Professional Documents

Culture Documents

Negotiable Instruments Act Notes Part 1

Negotiable Instruments Act Notes Part 1

Uploaded by

zombiesunami007Copyright:

Available Formats

You might also like

- Master Your DestinyDocument1 pageMaster Your Destinyzombiesunami007No ratings yet

- Paranoia XP - Gamemaster Screen (MGP6631)Document2 pagesParanoia XP - Gamemaster Screen (MGP6631)Alex Antia100% (1)

- Heirs of Leonilo P. Nuñez, Sr. v. Heirs of Gabino T. Villanoza G.R. No. 218666Document2 pagesHeirs of Leonilo P. Nuñez, Sr. v. Heirs of Gabino T. Villanoza G.R. No. 218666Won Lee100% (1)

- Negotiable InstrumentsDocument20 pagesNegotiable InstrumentsFRANCIS JOSEPH100% (2)

- 08 - Chapter 2 PDFDocument110 pages08 - Chapter 2 PDFIshaan HarshNo ratings yet

- Negotiable Instruments 11 08052023 085030pmDocument46 pagesNegotiable Instruments 11 08052023 085030pmMeraj AliNo ratings yet

- NI Act 1881Document11 pagesNI Act 1881AngelinaGuptaNo ratings yet

- N.I. Act 1881 SummaryDocument23 pagesN.I. Act 1881 SummaryAnanth Swamy100% (1)

- Negotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Document21 pagesNegotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Muhammad Nausherwan0% (1)

- Negotiable Instruments Act-1881Document37 pagesNegotiable Instruments Act-1881Md ToufikuzzamanNo ratings yet

- Negotiable Instrument ActDocument30 pagesNegotiable Instrument ActRiyaNo ratings yet

- Promissory NoteDocument10 pagesPromissory NoteMALKANI DISHA DEEPAKNo ratings yet

- Negotiable Instruments: Class-11 Accountancy Chapter 6Document4 pagesNegotiable Instruments: Class-11 Accountancy Chapter 6Anil MachingsNo ratings yet

- National University of Modern Languages Department of Management SciencesDocument12 pagesNational University of Modern Languages Department of Management SciencesAhmadshabir ShabirNo ratings yet

- Negotiable Instrument ACT, 1881: Csmahima SinghDocument24 pagesNegotiable Instrument ACT, 1881: Csmahima SinghMahima Singh ThakuraiNo ratings yet

- Negotiable Instrument Act 1881Document19 pagesNegotiable Instrument Act 1881Shaktikumar95% (19)

- Negotiable Instruments Act 1881Document64 pagesNegotiable Instruments Act 1881gauravNo ratings yet

- Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, 1881 1881 1881 1881Document23 pagesNegotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, 1881 1881 1881 1881FACTS YOU MISSED -हिंदीNo ratings yet

- Negotiable InstrumentsDocument65 pagesNegotiable InstrumentsfariaNo ratings yet

- Negotiable Instruments AcDocument44 pagesNegotiable Instruments AcMamta KrupaNo ratings yet

- Promissory NoteDocument30 pagesPromissory NoteSabyasachi GhoshNo ratings yet

- Presentation - NEGOTIABLE INSTRUMENT ACTDocument30 pagesPresentation - NEGOTIABLE INSTRUMENT ACThuziNo ratings yet

- Negotiable Instruments Act 1881Document23 pagesNegotiable Instruments Act 1881Sarvar Pathan100% (1)

- Negotiable Instruments ActDocument49 pagesNegotiable Instruments ActJasMeetEdenNo ratings yet

- Business RegulatoryframeworkDocument28 pagesBusiness Regulatoryframeworknidhi boranaNo ratings yet

- 4 - Negotiable Instrument Act PDFDocument48 pages4 - Negotiable Instrument Act PDFAmit royNo ratings yet

- Unit 2 Negotiable Instrument Act, 1881Document18 pagesUnit 2 Negotiable Instrument Act, 1881gonep54580No ratings yet

- Negotiable Instrument123Document16 pagesNegotiable Instrument123Teja RaviNo ratings yet

- Selected Contract II (160-164)Document21 pagesSelected Contract II (160-164)Shivam KesarwaniNo ratings yet

- Cmat3 Buslaw Unit3Document8 pagesCmat3 Buslaw Unit3Aditya JainNo ratings yet

- Unit 6b.law BBA 4th SemDocument47 pagesUnit 6b.law BBA 4th Semnischal bhattaraiNo ratings yet

- Negotiable InstrumentDocument37 pagesNegotiable Instrumentprathamwalke4No ratings yet

- Negotiable Instruments ACT, 1881: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments ACT, 1881: Legal Aspects of BusinessVipul BatraNo ratings yet

- Negotiable Instruments Act 1881Document20 pagesNegotiable Instruments Act 1881Ankit Tiwari100% (1)

