Professional Documents

Culture Documents

FA 1 Sum

FA 1 Sum

Uploaded by

AashayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA 1 Sum

FA 1 Sum

Uploaded by

AashayCopyright:

Available Formats

Chapter : Redemption of Debentures

Illustration 8:

Noida Toll Bridge Corporation Ltd. has outstanding 50,000, 8% debentures of Rs.100 each issued in

2005 due for redemption on March 31, 2015. It was decided to invest the required amount in

investment earning 10% p.a. Interest on April 30th, 2014. Company decided to create debentures

redemption reserves @ 25%. Record necessary entries regarding redemption on debentures.

Solution:

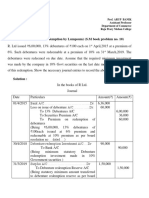

Date No. Particulars Dr.(Rs.) Cr.(Rs.)

2014

April 30 1 Debenture Redemption Investment A/c. Dr. 7,50,000

To Bank A/c 7,50,000

[Being investment made @ 15% of the face value

of debentures to be redeemed]

2015

March 31 2 Bank A/c Dr. 8,18,750

To Debenture Redemption Investment A/c 7,50,000

To Interest Earned A/c ( for 11 months ) 68,750

[Being investment encashed]

March 31 3 Profit & Loss A/c Dr. 12,50,000

To Debenture Redemption Reserve A/c 12,50,000

[Being transfer of profit equal to 25% of the

nominal value of debentures issued]

March 31 4 8% Debentures A/c Dr. 50,00,000

To Debentureholders A/c 50,00,000

[Being amount due to debentureholders on

redemption]

March 31 5 Debentureholders A/c Dr. 50,00,000

To Bank A/c 50,00,000

[Being amount due to debentureholders paid]

March 31 6 Debenture Redemption Reserve A/c Dr. 12,50,000

To General Reserve A/c 12,50,000

[Being transfer of DRR on redemption of all the

debentures]

THE END!!!!

You might also like

- Advanced Accounting by Sohail Afzal Keybook Solution PDF PDFDocument9 pagesAdvanced Accounting by Sohail Afzal Keybook Solution PDF PDFDaud Khan0% (1)

- DK Goal 6Document52 pagesDK Goal 6sahiltiwariii225No ratings yet

- Ts Grewal Class 12 Accountancy Chapter 10Document5 pagesTs Grewal Class 12 Accountancy Chapter 10Saif WaliNo ratings yet

- 12 Accountancy Notes CH09 Redemption of Debentures 01Document12 pages12 Accountancy Notes CH09 Redemption of Debentures 01hazeleydenhereNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Class 12 Accounts Notes Chapter 10 Studyguide360Document18 pagesClass 12 Accounts Notes Chapter 10 Studyguide360AKSHAJ AGGARWALNo ratings yet

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- CA Inter Accounts A MTP 1 Nov 2022Document13 pagesCA Inter Accounts A MTP 1 Nov 2022smartshivenduNo ratings yet

- 12 Redemption of DebenturesDocument13 pages12 Redemption of DebenturesRohith KumarNo ratings yet

- 637617311650478425SM Session12Document4 pages637617311650478425SM Session12kreshmith2No ratings yet

- 17269pe2 Sugg June09 1 PDFDocument22 pages17269pe2 Sugg June09 1 PDFSahil GoyalNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Int Reconstruction 2019 Old-1Document14 pagesInt Reconstruction 2019 Old-1H122 Pallabi MukherjeeNo ratings yet

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- Marking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015Document13 pagesMarking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015kamalNo ratings yet

- 2016 12 Accountancy Lyp Set 01 Outside Delhi Ans Bw0uiwDocument18 pages2016 12 Accountancy Lyp Set 01 Outside Delhi Ans Bw0uiwVijayNo ratings yet

- 67 1 1 Accountancy MsDocument12 pages67 1 1 Accountancy MsEric PottsNo ratings yet

- Internal Reconstruction PDFDocument19 pagesInternal Reconstruction PDFvasudevprasadNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- TrailDocument6 pagesTrailNaman agrawalNo ratings yet

- BuyBack of Shares PQ SolDocument11 pagesBuyBack of Shares PQ SolKaran MokhaNo ratings yet

- March 2023 Answer Key CorporateaccountingDocument11 pagesMarch 2023 Answer Key Corporateaccountinghisarahhh4No ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Ts Grewal Class 12 Accountancy Chapter 8Document8 pagesTs Grewal Class 12 Accountancy Chapter 8Tarun50% (2)

- Chapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)Document2 pagesChapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)shubham ThakerNo ratings yet

- 8 BuyBack of SharesDocument20 pages8 BuyBack of SharesNIKHIL MITTALNo ratings yet

- Problem - 7: Problem On Redemption by Annual DrawingDocument5 pagesProblem - 7: Problem On Redemption by Annual DrawingGopal DasNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- Xii Accountancy Question Bank 1Document46 pagesXii Accountancy Question Bank 1KavoNo ratings yet

- Wa0005.Document36 pagesWa0005.mitanshigoyal7No ratings yet

- Journal Entries of The Hypothetical CaseDocument3 pagesJournal Entries of The Hypothetical Casekimice5490No ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Book Keeping and Accounts Model Answer Series 2 2011Document16 pagesBook Keeping and Accounts Model Answer Series 2 2011i saiNo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- ESOP PQ SolDocument7 pagesESOP PQ SolvedthkNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Class Work Chp. 8Document12 pagesClass Work Chp. 8Isha KatiyarNo ratings yet

- Corporate AccountingDocument93 pagesCorporate AccountingKalp JainNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Accounting For Share Capital (9 Questions - 3 Solved and 6 Unsolved)Document5 pagesAccounting For Share Capital (9 Questions - 3 Solved and 6 Unsolved)yuvraj gosain100% (2)

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNo ratings yet

- CR Assignment Punishment For Whole ClassDocument3 pagesCR Assignment Punishment For Whole Classpamela17desaiNo ratings yet

- CBSE Class XII 2024 Commerce Accountancy Sample Paper SolDocument11 pagesCBSE Class XII 2024 Commerce Accountancy Sample Paper Solrajputudbhav2429No ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- Bhaskar AssignmentDocument2 pagesBhaskar Assignment2009silmshady6709No ratings yet

- DebentureDocument3 pagesDebentureKevin DsilvaNo ratings yet

- CH - 02 Issue and Redemption of DebenturesDocument7 pagesCH - 02 Issue and Redemption of DebenturesMahathi AmudhanNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- Problems On Issue of SharesDocument8 pagesProblems On Issue of SharesgeddadaarunNo ratings yet

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDocument17 pagesTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (2)

- CR Assignment Roll No. 118 New Sum 22Document4 pagesCR Assignment Roll No. 118 New Sum 22pamela17desaiNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set1 PDFDocument42 pages12 Accountancy Lyp 2017 Outside Delhi Set1 PDFAshish GangwalNo ratings yet

- 637617311031534884SM Session11Document3 pages637617311031534884SM Session11kreshmith2No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet