Professional Documents

Culture Documents

Fudamental

Fudamental

Uploaded by

NeerajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fudamental

Fudamental

Uploaded by

NeerajCopyright:

Available Formats

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

. Accounting for Partnership .

Fundamental

TOPICS COVER .

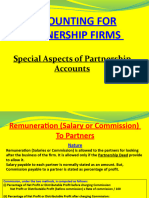

1. Profit and loss Appropriation Account

2. Calculation of Interest on Capital

3. Interest on Drawings

4. Past Adjustments

According to Section – 4 of Indian Partnership Act, 1932

“Partnership is the relations between two or more persons who have agreed to share profits of a business carried

on by all or any of them acting for all.”

Partnership Deed__________________________________________________________________________________________________________

▪ Since partnership is the outcome of an agreement it is essential that there must be some terms and conditions

agreed upon by all the partners. Such terms and conditions may be either written or oral. The law does not make

it compulsory to have a written agreement.

▪ However, in order to avoid all misunderstanding and dispute, it is always the best course to have a written

agreement duly signed and registered under the Act.

▪ The partnership deed is a written agreement among the partners which contains the terms of agreement.

It is also called ‘Articles of Partnership’

▪ It generally contains the details about all the aspects affecting the relationship between the partners including

the objective of the business, contribution of capital by each partner, ratio in which the profit and the losses will

be shared by the partners and entitlements of partners to interest on capital, interest on loan etc .

Rules Applicable in the Absence of Partnership Deed__________________________________________________________________

In the absence of partnership deed, the relevant provisions of the Indian Partnership Act, 1932 shall become applicable which

are as follows:

» The partners shall share firm’s profits or losses equally

» If any partner has given some loan to the firm, he is entitled to take interest on such loan @ 6 % p.a.

» No interest is allowed to partners on the capital invested by them.

» No interest will be charged on drawings made by the partners.

» No partner is entitled to get remuneration such as salary, commission etc. from the firm.

Transaction of the Partnership__________________________________________________________________________________________________

▪ Income and Expenses shows in the profit and loss account and assets and Liabilities in the Balance Sheet.

▪ Profit and Loss Appropriation Account is an Account which is prepared to carry out adjustments of Partners’

right and obligations such as salary payable, commission, interest on capital, interest on Drawings and

distribution of profit among the partners.

▪ Profit and Loss Appropriation Account is prepared to show the distribution of profit among partners as per

the provisions of partnership Deed (or a per the provisions of Indian Partnership Act, 1932 in the absence

Partnership Deed). It is an extension of profit and loss account. It is nominal account in nature. It records

entries for interest on capital, interest on Drawings, salary to partners and division of profit among the

Partners.

Difference between Profit and Loss Account and Profit and Loss Appropriation Account .

No. Basis Profit and Loss A/C Profit and Loss Appropriation A/c

Prepared to ascertain net profit or loss Prepared to distribute net profit to the partners.

1 Objectives during the year

2 Preparation Prepared after Trading Account Prepared after Profit and Loss Account.

Income and Expenses charged against profit Shows items of appropriations such as interest on

3 Items is shown. capital, drawings, salary etc.

4 Usage It is prepared by all business concern It is prepared by partnership firms only.

Accounting for Partnership – FUNDAMENTAL 1

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

1. PROFIT AND LOSS APPROPRIATION ACCOUNT_________________________________________

Format of Profit and Loss Appropriation Account__________________________________________________________________________

Dr. Profit & Loss Appropriation A/c Cr.

Particular Amount Particular Amount

To Profit and Loss A/c (Net Loss) ×××× By Profit and Loss A/c (Net profit) ××××

To Interest on Capital ×××× By Interest on drawings ××××

A ×××× A ××××

B ×××× ×××× B ×××× ××××

To Partner's Salary ×××× By Capital A/c (if loss)

To Partner's Commission ×××× A ××××

To Reserve (transfer) ×××× B ×××× ××××

To Capital A/c - Share of profit

A ××××

B ×××× ××××

×××× ××××

Journal Entries for preparation of Profit and Loss Appropriation Account .

1. Transfer of Profit of Profit and Loss Account . 2. For interest on Capital____________________________

Profit & Loss A/c _______________ Dr. Interest on Capital A/c _____________ Dr.

To Profit & Loss Appropriation A/c To Partners’ capital/Current A/c (individually)

(Being Profit transfer to Profit & Loss App. A/c) (Being interest charged on capital)

Transfer of Loss of Profit and Loss A/c . Transfer to profit & Loss appropriation A/c .