- Negotiable InstrumentsDocument46 pagesNegotiable InstrumentsNaina ParasharNo ratings yet

- Nature of Negotiable Instruments: Meaning & DefinitionDocument9 pagesNature of Negotiable Instruments: Meaning & DefinitionAhmadshabir ShabirNo ratings yet

- Law 01Document59 pagesLaw 01NarasimhaModugulaNo ratings yet

- NI ActDocument15 pagesNI ActSrinivas ReddyNo ratings yet

- MBA Negotiable Instruments Act 1881 F2Document72 pagesMBA Negotiable Instruments Act 1881 F2khmahbub100% (1)

- Bill of Exchange (Credit Instruments)Document12 pagesBill of Exchange (Credit Instruments)Aziz Shaikh100% (1)

- Negotiable Instrument Act 1881Document51 pagesNegotiable Instrument Act 1881dikshachhikara20No ratings yet

- Annexure III Negotiable Instrument Act 1881Document11 pagesAnnexure III Negotiable Instrument Act 1881keenu23No ratings yet

- Negotiable Instruments Act 1881Document47 pagesNegotiable Instruments Act 1881SupriyamathewNo ratings yet

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- THE Negotiable Instruments ACT, 1881Document46 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Negotiable Instrument Act-1Document56 pagesNegotiable Instrument Act-1Law LawyersNo ratings yet

- Assignment - 1Document13 pagesAssignment - 1Mohd shakeeb HashmiNo ratings yet

- Module 6 - NotesDocument17 pagesModule 6 - Notesk.akshayaNo ratings yet

- Negotiable Instrument Act Module 4Document20 pagesNegotiable Instrument Act Module 4SANAT MishraNo ratings yet

- Withoutred Script LawDocument7 pagesWithoutred Script LawNeha PatilNo ratings yet

- THE Negotiable Instruments ACT, 1881Document55 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Dept Applied Eco 1Document6 pagesDept Applied Eco 1Meghna TripathiNo ratings yet

- Compiled by CA Vijay RajaDocument194 pagesCompiled by CA Vijay RajaesaiinternalauditNo ratings yet

- Chapter 4 LABDocument23 pagesChapter 4 LABVishvesh ShahNo ratings yet

- Negotiable Instruments Act 1881Document38 pagesNegotiable Instruments Act 1881Shubham ShuklaNo ratings yet

- The Negotiable Instruments Act, 1881: by Syed Rahmat Alam (Bba Finance Final)Document44 pagesThe Negotiable Instruments Act, 1881: by Syed Rahmat Alam (Bba Finance Final)Syed Rahmat AlamNo ratings yet

- Banking PresentationDocument21 pagesBanking Presentationpreetha1507mNo ratings yet

- THE Negotiable Instruments ACT, 1881Document54 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Negotiable Instrument Act 1881Document22 pagesNegotiable Instrument Act 1881Akash saxenaNo ratings yet

- Law Negotiable Instrument 1881 NotesDocument71 pagesLaw Negotiable Instrument 1881 Notesshubh1612100% (2)

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Knt Nallasamy Gounder100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Companies ActDocument30 pagesCompanies Actzombiesunami007No ratings yet

- SAMPURN Accounts Summary NotesDocument97 pagesSAMPURN Accounts Summary Noteszombiesunami007No ratings yet

- 70142bos56088 230802 214313Document2 pages70142bos56088 230802 214313zombiesunami007No ratings yet

- Partnership Act Bulls EyeDocument43 pagesPartnership Act Bulls Eyezombiesunami007No ratings yet

- Companies Act Bulls EyeDocument23 pagesCompanies Act Bulls Eyezombiesunami007No ratings yet

- Dwnload Full Contemporary Issues in Accounting 2nd Edition Rankin Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Issues in Accounting 2nd Edition Rankin Solutions Manual PDFquachhaitpit100% (20)

- Templates 29 Waiver of Eval and 30Document3 pagesTemplates 29 Waiver of Eval and 30May BusligNo ratings yet

- Request For IMDS Data Registration of New PartDocument2 pagesRequest For IMDS Data Registration of New Partminhchi2608No ratings yet

- Anointed With The Oil of GladnessDocument2 pagesAnointed With The Oil of GladnessSonofManNo ratings yet

- Cross Border Governance in Asia - Shabbir Cheema FullbookDocument341 pagesCross Border Governance in Asia - Shabbir Cheema Fullbookokkiharris6126No ratings yet

- November Free Chapter - Cross My Heart by James PattersonDocument12 pagesNovember Free Chapter - Cross My Heart by James PattersonRandomHouseAU67% (3)

- KOHLBERG Notes Stdnts 2020Document5 pagesKOHLBERG Notes Stdnts 2020kartik VermaNo ratings yet

- DSOI - Smart Card FormDocument4 pagesDSOI - Smart Card FormdotpolkaNo ratings yet

