Professional Documents

Culture Documents

1966 Benston

1966 Benston

Uploaded by

stephanbubeckCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1966 Benston

1966 Benston

Uploaded by

stephanbubeckCopyright:

Available Formats

Multiple Regression Analysis of Cost Behavior

Author(s): George J. Benston

Source: The Accounting Review, Vol. 41, No. 4 (Oct., 1966), pp. 657-672

Published by: American Accounting Association

Stable URL: http://www.jstor.org/stable/243582 .

Accessed: 17/06/2014 20:18

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

American Accounting Association is collaborating with JSTOR to digitize, preserve and extend access to The

Accounting Review.

http://www.jstor.org

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Multiple Regression Analysis

of Cost Behavior

George J. Benston

ACCOUNTANTS probably have always ment is discussed in the first section of this

been concerned with measuring and paper. Multiple regression analysis is con-

reporting the relationship between sidered first in relation to other methods of

cost and output. The pre-eminence of cost analysis. Then its applicability to cost

financial accounting in this century re- decision problems is delineated. Second,

sulted in directing much of our attention the method of multiple regression is dis-

towards attaching costs to inventories. cussed in nonmathematical terms so that

However, the recent emphasis on decision its uses can be understood better. The

making is causing us to consider ways of third section represents the "heart" of the

measuring the variability of cost with out- paper. Here the technical requirements of

put and other decisions variables. In this multiple regression are outlined, and the

paper, the application, use, and limitations implications of these requirements for the

of multiple regression analysis, a valuable recording of cost data in the firm's ac-

tool for measuring costs, are discussed.' counting records are outlined. The func-

A valid objection to multiple regression tional form of the regression equation is

analysis in the past has been that its com- then considered. In the final section, we

putational difficulty often rendered it too discuss some applications for multiple re-

costly. Today, with high speed computers gression analysis.

and library programs, this objection is no

longer valid: most regression problems 1 The use of statistical analysis for auditing and con-

ought to cost less than $30 to run. Un- trol is outside the scope of this paper. Excellent discus-

fortunately, this new ease and low cost of sions of these uses of statistics may be found in Richard

N. Cyert and H. Justin Davidson, Statistical Sampling

using regression analysis may prove to be for Accounting Information (Prentice-Hall, 1962), and

its undoing. Analysts may be tempted to Herbert Arkin, Handbookof Sampling for Auditing and

Accounting, Volume I: Methods (McGraw-Hill, 1963).

use the technique without adequately

realizing its technical data requirements

and limitations. The "GI-GO" adage,

"garbage in, garbage out," always must be George J. Benston is A ssociate Professor

kept in mind. A major purpose of this of Accounting at the University of Rochester.

paper is to state these requirements and This manuscript was awarded first place in

limitations explicitly and to indicate how the American Accounting Association's 1966

they may be handled. Manuscript Contest, open to members ac-

The general problem of cost measure- quiring the doctoratein 1962 or later.

657

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

658 The Accounting Review, October 1966

THE GENERAL PROBLEM A variant of the fixed-variable method

In his attempts to determine the factors is one in which cost and output data for

that cause costs to be incurred and the many periods are plotted on a two-

magnitudes of their effects, the accountant dimensional graph. A line is then fitted to

is faced with a formidable task. Engineers, the data, the slope being taken as variable

foremen, and others who are familiar with cost per unit of output. When the least-

the production process being studied squares method of fitting the line is used,

usually can provide a list of cost-causing the procedure is called simple linear re-

factors, such as the number of different gression. Until the recent advent of com-

units produced, the lot sizes in which units puters, simple regression was considered to

were made, and so forth. Other factors be quite sophisticated.2 While it was rec-

that affect costs, such as the season of the ognized that its use neglects the effects on

year, may be important, though they are cost of factors other than output, it was de-

more subtle than production factors. The fended on the then reasonable grounds that

accountant must separate and measure multiple regression with more than two or

the effects of many different causal factors three variables is too difficult computation-

whose importance may vary in different ally to be considered economically feasible.

periods. Multiple Regression

CommonlyUsed Methodsof Cost Analysis Multiple regression can allow the ac-

Perhaps the most pervasive method of countant to estimate the amount by which

analyzing cost variability is separation of the various cost-causing factors affect

costs into two or three categories: variable, costs. A very rough description is that it

fixed and sometimes semivariable. But this measures the cost of a change in one vari-

method does not provide a solution to the able, say output, while holding the effects

problem of measuring the costs caused by on cost of other variables, say the season

each of many factors operating simulta- of the year or the size of batches, constant.

neously. In this "direct costing" type of pro- For example, consider the problem of ana-

cedure, output is considered to be the sole lyzing the costs incurred by the shipping

cause of costs. Another objection to this department of a department store. The

method is that there is no way to deter- manager of the department believes that

mine whether the accountant's subjective his costs are primarily a function of the

separation of costs into variable and fixed number of orders processed. However,

is reasonably accurate. Dividing output heavier packages are more costly to handle

during a period into variable cost during than are lighter ones. He also considers the

that period yields a single number (unit weather an important factor; rain or ex-

variable cost) whose accuracy cannot be treme cold slows down delivery time. We

assessed. If the procedure is repeated for might want to eliminate the effect of the

several periods, it is likely that different weather, since it is not controllable. But

unit variable costs will be computed. But we would like to know how much each

the accountant cannot determine whether order costs to process and what the cost of

the average of these numbers (or some heavier against lighter packages is. If we

other summary statistic) is a useful num- can make these estimates, we can (1) pre-

ber. Another important short-coming of pare a flexible budget for the shipping

this method is the assumption of linearity department that takes account of changes

between cost and output. While linearity in operating conditions, (2) make better

may be found, it should not be assumed 2National Association of Accountants, Separating

automatically. and Using Costs as Fixed and Variable, June, 1960.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 659

pricing decisions, and (3) plan for capital cost of output may be affected by such con-

budgeting more effectively. A properly ditions as whether production is increasing

specified multiple regression equation can or decreasing, the lot sizes are large or

provide the required estimates. small, the plant is new or old, the White

A criticism of multiple regression analy- Sox are losing or winning, and so forth.

sis is that it is complicated, and so would Since there is some change in the environ-

be difficult to "sell" to lower management ment of different time periods or in the

and supervisory personnel. However, the circumstances affecting different decisions,

method allows for a more complete speci- it would seem that the accountant must

fication of "reality" than do simple re- make an individual cost analysis for every

gression or the fixed-variable dichotomy. decision considered.

