Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsDividend Kings

Dividend Kings

Uploaded by

P. IulianCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Fortune 500 Companies 2024Document13 pagesFortune 500 Companies 2024syed.showzib100% (1)

- 100K+ Usa SSN SampleDocument1 page100K+ Usa SSN Sampleloridzurnakwsb15No ratings yet

- 50x USA Phone Number Email DOB SSN Etc FullzDocument5 pages50x USA Phone Number Email DOB SSN Etc Fullzkelly55.keNo ratings yet

- Instacart CC PP Mixed SCOOBY - FODocument88 pagesInstacart CC PP Mixed SCOOBY - FOhacked.02.meNo ratings yet

- Consulting CompaniesDocument3 pagesConsulting CompaniesAnimesh KharghariaNo ratings yet

- SSN Tts-Us2Document24 pagesSSN Tts-Us2micheald.lucy900100% (1)

- 100 Top Venture Capital FirmsDocument12 pages100 Top Venture Capital FirmsAtrij DixitNo ratings yet

- Global and Regional MA League Tables 2022 Financial AdvisorsDocument38 pagesGlobal and Regional MA League Tables 2022 Financial AdvisorsKoo JasperNo ratings yet

- Sbs Secret Lenders Listpdf 2Document8 pagesSbs Secret Lenders Listpdf 2chrisengstrandNo ratings yet

- Roll Bet Total Amount Lost Probability of Lose Streak (AbDocument6 pagesRoll Bet Total Amount Lost Probability of Lose Streak (AbTanpa NamaNo ratings yet

- Inco JKDocument62 pagesInco JKaldywsNo ratings yet

- Step 1: Step Activity Clock ActivityDocument12 pagesStep 1: Step Activity Clock ActivityHosnaNo ratings yet

- Ratio Analysis of Selected Insurance Co: Rupali LifeDocument3 pagesRatio Analysis of Selected Insurance Co: Rupali LifeAmitNo ratings yet

- Rs-Using Newmark's Linear Acceleration MethodDocument14 pagesRs-Using Newmark's Linear Acceleration MethodlucianduNo ratings yet

- NRTL MethodDocument18 pagesNRTL MethodNurfarahin AzmanNo ratings yet

- Assignment 2Document38 pagesAssignment 2Shubham ThakurNo ratings yet

- Chumney FRAGILITY - CurvesDocument30 pagesChumney FRAGILITY - CurvesNitin shepurNo ratings yet

- Tarea 5 Metodos NumericosDocument18 pagesTarea 5 Metodos NumericosMaría Estefanía VazquezNo ratings yet

- Penn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperDocument16 pagesPenn World Table, Version 9.1: When Using These Data, Please Refer To The Following Paperjuan Jose ZuluagaNo ratings yet

- Data Pengujian TarikDocument16 pagesData Pengujian TarikMoch Fahrizal SaugiNo ratings yet

- Loteria CD MaximoDocument50 pagesLoteria CD Maximoraul rocha mejiaNo ratings yet

- Tarea Operativa IiDocument45 pagesTarea Operativa Iidaniel Angel Tomicha ZeballosNo ratings yet

- Total Beta EmergDocument12 pagesTotal Beta EmergjajjaNo ratings yet

- Worshop Matériaux CompositesDocument42 pagesWorshop Matériaux CompositesInnov'Action ProdNo ratings yet

- Bridge Rectified CapacitorDocument773 pagesBridge Rectified CapacitorVital RogatchNo ratings yet

- LEVERETTDocument12 pagesLEVERETTJuan Diego Medina MedinaNo ratings yet

- Para Estructuras Fuera Del Nivel Del Suelo I en (KV) P (I) P (I) en (%)Document4 pagesPara Estructuras Fuera Del Nivel Del Suelo I en (KV) P (I) P (I) en (%)Angel Danilo Ortiz ArcosNo ratings yet

- 1 S-V TT - 090622Document70 pages1 S-V TT - 090622Tuấn LvNo ratings yet

- Fin 542 Yen BalDocument36 pagesFin 542 Yen BalIqbal AzhamNo ratings yet

- Curvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)Document7 pagesCurvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)datalifeNo ratings yet

- II Korelacja WykDocument17 pagesII Korelacja WykMateusz MaćkowskiNo ratings yet

- Ects1 Buzea Stefania GeorgianaDocument82 pagesEcts1 Buzea Stefania GeorgianaPirtac Vladut-MihaiNo ratings yet

- Data Triaxial - Kelompok 1Document8 pagesData Triaxial - Kelompok 1Andini ZahrianiNo ratings yet

- Materials 1Document23 pagesMaterials 1Empire Hack SevenNo ratings yet

- Data Analytics - Indian Stock Market Top 2000 PDFDocument45 pagesData Analytics - Indian Stock Market Top 2000 PDFRohit SharmaNo ratings yet

- Sistem PDB IVP-EulerDocument9 pagesSistem PDB IVP-EulerMuhammad RizaldiNo ratings yet

- Analisis BetaDocument4 pagesAnalisis Betaalexa gironNo ratings yet

- HydrologyDocument23 pagesHydrologyYang RhiaNo ratings yet

- CFE SismoDocument29 pagesCFE SismoDaniel RosalesNo ratings yet

- Name Roll No (In Numbers Only) Batch Semster: Student PortalDocument18 pagesName Roll No (In Numbers Only) Batch Semster: Student PortalNirajanNo ratings yet

- Trabalho 2 Diego Cardoso Lucas Lima Lucas Rodrigues e Warlly AfonsoDocument14 pagesTrabalho 2 Diego Cardoso Lucas Lima Lucas Rodrigues e Warlly AfonsoLucas RodriguesNo ratings yet

- New Microsoft Office Excel WorksheetDocument3 pagesNew Microsoft Office Excel Worksheetmohsen ranjbarNo ratings yet

- A) Number of Arrivals Against TimeDocument32 pagesA) Number of Arrivals Against TimeQandeelNo ratings yet

- Seismic Hazard CurveDocument46 pagesSeismic Hazard CurveCORAL ALONSONo ratings yet

- Steel Test Lab Sample 3Document14 pagesSteel Test Lab Sample 3Robel FitsumNo ratings yet