- Lina vs. Cariño, G.R. No. 100127Document2 pagesLina vs. Cariño, G.R. No. 100127Bug RancherNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- FTWZDocument7 pagesFTWZchandan jhaNo ratings yet

- Boulder Ordinance 8245Document50 pagesBoulder Ordinance 8245Michael_Lee_RobertsNo ratings yet

- Toastmasters Club HistoryDocument272 pagesToastmasters Club HistoryRecordSetter100% (2)

- Philippine American General Insurance Co v. Sweet LinesDocument11 pagesPhilippine American General Insurance Co v. Sweet LinesPablo Jan Marc FilioNo ratings yet

- Cambridge Primary 2024 Copyright Acknowledgement Booklet v2 - tcm142-707670Document4 pagesCambridge Primary 2024 Copyright Acknowledgement Booklet v2 - tcm142-707670Sara KhalilNo ratings yet

- 56 - PEOPLE OF THE PHILIPPINES v. BENJIE CARANTO Y AUSTRIA, G.R. No. 217668, February 20, 2019Document2 pages56 - PEOPLE OF THE PHILIPPINES v. BENJIE CARANTO Y AUSTRIA, G.R. No. 217668, February 20, 2019Ian PalmaNo ratings yet

- Jai Hanuman Plastic Industries 31.03.22Document4 pagesJai Hanuman Plastic Industries 31.03.22personalmailuse200No ratings yet

- All About IndiaDocument5 pagesAll About IndiaSurya UpadhyayulaNo ratings yet

- 为您的作品指定版权Document8 pages为您的作品指定版权vyf1pusel1j2100% (1)

- Jane AustenDocument5 pagesJane AusteneleanorpickeringNo ratings yet

- Elliott McGinnies ChargingDocument7 pagesElliott McGinnies ChargingWJLA-TVNo ratings yet

- State Bank of India34 PDFDocument2 pagesState Bank of India34 PDFKhushboo PatidarNo ratings yet

- Sluu 083 ADocument19 pagesSluu 083 Amartinch buggsyNo ratings yet

- Taxation SyllabusDocument24 pagesTaxation SyllabusMC TravellersNo ratings yet

- TAXATION LAW II (Notes For Exams)Document59 pagesTAXATION LAW II (Notes For Exams)MrinalBhatnagarNo ratings yet

- SwgdogDocument155 pagesSwgdogapi-108066188No ratings yet

- Strict Liability PDFDocument17 pagesStrict Liability PDFhonourtmanyofaNo ratings yet

Negotiable Instruments Act Notes Part 1

Negotiable Instruments Act Notes Part 1

Uploaded by

zombiesunami007Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Negotiable Instruments Act Notes Part 1

Negotiable Instruments Act Notes Part 1

Uploaded by

zombiesunami007Copyright:

Available Formats

CA FOUNDATION Jai Shree Krishna LAW

THE NEGOTIABLE INSTRUMENTS ACT, 1881

1. MEANING OF NEGOTIABLE INSTRUMENTS

Negotiable Instruments is an instrument (document) which is freely

transferable from one person to another by mere delivery or by indorsement

and delivery.

The property in such an instrument pass to a bonafide transferee for value.

The Act does not define the term „Negotiable Instruments‟.

However, Section 13 of the Act provides for only three kinds of negotiable

instruments namely bills of exchange, promissory notes and cheques,

payable either to order or bearer.

It is to be noted that Hundies, Treasury Bills, Bearer Debentures, Railway

Receipts, Delivery Orders, Bill of Lading etc. are also considered as negotiable

instruments either by mercantile custom or usage.

Type of Negotiable Instrument

Promissory Note Bill of Exchange Cheque

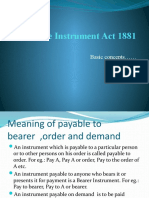

A negotiable instrument is payable to order when:

It is expressed to be so payable

When it is expressed to be payable to a specified person and does not

contain words prohibiting its transfer. (i.e. it is transferrable by

indorsement and delivery)

A negotiable instrument is payable to bearer when:

When it is expressed to be so payable e.g. pay bearer

When the only or last indorsement the instrument is an indorsement in

blank i.e., the person who possesses it can demand payment.

For example,. A cheque made payable to specified person and that cheque is

endorsed by signing on the back of the cheque by that specified person.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Essential Characteristics of Negotiable Instruments

1. It is necessarily in writing and be signed.

2. It is freely transferable from one person to another.

3. Holder’s title is free from defects.

4. It can be transferred any number of times till its satisfaction.

5. Every negotiable instrument must contain an unconditional promise or order to

pay money. The promise or order to pay must consist of money only.

6. The sum payable, the time of payment, the payee, must be certain.

The instrument should be delivered. Mere drawing of instrument does not

create liability.

PROMISSORY NOTE

According to section 4 of the NI Act, 1881,

“A 'promissory note' is an instrument in writing (not being a bank-note

or a currency-note)

containing an unconditional undertaking

to pay a certain sum of money, signed by the maker,

only to, or to the order of, a certain person, or

to the bearer of the instrument.”