Studies have shown that supervisors tend However, the maximization rule of

to disregard data that they believe are economics also applies to information

"unrealistic such as those based on the technology: the marginal cost of the in-

simplification that costs incurred are a formation must not exceed the marginal

function of units of output only.3 There- revenue gained from it. The marginal

fore, multiple regression analysis should revenue from cost information is the addi-

prove more acceptable to supervisors than tional revenue that accrues or the losses

procedures that require gross simplifica- that are avoided from not making mis-

tion of reality. takes, such as accepting contracts where

The regression technique also can allow the marginal costs exceed the marginal

the accountant to make probability state- revenue from the work, or rejecting con-

ments concerning the reliability of the tracts where the reverse situation obtains.

estimates made.4 For example, he may The marginal cost of information is the

find that the marginal cost of processing a cost of gathering and presenting the in-

package of average weight is $.756, when formation, plus the opportunity cost of

the effects on cost of different weather con- delay, since measurement and presentation

ditions and other factors are accounted are not instantaneous.5 Since these costs

for. If the properties underlying regression can be expected to exceed the marginal

analysis (discussed below) are met, the re- revenue from information for many de-

liability of this cost estimate may be de- cisions, it usually is not economical to

termined from the standard error of the estimate different costs for each different

coefficient (say $.032) from which the ac- decision. Thus, it is desirable to group de-

countant may assess a probability of .95 cision problems into categories that can be

that the marginal cost per package is be- served by the same basic cost information.

tween $.692 and $.820 (.756?.064). Two such categories are proposed here: (1)

Multiple regression analysis, then, is a recurring problems and (2) one-time

very powerful tool; however, it is not ap- problems.

plicable to all cost situations. To decide

the situations for which it is best used, let 3 H. A. Simon, H. Guetzkow, G. Kozmetsky, and G.

Tyndall, Centralization versus Decentralization in

us first consider the problem of cost esti- Organizing the ControllersDepartment (New York: The

mation in general and then consider the Controllership Foundation, 1954).

4 This and the following statements are made in the

sub-class of problems for which multiple context of a Bayesian analysis, in which the decision

regression analysis is useful. maker combines sample information with his prior

judgment concerning unknown parameters. In the

examples given, a jointly diffuse prior distribution is

Types of Cost Decision Problems assumed for all parameters.

6 These two costs are related since delay can be re-

In general, cost is a function of many duced by expending more resources on the information

variables, including time. For example, the system.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

660 The Accounting Review, October 1966

Recurring decision problems are those for cost data are therefore not applicable. Or

which the data required for analysis are the decision may involve a substantial

used with some regularity. Examples are commitment of resources, making the

determining the prices that will be pub- marginal revenue from avoiding wrong

lished in a catalogue, preparation of output decisions quite high.

schedules for expected production, the set-

ting of budgets and production cost MULTIPLE REGRESSION ANALYSIS

standards, and the formulation of fore- Regression analysis is particularly use-

casts. These decisions require cost data in ful in estimating costs for recurring de-

the form of schedules of expected costs due cisions.6 The procedure essentially con-

to various levels of activity over an ex- sists of estimating mathematically the

pected range. average relationship between costs (the

One-time problems are those which oc- "dependent" variable) and the factors

cur infrequently, unpredictably, or are of that cause cost incurrences (the "inde-

such a magnitude as to require individual pendent" variables). The analysis pro-

cost estimates. Examples of these prob- vides the accountant with an estimate of

lems are cost-profit-volume decisions, such the expected marginal cost of a unit

as whether the firm should take a one-time change in output, for example, with the

special order, make, buy, or lease equip- effects on total cost of other factors ac-

ment, develop a new product, or close a counted for. These are the data he re-

plant. These decisions require that cost quires for costing recurring decisions.

estimates be made which reflect conditions The usefulness of multiple regression

especially relevant to the problem at hand. analysis for recurring decisions of costs can

These categories present different re- be appreciated best when the essential

quirements for cost estimation. Recurring nature of the technique is understood. It is

problems require a schedule of expected not necessary that the mathematical

costs and activity. Since these problems proofs of least squares or the methods of

are repetitive, the marginal cost of gather- inverting matrices be learned since library

ing and presenting data each time usually computer programs do all the work.7 How-

is expected to be greater than the mar- ever, it is necessary that the assumptions

ginal revenue from the data. Thus, while underlying use of multiple regression be

the marginal cost of additional production, fully understood so that this valuable tool

for example, will differ depending on such is not misused.

factors as whether overtime is required or Multiple regression analysis presup-

excess capacity is available, in general it is poses a linear relationship between the con-

more profitable to estimate the amount tributive factors and costs.8 The functional

that the marginal cost of the additional relationship between these factors, xi,

production may be, on the average, rather , Ix, and cost, C, is assumed in

X2)...

than to take account of every special multiple regression analysis to be of the

factor that may exist in individual cir- following form:

cumstances.

In contrast, one-time problems are

6 Indeed, its use requires the assumption that the

characterized by the economic desirability past costs used for a regressions analysis are a sample

of making individual cost estimates. We from a universe of possible costs generated by a con-

do not rely on average marginal costs be- tinuing, stationary, normal process.

7 The mathematics of multiple regression is described

cause the more accurate information is in many statistics and econometrics texts.

8 A curvilinear or exponential relationship also can

worth its cost. This situation may occur be expressed as a linear relationship. This technique is

when the problem is unique, and average discussed below.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 661

(1) C8 = 0oXo,9 + 31X1,t + 12X2,t + * of increasing the batches by 3 units, given

+ InXn,t + Pt,

fixed values of the number of units and the

relative proportions of de luxe units pro-

where duced, is estimated to be -$60 ($-20

i3 is a constant term (x0= 1 for all ob- times 3).

servations and time periods), It is tempting to interpret the constant

the O's are fixed coefficients that express term, bo, as fixed cost. But this is not cor-

the marginal contribution of each xi rect unless the linear relationship found in

to C, and the range of observations obtains back to

y is the sum of unspecified factors, the zero output.9 This can be seen best in the

disturbances, that are assumed to be following two-dimensional graph of cost on

randomly distributed with a zero output. The line was fitted with the equa-

mean and constant variance, and tion C=bo+bixi, where the dots are the

t= 1, 2, * , m= time periods. observed values of cost and output. The

slope of the line is the coefficient, bi, an

The 3 coefficients are estimated from a estimate of the marginal change in total

sample of C's and x's from time periods 1 cost (C) with a unit change (z) in output

through m. For example, assume that the (xl). The intercept on the C axis is bo, the

cost recorded in a week is a function of constant term. It would be an estimate of

such specified factors as xi= units of out- fixed cost if the range of observations in-

put, x2= number of units in a batch, and cluded the point where output were zero,

x3=the ratio of the number of "de luxe" and the relationship between total cost and

units to total units produced. Then the output were linear. However, if more ob-

right hand side of equation (2) is an esti- servations of cost and output (the x's) were

mate of the right hand side of equation (1), available, it might be that the dashed

obtained from a sample of weekly observa- curve would be fitted and bowould be zero.

tions, where the b's are estimates of the O3's Thus the value of the constant term, bo, is

and u is the residual, the estimate of /u, the not the costs that would be expected if

disturbance term: there were no output; it is only the value

(2) Ct = bo0,+ b1x1,t + b2X2,9+ b3X3,t+ Ut. that is calculated as a result of the regres-

sion line computed from the available data.