Profit & Loss Appropriation A/c _______ Dr. Profit & Loss Appropriation A/c ___________ Dr.

To Profit & Loss A/c To Interest on Capital A/c

(Being loss transfer to Profit & Loss Appropriation A/c) (Being Interest transfer to Profit & loss Appropriation A/c)

3. For Partners’ Salary/Bonus/Commission etc. . 4. For Interest on Drawings .

Partners’ Salary/Bonus/Commission __________ Dr. Partners’ capital/Current A/c (individually) _______ Dr.

To Partners’ capital/Current A/c (individually) To Interest on Drawings

(Being partners’ Salary etc. transfer to capital A/c) (Being interest on drawings charged on capital)

Transfer to profit & Loss appropriation A/c .

Transfer to profit & Loss appropriation A/c___________

Profit & Loss Appropriation A/c ___________ Dr. Interest on Drawings ______________ Dr.

To Partners’ Salary/Bonus/Commission To Profit & Loss Appropriation A/c

(Being Salary transfer to Profit & loss Appropriation A/c) (Being Interest On drawings transfer to Profit & loss Appropriation A/c)

5. For Transfer to Reserve____________________________ 6. For transfer of partners’ profit after appropriation___________

Profit & Loss Appropriation A/c ___________ Dr. Profit & Loss Appropriation A/c ___________ Dr.

To Reserve A/c To Partners’ Capital/Current A/c (individually)

(Being transfer of reserve to profit & loss Appropriation A/c) (Being transfer of profit to partners’ capital A/c)

• For loss reverse entry is to be made

7. For allowing Interest on Loan________________________ For transferring intt. on loan to Profit & Loss A/c_________________

Interest on Partners’ loan A/c ______________ Dr. Profit & Loss A/c ____________ Dr.

To Partners’ Loan A/c To Interest on Loan A/c

(Being intt. on loan allowed @ _____ % p.a.) (Being interest on loan transferred to P & L A/c)

CAPITAL ACCOUNT

Fluctuating Capital Capital A/c

Capital A/c

Capital A/c

Fixed Capital

Current A/c

Accounting for Partnership – FUNDAMENTAL 2

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

Difference between Fixed capital Account and Fluctuating Capital Account

No Basis Fixed Capital Account Fluctuating Capital Account

Under this method two separate accounts are Each partner has one account i.e. capital

1 Number of accounts maintained for each partner viz. capital account under this method

account and current account

All adjustments for drawings, salary, interest All adjustments for drawings, salary,

2 Adjustments on capital etc. are made in the current interest on capital etc. are made in the

account and not in capital account. capital accounts.

The capital account balance remains The balance of the capital account

3 Fixed balance unchanged unless there is addition to or fluctuates from year to year.

withdrawal of capital.

The capital account always shows a credit The capital account may sometime show

4 Credit balance

balance. a debit balance.

Format of Fluctuating Capital .

Dr. Partners' Capital Account Cr.

Particulars A B Particulars A B

To Drawings A/C ×××× ×××× By Opening balance ×××× ××××

To Interest on drawings ×××× ×××× By Addition to capital ×××× ××××

To Share of loss ×××× ×××× By Interest on capital ×××× ××××

To Withdrawal of capital ×××× ×××× By Salary ×××× ××××

To Closing balance By Commission/Bonus

×××× ×××× ×××× ××××

By Share of profit

××××

×××× ×××× ×××× ××××

Format of Fixed Capital Account .

Dr. Partners' Capital Account Cr.

Particular A B Particular A B

To Cash/Bank A/c ×××× ×××× By Balance b/d ×××× ××××

(if permanent withdrawal of (opening Balance)

capital) By Cash/Bank A/c ×××× ××××

To Balance c/d ×××× ×××× (If capital is contributed initially)

(Closing Balance)

×××× ×××× ×××× ××××

Dr. Partners' Current Account Cr.