- Qro SpectrumDocument23 pagesQro SpectrumGerardo HernándezNo ratings yet

- Simulation of Waiting Time in Domino'sDocument7 pagesSimulation of Waiting Time in Domino'samartyadasNo ratings yet

- Economics Assessment Data Set Popular IndicatorsDocument5 pagesEconomics Assessment Data Set Popular IndicatorsWANKHEDE ADITI PRASHANTNo ratings yet

- Customer Job No. Test Standard DIN EN ISO 6892-1 Type and Designation Material Specimen Removal Specimen Type Pre-Treatment Tester Notes Machine DataDocument53 pagesCustomer Job No. Test Standard DIN EN ISO 6892-1 Type and Designation Material Specimen Removal Specimen Type Pre-Treatment Tester Notes Machine DataF9 MOVIESNo ratings yet

- Mol Fraction of BenzeneDocument12 pagesMol Fraction of BenzeneAUDREY MUGASNo ratings yet

- Laboratory Activity 8,9,10,11 - 091346Document22 pagesLaboratory Activity 8,9,10,11 - 091346Vanvan BitonNo ratings yet

- Results Discussion ConclusionDocument9 pagesResults Discussion ConclusionSyafiq FauziNo ratings yet

- BS Practice Assignment 1Document10 pagesBS Practice Assignment 1ArpitaNo ratings yet

- SpeedSix v1Document148 pagesSpeedSix v1Jordi NiveraNo ratings yet

- 1611560836127Document48 pages1611560836127Pratik KumarNo ratings yet

- CLVDocument17 pagesCLVAbhijeet GangulyNo ratings yet

- UntitledDocument10 pagesUntitledIFKHYNA KHAULA HAKIKANo ratings yet

- TUGAS EKOTEK TenikDocument4 pagesTUGAS EKOTEK TenikHaryantoNdutCivilNo ratings yet

- Pruebas de Viscoelasticidad SalchichaDocument34 pagesPruebas de Viscoelasticidad SalchichaCatalina Mazo RivasNo ratings yet

- Libro 2Document46 pagesLibro 2Yuriannys Orta ProspertNo ratings yet

- Tablas de Interés CompuestoDocument31 pagesTablas de Interés CompuestoGloria SepúlvedaNo ratings yet

- Tau (Noise) STD Deviation 0.001 Mean 0Document16 pagesTau (Noise) STD Deviation 0.001 Mean 0RAVINDRA KUMARNo ratings yet

- GG Max Mach Number 1Document6 pagesGG Max Mach Number 1RONALD CRISTOPHER ARANA RODRIGUEZNo ratings yet

- D H Arcos: Sen RII R Sen D RDocument8 pagesD H Arcos: Sen RII R Sen D RMamani Loza Neyber HenryNo ratings yet

- Practica No2 - Material 1 1Document49 pagesPractica No2 - Material 1 1SnikeNo ratings yet

- UTM Tension Test Graph 1Document4 pagesUTM Tension Test Graph 1l227168No ratings yet

- Regresi LBDS TabelDocument12 pagesRegresi LBDS TabelSITI AFIFAH AMELIANo ratings yet

- Book 1Document8 pagesBook 1Arvin IlaganNo ratings yet

- PI Sheet RTLx-SC3 - NAM StandardDocument1 pagePI Sheet RTLx-SC3 - NAM StandardP. IulianNo ratings yet

- Product Data: Heradesign Superfi NeDocument6 pagesProduct Data: Heradesign Superfi NeP. IulianNo ratings yet

- Basotect G+: The Innovative Product For Green BuildingDocument4 pagesBasotect G+: The Innovative Product For Green BuildingP. IulianNo ratings yet

- Declaration of Performance: No. KA-WF-THA2A1-13Document2 pagesDeclaration of Performance: No. KA-WF-THA2A1-13P. IulianNo ratings yet

- Untitled Spreadsheet - Sheet1Document8 pagesUntitled Spreadsheet - Sheet1Scientist 235No ratings yet

- LogcatDocument10,401 pagesLogcatsolehaxx78No ratings yet

- 7958642551100175218fct 101421 UpsmailinnovDocument220 pages7958642551100175218fct 101421 Upsmailinnovluissanchez.opxNo ratings yet

- 1200SUBWAYACCOUNTHUBDocument22 pages1200SUBWAYACCOUNTHUBliveyourbestlifehoNo ratings yet

- Hiring Finance RolesDocument1 pageHiring Finance RolesSAKSHAM SINGHNo ratings yet

- Mortgage AccountsDocument16 pagesMortgage Accountsvasanth kumarNo ratings yet

- 9000 InvestorsDocument384 pages9000 InvestorsIvaturi SyamsundarNo ratings yet

- VC Funds For Early Stage ListDocument50 pagesVC Funds For Early Stage ListmarkNo ratings yet

- BD 060123Document179 pagesBD 060123venkii VenkatNo ratings yet

- Pike County Properties Sold ListDocument20 pagesPike County Properties Sold ListSheera LaineNo ratings yet

- Company Name Exchange:Ticker Watch Lists Ount Raised ($usdmm, Today'S Rate)Document953 pagesCompany Name Exchange:Ticker Watch Lists Ount Raised ($usdmm, Today'S Rate)Keval KatrodiyaNo ratings yet

- Ru2000 Membershiplist 20200629Document23 pagesRu2000 Membershiplist 20200629Jameson CorderoNo ratings yet

- PpypalDocument12 pagesPpypaljames.cool0560100% (1)

- 10 Super Investor Portfolios - Q4 2023Document10 pages10 Super Investor Portfolios - Q4 2023Rimpal JohalNo ratings yet

- ENR TOP 500 List - 2022Document12 pagesENR TOP 500 List - 2022AshrafNo ratings yet

- 50Document5 pages50dan4oNo ratings yet

- Pia Casos Ed Eq3Document77 pagesPia Casos Ed Eq3tomas olvera sepulvedaNo ratings yet

- Mississippi River Portsriverbend Map 2019 PrintDocument1 pageMississippi River Portsriverbend Map 2019 PrintSahil SinghNo ratings yet

- Premium BinsDocument7 pagesPremium Binsmpacholski4No ratings yet

- Zrzut Ekranu 2022-11-20 o 23.44.07Document74 pagesZrzut Ekranu 2022-11-20 o 23.44.07Bartek SalahNo ratings yet

- Company ListDocument4 pagesCompany ListGunpreet HundalNo ratings yet

Dividend Kings

Dividend Kings

Uploaded by

P. Iulian0 ratings0% found this document useful (0 votes)

9 views19 pagesOriginal Title

dividend_kings

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views19 pagesDividend Kings

Dividend Kings

Uploaded by

P. IulianCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 19

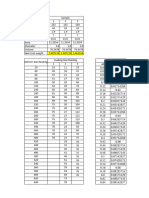

Ticker Name

TDS Telephone And Data Systems, Inc.

LEG Leggett & Platt, Inc.

KVUE Kenvue Inc

CDUAF Canadian Utilities Ltd.

TR Tootsie Roll Industries, Inc.

HRL Hormel Foods Corp.

UBSI United Bankshares, Inc.

GRC Gorman-Rupp Co.

NWN Northwest Natural Holding Co

FTS Fortis Inc.

ABM ABM Industries Inc.

MO Altria Group Inc.

CWT California Water Service Group

UVV Universal Corp.

MSEX Middlesex Water Co.

NFG National Fuel Gas Co.

CBSH Commerce Bancshares, Inc.

BKH Black Hills Corporation

ADM Archer Daniels Midland Co.

SJW SJW Group

KO Coca-Cola Co

WMT Walmart Inc

AWR American States Water Co.

FUL H.B. Fuller Company

SYY Sysco Corp.

SCL Stepan Co.

CL Colgate-Palmolive Co.

ED Consolidated Edison, Inc.

SWK Stanley Black & Decker Inc

MMM 3M Co.

FRT Federal Realty Investment Trust.

EMR Emerson Electric Co.

TNC Tennant Co.

RPM RPM International, Inc.

CINF Cincinnati Financial Corp.

ABT Abbott Laboratories

KMB Kimberly-Clark Corp.

PPG PPG Industries, Inc.

GPC Genuine Parts Co.

PG Procter & Gamble Co.

JNJ Johnson & Johnson

PEP PepsiCo Inc

TGT Target Corp

DOV Dover Corp.

ABBV Abbvie Inc

NUE Nucor Corp.

MSA MSA Safety Inc

LANC Lancaster Colony Corp.

BDX Becton Dickinson & Co.

LOW Lowe`s Cos., Inc.

ITW Illinois Tool Works, Inc.

NDSN Nordson Corp.

SPGI S&P Global Inc

PH Parker-Hannifin Corp.

FMCB Farmers & Merchants Bancorp

GWW W.W. Grainger Inc.

Sector Price Dividends Per Share (TTM) Dividend Yield

Communication Services 15.72 0.726246962889614 0.0483460559796438

Consumer Cyclical 19.38 1.77500487913294 0.0949432404540764

N/A 20.14 0.397958169195344 0.0397219463753724

Utilities 22.7173 1.79889997839928 0.0589858830054628

Consumer Defensive 32.58 0.358528250397324 0.0110497237569061

Consumer Defensive 34.16 1.09370673106188 0.0330796252927401

Financial Services 34.39 1.41370748021219 0.0430357662111079

Industrials 37.03 0.704305273702624 0.0194436943019174

Utilities 37.73 1.90891918914166 0.0516830108666843

Utilities 39.73 1.97622994973767 0.0440473194059904

Industrials 41.79 0.878095710061316 0.0215362526920316

Consumer Defensive 43.05 3.71528830091057 0.0910569105691057

Utilities 47.05 1.05136068025784 0.0238044633368757

Consumer Defensive 50.58 3.12181441238652 0.0632661130881771

Utilities 51.45 1.25522083631214 0.0252672497570457

Energy 51.57 1.9319923892214 0.0383944153577661

Financial Services 52.15 1.01821786980672 0.0207094918504315

Utilities 53.37 2.47979197845471 0.0487165074011617

Consumer Defensive 57.07 1.82951235857795 0.0350446819695111

Utilities 57.54 1.52586583071548 0.0278067431352103

Consumer Defensive 60.5 1.81849121885027 0.0320661157024793

Consumer Defensive 61.41 0.755835822811482 0.0135157140530858

Utilities 73.03 1.67404341270639 0.0235519649459126

Basic Materials 78.91 0.816559105865813 0.0103915853503992

Consumer Defensive 80.13 1.96924877978536 0.0252090353176089

Basic Materials 86.56 1.47050885973532 0.0173290203327172

Consumer Defensive 88.76 1.90221319913179 0.0216313654799459

Utilities 89.93 3.21554983071934 0.0369176025797843

Industrials 91.39 3.18736720063226 0.0354524565050881

Industrials 98.72 5.86935424224858 0.0611831442463533

Real Estate 101.13 4.28138977531929 0.043112825076634

Industrials 110.6 2.07333319929336 0.0189873417721519

Industrials 111.72 1.08546244348269 0.0100250626566416

Basic Materials 118.26 1.74857945120822 0.0155589379333672

Financial Services 118.34 2.93591852174766 0.0272942369443975

Healthcare 120.76 2.06464665592903 0.0182179529645578

Consumer Defensive 126.71 4.69209089172553 0.0385131402414963

Basic Materials 141.31 2.55196514162317 0.0183992640294388

Consumer Cyclical 154.01 3.81195844777142 0.0259723394584767

Consumer Defensive 161.93 3.72755763114587 0.0232199098375841

Healthcare 162.74 4.7058877022999 0.029249109008234

Consumer Defensive 164.54 4.94807245071862 0.0329403184635955

Consumer Defensive 167.57 4.3246808117071 0.0262576833562094

Industrials 175.27 2.02483168343975 0.011639185257032

Healthcare 180.92 5.90300802691092 0.0342692902940526

Basic Materials 182.89 2.06042015783937 0.011810377822735

Industrials 186.92 1.87228099072503 0.010057778728868

Consumer Defensive 202.75 3.46153971125338 0.0177558569667078

Healthcare 237.82 3.6983737465466 0.0159784711126062

Consumer Cyclical 243.26 4.3163656029472 0.0180876428512703

Industrials 262.88 5.39734071773982 0.0213024954351796

Industrials 263.87 2.66881198914351 0.0103081062644484

Financial Services 428.61 3.59841507097416 0.0084925690021231

Industrials 538.28 5.89117632182771 0.010997993609274

Financial Services 951 17.1000003814697 0.0185068349106204

Industrials 972.43 7.41540434991855 0.007650936314182

Years of Dividend Increases 1-Year Dividend Growth 5-Year Dividend Growth (Annualized)

