Professional Documents

Culture Documents

Desiree Smith - Assignment 1 2

Desiree Smith - Assignment 1 2

Uploaded by

Des Smith0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

Desiree Smith- Assignment 1 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesDesiree Smith - Assignment 1 2

Desiree Smith - Assignment 1 2

Uploaded by

Des SmithCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Desiree Smith

FINANCIAL RATIO ASSIGNMENT

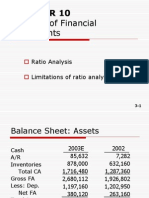

1. Complete 10 (A,B,C,D,E) on page 108-109/111-112. Calculate and

interpret your findings. Round answers to two decimal places.

A. Current Ratio= 1,600,000/850,000=1.88 vs the industry average at

2.5 times.

Quick Ratio= [1,600,000-1,040,000]/850,000=0.66 vs the industry

average at 1.1 times.

Net working capital= 1,600,000-850,000= $750,000

Assessment: Comparing both current and quick ratios to the

industry’s average the liquidity is below average which means the

inventory isn’t moving quick enough or moving very slowly.

B. Average collection period= 320,000/ [3,000,000/365] =

320,000/8,219.78= 38.9 days vs industry average at 35days.

Inventory Turn Over Ratio=1,800,000/1,040,000=1.73 vs industry

average at 2.4 times.

Total asset turnover ratio= 3,000,000/2,400,000=1.25 vs industry

average at 1.4 times.

Assessment: Based on the data above, this proves that there is an

inventory problem seeing it is way below the industry’s average

and the collection period is higher than it should be based on the

industry average.

Desiree Smith

C. Times interest earned ratio= 340,000/117,800=2.89 vs industry

average at 3.5 times.

Total assets to stockholders’ equity ratio= 2,400,000/750,000=3.2

vs industry average at 3.0 times.

Assessment: The data shows that this company interest coverage

is very low which means his interest charges are high and the

equity ratio is higher than industry as well. The company has more

risks financially than an average firm.

D. Net profit margin ratio = 133,320/3,000,000=0.044=4.4% vs

industry’s average of 4.0%.

Return on investment ratio= 133,320/2,400,000=0.055=5.5% vs

industry average of 5.6%.

Return on stockholders’ equity ratio =

133,320/750,000=0.1778=17.78% vs industry’s average of 16.8%.

Assessment: The data above shows that the profit margin is

slightly above the industry’s average and investment ratio is

slightly below the industry’s average. The equity which is highly

greater than industry’s average shows that his leverage is too

high.

E. The company’s liquidity is low, and the inventory is moving too

slow which results in lower asset turnover. The company also has

a high financial risk. Unbelievingly, this company is above the

industry’s average compared to other companies despite all the

odds.

You might also like

- Case 1 New (Signal Cable Company)Document6 pagesCase 1 New (Signal Cable Company)nicole100% (3)

- East Coast Yachts SolutionDocument3 pagesEast Coast Yachts Solutionbrentk112100% (3)

- Ratios-Industry Averages The President of Brewster Company Has Been Concerned About ItsDocument6 pagesRatios-Industry Averages The President of Brewster Company Has Been Concerned About ItsAzenith Margarette Cayetano100% (1)

- QuestionDocument2 pagesQuestionOyedele AjagbeNo ratings yet

- Working Capital Management: Applications and Case StudiesFrom EverandWorking Capital Management: Applications and Case StudiesRating: 4.5 out of 5 stars4.5/5 (4)

- Solution To Chapter 3 Case StudyDocument4 pagesSolution To Chapter 3 Case StudyAhmed Alnaqbi100% (2)

- Financial Management 1Document4 pagesFinancial Management 1Edith MartinNo ratings yet

- Commodity Daily Briefing 102634710Document9 pagesCommodity Daily Briefing 102634710jasonkstearnsNo ratings yet

- Overnight-Intraday Daily Reversal in Commodities - QuantPediaDocument7 pagesOvernight-Intraday Daily Reversal in Commodities - QuantPediaJames LiuNo ratings yet

- Hammersmith and Fulham in Sterling Interest Swap Loss of About 600 Million in 1988Document9 pagesHammersmith and Fulham in Sterling Interest Swap Loss of About 600 Million in 1988Noor Afzan AbdullahNo ratings yet

- Assignment - Jackson CODocument4 pagesAssignment - Jackson COMhmd KaramNo ratings yet

- Ratio Analysis and Example PDFDocument9 pagesRatio Analysis and Example PDFthexplorer008No ratings yet

- ch3 RatioDocument18 pagesch3 RatioEman Samir100% (1)

- FINMAN Types of Ratio AnalysisDocument4 pagesFINMAN Types of Ratio AnalysiskonyatanNo ratings yet

- Analysis of Financial StatementsDocument35 pagesAnalysis of Financial Statementsfrasatiqbal100% (1)

