Professional Documents

Culture Documents

3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HK

3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HK

Uploaded by

jed loverOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HK

3115 Ishares Core Hang Seng Index Etf Fund Fact Sheet en HK

Uploaded by

jed loverCopyright:

Available Formats

3115/ iShares Core Hang Seng Index ETF

83115/

As of 31/03/2024

9115

IMPORTANT: Investment involves risk, including the loss of principal. Investors should refer to the Prospectus and Key Facts Statement of the iShares Core Hang Seng Index ETF (the

“ETF”) for details, including the risk factors. Investors should not base investment decisions on this marketing material alone. Investors should note:

• The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the Hang Seng Index (net total return version).

• The ETF is subject to tracking error risk, which is the risk that its performance may not track that of the underlying index exactly.

• The ETF’s investments are concentrated in Hong Kong market. The value of the ETF may be more volatile than that of a fund having a more diverse portfolio of investments.

• The ETF’s base currency is in HKD but has units traded in USD and RMB (in addition to HKD). Investors may be subject to additional costs or losses associated with foreign currency

fluctuations between the base currency and the USD or RMB trading currency when trading units in the secondary market.

• RMB is currently not freely convertible and is subject to exchange controls and restrictions. Non-RMB based investors are exposed to foreign exchange risk on RMB-denominated

investments.

• If there is a suspension of the inter-counter transfer of units between the counters and/or any limitation on the level of services provided by brokers and CCASS participants,

Unitholders will only be able to trade their units in one counter. The market price of units traded in each counter may deviate significantly.

• The units of the ETF are traded on the SEHK. The trading price of the units is subject to market forces and may trade at a substantial premium or discount to the ETF’s NAV.

• The Manager may at its discretion pay distributions out of capital, or effectively out of capital, of the ETF. Payment of distributions out of capital or effectively out of capital amounts to

a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate

reduction of the NAV per unit.

• The Fund may use derivatives for hedging and for investment purposes. However, usage for investment purposes will not be extensive. The Fund may suffer losses from its

derivatives usage.

INVESTMENT OBJECTIVE FUND DETAILS

The iShares Core Hang Seng Index ETF seeks to track the investment results of an index composed of Asset Class Equity

Hong Kong equities. Inception Date 18/11/2016

Benchmark HSI Net Total Return Index

WHY 3115 / 83115 / 9115 ? Number of Holdings 82

Net Assets 1,333,836,228 HKD

1 Cost effective, Physical access to the largest and most traded companies listed in Hong Kong Management Fee (in %) 0.09

Units Outstanding 22,250,000

2 Access to market liquidity for Hong Kong equity exposure in three trading counters (HKD, RMB, USD)

Domicile Hong Kong

Base Currency Hong Kong Dollar

GROWTH OF 10,000 HKD SINCE INCEPTION Bloomberg Benchmark HSINH

Ticker

TOP 10 HOLDINGS(%)

TENCENT HOLDINGS LTD 8.63

HSBC HOLDINGS PLC 8.28

ALIBABA GROUP HOLDING LTD 7.52

AIA GROUP LTD 5.65

MEITUAN 5.42

CHINA CONSTRUCTION BANK CORP H 4.82

CHINA MOBILE LTD 3.88

INDUSTRIAL AND COMMERCIAL BANK OF 2.90

CNOOC LTD 2.66

Fund Benchmark

HONG KONG EXCHANGES AND

CLEARING L 2.56

The chart shows change of investment amount based on a hypothetical investment in the Fund. Total of Portfolio 52.32

CUMULATIVE AND ANNUALISED PERFORMANCE Holdings are subject to change.

Cumulative Annualized Performance is calculated based on NAV-to-NAV

1 Month 3 Month YTD 1 Year 3 Year 5 Year Since with dividend reinvested. Performance is calculated

Inception in the base currency of the Index Fund, including

ongoing charges and taxes, and excluding your

Fund 0.64% -2.53% -2.53% -15.98% -14.07% -8.02% -1.14%

trading costs on SEHK. Investment involves risk,

Benchmark 0.64% -2.53% -2.53% -15.82% -13.79% -7.78% -0.92%

including the loss of principal. Past performance

Past performance is not a reliable indicator of current or future performance and should not be the sole does not represent future returns.

factor of consideration when selecting a product or strategy. Investors may not get back the full amount

invested. Performance is shown on a Net Asset Value (NAV) basis with gross income reinvested, net of fees.