50 0.0277777777777779 0.0231458730804617

52 0.0454545454545454 0.0389504774898828

61 N/A N/A

52 0.0100312082032992 0.0139869434662538

58 N/A N/A

58 0.0272727272727273 0.0611085929036588

50 0.0277777777777779 0.0170552861710354

51 0.0285714285714285 0.0592238410488122

68 0.00515463917525794 0.00520861519735605

50 0.0385951919790362 N/A

56 0.0227272727272727 0.0456395525912732

54 0.0425531914893615 0.041423126681444

56 0.0769230769230771 0.0723046425561171

53 0.0126582278481013 0.0103114593179361

51 0.04 0.0625134194396775

53 0.0421052631578947 0.0309634142676969

54 0 0.00757662405217419

54 0.04 0.0517787586399254

51 0.111111111111111 0.0739409237857793

56 0.0526315789473684 0.0592238410488122

62 0.0454545454545454 0.0283467221002136

51 0.0178571428571428 0.0146582647796441

69 0.0817610062893082 0.0935210621823617

54 N/A N/A

53 0.0204081632653062 0.0509476404473832

56 0.0273972602739727 0.0844717711976986

61 0.0212765957446808 0.0222439674959112

50 0.0246913580246915 0.0232205988972889

56 0.0125 0.0418092681026443

66 0.0066666666666666 0.00953851182404431

56 0.0092592592592593 0.0133635179823601

67 0.00961538461538458 0.0138942140146645

53 0.0566037735849057 0.0494145228445839

50 0.0952380952380953 0.0561800440386273

64 0.0869565217391304 0.0601678923171742

52 0.0784313725490198 0.114403692016759

52 0.0338983050847459 0.0344381316092159

52 0.0483870967741935 0.0625134194396775

68 0.0526315789473684 0.0557279765121141

67 0.0300010949304721 0.0475001826727048

61 0.0530973451327435 0.0460794515911231

52 0.1 0.057833778723468

55 0.0185185185185186 0.10756634324829

68 0.00990099009900991 0.0121987292499426

52 0.0472972972972974 0.0769352293553696

51 0.0588235294117647 0.0618587587949346

53 0.0217391304347827 0.0227505306621236

61 0.0588235294117647 0.0672491818795389

52 0.043956043956044 0.0429093859381833

60 0.0476190476190477 0.180402959136969

60 0.0687022900763357 0.0696103757250688

60 0.0461538461538462 0.142058035063606

51 0.0111111111111111 0.098078295296111

67 0.112781954887218 0.109572817173184

58 N/A N/A

52 0.0813953488372092 0.0525193538142661

Market Cap ($M) Trailing P/E Ratio Payout Ratio Beta 52-Week High

1666.32 N/A N/A 0.490497037793 21.31

2591.689125 N/A N/A 0.8182289408731 31.88

38559.678479 23.1728837014063 0.4425199257148 0.5996698153472 27.28

4641.774295 0 N/A 28.39

1303.588679 14.1830085233702 0.2716123109071 0.3905003480431 45.5

18709.432 23.5422868043427 0.7542805041806 0.3541149217402 41.01

4641.022596 12.6695547152845 0.5197453971368 1.445759570207 37.93

970.864908 27.7778864129782 0.5256009505243 1.1254420726901 38.66

1421.5434 15.1440682682064 0.737034435962 0.4936701617045 46.81

19491.292389 0 N/A 0.4500379386314 44.4

2644.951116 10.2676673771739 0.2234340229164 1.132239881103 52.78

75917.029414 9.35745463006902 0.8129733700023 0.5294818298717 44.96

2713.617172 52.2744152867408 1.154073194575 0.6116128046667 60.32

1242.914479 9.34613518013039 0.5857062687404 0.5504967689702 66.97

916.924922 29.1977111673672 0.7131936569955 0.7015125439991 81.92

4751.021518 10.7929438821937 0.4050298509898 0.7549768793781 56.58

6773.093164 14.3249174925289 0.2797301840128 1.2951896513549 56.47

3639.649927 13.881197280206 0.634217897303 0.6813250015382 63.86

30440.068223 7.73179279218949 0.2544523447257 0.7347473159238 85.49

1844.752712 21.7062928638498 0.5693529219088 0.649272069264 79.99

260903.598164 24.3516518726899 0.7362312626924 0.3421417718464 63.49

494350.5 10.1479297631494 0.1255541233906 0.3120977634328 61.57

2701.289435 21.6885678320982 0.4982272061626 0.5426620466052 93.16

4277.550597 29.5194857152913 0.3152737860486 1.1726894167645 83.41

39891.097707 19.1602285654096 0.4803045804355 0.5127521226778 82.89

1937.334763 48.1876122535071 0.8402907769916 1.0186302044098 102.68

