Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 views2023 RMC

2023 RMC

Uploaded by

JeromeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Epistemic Beliefs InventoryDocument4 pagesEpistemic Beliefs InventoryAlberto RojasNo ratings yet

- The Life and Ministry of Apostle PeterDocument113 pagesThe Life and Ministry of Apostle PeterDukejack100% (1)

- Karamat Sidi Ahmad Ibn Idris p59cDocument2 pagesKaramat Sidi Ahmad Ibn Idris p59cibnbadawiNo ratings yet

- Present Perfect SlidesDocument22 pagesPresent Perfect SlidesKinanti Ithuww VeraNo ratings yet

- November Compliance Calendar 2023Document4 pagesNovember Compliance Calendar 2023Astik Dubey ADNo ratings yet

- Indirect Tax Newsletter - July 2023Document15 pagesIndirect Tax Newsletter - July 2023ELP LawNo ratings yet

- Summary of All Notifications of GSTDocument126 pagesSummary of All Notifications of GSTKumar Sunny SrmfincorpNo ratings yet

- TdsCertificate 20240301102850Document3 pagesTdsCertificate 20240301102850pratik.upadhyay950No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToSOUMYAJIT BARINo ratings yet

- 16A For The Quarter-01 MEENAKSHI ISPATDocument3 pages16A For The Quarter-01 MEENAKSHI ISPATrenukm07No ratings yet

- FY2022 23 Form16 PF FormDocument3 pagesFY2022 23 Form16 PF FormJoydip MukhopadhyayNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- TDS CertificateDocument3 pagesTDS CertificateP D DeshpandeNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- ECRRSDocument3 pagesECRRSMaunik ParikhNo ratings yet

- HSRPM9590K Q3 2023-24Document3 pagesHSRPM9590K Q3 2023-24jishna mathewNo ratings yet

- Aacca3193k Q3 2024-25Document3 pagesAacca3193k Q3 2024-25Yogesh KanojiyaNo ratings yet

- Latest Updates in GST - NovDocument6 pagesLatest Updates in GST - NovVishwanath HollaNo ratings yet

- Aino Communique 114th Edition Apr 23Document12 pagesAino Communique 114th Edition Apr 23Swathi JainNo ratings yet

- 16A For The Quarter-01 MEENAXI BUILDINGDocument3 pages16A For The Quarter-01 MEENAXI BUILDINGrenukm07No ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- New Microsoft Word DocumentDocument8 pagesNew Microsoft Word DocumentMuhammad WaqarNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- Adobe Scan Jan 26, 2023Document25 pagesAdobe Scan Jan 26, 2023Rafael AbedesNo ratings yet

- Aqxpa3351p Q1 2024-25Document3 pagesAqxpa3351p Q1 2024-25amrithavinilNo ratings yet

- Suneetha HOFPS9571N Q4 2023-24Document3 pagesSuneetha HOFPS9571N Q4 2023-24Kr NagendraNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- 16A For The Quarter-01 MR ROOFINGSDocument3 pages16A For The Quarter-01 MR ROOFINGSrenukm07No ratings yet

- Compliance ManualDocument19 pagesCompliance ManualBPDUTTANo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Ahypl9744k Q2 2024-25Document3 pagesAhypl9744k Q2 2024-25krishna lvNo ratings yet

- Ahnpp9921f Q4 2023-24Document3 pagesAhnpp9921f Q4 2023-24ps245702No ratings yet

- Mvat Trade Circular 11t 2023 For Upload 26jun2023Document28 pagesMvat Trade Circular 11t 2023 For Upload 26jun2023Shubham AgrawalNo ratings yet

- Fqlps2923a - Q4 - 2024-25 2Document3 pagesFqlps2923a - Q4 - 2024-25 2eng.dasharath1996No ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Form 16Document7 pagesForm 16Pandu YerraNo ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document13 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Wallaze EbdaoNo ratings yet

- Notification No 73 2022Document2 pagesNotification No 73 2022uslls visNo ratings yet

