Professional Documents

Culture Documents

FMI Class5 Q

FMI Class5 Q

Uploaded by

Fariha KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMI Class5 Q

FMI Class5 Q

Uploaded by

Fariha KhanCopyright:

Available Formats

LI Financial Markets and Institutions

EXERCISES CLASS 5

1. What does the EMH have to say about each of the following statements?

(a) Short-term interest rates are 1% below long-term rates. You should borrow short-term.

(b) Interest rates in Japan are lower than in the US. It is better to borrow Japanese yen

rather than U.S. dollars.

(c) The stock market cycle has obviously topped out, and the next move is almost surely

down. It is better to issue new stocks now and get a decent price for the shares.

(d) There are so many people who have made a bundle in the stock market last year.

(e) If markets are efficient, you might as well select your portfolio by throwing darts at

the stock listings in The Wall Street Journal.

2. Answer the following questions:

(a) If markets are efficient, what should be the correlation coefficient between stock returns

for two consecutive time periods?

(b) A successful firm like Microsoft has consistently generated large profits for years. Is

this a violation of the EMH?

(c) SG Industries has never missed a dividend payment in its 94-year history. Does this

make it more attractive to you as a possible purchase for your stock portfolio?

3. Why are the following effects considered efficient market anomalies? Are there any possible

explanations in behavioural finance for these effects?

(a) Monday effect.

(b) Book-to-market effect.

(c) Momentum effect.

(d) Small-firm effect.

4. Suppose you find that prices of stocks before large dividend increases show on average

consistently positive abnormal returns. Is this a violation of the EMH?

Mary Dawood – University of Birmingham | Page 1

LI Financial Markets and Institutions

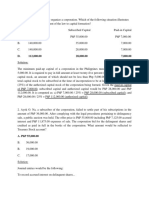

5. Suppose that, after conducting an analysis of past stock prices, you come up with the

following observations. Which would appear to contradict the weak form of the efficient

market hypothesis? Explain.

(a) The average rate of return is significantly greater than zero.

(b) The correlation between the return during a given week and the return during the

following week is zero.

(c) One could have made superior returns by buying stock after a 10% rise in price and

selling after a 10% fall.

(d) Insiders earn abnormal trading profits.

6. Which of the following hypothetical phenomena would be either consistent with or a vio-

lation of the efficient market hypothesis? Explain briefly.

(a) Nearly half of all professionally managed mutual funds are able to outperform the S&P

500 in a typical year.

(b) Money managers who outperform the market (on a risk-adjusted basis) in one year

are likely to outperform the market in the following year.

(c) Stock prices tend to be predictably more volatile in January than in other months.

(d) Stock prices of companies that announce increased earnings in January tend to out-

perform the market in February.

7. A valuation model applied to past monthly returns in Ford’s stock price produces the

following estimates, which are believed to be stable over time:

rF = 0.1% + 1.1rM

where rF is the rate of return on Ford’s stock price and rM is the rate of return on the

market portfolio as measured by S&P500. If the market index subsequently rises by 8%

and Ford’s stock price rises by 7%, what is the abnormal change in Ford’s stock price?

Mary Dawood – University of Birmingham | Page 2

You might also like

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Filmore EnterprisesDocument7 pagesFilmore EnterprisesJoshua Everett100% (1)

- Chap 14 - Bret Company (Case Study)Document5 pagesChap 14 - Bret Company (Case Study)Al HiponiaNo ratings yet

- Preferred Stock in Private Equity Transactions Significant Tax IssuesDocument23 pagesPreferred Stock in Private Equity Transactions Significant Tax IssuesDestiny AigbeNo ratings yet

- Homework 3Document3 pagesHomework 3sharkfinnnNo ratings yet

- Module 3 - FILMORE ENTERPRISES - QuestionsDocument4 pagesModule 3 - FILMORE ENTERPRISES - Questionsseth litchfieldNo ratings yet

