Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsAccounting For Receivables

Accounting For Receivables

Uploaded by

kapitanadaveBasic receivables

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Quiz #4 Ans KeyDocument7 pagesQuiz #4 Ans KeyMarriz Bustaliño Tan57% (7)

- Accounts Receivable and Receivable FinancingDocument4 pagesAccounts Receivable and Receivable FinancingLui50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful AccountDocument4 pagesAEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful Accountjames bryan angklaNo ratings yet

- Chapter 5 Est. of Doubtful AcctDocument11 pagesChapter 5 Est. of Doubtful AcctXENA LOPEZNo ratings yet

- 8-12 Valix SyncDocument2 pages8-12 Valix SyncRuhhmonNo ratings yet

- Module 3 - ProblemsDocument28 pagesModule 3 - ProblemsCristina TayagNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

- Accounting For Trade Receivables (Accounts Receivable) - Continuation 11Document5 pagesAccounting For Trade Receivables (Accounts Receivable) - Continuation 11rufamaegarcia07No ratings yet

- Assignment 3Document3 pagesAssignment 3AnishNo ratings yet

- Accounts ReceivableDocument8 pagesAccounts ReceivableFireworks PHNo ratings yet

- Prob 3Document3 pagesProb 3jikee11No ratings yet

- Accounting For Receivables Practice SolutionsDocument3 pagesAccounting For Receivables Practice SolutionsNgân GiangNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Problem 4Document6 pagesProblem 4Peachy Rose TorenaNo ratings yet

- Chapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Document7 pagesChapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Rhea Jane SuarezNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- This Study Resource Was: Chapter 18: Accounts ReceivableDocument7 pagesThis Study Resource Was: Chapter 18: Accounts ReceivableXENA LOPEZNo ratings yet

- Summative Assessment Test 1-APPLIED AUDITDocument5 pagesSummative Assessment Test 1-APPLIED AUDITChristine Rey RocoNo ratings yet

- PNC Drill 2B IA TuesdayDocument13 pagesPNC Drill 2B IA Tuesdaysophia lorreine chattoNo ratings yet

- RECEIVABLESDocument23 pagesRECEIVABLESSaghielyn BicomongNo ratings yet

- Unit 3: Completion of The Accounting Cycle For A Merchandising BusinessDocument8 pagesUnit 3: Completion of The Accounting Cycle For A Merchandising BusinessChristine Joyce MagoteNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim Agbayani100% (1)

- HW On ReceivablesDocument13 pagesHW On ReceivablesHimawari NaminayagiNo ratings yet

- Chapter 9 ProblemsDocument1 pageChapter 9 ProblemsQasim KhanNo ratings yet

- Chapter 4, 5, 6 AssignmentDocument23 pagesChapter 4, 5, 6 AssignmentSamantha Charlize VizcondeNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- (VALIX) Cash To AccrualDocument22 pages(VALIX) Cash To AccrualMaeNo ratings yet

- Accounts ReceivableDocument7 pagesAccounts ReceivablePeter PiperNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- 04 Accounts Receivable - (M.C)Document2 pages04 Accounts Receivable - (M.C)kyle mandaresioNo ratings yet

- Doubtful AccountsDocument3 pagesDoubtful AccountsMikhaela TorresNo ratings yet

- Cash To AccrualDocument23 pagesCash To Accruallascona.christinerheaNo ratings yet

- Three Methods of Estimating Doubtful AccountsDocument8 pagesThree Methods of Estimating Doubtful AccountsJay Lou PayotNo ratings yet

- 4 Accounts ReceivableDocument10 pages4 Accounts ReceivableAYEZZA SAMSONNo ratings yet

- ARMADA IC, 2BSACCTY B - ACC212 Act1Document9 pagesARMADA IC, 2BSACCTY B - ACC212 Act1Ian Cleo Caballero ArmadaNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Intermediate Accounting Chapter 4 Exercises - ValixDocument34 pagesIntermediate Accounting Chapter 4 Exercises - ValixAbbie ProfugoNo ratings yet

- Question Paper and Model Answer Keys Pertaining To LDCE-2018Document153 pagesQuestion Paper and Model Answer Keys Pertaining To LDCE-2018tamalkrishnaNo ratings yet