Particular A B Particular A B

To Balance b/d (Opening Bal.) ×××× ×××× By Balance b/d ((Opening Bal.) ×××× ××××

To Drawings A/c` ×××× ×××× By Interest on Capital A/c ×××× ××××

To Interest on Drawings A/c ×××× ×××× By Salary A/c ×××× ××××

To Profit & Loss Appropriation ×××× ×××× By Commission/Bonus A/c ×××× ××××

A/c(Share of Loss) By Profit & Loss Appropriation

×××× ××××

To Balance c/d (Closing Bal.) A/c(Share of Profit)

×××× ××××

×××× ×××× ×××× ××××

2. CALCULATION OF INTEREST ON CAPITAL_____________________________________________

If there is addition and withdrawal, following points will be born in mind while calculating the interest on capital

1. On the opening balances of capital accounts of partners, interest is calculating for the whole year,

2. On the additional capital brought in by any partner during the year, interest is calculated from the date of

introduction of capital to the last day of the financial year.

Accounting for Partnership – FUNDAMENTAL 3

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

3. On the amount of capital withdrawn (other than usual drawings) during the year interest for the period from

the date of withdrawal to the last day of the financial year is calculated and deducted from the total of the

interest calculated under point 1 and 2 above.

4. No interest is allowed on the balance of partners’ current account.

Alternatively, it can be calculated with respect to the amount remained invested for the relevant periods .

On the opening balance Interest is calculated for the whole year

Interest is calculated from the date of introduction of additional capital to the last

On additional capital Add

day of the financial year

Interest for the period from the date of withdrawal to the last day of the financial year

On the capital withdrawn Less

is calculated.

Charging of interest on capital .

A. As an appropriation of profit .

Interest on capital is not allowed because it is an appropriation and will be paid only when there is

Where there is loss

some profit.

Interest on capital is allowed in full. All partners are entitled for interest on capital at an agreed

In case of sufficient profit

rate or rate of interest on capital already mentioned in the partnership deed.

In case of insufficient Interest on capital is allowed only to the extent to the profit in the ratio of capital of each partner. In

profit this case partners do not get full amount of interest.

B. As a charge against Profit. – interest on capital allowed in full irrespective of amount of profit or loss

Interest on capital is always calculated on the opening capital. If opening capital is not given, it should be

ascertained as follows –

Particulars Amount

Capital at the end xxxx

Add : Drawings xxxx

Interest on Drawings xxxx

Losses during the year xxxx xxxx

Less : Additional Capital Introduced xxxx

Profit during the year xxxx (xxxx)

Opening Capital xxxx

3. INTEREST ON DRAWINGS______________________________________________________________

✓ Interest on drawings is to be charged from the partners, if the same has been specifically provided in the

partnership deed.

✓ Interest on drawings is to be calculated with reference to the time period for which the money was withdrawn.

✓ In the absence of any particular date of withdrawal, it is assumed that withdrawal is made evenly throughout

the year. Hence, interest is charged for the average of the period of the year i.e. for six months.

There are following conditions for interest on Drawings_________________________________________________________________

A. When date of Drawings is given in % p.a.

1. When date of Drawings is not given – Interest is calculated for a period of 6 months

𝑹𝒂𝒕𝒆 𝟔

Interest on Drawings = 𝑻𝒐𝒕𝒂𝒍 𝑫𝒓𝒂𝒘𝒊𝒏𝒈𝒔 × ×

𝟏𝟎𝟎 𝟏𝟐

2. When date of Drawings is given

𝑹𝒂𝒕𝒆 𝑻𝒊𝒎𝒆 𝑳𝒆𝒇𝒕 𝒂𝒇𝒕𝒆𝒓 𝒅𝒓𝒂𝒘𝒊𝒏𝒈𝒔

Interest on Drawings = 𝑻𝒐𝒕𝒂𝒍 𝑫𝒓𝒂𝒘𝒊𝒏𝒈𝒔 × 𝟏𝟎𝟎

× 𝟏𝟐

B. When different amount is withdrawn on different date

We have the following two methods to calculate the amount of interest on drawings –

Accounting for Partnership – FUNDAMENTAL 4

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

1. Simple Interest Method – In this method, interest on drawing is calculated for each amount of drawing

individually on the basis of periods for which drawing is made.

