Professional Documents

Culture Documents

Btap NLDT

Btap NLDT

Uploaded by

tsunami133100100020Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Btap NLDT

Btap NLDT

Uploaded by

tsunami133100100020Copyright:

Available Formats

Search...

Home Subjects C

MT Exam HW review problems template .xlsx

School Course Subject Date Pages

Point Loma Nazarene University * FIN 415 Finance Mar 8, 2023 12

*We aren't endorsed by this school

Uploaded by ChiefBook8982 on coursehero.com Helpful Unhelpful

Home / Finance

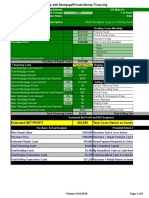

You have decided to buy 200 shares of stock selling at 75 dollars per share using margin with an initial margin requirement of 50 percent. The stock pays

an annual dividend of $1.50 per share, paid quarterly . The interest rate on the margin loan is 6 percent. Determine your return on invested capital if the

stock increases to $85 per share in 6 months and you sell it. What is the annual return on this transaction.

# of Shares Price/Sh Total

Market Value of Securities at purchase 200 $ 75.00 $ 15,000.00 a

Market Value of Securities at sale 200 $ 85.00 $ 17,000.00 b

Gain/loss $ 2,000.00 b-a

Dividend received (6 mos.) 200 $ 0.75 $ 150.00 c

Total gain on investment $ 2,150.00 (b-a) + c

purchase Margin Req. % Total

Equity invested $ 15,000 50% $ 7,500

Margin Loan (Mkt Val. At Purchase - Equity invested) $ 7,500

Interest paid on loan @ 6% for 6 mos. $225.00

Return on Invested Capital

Return $ 1,925.00 (Sale value - Purchase Value + Dividend - Interest)

Equity Invested $ 7,500

Return % (6 mos.) 25.67% (Return/Equity Invested)

1 You want to invest in Ocean Surf Inc. common stock, but you think the valuation is a little rich at

its current price of $50. You decide to place a limit order, set to expire in 60 days, to buy 200

shares at $45.00. Discuss what most likely happens in each of the following scenarios (i.e., did

you buy the stock or not, and if bought, at what price?).

a.) The stock drops to $46.50 the next week.

b.) The stock trades in an orderly manner between $42.50 and $55.00 during the 60 day period.

c.) The stock closes the day you placed the order at $50, but opens the next day, following a bad

earnings report after the market closed, at $39.50 and trades at that price most of the morning.

d.) The stock trades in an orderly manner between $45.50 and $55.00 during the 60 day period

and closes the period at $54.25.

The order will not be executed. The limit order will be executed only is the stock prices

falls to $45 or below. However, since there are two or more months before the limit order

expires, it is still conceivable that the stock price might fall to $45

b. If stock price moved smoothly, you likely bought 200 shares @ $45

C. as the stock price moved below limit price, you likely bought 200 shares @ $39.50

d. Since the stock did not reach limit price of $45 then the limit order was not executed

2 You now own 200 shares of Ocean Surf Inc. and it is trading at $53.00 per share. You paid $45 per share and

want to protect some of your gains in case the stock falls. You decide to place a stop loss order at $48 for 100

shares and a stop-limit at $48 for the other 100 shares. After another bad earnings report, the stock drops

immediately to $44, then slowly recovers to $47 during the trading day. What is the likely outcome of this

transaction at the end of the day, with any gain/loss estimate based on the $45/share purchase price? Did

your profit protection plan work to your satisfaction so far?

the likely loss that you would experience is $1 per share ($45-$44 sale), or $100, on the 100 shares with the stop loss order (which converted to a ma

You will still own the other 100 shares with the stop-limit order as the stock has not recovered to the limit price yet. It did not go to plan!

You sell 200 shares short for $50 per share. You want to limit your losses to no

3 more than $1000. The stock is fairly liquid and easy to trade.

a.) What order should you place?

b.) Are you assured that this will work effectively to limit your loss?

c.) If the answer to b.) is no, how could you be more likely to limit your loss to less

than $1000?

a.)

Shares sold short 200.00

sales price (per share) $ 50

proceeds 10000

maximum loss limit $1,000.00

shares sold short 200.00

loss per share $5.00

Order Required: Buy Stop Order at $ 55.00

b.) No; stop loss could be excercised above $55 if market

price moves fast; stop limit wouldn't work because it

could increase losses

c.) lower buy stop price or place a market order before

stock reaches $55

arket order as soons as the stock trades at or below the limit price).

