Professional Documents

Culture Documents

03 Npo

03 Npo

Uploaded by

bhawanar3950Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 Npo

03 Npo

Uploaded by

bhawanar3950Copyright:

Available Formats

Financial Statements Financial Statements of Not-For-Profit Organizations

of Not-For-Profit Organizations

Practical Questions

Question No. 1

The receipts and payments for the Swaraj Club for the year ended March 31, 2016 were: Entrance fees ₹ 300;

Membership Fees ₹ 3,000; Donation for Club Pavilion ₹ 10,000, Foodstuff sales ₹ 1,200; Salaries and Wages ₹

1,200 Purchase of Foodstuff ₹ 800; Construction of Club Pavilion ₹ 11,000; General Expenses ₹ 600; Rent and

Taxes ₹ 400; Bank Charges ₹ 160.

Cash in hand-April. 1st ₹ 200, March 31st ₹ 350

Cash in Bank-April. 1st ₹ 400; March 31st ₹ 590

You are required to prepare Receipts and Payment Account.

Swaraj Club

Receipts and Payments Accounts fortheyearended 31stMarch,2016

Receipts ₹ Payments ₹

To Balance b/d(opening bal.) By Salaries and Wages 1,200

Cash in hand 200

To Cash with bank 400 By Purchase of Foodstuff 800

To Entrance Fees 300 By Club Pavilion (Expenditure

To Membership Fees 3,000 on its construction) 11,000

To Donation of Account By General Expenses 600

of Club Pavilion 10,000 By Rent and Taxes 400

To Sales of foodstuff 1,200 By Bank Charges 160

By Balance c/d (closing bal)

Cash in hand 350

Cash in bank 590

15,100 15,100

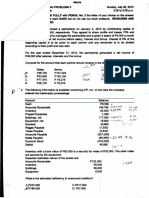

Question No. 2

The following was the Receipts and Payments Account of Exe Club for the year ended March. 31, 2016

All the figures in thousands

Receipts ₹ Payments ₹

Cash in hand 100 Groundsman’s Fee 750

Balance at Bank as per Pass Book: Moving Machine 1,500

Deposit Account 2,230 Rent of Ground 250

Current Account 600 Cost of Teas 250

Bank Interest 30 Fares 400

By CMA, CS Rohan Nimbalkar 1

Financial Statements of Not-For-Profit Organizations

Donations and Subscriptions 2,600 Printing & Office Expenses 280

Receipts from teas 300 Repairs to Equipment 500

Contribution to fares 100 Honorarium to Secretary and Treasurer of 400

2015

Sale of Equipment 80 Balance at Bank as per Pass Book

Net proceeds of Variety Entertainment 780 Deposit Account 3,090

Donation for forth coming Tournament 1,000 Current Account 150

7,820 Cash in hand 250

7,820 7,820

You are given the following additional information:

April, 1, 2015 March, 31, 2016

₹ ₹

Subscription due 150 100

Amount due for printing etc. 100 80

Cheques unpresented being payment for repairs 300 260

Estimated value of machinery and equipment 800 1,750

Interest not yet entered in the Pass book 20

Bonus to Groundsman o/s. 300

For the year ended March. 31, 2016, the honorarium to the Secretary and Treasurer are to be increased by a total

of ₹ 200.

Required - Prepare the Income and Expenditure Account for period ending 31-03-2016 and the relevant Balance

Sheet.

SOLUTION

IncomeandExpenditureAccountofExeClub for the year ending 31st March, 2016 (all figures in thousands)

Expenditure ₹ Income ₹

To Groundsman’s fee 750 By Donations and 2,550

To Rent of Ground 250 Subscription By Receipts 50

To Fares’ Expenses 400 from teas

Less : Contribution (100) 300 (Fares) less expenses (₹ 300

To Printing & Office Expenses 260 - ₹ 250)

To Repairs 460 By Proceeds of Variety 780

To Depreciation on Machinery Entertainment 50

Opening balance and Purchases 2,300 By Interest (₹ 30 + ₹ 20)

Less: Closing Balance (1,750)

550

Less: Sale (80) 470

By CMA, CS Rohan Nimbalkar 2

Financial Statements of Not-For-Profit Organizations

To Honorarium to Sect. & Treasurer 600

To Bonus to Groundsman 300

To Excess of Income over Expenditure 40

3,430 3,430

Balance Sheet of Exe Club as on 31st March, 2016

Liabilities ₹ Assets ₹

Outstanding Expenses:

Grounds man Bonus 300 Cash in hand 250

Printing 80 Cashin Deposit A/c 3,090

Honorarium 600 Subscription Due Interest 100

Bank Overdraft (₹ 260-₹ 150) 110 Due 20

Capital Fund: Machinery &Equipments 1,750

Opening 3,080

Add: Surplus for the year 40 3,120

Tournament Fund (Donation) 1,000

5,210 5,210

Balance Sheet as on 1st April, 2015

Liabilities ₹ Assets ₹

Outstanding Expenses and Cash in hand 100

Honorarium (₹ 100 + ₹ 400) 500 Cash in Deposit A/c 2,230

Capital Fund (Balancing Figure) 3,080 Cash in Current A/c 300

Subscription Due 150

Machinery 800

3,580 3,580

Question No. 3

The Income and Expenditure Account of the Youth Club for the Year 2016 is as follows:

Expenditure ₹ Income ₹

To Salaries 4,750 By Subscription 7,500

To General Expenses 500 By Entrance Fees 250

To Audit Fee 250 By Contribution for annual dinner 1,000

To Secretary’s Honorarium 1,000 By Annual Sport meet receipts 750

To Stationery & Printing 450

To Annual Dinner Expenses 1,500

To Interest & Bank Charges 150

To Depreciation 300

To Surplus 600

9,500 9,500

This account had been prepared after the following adjustments:

By CMA, CS Rohan Nimbalkar 3

Financial Statements of Not-For-Profit Organizations

₹

Subscription outstanding at the end of 2015 600

Subscription received in Advance on 31st December, 2015 450

Subscription received in advance on 31st December, 2016 270

Subscription outstanding on 31st December, 2016 750

Salaries Outstanding at the beginning and the end of 2016 were respectively ₹ 400 and ₹ 450. General Expenses

include insurance prepaid to the extent of ₹ 60. Audit fee for 2016 is as yet unpaid. During 2016 audit fee for

2015 was paid amounting to ₹ 200.

The Club owned a freehold lease of ground valued at ₹ 10,000. The club had sports equipment on 1st January,

2016 valued at ₹ 2,600. At the end of the year, after depreciation, this equipment amounted to ₹ 2,700. In 2015,

the Club has raised a bank loan of ₹ 2,000. This was outstanding throughout 2016. On 31st December, 2016

cash in hand amounted to ₹ 1,600.

Required

Prepare the Receipts and Payments Account for 2016 and Balance Sheet as at the end of the year.

SOLUTION

The Youth Club Receipts and Payments Account

for the year ended 31st December, 2016

Receipts ₹ ₹ Payments ₹ ₹

To Balanceb/d(balancingfigure) 1,390 By Salaries 4,750

To Subscriptions as per Income & 7500 Add: Paid for 2015 400

Expenditure Account 5,150

Add: 2015’s Received 600 Less: Unpaid for 2016 By (450) 4,700

2017’s Received 270 General Expenses 500

8,370 Add : Paid for 2017 60 560

Less: 2016’s Received in 2015 (450) By Audit fee (2016) Secy. By 200

7,920 Honorarium 1,000

Less: 2016’s Outstanding (750) 7,170 By Stationery & Printing 450

To Entrance Fees 250 By Annual Dinner Expenses 1,500

To Contribution for annual By Interest & Bank Charges 150

dinner 1,000 By SportsEquipments 400

To Sport meet :

Receipt less 750 [2700-(2600-300)] 1,600

Balance c/d

10,560 10,560

To Balance b/d 1,600

By CMA, CS Rohan Nimbalkar 4

Financial Statements of Not-For-Profit Organizations

Balance Sheet of Youth Club as at December 31, 2016

Liabilities ₹ ₹ Assets ₹ ₹

Subscription received FreeholdGround 10,000

in advance 270 Sport Equipment:

Audit Fee Outstanding 250 As per last Balance

Salaries Outstanding 450 Sheet Additions 2,600

Bank Loan 2,000 400

CapitalFund : Less : Depreciation 3,000

Balance as per previous (300) 2,700

Balance Sheet 11,540 Subscription Outstanding 750

Add : Surplus for 2016 600 12,140 Insurance Prepaid 60

Cash in hand 1,600

15,110 15,110

Balance Sheet of Youth Club as at 31st December, 2015

Liabilities ₹ Assets ₹

Subscriptions received in advance 450 Freehold Ground 10,000

Salaries outstanding 400 Sports Equipment 2,600

Audit fees unpaid 200 Subscriptions Outstanding 600

Bank Loan 2,000 Cash in hand 1,390

Capital Fund (balancing figure) 11,540

14,590 14,590

Question No. 4

The Sportwriters Club gives the following Receipts and Payments Account for the year ended March 31, 2016:

Receipts and Payments Account

Receipts ₹ Payments ₹

Balance b/d 4,820 By Salaries 12,000

Subscriptions 28,600 By Rent and electricity 7,220

Miscellaneous income 700 By Library books 1,000

Interest on Fixed deposit 2,000 By Magazines and newspapers 2,172

By Sundry expenses 10,278

By Sports equipments 1,000

By Balance c/d 2,450

36,120 36,120

Figures of other assets and liabilities are furnished as follows:

By CMA, CS Rohan Nimbalkar 5

Financial Statements of Not-For-Profit Organizations

As at 31st March As at 31st March

2015 2015

₹ ₹

Salaries outstanding 710 170

Outstanding rent & electricity 864 973

Outstanding for magazines and newspapers 226 340

Fixed Deposit (10%) with bank 20,000 20,000

Interest accrued thereon 500 500

Subscription receivable 1,263 1,575

Prepaid expenses 417 620

Furniture 9,600

Sports equipments 7,200

Library books 5,000

The closing values of furniture and sports equipments are to be determined after charging depreciation at

10% and 20% p.a. respectively inclusive of the additions, if any, during the year. The Club's library books are

revalued at the end of every year and the value at the end of March 31, 2016 was ₹ 5,250.

Required

From the above information you are required to prepare:

(a) The Club's Balance Sheet as at March 31, 2015;

(b) The Club's Income and Expenditure Account for the year ended March 31, 2016.

(c) The Club's Closing Balance Sheet as at March 31, 2016.

SOLUTION

a) Sportswriters Club Balance Sheet as on 31st March, 2015

Liabilities ₹ ₹ Assets ₹

Outstanding expenses : Furniture 9,600

Salaries 710 Library Books 5,000

Rent &Electricity 864 Sports Equipment 7,200

Magazines &Newspapers 226 1,800 Fixed Deposit 20,000

Capital Fund (Balancing figure) 47,000 Cash in hand & at Bank 4,820

Prepaid Expenses 417

Subscription receivable 1,263

Interest accrued 500

48,800 48,800

By CMA, CS Rohan Nimbalkar 6

Financial Statements of Not-For-Profit Organizations

b) Income and Expenditure Account for the year ending 31st March, 2016

Expenditure ₹ Income ₹

To Salaries 11,460 By Subscription By 28,912

To Rent & Electricity 7,329 Interest on FD By 2,000

To Magazines & Newspapers To 2,286 Misc. Income 700

Sundry Expenses 10,075 By Excess of expenditure

To Depreciation : over income 2,888

Furniture 960

Sports Equipment 1,640

Library Books 750 3,350

34,500 34,500

c) Balance Sheet of Sports Writers Club as on 31st March, 2016

Liabilities ₹ ₹ Assets ₹ ₹

Outstanding Expenses: Furniture

Salaries 170 Cost 9,600

Rent & Electricity 973 Less : Depreciation (960) 8,640

Newspapers Capital 340 1,483 Magazines&Sport

Fund: Equipment:

Opening balance 47,000 Opening balance 7,200

Less : Excess of exp. Addition 1,000

(2,888) 44,112

overincome

8,200

Less : Depreciation 6,560

(1,640)

Library Books :

Opening Balance

5,000

Addition

1,000

6,000

Less : Depreciation (750) 5,250

Fixed Deposit 20,000

Cash in hand & at bank 2,450

Prepaid Expenses 620

Subscription Receivable 1,575

Interest accrued 500

45,595 45,595

By CMA, CS Rohan Nimbalkar 7

Financial Statements of Not-For-Profit Organizations

Working Notes:

(i) Expenses Salaries Rent & Magazines Sundry

Electricity & News- Expenses

Papers

₹ ₹ ₹ ₹

Paid during the year 12,000 7,220 2,172 10,278

Add : Outstanding on 31.3.2016 170 973 340 –

Less : Prepaid on 31.3.2015 – – – 417

12,170 8,193 2,512 10,695

Less : Outstanding on 31.3.2015 (710) (864) (226) –

Less : Prepaid on 31.3.2016 – – – (620)

Expenditure for the year 11,460 7,329 2,286 10,075

₹

(ii) Depreciation

(a) Furniture @10% on ₹ 9,600 960

(b) Sports Equipment @ 20% on ₹ 8,200 1,640

(c) Library books - book value 6,000

Revalued at (5,250) 750

(iii) Subscription

Received in cash 28,600

Add : Receivable on 31.3.2016 1,575

30,175

Less: Receivable on 31.3.2015 (1,263)

28,912

Question No. 5

From the following data, prepare an Income and Expenditure Account for the year ended 31st December,

2016, and Balance Sheet as at that date of the Mayura Hospital.

Receipts and Payments Account for the year ended 31 December, 2016

Receipts ₹ ₹ Payments ₹ ₹

To Balance b/d By Salaries :

Cash 400 (₹3,600 for 2015) 15,600

Bank 2,600 3,000 By Hospital Equipment 8,500

To Subscriptions : By Furniture purchased 3,000

For 2015 2,550 By Additions to Building 25,000

For 2016 12,250 By Printing & Stationery 1,200

For 2017 1,200 By Diet expenses 7,800

By Rent and rates

To Government Grant : (₹150 for 2017) 1,000

By Electricity and water

For building 40,000 charges 1,200

For maintenance 10,000 By office expenses 1,000

By CMA, CS Rohan Nimbalkar 8

Financial Statements of Not-For-Profit Organizations

Fees from sundry

Patients 2,400 By Investments 10,000

To Donations (not to be

capitalised) 4,000 By Balances :

To Net collections from

benefit shows 3,000 Cash 700

Bank 3,400 4,100

78,400 78,400

Additional information:

₹

Value of building under construction as on 31.12.2016 70,000

Value of hospital equipment on 31.12.2016 25,500

Building Fund as on 1.1. 2016 40,000

Subscriptions in arrears as on 31.12.2015 3,250

Investments in 8% Govt. securities were made on 1st July, 2016.

SOLUTION

Mayura Hospital Income & Expenditure Account

for the year ended 31 December, 2016

Expenditure ₹ Income ₹

To Salaries 12,000 By Subscriptions 12,250

To Diet expenses 7,800 By Govt. Grants (Maintenance) 10,000

To Rent & Rates 850 By Fees, Sundry Patients 2,400

To Printing & Stationery 1,200 By Donations 4,000

To Electricity & Water-charges 1,200 By Benefit shows (net collections) 3,000

To Office expenses 1,000 By Interest on Investments 400

To Excess of Income over

expenditure transferred to Capital

Fund

32,050 32,050

Balance Sheet as at 31st December, 2016

Liabilities ₹ ₹ Assets ₹ ₹

Capital Fund : Building :

Opening balance 24,650 Opening balance 45,000

Excess of Income Addition 25,000 70,000

Over Expenditure 8,000 32,650 Hospital Equipment :

Building Fund : Opening Opening balance 17,000

balance Add : Govt. 40,000 Addition 8,500 25,500

Grant Subscriptions 40,000 80,000 Furniture 3,000

received in advance Investments -

10,000

1,200 8% Govt. Securities

700

Subscriptions receivable

400

Accrued interest

By CMA, CS Rohan Nimbalkar 9

Financial Statements of Not-For-Profit Organizations

Prepaid expenses (Rent) 150

Cash at Bank 3,400

Cash in hand 700

1,13,850 1,13,850

Working Notes:

Balance sheet as at 31st December, 2015

Liabilities ₹ Assets ₹

(1) Capital Fund Building 45,000

(Balancing Figure) 24,650 Equipment 17,000

Building Fund 40,000 Subscription Receivable 3,250

Creditors for Expenses : Cash atBank 2,600

3,600

Salaries payable Cash in hand 400

68,250 68,250

(2) Value of Building ₹

Balance on 31st December, 2016 70,000

Paid during the year 25,000

Balance on 31st December, 2015 45,000

(3) Value of Equipment

Balance on 31st December, 2016 25,500

Paid during the year (8,500)

Balance on 31st December, 2015 17,000

(4) Subscription due for 2015

Receivable on 31st December, 2015 3,250

Received in 2016 2,550

Still Receivable for 2015 700

By CMA, CS Rohan Nimbalkar 10

Financial Statements of Not-For-Profit Organizations

Question No. 6

Summary of receipts and payments of Bombay Medical Aid society organizations such as public hospitals, public

for the year ended 31.12.2016 are as follows:

Opening cash balance in hand ₹8,000, subscription ₹ 50,000, donation ₹ 15,000, (raised for meeting

revenue expenditure), interest on investments @ 9% p. a. ₹ 9000, payments for medicine supply ₹30,000

Honorarium to doctor ₹10,000, salaries ₹ 28,000, sundry expenses ₹ 1,000, equipment purchase ₹15,000,

charity show expenses ₹ 1,500, charity show collections ₹ 12,500.

Additional information:

Particulars 1.1.2016 31.12.2016

Subscription due 1,500 2,200

Subscription received in advance 1,200 700

Stock of medicine 10,000 15,000

Amount due for medicine supply 9,000 13,000

Value of equipment 21,000 30,000

Value of building 50,000 48,000

You are required to prepare receipts and payments account and income and expenditure account for the year

ended 31.12.2016 and balance sheet as on 31.12.2016.

Answer

Receipts and Payments Account of Bombay Medical Aid Society

for the year ended 31st December, 2016

Receipts ₹ Payments ₹

To Cash in hand (opening) 8,000 By Medicine supply 30,000

To Subscription 50,000 By Honorarium to doctors 10,000

To Donation 15,000 By Salaries 28,000

To Interest on investment 9,000 By Sundry expenses 1,000

To Charity show collections 12,500 By Purchase of equipment 15,000

By Charity show expenses 1,500

By Cash in hand (closing) 9,000

94,500 94,500

Income and Expenditure Account of Bombay Medical Aid Society

for the year ended 31st December, 2016

Expenditure ₹ Income ₹

To Medicine consumed To 29,000 By Subscription By 51,200

Honorarium to doctors 10,000 Donation 15,000

To Salaries 28,000 ByInterestoninvestments 9,000

To Sundryexpenses To 1,000 By Profit on charity show:

Depreciation on Show collections 12,500

Equipment Less: Show expenses (1,500) 11,000

6,000

Building 2,000

By CMA, CS Rohan Nimbalkar 11

Financial Statements of Not-For-Profit Organizations

To Surplus-excess of income 8,000

over expenditure 10,200

86,200 86,200

Balance Sheet of Bombay Medical Aid Society as on 31st March, 2016

Liabilitie ₹ ₹ Asset ₹ ₹

Capital fund: Building 50,000

Opening balance 1,80,300 Less: Depreciation (2,000) 48,000

Add: Surplus 10,200 1,90,500 Equipment 21,000

Subscription received in advance 700 Add:- Purchase 15,000

36,000

Amount due for medicine supply 13,000 Less: Depreciation (6,000) 30,000

Stock of medicine 15,000

Investments 1,00,000

Subscription receivable 2,200

Cash in hand 9,000

2,04,200 2,04,200

Working Notes:

Subscription for the year ended 31st December, 2016: ₹

Subscription received during the year 50,000

Less: Subscription receivable on 1.1.2016 1,500

Less: Subscription received in advance on 31.12.2016 700 (2,200)

47,800

Add: Subscription receivable on 31.12.2016 2,200

Add: Subscription received in advance on 1.1.2016 1,200 3,400

51,200

Purchase of medicine:

Payment for medicine supply 30,000

Less: Amounts due for medicine supply on 1.1.2016 (9,000)

Add: Amounts due for medicine supply on 31.12.2016 21,000

Add: Amounts due for medicine supply on 31.12.2016 13,000

34,000

Medicine consumed:

Stock of medicine on 1.1.2016 10,000

Add: Purchase of medicine during the year 34,000

44,000

Less: Stock of medicine on 31.12.2016 (15,000)

29,000

By CMA, CS Rohan Nimbalkar 12

Financial Statements of Not-For-Profit Organizations

Depreciation on equipment:

Value of equipment on 1.1.2016 21,000

Add: Purchase of equipment during the year 15,000

36,000

Less: Value of equipment on 31.12.2016 (30,000)

Depreciation on equipment for the year 6,000

Balance Sheet of Medical Aid Society as on 1st January, 2016

Liabilities Assets

Capital fund (balancing figure) 1,80,300 Building 50,000

Equipment 21,000

Subscription received in advance 1,200 Stock of medicine 10,000

Amount due for medicine supply 9,000 Investments (₹ 9,000 x 100/9) 1,00,000

Subscription receivable 1,500

Cash in hand 8,000

1,90,500 1,90,500

Question No. 7

On 31st December 2012, a club had subscription in arrears of ₹16,000 and in advance ₹4,000. During

the year ended 31-12-2013, the club received subscription of ₹2,08,000 of which ₹10,400 was related

to 2014. On 31st December 2012, there were 4 members who had not paid subscription for 2013 @ ₹

1,600 per person. Write up subscription A/c for the year 2013.

Solution:

A single subscription account should be prepared to reflect both advance and arrears figures. The

balancing figure will reflect the subscription amount that will be recognised as Income and transferred

to I & E A/c as shown below:

Subscription Account

Particulars Amount (₹) Particulars Amount (₹)

To, Balance b/d (arrears) 16,000 By, Balance b/d (advance) 4,000

To, I & E A/c (income for 2013) 1,92,000 By, R & P A/c (received) 2,08,000

To, Balance c/d (advance) 10,400 By, Balance c/d (arrears) 6,400

2,18,400 2,18,400

By CMA, CS Rohan Nimbalkar 13

Financial Statements of Not-For-Profit Organizations

Question No. 8

The sports club of Orissa had received in 2012-2013 ₹ 2,000 towards subscription. Subscription for

2011-12 unpaid on 1.4.2012 were ₹ 200.

Subscriptions paid in advance on 31.3.2012 were ₹ 50 and the same on 31.3.2013 was ₹ 40.

Subscriptions for 2012-2013 unpaid on 31.3.2013 were ₹ 90.

Show how the subscriptions item will appear in the Income and Expenditure Account.

Solution:

Particulars Amount

(₹)

Subscriptions received during the year 2012-2013 2,000

Add : Subscription outstanding on 31.3.2013 90

2,090

Less : Subscription outstanding on 1.4.2012 200

1,890

Add : Subscription paid in advance on 31.3.2012 50

1,940

Less : Subscription received in advance on 31.3.2013 40

Subscription Income for 2012-2013 1,900

Question No. 9

The amount of Subscription appears in the Income and Expenditure Account of South Indian Club is

₹ 3,000.

Adjustments were made in respect of the following:

Subscription for 2012 unpaid at 1st Jan. 2013, ₹ 400; ₹ 200 of which was received in 2013.

Subscription paid in advance at 1.1.2013 ₹ 100.

Subscription paid in advance at 31.12.2013 ₹ 80.

Subscription for 2013 unpaid at 31.12.2013 ₹ 140.

Prepare Subscription Account.