2. Product Method – In this method, the amount of drawings is multiplied by the product for which is remained

withdrawn during the period. There are following steps involved in this method

a. Calculate the period of each drawings from the date of drawings to the closing date of accounting year.

b. Then each amount of drawings is multiplied by this period

c. Then added the total of step b above and calculate the interest at the given rate

Interest on drawing can be calculated using either Product Method or Direct Method

Direct method is used only if all the following three conditions are satisfied –

1. Amount should be same throughout the period

2. Date of drawings should be same throughout the period

3. Drawings should be made throughout the period regularly without any gap.

C. When an equal amount is withdrawn regularly

𝑹𝒂𝒕𝒆 𝑻𝒊𝒎𝒆 (𝒊𝒏 𝒎𝒐𝒏𝒕𝒉𝒔) 𝒇𝒐𝒓 𝒘𝒉𝒊𝒄𝒉 𝒊𝒏𝒕𝒆𝒓𝒔𝒕 𝒊𝒔 𝒕𝒐 𝒃𝒆 𝒄𝒉𝒂𝒓𝒈𝒆𝒅

Interest on Drawings = 𝑻𝒐𝒕𝒂𝒍 𝑫𝒓𝒂𝒘𝒊𝒏𝒈𝒔 × ×

𝟏𝟎𝟎 𝟏𝟐

1. Fixed amount is withdrawn every month .

a) If amount is withdrawn during the month (implicitly assumed to be in the middle of the moth), interest is

calculated for six months ;

Interest on Drawing = Total Drawing × Rate % × 6/12

b) If withdrawal is made in the beginning of the month, interest is calculated for 6 ½ months (six and half

months), or is can be calculated as Average period = (Total period in months + 1)÷2

Interest on Drawing = Total Drawing × Rate % × 6.5/12

c) If withdrawal is made at the end of the month, interest is calculated for 5 ½ months (five and half months),

or is can be calculated as Average period = (Total period in months – 1) ÷2

Interest on Drawing = Total Drawing × Rate % × 5.5/12

2. If amount is withdrawn at each quarter .

a) If withdrawal is made in the beginning of each quarter, interest is calculated for 7 ½ months (seven and

half months), or is can be calculated as Average period = (Total period in months + 3)÷2

Interest on Drawing = Total Drawing × Rate % × 7.5/12

b) If withdrawal is made in the end of each quarter, interest is calculated for 4 ½ months (four and half

months), or is can be calculated as Average period = (Total period in months – 3)÷2

Interest on Drawing = Total Drawing × Rate % × 4.5/12

c) If withdrawal is made in the middle of each quarter

Interest on Drawing = Total Drawing × Rate % × 6/12

Calculation of time (in moths) for which interest is to be charged_______________________________________________________

Monthly drawings for Quarterly drawings for Half yearly drawings for Monthly drawings for

Conditions 12 months 9 months 12 months 9 months 12 months 9 months 6 months

When drawings are made

in the Beginning of each 6.5 5 7.5 6 9 7.5 3.5

period

When drawings are made

at the middle of each 6 4.5 6 4.5 6 4.5 3

period

When drawings is made

at the end of each period 5.5 4 4.5 3 3 1.5 2.5

Accounting for Partnership – FUNDAMENTAL 5

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

3. Commission to Partners .

Partners would be entitled to get commission only when partnership deed provides for it. Commission payable

to a partner may be calculated in either of two ways –

1. Commission on net profit before charging such commission

𝑹𝒂𝒕𝒆 𝒐𝒇 𝑪𝒐𝒎𝒎𝒊𝒔𝒔𝒊𝒐𝒏

Commission = 𝑵𝒆𝒕 𝒑𝒓𝒐𝒇𝒊𝒕 𝒃𝒆𝒇𝒐𝒓𝒆 𝒔𝒖𝒄𝒉 𝒄𝒐𝒎𝒎𝒊𝒔𝒔𝒊𝒐𝒏 × 𝟏𝟎𝟎

2. Commission on net profit after charging such commission

𝑹𝒂𝒕𝒆 𝒐𝒇 𝑪𝒐𝒎𝒎𝒊𝒔𝒔𝒊𝒐𝒏

Commission = 𝑵𝒆𝒕 𝒑𝒓𝒐𝒇𝒊𝒕 𝒃𝒆𝒇𝒐𝒓𝒆 𝒔𝒖𝒄𝒉 𝒄𝒐𝒎𝒎𝒊𝒔𝒔𝒊𝒐𝒏 × 𝟏𝟎𝟎 + 𝑹𝒂𝒕𝒆 𝒐𝒇 𝑪𝒐𝒎𝒎𝒊𝒔𝒔𝒊𝒐𝒏

4. PAST ADJUSTMENTS___________________________________________________________________

✓ Sometime a few adjustments or errors in the recordings of transection or the preparation of summary

statements are found after the final accounts have been prepared and the profits distributed among the

partners.

✓ The omission may be in respect of interest on capital, interest on drawings, interest on partners’ loan, partners’

salary, partners’ commission or outstanding expenses. There may also be some changes in the provision of

partnership deed or system of accounting having impact with retrospective effect.