- Chapter 05 - Financial Instruments and MarketsDocument19 pagesChapter 05 - Financial Instruments and MarketsAna SaggioNo ratings yet

- September 2008 Caia Level I Sample Questions: Chartered Alternative Investment AnalystDocument27 pagesSeptember 2008 Caia Level I Sample Questions: Chartered Alternative Investment AnalystRavi Gupta100% (1)

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- Accounting Textbook Solutions - 60Document19 pagesAccounting Textbook Solutions - 60acc-expertNo ratings yet

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- IM Problem Set 4Document3 pagesIM Problem Set 4Moe EltayebNo ratings yet

- Chapter 11 Study NotesDocument4 pagesChapter 11 Study NotesRajaa BerryNo ratings yet

- Portfolio Chapter 11Document3 pagesPortfolio Chapter 11Lim XiaopeiNo ratings yet

- Portfolio Chapter 11Document3 pagesPortfolio Chapter 11Lim XiaopeiNo ratings yet

- 431 FinalDocument6 pages431 FinalfNo ratings yet

- FIN 534 GENIUS Expect Success Fin534geniusdotcomDocument31 pagesFIN 534 GENIUS Expect Success Fin534geniusdotcomisabella45No ratings yet

- @mas - Simulation Exam (Corrected) With SolmanDocument10 pages@mas - Simulation Exam (Corrected) With SolmanMai Flor A. LofrancoNo ratings yet

- Equity and Fixed IncomeDocument5 pagesEquity and Fixed IncomePhuong DoNo ratings yet

- Equity Question 2Document3 pagesEquity Question 2Istiak MahmudNo ratings yet

- Tutorial-1 FMADocument6 pagesTutorial-1 FMANguyễn NhungNo ratings yet

- Tutorial 8Document3 pagesTutorial 8NokubongaNo ratings yet

- Chapter 7 Test BankDocument93 pagesChapter 7 Test BankM.Talha100% (1)

- Equity QUIZDocument8 pagesEquity QUIZSaYeD SeeDooNo ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Monetary A-7Document6 pagesMonetary A-7mohanms.0709No ratings yet

- 2 AssignmentDocument14 pages2 AssignmentHira NazNo ratings yet

- MCQ 4Document27 pagesMCQ 4Rishad kNo ratings yet

- BKM CH 11 Answers W CFADocument10 pagesBKM CH 11 Answers W CFAlevajunk80% (5)

- Amity University, Lucknow Financial Engineering MBA (G) IV Semester Assignment in Lieu of Mid Semester Examination Submission Date 12/03/09Document1 pageAmity University, Lucknow Financial Engineering MBA (G) IV Semester Assignment in Lieu of Mid Semester Examination Submission Date 12/03/09asifanisNo ratings yet

- Portfolio ManagamentDocument74 pagesPortfolio ManagamentM Umar MughalNo ratings yet

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHANo ratings yet

- FM AssignmentDocument3 pagesFM Assignmentjeaner2008No ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Chapter 7 - Test BankDocument93 pagesChapter 7 - Test Bankjoess100% (1)

- Tutorial 1 - Investment Overview N Risk Return Concepts (Student)Document3 pagesTutorial 1 - Investment Overview N Risk Return Concepts (Student)bkkcheesepieNo ratings yet

- Solutions Manual To Accompany Investment 8th Edition 9780073382371Document8 pagesSolutions Manual To Accompany Investment 8th Edition 9780073382371JohnCallahancori100% (38)

- UntitledDocument3 pagesUntitledMuhammad AbdullahNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- Chapter 13 The Stock Market: Financial Markets and Institutions, 9e, Global Edition (Mishkin)Document13 pagesChapter 13 The Stock Market: Financial Markets and Institutions, 9e, Global Edition (Mishkin)Mahmoud SamyNo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- Ch.7 FinanceDocument18 pagesCh.7 FinanceJohnCharles ShawNo ratings yet

