Professional Documents

Culture Documents

QB Ipu 2024

QB Ipu 2024

Uploaded by

uditnarayan8721663Copyright:

Available Formats

You might also like

- Andrew Biel - Trail Guide To Movement-Books of Discovery (2015)Document284 pagesAndrew Biel - Trail Guide To Movement-Books of Discovery (2015)mindcontrolpseNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Sample Exercises ITDocument1 pageSample Exercises ITCris Joy BiabasNo ratings yet

- Vesys Test Drive READMEDocument29 pagesVesys Test Drive READMEHota bNo ratings yet

- Ami 335Document2 pagesAmi 335Daniel PaisNo ratings yet

- Atlas Housing V Dream PropertyDocument103 pagesAtlas Housing V Dream PropertyElizabeth LauNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- CFP Sample Paper Tax PlanningDocument4 pagesCFP Sample Paper Tax PlanningamishasoniNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- 5.1 Questions On Income From House PropertyDocument3 pages5.1 Questions On Income From House PropertyAashi GuptaNo ratings yet

- Practice Questions: Question # 1 (A)Document4 pagesPractice Questions: Question # 1 (A)Hamid Rana khanNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- Income Under The Head "Income From House Property" and Its ComputationDocument20 pagesIncome Under The Head "Income From House Property" and Its ComputationAanchal SinghalNo ratings yet

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document5 pagesUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Uj 35520+SOURCE1+SOURCE1.1Document14 pagesUj 35520+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Paper 4 Taxation For Nov 2011Document51 pagesPaper 4 Taxation For Nov 2011ACHAL JAINNo ratings yet

- Retirement BenifitDocument10 pagesRetirement BenifitAyush SarawagiNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- QuestionsDocument5 pagesQuestionsTris EatonNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Examples & Practice Questions For Income From PropertyDocument8 pagesExamples & Practice Questions For Income From PropertyAbdulAzeemNo ratings yet

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- House Property - IllustrationDocument10 pagesHouse Property - IllustrationAnirban ThakurNo ratings yet

- CFP Sample Paper Tax PlanningDocument8 pagesCFP Sample Paper Tax Planningchaitanya_koli2611No ratings yet

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- Bachelor's Degree Programme (BDP) : Assignment 2020-2021Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2020-2021Tulasiram PatraNo ratings yet

- Question BankDocument16 pagesQuestion BankTris EatonNo ratings yet

- Income Tax InternalDocument1 pageIncome Tax InternalPavani KunchallaNo ratings yet

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Document5 pagesOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20No ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Quiz 3 Chapter 8: Income From Property 50 Marks Name: SectionDocument4 pagesQuiz 3 Chapter 8: Income From Property 50 Marks Name: SectionHadiNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- DT QB For StudentDocument4 pagesDT QB For Studentdipali mohodNo ratings yet

- PR - No.11 To 17 QuestionsDocument5 pagesPR - No.11 To 17 QuestionsSiva SankariNo ratings yet

- Income From House Property - Income Tax Deductions On Home Loans & PropertyDocument13 pagesIncome From House Property - Income Tax Deductions On Home Loans & Propertyrajesh_bNo ratings yet

- House Property (Unit-2)Document34 pagesHouse Property (Unit-2)sanahir650No ratings yet

- Income Tax and Auditing Code: B-104: AssignmentDocument2 pagesIncome Tax and Auditing Code: B-104: AssignmentHritik singhNo ratings yet

- QUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Document5 pagesQUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Hemant WadhwaniNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- House ProDocument7 pagesHouse Prosb_jainNo ratings yet

- 1 Business TaxationDocument4 pages1 Business TaxationchouhanjainilNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

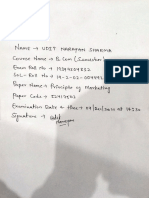

- Ans 3 PomDocument5 pagesAns 3 Pomuditnarayan8721663No ratings yet

- Ans 1 PomDocument4 pagesAns 1 Pomuditnarayan8721663No ratings yet

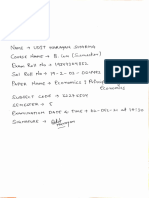

- Ans 5 FMDocument4 pagesAns 5 FMuditnarayan8721663No ratings yet

- Ans 3 FMDocument4 pagesAns 3 FMuditnarayan8721663No ratings yet

- Ans 2 EcoDocument4 pagesAns 2 Ecouditnarayan8721663No ratings yet

- Section 44AE - TheoryDocument44 pagesSection 44AE - Theoryuditnarayan8721663No ratings yet

