Professional Documents

Culture Documents

Cost Accounting Chat GPT

Cost Accounting Chat GPT

Uploaded by

Manleen KaurCopyright:

Available Formats

You might also like

- Strategic AnalysisDocument16 pagesStrategic Analysisrashedkalodi100% (1)

- Supply Chain at SiemensDocument2 pagesSupply Chain at SiemensRanjan Das100% (1)

- Nomas Systems Analysis and Design by Knight Associates, IncDocument50 pagesNomas Systems Analysis and Design by Knight Associates, IncPawan ShresthaNo ratings yet

- Strengthening Our Foundations: Thorntons PLC Annual Report and Accounts 2010Document76 pagesStrengthening Our Foundations: Thorntons PLC Annual Report and Accounts 2010amjanjuaNo ratings yet

- Meaningof Cost AccountingDocument13 pagesMeaningof Cost AccountingEthereal DNo ratings yet

- AMA - Essay 2Document8 pagesAMA - Essay 2Deborah WilliamsNo ratings yet

- Cost ModelingDocument2 pagesCost ModelingSharan RajNo ratings yet

- Addie ModelDocument5 pagesAddie ModelsiaurustraumenNo ratings yet

- Cost Accounting NotesDocument8 pagesCost Accounting Notesmehak vardhanNo ratings yet

- Cost Accounting - Theory QuestionsDocument16 pagesCost Accounting - Theory Questionsaryanmittal595No ratings yet

- Untitled DocumentDocument7 pagesUntitled Documentfaith olaNo ratings yet

- Assignment 02 - FIMO411Document4 pagesAssignment 02 - FIMO411Riznel Anthony CapaladNo ratings yet

- Exploring The Fundamentals of Cost AccountingDocument3 pagesExploring The Fundamentals of Cost Accountingiraleigh17No ratings yet

- Topic One Introduction TopicDocument37 pagesTopic One Introduction Topicramadhanamos620No ratings yet

- Activity Based CostingDocument24 pagesActivity Based CostingShaikh SuhailNo ratings yet

- Chap 003Document5 pagesChap 003abhinaypradhanNo ratings yet

- Unit 5 ABC - TheoryDocument9 pagesUnit 5 ABC - Theoryzidanehossain54No ratings yet

- Ii B.com - 3 Sem-Cost-TheoryDocument19 pagesIi B.com - 3 Sem-Cost-TheoryAR Ananth Rohith BhatNo ratings yet

- Course Outline Standard-Cost & Manageraial Acc IIDocument4 pagesCourse Outline Standard-Cost & Manageraial Acc IIsubeyr963No ratings yet

- Intoduction To Cost Accounting - 090057Document12 pagesIntoduction To Cost Accounting - 090057mika piusNo ratings yet

- MGT ActDocument4 pagesMGT ActSAJJADNo ratings yet

- Introduction To Cost AccountingDocument3 pagesIntroduction To Cost Accountingiraleigh17No ratings yet

- Nutan Cost AnalysisDocument76 pagesNutan Cost AnalysisBhushan NagalkarNo ratings yet

- Costing-An-Overview-of-Cost-and-Management-AccountingDocument6 pagesCosting-An-Overview-of-Cost-and-Management-Accountingrajasija30No ratings yet

- Costing An Overview of Cost and Management Accounting 1 PDFDocument6 pagesCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- Part - 3 - ABC CostingDocument14 pagesPart - 3 - ABC CostingDaniel BalchaNo ratings yet

- Cma Assignment No 01Document3 pagesCma Assignment No 01Shivani BalaniNo ratings yet

- Cost AccountingDocument35 pagesCost Accountingfaisalkazi2467% (3)

- Cost Management Concepts and Cost Behavior: Central Focus and Learning ObjectivesDocument9 pagesCost Management Concepts and Cost Behavior: Central Focus and Learning ObjectivesJane Michelle EmanNo ratings yet

- Shah Cost Assignment Word PadDocument5 pagesShah Cost Assignment Word PadMuhammadQasimNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument174 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- Basic Cost Concepts: Learning ObjectivesDocument31 pagesBasic Cost Concepts: Learning Objectivesversatile3No ratings yet

- Part - 1 - Advanced Cost ConceptsDocument23 pagesPart - 1 - Advanced Cost ConceptsDaniel BalchaNo ratings yet

- Primary Steps in ABC MethodDocument4 pagesPrimary Steps in ABC MethodSa'adatul Dara'inNo ratings yet

- Management Accounting (MBA)Document5 pagesManagement Accounting (MBA)Razzaqeee100% (1)

- CMA Assignment No 1Document3 pagesCMA Assignment No 1Shivani BalaniNo ratings yet

- Cost Structure For CompaniesDocument21 pagesCost Structure For CompaniesJuan LamasNo ratings yet

- 2024 Activity Based Costing and ManagementDocument12 pages2024 Activity Based Costing and Managementwambualucas74No ratings yet

- Cost Accounting - UNIT 1 - MidDocument60 pagesCost Accounting - UNIT 1 - MidPrathamesh DivekarNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- 1 Cost AccountingDocument31 pages1 Cost Accountingarchana_anuragiNo ratings yet

- Abc Costing.Document31 pagesAbc Costing.shahidulislamtaluckderNo ratings yet

- Costh AbcDocument19 pagesCosth AbcJEAN PIERRE ALEXANDER PAICO GUEVARANo ratings yet

- ABCD EditedDocument6 pagesABCD Editedcharles wambuiNo ratings yet

- Basic Cost Concepts Learning Objectives: Lobusz UblishingDocument42 pagesBasic Cost Concepts Learning Objectives: Lobusz UblishingHema LathaNo ratings yet

- Faculty of BusinessDocument7 pagesFaculty of BusinesssummycinthiatNo ratings yet

- UNit Costing Study MaterialDocument42 pagesUNit Costing Study MaterialChetana SoniNo ratings yet

- Managing Financial Principlemns and TechniquesDocument23 pagesManaging Financial Principlemns and Techniquesamersown100% (1)

- Question 4Document2 pagesQuestion 49gzqffwypnNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument148 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (3)

- Unit - 9 Modern Methods of Management AccountingDocument18 pagesUnit - 9 Modern Methods of Management AccountingAayushi KothariNo ratings yet

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- RFG 196 0113Document16 pagesRFG 196 0113Lets fight CancerNo ratings yet

- Course Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The CourseDocument29 pagesCourse Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The Courseavinash singhNo ratings yet

- Cost Accounting Viva - 045411Document23 pagesCost Accounting Viva - 045411MD: TonuNo ratings yet

- Cost Accounting-2Document114 pagesCost Accounting-2Saurabh BansalNo ratings yet

- BBA M&CA 301A UNIT II NotesDocument46 pagesBBA M&CA 301A UNIT II Notesrahmanakhtar28No ratings yet

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- Basic Cost Concepts: Learning ObjectivesDocument29 pagesBasic Cost Concepts: Learning ObjectivesvallikakNo ratings yet

- In Traditional Costing System Below Are The StepsDocument7 pagesIn Traditional Costing System Below Are The StepsNikhil KumarNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Organize Chat by TopicDocument5 pagesOrganize Chat by TopicManleen KaurNo ratings yet

- Financial Sector Reforms in India Since 1991: ImportanceDocument12 pagesFinancial Sector Reforms in India Since 1991: ImportanceManleen KaurNo ratings yet

- Researchpaper MadhviDocument13 pagesResearchpaper MadhviManleen KaurNo ratings yet

- Comparative Studyonthe Food Delivery Industrywith Referenceto Zomatoand Swiggyin Raipur Area 1Document15 pagesComparative Studyonthe Food Delivery Industrywith Referenceto Zomatoand Swiggyin Raipur Area 1Manleen KaurNo ratings yet

- Jm-Ug 1Document67 pagesJm-Ug 1Manleen KaurNo ratings yet

- ACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DDocument10 pagesACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DManleen KaurNo ratings yet

- APznzaYNKam8shVA4DU Mw1t7OEDBCNnTw6jUimixQuqGyYZtRisZ6voyo2QXF6GGXFbql9uqApNMhAIsdNfMHkIc64YNQ9j5LAsTR4QY- ACzU4Cem3BFl9rk6HnjgTQCFa0tdrkPb9k b0W-6-Up5FnlqKXHg2RC9liOBXkrLtpZMMLGxte8e ImGCXzx7edjHw3HDKX83c-ZU50zeiB29ihvdFyRu SDocument53 pagesAPznzaYNKam8shVA4DU Mw1t7OEDBCNnTw6jUimixQuqGyYZtRisZ6voyo2QXF6GGXFbql9uqApNMhAIsdNfMHkIc64YNQ9j5LAsTR4QY- ACzU4Cem3BFl9rk6HnjgTQCFa0tdrkPb9k b0W-6-Up5FnlqKXHg2RC9liOBXkrLtpZMMLGxte8e ImGCXzx7edjHw3HDKX83c-ZU50zeiB29ihvdFyRu SManleen KaurNo ratings yet

- ACFrOgAgAvlOk8V3KkRXNOd4ZYgPkBKkC-PF6aWUwz0mZvSZEDfOMTgftx So R2VKRRRQROw0Qw2SmvcOS84GhhNLahOUUiXCF6g XTlg4DCLM30fidg16h1U97is5Xo ysVHiCOQ20Pn7RkGljDocument10 pagesACFrOgAgAvlOk8V3KkRXNOd4ZYgPkBKkC-PF6aWUwz0mZvSZEDfOMTgftx So R2VKRRRQROw0Qw2SmvcOS84GhhNLahOUUiXCF6g XTlg4DCLM30fidg16h1U97is5Xo ysVHiCOQ20Pn7RkGljManleen KaurNo ratings yet

- Agricultural Income (Sec. 2 (1A) )Document9 pagesAgricultural Income (Sec. 2 (1A) )Manleen KaurNo ratings yet

- What Is Tax?: Not A DebtDocument13 pagesWhat Is Tax?: Not A DebtManleen KaurNo ratings yet

- Income Tax Law & Practice Residential StatusDocument11 pagesIncome Tax Law & Practice Residential StatusManleen KaurNo ratings yet

- ADC Program ContentsDocument4 pagesADC Program ContentsSiddharth Kulkarni100% (1)

- ISO-IEC 17799 The New International Standard For Information Security ManagementDocument39 pagesISO-IEC 17799 The New International Standard For Information Security ManagementCarlos Zumba100% (1)

- Variation Order No - 05 (Rentral Charges For Ware House From 1st of Jan-2024 To 31st Dec-2025)Document5 pagesVariation Order No - 05 (Rentral Charges For Ware House From 1st of Jan-2024 To 31st Dec-2025)muhammad75makeNo ratings yet

- Taco Bell: The Breakfast OpportunitiesDocument14 pagesTaco Bell: The Breakfast OpportunitiesQudsia NourasNo ratings yet

- Corporate Governance in The 21st CenturyDocument8 pagesCorporate Governance in The 21st CenturymayhemclubNo ratings yet

- Transaction Processing SystemDocument20 pagesTransaction Processing Systemanil2610No ratings yet

- Workshop 6 AnsDocument5 pagesWorkshop 6 AnsSAMUEL THOMASNo ratings yet

- LaamDocument33 pagesLaamARHAM MURTAZANo ratings yet

- Bpo 102 Part 1Document30 pagesBpo 102 Part 1Mary Lynn Dela PeñaNo ratings yet

- PPT6 The Internal Environment AnalysisDocument16 pagesPPT6 The Internal Environment AnalysisRenee Rose Piñera BulusanNo ratings yet

- Final Professional: (Pharmaceutical Quality Management) (Document7 pagesFinal Professional: (Pharmaceutical Quality Management) (Noman ZakiNo ratings yet

- Sample Business Case: Satellite Technologies Sales Model Transition PlanDocument9 pagesSample Business Case: Satellite Technologies Sales Model Transition PlanMJ SapiterNo ratings yet

- Datebase 2Document11 pagesDatebase 2jm syNo ratings yet

- Business Forecasting: by ITH PhannyDocument2 pagesBusiness Forecasting: by ITH PhannysmsNo ratings yet

- International Organisation For Standardization (ISO) What Are ISO 9000 Standards?Document7 pagesInternational Organisation For Standardization (ISO) What Are ISO 9000 Standards?sandeep singh gaurNo ratings yet

- Post 716Document2 pagesPost 716RiteshNo ratings yet

- A20 Midterm ReviewerDocument2 pagesA20 Midterm ReviewerEy EmNo ratings yet

- Bsxii. 2017 Mainnn For 12thDocument250 pagesBsxii. 2017 Mainnn For 12thAejaz MohamedNo ratings yet

- H&M SWOT AnalysisDocument10 pagesH&M SWOT AnalysisMayumi KeviniaNo ratings yet

- Econ101 Ch22Document17 pagesEcon101 Ch22Jeries LamaNo ratings yet

- Admission Bulletin 2023Document16 pagesAdmission Bulletin 2023Al OkNo ratings yet

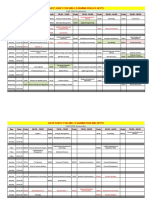

- Date Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterDocument4 pagesDate Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterAbu HureraNo ratings yet

- U6 - M2 - L6 - Microservice Architecture - Benefits and Drawbacks - Annotated - TaggedDocument13 pagesU6 - M2 - L6 - Microservice Architecture - Benefits and Drawbacks - Annotated - TaggedMarwan cleancodeNo ratings yet

- Cohesion and Coupling Concepts: Learning OutcomesDocument24 pagesCohesion and Coupling Concepts: Learning OutcomesJayson RodadoNo ratings yet

- Davies R.The State of ISO 55000 Next Steps Read Only PDFDocument29 pagesDavies R.The State of ISO 55000 Next Steps Read Only PDFTrevor MathabathaNo ratings yet

- Role of Doctors and Nurses in Material MDocument1 pageRole of Doctors and Nurses in Material MPrakash kumar gourNo ratings yet

Cost Accounting Chat GPT

Cost Accounting Chat GPT

Uploaded by

Manleen KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting Chat GPT

Cost Accounting Chat GPT

Uploaded by

Manleen KaurCopyright:

Available Formats

Mastering cost accounting to the extent of topping your class requires a consistent and dedicated effort over an

extended period of time. However, I can provide you with an overview of some key concepts and principles in cost

accounting to help you get started. Here are some fundamental topics to focus on:

1. Cost Concepts:

Understand the difference between direct costs and indirect costs.

Learn about fixed costs, variable costs, semi-variable costs, and step costs.

Grasp the concept of cost behavior and how costs change with changes in production levels.

2. Costing Methods:

Familiarize yourself with different costing methods, such as job order costing (used for customized or

unique products/services) and process costing (used for mass-produced goods).

Study activity-based costing (ABC), which assigns costs to activities and then to products based on their

usage of activities.

Explore standard costing, where costs are predetermined and compared to actual costs to assess

performance.

3. Cost Analysis and Decision Making:

Learn how to perform cost-volume-profit (CVP) analysis to understand the relationships between costs,

volume, and profit.

Study contribution margin analysis to determine the profitability of individual products or services.

Understand relevant costing techniques, such as differential costing and opportunity costing, to aid

decision making.

4. Cost Control and Budgeting:

Grasp the importance of cost control measures in managing and reducing costs within an organization.

Learn about budgeting techniques, including preparing various budgets (e.g., sales budget, production

budget, cash budget) and analyzing budget variances.

5. Performance Measurement:

Explore variance analysis, which compares actual costs to standard costs to identify areas of

improvement.

Understand key performance indicators (KPIs) used in cost accounting to evaluate operational efficiency

and effectiveness.

6. Costing Systems:

Study the principles behind job order costing, including cost accumulation, job cost sheets, and allocating

indirect costs.

Learn about process costing, focusing on the flow of costs in different production departments and the

computation of equivalent units.

7. Cost Allocation:

Understand the various methods of allocating indirect costs, such as direct labor hours, machine hours, or

activity-based costing.

Grasp the concept of cost allocation bases and their role in assigning indirect costs to products or

services.

Remember that actively engaging with the material through practice exercises, problem-solving, and reviewing real-

world examples will enhance your understanding of cost accounting. Additionally, seek out additional resources like

textbooks, online courses, and educational websites to deepen your knowledge and stay ahead in your studies.

Consistency, practice, and seeking clarification when needed are key to excelling in cost accounting.

You might also like

- Strategic AnalysisDocument16 pagesStrategic Analysisrashedkalodi100% (1)

- Supply Chain at SiemensDocument2 pagesSupply Chain at SiemensRanjan Das100% (1)

- Nomas Systems Analysis and Design by Knight Associates, IncDocument50 pagesNomas Systems Analysis and Design by Knight Associates, IncPawan ShresthaNo ratings yet

- Strengthening Our Foundations: Thorntons PLC Annual Report and Accounts 2010Document76 pagesStrengthening Our Foundations: Thorntons PLC Annual Report and Accounts 2010amjanjuaNo ratings yet

- Meaningof Cost AccountingDocument13 pagesMeaningof Cost AccountingEthereal DNo ratings yet

- AMA - Essay 2Document8 pagesAMA - Essay 2Deborah WilliamsNo ratings yet

- Cost ModelingDocument2 pagesCost ModelingSharan RajNo ratings yet

- Addie ModelDocument5 pagesAddie ModelsiaurustraumenNo ratings yet

- Cost Accounting NotesDocument8 pagesCost Accounting Notesmehak vardhanNo ratings yet

- Cost Accounting - Theory QuestionsDocument16 pagesCost Accounting - Theory Questionsaryanmittal595No ratings yet

- Untitled DocumentDocument7 pagesUntitled Documentfaith olaNo ratings yet

- Assignment 02 - FIMO411Document4 pagesAssignment 02 - FIMO411Riznel Anthony CapaladNo ratings yet

- Exploring The Fundamentals of Cost AccountingDocument3 pagesExploring The Fundamentals of Cost Accountingiraleigh17No ratings yet

- Topic One Introduction TopicDocument37 pagesTopic One Introduction Topicramadhanamos620No ratings yet

- Activity Based CostingDocument24 pagesActivity Based CostingShaikh SuhailNo ratings yet

- Chap 003Document5 pagesChap 003abhinaypradhanNo ratings yet

- Unit 5 ABC - TheoryDocument9 pagesUnit 5 ABC - Theoryzidanehossain54No ratings yet

- Ii B.com - 3 Sem-Cost-TheoryDocument19 pagesIi B.com - 3 Sem-Cost-TheoryAR Ananth Rohith BhatNo ratings yet

- Course Outline Standard-Cost & Manageraial Acc IIDocument4 pagesCourse Outline Standard-Cost & Manageraial Acc IIsubeyr963No ratings yet

- Intoduction To Cost Accounting - 090057Document12 pagesIntoduction To Cost Accounting - 090057mika piusNo ratings yet

- MGT ActDocument4 pagesMGT ActSAJJADNo ratings yet

- Introduction To Cost AccountingDocument3 pagesIntroduction To Cost Accountingiraleigh17No ratings yet

- Nutan Cost AnalysisDocument76 pagesNutan Cost AnalysisBhushan NagalkarNo ratings yet

- Costing-An-Overview-of-Cost-and-Management-AccountingDocument6 pagesCosting-An-Overview-of-Cost-and-Management-Accountingrajasija30No ratings yet

- Costing An Overview of Cost and Management Accounting 1 PDFDocument6 pagesCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- Part - 3 - ABC CostingDocument14 pagesPart - 3 - ABC CostingDaniel BalchaNo ratings yet

- Cma Assignment No 01Document3 pagesCma Assignment No 01Shivani BalaniNo ratings yet

- Cost AccountingDocument35 pagesCost Accountingfaisalkazi2467% (3)

- Cost Management Concepts and Cost Behavior: Central Focus and Learning ObjectivesDocument9 pagesCost Management Concepts and Cost Behavior: Central Focus and Learning ObjectivesJane Michelle EmanNo ratings yet

- Shah Cost Assignment Word PadDocument5 pagesShah Cost Assignment Word PadMuhammadQasimNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument174 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (1)

- Basic Cost Concepts: Learning ObjectivesDocument31 pagesBasic Cost Concepts: Learning Objectivesversatile3No ratings yet

- Part - 1 - Advanced Cost ConceptsDocument23 pagesPart - 1 - Advanced Cost ConceptsDaniel BalchaNo ratings yet

- Primary Steps in ABC MethodDocument4 pagesPrimary Steps in ABC MethodSa'adatul Dara'inNo ratings yet

- Management Accounting (MBA)Document5 pagesManagement Accounting (MBA)Razzaqeee100% (1)

- CMA Assignment No 1Document3 pagesCMA Assignment No 1Shivani BalaniNo ratings yet

- Cost Structure For CompaniesDocument21 pagesCost Structure For CompaniesJuan LamasNo ratings yet

- 2024 Activity Based Costing and ManagementDocument12 pages2024 Activity Based Costing and Managementwambualucas74No ratings yet

- Cost Accounting - UNIT 1 - MidDocument60 pagesCost Accounting - UNIT 1 - MidPrathamesh DivekarNo ratings yet

- Cost Accounting BookDocument148 pagesCost Accounting BookSharma Vishnu100% (2)

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- 1 Cost AccountingDocument31 pages1 Cost Accountingarchana_anuragiNo ratings yet

- Abc Costing.Document31 pagesAbc Costing.shahidulislamtaluckderNo ratings yet

- Costh AbcDocument19 pagesCosth AbcJEAN PIERRE ALEXANDER PAICO GUEVARANo ratings yet

- ABCD EditedDocument6 pagesABCD Editedcharles wambuiNo ratings yet

- Basic Cost Concepts Learning Objectives: Lobusz UblishingDocument42 pagesBasic Cost Concepts Learning Objectives: Lobusz UblishingHema LathaNo ratings yet

- Faculty of BusinessDocument7 pagesFaculty of BusinesssummycinthiatNo ratings yet

- UNit Costing Study MaterialDocument42 pagesUNit Costing Study MaterialChetana SoniNo ratings yet

- Managing Financial Principlemns and TechniquesDocument23 pagesManaging Financial Principlemns and Techniquesamersown100% (1)

- Question 4Document2 pagesQuestion 49gzqffwypnNo ratings yet

- Cost Accounting Book of 3rd Sem Mba at Bec DomsDocument148 pagesCost Accounting Book of 3rd Sem Mba at Bec DomsBabasab Patil (Karrisatte)100% (3)

- Unit - 9 Modern Methods of Management AccountingDocument18 pagesUnit - 9 Modern Methods of Management AccountingAayushi KothariNo ratings yet

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- RFG 196 0113Document16 pagesRFG 196 0113Lets fight CancerNo ratings yet

- Course Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The CourseDocument29 pagesCourse Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The Courseavinash singhNo ratings yet

- Cost Accounting Viva - 045411Document23 pagesCost Accounting Viva - 045411MD: TonuNo ratings yet

- Cost Accounting-2Document114 pagesCost Accounting-2Saurabh BansalNo ratings yet

- BBA M&CA 301A UNIT II NotesDocument46 pagesBBA M&CA 301A UNIT II Notesrahmanakhtar28No ratings yet

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- Basic Cost Concepts: Learning ObjectivesDocument29 pagesBasic Cost Concepts: Learning ObjectivesvallikakNo ratings yet

- In Traditional Costing System Below Are The StepsDocument7 pagesIn Traditional Costing System Below Are The StepsNikhil KumarNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Organize Chat by TopicDocument5 pagesOrganize Chat by TopicManleen KaurNo ratings yet

- Financial Sector Reforms in India Since 1991: ImportanceDocument12 pagesFinancial Sector Reforms in India Since 1991: ImportanceManleen KaurNo ratings yet

- Researchpaper MadhviDocument13 pagesResearchpaper MadhviManleen KaurNo ratings yet

- Comparative Studyonthe Food Delivery Industrywith Referenceto Zomatoand Swiggyin Raipur Area 1Document15 pagesComparative Studyonthe Food Delivery Industrywith Referenceto Zomatoand Swiggyin Raipur Area 1Manleen KaurNo ratings yet

- Jm-Ug 1Document67 pagesJm-Ug 1Manleen KaurNo ratings yet

- ACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DDocument10 pagesACFrOgCPKi70npV5R8ZO4Qe-CnF8yvJMWMlGx2SIx6bqMAfZA-YZJASbPgbSy7zbg0 cxrqcx5 sDGlx7VQi8IwTtYXto39d9pXkFK7wWNgU2QXrc U6WVrwDtAG6rQO7MrVVMWrGFcak-ZPM95DManleen KaurNo ratings yet

- APznzaYNKam8shVA4DU Mw1t7OEDBCNnTw6jUimixQuqGyYZtRisZ6voyo2QXF6GGXFbql9uqApNMhAIsdNfMHkIc64YNQ9j5LAsTR4QY- ACzU4Cem3BFl9rk6HnjgTQCFa0tdrkPb9k b0W-6-Up5FnlqKXHg2RC9liOBXkrLtpZMMLGxte8e ImGCXzx7edjHw3HDKX83c-ZU50zeiB29ihvdFyRu SDocument53 pagesAPznzaYNKam8shVA4DU Mw1t7OEDBCNnTw6jUimixQuqGyYZtRisZ6voyo2QXF6GGXFbql9uqApNMhAIsdNfMHkIc64YNQ9j5LAsTR4QY- ACzU4Cem3BFl9rk6HnjgTQCFa0tdrkPb9k b0W-6-Up5FnlqKXHg2RC9liOBXkrLtpZMMLGxte8e ImGCXzx7edjHw3HDKX83c-ZU50zeiB29ihvdFyRu SManleen KaurNo ratings yet

- ACFrOgAgAvlOk8V3KkRXNOd4ZYgPkBKkC-PF6aWUwz0mZvSZEDfOMTgftx So R2VKRRRQROw0Qw2SmvcOS84GhhNLahOUUiXCF6g XTlg4DCLM30fidg16h1U97is5Xo ysVHiCOQ20Pn7RkGljDocument10 pagesACFrOgAgAvlOk8V3KkRXNOd4ZYgPkBKkC-PF6aWUwz0mZvSZEDfOMTgftx So R2VKRRRQROw0Qw2SmvcOS84GhhNLahOUUiXCF6g XTlg4DCLM30fidg16h1U97is5Xo ysVHiCOQ20Pn7RkGljManleen KaurNo ratings yet

- Agricultural Income (Sec. 2 (1A) )Document9 pagesAgricultural Income (Sec. 2 (1A) )Manleen KaurNo ratings yet

- What Is Tax?: Not A DebtDocument13 pagesWhat Is Tax?: Not A DebtManleen KaurNo ratings yet

- Income Tax Law & Practice Residential StatusDocument11 pagesIncome Tax Law & Practice Residential StatusManleen KaurNo ratings yet