Performance is calculated in the relevant share class currency, including ongoing charges and taxes and

excluding subscription and redemption fees, if applicable. Benchmark performance displayed in denominated

currency and for comparative purpose only.

CALENDAR YEAR PERFORMANCE (% HKD)

2023 2022 2021 2020 2019

Fund -10.80% -12.79% -12.54% -0.65% 12.71%

Benchmark -10.61% -12.70% -11.94% -0.46% 12.87%

*Performance shown from index fund launch date to calendar year end.

SECTOR BREAKDOWN (%) TRADING INFORMATION

Exchange Hong Kong Stock Exchange

Board Lots 100 100 100

Trading Currency HKD CNH USD

Stock Code 3115 83115 9115

Bloomberg Ticker 3115 HK 83115 HK 9115 HK

ISIN HK0000313426 HK0000313434 HK0000313442

SEDOL BZ1BB92 BZ1BBB4 BZ1BBC5

As a percentage of NAV of the Fund. Based on Global Industry Classification Standard (GICS).

Please note this data excludes underlying investments of any exchange traded funds that may be

invested by the Fund.

Disclaimer: Unless otherwise specified, all information as of the month end. Sources: BlackRock and Hang Seng Indexes Company Limited. The above iShares Funds data is for

information only. Investment involves risk, including possible loss of principal. Investment in emerging market countries may involve heightened risks such as increased volatility

and lower trading volume, and may be subject to a greater risk of loss than investment in a developed country. Before deciding to invest, investors should read the Prospectus and

Key Fact Statements for details, including the risk factors. Performance is calculated on NAV to NAV basis, inclusive of all transaction fees and assumes dividend reinvestment. The

investment returns are denominated in base currency, which may be a foreign currency. If so, US/HK dollar-based investors are therefore exposed to fluctuations in the US/HK

dollar/foreign currency exchange rate. Rates of exchange may cause the value of investments to go up or down. Investors may not get back the amount they invest. Individual stock

prices/performance do not represent the return of the Fund. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or

redeemed, may be worth more or less than the original cost. Index returns are for illustrative purposes only and do not represent actual iShares Funds or iShares Trusts

performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Past performance does not guarantee future results.

Index Disclaimer: Hang Seng Index is the intellectual property (including registered trademarks) of Hang Seng Indexes Company Limited and/or of its licensors (“licensors”), and is

used under a licence. iShares funds are not sponsored, subscribed, sold or promoted by Hang Seng Indexes Company Limited and its licensors and none of them bear any liability

in this respect.

Issued by BlackRock Asset Management North Asia Limited. This material and the website have not been reviewed by the Securities and Futures Commission of Hong Kong.

BlackRock is a registered trademark of BlackRock, Inc. ©2024 BlackRock, Inc. All rights reserved. iShares® and BlackRock® are registered trademarks of BlackRock, Inc., or its

subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

You might also like

- Tardiness: Its Effects To The Academic Performance of The Grade 10 Students of Sjsfi Enrolled in S.Y. 2019-2020Document24 pagesTardiness: Its Effects To The Academic Performance of The Grade 10 Students of Sjsfi Enrolled in S.Y. 2019-2020Alyana Linog99% (86)

- Us Ishares Template Ishares Msci All Country Asia Ex Japan Etf Baax39Document3 pagesUs Ishares Template Ishares Msci All Country Asia Ex Japan Etf Baax39Caroline CostaNo ratings yet

- BGF China Fund D2 USD: March 2019 FactsheetDocument2 pagesBGF China Fund D2 USD: March 2019 FactsheetRicky ShooterNo ratings yet

- Ishares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021Document3 pagesIshares Msci Emerging Markets Etf: Fact Sheet As of 03/31/2021hkm_gmat4849No ratings yet

- Ishares China Large-Cap Etf: Fact Sheet As of 06/30/2021Document3 pagesIshares China Large-Cap Etf: Fact Sheet As of 06/30/2021radhika kumarfNo ratings yet

- Hock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Document3 pagesHock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Rhb InvestNo ratings yet

- Aok Ishares Core Conservative Allocation Etf Fund Fact Sheet en UsDocument3 pagesAok Ishares Core Conservative Allocation Etf Fund Fact Sheet en Usguilherme wigandNo ratings yet

- Malaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Document4 pagesMalaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Rhb InvestNo ratings yet

- Dialog Group Berhad: Focus On Domestic Drivers - 30/6/2010Document5 pagesDialog Group Berhad: Focus On Domestic Drivers - 30/6/2010Rhb InvestNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- WCT Berhad: 1HFY12/10 Net Profit Declines 15% YoY - 20/08/2010Document4 pagesWCT Berhad: 1HFY12/10 Net Profit Declines 15% YoY - 20/08/2010Rhb InvestNo ratings yet