If the values estimated for coefficients of The data for the calculations are taken

the three independent variables, x1, x2, and from the accounting and production re-

X3, are b=100, bi=30, b2=-20, and cords of past time periods. The coefficients

b3= 500, the expected cost (C) for any estimated from these data are averages of

given week (I) is estimated by: past experience. Therefore, the b's calcu-

C = 100 + 30xi - 20X2 + 50OX3. lated are best suited for recurring cost

decisions. The fact that the b's are aver-

Given estimates of the O3's,one has, in ages of past data must be emphasized, be-

effect, estimates of the marginal cost as- cause their use for decisions is based on the

sociated with each of the determining assumption that the future will be like an

factors. In the example given above, the average of past experience.

marginal cost of producing an additional The mathematical method usually used

unit of output, xi, is estimated to be $30, for estimating the O's is the least-squares

with the effects or costs of the size of technique. It has the properties of provid-

batch (x2) and the ratio of the number of

de luxe to total units (X3) accounted for. 9 Fixed cost is defined here as avoidable cost related

Or, f2, the marginal reduction in total cost to time periods and not to output variables.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

662 The Accounting Review, October 1966

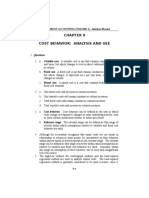

COST 0

(C) 0

OUTPUT

*X

0~~~~~~~~~~~~~~~~~~

-4-/ +

OUTPUTXi

ing best, linear, unbiased estimates of the cost function is used, the coefficient (b,) of

fl's. These properties are desirable because output (xi) is the estimated marginal cost

they tend "to yield a series of estimates of output. With an estimate of the stan-

whose average would coincide with the dard error of the coefficient, sb1,we can say

true value being estimated and whose that the true marginal cost, ,31, is within

variance about that true value is smaller the range bi?Sb1, with a given probabil-

than that of any other unbiased estima- ity."

tors."'0 While these properties are not al-

ways of paramount importance, they are REQUIREMENTSOF MULTIPLE

very valuable for making estimates of the REGRESSIONAND COST

expected average costs required for re- RECORDINGIMPLICATIONS

curring problems. Although multiple regression is an ex-

Another important advantage of the cellent tool for estimating recurring costs,

least-squares technique is that when it is it does have several requirements that

combined with the assumptions about the make its use hazardous without careful

disturbance term (gt) that are discussed in planning.'2 Most of the data requirements

Section III-7 below, the reliability of the of multiple regressions analysis depend on

relations between the explanatory vari- the way cost-accounting records are main-

ables and costs can be determined. Two tained. If the data are simply taken from

types of reliability estimates may be com- the ordinary cost-accounting records of the

puted. One, the standard error of estimate, 10 J. Johnston, Statistical Cost Analysis (New York:

shows how well the equation fits the data. McGraw-Hill, 1960), p. 31.

The second, the standard error of the re- 11The interpretation of the confidence interval is

admittedly Bayesian.

gression coefficients, assesses the probabil- 12 Proofs of the requirements described may be found

ity that the O's estimated are within a in many econometrics textbooks, such as Arthur S.

Goldberger, Econometric Theory (Wiley, 1964), and J.

range of values. For example, if a linear Johnston, EconometricMethods (McGraw-Hill, 1963).

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 663

company, it is unlikely that the output of duction within the period. Otherwise, the

the regression model will be meaningful. variations that occur during the period

Therefore, careful planning of the extent to will be averaged out, possibly obscuring

which the initial accounting data are coded the true relationship between cost and out-

and recorded is necessary before regression put.

analysis can be used successfully. This

section of the paper is organized into four 2. Number of Time Periods (Observations)

groupings that include several numbered For a time series, each observation

subsections in which the principal techni- covers a time period in which data on costs

cal requirements are described, after which and output and other explanatory vari-

the implications for the cost system are ables are collected for analysis. As a mini-

discussed. In the first group, (1) the length mum, there must be one more observation

and (2) number of time periods, (3) the than there are independent variables to

range of observations, and (4) the specifi- make regression analysis possible. (The

cation of cost-related factors are described, excess number is called "degrees of free-

following which their implications for cost dom.") Of course, many more observations

recording are outlined. In the second must be available before one could have

group, (5) errors of measurement and their any confidence that the relationship esti-

cost recording implication are considered. mated from the sample reflects the "true"

The third group deals with (6) correlations underlying relationship. The standard er-

among the explanatory variables and the rors, from which one may determine the

important contribution that accounting range within which the true coefficients lie

analysis can make to this problem. Finally, (given some probability of error), are re-

(7) the requirements for the distribution of duced by the square root of the number of

the nonspecified factors (disturbances) are observations.

given. The implications of these require-

3. Range of Observations

ments for the functional form of the vari-

ables are taken up in Section V. The observations on cost and output

should cover as wide a range as possible. If

1. Length of Time Periods there is very little variation from period to

(a) The time periods (1, 2, 3, * * *, m) period in cost and output, the functional

chosen should be long enough to allow the relationship between the two cannot be

bookkeeping procedures to pair output estimated effectively by regression analy-

produced in a period with the cost in- s1s.

curred because of that production. For

4. Specification of Cost-Related Factors

example,+ if 500 units are produced in a

day, but records of supplies used are kept All factors that affect cost should be

on a weekly basis, an analysis of the cost of specified and included in the analysis.'3

supplies used cannot be made with shorter This is a very important requirement that

than weekly periods. Lags in recording is often difficult to meet. For example, ob-

costs must be corrected or adjusted. Thus, servations may have been taken over a

production should not be recorded as period when input prices changed. The

occurring in one week while indirect labor true relationship between cost and output

is recorded a week later when the pay may be obscured if high output coincided

checks are written. 13 Complete specification is not mandatory if require-

(b) The time periods chosen should be ment 7 (below) is met. However, requirement 7 is not

likely to be fulfilled if the specification is seriously in-

short enough to avoid variations in pro- complete.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

664 The Accounting Review, October 1966

with high input due to price-level effects. each period. Increases in production may

If the higher costs related to higher price be met by overtime. However, decreases

levels are not accounted for (by inclusion may be accompanied by idle time or slower

of a price index as an independent vari- operations. Thus, we would expect the

able) or adjusted for (by stating the de- additional costs of increases to be greater

pendent variable, cost, in constant dol- than the cost savings from decreases."

lars), the marginal cost of additional out- Other commonly found factors that

put estimated will be meaningful only if affect costs are changes in technology,

changes in input prices are proportional to changes in capacity, periods of adjustment

changes in output and are expected to re- to new processes or types of output, and

main so. seasonal differences. The effect of these

factors may be accounted for by including

Implications for Cost Recording variables in the regression equation, by

of 1, 2, 3, and 4 specific adjustment of the data, or by

In general, the time period requirements excluding data that are thought to be

(la, lb and 2) call for the recording of pro- "contaminated."

duction data for periods no longer than one The wide range of observations needed

month and preferably as short as one week for effective analysis also argues against

in length. If longer periods are chosen, it is observation periods of longer than one

unlikely that there will be a sufficient num- month. With long periods, variations in

ber of observations available for analysis production would more likely be averaged

because, as a bare minimum, one more out than if shorter periods were used

period than the number of explanatory (which violates requirement lb). In addi-

variables is needed. Even if it is believed tion, if stability of conditions limits the

that only one explanatory variable (such number of explanatory variables other

as units of output) is needed to specify the than output that otherwise would reduce

cost function in any one period, require- the degrees of freedom, this same stability

ment 4 (that all cost related factors be probably would not produce a sufficient

specified) demands consideration of differ- range of output to make regression anal-

ences among time periods. Thus, such ysis worthwhile. Thus, weekly or monthly

events as changes in factor prices and pro- data usually are required for multiple re-

duction methods, whether production is gression.

increasing or decreasing, and the seasons

of the year might have to be specified as 5. Errors of Measurement

explanatory variables.