✓ The adjustments can also be made directly in the partners’ Capital Account without preparing a Profit and

Loss Appropriation Account. In such a situation, we shall prepare a statement to find out the net effect of

omission and commission and then to debit the capital account of the partner who had been credited in excess

and credit the capital account of the partner who had been debited in excess.

Pass necessary adjustment or rectifying entry .

Partners’ capital (individually) A/c ______________ Dr. (who received more)

To Partners’ Capital (individually) A/c (who received less)

(Being adjustment entry made)

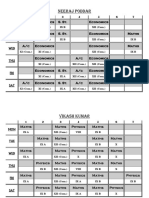

Statement showing adjustments in Capital Account .

Particulars A B

1) What amount partner should get xxxx xxxx

(Salary + Interest + Commission + Profit etc.)

2) Less : Amount already received (wrong Profit) (xxxx) (xxxx)

xxxx xxxx

5. CHANGE IN PROFIT SHARING RATIO___________________________________________________

Any change in relation of partner will result in reconstruction of partnership firm. Existing agreement comes to

end and new agreement takes place. The firm is said to be reconstructing when :

1) Change in profit sharing ratio

2) Admission of new partner

3) Death of a partner

4) Amalgamation of two or more partnership firm

Change in profit sharing ratio________________________________________________________________________________________________

When there is change in profit sharing ratio of existing partners without admission or retirement of old partner.

This change is mostly made when there is change in capitals of the partner. As a result of this change in the profit-

sharing ratio, one or more partner may get extra share of profit whereas other may loss. Gaining partner

compensate the losing or sacrificing partner.

Gaining partner – whose profit ratio has increased

Sacrificing or Losing partner – whose sharing ratio has decreased

▪ Sacrificing Ratio – the ratio in which the old partner agrees to sacrifice their share of profit in favour of the

incoming partner is called sacrificing ratio.

▪ Sometime, the partner of a firm decides to change their existing profit-sharing ratio without any admission or

retirement of a partner. This result in a gain additional share in future profits of the firm for some partners

while a loss of a part thereof for other partners.

Accounting for Partnership – FUNDAMENTAL 6

Meticulous Academy Contact Number –

79799 92932, 79797 62083,

74881 90177

Sacrificing Ratio = old Share of profit – New share of Profit

▪ Gaining Ratio – Whenever as a result in change in profit sharing ratio, one or more partner get some portion

of other partners’ share of profit, is called gaining ratio.

Gaining Ratio = New Share of profit – Old share of Profit

In short – Take the result of new ratio minus old ratio. If the result is negative it is sacrificing and positive it is gain.

Revaluation of Assets and Reassessment of Labilities___________________________________________________________________

» At the time of change in profit sharing ratio, Admission of partner, retirement or death of partner, Assets and

liabilities of a firm be revalued because actual realizable value of assets and liabilities may be different from

their book values.

» Revaluation of assets and liabilities is completed with the help of “revaluation account”. This account is also

known as “Profit and loss Adjustment Account”.

» Increase in the value of an Asset and Decrease in the value of Liability results in Profit (credited to this A/c)

» Decrease in the value of an Asset and Increase in the value of Liability results in Loss (Debited to this A/c)

» All Losses due to revaluation are shown in debit side of this account and all gains due to revaluation are

shown in credit side of this account

Following journal entries are recorded on revaluation of assets and re-assessment of Liabilities

1) For increase in the value of Assets 5) When unrecorded Assets are recorded

. .

Assets A/c _____________ Dr. Assets A/c __________ Dr.

To Revaluation A/c To Revaluation A/c

2) For decrease in the value of Assets 6) When unrecorded Liabilities are recorded

. .

Revaluation A/c _________________ Dr. Revaluation A/c _____________ Dr.

To Assets A/c To Liabilities A/c

3) For increase in the value of Liabilities 7) When profit on revaluation transferred to old Partners

. .

Revaluation A/c ________ Dr. Revaluation A/c ________________ Dr.

To Liabilities A/c To old Partners’ Capital A/c

4) For decrease in the value of Liabilities 8) When loss on revaluation transferred to old Partners

. .

Liabilities A/c _____________ Dr. Old Partners’ Capital A/c ___________ Dr.