- Hartalega Berhad: Looking For Landbank For Further Expansion - 06/09/2010Document4 pagesHartalega Berhad: Looking For Landbank For Further Expansion - 06/09/2010Rhb InvestNo ratings yet

- KFC Holding (M) Berhad: Some Hiccups in India-26/08/2010Document5 pagesKFC Holding (M) Berhad: Some Hiccups in India-26/08/2010Rhb InvestNo ratings yet

- KFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Document3 pagesKFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Rhb InvestNo ratings yet

- Hai-O Enterprise Berhad: MLM Division Slows Down - 28/06/2010Document4 pagesHai-O Enterprise Berhad: MLM Division Slows Down - 28/06/2010Rhb InvestNo ratings yet

- Hong Leong Bank Berhad: Stronger Net Profit, But Mainly Due To Low Tax Rate - 25/05/2010Document5 pagesHong Leong Bank Berhad: Stronger Net Profit, But Mainly Due To Low Tax Rate - 25/05/2010Rhb InvestNo ratings yet

- Puncak Niaga Holdings Berhad: 1HFY10 Net Profit Declines On Higher ExpensesDocument3 pagesPuncak Niaga Holdings Berhad: 1HFY10 Net Profit Declines On Higher ExpensesRhb InvestNo ratings yet

- T 000000Document4 pagesT 000000Marin DraganovNo ratings yet

- PERFIN - Session8 FactSheet 2Document3 pagesPERFIN - Session8 FactSheet 2Mob Morphling KurustienNo ratings yet

- Media Chinese Int'l Berhad: FY10 Core Net Profit Surged 95.6% YoY - 27/05/2010Document4 pagesMedia Chinese Int'l Berhad: FY10 Core Net Profit Surged 95.6% YoY - 27/05/2010Rhb InvestNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Document5 pagesAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestNo ratings yet

- Ann Joo Resources Berhad: 2QFY12/10 Net Profit Rises 71% QoQ - 04/08/2010Document4 pagesAnn Joo Resources Berhad: 2QFY12/10 Net Profit Rises 71% QoQ - 04/08/2010Rhb InvestNo ratings yet

- 2021 LOTTE CHEMICAL Company Intro. E-Brochure ENG 00Document25 pages2021 LOTTE CHEMICAL Company Intro. E-Brochure ENG 00Malik SahibNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Portfolio Holding Vs Performance (Since Inception) Sector - HoldingsDocument3 pagesPortfolio Holding Vs Performance (Since Inception) Sector - HoldingsAshok MishraNo ratings yet

- PNC Infratech Ltd. Initiating CoverageDocument29 pagesPNC Infratech Ltd. Initiating Coveragekalpesh_chandakNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- Aom Ishares Core Moderate Allocation Etf Fund Fact Sheet en UsDocument3 pagesAom Ishares Core Moderate Allocation Etf Fund Fact Sheet en UshhthunderbirdNo ratings yet

- Plantation Sector Update: The Battle of The Giants - IOIC Vs KLK - 06/10/2010Document3 pagesPlantation Sector Update: The Battle of The Giants - IOIC Vs KLK - 06/10/2010Rhb InvestNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFAJAY KUMAR TALATHOTANo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50market moneyNo ratings yet

- Kossan Rubber Industries Berhad: Demand For Gloves Still Firm - 6/6/2010Document5 pagesKossan Rubber Industries Berhad: Demand For Gloves Still Firm - 6/6/2010Rhb InvestNo ratings yet

- Ishares Core Msci All Country World Ex Canada Index Etf: Key FactsDocument2 pagesIshares Core Msci All Country World Ex Canada Index Etf: Key FactsChrisNo ratings yet

- Ta Ann Holdings Berhad: Earnings Expected To Pick Up From 2QFY12/10 - 31/5/2010Document4 pagesTa Ann Holdings Berhad: Earnings Expected To Pick Up From 2QFY12/10 - 31/5/2010Rhb InvestNo ratings yet

- SBI Smallcap Fund (1) 09162022Document4 pagesSBI Smallcap Fund (1) 09162022chandana kumarNo ratings yet

- Hock Seng Lee Berhad: Close To Clinching Another Job Worth About RM100m? - 17/09/2010Document3 pagesHock Seng Lee Berhad: Close To Clinching Another Job Worth About RM100m? - 17/09/2010Rhb InvestNo ratings yet