- AFSPH8459KDocument2 pagesAFSPH8459Kcontagious4No ratings yet

- Form 16: SLN Facility Management Private LimitedDocument10 pagesForm 16: SLN Facility Management Private LimitedChetan NarasannavarNo ratings yet

- Form 16: CGI Information Systems and Management Consultants Private LimitedDocument9 pagesForm 16: CGI Information Systems and Management Consultants Private LimitedNimish ShuklaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToCA Ramajayam JayachandranNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- XXXXXXXXXXXXX 2023-24 SignedDocument2 pagesXXXXXXXXXXXXX 2023-24 SignedpinkyyymehtaNo ratings yet

- Kreston Sri Lanka Budget Proposals 2024Document18 pagesKreston Sri Lanka Budget Proposals 2024nipuna athukoralaNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Gjwpp7325e Q1 2024 25Document3 pagesGjwpp7325e Q1 2024 25Adarsh PandeyNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Circular 4 2023Document2 pagesCircular 4 2023pramodgvpbaNo ratings yet

- Igkc TanDocument2 pagesIgkc TanJyoti prakash MohapatraNo ratings yet

- Statecircular 291022Document6 pagesStatecircular 291022King KiteNo ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- Form No 16A of Vivekananda AcharyaDocument2 pagesForm No 16A of Vivekananda AcharyaVivekananda AcharyaNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSurbhiNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMUNNA SKNo ratings yet

- CalendarDocument83 pagesCalendarwaseem.sir4455No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- TDS CertificateDocument2 pagesTDS CertificateJyoti MeenaNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- A Comprehensive Review On Fresh State Rheological Properties of Extrusion Mortars Designed For 3D Printing ApplicationsDocument20 pagesA Comprehensive Review On Fresh State Rheological Properties of Extrusion Mortars Designed For 3D Printing ApplicationsAlfonzo SamudioNo ratings yet

- Paint DeptDocument3 pagesPaint DeptYanelfi GuzmanNo ratings yet

- Mec 3772RT Machine SpecificationDocument2 pagesMec 3772RT Machine SpecificationDushyant SharmaNo ratings yet

- Print Supple Admit Card - I-EMS - EUBDocument1 pagePrint Supple Admit Card - I-EMS - EUBMustak JuliatNo ratings yet

- ETI 22618 UT2 Question Bank 2022-23 240523Document19 pagesETI 22618 UT2 Question Bank 2022-23 240523Harshal MakodeNo ratings yet

- Diagnostic Test 2022 23 EnglishDocument14 pagesDiagnostic Test 2022 23 EnglishRona Janoras GonzalesNo ratings yet

- 3-Phase Distribution Transformers 11 or 33 kV/415-240V (Outdoor Type)Document2 pages3-Phase Distribution Transformers 11 or 33 kV/415-240V (Outdoor Type)Nanban VkyNo ratings yet

- حلول وترجمة مواضيع كتاب الطالب والأنشطة أنجليزي بكالوريا سوريا PDFDocument130 pagesحلول وترجمة مواضيع كتاب الطالب والأنشطة أنجليزي بكالوريا سوريا PDFlaura ..No ratings yet

- Cost TypesDocument3 pagesCost TypesAsif IqbalNo ratings yet

- Introduction of Guest SpeakerDocument2 pagesIntroduction of Guest SpeakerAldrin Jay BalangatanNo ratings yet

- Marco Island Veterans' Community Park Construction Document Proposal - 7-2-19Document14 pagesMarco Island Veterans' Community Park Construction Document Proposal - 7-2-19Omar Rodriguez OrtizNo ratings yet

- ANS Drugs - SANGALANG, AQ - #SGD - PANOSOJBA - C6 - AY2022-2023Document8 pagesANS Drugs - SANGALANG, AQ - #SGD - PANOSOJBA - C6 - AY2022-2023Jasper PanosoNo ratings yet

- Medsurg Careplan 3Document10 pagesMedsurg Careplan 3api-520874306No ratings yet

- Aspergers Boarding SchoolDocument4 pagesAspergers Boarding SchoolBrian HaraNo ratings yet