It is difficult to believe that data from a

The necessity of identifying all relevant

"real life" production situation will be re-

explanatory variables such as those just

ported without error. The nature of the

mentioned, can be met by having a journal

errors is important since some kinds will

kept in which the values or the behavior of

affect the usefulness of regression analysis

these variables in specific time periods is

more than others will. Errors in the de-

noted. If such a record is not kept, it will

pendent variable, cost, are not fatal since

be difficult (if not impossible) to recall un-

usual events and to identify them with the

14 A dummy variable can be used to represent qualita-

relevant time periods, especially when tive variables, such as P= 1 when production increased

short time periods are used. For example, and P = 0 when production decreased. From the coeffi-

it is necessary to note whether production cient of P, we can estimate the cost effect of differences

in the direction of output change and also reduce con-

increased or decreased substantially in tamination of the coefficient estimated for output.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 665

they affect the disturbance term, M." The error is difficult to correct. Usually, all that

predictive value of the equation is less- one can do is eliminate the bonus payment

ened, but the estimate of marginal cost (p3,) from the data of the period in which it is

is not affected. paid and realize that the estimated coeffi-

But where there are errors in measuring cient of output will be biased downward.

output or the other independent variable Average marginal costs, then, will be un-

(x's), the disturbance term, ,u, will be cor- derstated.

related with the independent variables.'6 A somewhat similar situation follows

If this condition exists, the sample coeffi- from the high cost of the careful record

cient estimated by the least-squares proce- keeping required to charge such input

dure will be an underestimate of the true factors as production supplies to short

marginal cost. Thus, it is very important time periods. In this event, these items of

that the independent variables be mea- cost should be deducted from the other

sured accurately. cost items and not included in the analysis.

The possibility of measurement errors is If these amounts are large enough, specific

intensified by the number of observations analysis may be required, or the decision

requirement. Short reporting periods in- not to account for them carefully may be

crease the necessity for careful classifica- re-evaluated.

tion. For example, if a cost caused by pro- This separation of specific cost items

duction in week 1 is not recorded until also is desirable where the accountant

week 2, the dependent variable (cost) of knows that their allocation to time periods

both observations will be measured in- bears no relation to production. For ex-

correctly. This error is most serious when ample, such costs as insurance or rent may

production fluctuates between observa- be allocated to departments on a monthly

tions. However, when production is in- basis. There is no point in including these

creasing or decreasing steadily, the mea- costs in the dependent variable because it

surement error tends to be constant (either is known that they do not vary with the

in absolute or proportional terms) and independent variables. At best, their in-

hence will affect only the constant term. clusion will only increase the constant

The regression coefficients estimated, and term. However, if by chance they are cor-

hence the estimates of average marginal related with an independent variable, they

cost, will not be affected.'7 will bias the estimates made (requirement

Another important type of measure- 7a). This type of error may be built into

ment error is the failure to charge the pe- the accounting system if fixed costs are

riod in which production occurs with future allocated to time periods on the basis of

costs caused by that production. For ex- production. For example, depreciation

ample, overtime pay for production 15 Let y stand for the measurement errors in C:

workers may be paid for in the week fol- C+-Y=0O+olxl+I+

lowing their work. This can be adjusted for C=flo+Iixi+,A- y.

easily. However, the foreman may not be 16In this event, where ,6stands for the measurement

error in xi:

paid for his overtime directly. Rather,

C=fl0+fl1(X+V)+As

many months after his work he might get a

year-end bonus or a raise in pay. These The new disturbance term ,ll +Au is not independent of

costs cannot easily be associated with the xi because of the covariance between these variables.

17 If the error is

proportionally constant (i.e., 10 per

production that caused them but will be cent of production), transformation of the variables

charged in another period, thus making (such as to logarithms) is necessary.

18 Actually, the present value of the future payment

both periods' costs incorrect."8This type of should be included as a current period cost.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

666 The Accounting Review, October 1966

may be charged on a per unit basis. The centers where a single output is likely to

variance of this cost, then, may be a be produced. This allows a set of multiple

function of the accounting method and regressions to be computed, one for each

not of the underlying economic relation- cost center. The procedure (which may be

ships."9 followed anyway for inventory costing)

also reduces the number of explanatory

6. Correlations among the explanatory (in- variables that need be specified in any one

dependent) variables regression.21 Care must be taken to assure

When the explanatory variables are that the allocation of costs to cost centers

highly correlated with one another, it is is not arbitrary or unrelated to output.

very difficult, and often impossible, to For example, allocation of electricity or

estimate the separate relationships of each rent on a square footage basis can serve no

to the dependent variable. This condition useful purpose. However, allocation of the

is called multicollinearity, and it is a salary of the foremen on a time basis is

severe problem for cost studies. When we necessary when they spend varying

compute marginal costs, we usually want amounts of time per period supervising

to estimate the marginal cost of each of the different cost centers.

different types of output produced in a A further complication arises if several

multiproduct firm. However, this is not al- different types of outputs are produced

ways possible. For example, consider a within the cost centers. For example, the

manufacturer who makes refrigerators, assembly department may work on differ-

freezers, washing machines, and other ent models of television sets at the same

major home appliances. If the demand for time. In most instances, it is neither fea-

all home appliances is highly correlated, sible nor desirable to allocate the cost

the number of refrigerators, freezers and center's costs to each type of output. Cost,

washing machines produced will move to- then, should be regressed on several output

gether, all being high in one week and low variables, one for the quantity of each

in another. In this situation it will be im- type of output. If these independent vari-

possible to disentangle the marginal cost of ables are multicollinear, the standard

producing refrigerators from the marginal errors of their regression coefficients will be

cost of producing freezers and washing so large relative to the coefficients as to

machines by means of multiple regres- make the estimates useless. In this event,

sion.20 an index of output may be constructed, in

Problems similar to that of our man- which the different types of output are

ufacturer can be alleviated by disaggrega- weighted by a factor (such as labor hours)

tion of total cost into several sub-groups that serves to describe their relationship to

that are independent of each other. Pre- cost. Cost then may be regressed on this

analysis and preliminary allocations of weighted index. The regression coefficient

cost and output data may accomplish this computed expresses the average relation-

disaggregation. This is one of the most im-

portant contributions the accountant can 19 Depreciation is assumed to be time, not user, de-

make to regression analysis. preciation.

20 However, the computed regression can provide

If the total costs of the entire plant are useful predictions of total costs if the past relationships

regressed on outputs of different types, it of production among the different outputs are main-

is likely that the computed coefficients will tained.

21 The author used this procedure with considerable

have very large standard errors and, hence, success in estimating the marginal costs of banking

will not be reliable. This situation may be operations. See "Economies of Scale and Marginal Costs

in Banking Operations," National Banking Review,

avoided by first allocating costs to cost 1965, pp. 507-549.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 667

ship between the "bundle" of outputs and (3) E = bo+ biM + b2S1+ b3S2+ b4S3

cost and cannot be decomposed to give the

where

relationship between one output element

and cost. However, since the outputs were E= electricity cost

collinear in the past, it is likely that they M= total machine hours in the plant

will be collinear in the future, so that S= seasonal dummy variables

knowledge about the cost of the "bundle" where

of outputs may be sufficient.