Assume the expected risk-free rate of return on treasury notes is 2.5%, the

expected inflation rate is 2%, and the equity risk premiums on Normal Co.

and Risky Co are 4% and 7.5%, respectively.

a.) Calculate the "real" risk-free rate of return.

b.) Calculate the required market rate of return Normal Co. and Risky Co.

(a) (b)

Investment Risk-Free Inflation Real Risk Prem. Req Return*

Normal Co. 2.5% 2.0% 0.5% 7.5% 10.0%

Risky Co. 2.5% 2.0% 0.5% 4.0% 6.5%

* this is the nominal required rate of return, not the real (inflation-adjusted) rate of return

Assume the risk-free rate of return is currently 3% and the equity market

rate of return is 10%. Given the betas of the Investments noted below:

a.) what is each investment's expected rate of return using the Capital

Asset Pricing Model (CAPM

b.) which investment would be most and least risky?

Risk-free rate 3.0%

Market return 10.0% 7.0%

Beta

Investment A 1.00

Investment B 1.50

Investment C 0.75

Investment D 0.20

Investment E 2.00

a.

Investment A 10.00%

Investment B 13.50%

Investment C 8.25%

Investment D 4.40%

Investment E 17.00%

b. Investment E is most risky

Investment D would be less risky because it's B is least below 1.0

1 MicroMacro Stock pays a dividend of $.25 per quarter and it's

current stock price is $36.50. What is MicroMacro's dividend

yield?

Dividend per quarter $ 0.25

Annual dividend $ 1.00

Stock price $36.50

Dividend yield 2.74% dividend / stock price

2 MicroMacro's net income for the year is $525,000,000 and it

pays $40,000,000 in preferred stock dividends. MicroMacro has

250,000,000 common shares outstanding.

a What is the net income available for common shareholders?

Total net income 525,000,000

Preferred dividends 40,000,000

Net income available to common shareholders 485,000,000.00 net income - preferred dividends

b. What is the EPS per share for common shareholders?

Net income available to common shareholders 485,000,000.00

Common shares outstanding 250,000,000

EPS $ 1.94 common shareholder net income / shares outstanding

c. Using the information in Problem 1 above, what is MicroMacro's dividend payout ratio?

EPS $ 1.94

Dividend Payment $ 1.00

Payout ratio 51.5% dividend payment / EPS

3 You are provided with the following information:

Total Assets $500,000,000

Total debt $225,000,000

Preferred stock equity $50,000,000

Common stockholders equity $225,000,000

Net Income $45,000,000

# of Preferred shares outstanding 2,000,000

# of Common shares outstanding 20,000,000

Preferred Dividends paid per share $2.00

Common Dividends paid per share $1.00

Market price of preferred stock $26.00

Market price of common stock $50.00

Calculate the following:

a. The company's book value per common share share $ 11.25

b. EPS available to common shareholders $ 2.05

c. Dividend payout ratio (common stock) 48.8%

d. Common stock dividend yield 2.00%

e. Preferred stock dividend yield 7.69%

f. P/E Ratio 24.39

1 Given the following information:

Shares outstanding 1,500,000

Dividend paid per share (annual) $1.50

Net Income $6,250,000 7000000

Stock Price $75.00

Answer the following:

i.) What is the earnings per share (EPS)?

ii.) What is the dividend yield?

iii.) What is the P/E ratio?

iv.) Assuming the P/E ratio remains unchanged, what will the stock price be if the Net Income increases to $7,000,000?

i. EPS calc. $4.17 (net income - dividends) / shares outstanding

ii. Dividend yield calc. 2.0% annual dividends received per share / current market price of stock

iii. P/E ratio calc. 18.0 stock price / EPS

iv. Price at higher NI calc $84.00 ((net income - dividends)/shares o/s)*P/E ratio

2 A company's stock is trading at a P/E of 14. It announces that it expects that sales of a new product will be much more robust than

expected. As a result, management believes that future earnings should grow at a significantly higher rate than previously expected.

(i.) What would be the expected impact on the company's P/E ratio? Higher, lower, no change?

(ii.) What is your reasoning for your answer in (i.)?

(iii.) What would be the expected impact on the stock price?

(iv.) If the P/E and stock price react differently than you had expected, why might that be? (there is no correct answer to this last

question, but there are many credible answers, so think about it and be (realistically) creative if necessary; no martian invasions please).