To Revaluation A/c To Revaluation A/c

Performa of Revaluation Account_______________________________________________________________________________________________

Revaluation Account

Particulars Amount Particulars Amount

To Assets A/c (Decrease in value) xxxx By Assets A/c (increase in value) xxxx

To liabilities (increase in value) xxxx By liabilities (decrease in value) xxxx

To unrecorded liabilities xxxx By unrecorded Assets xxxx

To Profit xxxx To Loss xxxx

(transferred to old partners’ capital a/c) (transferred to old partners’ capital

a/c)

xxxx xxxx

Adjustment of Goodwill_______________________________________________________________________ ________________________________

A change in profit sharing ratio basically implies that some partners will gain in future while other will lose.

Therefore, the gaining partner must compensate the sacrificing partner by paying the proportionate amount of

Goodwill in their sacrificing ratio. It means the amount of Goodwill so paid be equal to the share gained by him.

Accounting treatment

✓ Calculate sacrificing / gaining share of partner

✓ Calculate gaining partner share of goodwill i.e. share gained x Goodwill

✓ Then pass following journal entry to make adjustment for goodwill

Gaining Partners’ Capital A/c ___________________ Dr.

To Sacrificing Partners’ capital A/c

(Being adjustment for goodwill is made due to change in ratio)

END

Accounting for Partnership – FUNDAMENTAL 7

You might also like

- Affidavit of Damage To VehicleDocument2 pagesAffidavit of Damage To VehicleJ Ph Selrahc92% (96)

- Equity and Adequacy in Alabama Schools and DistrictsDocument96 pagesEquity and Adequacy in Alabama Schools and DistrictsTrisha Powell Crain100% (1)

- Lenovo Thinkpad E495 E595 LCFC PICASSO EX95 JINN - DOOKU 2.0 FE495 - FE595 NM-C061 Rev 1.0 (0.1)Document65 pagesLenovo Thinkpad E495 E595 LCFC PICASSO EX95 JINN - DOOKU 2.0 FE495 - FE595 NM-C061 Rev 1.0 (0.1)Jose Mauro de SouzaNo ratings yet

- AgriPinay Simple Business PlanDocument6 pagesAgriPinay Simple Business PlanKristy Dela PeñaNo ratings yet

- Fundamental: Accounting For PartnershipDocument7 pagesFundamental: Accounting For PartnershipNeeraj PoddarNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Introduction To Ratio AnalysisDocument17 pagesIntroduction To Ratio AnalysisArnav JangidNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- Course Materials BADVAC2X Week2Document8 pagesCourse Materials BADVAC2X Week2Mitchie FaustinoNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- Partnership OperationDocument24 pagesPartnership OperationCASALJAY, KENT FRANCES P.No ratings yet

- Partnership OperationDocument34 pagesPartnership OperationejcapolinarNo ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Ahmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesDocument4 pagesAhmadhiyya International School Syllabus: Subject: ACCOUNTING-Gr-11-Unit: Partnership Accounts-NotesMohamed MuizNo ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- Unit 5Document37 pagesUnit 5Rej HaanNo ratings yet

- Class Notes: Class: XII Topic: Accounting of Partnership Firm: Fundamentals Subject: ACCOUNTANCYDocument4 pagesClass Notes: Class: XII Topic: Accounting of Partnership Firm: Fundamentals Subject: ACCOUNTANCYDilip ChenaniNo ratings yet

- Partnership OperationDocument10 pagesPartnership OperationchristineNo ratings yet

- Partnership OperationsDocument12 pagesPartnership Operationsninny ragayNo ratings yet

- Module 3 Partnership OperationsDocument17 pagesModule 3 Partnership OperationsClaire CastrenceNo ratings yet

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Partners Hi P Operations: Lesson 4 of Financial Accounting andDocument32 pagesPartners Hi P Operations: Lesson 4 of Financial Accounting andMonicaNo ratings yet

- Partnership Operations: Accounting Cycle of A PartnershipDocument13 pagesPartnership Operations: Accounting Cycle of A Partnershipred100% (1)

- Partnership Operation 2 PDF FreeDocument12 pagesPartnership Operation 2 PDF Freehustice freedNo ratings yet

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- Chapter 5Document8 pagesChapter 5Gautam KumarNo ratings yet

- Class: XII Subject: Accountancy Notes On Partnership-FundamentalsDocument11 pagesClass: XII Subject: Accountancy Notes On Partnership-FundamentalsSurbhi DevnaniNo ratings yet

- Kentcoc 2Document1 pageKentcoc 2Starilazation KDNo ratings yet

- Partnership Operations - Learning MaterialDocument5 pagesPartnership Operations - Learning MaterialFaith CastroNo ratings yet