- Finance Assi FinalDocument8 pagesFinance Assi FinalVagdevi YadavNo ratings yet

- Section B&CDocument3 pagesSection B&CTanmay ChopraNo ratings yet

- Receivables Quiz (ARNR) AK PDFDocument5 pagesReceivables Quiz (ARNR) AK PDFNeil Vincent Boco86% (7)

- Accounts ReceivableDocument2 pagesAccounts ReceivableMike MikeNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Ia1 Midterm Activity-1Document2 pagesIa1 Midterm Activity-1Lorraine Millama PurayNo ratings yet

- AR and Allowance For Doubtful AccountsDocument5 pagesAR and Allowance For Doubtful AccountsmedinachrstianaNo ratings yet

- Bookkeeping As An Entrepreneurial ToolDocument29 pagesBookkeeping As An Entrepreneurial ToolVignette San AgustinNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablealford sery Cammayo0% (1)

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- French Business Dictionary: The Business Terms of France and CanadaFrom EverandFrench Business Dictionary: The Business Terms of France and CanadaNo ratings yet

- 033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)Document11 pages033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)wewNo ratings yet

- S&P Gru Rating DowngradeDocument8 pagesS&P Gru Rating Downgraderyan turbevilleNo ratings yet

- Tugas Bahasa Inggris Ke-2Document5 pagesTugas Bahasa Inggris Ke-2Muhammad izzul hikam1CNo ratings yet

- Donor S Tax. CPA REVIEWER. TABAG PDFDocument19 pagesDonor S Tax. CPA REVIEWER. TABAG PDFHansNo ratings yet

- Wells Fargo Clear Access BankingDocument7 pagesWells Fargo Clear Access BankingdebokillsNo ratings yet

- PE Slide 4Document13 pagesPE Slide 4Ajay PasiNo ratings yet

- Train LawDocument44 pagesTrain LawJuan MiguelNo ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- Trendshadow PDFDocument15 pagesTrendshadow PDFMuhammad Azri Bin TokimanNo ratings yet

- Read The Material Below and Answer The Questions That FollowDocument2 pagesRead The Material Below and Answer The Questions That FollowENo ratings yet

- FM PPT IciciDocument14 pagesFM PPT IciciAananNo ratings yet

- United States v. Robert Neil Goode, 945 F.2d 1168, 10th Cir. (1991)Document5 pagesUnited States v. Robert Neil Goode, 945 F.2d 1168, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- Swati Raju Final ReportDocument62 pagesSwati Raju Final Reportshubham kumarNo ratings yet

- FAR610 - Test 1-Apr2018-Q PDFDocument3 pagesFAR610 - Test 1-Apr2018-Q PDFIman NadhirahNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Indemnity & Guarantee PDFDocument55 pagesIndemnity & Guarantee PDFKomal SandhuNo ratings yet

- SICHOTS240114220Document1 pageSICHOTS240114220Sandu MonicaNo ratings yet

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDocument35 pagesFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Hotel Security Service AgreementDocument2 pagesHotel Security Service AgreementmaolewiNo ratings yet

- Villafuerte Vs Court of AppealsDocument3 pagesVillafuerte Vs Court of AppealsOlga ReservaNo ratings yet

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- HDFC Offer DetailsDocument3 pagesHDFC Offer DetailsKarthik ReddyNo ratings yet

- Banking PrinciplesDocument3 pagesBanking PrinciplesNathalieNo ratings yet

- A Handbook of International Trade in Services PDFDocument675 pagesA Handbook of International Trade in Services PDFFAUSTINOESTEBANNo ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

- Scenario A - Coxton Civil Engineering PDFDocument2 pagesScenario A - Coxton Civil Engineering PDFAwez GiniwaleNo ratings yet

- Base Method-FI AADocument4 pagesBase Method-FI AAGanesh RameshNo ratings yet

- Status Watchlist For Complaince - Dec 2011Document10 pagesStatus Watchlist For Complaince - Dec 2011ProshareNo ratings yet

- Land Law: Session Three Easements, Profits and MortgagesDocument39 pagesLand Law: Session Three Easements, Profits and MortgagesAngel MoongaNo ratings yet

