer Cinto100% (1)

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Accounting Reviewer Final ExamDocument7 pagesAccounting Reviewer Final ExamJanina Frances RuideraNo ratings yet

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessLINDIE MARIE RABENo ratings yet

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessRodNo ratings yet

- BASACC1 Midterm Comprehensive HWDocument5 pagesBASACC1 Midterm Comprehensive HWDufuxwerr WerrNo ratings yet

- Work Sheet Questions For Accounting & Finance For ManagersDocument8 pagesWork Sheet Questions For Accounting & Finance For Managersabdoahmednur2No ratings yet

- Accounting Cycle Part I TheoriesDocument3 pagesAccounting Cycle Part I TheoriesHeeseung Lee100% (1)

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Model Exit Exam 3Document36 pagesModel Exit Exam 3mearghaile4No ratings yet

- Accounting Process REVIEWDocument5 pagesAccounting Process REVIEWangelicaf.kmcastilloNo ratings yet

- Answers With ExplanationDocument10 pagesAnswers With Explanationdebate ddNo ratings yet

- Financial Acctg 1 ReviewerDocument9 pagesFinancial Acctg 1 ReviewerAllyza May GasparNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesDocument11 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesAngelaNo ratings yet

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- Ch03 Test BankDocument4 pagesCh03 Test Bankrenn billNo ratings yet

- Bac 101Document13 pagesBac 101Lhyn Cantal Calica0% (1)

- Fundamentals of Accounting I ACCOUNTING CYCLE: CompletionDocument14 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Completionericacadago100% (1)

- Accounting and Finance Mock ExamDocument35 pagesAccounting and Finance Mock ExamAbdisen TeferaNo ratings yet

- Midterm Mock Exam Questionnaire (With Answers)Document15 pagesMidterm Mock Exam Questionnaire (With Answers)Ella Mae Magbato100% (1)

- MBE - BFAR (1st Sem, 2021-2022)Document11 pagesMBE - BFAR (1st Sem, 2021-2022)Bai Dianne BagundangNo ratings yet

- Theories Accounting ProcessDocument5 pagesTheories Accounting Processshella vienNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1julietpamintuanNo ratings yet

- Level III Theory AssessmentDocument4 pagesLevel III Theory AssessmentElias TesfayeNo ratings yet

- Accounting and Finance For Bankers - JAIIBDocument19 pagesAccounting and Finance For Bankers - JAIIBAjaya Kumar KosuriNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Chapter 3 Test Bank 3Document13 pagesChapter 3 Test Bank 3Namina StraussNo ratings yet

- Cpa Review School of The Philippines Manila: Accounting ProcessDocument3 pagesCpa Review School of The Philippines Manila: Accounting ProcessAlliah Mae ArbastoNo ratings yet

- PRACTICE EXAM For BASIC ACCOUNTINGDocument12 pagesPRACTICE EXAM For BASIC ACCOUNTINGKristian Paolo De LunaNo ratings yet

- Toa Q2Document12 pagesToa Q2Rachel Leachon100% (1)

- CFAS.101 - Diagnostic Test Part 2Document2 pagesCFAS.101 - Diagnostic Test Part 2Mika MolinaNo ratings yet

- Cash & Accrual Basis Multiple ChoiceDocument17 pagesCash & Accrual Basis Multiple Choiceedison martin100% (2)

- Level 4 ThoeryDocument4 pagesLevel 4 ThoeryElias TesfayeNo ratings yet

- Quick Tests Unit 1 and Unit 2Document47 pagesQuick Tests Unit 1 and Unit 2junjun100% (2)

- Accounting Process Quizzer PDFDocument6 pagesAccounting Process Quizzer PDFDaniel Laurence Salazar Itable100% (1)

- ACC101 - MCQ SampleDocument11 pagesACC101 - MCQ SampleBảo NgọcNo ratings yet

- Theory FarDocument10 pagesTheory FarLhea VillanuevaNo ratings yet

- Exams BookkeepigDocument5 pagesExams BookkeepigRosita Aquino PacibeNo ratings yet

- PS - BasicDocument4 pagesPS - BasicErwin Dave M. DahaoNo ratings yet

- Acc 362 Final ExamDocument5 pagesAcc 362 Final ExamgoonsammyNo ratings yet

- TOA - Accounting ProcessDocument4 pagesTOA - Accounting ProcessJoanna CaballeroNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- Accounting L-III & IV COC 207 Multiple ChoicesDocument31 pagesAccounting L-III & IV COC 207 Multiple ChoicesYasinNo ratings yet

- TBCH 02Document40 pagesTBCH 02Tornike JashiNo ratings yet

- 6951 Accounting ProcessDocument4 pages6951 Accounting Processjohn paulNo ratings yet