- WK 1 Intro 2 PartnershipDocument6 pagesWK 1 Intro 2 PartnershipkehindeadeniyiNo ratings yet

- Reserve and ProvisionDocument19 pagesReserve and ProvisionRojesh BasnetNo ratings yet

- Libro de AprendizajeDocument3 pagesLibro de AprendizajeElioenai SerranoNo ratings yet

- 12 AccountancyDocument4 pages12 AccountancyAbhishek DhillonNo ratings yet

- Changes in A PartnershipDocument18 pagesChanges in A PartnershipHadi HarizNo ratings yet

- Block 5 ECO 02 Unit 2Document9 pagesBlock 5 ECO 02 Unit 2HozefadahodNo ratings yet

- Last-Minute Tips For Qualifying Exam (Nov. Batch)Document7 pagesLast-Minute Tips For Qualifying Exam (Nov. Batch)aldrin casioNo ratings yet

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionDocument4 pagesChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalNo ratings yet

- Partnership Firms - Part 4 Special AspectsDocument20 pagesPartnership Firms - Part 4 Special AspectsDeepti BistNo ratings yet

- Fundamental of PatnershipDocument21 pagesFundamental of PatnershipHamza RiyazNo ratings yet

- Partnership Operations PDFDocument5 pagesPartnership Operations PDFSameer Hussain67% (3)

- PartnershipDocument6 pagesPartnershipabhishekanandsingh123goNo ratings yet

- AccountancyDocument6 pagesAccountancyManu BabuNo ratings yet

- Partnership AccountingDocument7 pagesPartnership AccountingZaid ZubairiNo ratings yet

- Profit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership FirmDocument10 pagesProfit & Loss Appropriation Account, Admission, Retirement and Death of A Partner, and Dissolution of A Partnership Firmd-fbuser-65596417No ratings yet

- Accounting For Partnership - Basic ConceptsDocument19 pagesAccounting For Partnership - Basic ConceptsAashutosh PatodiaNo ratings yet

- C Apre6 Spectrans Module 2 PDFDocument11 pagesC Apre6 Spectrans Module 2 PDFSittie Ainna Acmed UnteNo ratings yet

- Accounts Foundation RevisionDocument66 pagesAccounts Foundation RevisionABHISHEK SINGH 2124600No ratings yet

- 23 PartnershiptheoryDocument10 pages23 PartnershiptheorySanjeev MiglaniNo ratings yet

- Simplified Business Plan On Swine Production: By: Jourly C. RanqueDocument7 pagesSimplified Business Plan On Swine Production: By: Jourly C. RanqueJOURLY RANQUENo ratings yet

- CH 19-Notes 1025242961Document7 pagesCH 19-Notes 1025242961ayten.ayman.elerakyNo ratings yet

- Notes On Depreciation Class-11Document5 pagesNotes On Depreciation Class-11Suresh Kumar100% (1)

- SYJC AccountsDocument6 pagesSYJC Accountsprabodhcms0% (1)

- POA Section 8 PartnershipsDocument26 pagesPOA Section 8 Partnershipskxng ultimateNo ratings yet

- Partnership Operations ReviewDocument37 pagesPartnership Operations ReviewShin Shan JeonNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Chapter 8 Partnership AccountingDocument16 pagesChapter 8 Partnership Accountingk.muhammed aaqibNo ratings yet

- PC2 AnswerSheetDocument3 pagesPC2 AnswerSheetLuWiz DiazNo ratings yet

- 02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountDocument14 pages02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountHOD Dept of BBA Vels UniversityNo ratings yet

- Non Trading by MeDocument23 pagesNon Trading by MeQuality Assurance ManagerNo ratings yet

- Teacher's RoutineDocument16 pagesTeacher's RoutineNeerajNo ratings yet

- Rouitne VI To XIIDocument10 pagesRouitne VI To XIINeerajNo ratings yet

- 11 Economics Imp Vsa ch3Document2 pages11 Economics Imp Vsa ch3NeerajNo ratings yet

- Cbse Training: ReceiptDocument1 pageCbse Training: ReceiptNeerajNo ratings yet

- Cbse Training: ReceiptDocument1 pageCbse Training: ReceiptNeerajNo ratings yet

- CBSE Class 12 Economics Sample Question Paper 2020Document12 pagesCBSE Class 12 Economics Sample Question Paper 2020NeerajNo ratings yet