A valid objection to the allocation of S1= 1 for summer, 0 for other seasons

costs to cost centers is that one can never S2= 1 for spring, 0 for other seasons

be sure that the allocations are accurate. S3= 1 for winter, 0 for other seasons

Nevertheless, some allocations must be bo, bi, b2, b3, and b4 are the computed con-

made for multicollinearity to be overcome. stants and coefficients.

Therefore, the statistical method cannot If the regression is fully specified, with all

be free from the accountant's subjective factors that cause the use of electricity in-

judgment; in fact, it depends on it. cluded (such as the season of the year), the

A limitation of analysis of costs by cost regression coefficient of M, bi, is the esti-

centers also is that cost externalities mate of the average marginal cost of

among cost centers may be ignored. For electricity per machine hour. This cost can

example, the directly chargeable costs of be added to the other costs (such as mate-

the milling department may be a function rials and labor) to estimate the marginal

of the level of operations of other depart- cost of specific outputs.

ments. The existence and magnitude of For some activities, physical units, such

operations outside of a particular cost cen- as labor hours, can be used as the depen-

ter may be estimated by including an dent variable instead of costs. This proce-

appropriate independent variable in the dure is desirable where most of the ac-

cost center regression. An over-all index of tivity's costs are a function of such physi-

production, such as total direct labor cal units and where factor prices are ex-

hours on total sales is one such variable. pected to vary. Thus, in a shipping de-

Or, if a cost element is allocated between partment, it may be best to regress hours

two cost centers, the output of one cost worked on pounds shipped, percentage of

center may be included as an independent units shipped by truck, the average num-

variable in the other cost center's regres- ber of pounds per sale, and other explana-

sions. The existence and effect of these tory variables. Then, with the coefficients

possible inter-cost center elements may be estimated, the number of labor hours can

determined from the standard error of the be estimated for various situations. These

coefficient and sign of this variable. hours then can be costed at the current

Some types of costs that vary with ac- labor rate.

tivity cannot be associated with specific

cost centers because it is difficult to make 7. Distribution of the Non-Specified Factors

meaningful allocations or because of book- (Disturbances)

keeping problems (as discussed above). In (a) Serial correlation of the disturbances.

this event, individual regression analyses A very important requirement of least

of these costs probably will prove valuable.

22 Machine hours may not be recorded by cost center

For example, electricity may be difficult to although direct labor hours are. If machine hours (M)

allocate to cost centers although it varies are believed to be proportional to direct labor hours

with machine hours.22A regression can be (L), so that Mj=kjLi, where k is a constant multiplier

that may vary among cost centers, i, kiL, is a perfect

computed such as the following: substitute for Mi.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

668 The AccountingReview, October1966

squares that affects the coefficients and the is that the variance of the disturbance

estimates made about their reliability is term is constant; it should not be a func-

that the disturbances not be serially cor- tion of the level of the dependent or inde-

related. For a time series (in which the pendent variables.23 If the variance of the

observations are taken at successive pe- disturbance is nonconstant, the standard

riods of time), this means that the distur- errors of the coefficients estimated are not

bances that arose in a period t are inde- correct, and the reliability of the coeffi-

pendent from the disturbances that arose cients cannot be determined.

in previous periods, t-1, t-2, etc. The con- When the relationship estimated is be-

sequences of serial correlation of the dis- tween only one independent variable (out-

turbances are that (1) the standard errors put) and the dependent variable (cost),

of the regression coefficients (b's) will be the presence of non-constant variance of

seriously underestimated, (2) the sampling the disturbances can be detected by plot-

variances of the coefficients will be very ting the independent against the dependent

large, and (3) predictions of cost made variable. However, where more than one

from the regression equation will be more independent variable is required, such ob-

variable than is ordinarily expected from servations cannot be easily made. In this

least-squares estimators. Hence, the tests event, the accountant must attempt to

measuring the probability that the true estimate the nature of the variance from

marginal costs and total costs are within a other information and then transform the

range around the estimates computed from data to a form in which constant variance

the regression are not valid. is achieved. At the least, he should decide

(b) Independence from explanatory vari- whether the disturbances are likely to bear

ables. The disturbances which reflect the a proportional relationship to the other

factors affecting cost that cannot be spec- variables (as is commonly the situation

ified must be uncorrelated with the ex- with economic data). If they do, it may be

planatory (independent) variables. (xi, desirable to transform the variables to

x2, . . .I, n). If the unspecified factors are logarithms. The efficacy of the transforma-

correlated with the explanatory variables, tions may be tested by plotting the inde-

the coefficients will be biased and inconsis- pendent variables against the residuals

tent estimates of the true values. Such (the estimates of the disturbances).

correlation often is the result of bookkeep- (d) Normal distribution of the distur-

ing procedures. For example, repairs to bances. For the traditional statistical tests

equipment in a machine shop is a cost- of the regression coefficients and equations

causing activity that often is not specified to be strictly valid, the disturbances

because of quantification difficulties. How- should be normally distributed. Tests of

ever, these repairs may be made when normality can be made by plotting the re-

output is low because the machines can be siduals on normal probability paper, an

taken out of service at these times. Thus, option available in many library regression

repair costs will be negatively correlated programs. While requirement 7 does not

with output. If these costs are not sepa- have implications for the accounting sys-

rated from other costs, the estimated co- tem, it does determine the form in which

efficient of output will be biased down- the variables are specified. These consider-

ward, so that the true extent of variable- ations are discussed in the following sec-

ness of cost with output will be masked. tion.

(c) Variance of the disturbances. A basic 23 Constant variance is known as homoscedasticity.

assumption underlying use of least squares Non-constant variance is called heteroscedasticity.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 669

FUNCTIONALFORM OF THE noted by bars over the letters). Thus, the

REGRESSIONEQUATION estimated marginal cost of P is a function

Thus far we have been concerned with of the levels of the other variables.

correct specification of the regression The logarithmic form of the variables

equation rather than with its functional also allows for estimates of nonlinear re-

form. However, the form of the variables lationships between cost and the explana-

must fit the underlying data well and be of tory variables. The form of the relation-

such a nature that the residuals are dis- ships may be approximated by graphing

tributed according to requirement 7 above. the dependent variable against the inde-

The form chosen first should follow the pendent variable. (The most important

underlying relationship that is thought to independent variable should be chosen

exist. Consider, for example, an analysis of where there is more than one, although in

the costs (C) of a shipping department. this event the simple two-dimensional

Costs may be a function of pounds shipped plotting can only be suggestive.) If the

(P), percentage of pounds shipped by plot indicates that a non-linear rather than

truck (T), and the average number of a linear form will fit the data best, the

effect of using logarithms may be deter-

pounds per sale (A). If the accountant be-

mined by plotting the data on semi-log and

lieves that the change in cost due to a

change of each explanatory variable is un- log-log ruled paper.

affected by the levels of the other explana- If the data seem curvilinear even in

tory variables, a linear form could be used, logarithms, or if an additive rather than a

multiplicative form describes the underly-

as follows:

ing relationships best, polynomial forms of

(4) C= a + bP + cT + dA. the variables may be used. Thus, for an

additive relationship between cost (C) and

In this form, the estimated marginal cost quantity of output (Q), the form fitted

of a unit change in pounds shipped (P) is may be C=a+bQ+cQ2+cQ3. If a multi-

aCl/)P or b. plicative relationship is assumed, the form

However, if the marginal cost of each may be log C=log a+log Q+(log Q)2

explanatory variable is thought to be a Either form describes a large family of

function of the levels of the other explana- curves with two bends.

tory variables, the following form would be When choosing the form of the vari-

better: ables, attention must always be paid to the

C = apbTcAd. effect of the form on the residuals, the

(5)

estimates of the disturbances. Unless the

In this case, a linear form could be variance of the residuals is constant, not

achieved by converting the variable to subject to serial correlation, and approxi-

logarithms: mately normally distributed (requirement

5), inferences about the reliability of the

(6) logC=loga + blogP + clog T coefficients estimated cannot be made.

+ d log A. Graphing is a valuable method for deter-

mining whether or not these requirements

Now, an approximation to the expected are met. (The graphs mentioned usually

marginal cost of a unit change in pounds can be produced by the computers.) Three

shipped (P) is OC/OP= baP-lTeAd, graphs are suggested. First, the residuals

where the other explanatory variables are should be plotted in time sequence. They

held constant at some average values (de- should appear to be randomly distributed,

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

670 The Accounting Review, October 1966

with no cycles or trends.24 Second, the re- and another product, digits, are produced.

siduals can be plotted against the pre- The widgets are assembled in batches

dicted value of the dependent variable. while the larger digits are assembled

There should be as many positive or nega- singly. Weekly observations on cost and

tive residuals scattered evenly about a output are taken and punched on cards. A

zero line, with the variance of the residuals graph is prepared, from which it appears

about the same at any value of the pre- that a linear relationship is present. Fur-

dicted dependent variable. Finally, the ther, the cost of producing widgets is not

residuals should be plotted on normal prob- believed to be a function of the production

ability paper to test for normality. of digits or other explanatory variables.

If the graphs show that the residuals do Therefore, the following regression is com-

not meet the requirements of least squares, puted:

the data must be transformed. If serial

(7) C = 110.3 + 8.21N - 7.83B + 12.32D

correlation of the residuals is a problem,

transformation of the variables may help. A (40.8) (.53) (1.69) (2.10)

commonly used method is to compute first + 235S + 523WV- 136A

differences, in which the observation from

(100) (204) (154)

period i, t-1, t-2, t-3, etc., are re-

placed with t-(t-1), (t-1)-(t-2), where

(t-2)-(t-3), and so forth. With first C= expected cost

difference data, one is regressing the N=number of widgets

change in cost on the change in output, B=average number of widgets in a

etc., a procedure which in many instances batch

may be descriptively superior to other D = number of digits

methods of stating the data. However, the S= summer dummy variable, where

residuals from first difference data also S = 1 for summer, 0 for other

must be subjected to serial correlation seasons

tests, since taking first differences often W= winter dummy variable, where

results in negative serial correlations.25 W= 1 for winter, 0 for other seasons

Where non-constant variance of the re- A = autumn dummy variable, where

siduals is a problem, the residuals may in- A = 1 for autumn, 0 for other

crease proportionally to the predicted seasons

dependent variables. In this event trans- R2= .892 (the coefficient of multiple

formation of the dependent variable to determination)

logarithms will be effective in achieving Standard error of estimate= 420.83,

constant variance. If the residuals increase which is 5% of the dependent variable,

more than proportionately, the square root cost.

of the dependent variable may be a better Number of observations= 156.

transformation.

24 A more formal test for serial correlation is provided

AN ILLUSTRATION by the Durbin-Watson statistic, which is built into

many library regression computer programs. (J. Durbin,

Assume that a firm manufactures a and G. J. Watson, "Testing for Serial Correlation in

Least-Squares Regression," Parts I and II, Biometrica,

widget and several other products, in 1950 and 1951.)

25 If there are random measurement errors in the

which the services of several departments data, observations from period t -1 might be increased

are used. Analysis of the costs of the as- by a positive error. Then t-(1-1) will be lower and

sembly department will provide us with an (t-1)- (t-2) will be higher than if the error were not

present. Consequently, t-(t-1) and (t-1) - 2) will

illustration. In this department, widgets be negatively serially correlated.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

Benston: Multiple Regression Analysis 671

The numbers in parentheses beneath the These calculations also reflect the differ-

coefficients are the standard errors of the ence between the production reported for

coefficients. These results may be used for a given week and the means of the produc-

such purposes as price and output deci- tion data from which the regression was

sions, analysis of efficiency, and capital computed. The greater the difference be-

budgeting. tween given output and the mean output,

For price and output decisions, we the less confidence we have in the predic-

would want to estimate the average mar- tion of the regression equation. For this

ginal cost expected if an additional widget example, the adjusted standard error of

is produced. From the regression we see estimate for the values of the independent

that the estimated average marginal cost, variables given is 592.61. Thus, we assess

aC/dN is 8.21, with the other factors a probability of .67 that the actual costs

affecting costs accounted for. The standard incurred will be between 2918.53 and

error of the coefficient, .53, allows us to 9103.75 (8511.14+592.61) and probability

assess a probability of .67 that the "true" .95 that they will be between 9696.36 and

marginal cost is between 7.68 and 8.74 7325.92 (8511.14+2.592.61). With these

(8.21+.53) and .95 that it is between 7.15 figures, management can decide how un-

and 9.27 (8.21 + 1.06).26 usual the actual production costs are in

The regression also can be used for the light of past experience.

flexible budgeting and analysis of perfor- The regression results may be useful for

mance. For example, assume that the fol- capital budgeting, if the company is con-

lowing production is reported for a given sidering replacing the present widget as-

week: sembly procedure with a new machine.

While the cash flow expected from using

W= 532

the new machine must be estimated from

B=20

engineering analyses, they are compared

D=321

with the cash flows that would otherwise

S= summer= 1

take place if the present machines were

Then we expect that, if this week is like kept. These future expected flows may be

an average of the experience for past estimated by "plugging" the expected out-

weeks, total costs would be: put into the regression equation and cal-

culating the expected costs. XWhilethese

100.3+8.21(532) - 7.83(20)

estimates may be statistically unreliable

+12.32(321)+235.3(1) = 8511.14.

for data beyond the range of those used to

The actual costs incurred can be compared calculate the regression, the estimates may

to this expected amount. Of course, we do still be the best that can be obtained.

not expect the actual amount to equal the

predicted amount, if only because we could CONCLUSION

not specify all of the cost-causing variables The assertion has been made throughout

in the regression equation. However, we this paper that regression analysis is not

can calculate the probability that the ac- only a valuable tool but a method made

tual cost is within some range around the available, inexpensive and easy to use by

expected cost. This range can be com- computers. The reader may be inclined to

puted from the standard error of estimate accept all but the last point, having read

and a rather complicated set of relation-

" The statements about probability are based on a

ships that reflect uncertainty about the Bayesian approach, with normality and diffuse prior

height and tilt of the regression plane. distributions assumed.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

672 The Accounting Review, October 1966

through the list of technical and book- limited as it may be. Nevertheless, it is

keeping problems. Actually it is the ease of necessary to remember that it is a tool, not

computation that the library computer a cure-all. The method must not be used in

programs afford which makes it necessary cost situations where there is not an on-

to stress precautions and care: it is all too going stationary relationship between cost

easy to "crank out" numbers that seem and the variables upon which cost depend.

useful but actually render the whole pro- Where the desired conditions prevail,

gram, if not deceptive, worthless. multiple regression can provide valuable

But when one considers that costs often information for solving necessary decision

are caused by many different factors whose problems, information that can put "life"

effects are not obvious, one recognizes the into the economic models that accountants

great possibilities of regression analysis, are now embracing.

This content downloaded from 62.122.73.86 on Tue, 17 Jun 2014 20:18:12 PM

All use subject to JSTOR Terms and Conditions

You might also like

- Ebook PDF Vital Statistics Probability and Statistics For Economics and Business PDFDocument30 pagesEbook PDF Vital Statistics Probability and Statistics For Economics and Business PDFjerry.leverett380100% (39)

- Practical Signal Processing Using MatlabDocument0 pagesPractical Signal Processing Using MatlabErasmo Vizzaccaro100% (1)

- Chapter 9 QADocument4 pagesChapter 9 QALisden LeeNo ratings yet

- Useful Arbitrary Allocations (With A Comment On The Neutrality of Financial AccountingDocument9 pagesUseful Arbitrary Allocations (With A Comment On The Neutrality of Financial AccountingFRANCISCO JAVIER PEREZ CASANOVANo ratings yet

- Activity Analysis, Cost Behavior and Cost Estimation SolutionDocument62 pagesActivity Analysis, Cost Behavior and Cost Estimation Solutionkayetrish86% (14)

- ECON2206 Assignment 2 William Chau z3376203Document5 pagesECON2206 Assignment 2 William Chau z3376203Peter DundaroNo ratings yet

- AssignmentsDocument6 pagesAssignmentsPeter ChenzaNo ratings yet

- Customer Profitability Analysis Using TiDocument21 pagesCustomer Profitability Analysis Using TiKIttipot JarukornNo ratings yet

- NOTES CHAPTER V Cost EstimationDocument10 pagesNOTES CHAPTER V Cost EstimationHanna CasasNo ratings yet

- Chap 006Document56 pagesChap 006Garrett HarperNo ratings yet

- Cost Estimating SurfaceDocument15 pagesCost Estimating Surfacenicholas.landry-st-onge.1No ratings yet

- CH 02Document47 pagesCH 02Mary BrownNo ratings yet

- Chapter 3 Answer Cost Accounting PDFDocument17 pagesChapter 3 Answer Cost Accounting PDFCris VillarNo ratings yet

- PMBOK Cost (6th Edition) - 268-307-5Document3 pagesPMBOK Cost (6th Edition) - 268-307-5Nathan yemaneNo ratings yet

- Chapter 3 Answer Cost AccountingDocument17 pagesChapter 3 Answer Cost AccountingJuline Ashley A CarballoNo ratings yet

- Chap 006Document61 pagesChap 006palak32No ratings yet

- Chapter 10Document6 pagesChapter 10Arda Raditya TantraNo ratings yet

- WR011i002p00208 Cohon&MarksDocument13 pagesWR011i002p00208 Cohon&MarksPaulo BuenoNo ratings yet

- Paper 2Document12 pagesPaper 2THULASI MANOHARANNo ratings yet

- Fundamentals of Cost Accounting 5th Edition Lanen Solutions Manual 1Document36 pagesFundamentals of Cost Accounting 5th Edition Lanen Solutions Manual 1brittanymartinezdknybgqpes100% (33)

- Cost Accounting - Week 3-Kode DosenDocument20 pagesCost Accounting - Week 3-Kode Dosenqjcn52f9dvNo ratings yet

- TDABC Chapter 2Document8 pagesTDABC Chapter 2veblen07No ratings yet

- Fundamentals of Cost Accounting 5th Edition Lanen Solutions ManualDocument38 pagesFundamentals of Cost Accounting 5th Edition Lanen Solutions Manualjeanbarnettxv9v100% (23)

- Fundamentals of Cost Accounting 5Th Edition Lanen Solutions Manual Full Chapter PDFDocument54 pagesFundamentals of Cost Accounting 5Th Edition Lanen Solutions Manual Full Chapter PDFmarrowscandentyzch4c100% (12)

- Life Cycle Costing CalculationDocument9 pagesLife Cycle Costing CalculationSiu EricNo ratings yet

- CH 03 ImaimDocument19 pagesCH 03 Imaimkevin echiverriNo ratings yet

- Weitzman 1976Document16 pagesWeitzman 1976Marysol AyalaNo ratings yet

- Efficient Global Optimization of Expensive Black-Box FunctionsDocument38 pagesEfficient Global Optimization of Expensive Black-Box FunctionsBengt HörbergNo ratings yet

- Management Approaches, Techniques, and Management ProcessesDocument13 pagesManagement Approaches, Techniques, and Management Processesapi-3709659No ratings yet

- Chapter Five: Cost Estimation: Total CostsDocument2 pagesChapter Five: Cost Estimation: Total CostsPattraniteNo ratings yet

- Pash Nina 2018Document18 pagesPash Nina 2018asesor.askaniNo ratings yet

- An Index For Operational Flexibility in Chemical Process DesignDocument10 pagesAn Index For Operational Flexibility in Chemical Process Designmauricio colomboNo ratings yet

- Strategic Cost ManagementDocument54 pagesStrategic Cost ManagementnarunsankarNo ratings yet

- DOC-20230517-WA0028Document6 pagesDOC-20230517-WA0028layansafsouf1No ratings yet

- An Events Approach To Basic AccountingDocument9 pagesAn Events Approach To Basic AccountingEycha ErozNo ratings yet

- W10. Cost EstimationDocument21 pagesW10. Cost EstimationRafli RifaldiNo ratings yet

- Chapter 3 AnswerDocument16 pagesChapter 3 AnswerSia DLSLNo ratings yet

- A Presentation On Cost AccountingDocument16 pagesA Presentation On Cost Accountingrupesh220387No ratings yet

- SSRN-id920957 - The Legacy of Activity-Based CostingDocument22 pagesSSRN-id920957 - The Legacy of Activity-Based CostingMNo ratings yet

- Long Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationDocument39 pagesLong Horizon Versus Short Horizon Planning in Dynamic Optimization Problems With Incomplete InformationrerereNo ratings yet

- Application of The Parametric Cost Estimation in The Textile Supply ChainDocument12 pagesApplication of The Parametric Cost Estimation in The Textile Supply ChainProf Dr Kathirrvelu SubramanianNo ratings yet

- Kebijakan Dan Standar AkuntansiDocument17 pagesKebijakan Dan Standar Akuntansinita selviaNo ratings yet

- Chapter3 CropDocument43 pagesChapter3 CropOlga IevtushenkoNo ratings yet

- A Model For Optimizing Multi-Product Inventory Systems With Multiple ConstraintsDocument13 pagesA Model For Optimizing Multi-Product Inventory Systems With Multiple ConstraintsDana Marsetiya UtamaNo ratings yet

- Costing Life CycleDocument8 pagesCosting Life CycleDxtr MedinaNo ratings yet

- Leading Industry Tools We Mean Commercially Available Tools That Have BeenDocument8 pagesLeading Industry Tools We Mean Commercially Available Tools That Have BeenSwapnil JaiswalNo ratings yet