Accounting For Receivables

Accounting For Receivables

Uploaded by

kapitanadave0 ratings0% found this document useful (0 votes)

3 views2 pagesBasic receivables

Original Title

Accounting for Receivables

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBasic receivables

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesAccounting For Receivables

Accounting For Receivables

Uploaded by

kapitanadaveBasic receivables

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

FILIPINO ACADEMY UK

ACCOUNTING FOR RECEIVABLES

Prepared by: Dave Christian B. Cabo, CPA, MBA, CMA, MRITax,CTT

I. Provide what is required.

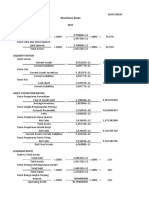

1. ABC Company provided the following information:

Trade receivables, collectible in one year 200,000.00

Trade receivables, collectible in two years 150,000.00

Notes receivable, collectible 30 days (trade) 100,000.00

Notes receivable, collectible 370 days (non-trade) 200,000.00

Non-trade receivables, collectible 2 years 600,000.00

Non-trade receivables, collectible 1 year 800,000.00

Compute for the following:

1. Current trade receivables

2. Non-current trade receivables

3. Current non-trade receivables

4. Non-current non-trade receivables

5. Current Trade and Non-trade receivables

2. DEF Company provided the following information:

Trade receivables, collectible in one year 300,000.00

Trade receivables, collectible in two years 50,000.00

Notes receivable, collectible 30 days (non-trade) 200,000.00

Notes receivable, collectible 370 days (trade) 300,000.00

Non-trade receivables, collectible 2 years 700,000.00

Non-trade receivables, collectible 1 year 80,000.00

Compute for the following:

6. Current trade receivables

7. Non-current trade receivables

8. Current non-trade receivables

9. Non-current non-trade receivables

10. Current Trade and Non-trade receivables

Allowance for doubtful accounts Accounts Receivable

Beginning balance Beginning balance

+ Recovery - Collection

- Write-off + Recovery

+ Doubtful accounts expense - Write-off

Ending allowance for doubtful accounts Ending balance

II. Compute for the ending allowance for doubtful accounts

1. Beginning balance- 2,000.00

Recovery- 500.00

Write-off- 100.00

2% of the total sales (2,000,000.00) is the estimated uncollectible amount.

2. Beginning balance- 3,000.00

Recovery- 800.00

Write-off- 1,100.00

3% of the total sales (2,000,000.00) is the estimated uncollectible amount.

3. 3% of the accounts receivable is estimated to be uncollectible- 400,000.00

4. 5% of the accounts receivable is estimated to be uncollectible- 500,000.00

III. Compute for the ending balance of the accounts receivables

1. Beginning balance- 400,000.00

Collection- 200,000.00

Recovery- 100,000.00

Write-off- 10,000.00

2. Beginning balance- 400,000.00

Collection- 100,000.00

Write-off- 10,000.00

IV. Prepare the journal entries required.

Allowance method Direct write-off

Doubtful account expense XXX

Doubtful accounts No entry

Allowance for doubtful account XXX

Accounts receivable proved to be Allowance for doubtful account XXX Doubtful accounts expense XXX

worthless Accounts Receivable XXX Accounts Receivable XXX

Recovery of accounts previously Accounts Receivable XXX Accounts Receivable XXX

written-off Allowance for doubtful accounts XXX Doubtful accounts expense XXX

A. Allowance method

1. 200,000.00 of the accounts receivables is estimated to be worthless.

2. 10,000.00 of the accounts receivables has been proven to be worthless.

3. 5,000 of the accounts previously written-off has been recovered.

B. Direct write-off

4. 200,000.00 of the accounts receivables is estimated to be worthless.

5. 10,000.00 of the accounts receivables has been proven to be worthless.

6. 5,000 of the accounts previously written-off has been recovered.