Solution:

Subscription Account

Particula Amount Particula Amount

rs (₹) rs (₹)

To, Balance b/d 400 By, Balance b/d 100

3,000 3,040

To, Income & Expenditure A/c By, Cash Received (bal fig)

80 340

To, Balance (paid in advance to 2013) By, Balance c/d

[200 + 140]

3,480 3,480

By CMA, CS Rohan Nimbalkar 14

Financial Statements of Not-For-Profit Organizations

To, Balance b/d: By, Balance b/d (2013) 80

For 2012 200

For 2013 140

Question No. 10

From the following information, prepare the Subscription Account for the year ending on March, 31,

2013

(i) Subscription in arrears on 31.03.2012 ₹ 1,500

(ii) Subscription received in advance on 31.03.2012 ₹ 1,000

(iii) Amount of Subscription received during 2012-13 ₹ 40,000, which includes ₹ 500 for the

year 2011-12, ₹ 1,500 for the year 2013-14.

(iv) Subscription outstanding ₹ 1,000.

Solution:

Subscription Account

Particulars Amount (₹) Particulars Amount (₹)

To, Balance b/d 1,500 By, Balance b/d 1,000

To, Income & Expenditure A/c 39,500 By, Bank A/c 40,000

By, Balance c/d

To, Balance c/d

1,500 For 2011-12 500

For 2013-14

For 2012-13 1,000

42,500 42,500

Question No. 11

The accumulated balance of Life Membership fees at the beginning of the year 2012 was ₹6,40,000. This

represents the balance of life membership fees paid by 20 members since the club started about 6 years

ago. In the current year, 10 new life memberships were received totaling ₹ 4,00,000.

It’s the policy of the club to spread these fees over 20 years to income. The amount payable per person

is always ₹ 40,000.

What is the amount to be recognised as income for the current year and what amount will be deferred

through the balance sheet?

Solution:

Income to be recognised for new members

Life membership fees per person ₹40,000

Income to be spread over 20 years

Income to be recognised each year ₹2,000

Members added during the year 10

By CMA, CS Rohan Nimbalkar 15

Financial Statements of Not-For-Profit Organizations

Income to be recognised (10×2000) ₹20,000

Amount to be carried forward ₹3,80,000

Income to be recognised for old members

No. of members 20

Income to be recognised each year ₹2,000

Income to be recognised (20×2000) ₹40,000

Total income to be recognised (20,000+40,000) ₹60,000

Amount to be shown in the balance sheet

Accumulated Balance ₹6,40,000

Add: New fees received ₹4,00,000

Less: Recognised as income (₹60,000)

Balance to be carried forward ₹9,80,000

Question No. 12

The following summary of the Cash Book has been prepared by the treasurer of a club:

Receipts Amount Payments Amount

(₹) (₹)

To Balance b/d 4,740 By Wages - outdoor staff 13,380

To Subscriptions 29,720 By Restaurant Purchase 50,400

To Entrance Fees 3,200 By Rent - 18 months’ to July 30, 7,500

To Restaurant Receipts 56,800 2013

To Games & Competition Receipts 13,640 By Rates 2,700

To Due to Secretary for Petty Expenses 80 By Secretary’s Salary 3,120

By Lighting 7,200

By Competition Prizes 4,000

By Printing & Postage etc. 6,000

By Placed in Fixed Deposit 8,000

By Balance c/d 5,880

1,08,180 1,08,180

By CMA, CS Rohan Nimbalkar 16

Financial Statements of Not-For-Profit Organizations

On April 1, 2012 the club’s assets were:- Furniture ₹ 48,000, Restaurant stock ₹ 2,600; Stock of prizes ₹

800; ₹ 5,200 was owing for supplies to the restaurant.

On March, 31, 2013, the Restaurant stocks were ₹ 3,000 and prizes in hand were ₹ 500, while the club

owed ₹ 5,600 for restaurant supplies.

It was also found that subscriptions unpaid at March 31, 2013, amounted to ₹ 1,000 and that the figure

of ₹ 29,720

shown in the Cash Book included ₹ 700 in respect of previous year and ₹ 400 paid in advance for the

following year.

Prepare an account showing the Profit or Loss made on the Restaurant and a General Income and

Expenditure Account for the year ended 31.3.2013, together with a Balance Sheet as at that date, after

writing 10% off the Furniture.

Restaurant Trading Account For the year ended 31st March, 2013

Particulars Amount Amount Particulars Amount Amount

(₹) (₹) (₹) (₹)

To Opening Stock A/c 2,600 By Restaurant Receipts A/c 56,800

” Purchases A/c 50,400 ” Closing Stock A/c 3,000

” Add: Outstanding for 31.3.13 5,600

56,000

Less: Outstanding for 01.04.12 5,200

50,800

” Income & Expenditure A/c 6,400

(G.P. transferred)

59,800 59,800

Balance Sheet as at 1st April, 2012

Liabilities Amount Assets Amount

(₹) (₹)

Accumulated Fund: (bal. fig.) 50,390 Furniture and Equipment 48,000

Owing for supplies to Restaurant 5,200 Restaurant Stock 2,600

Outstanding Rent (Jan. to March 2012) 1,250 Stock of Prize 800

Outstanding Subscriptions 700

Cash and Bank 4,740

56,840 56,840

By CMA, CS Rohan Nimbalkar 17

Financial Statements of Not-For-Profit Organizations

Income and Expenditure Account

For the year ended 31st March, 2013

Expenditure Amount Amount Income Amount Amount

To Wages 13,380 By Subscription :

Subscription already received 29,720

To Rent 7,500 Less: Outstanding for 1.4.12 700

To Less: Outstanding on 1.4.2012 1,250 29,020

6,250 Add: Outstanding for 2013 1,000

To Less: Prepaid for 3 months 30,020

(7,500 x3/18) 1,250 5,000

To Rates 2,700 Less: Received in advance 400 29,620

To Secretary’s Salary 3,120 By Games Competition Receipts 13,640

To Lighting, Cleaning, Services 7,200 By RestaurantTrading–

Gross Profit 6,400

To Competition Prize 4,000

To Add: Opening Stock 800

4,800

To Less: Closing Stock 500 4,300

To Printing, Postage and Sundries 6,000

To Dep. on Furniture and 4,800

Equipment @10%

To Surplus – Excess of income over 3,160

expenditure

49,660 49,660

Balance Sheet as at 31st March, 2013

Liabilities Amount Amount Assets Amount Amount

(₹) (₹) (₹) (₹)

Accumulated Fund: Furniture and Equipment 48,000

Balance on 1.4.2012 50,390 Less: Depreciation 4,800 43,200

Add: Surplus 3,160 53,550 Restaurant Stock 3,000

Entrance fees 3,200 Stock of Prize 500

Subscription received in advance 400 Outstanding Subscriptions 1,000

Owing for supplies to Restaurant 5,600 Prepaid Rent 1,250

Outstanding Petty Expenses 80 Fixed Deposit with Bank 8,000

Cash and Bank 5,880

62,830 62,830

By CMA, CS Rohan Nimbalkar 18

Financial Statements of Not-For-Profit Organizations

Question No. 13

‘Citizen Club’ was registered in a city and the accountant prepared the following Receipts and Payments

Account for the year ended Dec. 31, 2013 and showed a deficit of ₹ 14,520 :

(₹)

Receipts:

Subscriptions 62,130

Fair Receipts 7,200

Variety Show Receipts (net) 12,810

Interest 690

Bar Collection 22,350

Cash spent more 1,000

1,06,180

Payments: (₹)

Premises 30,000

Honorarium to Secretary 12,000

Rent 2,400

Rates and Taxes 3,780

Printing and Stationery 1,410

Sundry Expenses 5,350

Wages 2,520

Fair Expenses 7,170

Bar Purchase- payments 17,310

Repairs 960

New Car (less proceeds of old car ₹ 9,000) 37,800

1,20,700

Deficit 14,520

The additional information should be obtained:

1.1.2013 31.12.2013

(₹) (₹)

Cash in hand 450 -

Bank balance as per Pass Book 24690 10,440

Cheques issued not presented for Sundry Expenses 270 90

Subscriptions due 3,600 2,940

Premises at Cost 87,000 1,17,000

Accumulated dep. on Premises 56,400 -

Car at Cost 36,570 46,800

Accumulated dep. on Car 30,870 -

Bar Stock 2,130 2,610

Creditors for Bar Purchases 1,770 1,290

By CMA, CS Rohan Nimbalkar 19

Financial Statements of Not-For-Profit Organizations

Cash overspent represents honorarium to secretary not withdrawn due to Cash deficit. His annual

honorarium is ₹ 12,000. Depreciation on premises and car is to be provided at 5% and 20% on written-

down value.