- A Logit Model For Budget Allocation Subject To Multi Budget SourcesDocument17 pagesA Logit Model For Budget Allocation Subject To Multi Budget SourcesKHAIRUR RIJALNo ratings yet

- Willigers Bratvold 2009 Least Squares MC Simulation Spe-116026-PaDocument10 pagesWilligers Bratvold 2009 Least Squares MC Simulation Spe-116026-Patonystark8052No ratings yet

- Chapter 5 - Cost EstimationDocument36 pagesChapter 5 - Cost Estimationalleyezonmii0% (2)

- Dea 082917 PDFDocument54 pagesDea 082917 PDFГалина Йорданова-ЧавговаNo ratings yet

- Quantitative Techniques in Decision MakingDocument14 pagesQuantitative Techniques in Decision MakingSELAM ANo ratings yet

- "Standard Cost Variance": Joy SahaDocument5 pages"Standard Cost Variance": Joy SahaJoy SahaNo ratings yet

- Carter CTRL FableDocument919 pagesCarter CTRL FableNaruto MLNo ratings yet

- This Content Downloaded From 129.78.139.29 On Sat, 19 Sep 2020 12:04:40 UTCDocument28 pagesThis Content Downloaded From 129.78.139.29 On Sat, 19 Sep 2020 12:04:40 UTCjzhaNo ratings yet

- Artikel ABC Lean - 2Document9 pagesArtikel ABC Lean - 2morisakiNo ratings yet

- Mining CostDocument23 pagesMining CostAnkush kumarNo ratings yet

- L8 Cma1Document53 pagesL8 Cma11234778No ratings yet

- Cost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualDocument19 pagesCost Behavior: Analysis and Use: Management Accounting (Volume I) - Solutions ManualYella Mae Pariña RelosNo ratings yet

- 2000-Stochastic Budget SimulationDocument9 pages2000-Stochastic Budget SimulationSmita SangewarNo ratings yet

- Powerful Forecasting With MS Excel SampleDocument257 pagesPowerful Forecasting With MS Excel SamplelpachasmNo ratings yet

- Financial Econometrics: Problems, Models, and MethodsFrom EverandFinancial Econometrics: Problems, Models, and MethodsRating: 4 out of 5 stars4/5 (1)

- Optimization Under Stochastic Uncertainty: Methods, Control and Random Search MethodsFrom EverandOptimization Under Stochastic Uncertainty: Methods, Control and Random Search MethodsNo ratings yet

- Scientific Method for Auditing: Applications of Statistical Sampling Theory to Auditing ProcedureFrom EverandScientific Method for Auditing: Applications of Statistical Sampling Theory to Auditing ProcedureNo ratings yet

- Rabe-Hesketh 2006Document23 pagesRabe-Hesketh 2006BipinNo ratings yet

- Cerne 0104-7760: Issn: Cerne@Document7 pagesCerne 0104-7760: Issn: Cerne@daniel ortizNo ratings yet

- Xii Standard Business Mathematics: (New Reduced Syllabus 2020-2021) Model Question PapersDocument20 pagesXii Standard Business Mathematics: (New Reduced Syllabus 2020-2021) Model Question PapersRamya RamyaNo ratings yet

- GLM, GAMs & GLLMs - An Overview of Theory For Applications in Fisheries Research, VENABLES, 2004Document19 pagesGLM, GAMs & GLLMs - An Overview of Theory For Applications in Fisheries Research, VENABLES, 2004Igor MonteiroNo ratings yet

- Estimation PDFDocument348 pagesEstimation PDFA SanthakumaranNo ratings yet

- Newbold Chapter 7Document62 pagesNewbold Chapter 7AshutoshNo ratings yet

- Jimma University: M.SC in Economics (Industrial Economics) Regular Program Individual Assignment: EconometricsDocument20 pagesJimma University: M.SC in Economics (Industrial Economics) Regular Program Individual Assignment: Econometricsasu manNo ratings yet

- Introduction To Estimation: OPRE 6301Document18 pagesIntroduction To Estimation: OPRE 6301faisal gazi100% (1)

- Kao Chiang Chen (1999) International R&D Spillovers An Application of Estimation and Inference in Panel CointegrationDocument19 pagesKao Chiang Chen (1999) International R&D Spillovers An Application of Estimation and Inference in Panel CointegrationAlejandro Granda SandovalNo ratings yet

- DOANE - Stats Answer Key Chap 008Document73 pagesDOANE - Stats Answer Key Chap 008BG Monty 1100% (1)

- Notes On Mathematical Statistics and Data Analysis 3e by J.A. Rice (2006)Document8 pagesNotes On Mathematical Statistics and Data Analysis 3e by J.A. Rice (2006)Ehab AdelNo ratings yet

- A Statistical Model of The Divide-the-Dollar Game: Kristopher W. Ramsay Curtis S. SignorinoDocument24 pagesA Statistical Model of The Divide-the-Dollar Game: Kristopher W. Ramsay Curtis S. SignorinoPaula Zepeda HernándezNo ratings yet

- Statistics For Data ScienceDocument30 pagesStatistics For Data ScienceArminSayadiNo ratings yet

- CH 05Document30 pagesCH 05曾書瑋No ratings yet

- Sjos 12054Document16 pagesSjos 12054唐唐No ratings yet

- Applied Robust Statistics-David OliveDocument588 pagesApplied Robust Statistics-David OliveBoobalan DhanabalanNo ratings yet

- FMOLS ModelDocument8 pagesFMOLS ModelSayed Farrukh AhmedNo ratings yet

- STA 2402 Design and Analysis of Sample Surveys PDFDocument81 pagesSTA 2402 Design and Analysis of Sample Surveys PDFKevin WasikeNo ratings yet

- Bbs14e PPT ch08Document58 pagesBbs14e PPT ch08Nguyen Thi Nhung (K16HL)No ratings yet

- J.D. Opdyke - Robust Stats - ABA Presentation - 08-08-11 - Updated ScribDocument97 pagesJ.D. Opdyke - Robust Stats - ABA Presentation - 08-08-11 - Updated ScribjdopdykeNo ratings yet

- Bias-Corrected Matching Estimators ForDocument11 pagesBias-Corrected Matching Estimators ForMbengue ibNo ratings yet

- MIT18.650. Statistics For Applications Fall 2016. Problem Set 5Document3 pagesMIT18.650. Statistics For Applications Fall 2016. Problem Set 5yilvasNo ratings yet

- Statistical Comparison of The Slopes of Two Regression Lines A TutorialDocument12 pagesStatistical Comparison of The Slopes of Two Regression Lines A TutorialAstridChoqueNo ratings yet

- P.1 Biasedness - The Bias of On Estimator Is Defined As:: Chapter Two EstimatorsDocument8 pagesP.1 Biasedness - The Bias of On Estimator Is Defined As:: Chapter Two EstimatorsFerekkanNo ratings yet

- Articulo 2 Publicado - Numerical Analysis of Histogram Based Estimation Techniques For Entropy Based Spectrum SensingDocument8 pagesArticulo 2 Publicado - Numerical Analysis of Histogram Based Estimation Techniques For Entropy Based Spectrum SensingGUILLERMO PRIETO AVALOSNo ratings yet