You might also like

- Quiz #4 Ans KeyDocument7 pagesQuiz #4 Ans KeyMarriz Bustaliño Tan57% (7)

- Accounts Receivable and Receivable FinancingDocument4 pagesAccounts Receivable and Receivable FinancingLui50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful AccountDocument4 pagesAEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful Accountjames bryan angklaNo ratings yet

- Chapter 5 Est. of Doubtful AcctDocument11 pagesChapter 5 Est. of Doubtful AcctXENA LOPEZNo ratings yet

- 8-12 Valix SyncDocument2 pages8-12 Valix SyncRuhhmonNo ratings yet

- Module 3 - ProblemsDocument28 pagesModule 3 - ProblemsCristina TayagNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

- Accounting For Trade Receivables (Accounts Receivable) - Continuation 11Document5 pagesAccounting For Trade Receivables (Accounts Receivable) - Continuation 11rufamaegarcia07No ratings yet

- Assignment 3Document3 pagesAssignment 3AnishNo ratings yet

- Accounts ReceivableDocument8 pagesAccounts ReceivableFireworks PHNo ratings yet

- Prob 3Document3 pagesProb 3jikee11No ratings yet

- Accounting For Receivables Practice SolutionsDocument3 pagesAccounting For Receivables Practice SolutionsNgân GiangNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Problem 4Document6 pagesProblem 4Peachy Rose TorenaNo ratings yet

- Chapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Document7 pagesChapter 18: Accounts Receivable: Problem 18-1 (AICPA Adapted)Rhea Jane SuarezNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- This Study Resource Was: Chapter 18: Accounts ReceivableDocument7 pagesThis Study Resource Was: Chapter 18: Accounts ReceivableXENA LOPEZNo ratings yet

- Summative Assessment Test 1-APPLIED AUDITDocument5 pagesSummative Assessment Test 1-APPLIED AUDITChristine Rey RocoNo ratings yet

- PNC Drill 2B IA TuesdayDocument13 pagesPNC Drill 2B IA Tuesdaysophia lorreine chattoNo ratings yet

- RECEIVABLESDocument23 pagesRECEIVABLESSaghielyn BicomongNo ratings yet

- Unit 3: Completion of The Accounting Cycle For A Merchandising BusinessDocument8 pagesUnit 3: Completion of The Accounting Cycle For A Merchandising BusinessChristine Joyce MagoteNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim Agbayani100% (1)

- HW On ReceivablesDocument13 pagesHW On ReceivablesHimawari NaminayagiNo ratings yet

- Chapter 9 ProblemsDocument1 pageChapter 9 ProblemsQasim KhanNo ratings yet

- Chapter 4, 5, 6 AssignmentDocument23 pagesChapter 4, 5, 6 AssignmentSamantha Charlize VizcondeNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Acctg 115 - CH 7 SolutionsDocument9 pagesAcctg 115 - CH 7 SolutionsShehryaar MunirNo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- (VALIX) Cash To AccrualDocument22 pages(VALIX) Cash To AccrualMaeNo ratings yet

- Accounts ReceivableDocument7 pagesAccounts ReceivablePeter PiperNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- 04 Accounts Receivable - (M.C)Document2 pages04 Accounts Receivable - (M.C)kyle mandaresioNo ratings yet

- Doubtful AccountsDocument3 pagesDoubtful AccountsMikhaela TorresNo ratings yet

- Cash To AccrualDocument23 pagesCash To Accruallascona.christinerheaNo ratings yet

- Three Methods of Estimating Doubtful AccountsDocument8 pagesThree Methods of Estimating Doubtful AccountsJay Lou PayotNo ratings yet

- 4 Accounts ReceivableDocument10 pages4 Accounts ReceivableAYEZZA SAMSONNo ratings yet

- ARMADA IC, 2BSACCTY B - ACC212 Act1Document9 pagesARMADA IC, 2BSACCTY B - ACC212 Act1Ian Cleo Caballero ArmadaNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Intermediate Accounting Chapter 4 Exercises - ValixDocument34 pagesIntermediate Accounting Chapter 4 Exercises - ValixAbbie ProfugoNo ratings yet

- Question Paper and Model Answer Keys Pertaining To LDCE-2018Document153 pagesQuestion Paper and Model Answer Keys Pertaining To LDCE-2018tamalkrishnaNo ratings yet

- Finance Assi FinalDocument8 pagesFinance Assi FinalVagdevi YadavNo ratings yet

- Section B&CDocument3 pagesSection B&CTanmay ChopraNo ratings yet

- Receivables Quiz (ARNR) AK PDFDocument5 pagesReceivables Quiz (ARNR) AK PDFNeil Vincent Boco86% (7)