73062.87557 31.7664676393217 0.6867195664736 0.2473807443058 89.19

31071.717088 12.3349412813934 0.4459847199333 0.2952981373129 97.36

14056.132481 N/A N/A 1.4230458189514 102

54562.544 N/A N/A 1.0620862201064 108.85

8392.766463 0 N/A 0.8798018522357 105.37

63130.48 5.72664005805515 0.1079298906452 0.9481130248965 111.2

2080.237349 18.9976013567123 0.1861856678358 1.0280387696583 117

15240.422351 29.1306952393659 0.4306845938937 1.0067952891355 119.39

18539.73823 10.0595432610526 0.2517940413163 0.915630311645 119.38

209540.85474 36.6138135138284 0.6313904146572 0.4765698469067 121.64

42690.419823 24.2009182668367 0.9005932613677 0.2895488634808 142.41

33258.883541 26.1880972765827 0.4770028302099 1.0312825967626 150.73

21472.55964 16.3100404090772 0.4085700372745 0.9282880778856 170.35

381024.699274 26.2993304303023 0.6361019848372 0.3092986803841 162.62

392002.778685 11.1513321390698 0.3427449164093 0.2495954832564 172.01

226148.59225 24.9227013720895 0.7542793369998 0.3688169839067 187.02

77360.667826 21.299743344163 0.5516174504728 0.7444893959948 175.53

24519.689351 23.2012109358382 0.2692595323723 1.0866251102188 175.51

319590.36011 66.3050539647884 2.1702235393055 0.2294496587903 182.89

44029.859817 9.76736381647812 0.1144677865466 1.1658133049673 195

7349.414207 125.596660860619 1.2650547234629 0.7631466056778 188.27

5579.88275 43.3079488831282 0.7380681687107 0.4640257927793 214.36

68706.728814 56.3631901675472 0.8805651777492 0.5420495620035 284.02

139898.826 18.2993886200131 0.3333100851697 1.063495215812 245.29

78548.544 26.5635928305715 0.5541417574682 0.8705889794363 267.12

15091.317688 30.6233668723265 0.3117771015355 0.9910220984742 275.67

142727.13 51.2667178217822 0.4372314788547 1.1129479166015 460.2

69120.994491 26.2565586287831 0.2909222874977 1.3439385879414 543.92

706.513116 0 N/A 1075

47817.647548 26.1441484677474 0.2031061174998 0.9545499119298 999

52-Week Low

6.15

19.12

17.64

20.04

28.91

28.51

24.29

22.39

34.95

35.52

37.21

38.16

44.56

43.86

48.59

45.32

38.36

45.3

50.24

54.39

51.14

44.89

70.22

62.04

61.82

63.04

66.78

78.98

70.46

82.65

81.61

75.69

62.52

77.46

91.41

89.24

114.07

118.66

124.63

135.37

142.71

151.16

101.13

126.39

127.03

128.56

121.17

154.96

225.92

180.94

214.62

198.08

322.96

296.45

923.47

619.9

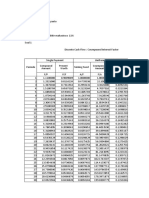

Ticker Name

HRL Hormel Foods Corp.

TGT Target Corp

TNC Tennant Co.

DOV Dover Corp.

WMT Walmart Inc

RPM RPM International, Inc.

ABT Abbott Laboratories

CINF Cincinnati Financial Corp.

GPC Genuine Parts Co.

EMR Emerson Electric Co.

KMB Kimberly-Clark Corp.

NFG National Fuel Gas Co.

CL Colgate-Palmolive Co.

ADM Archer Daniels Midland Co.

MO Altria Group Inc.

MMM 3M Co.

LOW Lowe`s Cos., Inc.

MSA MSA Safety Inc

LANC Lancaster Colony Corp.

ABBV Abbvie Inc

JNJ Johnson & Johnson

PH Parker-Hannifin Corp.

KVUE Kenvue Inc

PG Procter & Gamble Co.

NWN Northwest Natural Holding Co

GWW W.W. Grainger Inc.

ITW Illinois Tool Works, Inc.

BKH Black Hills Corporation

FTS Fortis Inc.

ABM ABM Industries Inc.

FRT Federal Realty Investment Trust.

ED Consolidated Edison, Inc.

KO Coca-Cola Co

SWK Stanley Black & Decker Inc

CBSH Commerce Bancshares, Inc.

CDUAF Canadian Utilities Ltd.

PPG PPG Industries, Inc.

FUL H.B. Fuller Company

GRC Gorman-Rupp Co.

NDSN Nordson Corp.

SYY Sysco Corp.

SPGI S&P Global Inc

UBSI United Bankshares, Inc.

TR Tootsie Roll Industries, Inc.

CWT California Water Service Group

NUE Nucor Corp.

BDX Becton Dickinson & Co.

FMCB Farmers & Merchants Bancorp

PEP PepsiCo Inc

UVV Universal Corp.

AWR American States Water Co.

SJW SJW Group

SCL Stepan Co.

LEG Leggett & Platt, Inc.

MSEX Middlesex Water Co.

TDS Telephone And Data Systems, Inc.