Specimen of Promissory note

₹50,000 Lucknow

April

Three months after date, I promise to pay Shri ADITYA KAMDAR 10, 2022

(Payee) or to his order the

sum of Rupees Fifty Thousand, for value received.

Stamp

Sd/- Ram

To,

Shri ADITYA KAMDAR,

B-20, Green Park, Mumbai.

(Maker)

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Parties to promissory note

Maker: The person who makes the promise to pay is called the Maker. He is the

debtor and must sign the instrument.

Payee: Payee is the person to whom the amount on the note is payable.

Essential Characteristics of a Promissory Note

In writing- An oral promise to pay is not sufficient.

There must be an express promise to pay. Mere acknowledgment of debt is

insufficient.

Example 1: I acknowledge myself to be indebted to B in Rs 1,000, to be

paid on demand, for value received. (Valid promissory note as the promise to

pay is definite)

Example 2: “Mr. B, I.O.U Rs 1,000.” – Invalid promissory note as there is no

promise to pay. It is just an acknowledgement of debt.

The promise to pay should be definite and unconditional. Therefore, instruments

payable on performance or non-performance of a particular act or on the happening

or non-happening of an event, are not promissory notes. However, the promise to

pay may be subject to a condition, which according to the ordinary experience of

mankind, is bound to happen.

Example 3: I promise to pay B Rs 500 seven days after my marriage with C.

(the promissory note is invalid as marriage with C may or may not happen.)

Example 4: I promise to pay B Rs 500 on D’s death- as the death of D is

certain, promise in unconditional. Thus, the promissory note is valid.

Example 5: I promise to pay B Rs 500 on D’s death, provided D leaves me

enough to pay that sum. Invalid promissory note as promise is dependent on D’s

leaving behind money which is not certain.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

A promissory note must be signed by the maker otherwise it is incomplete and

ineffective.

Promise to pay money only.

Example 6: I promise to pay B Rs 500 and to deliver to him my black horse on 1st

January next. It is not a valid promissory note, as the promisor needs to

deliver its black horse which is not money.

Promise to pay a certain sum.

Example 7: “I promise to pay B ` 500 and all other sums which shall be due to

him.”- Promissory note invalid as the amount payable is not certain.

But sometimes, the language of a promissory note is such that the amount payable

can be easily ascertained. In such cases, the promissory note will be valid.

Example 8: “I promise to pay B ₹500 alongwith simple interest at the rate

of 12% per annum.

The maker and payee must be certain, definite and different persons. A promissory

note cannot be made payable to the bearer [Section 31 of the Bank of India Act,

1934 (RBI Act)]. Only the Reserve Bank or the Central Government can make or

issue a promissory note 'payable to bearer'.

Stamping: A promissory note must be properly stamped in accordance with the

provisions of the Indian Stamp Act and such stamp must be duly cancelled by

maker's signatures or initials on such stamp or otherwise.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

BILLS OF EXCHANGE

A “bill of exchange” is an instrument in writing

containing an unconditional order,

signed by the maker,

directing a certain person to pay a certain sum of money only to, or

to the order of, a certain person or to the bearer of the instrument.

Specimen of Bill of Exchange

Mr. A (Drawer) 48, MP

Nagar, Bhopal (M.P.)

April 10, 2022

Rs 10,000/-

Four months after date, pay to Mr. B (Payee) a sum of Rupees Ten Thousand, for value received.

To,

Mr. C (Drawee)

576, Arera Colony, Bhopal (M.P.) Signature

Mr. A

Parties to the bill of exchange

a. Drawer: The maker of a bill of exchange.

b. Drawee: The person directed by the drawer to pay is called the 'drawee'. He is

the person on whom the bill is drawn. On acceptance of the bill, he is called

an acceptor and is liable for the payment of the bill. His liability is primary

and unconditional.

c. Payee: The person named in the instrument, to whom or to whose order the

money is, by the instrument, directed to be paid.

Essential characteristics of bill of exchange

It must be in writing.

Must contain an express order to pay.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

The order to pay must be definite and unconditional.

The drawer must sign the instrument.

Drawer, drawee, and payee must be certain.

All these three parties may not necessarily be three different persons.

One can play the role of two. But there must be two distinct persons in any

case. As per Section 31 of RBI Act, 1934, a bill of exchange cannot be made

payable to bearer on demand.

Example : “On demand pay to the bearer the sum of rupees five hundred,

for value received.” It is invalid BOE.

However, a bill of exchange payable on demand, in which name of the

payee is mentioned, is valid.

(a) The sum must be certain.

(b) The order must be to pay money only.

(c) It must be stamped.

Example 10: “On demand pay to A or order the sum of rupees five hundred for

value received.” It is valid BOE.

firstly the seller sold goods to the buyer/customer and

then draws a bill of exchange on him.