- JRU Prospectus 2022Document38 pagesJRU Prospectus 2022NeerajNo ratings yet

- Class 11 Sample Papers Economics 2023 3Document4 pagesClass 11 Sample Papers Economics 2023 3NeerajNo ratings yet

- Subject Verb Agreement ExcercisesDocument14 pagesSubject Verb Agreement ExcercisesEmilyn Mata CastilloNo ratings yet

- Mlaw Past Papers Since 2019-1Document107 pagesMlaw Past Papers Since 2019-1JawadNo ratings yet

- Breakdown of ExpensesDocument6 pagesBreakdown of ExpensesKim SablayanNo ratings yet

- GOPAL JAGDISH KULKARNI (1042190088) 2019-2020 Semester I Fy, MGMT, Mba, En, Revised - CDocument1 pageGOPAL JAGDISH KULKARNI (1042190088) 2019-2020 Semester I Fy, MGMT, Mba, En, Revised - CGopal KulkarniNo ratings yet

- Erp. ReportingDocument67 pagesErp. ReportingKenneth Roy MatuguinaNo ratings yet

- Q2 Week 8 - ADM ModuleDocument4 pagesQ2 Week 8 - ADM ModuleCathleenbeth MorialNo ratings yet

- Astm C0969 - 1 (En)Document3 pagesAstm C0969 - 1 (En)Dinesh Sai100% (1)

- 1571200894498vXFbvpGvTzdbgeN8 PDFDocument3 pages1571200894498vXFbvpGvTzdbgeN8 PDFBazidpur GsssNo ratings yet

- Mathematics of Finance HandoutDocument10 pagesMathematics of Finance Handoutleandro2620010% (2)

- Criminal Procedure Code Project: Rajesh Ranjan Yadav Vs - CBI and OthersDocument8 pagesCriminal Procedure Code Project: Rajesh Ranjan Yadav Vs - CBI and OthersRahul MuthuNo ratings yet

- Meiji Japan and East Asia HandoutDocument4 pagesMeiji Japan and East Asia HandoutgozappariNo ratings yet

- Case Note Judgment of The Supreme Court in The Essar Steel CaseDocument9 pagesCase Note Judgment of The Supreme Court in The Essar Steel CaseSakthi NathanNo ratings yet

- Preliminary Program IPSADocument261 pagesPreliminary Program IPSApics3441100% (1)

- HSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Document15 pagesHSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Madhuritha RajapakseNo ratings yet

- Know Your Vessel Case Studies in Steering Clear of Sanctions EvasionDocument15 pagesKnow Your Vessel Case Studies in Steering Clear of Sanctions EvasionAlly Hassan AliNo ratings yet

- Flag and Class RequirementsDocument4 pagesFlag and Class RequirementsAlexPredaNo ratings yet

- Maharashtra State PoliticsDocument2 pagesMaharashtra State Politicsvedanti shindeNo ratings yet

- PTA (TGT) Contract 13012015 RamanDocument15 pagesPTA (TGT) Contract 13012015 Ramanसबका बापNo ratings yet

- Impres Battery Fleet Management Troubleshooting Guide: JANUARY 2021Document10 pagesImpres Battery Fleet Management Troubleshooting Guide: JANUARY 2021Alfonso Garcia LozanoNo ratings yet

- RousseauDocument3 pagesRousseauपुष्कर मिश्रNo ratings yet

- DirectoryDocument3 pagesDirectoryfem-femNo ratings yet

- Quotation For Food Stall For Mr. Abdullah Hamed Rev. 00Document2 pagesQuotation For Food Stall For Mr. Abdullah Hamed Rev. 00anwar surNo ratings yet

- R131S2 (B) - SANTOS VS NSODocument17 pagesR131S2 (B) - SANTOS VS NSOAllyza SantosNo ratings yet

- Item5 Malaysia 1 Main 0Document10 pagesItem5 Malaysia 1 Main 0veiathishvaarimurugan100% (1)

- Purchase-To-Pay Process Map: Inventory DepartmentDocument2 pagesPurchase-To-Pay Process Map: Inventory DepartmentDanielle MarundanNo ratings yet

- Esguerra v. Trinidad, G.R. No. 169890, Mar. 12, 2007Document12 pagesEsguerra v. Trinidad, G.R. No. 169890, Mar. 12, 2007idko2wNo ratings yet

- Asme PTC-1-2011Document28 pagesAsme PTC-1-2011andhucaosNo ratings yet