I. Higher P/E

ii. Given higher expected future earnings, the market would likely increase the P/E to recognize higher NPV of future earnings. Since growth

companies usually have higher P/Es, this news show result in a higher P/E ratio than before

iii. Applying higher P/E ratio to EPS will result in higher stock price

iv. It could be because investors did not believe the product would sell as well as the company expects, so there was no change in investor

expectations (so P/E wouldn't increase)

1 You have been asked by your friend, the CEO of a small local company on which no research is available, to develop

a ballpark estimate of what the current value of the company might be. You decide to estimate the value of the

company by using the data you have been provided by the CEO for 2021, along with the following answers he has

provided to follow-up questions you had.

1. The revenue growth rate for each of the next 5 years is expected to be 15%.

2. Pretax profit margins and the tax rate are not expected to change.

3. The incremental operating capital required to support growth is expected to be 8% of revenue.

4. After 5 years, he is very uncertain about prospects so he expects the company may not grow any further, but will

continue to maintain the Year 5 performance indefinitely.

5. He believes that a reasonable return on similar investments would be 12%.

What is your assessment of the estimated value of your friend's company based on this information?

2022 Actual 2023 Est. 2024 Est. 2025 Est. 2026 Est. 2027 Est.

15% Revenue 10,000,000 11,500,000 13,225,000 15,208,750 17,490,063 20,113,572

10% Profit Before Tax 1,000,000 1,150,000 1,322,500 1,520,875 1,749,006 2,011,357

21% Taxes (210,000) (241,500) (277,725) (319,384) (367,291) (422,385)

Profit After Tax 790,000 908,500 1,044,775 1,201,491 1,381,715 1,588,972

8% Operating Cap'l Adjustment (120,000) (138,000) (158,700) (182,505) (209,881)

Operating Cash Flow 788,500 906,775 1,042,791 1,199,210 1,379,091

12% Terminal Value Estimate 0 0 0 0 13,241,435 With no g

as a perp

NPV of cashflows $3,713,784.66 perpetuit

formula s

PV of Terminal Value $7,513,545.72 --> use PV then add a - in front model, w

Total Value $11,227,330.38 in operati

2 The stock price, EPS and expected EPS growth rate for Companys A & B are provided below.

a.) Calculate the P/E ratio for each stock.

b.) Calculate the PEG ratio for each stock.

c.) Calculate the estimated EPS in 5 years for each stock.

d.) Calculate the P/E in 5 years for each stock, assuming that the stock price does not change.

e.) Which stock looks like a better investment value

Co. based

A on the answer

Co. to

B (d)? Briefly explain why.

f.) What would you expect to happen to the stock prices of each company over the next 5 years (assume no

systematic risk issues arise) if you don't think they will remain unchanged. Just provide a few sentences as to

what will happen and why - feel free to wager a price estimate at the end of Yr 5 for each as well!

what will happen and why - feel free to wager a price estimate at the end of Yr 5 for each as well!

Co. A Co. B

Stock Price $36.00 $75.00

EPS - current $3.00 $3.00

a. PE ratio 12.00 25.00 stock price / EPS

EPS est. Annual Growth Rate - 5 years 8% 25%

b. PEG ratio 1.50 1.00 (P/E) / EPS

c. EPS in 5 years $4.41 $9.16 EPS * ( 1 + Growth Rate)^# years

d. P/E ratio in 5 years if price unchanged 8.2 8.2 stock price / EPS

E. Company B is better because EPS is growing faster but market does not

expect growth

f. A will grow slower than B because it is more expensive. You would expect B to

have higher PEG ratio than A, assuming the EPS groth is accepted as reasonable

by investors. So A PEG should shrink and B PEG should increase

3 You are deciding between two dividend paying stocks, one whose dividend is constant (Co. Z) and another whose dividend is

growing steadily (Co. A). Using the information provided below for each company, determine the following:

(i) what the stock would be worth to you at your required rate of return.

(ii) What is the trailing and the forward dividend yield based on the current stock price.

(iii) Based on the current stock price, should you buy the stock?

Co. Z Co. A

Recent dividend paid $ 3.00 $ 4.00

Dividend growth rate 0% 5%

Your required rate of return 8% 10%

(i) Value of stock $ 37.50 $ 84.00

Current stock price $ 40.00 $ 60.00

(ii) Trailing Dividend yield 7.5% 6.7%

Forward Dividend yield no div. growth rate 7.5% 7.0%

(iii) Buy Stock? (Y/N) no yes pay $60 for stock valued at $84

growth , the terminal value calc is the same

petuity, using the profit after tax as the

ty payment. With growth, you would use a

similar to the dividend growth valuation

with a little more complexity due to changes

ting capital/cashflow.