- Problem 4Document7 pagesProblem 4billyNo ratings yet

- CFI5104201205 Investment AnalysisDocument7 pagesCFI5104201205 Investment AnalysisNelson MrewaNo ratings yet

- Cfi1203 Revision QuestionsDocument22 pagesCfi1203 Revision QuestionsLeonorahNo ratings yet

- FIN 3331 Risk and Return AssignmentDocument2 pagesFIN 3331 Risk and Return AssignmentHelen Joan BuiNo ratings yet

- BUS 365: Investments Practice Problems Risk and ReturnDocument4 pagesBUS 365: Investments Practice Problems Risk and ReturnAmeya RanadiveNo ratings yet

- 3017 Tutorial 7 SolutionsDocument3 pages3017 Tutorial 7 SolutionsNguyễn HảiNo ratings yet

- Your ResultsDocument26 pagesYour ResultsSidra KhanNo ratings yet

- 18BSP422 1 EX1 OutlineAnswersDocument7 pages18BSP422 1 EX1 OutlineAnswersalexwilliamduffNo ratings yet

- Studocudocument 2Document17 pagesStudocudocument 2Kathleen J. GonzalesNo ratings yet

- Practice Questions 6 SolutionsDocument2 pagesPractice Questions 6 SolutionsNevaeh LeeNo ratings yet

- APS 1 QuestionsDocument12 pagesAPS 1 Questions980921kill123No ratings yet

- 17BSP422-Jan2018 Outline AnswersDocument7 pages17BSP422-Jan2018 Outline AnswersalexwilliamduffNo ratings yet

- Critical ReasoningDocument28 pagesCritical ReasoningMane DaralNo ratings yet

- Fixed Income DerivativesDocument24 pagesFixed Income DerivativesKrishnan ChariNo ratings yet

- Cap.15 MFIDocument44 pagesCap.15 MFIAndreea VladNo ratings yet

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimNo ratings yet

- HW Assignment 3Document6 pagesHW Assignment 3Jeremiah Faulkner0% (1)

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- FIN 4604 Sample Questions IIIDocument18 pagesFIN 4604 Sample Questions IIIMohan RajNo ratings yet

- 03 PS3 EqDocument2 pages03 PS3 EqhatemNo ratings yet

- FMI Class4 QDocument3 pagesFMI Class4 QFariha KhanNo ratings yet

- Topic 1.3 ConsolidationDocument1 pageTopic 1.3 ConsolidationFariha KhanNo ratings yet

- AES Lecture5 TestingDocument58 pagesAES Lecture5 TestingFariha KhanNo ratings yet

- Seminar 1 TGE 2023Document1 pageSeminar 1 TGE 2023Fariha KhanNo ratings yet

- FMI-Lecture5-Stock MarketDocument44 pagesFMI-Lecture5-Stock MarketFariha KhanNo ratings yet

- Micro 2-2 Consumer Theory - Auctions - DUBAIDocument39 pagesMicro 2-2 Consumer Theory - Auctions - DUBAIFariha KhanNo ratings yet

- FMI-Lecture7-Depository InstitutionsDocument41 pagesFMI-Lecture7-Depository InstitutionsFariha KhanNo ratings yet

- Class XII Phase Test I - SubDocument2 pagesClass XII Phase Test I - SubFariha KhanNo ratings yet

- Micro 1-2 Consumer Theory - Optimal ChoiceDocument44 pagesMicro 1-2 Consumer Theory - Optimal ChoiceFariha KhanNo ratings yet

- MACRO Lecture2 Money 2Document36 pagesMACRO Lecture2 Money 2Fariha KhanNo ratings yet

- Holiday HW For 12th CRP 2021Document37 pagesHoliday HW For 12th CRP 2021Fariha KhanNo ratings yet

- ECTRX Topic1 ReviewDocument40 pagesECTRX Topic1 ReviewFariha KhanNo ratings yet