- 35 Basic Accounting Test QuestionsDocument9 pages35 Basic Accounting Test QuestionsDenny OctavianoNo ratings yet

- Summative Test Accounting Concepts PrinciplesDocument2 pagesSummative Test Accounting Concepts PrinciplesMarlyn LotivioNo ratings yet

- Reviewer in FARDocument7 pagesReviewer in FARshezcas012No ratings yet

- Fabm1 Pre TestDocument6 pagesFabm1 Pre Testlynlynie0613No ratings yet

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- Accounting 101 FinalsDocument16 pagesAccounting 101 FinalsDanilo Diniay Jr100% (1)

- Accounting FinalDocument40 pagesAccounting FinalvarunNo ratings yet

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Practice Mcqs Nov. BatchDocument16 pagesPractice Mcqs Nov. Batchkrezyl codilloNo ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. BiliganNo ratings yet

- HyundaiDocument17 pagesHyundaikumraashuNo ratings yet

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- The LEGO Group - CaseDocument6 pagesThe LEGO Group - CaseVijay KoushalNo ratings yet

- An Assignment: "International Marketing On Exporting Readymade Garments To The United States"Document16 pagesAn Assignment: "International Marketing On Exporting Readymade Garments To The United States"muhtasimNo ratings yet

- Chopra scm6 Inppt 01r1Document37 pagesChopra scm6 Inppt 01r1ArpitPatelNo ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- 17 Engineering EconomicsDocument7 pages17 Engineering EconomicsM Hadianto WaruwuNo ratings yet

- Acct 284 Clem Exam One - Doc Fall 2004Document3 pagesAcct 284 Clem Exam One - Doc Fall 2004noranycNo ratings yet

- Chapter 25 Real Options: True/FalseDocument23 pagesChapter 25 Real Options: True/FalsePaodou HuNo ratings yet

- 49 RKTheoriesof Stakeholder ManagementDocument18 pages49 RKTheoriesof Stakeholder Managementesvishnu narayananNo ratings yet

- World Class Manufacturing PDFDocument4 pagesWorld Class Manufacturing PDFRohit Gothwal0% (2)

- Financial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankDocument25 pagesFinancial Accounting Theory and Analysis Text and Cases 12th Edition Schroeder Test BankCherylHorngjmf100% (42)

- AmulDocument5 pagesAmulvekiyoNo ratings yet

- Gr10 ACC P1 (ENG) June 2022 Question PaperDocument12 pagesGr10 ACC P1 (ENG) June 2022 Question PaperJoy LenyatsaNo ratings yet

- Cost Accounting Assignment 02Document4 pagesCost Accounting Assignment 02Abdul GhaffarNo ratings yet

- CIMA Case StudyDocument10 pagesCIMA Case StudyDeanne Coleen PonceNo ratings yet

- Q6 Standard CostingDocument2 pagesQ6 Standard CostingJeepee JohnNo ratings yet

- Business Policy and Strategic ManagementDocument13 pagesBusiness Policy and Strategic Managementsirisha INo ratings yet

- Permission MarketingDocument35 pagesPermission Marketingtattid67% (3)

- Annual Report and Accounts 2016Document286 pagesAnnual Report and Accounts 2016Hung Wen GoNo ratings yet

- Chapter 4Document3 pagesChapter 4?????100% (1)

- Incomplete RecordsDocument2 pagesIncomplete RecordsOkasha AliNo ratings yet

- Summary Chapter 6-ACO 201Document8 pagesSummary Chapter 6-ACO 201Andrew PhilipsNo ratings yet

- Bank of Punjab Final Balance Sheet AnalysisDocument12 pagesBank of Punjab Final Balance Sheet AnalysisZara SikanderNo ratings yet

- 1 - ACG021 - Strategic Business Analysis - QuestionnaireDocument6 pages1 - ACG021 - Strategic Business Analysis - Questionnairedavis lizardaNo ratings yet

- Accounting Chapter 25Document3 pagesAccounting Chapter 25Eugene Dexter NonesNo ratings yet

- CVP Hotel Royal Century Chapter I, II and IIIDocument27 pagesCVP Hotel Royal Century Chapter I, II and IIIMADHU KHANALNo ratings yet

- Construction of Portfolio by Using Technical AnalysisDocument4 pagesConstruction of Portfolio by Using Technical AnalysisChandrashekhar ChanduNo ratings yet

- Green Modern Analysis of Results Presentation PDFDocument15 pagesGreen Modern Analysis of Results Presentation PDFharshiii2135No ratings yet

- UBER Market AnalysisDocument23 pagesUBER Market Analysiseshan75% (4)