You are required to prepare the correct Receipts and Payments Account, Income and Expenditure

Account and Balance Sheet as at Dec. 31, 2013.

Solution:

In the Books of Citizen Club Receipts and Payments Account

for the year ended 31st December, 2013

Receipts Amount Payments Amount

(₹) (₹)

To Balance b/d 450 By, Premises 30,000

” Bank (24,690 – 270) 24,420 ” Honorarium to Secretary 11,000

” Subscription 62,130 ” Rent 2,400

” Fair Receipts 7,200 ” Rates and Taxes 3,780

” Variety Show Receipts 12,810 ” Printing and Stationery 1,410

” Interest 690 ” Sundry Expenses 5,350

” Bar Receipts 22,350 ” Wages 2,520

” Fair Expenses 7,170

” Bar Purchases 17,310

” Repairs 960

” New Car 37,800

” Bank Balance (10,440 – 90) 10,350

1,30,050 1,30,050

Income and Expenditure Account

for the year ended 31st December, 2013

Expenditure Amount Amount Incom Amount Amount

(₹) (₹) e (₹) (₹)

To Honorarium to Secretary 11,000 By, Subscriptions 62,130

Add: Outstanding 1,000 12,000 Add: Outstanding for 2012 2,940

” Rent 2,400 65,070

” Rates and Taxes 3,780 Less: Outstanding for 3,600 61,470

” Printing andStationery 1,410 2011 ” Fair receipts 7,200

” Sundry Expenses 5,350 ” Varietyshow 12,810

” Wages 2,520 receipts ” Interest 690

” Fair Expenses 7,170 3,300

By CMA, CS Rohan Nimbalkar 20

Financial Statements of Not-For-Profit Organizations

” Profit on sale of old car

”Repairs 960 6,000

[(₹ 9,000 - (36,570 - 30,870)]

”Depreciation on:

Premises@ 5% on 60,600 3,030 ” Profit on Bar Trading

Car @20% on 46,800 9,360

” Surplus—Excess ofIncome 43,490

over Expenditure

91,470 91,470

Balance Sheet

as at 31st December, 2013

Liabilities Amount Amount Assets Amount Amount

(₹) (₹) (₹) (₹)

Capital Fund as on 1.1.13 65,130 Premises at Cost Less: 1,17,000

Add: Surplus 43,490 1,08,620 Depreciation Car at Cost 59,430 57,570

Creditors(forbarpurchase) 1,290 Less: Depreciation Bar 46,800

37,440

Secretary’s honorarium Stock 9,360

1,000 2,610

outstanding Outstanding Subscription

2,940

Cash at bank

10,350

1,10,910 1,10,910

Balance Sheet

as at 1st January, 2013

Liabilities Amount Amount Assets Amount Amount (₹)

(₹) (₹) (₹)

Capital Fund (bal. in figure) 65,130 Premises at Cost 87,000

Creditors(forbarpurchase) 1,770 Less: Depreciation 56,400 30,600

Car at Cost 36,570

5,700

Less: Depreciation 30,870

2,130

Bar Stock

3,600

Outstanding 24,420

Subscription Cash at 450

bank

Cash in Hand

66,900 66,900

By CMA, CS Rohan Nimbalkar 21

Financial Statements of Not-For-Profit Organizations

Bar Trading Account for the year ended 31.12.2013

Particulars Amount Amount Particulars Amount

(₹) (₹) (₹)

To, Opening stock To, Bar 2,130 By, Bar Receipts By, 22,350

Purchase 17,310 Closing Stock 2,610

Add: closing creditors for bar 1,290

purchase 18,600

Less: Opening creditors for purchase

1,770

16,830

To, Income and Expenditure A/c

6,000

(Gross profit Transferred)

24,960 24,960

2. Calculation of Depreciation of Premises

W.D.V ₹

Cost Price 87,000

Less: Accumulated Dep 56,400

30,600

Add: Purchase 30,000

60,600

Depreciation of Premises: 60,600 x 5% = 3,030

Question No. 14

The following information was obtained from the books of Young Bengal Club as on 31-03-2013 at the

end of first year of the club. Prepare the Receipts & Payments A/c, Income & Expenditure A/c and

Balance sheet of the club

(1) Donations received for Building & Books - ₹ 2,00,000

(2) Other revenue incomes and receipts were:

Rev. Income (₹) Actual Receipts (₹)

Entrance fees 17,000 17,000

Subscription 20,000 19,000

Locker rent 600 600

Sundry Income 1,600 1,060

Refreshment account Nil 16,000

By CMA, CS Rohan Nimbalkar 22

Financial Statements of Not-For-Profit Organizations

(3) Other revenue expenditure and actual payments were

Rev. Exp (₹) Actual Payment (₹)

Land (cost ₹10,000) Nil 10,000

Furniture (cost ₹ 146,000) Nil 130,000

Salaries 5,000 4,800

Maintenance of play ground 2,000 1,000

Rent 8,000 8,000

Refreshment account Nil 8,000

Donations were utilized to the extent of ₹25,000 for buying books, balance were unutilized. In order

to keep it safe, 9% Govt. Securities were purchased on 31-3-2013 for ₹1, 60,000. Remaining amount

was put in bank as term deposit on 31-3-2013. Depreciate Furniture and books @ 10% for the whole

year.

Solution:

Receipt and Payments for the year ended 31.3.2013

Receipt Amount (₹) Paymen Amount (₹)

s ts

To Donations 2,00,000 By Library books 25,000

To Entrance fees 17,000 By Land 10,000

To Subscription 19,000 By Furniture 1,30,000

To Locker Rent 600 By Salaries 4,800

To Sundry income 1,060 By Maintenance 1,000

To Refreshment A/c 16,000 By Rent 8,000

By Refreshment A/c 8,000

To Balance c/d (Overdraft) (Bal. fig.) 1,08,140 By 9% Govt. Securities 1,60,000

By Term deposits 15,000

3,61,800 3,61,800

Income and Expenditure Account for the year ended 31.3.2013

Expenditures ₹ ₹ Income ₹ ₹

s

To Salary 4,800 By Subscriptions 19,000

Add: Outstanding 200 5,000 Add: Outstanding 1,000 20,000

₹₹ Playground maintenance 1,000 ₹₹ Locker Rent 600

1,000 2,000 1,060

Add: Outstanding ₹₹ Sundry Income

8,000 540 1,600

₹₹ Rent -Add: Outstanding

8,000

₹₹ Depreciation ₹₹ Profit on Refreshment

14,600

By CMA, CS Rohan Nimbalkar 23

Financial Statements of Not-For-Profit Organizations

on: Furniture 2,500 17,100

₹₹ Deficit

Library Books 1,900

(Excess of Expenditure over

Income)

40,100 40,100

Balance Sheet as at 31st March 2013

Liabiliti ₹ ₹ Asset ₹ ₹

es s

Capital Fund --- Land 10,000

Entrance Fees 17,000 Furniture 1,46,000

Donation for Building. Less: Depreciation 14,600 1,31,400

Library

Room Fund 2,00,000 Library Books 25,000

Creditors for Furniture 16,000 Less: Depreciation 2,500 22,500

Outstanding Salaries 200 9% Govt. Bond 1,60,000

Outstanding Expenses for Subscription 1,000

Playground

1,000 Receivable Accrued 540

Sundry Income

Bank Term Deposit 15,000

Bank overdraft 1,08,140

Deficit 1,900

3,42,340 3,42,340

Workings:

(1) Refreshment Account

Particulars Amount Particulars Amount

(₹) (₹)

To, Payment for Refreshment 8,000 By, Refreshment Receipts 16,000

To, Income and Expenditure A/c

8,000

(Profit on Refreshment)

16,000 16,000

(2) Calculation of Term Deposit:

Donation Recd – (library books purchase + 9% Govt. Securities)

= 2,00,000 – (25,000 + 1,60,000)

= 2,00,000 – 1,85,000

=15,000

(3) Since there was no capital fund

(4) Donation received for Building and Library Room is treated as capital item.

(5) Since the investment in Govt. Securities has been made at the closing date of the year, no

interest has accrued.

By CMA, CS Rohan Nimbalkar 24

Financial Statements of Not-For-Profit Organizations

Question No. 15

Following is the receipt and payment A/c of a club for the year ended 31-03-2013

Dr. Receipt and Payments for the year ended 31.3.2013 Cr.

Receipts Amount (₹) Payments Amount (₹)

To Opening balance: By Administrative expenses 1,25,000

Cash 3,000 “ Programme expenses 2,75,000

Bank 7,000 “ F.D. with bank 1,25,000

“ Membership fees received: “ Investment in ICICI Bonds 3,00,000

“ Fixed assets purchased 80,000

up to 31-03-2012 14,000

for 2012-13 1,50,000

for 2013-14 16,000

“ Advertisements 5,00,000

“ F.D. with bank 75,000

“ Interest on savings A/c 700

“ Interest on F.D 22,000

“ Sale of tickets - Programmed 25,000 “ Closing balance:

“ Govt. Security Maturity Cash 2,700

(cost 80,000 & interest 8,000) 1,00,000 Bank 5,000

9,12,700 9,12,700

The club informs you that:

(a) Membership fee for 2012-13 due is ₹25,000; and ₹1,000 from a member who has not yet

paid for 2011-12 as well. A provision needs to be done on this.

(b) Income receivable on 31-03-2013 on ICICI bond is ₹30,000 and on Govt. Securities is

₹24,000

(c) Prepaid expenses on 31-3-2013 amounts to ₹7,000

(d) Outstanding expenses as on 31-3-2013 ₹8,000

(e) Depreciation to be provided is ₹12,500

(f) Programme is an annual feature.

The Balance Sheet as on 31-3-2012 is also provided as below:

Balance Sheet as at 31.03.2012

Liabilities Amount Assets Amount

Trust fund (₹)

5,00,000 Cash (₹)

3,000

Accumulated surplus 1,05,000 Bank Account 7,000

Subscriptions in advance 10,000 Fixed Deposit 2,00,000

Outstanding Expenses 10,000 Govt. Securities 3,00,000

Fixed Assets 95,000

Subscription receivable 15,000

Prepaid expenses 5,000

6,25,000 6,25,000

Prepare Income and Expenditure Account and the Closing Balance Sheet for the year 2012-13.

By CMA, CS Rohan Nimbalkar 25

Financial Statements of Not-For-Profit Organizations

Solution:

Subscription Account

Particulars Amount (₹) Particulars Amount (₹)

To, Opening receivable 15,000 By, Opening advance received By, 10,000

To, I & E A/c (balancing 1,85,000 Received during year 1,80,000

figure) By, Closing receivable :

16,000 1,000

To, Closing advance received for 2011-12

25,000

for 2012-13

2,16,000 2,16,000

Expenses Account

Particulars Amount (₹) Particulars Amount (₹)

To, Opening prepaid 5,000 By, Opening outstanding 10,000

To, Bank 1,25,000 By, I & E A/c (balancing figure) 1,21,000

To, Closing outstanding 8,000 By, Closing prepaid 7,000

1,38,000 1,38,000

Provision for doubtful Subscriptions Account

Particulars Amount (₹) Particulars Amount (₹)

For 2011-12 1,000 By Balance c/d 2,000

For 2012-13 1,000

2,000 2,000

Income & Expenditure Account for the year ended 31.3.2013

Expenditures ₹ Incomes ₹

To Administrative Expenses ” 1,21,000 By Subscriptions 1,85,000

Depreciation on Assets ” 12,500 ” Interest Income 84,700

Provision on subscription 2,000 [700+22,000+30,000+24,000+8,000]

2,50,000

” Surplus 3,96,200 ” Surplus from Programme

[25,000 + 5,00,000 – 2,75,000]

” Profit on sale of investment 12,000

5,31,700 5,31,700

Balance Sheet as at 31st March 2013

By CMA, CS Rohan Nimbalkar 26

Financial Statements of Not-For-Profit Organizations

Liabiliti Amou Amou Asset Amou Amou

es nt nt s nt nt

(₹) (₹) (₹) (₹)

Trust Fund 5,00,000 Cash 2,700

Accumulated surplus 1,05,000 Bank 5,000

Add: surplus for 2012-13 3,96,200 5,01,200 Govt. Securities 3,00,000

Subscription Recd in Less: sold 80,000 2,20,000

Advance 16,000 Fixed Deposit 2,00,000

Outstanding Expenses 8,000 Add: Addition 1,25,000

3,25,000

Less: Matured 75,000 2,50,000

ICICI Bond 3,00,000

Accrued Interest:

Govt. Securities 24,000

ICICI Bonds 30,000 54,000

Outstanding Subscription:

2011 -12 1,000

2012 -13 25,000

26,000

Less: Prov. for doubtful debt 2,000 24,000

Prepaid Expenses 7,000

Fixed Assets 95,000

Add: Additions 80,000

1,75,000

Less: Depreciation 12,500 1,62,500

10,25,200 10,25,200

Profit on disposal of Investment ₹

Amount received 1,00,000

Less: Interest 8,000

Net received 92,000

Cost of disposed investment 80,000

Profit on disposal 12,000

Question No. 16

Prepare the Balance Sheet of Ocean Blue club based on following information:

₹ ₹

Furniture (before depreciation) 8,000 Outstanding consultancy 1,000

Depreciation on furniture 800 Allowances outstanding 800

Building fund 30,000 Capital Grants 10,000

Income from building fund 2,000 Entrance fees (50% be 4,000

Fixed deposits 20,000 funded)

Legacies received(funded) 8,000

Opening General fund 10,000 Prize fund 10,000

Excess of income over 20,000 Income of prize fund 1,000

expenditure

Opening balance of capital fund 60,000 Expenses of prize fund 800

Cost of swimming pool 40,000 Investment of prize fund 10,000

By CMA, CS Rohan Nimbalkar 27

Financial Statements of Not-For-Profit Organizations

Equipments 20,000 Balance in current A/c 10,000

Investment of general fund 36,000 Cash in hand 800

Subscription outstanding 10,000

Solution:

Balance Sheet as at ...............

Liabilitie Amount (₹) Amount (₹) Assets Amount (₹) Amount (₹)

s

Capital Fund Fixed Assets:

Op balance 60,000 40,000

Swimming Pool

Add: Capital grants 10,000 20,000

Equipments 8,000

8,000

Add: Legacies Furniture 800 7,200

2,000 80,000

Add: Entrance fees (50%) Less: Depreciation

General Fund Op 10,000 Investment 36,000

balance Surplus 20,000 30,000 General fund Prize 10,000 46,000

Building Fund fund Receivables

30,000 10,000

Op balance Add: Subscription

2,000 32,000 Cash & bank

Income 800

Cash in hand 10,000

Prize Fund

Current A/c 20,000 30,800

Op balance 10,000 Fixed deposit

Add: Income 1,000

Less: Expenses 800 10,200

Allowances

Outstanding 800

Consultancy

1,000

Outstanding

1,54,000 1,54,000

Question No. 17

The following are the items of Receipts and Payments of the Bengal Club as summarized from the books

of account maintained by the Secretary:

Receipts Amount Payments Amount

(₹) (₹)

Opening Balance 1.1.2013 4,200 Manager’s Salary 1,000

Entrance Fees 2012 1,000 Printing and Stationery 2,600

Do 2013 10,000 Advertising 1,800

Subscriptions 2012 600 Fire Insurance 1,200

Do 2013 15,000 Investments Purchased 20,000

Interest Received on Investments 3,000 Closing Balance 31.12.2013 7,600

Subscriptions 2014 400

34,200 34,200

By CMA, CS Rohan Nimbalkar 28

Financial Statements of Not-For-Profit Organizations

It was ascertained from enquiry that the following represented a fair picture of the Income and

Expenditure of the Club for the year 2013 for audit purpose:

Expenditure Amount Amount Income Amount

(₹) (₹) (₹)

Manager’s Salary 1,500 Entrance Fees 10,500

Printing & Stationery 2,000 Subscription 15,600

Add: Accrued 400 2,400 Interest on Investments 4,000

Advertising (accrued Nil) 1,600

Audit Fees 500

Fire Insurance 1,000

Depreciation 4,940

Excess of Income over Expenditure 18,160

30,100 30,100

You are required to prepare the Balance Sheet of the Club as on 31.12.2012 and 31.12.2013, it being

given that the values of the Fixed Assets as on 31.12.2012 were: Building ₹ 44,000, Cricket Equipment ₹

25,000 and Furniture ₹ 4,000. The rates of depreciation are Building 5%, Cricket Equipments 10%,

Furniture 6%.

Your are entitled to make assumptions as may be justified.

Solution:

In the books of Bengal Club

Balance Sheet as at 31st December, 2012

Liabilities Amoun Assets Amount

t (₹) (₹)

Outstanding Liabilities: Building 44,000

Advertisement (1,800 – 1,600) 200 Furniture 4,000

Printing and Stationery (2,600 – 2,000) 600 Cricket Equipment 25,000

Capital Fund 78,000 EntranceFeesinarrear 1,000

(Balancing figure) Subscription in arrear 600

Cash 4,200

78,800 78,800

Balance Sheet as at 31st December, 2013

Liabilities Amount Amount Assets Amount Amount

(₹) (₹) (₹) (₹)

Capital Fund: Building 44,000

Balance on 1.1.2012 78,000 Less: Depreciation 5% 2,200 41,800

Add: Excess of Income

18,160 96,160 Furniture 4,000

over Expenditure

400 Less:Depreciation6% 240 3,760

Subscription Received in Advance

By CMA, CS Rohan Nimbalkar 29

Financial Statements of Not-For-Profit Organizations

Outstanding Liabilities: 25,000

Printing and Stationery 400 Cricket Equipment 2,500 22,500

Manager’s Salary: (1,500 – 1,000) 500 Less:Depreciation10% 20,000

Audit Fees 500 Investments

Subscriptions in arrear 600

(15,600 – 15,000)

EntranceFeesinarrear

(10,500 – 10,000) 500

Accrued Interest on

Investments 1,000

(4,000 – 3,000)

Prepaid Insurance 200

(1,200 – 1,000) 7,600

97,960 Cash 97,960

Note: Advertisement expenses and Printing and Stationery which were paid in excess over Income and

Expenditure A/c are assumed to be outstanding for the previous year

Question No. 18

The Income and Expenditure Account of the Calcutta Club is:

Income and Expenditure Account for the year ended 31st December, 2013

Dr. Cr.

Expenditure Amount Income Amount

₹ ₹

To Salaries 1,750 By Subscription 2,000

To General Expenses 500 By Donation 1,050

To Depreciation 300

To Excess of Income over expenditure 500

3,050 3,050

Adjustments are made in respect of the following:

(1) Subscription for 2012 unpaid at 1.1.2013 ₹ 200; ₹ 180 of which was received in 2013.

(2) Subscription paid in advance at 1.1.2013 ₹ 50.

(3) Subscription paid in advance at 31.12.2013 ₹ 40.

(4) Subscription for 2012 unpaid at 31.12.2013 ₹ 70.

(5) Sundry Asset at the beginning of the period ₹ 2,600; Sundry Asset after depreciation ₹ 2,700

at the end of the period.

(6) Cash balance at 1.1.2013 ₹ 160.

Prepare a Receipts and Payments Account.

By CMA, CS Rohan Nimbalkar 30

Financial Statements of Not-For-Profit Organizations

Solution:

In the books of Calcutta Club Receipts and Payments Account

for the year ended 31st December, 2013

Receipts Amount Payments Amount

₹ ₹

To Balance b/d 160 By Salaries 1,750

,, Donations 1,050 ,, General Expenses 500

,, Subscriptions (Cash received) 2,100 ,, Sundry Assets 400

,, Balance c/d 660

3,310 3,310

Workings:

Subscription Account

Particulars Amount Particulars Amount

₹ ₹

To Balance b/d 200 By balance b/d 50

,, Income & Expenditure A/c 2,000 ,, Cash Received (bal. fig.) 2,100

,, Balance (received in advance for 40 ,, Balance (Unpaid for 2012) 20

2014) (200 - 180)c/d

,, Balance (Unpaid for 2013) c/d 70

2,240 2,240

To Balance b/d By Balance b/d 40

for 2012

20

for 2013

70

Sundry Assets Account

Particulars Amount Particulars Amount

₹ ₹

To Balance b/d 2,600 By Depreciation By 300

,, Purchase (bal. fig.) 400 Balance c/d 2,700

3,000 3,000

By CMA, CS Rohan Nimbalkar 31

You might also like

- Full Intermediate Accounting Spiceland 7Th Edition Solutions Manual PDF Docx Full Chapter ChapterDocument34 pagesFull Intermediate Accounting Spiceland 7Th Edition Solutions Manual PDF Docx Full Chapter Chapterbryozoumaltitudee6kpfr100% (22)

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaNo ratings yet

- U2A2 - Assignment - Business TransactionsDocument2 pagesU2A2 - Assignment - Business TransactionsZoya IliasNo ratings yet

- 3 7BDocument3 pages3 7BFaraz FaisalNo ratings yet

- China Trade, Inc. Journal Entries: Date GL Number Description Debit CreditDocument7 pagesChina Trade, Inc. Journal Entries: Date GL Number Description Debit CreditJalaj GuptaNo ratings yet

- Chapter 1 AnswerDocument15 pagesChapter 1 AnswerKristina Kitty100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Presentation2Document9 pagesPresentation2shuklabharat2004No ratings yet

- Npo QuestionDocument8 pagesNpo QuestionKritika MahalwalNo ratings yet

- QuestionDocument5 pagesQuestionakhileshmoney143No ratings yet

- Right Accountancy - Non-Trading Organizations - 27.01.2016Document2 pagesRight Accountancy - Non-Trading Organizations - 27.01.2016Sangeetha AchyuthNo ratings yet

- 7 Non Profit Seeking Organisation - H2pouucweunre9sj16afDocument20 pages7 Non Profit Seeking Organisation - H2pouucweunre9sj16aflifelofi9No ratings yet

- Question Sheet - Non Profit OrganisationDocument7 pagesQuestion Sheet - Non Profit OrganisationShivangi JhawarNo ratings yet

- Account Template 4Document3 pagesAccount Template 4lim studentNo ratings yet

- Assignment 9Document3 pagesAssignment 9nina0301No ratings yet

- Nonp 1 SlidesDocument20 pagesNonp 1 SlidesomponyeprimoganeditseNo ratings yet

- Non-Profit Organisations AccountsDocument2 pagesNon-Profit Organisations AccountsMasood Ahmad AadamNo ratings yet

- Lesson Notes and Questions On Receipts & Payments 2024Document6 pagesLesson Notes and Questions On Receipts & Payments 2024kxngdawkinz20No ratings yet

- ACC203Document3 pagesACC203Hongoc PhamNo ratings yet

- 03 - Accounts - Prelims 4Document6 pages03 - Accounts - Prelims 4Pawan TalrejaNo ratings yet

- Problem 5Document42 pagesProblem 5aliyah1999hajNo ratings yet

- Important Questions For Accountancy 12th ComDocument17 pagesImportant Questions For Accountancy 12th ComAnkit RoyNo ratings yet

- Chart of AccountsDocument5 pagesChart of AccountsJohn JosephNo ratings yet

- 2024 Sylvan View BudgetDocument1 page2024 Sylvan View Budgetapi-250618742No ratings yet

- Maker Date Payee AmountDocument3 pagesMaker Date Payee Amountmusic niNo ratings yet

- Excell For AccountingDocument4 pagesExcell For Accountingjennibonilla19No ratings yet

- General Journal Ref Date Account Titles & Explanation Debit CreditDocument5 pagesGeneral Journal Ref Date Account Titles & Explanation Debit CreditG02 BANDELARIA ChristellNo ratings yet

- Jawaban Chapter 1Document12 pagesJawaban Chapter 1Ruth Elisabeth100% (2)

- Sep 2012Document8 pagesSep 2012Kelsey FalzonNo ratings yet

- CCP302Document13 pagesCCP302api-3849444No ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- NPO Practical QsDocument13 pagesNPO Practical Qsyugabhore1234No ratings yet

- Dec 2010Document79 pagesDec 2010Saroj ShresthaNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentjannatulnisha78No ratings yet