One Month Price Return Three Month Price Return Six Month Price Return

0.154054054054053 0.088643497936485 -0.070612753500166

0.129927883399695 0.244369260655891 0.393461367350078

0.128284264615583 0.276570946698706 0.444179589135302

0.085487648838831 0.208443591946375 0.252636310944255

0.081796193895364 0.217165180473824 0.123961557256882

0.079704190632703 0.106459022375247 0.221155543990409

0.073136052608193 0.137452186223415 0.191553351021789

0.070659549443589 0.147768669426329 0.136017832235298

0.068151995095142 0.143048416090108 0.060155805249633

0.065873076296659 0.228983110927393 0.119031117361676

0.065718613615394 0.050840232642807 0.035055130511213

0.062641664949515 0.046269583318117 0.007805263178465

0.06223073240785 0.136152722683245 0.239377462767012

0.061965016747301 -0.227544723766365 -0.272686954626727

0.061652281134402 0.065464832235694 0.004105052012874

0.060548601852737 -0.021453288569182 -0.048721237356192

0.058296354302618 0.171457768095088 0.067172278614176

0.056024315903357 0.106982660903945 0.087325146400896

0.047452842665608 0.20944121727947 0.279155599578557

0.045357369850349 0.191912231198822 0.235859883053718

0.038806846652474 0.057429589705103 0.01044595225559

0.038749517560787 0.224584881468155 0.336464694842464

0.038679731820526 -0.019388261872997 -0.033821060206284

0.030679142002418 0.116570728787707 0.078606450856564

0.030311305297651 -0.004485488126649 -0.0342405618964

0.026625563497006 0.186668379985265 0.422605772318414

0.025193042664378 0.044210526315789 0.113524613773682

0.023348922291059 0.004521003278762 -0.00333342670663

0.018522079087354 0.009056875961943 0.015320530021338

0.017778860204578 -0.053153887982599 0.072850640398641

0.014936517542354 0.039796667468645 0.063210173511526

0.014782216204017 -0.010440278700863 0.015654381611833

0.013400335008375 0.018175698418041 0.05429717587768

0.013397381733343 -0.004112571566809 0.041917246301302

0.011609749473827 0.01908413355376 0.237406453021264

0.007642492792193 0.00950074432866 0.014020318525925

0.00758451381605 -0.023397410423959 0.066083442851258

0.00560723843507 0.013658896266636 0.169075140226792

0.003202228013805 0.111341202457375 0.163148636763412

0.00176952581188 0.121199322529957 0.148284340390348

0.001124437781109 0.095883291780123 0.162161652581396

-0.000065556468265 0.00630676191375 0.111402395812346

-0.012193195364 0.000183226354348 0.27123186396821

-0.015421437702287 -0.038274206974726 0.089967481633144

-0.016102049351735 -0.099257773089536 -0.022038939686512

-0.017248790972595 0.120218445353136 0.129000795097065

-0.018848650947837 0.008927279769654 -0.090790574837355

-0.020131102543125 -0.001060913225701 0.005014610756573

-0.020800986459392 -0.008362683483639 -0.048530496002775

-0.038585820186276 -0.151058826688777 0.109577952348255

-0.045749908860819 -0.101003262140702 -0.100293331723561

-0.050651707639003 -0.131314351278722 -0.081177064237763

-0.05932981596292 0.001581749366201 0.118980920703086

-0.072283389181426 -0.247118421512678 -0.248347761332961

-0.095645387527816 -0.234337400497345 -0.26849034606307

-0.178683385579937 -0.117483593166673 -0.08883298749174

Year-To-Date Price Return One Year Price Return Two Year Price Return

0.073386856038586 -0.100496359590799 -0.286381288817118

0.185304962973809 0.094870957203528 -0.138247129761767

0.208259250126536 0.675331744777334 0.422932754582309

0.143075157175279 0.218998205616836 0.197473465581263

0.1686013320647 0.365555795217775 0.337229685148933

0.063936980671721 0.412486398876317 0.560057463303823

0.102420285409637 0.27076061483936 0.099854913143703

0.143823699980669 0.105856253638607 0.048461904437047

0.119362034141232 -0.029806320338411 0.329502772351245

0.141983913101838 0.376846324778876 0.25307888052244

0.05308824714953 0.075458646488908 0.160682797693473

0.027905122583216 -0.032515871467379 -0.176362547414653

0.12018799369484 0.276481306509393 0.264859534470129

-0.202302378696008 -0.235293092982839 -0.285349348587228

0.067178978681209 0.00787807133576 0.007001054953486

-0.081963920214927 0.009381150788579 -0.22050624455669

0.098554213058822 0.262667027240823 0.14052628494403

0.110129845756568 0.420052891120415 0.497635207407092

0.223906346867433 0.124410550991671 0.396832789297677

0.178605815897237 0.257349364097574 0.310902401099036

0.046163221776446 0.106424523273395 0.017328465693138

0.17176853718321 0.613938615283364 1.06153348862112

-0.054912670927536 -0.237129881099836 -0.237129881099836

0.111999263840418 0.210336858281535 0.189204988594853

-0.018802174082646 -0.133002435773702 -0.252104138502463

0.17575665538262 0.448567461030357 1.11087710706749

0.003588608078185 0.160984593370534 0.344886561008214

0.001914845685965 -0.067042856243837 -0.186016008199321

-0.023081632803605 0.074849918703146 -0.090736405101762

-0.06308011012564 -0.04640422055696 -0.055093540991168

-0.008110289740076 0.094927259282196 -0.059242687107262

-0.002173626005399 0.028634305806242 0.079353420132888

0.02664177838113 0.054023495141909 0.109377263450511

-0.059947746302125 0.174989778784613 -0.329158589141016

-0.018694666327961 -0.015288983887748 -0.145220693690696

-0.040500587087454 -0.061132808464034 -0.12012905274818

-0.050694562940609 0.142684787680255 0.221136172540466

-0.028052347959969 0.194954267369313 0.238320616916234

0.047530679098608 0.505743621022669 0.004582066189017

0.004044793327422 0.267367648527976 0.268167397904282

0.103076306779933 0.126259715799682 0.084483614999519

-0.025011754862828 0.32458865621051 0.150293350165978

-0.064540961354851 0.038837854901024 0.094849844161384

-0.017200499544497 -0.224089889353027 0.037430941425591

-0.087447899190631 -0.121255530673878 -0.137564430627552

0.050850379223167 0.16606532490626 0.392531996104656

-0.020699469789184 0.051110711367084 -0.013904109617441

-0.100709219858156 -0.078138833067227 0.036393655222018

-0.016361494025774 0.006890474500348 0.157104299724753

-0.239332152277943 0.072760204795819 0.03952795812293

-0.086806523775166 -0.120474411501877 -0.09552082791488

-0.11363604854822 -0.208591336592128 -0.090683536062125

-0.080620920759847 -0.089049226702139 -0.066098154637573

-0.259457393962552 -0.350017775571669 -0.399220660857273

-0.20645080689069 -0.270833333333333 -0.457189730388407

-0.143324250681198 0.501217590603065 -0.066402978958433

Five Year Price Return

-0.096461227976903

1.48730889119786

0.951461500033188

1.09548586410845

1.03514190649151

1.27129119428125

0.678828768085014

0.607775579853487

0.660814652178976

0.87487815834753

0.273541573277638

0.017458779799191

0.522052266959325

0.52143660725235

0.143001274426507

-0.407771795371717

1.6405771364186

0.913250683742487

0.495599139597121

1.89432174132839

0.34001281221541

2.43185978263018

-0.237129881099836

0.833928296382201

-0.290510745762903

2.55309417309071

1.04800279216449

-0.126518200401634

0.310118547097327

0.385426336029704

-0.274377556145512

0.272817082612098

0.535743477532453

-0.218377159747321

0.15682459965883

0.094888787141239

0.387676381023272

0.693293134341169

0.222980002311871

1.11687879310552

0.377698917853863

1.26747664728123

0.193997722412021

0.0157601833232

-0.048262497496758

2.47370080474987

0.041974730951714

0.332872877844933

0.661718071461754

0.142088138134408

0.113956719967174

0.038234604211399

0.024120547128356

-0.447115041723129

-0.057690581850882

-0.399491171909022

Notes

Data Provided by IEX Cloud

Data updated on 2024-03-13

You might also like

- Fortune 500 Companies 2024Document13 pagesFortune 500 Companies 2024syed.showzib100% (1)

- 100K+ Usa SSN SampleDocument1 page100K+ Usa SSN Sampleloridzurnakwsb15No ratings yet