Page 1 of 12

Uploaded by ChiefBook8982 on coursehero.com

BalanceSheet-Q6 Young Money Assignment Post Closing TB for Manual

Form Module

Ch 5 Project 9 TemplateAlexandra PPP for chapter 9 F2021

Upchurch

Tax-reconciliation- Week 6 News 5

statement

Fin 335 Article 140 Conceptual Exam 1 F305

SUBJECTS LEGAL COMPANY CONNECT WITH US

Accounting Aerospace Engineering Copyright, Community Documents Sitemap Facebook

Guidelines, DSA & other

Anatomy Anthropology Study Guides Instagram

Legal Resources

Arts & Humanities Astronomy FAQ YouTube

Honor Code

Biology Business

Chemistry Civil Engineering Terms

Computer Science Communications Academic Integrity

Economics Electrical Engineering Cookie Policy

English Finance

Privacy Policy

Geography Geology

Do not Sell or Share My

Health Science History Personal Info

Industrial Engineering Information Systems

Law Linguistics

Management Marketing

Material Science Mathematics

Mechanical Engineering Medicine

Nursing Philosophy

Physics Political Science

Psychology Religion

Sociology Statistics

© Learneo, Inc. 2024 Course Sidekick is not sponsored or endorsed by any college or university.

You might also like

- How To See A Breakout Before It Really Happens Sudhir DixitDocument157 pagesHow To See A Breakout Before It Really Happens Sudhir DixitAbdul Sayyad94% (17)

- PeachTree Securities (B-2) FINALDocument45 pagesPeachTree Securities (B-2) FINALish june100% (1)

- Lesson 6 - Accurately Predicting Market DirectionDocument14 pagesLesson 6 - Accurately Predicting Market DirectionFeamor Tiosen67% (3)

- Two Candle Theory - High Probability TradesDocument11 pagesTwo Candle Theory - High Probability Tradessohan100% (3)

- Managerial Finance AssignmentDocument5 pagesManagerial Finance AssignmentvinneNo ratings yet

- Dividend Policy Q and ADocument3 pagesDividend Policy Q and AMd. HabibullahNo ratings yet

- Series 7Document112 pagesSeries 7Mike DeeNo ratings yet

- Binance Clone ScriptDocument3 pagesBinance Clone ScriptAhana zuriNo ratings yet

- Sniper TradingDocument103 pagesSniper TradingDennis Santana88% (8)

- The Laws of Charts and MenDocument49 pagesThe Laws of Charts and MenAlister Mackinnon100% (4)

- Ust Spread Sheet v004 ConstDocument12 pagesUst Spread Sheet v004 ConstConstantin WedekindNo ratings yet

- CF Tutorial 9 - SolutionsDocument9 pagesCF Tutorial 9 - SolutionschewNo ratings yet

- Sample Questions - Mini-Test 1Document4 pagesSample Questions - Mini-Test 1sam heisenbergNo ratings yet

- Benefits AIGDocument3 pagesBenefits AIGsavvy.shopper.mom2No ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Deal Analyzer For FlipsDocument8 pagesDeal Analyzer For FlipsAnonymous i1oQibwTjsNo ratings yet

- REALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Document1 pageREALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Oliver ProctorNo ratings yet

- FM02 Ch03 ShowDocument58 pagesFM02 Ch03 ShowRumah Cantik BungaNo ratings yet

- Capital StructureDocument39 pagesCapital StructureSneha DasNo ratings yet

- Assignment 1 - Solution Guide Private EquityDocument7 pagesAssignment 1 - Solution Guide Private Equitynoah.e.janitzaNo ratings yet

- Partnership LiquidationDocument20 pagesPartnership LiquidationIvhy Cruz Estrella0% (1)

- Thermo Fisher Acquires Life Technologies Finance ModelDocument19 pagesThermo Fisher Acquires Life Technologies Finance Modelvardhan0% (2)

- Managed Funds CalculatorDocument19 pagesManaged Funds CalculatorJulio Cesar ChavezNo ratings yet

- SCORE Financial ModelDocument59 pagesSCORE Financial Modelinsider infooNo ratings yet

- Tutorial 7 Solutions PDFDocument4 pagesTutorial 7 Solutions PDFmusuotaNo ratings yet

- 30-Stock-Portfolio-tracker V 1 2Document18 pages30-Stock-Portfolio-tracker V 1 2SomashekharNsNo ratings yet

- Chapter 7, Exercise 8Document51 pagesChapter 7, Exercise 8MagdalenaNo ratings yet

- Answer: 1 Price After Split Price Before Split Old Share New Share 2 Total Share Total Stock Before Split Stock Split P6-1Document7 pagesAnswer: 1 Price After Split Price Before Split Old Share New Share 2 Total Share Total Stock Before Split Stock Split P6-1Kristo Febrian Suwena -No ratings yet

- Essendon Project 3Document4 pagesEssendon Project 3matthew.epark29No ratings yet

- Cost To Sell CalculatorDocument2 pagesCost To Sell CalculatorAjay SinghNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- Partnership ProblemsDocument3 pagesPartnership ProblemsSana MinatozakiNo ratings yet

- Long-Term Financial Planning and GrowthDocument37 pagesLong-Term Financial Planning and GrowthNauryzbek MukhanovNo ratings yet

- Group 5 Case 6.2Document18 pagesGroup 5 Case 6.2cathy evangelistaNo ratings yet

- Chapter 14 SolutionsDocument11 pagesChapter 14 Solutionssalsabilla rpNo ratings yet

- CIEM5160 Exercise VIDocument3 pagesCIEM5160 Exercise VItszheiwong7No ratings yet

- Dividends and Other PayoutsDocument26 pagesDividends and Other Payoutsmger2000No ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Common and Preferred StockDocument12 pagesCommon and Preferred StockAmna ImranNo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Tying Up Loose Ends: The Trouble Starts After You Tell Me You Are Done.Document24 pagesTying Up Loose Ends: The Trouble Starts After You Tell Me You Are Done.Mansi aggarwal 171050No ratings yet

- Trial Balance Lesson NotesDocument16 pagesTrial Balance Lesson NotesJada ThompsonNo ratings yet

- Topic7 SlidesDocument47 pagesTopic7 Slidesrevantcr7No ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Final Exam Part ADocument2 pagesFinal Exam Part AAdianto TjandraNo ratings yet

- Advanced Accounting Fischer 10th Edition Solutions ManualDocument53 pagesAdvanced Accounting Fischer 10th Edition Solutions ManualMariaDaviesqrbg100% (46)

- Stock Valuation (Version 1)Document32 pagesStock Valuation (Version 1)محمد حمزه زاہد100% (1)

- Finance Management 4Document26 pagesFinance Management 4charithNo ratings yet

- Chap 014Document25 pagesChap 014Rizal YusanNo ratings yet

- Section A - Group 4 - OaktreeDocument6 pagesSection A - Group 4 - OaktreeArchita JainNo ratings yet

- Session 33 TestDocument3 pagesSession 33 TestAnshik BansalNo ratings yet

- Solution E13-22 E 13-23Document2 pagesSolution E13-22 E 13-23Ziyad Imad AyadNo ratings yet

- Case Study 2Document5 pagesCase Study 2Tabish Iftikhar SyedNo ratings yet

- FI CapitalizationTable - Template - v2.5Document14 pagesFI CapitalizationTable - Template - v2.5rrCarvalloNo ratings yet

- IB - Lecture 9Document55 pagesIB - Lecture 9Phan ChiNo ratings yet

- Financial Planning and ForecastingDocument16 pagesFinancial Planning and ForecastingarinNo ratings yet

- 2202 Working PaperDocument25 pages2202 Working Paperjannatulferdousdu003No ratings yet

- Dividend Decision and Stock Dividend-Repurchase-SplitDocument56 pagesDividend Decision and Stock Dividend-Repurchase-SplitA MerchantNo ratings yet

- 09 Partnership GoodwillDocument17 pages09 Partnership GoodwillBabamu Kalmoni JaatoNo ratings yet

- Advanced Rental Income Model v6.4 LockedDocument116 pagesAdvanced Rental Income Model v6.4 LockedVictor IonescuNo ratings yet

- Credit RiskDocument78 pagesCredit RiskcarinaNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-4A RNo ratings yet

- Dividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksFrom EverandDividend Investing: A Beginner's Guide: Learn How to Earn Passive Income from Dividend StocksNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Mobile World Investment CorporationDocument20 pagesMobile World Investment Corporationtsunami133100100020No ratings yet