- 03 Financial AnalysisDocument55 pages03 Financial Analysisselcen sarıkayaNo ratings yet

- Chap 003Document38 pagesChap 003MichaelFraserNo ratings yet

- Chapter 17: Financial Statement and Ratio AnalysisDocument9 pagesChapter 17: Financial Statement and Ratio Analysisfarhanahmednagda100% (2)

- FinMan Report On FS Analysis RATIODocument31 pagesFinMan Report On FS Analysis RATIOMara LacsamanaNo ratings yet

- Financial Administration Exercises 1Document8 pagesFinancial Administration Exercises 1ScribdTranslationsNo ratings yet

- Unknown Parameter ValueDocument59 pagesUnknown Parameter ValueTauqeerNo ratings yet

- Marvil PotkaDocument4 pagesMarvil PotkaEndri AbaziNo ratings yet

- Financial Management, Lecture 2, 3 & 4Document32 pagesFinancial Management, Lecture 2, 3 & 4Muhammad ImranNo ratings yet

- Assessing Martin Manufacturing-AnswerDocument4 pagesAssessing Martin Manufacturing-AnswerKhai Eman50% (2)

- Chapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallDocument76 pagesChapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallCherry BlasoomNo ratings yet

- FM10e ch03Document76 pagesFM10e ch03Cherry BlasoomNo ratings yet

- Financial Statement Analysis (ch-6)Document38 pagesFinancial Statement Analysis (ch-6)Wares KhanNo ratings yet

- Finance Assgn 1Document8 pagesFinance Assgn 1durga03No ratings yet

- Question #2: A. Both The Current and Acid-Test Ratios. B. Only The Current RatioDocument11 pagesQuestion #2: A. Both The Current and Acid-Test Ratios. B. Only The Current Ratioiceman2167No ratings yet

- Chapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallDocument48 pagesChapter 3 - Evaluating A Firm's Financial Performance: 2005, Pearson Prentice HallAura MaghfiraNo ratings yet

- Financial Statement AnalysisDocument45 pagesFinancial Statement Analysisshreyanshi sharmaNo ratings yet

- Module 4 - Financial Statement Analysis (Part 2) PDFDocument44 pagesModule 4 - Financial Statement Analysis (Part 2) PDFemmanvillafuerte100% (1)

- 5ffb Ims03Document32 pages5ffb Ims03Azadeh AkbariNo ratings yet

- Economics Se-14, 16Document48 pagesEconomics Se-14, 16Niki poorianNo ratings yet

- Bbap18011158 Fin 2013 (WM) Financial ManagementDocument8 pagesBbap18011158 Fin 2013 (WM) Financial ManagementRaynold RaphaelNo ratings yet

- Tutorial 3 AnswersDocument5 pagesTutorial 3 Answers杰克 l孙No ratings yet

- Longenecker-Materi KomplemenDocument13 pagesLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNo ratings yet

- Solution 2Document75 pagesSolution 2Asiful MowlaNo ratings yet

- Analysis 1Document59 pagesAnalysis 1Gautam M100% (1)

- Financial Statements & AnalysisDocument36 pagesFinancial Statements & AnalysisMahiNo ratings yet

- (PDF) FinMan Cabrera SM (Vol1)Document22 pages(PDF) FinMan Cabrera SM (Vol1)Florie May SaynoNo ratings yet

- Analysis of Financial Statements: S A R Q P I. QuestionsDocument22 pagesAnalysis of Financial Statements: S A R Q P I. QuestionsEstudyanteNo ratings yet

- Lecture 2 - Answer Part 2Document6 pagesLecture 2 - Answer Part 2Thắng ThôngNo ratings yet

- Analysis of Financial Statements: Why Are Ratios Useful?Document26 pagesAnalysis of Financial Statements: Why Are Ratios Useful?MostakNo ratings yet

- Kolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Document4 pagesKolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Wong Ji ChingNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- MGT Acct, CH 3, Part IIDocument34 pagesMGT Acct, CH 3, Part IIkbrom weldegebrealNo ratings yet

- Spring 2024 - ACC501 - 1 - BC220211877Document4 pagesSpring 2024 - ACC501 - 1 - BC220211877King BossNo ratings yet

- Chap 3 SolutionsDocument70 pagesChap 3 SolutionsHoàng Huy80% (10)

- Jo Jita Wahi SikanderDocument31 pagesJo Jita Wahi SikanderRupali GuptaNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Chapter 6 - Financial Statement AnalysisDocument22 pagesChapter 6 - Financial Statement AnalysisRameinor TambuliNo ratings yet

- Interpretation of Financial Statements - Use This Copy.Document38 pagesInterpretation of Financial Statements - Use This Copy.muzaire solomon100% (1)

- Analysis of Financial Statements 1-10-19Document28 pagesAnalysis of Financial Statements 1-10-19Shehzad QureshiNo ratings yet