- 50x USA Phone Number Email DOB SSN Etc FullzDocument5 pages50x USA Phone Number Email DOB SSN Etc Fullzkelly55.keNo ratings yet

- Instacart CC PP Mixed SCOOBY - FODocument88 pagesInstacart CC PP Mixed SCOOBY - FOhacked.02.meNo ratings yet

- Consulting CompaniesDocument3 pagesConsulting CompaniesAnimesh KharghariaNo ratings yet

- SSN Tts-Us2Document24 pagesSSN Tts-Us2micheald.lucy900100% (1)

- 100 Top Venture Capital FirmsDocument12 pages100 Top Venture Capital FirmsAtrij DixitNo ratings yet

- Global and Regional MA League Tables 2022 Financial AdvisorsDocument38 pagesGlobal and Regional MA League Tables 2022 Financial AdvisorsKoo JasperNo ratings yet

- Sbs Secret Lenders Listpdf 2Document8 pagesSbs Secret Lenders Listpdf 2chrisengstrandNo ratings yet

- Roll Bet Total Amount Lost Probability of Lose Streak (AbDocument6 pagesRoll Bet Total Amount Lost Probability of Lose Streak (AbTanpa NamaNo ratings yet

- Inco JKDocument62 pagesInco JKaldywsNo ratings yet

- Step 1: Step Activity Clock ActivityDocument12 pagesStep 1: Step Activity Clock ActivityHosnaNo ratings yet

- Ratio Analysis of Selected Insurance Co: Rupali LifeDocument3 pagesRatio Analysis of Selected Insurance Co: Rupali LifeAmitNo ratings yet

- Rs-Using Newmark's Linear Acceleration MethodDocument14 pagesRs-Using Newmark's Linear Acceleration MethodlucianduNo ratings yet

- NRTL MethodDocument18 pagesNRTL MethodNurfarahin AzmanNo ratings yet

- Assignment 2Document38 pagesAssignment 2Shubham ThakurNo ratings yet

- Chumney FRAGILITY - CurvesDocument30 pagesChumney FRAGILITY - CurvesNitin shepurNo ratings yet

- Tarea 5 Metodos NumericosDocument18 pagesTarea 5 Metodos NumericosMaría Estefanía VazquezNo ratings yet

- Penn World Table, Version 9.1: When Using These Data, Please Refer To The Following PaperDocument16 pagesPenn World Table, Version 9.1: When Using These Data, Please Refer To The Following Paperjuan Jose ZuluagaNo ratings yet

- Data Pengujian TarikDocument16 pagesData Pengujian TarikMoch Fahrizal SaugiNo ratings yet

- Loteria CD MaximoDocument50 pagesLoteria CD Maximoraul rocha mejiaNo ratings yet

- Tarea Operativa IiDocument45 pagesTarea Operativa Iidaniel Angel Tomicha ZeballosNo ratings yet

- Total Beta EmergDocument12 pagesTotal Beta EmergjajjaNo ratings yet

- Worshop Matériaux CompositesDocument42 pagesWorshop Matériaux CompositesInnov'Action ProdNo ratings yet

- Bridge Rectified CapacitorDocument773 pagesBridge Rectified CapacitorVital RogatchNo ratings yet

- LEVERETTDocument12 pagesLEVERETTJuan Diego Medina MedinaNo ratings yet

- Para Estructuras Fuera Del Nivel Del Suelo I en (KV) P (I) P (I) en (%)Document4 pagesPara Estructuras Fuera Del Nivel Del Suelo I en (KV) P (I) P (I) en (%)Angel Danilo Ortiz ArcosNo ratings yet

- 1 S-V TT - 090622Document70 pages1 S-V TT - 090622Tuấn LvNo ratings yet

- Fin 542 Yen BalDocument36 pagesFin 542 Yen BalIqbal AzhamNo ratings yet

- Curvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)Document7 pagesCurvas ROC (Receiver Operating Characteristic, o Característica Operativa Del Receptor)datalifeNo ratings yet

- II Korelacja WykDocument17 pagesII Korelacja WykMateusz MaćkowskiNo ratings yet

- Ects1 Buzea Stefania GeorgianaDocument82 pagesEcts1 Buzea Stefania GeorgianaPirtac Vladut-MihaiNo ratings yet

- Data Triaxial - Kelompok 1Document8 pagesData Triaxial - Kelompok 1Andini ZahrianiNo ratings yet

- Materials 1Document23 pagesMaterials 1Empire Hack SevenNo ratings yet

- Data Analytics - Indian Stock Market Top 2000 PDFDocument45 pagesData Analytics - Indian Stock Market Top 2000 PDFRohit SharmaNo ratings yet

- Sistem PDB IVP-EulerDocument9 pagesSistem PDB IVP-EulerMuhammad RizaldiNo ratings yet

- Analisis BetaDocument4 pagesAnalisis Betaalexa gironNo ratings yet

- HydrologyDocument23 pagesHydrologyYang RhiaNo ratings yet

- CFE SismoDocument29 pagesCFE SismoDaniel RosalesNo ratings yet

- Name Roll No (In Numbers Only) Batch Semster: Student PortalDocument18 pagesName Roll No (In Numbers Only) Batch Semster: Student PortalNirajanNo ratings yet

- Trabalho 2 Diego Cardoso Lucas Lima Lucas Rodrigues e Warlly AfonsoDocument14 pagesTrabalho 2 Diego Cardoso Lucas Lima Lucas Rodrigues e Warlly AfonsoLucas RodriguesNo ratings yet

- New Microsoft Office Excel WorksheetDocument3 pagesNew Microsoft Office Excel Worksheetmohsen ranjbarNo ratings yet

- A) Number of Arrivals Against TimeDocument32 pagesA) Number of Arrivals Against TimeQandeelNo ratings yet

- Seismic Hazard CurveDocument46 pagesSeismic Hazard CurveCORAL ALONSONo ratings yet

- Steel Test Lab Sample 3Document14 pagesSteel Test Lab Sample 3Robel FitsumNo ratings yet

- Qro SpectrumDocument23 pagesQro SpectrumGerardo HernándezNo ratings yet

- Simulation of Waiting Time in Domino'sDocument7 pagesSimulation of Waiting Time in Domino'samartyadasNo ratings yet