- Educational Documents (1) - 4Document1 pageEducational Documents (1) - 4uditnarayan8721663No ratings yet

- Sprui 03 BDocument329 pagesSprui 03 BHou BouNo ratings yet

- Finance Exam Questions #2Document21 pagesFinance Exam Questions #2Cody Chivas100% (1)

- Choosing An Ecommerce Platform GuideDocument40 pagesChoosing An Ecommerce Platform GuidejeetNo ratings yet

- In Design: Iman BokhariDocument12 pagesIn Design: Iman Bokharimena_sky11No ratings yet

- Engine Especifications G3520BDocument4 pagesEngine Especifications G3520BYaneth100% (1)

- Advertisement Do More Harm Than GoodDocument1 pageAdvertisement Do More Harm Than Good박성진No ratings yet

- Audit Free CloudDocument15 pagesAudit Free CloudKishore Kumar RaviChandranNo ratings yet

- Final BSR Road Bridge Nagaur of 2019Document66 pagesFinal BSR Road Bridge Nagaur of 2019Jakhar MukeshNo ratings yet

- HotelDocument2 pagesHotelKHAOULA ELAMRANINo ratings yet

- OJT ReportDocument52 pagesOJT ReportMARK MATUMBA0% (1)

- AnalogI PDFDocument48 pagesAnalogI PDFJerc ZajNo ratings yet

- Vernacular Architecture of Hills IndiaDocument12 pagesVernacular Architecture of Hills IndiaTushar JainNo ratings yet

- ACLU Letter On Riverside County RedistrictingDocument2 pagesACLU Letter On Riverside County RedistrictingThe Press-Enterprise / pressenterprise.comNo ratings yet

- Anexa 2. Eon 25Document11 pagesAnexa 2. Eon 25Alexandra AntonNo ratings yet

- FOURNIER RF-5B - Sperber Flight Manual (English)Document29 pagesFOURNIER RF-5B - Sperber Flight Manual (English)Rene QueirozNo ratings yet

- Budget Choux EkondjeDocument4 pagesBudget Choux EkondjePikol WeladjiNo ratings yet

- Scientific Programme 83Document8 pagesScientific Programme 83lakshminivas PingaliNo ratings yet

- Revisions HistoryDocument25 pagesRevisions Historyabdel taibNo ratings yet

- Computation of ProfitsDocument4 pagesComputation of ProfitsAngela LozanoNo ratings yet

- JVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Document81 pagesJVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Сержант БойкоNo ratings yet

- HW3 SolDocument6 pagesHW3 Solmary_nailynNo ratings yet

- Sikafloor®-169: Product Data SheetDocument4 pagesSikafloor®-169: Product Data SheetMohammed AwfNo ratings yet

- Ra 10639Document6 pagesRa 10639Rea Rosario MaliteNo ratings yet

- 003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English HDocument33 pages003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English Hcricketprediction8271No ratings yet

- Signed Letter To Kemp Re Georgia Secretary of State NetworkDocument2 pagesSigned Letter To Kemp Re Georgia Secretary of State NetworkDaily Caller News FoundationNo ratings yet

- Cooking RubricsDocument3 pagesCooking RubricsAndrea Mae ArtiendaNo ratings yet

QB Ipu 2024

QB Ipu 2024

Uploaded by

uditnarayan8721663Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QB Ipu 2024

QB Ipu 2024

Uploaded by

uditnarayan8721663Copyright:

Available Formats

1.

Differentiate between Tax planning and Tax Avoidance

2. State any 5 income Exempted from tax

3. Income of previous year is always taxable in the immediately following assessment year.

Comment

4. Perquisite in respect of rent free accommodation

5. State the kind of provident funds and explain

6. Narrate the basic features of Income tax Act 1961

7. How will you determine the residential status of HUF?

8. Describe in how many categories the residential status of an assesse is divided. Also

explain the conditions of those categories

9. Narrate the rules for leave encashment

10. Explain the steps for calculating gratuity.

11. How one can calculate the taxable income from house property

12. Gross Total Income of Mr. Dust aged 50 years as computed under Income-tax Act, for

the assessment year 2018-19 is Rs. 3,00,000. He deposits Rs. 20,000 in a PPF

account. Compute the tax payable by Mr. Dust assuming that he has agricultural

income of

a. Nil;

b. Rs. 5,000; and

c. Rs. 3,50,000.

13. Enumerate any 10 income which do not form part of total income, also explain the

meaning of income tax as per income tax act in India

14. X own two identical houses in Delhi, both of which are self occupied. From the following

information, suggest which house should be treated as self occupied.