- Nguyễn Thị Kim ChiDocument8 pagesNguyễn Thị Kim Chitsunami133100100020No ratings yet

- Financial Services and Markets Act 2022Document385 pagesFinancial Services and Markets Act 2022tsunami133100100020No ratings yet

- Practice Problems On Equity Valuation (Docx) - Course SidekickDocument1 pagePractice Problems On Equity Valuation (Docx) - Course Sidekicktsunami133100100020No ratings yet

- PhValuation Free Cash FlowDocument9 pagesPhValuation Free Cash Flowtsunami133100100020No ratings yet

- SV-Chapter 2.4 The Political, Legal and Regulatory EnvironmentsDocument5 pagesSV-Chapter 2.4 The Political, Legal and Regulatory Environmentstsunami133100100020No ratings yet

- Application 1Document3 pagesApplication 1tsunami133100100020No ratings yet

- Assignment BriefDocument3 pagesAssignment Brieftsunami133100100020No ratings yet

- Bodie Investments CH03Document41 pagesBodie Investments CH03rafat.jalladNo ratings yet

- PRICE CHART PATTERN TRADING Trading With Flag, Pennant, Wedge, Double Top, Triangle, Symmetrical Channel, Spike, Gap, Tower,... (Salvon, Derek)Document68 pagesPRICE CHART PATTERN TRADING Trading With Flag, Pennant, Wedge, Double Top, Triangle, Symmetrical Channel, Spike, Gap, Tower,... (Salvon, Derek)HotakoNo ratings yet

- Outline For Course Module 1Document46 pagesOutline For Course Module 1Derrick Kojo Senyo100% (2)

- Gap UP (Intraday)Document51 pagesGap UP (Intraday)pk singhNo ratings yet

- Trading API Reference & Developer Guide: February 25, 2013Document22 pagesTrading API Reference & Developer Guide: February 25, 2013aaaxx waNo ratings yet

- Options Trading CourseDocument12 pagesOptions Trading CourseYogesh NitNo ratings yet

- ANSWER - GB550 Financial Management Unit 1Document9 pagesANSWER - GB550 Financial Management Unit 1LAWRENCE KING'OLANo ratings yet

- The Lazy Trader GuideDocument15 pagesThe Lazy Trader GuideAlex Adallom75% (4)

- At April 2003 - IssueDocument67 pagesAt April 2003 - IssueSamuel Miller100% (1)

- Risk Reward and Money Management in Forex TradingDocument7 pagesRisk Reward and Money Management in Forex Tradingmalcolm iponyNo ratings yet

- Ccount Pening ORM: Corporate TREC Holder of DSE & CSEDocument19 pagesCcount Pening ORM: Corporate TREC Holder of DSE & CSEMohammad RumanNo ratings yet

- Fin221 End 10Document6 pagesFin221 End 10z_k_j_vNo ratings yet

- Chapter 12Document10 pagesChapter 12Ana JikiaNo ratings yet

- Pepperstone Reviewwbfvb PDFDocument24 pagesPepperstone Reviewwbfvb PDFeventbelief8No ratings yet

- Capítulo 3 - InvestimentosDocument31 pagesCapítulo 3 - InvestimentosLúcia Rodrigues da SilvaNo ratings yet

- Investment Analysis and Portfolio Management: First Canadian Edition by Reilly, Brown, Hedges, ChangDocument61 pagesInvestment Analysis and Portfolio Management: First Canadian Edition by Reilly, Brown, Hedges, ChangAdnan KhanNo ratings yet

- Tucknik ThesisDocument18 pagesTucknik ThesisIshan SaneNo ratings yet

- MRG Trading ConditionsDocument15 pagesMRG Trading ConditionsHaykal FauzanNo ratings yet

- TWSGuide PDFDocument1,742 pagesTWSGuide PDFeplan drawingsNo ratings yet

- Donchian Trading GuidelinesDocument9 pagesDonchian Trading GuidelinesIzzadAfif1990100% (1)

- Tmp42e9 TMPDocument120 pagesTmp42e9 TMPFrontiersNo ratings yet

- Securities and Regulations CodeDocument57 pagesSecurities and Regulations CodeBeth Diaz Laurente100% (1)

- Backtest of Trading Systems On Candle ChartsDocument12 pagesBacktest of Trading Systems On Candle Chartsmmm_gggNo ratings yet