- Economics Assessment Data Set Popular IndicatorsDocument5 pagesEconomics Assessment Data Set Popular IndicatorsWANKHEDE ADITI PRASHANTNo ratings yet

- Customer Job No. Test Standard DIN EN ISO 6892-1 Type and Designation Material Specimen Removal Specimen Type Pre-Treatment Tester Notes Machine DataDocument53 pagesCustomer Job No. Test Standard DIN EN ISO 6892-1 Type and Designation Material Specimen Removal Specimen Type Pre-Treatment Tester Notes Machine DataF9 MOVIESNo ratings yet

- Mol Fraction of BenzeneDocument12 pagesMol Fraction of BenzeneAUDREY MUGASNo ratings yet

- Laboratory Activity 8,9,10,11 - 091346Document22 pagesLaboratory Activity 8,9,10,11 - 091346Vanvan BitonNo ratings yet

- Results Discussion ConclusionDocument9 pagesResults Discussion ConclusionSyafiq FauziNo ratings yet

- BS Practice Assignment 1Document10 pagesBS Practice Assignment 1ArpitaNo ratings yet

- SpeedSix v1Document148 pagesSpeedSix v1Jordi NiveraNo ratings yet

- 1611560836127Document48 pages1611560836127Pratik KumarNo ratings yet

- CLVDocument17 pagesCLVAbhijeet GangulyNo ratings yet

- UntitledDocument10 pagesUntitledIFKHYNA KHAULA HAKIKANo ratings yet

- TUGAS EKOTEK TenikDocument4 pagesTUGAS EKOTEK TenikHaryantoNdutCivilNo ratings yet

- Pruebas de Viscoelasticidad SalchichaDocument34 pagesPruebas de Viscoelasticidad SalchichaCatalina Mazo RivasNo ratings yet

- Libro 2Document46 pagesLibro 2Yuriannys Orta ProspertNo ratings yet

- Tablas de Interés CompuestoDocument31 pagesTablas de Interés CompuestoGloria SepúlvedaNo ratings yet

- Tau (Noise) STD Deviation 0.001 Mean 0Document16 pagesTau (Noise) STD Deviation 0.001 Mean 0RAVINDRA KUMARNo ratings yet

- GG Max Mach Number 1Document6 pagesGG Max Mach Number 1RONALD CRISTOPHER ARANA RODRIGUEZNo ratings yet

- D H Arcos: Sen RII R Sen D RDocument8 pagesD H Arcos: Sen RII R Sen D RMamani Loza Neyber HenryNo ratings yet

- Practica No2 - Material 1 1Document49 pagesPractica No2 - Material 1 1SnikeNo ratings yet

- UTM Tension Test Graph 1Document4 pagesUTM Tension Test Graph 1l227168No ratings yet

- Regresi LBDS TabelDocument12 pagesRegresi LBDS TabelSITI AFIFAH AMELIANo ratings yet

- Book 1Document8 pagesBook 1Arvin IlaganNo ratings yet

- PI Sheet RTLx-SC3 - NAM StandardDocument1 pagePI Sheet RTLx-SC3 - NAM StandardP. IulianNo ratings yet

- Product Data: Heradesign Superfi NeDocument6 pagesProduct Data: Heradesign Superfi NeP. IulianNo ratings yet

- Basotect G+: The Innovative Product For Green BuildingDocument4 pagesBasotect G+: The Innovative Product For Green BuildingP. IulianNo ratings yet

- Declaration of Performance: No. KA-WF-THA2A1-13Document2 pagesDeclaration of Performance: No. KA-WF-THA2A1-13P. IulianNo ratings yet

- Untitled Spreadsheet - Sheet1Document8 pagesUntitled Spreadsheet - Sheet1Scientist 235No ratings yet

- LogcatDocument10,401 pagesLogcatsolehaxx78No ratings yet

- 7958642551100175218fct 101421 UpsmailinnovDocument220 pages7958642551100175218fct 101421 Upsmailinnovluissanchez.opxNo ratings yet

- 1200SUBWAYACCOUNTHUBDocument22 pages1200SUBWAYACCOUNTHUBliveyourbestlifehoNo ratings yet

- Hiring Finance RolesDocument1 pageHiring Finance RolesSAKSHAM SINGHNo ratings yet

- Mortgage AccountsDocument16 pagesMortgage Accountsvasanth kumarNo ratings yet

- 9000 InvestorsDocument384 pages9000 InvestorsIvaturi SyamsundarNo ratings yet

- VC Funds For Early Stage ListDocument50 pagesVC Funds For Early Stage ListmarkNo ratings yet

- BD 060123Document179 pagesBD 060123venkii VenkatNo ratings yet

- Pike County Properties Sold ListDocument20 pagesPike County Properties Sold ListSheera LaineNo ratings yet

- Company Name Exchange:Ticker Watch Lists Ount Raised ($usdmm, Today'S Rate)Document953 pagesCompany Name Exchange:Ticker Watch Lists Ount Raised ($usdmm, Today'S Rate)Keval KatrodiyaNo ratings yet

- Ru2000 Membershiplist 20200629Document23 pagesRu2000 Membershiplist 20200629Jameson CorderoNo ratings yet

- PpypalDocument12 pagesPpypaljames.cool0560100% (1)

- 10 Super Investor Portfolios - Q4 2023Document10 pages10 Super Investor Portfolios - Q4 2023Rimpal JohalNo ratings yet

- ENR TOP 500 List - 2022Document12 pagesENR TOP 500 List - 2022AshrafNo ratings yet

- 50Document5 pages50dan4oNo ratings yet

- Pia Casos Ed Eq3Document77 pagesPia Casos Ed Eq3tomas olvera sepulvedaNo ratings yet

- Mississippi River Portsriverbend Map 2019 PrintDocument1 pageMississippi River Portsriverbend Map 2019 PrintSahil SinghNo ratings yet

- Premium BinsDocument7 pagesPremium Binsmpacholski4No ratings yet

- Zrzut Ekranu 2022-11-20 o 23.44.07Document74 pagesZrzut Ekranu 2022-11-20 o 23.44.07Bartek SalahNo ratings yet

- Company ListDocument4 pagesCompany ListGunpreet HundalNo ratings yet