The Bill of exchange is delivered by the buyer who accepts it without any condition.

On maturity of bill of exchange, the buyer will pay the amount due to the payee.

(The payee may be the drawer himself or a third party.)

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Difference between promissory note and bill of exchange

Basis Promissory Note Bill of Exchange

Definition "A Promissory Note" is an “A bill of exchange” is an

instrument in writing (not instrument in writing

being a banknote or a containing an unconditional

currency-note) containing order, signed by the maker,

an unconditional directing a certain person to

undertaking signed by the pay a certain sum of money

maker, to pay a certain only to, or to the order of a

sum of money only to, or certain person or to the

to the order of, a certain bearer of the instrument.

person, or to the bearer of

the instrument.

Nature In a promissory note, there is In a bill of exchange, there is an

a promise to pay money. order for making payment.

Parties In a promissory note, there In a bill of exchange, there are 3

are only 2 parties namely: parties which are as under:

i. the maker and i. the drawer

ii. the payee ii. the drawee

iii. the payee

Acceptance A promissory note does not A bill of exchange needs

require any acceptance, as acceptance from the drawee.

it is signed by the person

who is liable to pay.

Payable to A promissory note cannot be On the other hand, a bill of

bearer made payable to bearer. exchange can be drawn

payable to bearer.

However, it cannot be

payable to bearer on

demand.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

1.CLASSIFICATION OF NEGOTIABLE INSTRUMENTS

“Bearer instrument” and “order instrument” [Section 13]

Bearer Instrument:

It is an instrument where the name of the payee is blank or

where the name of payee is specified with the words “or bearer” or

where the last indorsement is blank.

Such instrument can be negotiated by mere delivery.

Order Instrument:

It is an instrument which is payable to a person or

Payable to a person or his order or

Payable to order of a person or

where the last indorsement is in full,

such instrument can be negotiated by indorsement and delivery.

Bearer Instrument Order Instrument

name of the payee is blank or payable to a person, or

name of payee is specified with the words Payable to a person / his order, or

“or bearer” or

the last indorsement is blank Payable to order of a person, or

negotiated by mere delivery the last indorsement is in full,

“Inland instrument” and “Foreign instrument” [Sections 11 & 12]

“Inland instrument”:

A promissory note, bill of exchange or cheque drawn or made in India and

made payable in, or drawn upon any person resident in India

shall be deemed to be an inland instrument.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Place Residence Nature of Instrument w

+ Payable in India OR are Inland Instruments

P/N, BOE C drawn/made in

+ drawn upon a person

India ,

resident in India.

Examples :

(i) A promissory note made in Kolkata and payable in Mumbai.

(ii) A bill drawn in Varanasi on a person resident in Jodhpur (although it is

stated to be payable in Singapore)

(iii) A, a resident of Agra, drew (i.e., made) a bill of exchange in Agra on B, a

merchant in New York. And B accepted the bill of exchange as payable in Delhi. It

is an inland bill of exchange. In this case, the bill of exchange was drawn in

India and also payable in India.

(iv) A, resident of Mumbai, drew a bill of exchange in Mumbai on B, a merchant in

Mathura. And B accepted the bill of exchange as payable in London. It is also

an inland bill of exchange. In this case, the bill of exchange was drawn in India

on a person resident in India. It is immaterial that the amount is payable in

London.

An inland instrument remains inland even if it has been endorsed in a foreign

country.

(v) If the bills of exchange mentioned in above two examples, are endorsed in

France, they will remain inland bills.

“Foreign instrument”:

A foreign instrument is one which is not an inland instrument.

In other words, can be understood as follows:

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Place where bill Residence of Person on whom drawn and Nature

is drawn place where made payable

on a person resident in or outside India + made

payable in India

P/N, BOE, C on a person residing outside India + payable are foreign

drawn/made outside India. bills.

outside India on a person residing in India + payable outside

India

Liability of maker/ drawer of foreign bill

In the absence of a contract to the country, the liability of the maker or drawer of a

foreign promissory note or bill of exchange or cheque is regulated in all essential

matters by the law of the place where he made the instrument, and the respective

liabilities of the acceptor and indorser by the law of the place where the instrument

is made payable (Section 134).

Example : A bill of exchange is drawn by A in Berkley where the rate of

interest is 15% and accepted by B payable in Washington where the rate of

interest is 6%. The bill is indorsed in India and is dishonoured. An action on the

bill is brought against B in India. He is liable to pay interest at the rate of 6%

only. But if A is charged as drawer, he is liable to pay interest at 15%.

Inchoate and Ambiguous Instruments

Inchoate Instrument:

It means an instrument that is incomplete in certain respects.

The drawer/ maker/ acceptor/ indorser of a negotiable instrument may

sign and deliver the instrument to another person in his capacity leaving the

instrument,

either wholly blank or having written on it the word incomplete.

and this gives a power to its holder to make it complete by writing any

amount either within limits specified therein or within the limits specified

by the stamp‟s affixed on it.