- CRP - 12 PMT-3 Maths - 22-4-21Document2 pagesCRP - 12 PMT-3 Maths - 22-4-21Fariha KhanNo ratings yet

- How To Use The PSE Board Lot Table (By James Ryan Jonas)Document7 pagesHow To Use The PSE Board Lot Table (By James Ryan Jonas)blezylNo ratings yet

- The Hunt For Value IndiaDocument5 pagesThe Hunt For Value IndiaPankaj ChandakNo ratings yet

- Daily Equity Market Report - 24.01.2022Document1 pageDaily Equity Market Report - 24.01.2022Fuaad DodooNo ratings yet

- Simulated Final Exam. IntAccDocument6 pagesSimulated Final Exam. IntAccNicah AcojonNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- Capital Market - Secondary: Learning OutcomesDocument26 pagesCapital Market - Secondary: Learning OutcomesGiri SachinNo ratings yet

- All LowerbandDocument2 pagesAll Lowerbandprana132No ratings yet

- Mutual Funds ShivnadarDocument126 pagesMutual Funds ShivnadarKritika KoulNo ratings yet

- Ratio Analysis of SQUARE Pharma & BEXIMCO Pharma: Fin 254: Introduction To FinanceDocument15 pagesRatio Analysis of SQUARE Pharma & BEXIMCO Pharma: Fin 254: Introduction To Financenusrat islamNo ratings yet

- CBS Pe KKRDocument2 pagesCBS Pe KKRJames bondNo ratings yet

- Comparative Analysis of Aquino and Duterte Stock MarketDocument21 pagesComparative Analysis of Aquino and Duterte Stock MarketCrizia Delos ReyesNo ratings yet

- Vijaya Diagnostic Centre Limited: Matters" On Page 128Document302 pagesVijaya Diagnostic Centre Limited: Matters" On Page 128Abhishek SharmaNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument122 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- Bulk DealsDocument36 pagesBulk DealsKapil RampalNo ratings yet

- Stock Market TerminologyDocument2 pagesStock Market TerminologyErnest NievaNo ratings yet

- Amity School of Business:, 4 Semester Financial Management 2Document40 pagesAmity School of Business:, 4 Semester Financial Management 2Divya VishwanadhNo ratings yet

- Stock Market Reaction To Dividend AnnouncementDocument61 pagesStock Market Reaction To Dividend AnnouncementShaina SwaraNo ratings yet

- Stocks, Bonds and Mutual BondsDocument4 pagesStocks, Bonds and Mutual BondsChrisNo ratings yet

- ANALYSIS OF SELECT FMCG COMPANIESâ ™ STOCK PERFORMANCE WITH MARKET-2Document8 pagesANALYSIS OF SELECT FMCG COMPANIESâ ™ STOCK PERFORMANCE WITH MARKET-2AravindTimeTravellerNo ratings yet

- 006 Discounted Dividend Valuation PDFDocument71 pages006 Discounted Dividend Valuation PDFAprajita VishainNo ratings yet

- Trend Follower - 2nd IssueDocument6 pagesTrend Follower - 2nd IssuecrystalNo ratings yet

- Secret Formula of Intraday Trading TechniquesDocument11 pagesSecret Formula of Intraday Trading TechniquesManoj S67% (3)

- Money MessiahDocument4 pagesMoney MessiahRaghunath BabuNo ratings yet

- Dividend PolicyDocument76 pagesDividend PolicyNazli KerimovaNo ratings yet

- Chapter 16-Financial Statement Analysis: Multiple ChoiceDocument19 pagesChapter 16-Financial Statement Analysis: Multiple ChoiceRodNo ratings yet

- Solved On February 1 Hansen Company Purchased 120 000 of 5 20 YearDocument1 pageSolved On February 1 Hansen Company Purchased 120 000 of 5 20 YearAnbu jaromiaNo ratings yet