Particulars House 1 House 2

Standard Rent 3,30,000 3,30,000

Municipal Value 300000 300000

Fair Rent 300000 300000

Municipal Tax (Paid) 30000 30000

Insurance Premium (Paid) 15000 5000

Construction of both houses completed in September 2020. X had borrowed Rs 2500000 @9% p.a.

for constitution of house 2 (Date of Borrowing 1.06.2019), date of repayment of loan 30.06.2023

15. The following particular relate to the income Mr X for the assessment year 2024-25:

Dearness Allowance @Rs 6000 pm

Bonus @2 month basic salary

Entertainment Allowance @Rs 2000 pm

House Rent Allowance @Rs 7000 pm

Actual rent paid @Rs 4000 pm

Transport Allowance @Rs 200 pm

Children Education Allowance for 3 children @200 per month each

He is also provided with gas , electricity and water facility and employer spent Rs15000 on these

Facilities

Gift of smart watch worth Rs 14000 was received from employer

Car with engine capacity 1.7 liter is given for both office and personal use. All the maintenance

expenses are met by employer

He and his employer both contribute 10% of his salary to his recognized provident fund and interest

credited to this fund @12% amounted to Rs 30000 during the previous year.

He donated Rs 18000 to National Defence Fund

Compute his taxable income and tax liability for the assessment year 2022-23

16. What is tax incidence? How it can be determined

17. How to Compute the Total Tax Liability?

18. What is partly agricultural income? Explain the calculation process.

You might also like

- Andrew Biel - Trail Guide To Movement-Books of Discovery (2015)Document284 pagesAndrew Biel - Trail Guide To Movement-Books of Discovery (2015)mindcontrolpseNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Sample Exercises ITDocument1 pageSample Exercises ITCris Joy BiabasNo ratings yet

- Vesys Test Drive READMEDocument29 pagesVesys Test Drive READMEHota bNo ratings yet

- Ami 335Document2 pagesAmi 335Daniel PaisNo ratings yet

- Atlas Housing V Dream PropertyDocument103 pagesAtlas Housing V Dream PropertyElizabeth LauNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- CFP Sample Paper Tax PlanningDocument4 pagesCFP Sample Paper Tax PlanningamishasoniNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- 5.1 Questions On Income From House PropertyDocument3 pages5.1 Questions On Income From House PropertyAashi GuptaNo ratings yet

- Practice Questions: Question # 1 (A)Document4 pagesPractice Questions: Question # 1 (A)Hamid Rana khanNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- Income Under The Head "Income From House Property" and Its ComputationDocument20 pagesIncome Under The Head "Income From House Property" and Its ComputationAanchal SinghalNo ratings yet

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document5 pagesUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Uj 35520+SOURCE1+SOURCE1.1Document14 pagesUj 35520+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Paper 4 Taxation For Nov 2011Document51 pagesPaper 4 Taxation For Nov 2011ACHAL JAINNo ratings yet

- Retirement BenifitDocument10 pagesRetirement BenifitAyush SarawagiNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- QuestionsDocument5 pagesQuestionsTris EatonNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Examples & Practice Questions For Income From PropertyDocument8 pagesExamples & Practice Questions For Income From PropertyAbdulAzeemNo ratings yet

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- House Property - IllustrationDocument10 pagesHouse Property - IllustrationAnirban ThakurNo ratings yet

- CFP Sample Paper Tax PlanningDocument8 pagesCFP Sample Paper Tax Planningchaitanya_koli2611No ratings yet

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- Bachelor's Degree Programme (BDP) : Assignment 2020-2021Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2020-2021Tulasiram PatraNo ratings yet

- Question BankDocument16 pagesQuestion BankTris EatonNo ratings yet

- Income Tax InternalDocument1 pageIncome Tax InternalPavani KunchallaNo ratings yet

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Document5 pagesOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20No ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Quiz 3 Chapter 8: Income From Property 50 Marks Name: SectionDocument4 pagesQuiz 3 Chapter 8: Income From Property 50 Marks Name: SectionHadiNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- DT QB For StudentDocument4 pagesDT QB For Studentdipali mohodNo ratings yet

- PR - No.11 To 17 QuestionsDocument5 pagesPR - No.11 To 17 QuestionsSiva SankariNo ratings yet

- Income From House Property - Income Tax Deductions On Home Loans & PropertyDocument13 pagesIncome From House Property - Income Tax Deductions On Home Loans & Propertyrajesh_bNo ratings yet

- House Property (Unit-2)Document34 pagesHouse Property (Unit-2)sanahir650No ratings yet

- Income Tax and Auditing Code: B-104: AssignmentDocument2 pagesIncome Tax and Auditing Code: B-104: AssignmentHritik singhNo ratings yet

- QUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Document5 pagesQUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Hemant WadhwaniNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- House ProDocument7 pagesHouse Prosb_jainNo ratings yet

- 1 Business TaxationDocument4 pages1 Business TaxationchouhanjainilNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Ans 3 PomDocument5 pagesAns 3 Pomuditnarayan8721663No ratings yet

- Ans 1 PomDocument4 pagesAns 1 Pomuditnarayan8721663No ratings yet

- Ans 5 FMDocument4 pagesAns 5 FMuditnarayan8721663No ratings yet

- Ans 3 FMDocument4 pagesAns 3 FMuditnarayan8721663No ratings yet

- Ans 2 EcoDocument4 pagesAns 2 Ecouditnarayan8721663No ratings yet

- Section 44AE - TheoryDocument44 pagesSection 44AE - Theoryuditnarayan8721663No ratings yet

- Educational Documents (1) - 4Document1 pageEducational Documents (1) - 4uditnarayan8721663No ratings yet

- Sprui 03 BDocument329 pagesSprui 03 BHou BouNo ratings yet

- Finance Exam Questions #2Document21 pagesFinance Exam Questions #2Cody Chivas100% (1)

- Choosing An Ecommerce Platform GuideDocument40 pagesChoosing An Ecommerce Platform GuidejeetNo ratings yet

- In Design: Iman BokhariDocument12 pagesIn Design: Iman Bokharimena_sky11No ratings yet

- Engine Especifications G3520BDocument4 pagesEngine Especifications G3520BYaneth100% (1)

- Advertisement Do More Harm Than GoodDocument1 pageAdvertisement Do More Harm Than Good박성진No ratings yet

- Audit Free CloudDocument15 pagesAudit Free CloudKishore Kumar RaviChandranNo ratings yet

- Final BSR Road Bridge Nagaur of 2019Document66 pagesFinal BSR Road Bridge Nagaur of 2019Jakhar MukeshNo ratings yet

- HotelDocument2 pagesHotelKHAOULA ELAMRANINo ratings yet

- OJT ReportDocument52 pagesOJT ReportMARK MATUMBA0% (1)

- AnalogI PDFDocument48 pagesAnalogI PDFJerc ZajNo ratings yet

- Vernacular Architecture of Hills IndiaDocument12 pagesVernacular Architecture of Hills IndiaTushar JainNo ratings yet

- ACLU Letter On Riverside County RedistrictingDocument2 pagesACLU Letter On Riverside County RedistrictingThe Press-Enterprise / pressenterprise.comNo ratings yet

- Anexa 2. Eon 25Document11 pagesAnexa 2. Eon 25Alexandra AntonNo ratings yet

- FOURNIER RF-5B - Sperber Flight Manual (English)Document29 pagesFOURNIER RF-5B - Sperber Flight Manual (English)Rene QueirozNo ratings yet

- Budget Choux EkondjeDocument4 pagesBudget Choux EkondjePikol WeladjiNo ratings yet

- Scientific Programme 83Document8 pagesScientific Programme 83lakshminivas PingaliNo ratings yet

- Revisions HistoryDocument25 pagesRevisions Historyabdel taibNo ratings yet

- Computation of ProfitsDocument4 pagesComputation of ProfitsAngela LozanoNo ratings yet

- JVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Document81 pagesJVC - KD dv4200 - KD dv4201 - KD dv4202 - KD dv4203 - KD dv4204 - KD dv4205 - KD dv4206 - KD dv4207 Ma248Сержант БойкоNo ratings yet

- HW3 SolDocument6 pagesHW3 Solmary_nailynNo ratings yet

- Sikafloor®-169: Product Data SheetDocument4 pagesSikafloor®-169: Product Data SheetMohammed AwfNo ratings yet

- Ra 10639Document6 pagesRa 10639Rea Rosario MaliteNo ratings yet

- 003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English HDocument33 pages003 PDF CRUX Negotiable Instruments Act 1881 Lecture 2 English Hcricketprediction8271No ratings yet

- Signed Letter To Kemp Re Georgia Secretary of State NetworkDocument2 pagesSigned Letter To Kemp Re Georgia Secretary of State NetworkDaily Caller News FoundationNo ratings yet

- Cooking RubricsDocument3 pagesCooking RubricsAndrea Mae ArtiendaNo ratings yet