- Accounts ReceivableDocument2 pagesAccounts ReceivableMike MikeNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Ia1 Midterm Activity-1Document2 pagesIa1 Midterm Activity-1Lorraine Millama PurayNo ratings yet

- AR and Allowance For Doubtful AccountsDocument5 pagesAR and Allowance For Doubtful AccountsmedinachrstianaNo ratings yet

- Bookkeeping As An Entrepreneurial ToolDocument29 pagesBookkeeping As An Entrepreneurial ToolVignette San AgustinNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablealford sery Cammayo0% (1)

- 6809 Accounts ReceivableDocument2 pages6809 Accounts ReceivableEsse Valdez0% (1)

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- French Business Dictionary: The Business Terms of France and CanadaFrom EverandFrench Business Dictionary: The Business Terms of France and CanadaNo ratings yet

- 033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)Document11 pages033&117-Sergio F. Naguiat vs. NLRC 269 Scra 564 (1997)wewNo ratings yet

- S&P Gru Rating DowngradeDocument8 pagesS&P Gru Rating Downgraderyan turbevilleNo ratings yet

- Tugas Bahasa Inggris Ke-2Document5 pagesTugas Bahasa Inggris Ke-2Muhammad izzul hikam1CNo ratings yet

- Donor S Tax. CPA REVIEWER. TABAG PDFDocument19 pagesDonor S Tax. CPA REVIEWER. TABAG PDFHansNo ratings yet

- Wells Fargo Clear Access BankingDocument7 pagesWells Fargo Clear Access BankingdebokillsNo ratings yet

- PE Slide 4Document13 pagesPE Slide 4Ajay PasiNo ratings yet

- Train LawDocument44 pagesTrain LawJuan MiguelNo ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- Trendshadow PDFDocument15 pagesTrendshadow PDFMuhammad Azri Bin TokimanNo ratings yet

- Read The Material Below and Answer The Questions That FollowDocument2 pagesRead The Material Below and Answer The Questions That FollowENo ratings yet

- FM PPT IciciDocument14 pagesFM PPT IciciAananNo ratings yet

- United States v. Robert Neil Goode, 945 F.2d 1168, 10th Cir. (1991)Document5 pagesUnited States v. Robert Neil Goode, 945 F.2d 1168, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- Swati Raju Final ReportDocument62 pagesSwati Raju Final Reportshubham kumarNo ratings yet

- FAR610 - Test 1-Apr2018-Q PDFDocument3 pagesFAR610 - Test 1-Apr2018-Q PDFIman NadhirahNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Indemnity & Guarantee PDFDocument55 pagesIndemnity & Guarantee PDFKomal SandhuNo ratings yet

- SICHOTS240114220Document1 pageSICHOTS240114220Sandu MonicaNo ratings yet

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDocument35 pagesFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Hotel Security Service AgreementDocument2 pagesHotel Security Service AgreementmaolewiNo ratings yet

- Villafuerte Vs Court of AppealsDocument3 pagesVillafuerte Vs Court of AppealsOlga ReservaNo ratings yet

- Paparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisDocument29 pagesPaparan Realisasi Investasi Triwulan I 2023 Bahasa InggrisBobby KusumoNo ratings yet

- HDFC Offer DetailsDocument3 pagesHDFC Offer DetailsKarthik ReddyNo ratings yet

- Banking PrinciplesDocument3 pagesBanking PrinciplesNathalieNo ratings yet

- A Handbook of International Trade in Services PDFDocument675 pagesA Handbook of International Trade in Services PDFFAUSTINOESTEBANNo ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

- Scenario A - Coxton Civil Engineering PDFDocument2 pagesScenario A - Coxton Civil Engineering PDFAwez GiniwaleNo ratings yet

- Base Method-FI AADocument4 pagesBase Method-FI AAGanesh RameshNo ratings yet

- Status Watchlist For Complaince - Dec 2011Document10 pagesStatus Watchlist For Complaince - Dec 2011ProshareNo ratings yet

- Land Law: Session Three Easements, Profits and MortgagesDocument39 pagesLand Law: Session Three Easements, Profits and MortgagesAngel MoongaNo ratings yet