- Aok Ishares Core Conservative Allocation Etf Fund Fact Sheet en UsDocument3 pagesAok Ishares Core Conservative Allocation Etf Fund Fact Sheet en UsHéber ValverdeNo ratings yet

- AEON Co. (M) Berhad: Slower-Than-Expected SSS Growth in 1HFY12/10-10/08/2010Document4 pagesAEON Co. (M) Berhad: Slower-Than-Expected SSS Growth in 1HFY12/10-10/08/2010Rhb InvestNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFwartan solarNo ratings yet

- SBI Focused Equity Fund (1) 09162022Document4 pagesSBI Focused Equity Fund (1) 09162022chandana kumarNo ratings yet

- INF204K01HY3 - Reliance Smallcap FundDocument1 pageINF204K01HY3 - Reliance Smallcap FundKiran ChilukaNo ratings yet

- Hutchison Port Holdings Trust - Annual Report 2021Document185 pagesHutchison Port Holdings Trust - Annual Report 2021Lugie YanuardiNo ratings yet

- Affin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Document6 pagesAffin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Rhb InvestNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFSantanu Mitra RayNo ratings yet

- TA Asia Absolute Alpha Fund (TAAAAF) - USDDocument7 pagesTA Asia Absolute Alpha Fund (TAAAAF) - USDJason Wei Han LeeNo ratings yet

- WCT Berhad: 1QFY12/10 Net Profit Declines 11% YoY-24/05/2010Document4 pagesWCT Berhad: 1QFY12/10 Net Profit Declines 11% YoY-24/05/2010Rhb InvestNo ratings yet

- Evergreen Fibreboard Berhad: Stellar Results Due To Higher ASP and Improved Efficiency - 17/08/2010Document3 pagesEvergreen Fibreboard Berhad: Stellar Results Due To Higher ASP and Improved Efficiency - 17/08/2010Rhb InvestNo ratings yet

- LPI Capital Berhad: Below Expectations - 08/10/2010Document3 pagesLPI Capital Berhad: Below Expectations - 08/10/2010Rhb InvestNo ratings yet

- Faber Group Berhad: Award of Contract by Abu Dhabi Health Services - 6/7/2010Document3 pagesFaber Group Berhad: Award of Contract by Abu Dhabi Health Services - 6/7/2010Rhb InvestNo ratings yet

- Kuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Document4 pagesKuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Rhb InvestNo ratings yet

- Freight Management Berhad: FY06/10 Earnings Rose 21.1% YoY - 26/08/2010Document4 pagesFreight Management Berhad: FY06/10 Earnings Rose 21.1% YoY - 26/08/2010Rhb InvestNo ratings yet

- NewPortfolio - NGEN Portfolio AnalyticsDocument9 pagesNewPortfolio - NGEN Portfolio AnalyticsChandragupta MauryaNo ratings yet

- IHub Morning Shout - 23rd Oct 2023Document1 pageIHub Morning Shout - 23rd Oct 2023iqbalfawad66No ratings yet

- GF Special Situations: The Fund Our Experienced Fund Management TeamDocument2 pagesGF Special Situations: The Fund Our Experienced Fund Management Teamuniqueclub fabricsNo ratings yet

- IJM Land Berhad: Above Expectations - 26/08/2010Document4 pagesIJM Land Berhad: Above Expectations - 26/08/2010Rhb InvestNo ratings yet

- Hiap Teck Venture BHD: 3QFY07/10 Performance Improves On Better Margins But Likely To Weaken in Coming Quarters - 1/7/2010Document3 pagesHiap Teck Venture BHD: 3QFY07/10 Performance Improves On Better Margins But Likely To Weaken in Coming Quarters - 1/7/2010Rhb InvestNo ratings yet

- 10 CSOP FountainCap - 201801Document6 pages10 CSOP FountainCap - 201801Ricky YangNo ratings yet

- E.a50 - KFS (Clean) - 20170918Document11 pagesE.a50 - KFS (Clean) - 20170918Eddie NgNo ratings yet

- APM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Document7 pagesAPM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Rhb InvestNo ratings yet

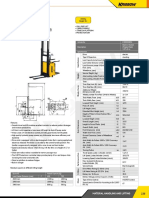

- Electric Stacker: Article No. KW0500894 Description Electric Stacker (Triplex Mast) 1.5T x3 M SpecificationDocument1 pageElectric Stacker: Article No. KW0500894 Description Electric Stacker (Triplex Mast) 1.5T x3 M SpecificationAsty RikyNo ratings yet

- MODBUS TCP/IP (0x/1x Range Adjustable) : HMI SettingDocument5 pagesMODBUS TCP/IP (0x/1x Range Adjustable) : HMI SettingÁnh VũNo ratings yet

- OceanofPDF - Com Ruination - Anthony ReynoldsDocument440 pagesOceanofPDF - Com Ruination - Anthony ReynoldsiAmNewbita100% (1)

- Badenian Gastropods From The Collections of The Mureş County MuseumDocument26 pagesBadenian Gastropods From The Collections of The Mureş County MuseumLouisaMjjNo ratings yet

- Tabel PeriodikDocument2 pagesTabel PeriodikNisrina KalyaNo ratings yet

- Mini Capstone Final Project Implementation and AssessmentDocument8 pagesMini Capstone Final Project Implementation and AssessmentSodium ChlorideNo ratings yet

- Vizsgaanyag PDFDocument30 pagesVizsgaanyag PDFSipka GergőNo ratings yet

- Week 10 RPH ENGLISHDocument4 pagesWeek 10 RPH ENGLISHAin HazirahNo ratings yet

- The Migration Industry and Future Directions For Migration PolicyDocument4 pagesThe Migration Industry and Future Directions For Migration PolicyGabriella VillaçaNo ratings yet

- Final Project On Employee EngagementDocument97 pagesFinal Project On Employee EngagementSanju DurgapalNo ratings yet

- Dictionary of Mission Theology, History, Perspectives Müller, KarlDocument552 pagesDictionary of Mission Theology, History, Perspectives Müller, KarlRev. Johana VangchhiaNo ratings yet

- Progress in The Development of A Reynolds-Stress Turbulence ClosureDocument30 pagesProgress in The Development of A Reynolds-Stress Turbulence ClosureMutiaRezaNo ratings yet

- Bahir Dar University College of Medicine and Health SciencesDocument21 pagesBahir Dar University College of Medicine and Health SciencesMegbaruNo ratings yet

- Bishop 1997Document25 pagesBishop 1997Celina AgostinhoNo ratings yet

- Nanotechnology and Its ApplicationDocument28 pagesNanotechnology and Its ApplicationsorinamotocNo ratings yet

- 2021 HhhhhhhterqasdwqwDocument1 page2021 HhhhhhhterqasdwqwHassan KhanNo ratings yet

- 1884 Journey From Heraut To Khiva Moscow and ST Petersburgh Vol 2 by Abbott S PDFDocument342 pages1884 Journey From Heraut To Khiva Moscow and ST Petersburgh Vol 2 by Abbott S PDFBilal AfridiNo ratings yet

- Filt Ers: 2 ElectrofiltersDocument8 pagesFilt Ers: 2 ElectrofiltersElancheran RengaNo ratings yet

- Six C's of Effective MessagesDocument40 pagesSix C's of Effective MessagessheilaNo ratings yet

- Matrices of Violence: A Post-Structural Feminist Rendering of Nawal El Saadawi's Woman at Point Zero and Lola Soneyin's The Secrets of Baba Segi's WivesDocument6 pagesMatrices of Violence: A Post-Structural Feminist Rendering of Nawal El Saadawi's Woman at Point Zero and Lola Soneyin's The Secrets of Baba Segi's WivesIJELS Research JournalNo ratings yet

- AbsintheDocument134 pagesAbsinthebrandon ambostaNo ratings yet

- Testbank ch01Document14 pagesTestbank ch01HườngNo ratings yet

- Operation & Maintenance Manual: Diesel Vehicle EngineDocument158 pagesOperation & Maintenance Manual: Diesel Vehicle Engineالمعز محمد عبد الرحمن100% (1)

- Qi Project Poster Improving Nurse ResponsivnessDocument1 pageQi Project Poster Improving Nurse Responsivnessapi-446692943No ratings yet

- The Challenges of TodayDocument5 pagesThe Challenges of TodayqamaradeelNo ratings yet

- Arts Lessonplantemplatevisualarts2019Document18 pagesArts Lessonplantemplatevisualarts2019api-451772183No ratings yet

- RAMMINGDocument3 pagesRAMMINGmatheswaran a sNo ratings yet

- GlobalCOD Method 2000 2015Document85 pagesGlobalCOD Method 2000 2015suma riadiNo ratings yet

- End-Of-Course Test (Word)Document4 pagesEnd-Of-Course Test (Word)los ikandasNo ratings yet