- Ias 1 QuestionsDocument7 pagesIas 1 QuestionsIssa AdiemaNo ratings yet

- Non Profit Organisation - DPP 06 - (Sampurna 2.0 Dec 2023)Document13 pagesNon Profit Organisation - DPP 06 - (Sampurna 2.0 Dec 2023)Arish HilalNo ratings yet

- Club Prepare The Income and Expenditure For The Year Ended 31-3-2016Document3 pagesClub Prepare The Income and Expenditure For The Year Ended 31-3-2016M JEEVARATHNAM NAIDUNo ratings yet

- BBB - Assignment FARDocument23 pagesBBB - Assignment FARcha618717No ratings yet

- Problems On Final Accounts-Sole ProprietorshipDocument12 pagesProblems On Final Accounts-Sole ProprietorshipRishiShuklaNo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Final Output - Ais Elect 1Document18 pagesFinal Output - Ais Elect 1Joody CatacutanNo ratings yet

- Cash and Cash Equivalents ActivityDocument2 pagesCash and Cash Equivalents ActivityKathleen Ebuen EncinaNo ratings yet

- Chapter-9: Final Accounts of Not - For Profit OrganisationsDocument10 pagesChapter-9: Final Accounts of Not - For Profit Organisationsadityatiwari122006No ratings yet

- Cpayslip 2022 2023 100000000671060 IGSLDocument1 pageCpayslip 2022 2023 100000000671060 IGSLFree DownloadNo ratings yet

- Accountancy Notes Not For Profit Organisation Problems and SolutionsDocument7 pagesAccountancy Notes Not For Profit Organisation Problems and SolutionsGod乡 DekuNo ratings yet

- Samsona, Melanie 2018-1383Document9 pagesSamsona, Melanie 2018-1383Melanie SamsonaNo ratings yet

- ABC Cash Flow StatementDocument1 pageABC Cash Flow StatementLps0625No ratings yet

- Multiple Choice Answers - Robles and EmpleoDocument6 pagesMultiple Choice Answers - Robles and EmpleoLeah La MadridNo ratings yet

- Jawaban Soal Ujian ThomasDocument6 pagesJawaban Soal Ujian Thomassuswinda alfianiNo ratings yet

- Jolly Company's Accounts Have The Following Balances As of December 31, 2018Document3 pagesJolly Company's Accounts Have The Following Balances As of December 31, 2018Allen CarlNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Simulation 9 - Nikita SaxenaDocument9 pagesSimulation 9 - Nikita Saxenaapi-663766273No ratings yet

- Practice Special Paste 2Document1 pagePractice Special Paste 2Sherraine GardnerNo ratings yet

- Tolentino Accounting Form For DemoDocument19 pagesTolentino Accounting Form For DemoarrmfarmeggcellentNo ratings yet

- CHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Document4 pagesCHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Drwskincare SuirabayaNo ratings yet

- Assignment 1 G10 - ACCT9700Document8 pagesAssignment 1 G10 - ACCT9700Senior BrosNo ratings yet

- Government of Andhra Pradesh: Aptc Form-10Document1 pageGovernment of Andhra Pradesh: Aptc Form-10ashok9705030066100% (2)

- Problem 5xDocument4 pagesProblem 5xMAXINE CLAIRE CUTINGNo ratings yet

- Septya Ayu Neraca Saldo KlasikDocument1 pageSeptya Ayu Neraca Saldo KlasikwongtawengtawengNo ratings yet

- The Correct Cash and Cash Equivalent Balance On December 31, 2018 IsDocument7 pagesThe Correct Cash and Cash Equivalent Balance On December 31, 2018 IsAldrin ZolinaNo ratings yet

- I Love GanzonDocument22 pagesI Love Ganzonarnel tanggaroNo ratings yet

- In The Books of Aastha Medical Stores Profit and Loss A/C For The Year Ended 31 March 2017Document1 pageIn The Books of Aastha Medical Stores Profit and Loss A/C For The Year Ended 31 March 2017Pranav BedmuthaNo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsKARTIK CHADHANo ratings yet

- Biofest 69 - MergedDocument80 pagesBiofest 69 - Mergedbhawanar3950No ratings yet

- E-Book - International TradeDocument57 pagesE-Book - International Tradebhawanar3950No ratings yet

- 7) PUBLIC FINANCE - Unit 2Document18 pages7) PUBLIC FINANCE - Unit 2bhawanar3950No ratings yet

- AP AND GP - PP Notes MathsDocument74 pagesAP AND GP - PP Notes Mathsbhawanar3950No ratings yet

- Bills of Exchange & Promissory Notes 01 - Class NotesDocument20 pagesBills of Exchange & Promissory Notes 01 - Class Notesbhawanar3950No ratings yet

- Accounting For Incomplete RecordsDocument23 pagesAccounting For Incomplete Recordsbhawanar3950No ratings yet

- Jean WatsonDocument6 pagesJean Watsonbhawanar3950No ratings yet

- Redemption of Preference SharesDocument12 pagesRedemption of Preference Sharesbhawanar3950No ratings yet

- 11 CA Foundation Accounts Introduction To Company Accounts WithoutDocument45 pages11 CA Foundation Accounts Introduction To Company Accounts Withoutbhawanar3950No ratings yet

- Probability OTMDocument7 pagesProbability OTMbhawanar3950No ratings yet

- Unit 4 Receivables ManagementDocument20 pagesUnit 4 Receivables ManagementAbin VargheseNo ratings yet

- EDocument17 pagesEMark Cyphrysse Masiglat67% (3)

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- Verge Ifrs 15Document2 pagesVerge Ifrs 15Wafa ObaidNo ratings yet

- Auditing TheoryDocument16 pagesAuditing TheoryJudeGuzmanNo ratings yet

- Overview of Financial Modeling and ForecastingDocument22 pagesOverview of Financial Modeling and ForecastingogambadelvinNo ratings yet

- Chapter 15Document5 pagesChapter 15Renzo RamosNo ratings yet

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDocument14 pagesCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNo ratings yet

- BUS FPX4060 - Assessment3 1Document10 pagesBUS FPX4060 - Assessment3 1AA TsolScholarNo ratings yet

- Sap Fico BeginnersDocument710 pagesSap Fico Beginnersprincereddy100% (3)

- Sap Fi/Co General Ledger Accounting: Basic Settings: V IewDocument32 pagesSap Fi/Co General Ledger Accounting: Basic Settings: V IewPunit BavadNo ratings yet

- CNY Community Foundation 2013 AuditDocument22 pagesCNY Community Foundation 2013 Auditjobrien1381No ratings yet

- Finance Case Study: Jones Electrical DistributionDocument9 pagesFinance Case Study: Jones Electrical DistributionRaju SharmaNo ratings yet

- Lesson 3 Elements of FS Analyzing Business TransDocument18 pagesLesson 3 Elements of FS Analyzing Business TransHaidie Diaz100% (1)

- Test Bank Cpar SalesmmmmmmDocument7 pagesTest Bank Cpar Salesmmmmmmaldric taclanNo ratings yet

- ACC5116 - HOBA - Additional ProblemsDocument5 pagesACC5116 - HOBA - Additional ProblemsKiana FernandezNo ratings yet

- Đề Assurance Tháng 12Document16 pagesĐề Assurance Tháng 12Phước NguyễnNo ratings yet

- Unit 12 Receivable Management BBS Notes eduNEPAL - Info - PDFDocument4 pagesUnit 12 Receivable Management BBS Notes eduNEPAL - Info - PDFGrethel Tarun MalenabNo ratings yet

- Current AssetsDocument6 pagesCurrent Assetsscribd12397No ratings yet

- Basic Acctg 4th SatDocument11 pagesBasic Acctg 4th SatJerome Eziekel Posada PanaliganNo ratings yet

- Chapter (13) : Accounting For PartnershipDocument12 pagesChapter (13) : Accounting For Partnershipmagdy kamel100% (1)

- 07 - Ncomplete Records Complete Notes-1 PDFDocument13 pages07 - Ncomplete Records Complete Notes-1 PDFDanny FarrukhNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- Qbo 2018 TBDocument20 pagesQbo 2018 TBWilson CarlosNo ratings yet

- CashDocument29 pagesCashQuendrick SurbanNo ratings yet