The principle of this rule of an inchoate instrument is based on the

principle of estoppel.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

1. Liability on drawing inchoate instrument: The person signing and

delivering the inchoate instrument is liable both to a holder and holder in

due course. However, there is a difference in their respective rights:

2. The holder of such an instrument cannot recover the amount in excess of

the amount intended to be paid by the signor.

3. The holder in due course can, however, recover any amount on such

instrument provided it is covered by the stamp affixed on the instrument.

Section 20 of the Act reads as

“Where one person signs and delivers to another a paper stamped in

accordance with the law relating to negotiable instruments then in force in India,

and either wholly blank or having written thereon an incomplete negotiable

instrument,

He thereby gives prima facie authority to the holder thereof to make or

complete, as the case may be, upon it a negotiable instrument, for any amount

specified therein and not exceeding the amount covered by the stamp. The

person so signing shall be liable upon such instrument, in the capacity in which

he signed the same, to any holder in due course for such amount. Provided

that no person other than a holder in due course shall recover from the

person delivering the instrument anything in excess of the amount intended

by him to be paid thereunder”.

Example : A person signed a blank acceptance on a bill of exchange and kept it

in his drawer. The bill was stolen by X and he filled it up for ₹ 20,000 and

negotiated it to an innocent person for value. It was held that the signer to the

blank acceptance was not liable to the holder in due course because he never

delivered the instrument intending it to be used as a negotiable instrument.

Further, as a condition of liability, the signer as a maker, drawer, indorser or

acceptor must deliver the instrument to another. In the absence of delivery, the

signer is not liable. Furthermore, the paper so signed and delivered must be

stamped in accordance with the law prevalent at the time of signing and on

delivering otherwise the signer is not estopped from showing that the instrument

was filled without his authority.

CA Pavneet Singh Saluja 96806-10072

CA FOUNDATION Jai Shree Krishna LAW

Ambiguous Instrument:

“Where an instrument may be construed either as a promissory note or bill of

exchange, the holder may at his election treat it as either, and the instrument

shall be thenceforward treated accordingly.“

An instrument which is vague and cannot be clearly identified either as a

bill of exchange, or as a promissory note, is an ambiguous instrument.

In other words, such an instrument may be construed either as promissory

note, or as a bill of exchange.

Section 17 provides that the holder may, at his discretion, treat it as either and

the instrument shall thereafter be treated accordingly.

Thus, after exercising his option, the holder cannot change that it is the other

kind of instrument.

CA Pavneet Singh Saluja 96806-10072

You might also like

- Master Your DestinyDocument1 pageMaster Your Destinyzombiesunami007No ratings yet

- Paranoia XP - Gamemaster Screen (MGP6631)Document2 pagesParanoia XP - Gamemaster Screen (MGP6631)Alex Antia100% (1)

- Heirs of Leonilo P. Nuñez, Sr. v. Heirs of Gabino T. Villanoza G.R. No. 218666Document2 pagesHeirs of Leonilo P. Nuñez, Sr. v. Heirs of Gabino T. Villanoza G.R. No. 218666Won Lee100% (1)

- Negotiable InstrumentsDocument20 pagesNegotiable InstrumentsFRANCIS JOSEPH100% (2)

- 08 - Chapter 2 PDFDocument110 pages08 - Chapter 2 PDFIshaan HarshNo ratings yet

- Negotiable Instruments 11 08052023 085030pmDocument46 pagesNegotiable Instruments 11 08052023 085030pmMeraj AliNo ratings yet

- NI Act 1881Document11 pagesNI Act 1881AngelinaGuptaNo ratings yet

- N.I. Act 1881 SummaryDocument23 pagesN.I. Act 1881 SummaryAnanth Swamy100% (1)

- Negotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Document21 pagesNegotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Muhammad Nausherwan0% (1)

- Negotiable Instruments Act-1881Document37 pagesNegotiable Instruments Act-1881Md ToufikuzzamanNo ratings yet

- Negotiable Instrument ActDocument30 pagesNegotiable Instrument ActRiyaNo ratings yet

- Promissory NoteDocument10 pagesPromissory NoteMALKANI DISHA DEEPAKNo ratings yet

- Negotiable Instruments: Class-11 Accountancy Chapter 6Document4 pagesNegotiable Instruments: Class-11 Accountancy Chapter 6Anil MachingsNo ratings yet

- National University of Modern Languages Department of Management SciencesDocument12 pagesNational University of Modern Languages Department of Management SciencesAhmadshabir ShabirNo ratings yet

- Negotiable Instrument ACT, 1881: Csmahima SinghDocument24 pagesNegotiable Instrument ACT, 1881: Csmahima SinghMahima Singh ThakuraiNo ratings yet

- Negotiable Instrument Act 1881Document19 pagesNegotiable Instrument Act 1881Shaktikumar95% (19)