- ADC Program ContentsDocument4 pagesADC Program ContentsSiddharth Kulkarni100% (1)

- ISO-IEC 17799 The New International Standard For Information Security ManagementDocument39 pagesISO-IEC 17799 The New International Standard For Information Security ManagementCarlos Zumba100% (1)

- Variation Order No - 05 (Rentral Charges For Ware House From 1st of Jan-2024 To 31st Dec-2025)Document5 pagesVariation Order No - 05 (Rentral Charges For Ware House From 1st of Jan-2024 To 31st Dec-2025)muhammad75makeNo ratings yet

- Taco Bell: The Breakfast OpportunitiesDocument14 pagesTaco Bell: The Breakfast OpportunitiesQudsia NourasNo ratings yet

- Corporate Governance in The 21st CenturyDocument8 pagesCorporate Governance in The 21st CenturymayhemclubNo ratings yet

- Transaction Processing SystemDocument20 pagesTransaction Processing Systemanil2610No ratings yet

- Workshop 6 AnsDocument5 pagesWorkshop 6 AnsSAMUEL THOMASNo ratings yet

- LaamDocument33 pagesLaamARHAM MURTAZANo ratings yet

- Bpo 102 Part 1Document30 pagesBpo 102 Part 1Mary Lynn Dela PeñaNo ratings yet

- PPT6 The Internal Environment AnalysisDocument16 pagesPPT6 The Internal Environment AnalysisRenee Rose Piñera BulusanNo ratings yet

- Final Professional: (Pharmaceutical Quality Management) (Document7 pagesFinal Professional: (Pharmaceutical Quality Management) (Noman ZakiNo ratings yet

- Sample Business Case: Satellite Technologies Sales Model Transition PlanDocument9 pagesSample Business Case: Satellite Technologies Sales Model Transition PlanMJ SapiterNo ratings yet

- Datebase 2Document11 pagesDatebase 2jm syNo ratings yet

- Business Forecasting: by ITH PhannyDocument2 pagesBusiness Forecasting: by ITH PhannysmsNo ratings yet

- International Organisation For Standardization (ISO) What Are ISO 9000 Standards?Document7 pagesInternational Organisation For Standardization (ISO) What Are ISO 9000 Standards?sandeep singh gaurNo ratings yet

- Post 716Document2 pagesPost 716RiteshNo ratings yet

- A20 Midterm ReviewerDocument2 pagesA20 Midterm ReviewerEy EmNo ratings yet

- Bsxii. 2017 Mainnn For 12thDocument250 pagesBsxii. 2017 Mainnn For 12thAejaz MohamedNo ratings yet

- H&M SWOT AnalysisDocument10 pagesH&M SWOT AnalysisMayumi KeviniaNo ratings yet

- Econ101 Ch22Document17 pagesEcon101 Ch22Jeries LamaNo ratings yet

- Admission Bulletin 2023Document16 pagesAdmission Bulletin 2023Al OkNo ratings yet

- Date Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterDocument4 pagesDate Sheet For Mid-1 Examination (Cs Dept) : Fall 2020 SemesterAbu HureraNo ratings yet

- U6 - M2 - L6 - Microservice Architecture - Benefits and Drawbacks - Annotated - TaggedDocument13 pagesU6 - M2 - L6 - Microservice Architecture - Benefits and Drawbacks - Annotated - TaggedMarwan cleancodeNo ratings yet

- Cohesion and Coupling Concepts: Learning OutcomesDocument24 pagesCohesion and Coupling Concepts: Learning OutcomesJayson RodadoNo ratings yet

- Davies R.The State of ISO 55000 Next Steps Read Only PDFDocument29 pagesDavies R.The State of ISO 55000 Next Steps Read Only PDFTrevor MathabathaNo ratings yet

- Role of Doctors and Nurses in Material MDocument1 pageRole of Doctors and Nurses in Material MPrakash kumar gourNo ratings yet