- 37 - Practice Questions (Corporate Finance-Working Capital Managament) - AnswersDocument5 pages37 - Practice Questions (Corporate Finance-Working Capital Managament) - AnswersSouradeep MondalNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Desiree Smith - Assignment 6 2Document4 pagesDesiree Smith - Assignment 6 2Des SmithNo ratings yet

- Desiree Smith - Assignment 5Document5 pagesDesiree Smith - Assignment 5Des SmithNo ratings yet

- Desiree Smith - Assignment 3 1Document3 pagesDesiree Smith - Assignment 3 1Des SmithNo ratings yet

- Desiree Smith - Case Analysis - A Breakdown in CommunicationDocument7 pagesDesiree Smith - Case Analysis - A Breakdown in CommunicationDes SmithNo ratings yet

- Desiree Smith - Case Analysis - The New Plant ManagerDocument6 pagesDesiree Smith - Case Analysis - The New Plant ManagerDes SmithNo ratings yet

- Cracker Barrell - DS CommentsDocument15 pagesCracker Barrell - DS CommentsDes SmithNo ratings yet

- Desiree Smith - Cracker BarrellDocument1 pageDesiree Smith - Cracker BarrellDes SmithNo ratings yet

- Foreign Exchange Rates (3070)Document10 pagesForeign Exchange Rates (3070)Ahmad vlogsNo ratings yet

- Test Fs and JournalDocument157 pagesTest Fs and Journaljerry lyn barataNo ratings yet

- Sweat EquityDocument17 pagesSweat EquitygeddadaarunNo ratings yet

- Chapter 2 - Equity Underwriting and IPO-Part 2Document29 pagesChapter 2 - Equity Underwriting and IPO-Part 2Đỗ Phương DiễmNo ratings yet

- Cash Flow Statement 2019-2020 CCLDocument2 pagesCash Flow Statement 2019-2020 CCLAmit SinghNo ratings yet

- FF l1 InretailDocument28 pagesFF l1 Inretailjmas204No ratings yet

- MA Semesterplanung HS23Document1 pageMA Semesterplanung HS23Google PlaysNo ratings yet

- Richland 2Document158 pagesRichland 2Nevin SmithNo ratings yet

- 401K EnrollmentDocument18 pages401K EnrollmentKimberly HadadNo ratings yet

- December 2003 ACCA Paper 2.5 QuestionsDocument10 pagesDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- Advanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)Document1 pageAdvanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)John Carlos Doringo100% (1)

- A Study On Portfolio Management With Reference To Angel Broking LTDDocument8 pagesA Study On Portfolio Management With Reference To Angel Broking LTDEditor IJTSRDNo ratings yet

- Advanced Accounting BU 455A Spring 2013 Test OneDocument14 pagesAdvanced Accounting BU 455A Spring 2013 Test OneMichael Tai Maimoni100% (2)

- Ar 2022 MBSSDocument293 pagesAr 2022 MBSSLeo Agung HastiNo ratings yet

- Activity Based Costing Sample Problems With Solutions - CompressDocument5 pagesActivity Based Costing Sample Problems With Solutions - CompressRaniya H. H.NaimNo ratings yet

- Statement of Account: L246G SBI Gold Fund - Regular Plan - Growth NAV As On 14/10/2015: 8.8804Document4 pagesStatement of Account: L246G SBI Gold Fund - Regular Plan - Growth NAV As On 14/10/2015: 8.8804hari sharmaNo ratings yet

- Chapter 4 - Return and RiskDocument28 pagesChapter 4 - Return and RiskShahriar HaqueNo ratings yet

- Vertex Learning SolutionsDocument5 pagesVertex Learning SolutionsAhsan New BegininnigsNo ratings yet

- Agecon SchoologyDocument55 pagesAgecon SchoologyJessa Lorraine Dela CruzNo ratings yet

- Taxation - Alan Melville: 28th Edition (Finance Act 2022)Document17 pagesTaxation - Alan Melville: 28th Edition (Finance Act 2022)Carlota CostaNo ratings yet

- EdgeReport JUBLFOOD CaseStudy 27 12 2023 348Document36 pagesEdgeReport JUBLFOOD CaseStudy 27 12 2023 348vijaygawdeNo ratings yet

- Govt Influence On Exchange RateDocument40 pagesGovt Influence On Exchange Rategautisingh100% (3)

- Trial TestDocument16 pagesTrial TestPhạm Thị Thùy TrangNo ratings yet

- AcadsDocument3 pagesAcadsReid PaladNo ratings yet

- A Guide To The Nyse MarketplaceDocument36 pagesA Guide To The Nyse MarketplaceHome ParkNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- 12 x10 Financial Statement AnalysisDocument19 pages12 x10 Financial Statement AnalysisHazel Jael HernandezNo ratings yet