- Negotiable Instruments Act 1881Document64 pagesNegotiable Instruments Act 1881gauravNo ratings yet

- Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, 1881 1881 1881 1881Document23 pagesNegotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, Negotiable Instruments Act, 1881 1881 1881 1881FACTS YOU MISSED -हिंदीNo ratings yet

- Negotiable InstrumentsDocument65 pagesNegotiable InstrumentsfariaNo ratings yet

- Negotiable Instruments AcDocument44 pagesNegotiable Instruments AcMamta KrupaNo ratings yet

- Promissory NoteDocument30 pagesPromissory NoteSabyasachi GhoshNo ratings yet

- Presentation - NEGOTIABLE INSTRUMENT ACTDocument30 pagesPresentation - NEGOTIABLE INSTRUMENT ACThuziNo ratings yet

- Negotiable Instruments Act 1881Document23 pagesNegotiable Instruments Act 1881Sarvar Pathan100% (1)

- Negotiable Instruments ActDocument49 pagesNegotiable Instruments ActJasMeetEdenNo ratings yet

- Business RegulatoryframeworkDocument28 pagesBusiness Regulatoryframeworknidhi boranaNo ratings yet

- 4 - Negotiable Instrument Act PDFDocument48 pages4 - Negotiable Instrument Act PDFAmit royNo ratings yet

- Unit 2 Negotiable Instrument Act, 1881Document18 pagesUnit 2 Negotiable Instrument Act, 1881gonep54580No ratings yet

- Negotiable Instrument123Document16 pagesNegotiable Instrument123Teja RaviNo ratings yet

- Selected Contract II (160-164)Document21 pagesSelected Contract II (160-164)Shivam KesarwaniNo ratings yet

- Cmat3 Buslaw Unit3Document8 pagesCmat3 Buslaw Unit3Aditya JainNo ratings yet

- Unit 6b.law BBA 4th SemDocument47 pagesUnit 6b.law BBA 4th Semnischal bhattaraiNo ratings yet

- Negotiable InstrumentDocument37 pagesNegotiable Instrumentprathamwalke4No ratings yet

- Negotiable Instruments ACT, 1881: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments ACT, 1881: Legal Aspects of BusinessVipul BatraNo ratings yet

- Negotiable Instruments Act 1881Document20 pagesNegotiable Instruments Act 1881Ankit Tiwari100% (1)

- Negotiable InstrumentsDocument46 pagesNegotiable InstrumentsNaina ParasharNo ratings yet

- Nature of Negotiable Instruments: Meaning & DefinitionDocument9 pagesNature of Negotiable Instruments: Meaning & DefinitionAhmadshabir ShabirNo ratings yet

- Law 01Document59 pagesLaw 01NarasimhaModugulaNo ratings yet

- NI ActDocument15 pagesNI ActSrinivas ReddyNo ratings yet

- MBA Negotiable Instruments Act 1881 F2Document72 pagesMBA Negotiable Instruments Act 1881 F2khmahbub100% (1)

- Bill of Exchange (Credit Instruments)Document12 pagesBill of Exchange (Credit Instruments)Aziz Shaikh100% (1)

- Negotiable Instrument Act 1881Document51 pagesNegotiable Instrument Act 1881dikshachhikara20No ratings yet

- Annexure III Negotiable Instrument Act 1881Document11 pagesAnnexure III Negotiable Instrument Act 1881keenu23No ratings yet

- Negotiable Instruments Act 1881Document47 pagesNegotiable Instruments Act 1881SupriyamathewNo ratings yet

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- THE Negotiable Instruments ACT, 1881Document46 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Negotiable Instrument Act-1Document56 pagesNegotiable Instrument Act-1Law LawyersNo ratings yet

- Assignment - 1Document13 pagesAssignment - 1Mohd shakeeb HashmiNo ratings yet

- Module 6 - NotesDocument17 pagesModule 6 - Notesk.akshayaNo ratings yet

- Negotiable Instrument Act Module 4Document20 pagesNegotiable Instrument Act Module 4SANAT MishraNo ratings yet

- Withoutred Script LawDocument7 pagesWithoutred Script LawNeha PatilNo ratings yet

- THE Negotiable Instruments ACT, 1881Document55 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Dept Applied Eco 1Document6 pagesDept Applied Eco 1Meghna TripathiNo ratings yet

- Compiled by CA Vijay RajaDocument194 pagesCompiled by CA Vijay RajaesaiinternalauditNo ratings yet

- Chapter 4 LABDocument23 pagesChapter 4 LABVishvesh ShahNo ratings yet

- Negotiable Instruments Act 1881Document38 pagesNegotiable Instruments Act 1881Shubham ShuklaNo ratings yet

- The Negotiable Instruments Act, 1881: by Syed Rahmat Alam (Bba Finance Final)Document44 pagesThe Negotiable Instruments Act, 1881: by Syed Rahmat Alam (Bba Finance Final)Syed Rahmat AlamNo ratings yet

- Banking PresentationDocument21 pagesBanking Presentationpreetha1507mNo ratings yet

- THE Negotiable Instruments ACT, 1881Document54 pagesTHE Negotiable Instruments ACT, 1881Shradha PadhiNo ratings yet

- Negotiable Instrument Act 1881Document22 pagesNegotiable Instrument Act 1881Akash saxenaNo ratings yet

- Law Negotiable Instrument 1881 NotesDocument71 pagesLaw Negotiable Instrument 1881 Notesshubh1612100% (2)

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Knt Nallasamy Gounder100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Companies ActDocument30 pagesCompanies Actzombiesunami007No ratings yet

- SAMPURN Accounts Summary NotesDocument97 pagesSAMPURN Accounts Summary Noteszombiesunami007No ratings yet

- 70142bos56088 230802 214313Document2 pages70142bos56088 230802 214313zombiesunami007No ratings yet

- Partnership Act Bulls EyeDocument43 pagesPartnership Act Bulls Eyezombiesunami007No ratings yet

- Companies Act Bulls EyeDocument23 pagesCompanies Act Bulls Eyezombiesunami007No ratings yet

- Dwnload Full Contemporary Issues in Accounting 2nd Edition Rankin Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Issues in Accounting 2nd Edition Rankin Solutions Manual PDFquachhaitpit100% (20)

- Templates 29 Waiver of Eval and 30Document3 pagesTemplates 29 Waiver of Eval and 30May BusligNo ratings yet

- Request For IMDS Data Registration of New PartDocument2 pagesRequest For IMDS Data Registration of New Partminhchi2608No ratings yet

- Anointed With The Oil of GladnessDocument2 pagesAnointed With The Oil of GladnessSonofManNo ratings yet

- Cross Border Governance in Asia - Shabbir Cheema FullbookDocument341 pagesCross Border Governance in Asia - Shabbir Cheema Fullbookokkiharris6126No ratings yet

- November Free Chapter - Cross My Heart by James PattersonDocument12 pagesNovember Free Chapter - Cross My Heart by James PattersonRandomHouseAU67% (3)

- KOHLBERG Notes Stdnts 2020Document5 pagesKOHLBERG Notes Stdnts 2020kartik VermaNo ratings yet

- DSOI - Smart Card FormDocument4 pagesDSOI - Smart Card FormdotpolkaNo ratings yet

- Lina vs. Cariño, G.R. No. 100127Document2 pagesLina vs. Cariño, G.R. No. 100127Bug RancherNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- FTWZDocument7 pagesFTWZchandan jhaNo ratings yet

- Boulder Ordinance 8245Document50 pagesBoulder Ordinance 8245Michael_Lee_RobertsNo ratings yet

- Toastmasters Club HistoryDocument272 pagesToastmasters Club HistoryRecordSetter100% (2)

- Philippine American General Insurance Co v. Sweet LinesDocument11 pagesPhilippine American General Insurance Co v. Sweet LinesPablo Jan Marc FilioNo ratings yet

- Cambridge Primary 2024 Copyright Acknowledgement Booklet v2 - tcm142-707670Document4 pagesCambridge Primary 2024 Copyright Acknowledgement Booklet v2 - tcm142-707670Sara KhalilNo ratings yet

- 56 - PEOPLE OF THE PHILIPPINES v. BENJIE CARANTO Y AUSTRIA, G.R. No. 217668, February 20, 2019Document2 pages56 - PEOPLE OF THE PHILIPPINES v. BENJIE CARANTO Y AUSTRIA, G.R. No. 217668, February 20, 2019Ian PalmaNo ratings yet

- Jai Hanuman Plastic Industries 31.03.22Document4 pagesJai Hanuman Plastic Industries 31.03.22personalmailuse200No ratings yet

- All About IndiaDocument5 pagesAll About IndiaSurya UpadhyayulaNo ratings yet

- 为您的作品指定版权Document8 pages为您的作品指定版权vyf1pusel1j2100% (1)

- Jane AustenDocument5 pagesJane AusteneleanorpickeringNo ratings yet

- Elliott McGinnies ChargingDocument7 pagesElliott McGinnies ChargingWJLA-TVNo ratings yet

- State Bank of India34 PDFDocument2 pagesState Bank of India34 PDFKhushboo PatidarNo ratings yet

- Sluu 083 ADocument19 pagesSluu 083 Amartinch buggsyNo ratings yet

- Taxation SyllabusDocument24 pagesTaxation SyllabusMC TravellersNo ratings yet

- TAXATION LAW II (Notes For Exams)Document59 pagesTAXATION LAW II (Notes For Exams)MrinalBhatnagarNo ratings yet

- SwgdogDocument155 pagesSwgdogapi-108066188No ratings yet

- Strict Liability PDFDocument17 pagesStrict Liability PDFhonourtmanyofaNo ratings yet