- Ratio - Analysis - Green - Park Project Report1Document99 pagesRatio - Analysis - Green - Park Project Report1Raju AmmuNo ratings yet

- Military Service: The Ministry of Aliyah and Immigrant AbsorptionDocument64 pagesMilitary Service: The Ministry of Aliyah and Immigrant AbsorptionKERVIN6831117No ratings yet

- Arvind Mill Case Analysis: Increasing No of Players Increases Bargaining Power of The SuppliersDocument5 pagesArvind Mill Case Analysis: Increasing No of Players Increases Bargaining Power of The SuppliersPritam D BiswasNo ratings yet

- Report in Inventory MNGMNTDocument17 pagesReport in Inventory MNGMNTEzel May ArelladoNo ratings yet

- Nahuatl Grammar Veracruz 2d Edition WolgemuthDocument169 pagesNahuatl Grammar Veracruz 2d Edition WolgemuthWilfrido Barajas100% (1)

- ENGG102 Students Notes - Week 10Document3 pagesENGG102 Students Notes - Week 10HoangViet NguyenNo ratings yet

- Drainage Handbook SpecificationsDocument57 pagesDrainage Handbook Specificationshussainelarabi100% (1)

- Management Information Systems 7th Edition Sousa Solutions Manual DownloadDocument15 pagesManagement Information Systems 7th Edition Sousa Solutions Manual DownloadLouis Held100% (27)

- Discourse MarkersDocument6 pagesDiscourse MarkersAlina HilimNo ratings yet

- 545 Znshine PDFDocument2 pages545 Znshine PDFDS INSTALAÇÕES ELÉTRICASNo ratings yet

- 29primary AngleClosure GlauDocument9 pages29primary AngleClosure GlauShari' Si WahyuNo ratings yet

- Jollibee V. Mcdonald'S in The PhilippinesDocument12 pagesJollibee V. Mcdonald'S in The PhilippinesCharls DNo ratings yet

2023 RMC

2023 RMC

Uploaded by

Jerome0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

2023-RMC

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pages2023 RMC

2023 RMC

Uploaded by

JeromeCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

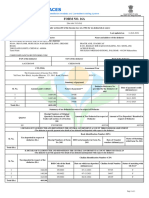

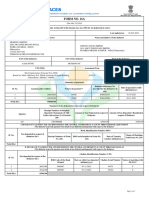

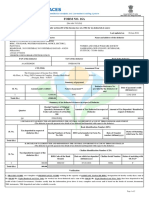

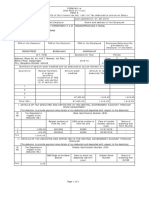

Relevant to

Date of Estate Tax,

Year No. of Issuance Subject Matter

Issuance Income Tax,

DST and CGT

Announces the availability of revised

RMC No. 9- January 26, Capital Gains

2023 BIR Form Nos. 1606 and 1706

2023 2023 Tax

version January 2018

Prescribes the guidelines in the filing

of Annual Income Tax Returns for

RMC No. 32-

2023 Calendar Year 2022 as well as March 16, 2023 Income Tax

2023

payment of taxes due thereon until

April 17, 2023

Prescribes supplemental guidelines in

RMC No. 44- the filing of Annual Income Tax

2023 April 14, 2023 Income Tax

2023 Returns and payment of taxes due

thereon for Taxable Year 2022

Prescribes procedures in the

RMC No. 61- processing of taxpayer's request for

2023 May 24, 2023 Income Tax

2023 stamping of electronically filed

ITRs/AITRs thru eBIRForms

2023 RMC No. 92- Announces the availability of BIR

September 13,

2023 Form No. 1621 in the Electronic Estate Tax

2023

Filing and Payment System (eFPS)

2023 RMC No. 99- Clarifies the applicable taxes due on Income tax and

2023 sale of real property considered as October 3, Documentary

ordinary assets of the seller and other 2023 Stamp Tax

relevant matters (DST)

2023 RMC No. 115- Classifies the costs associated with

2023 franchises, concessions, licenses,

rights, operations agreements or

similar arrangements (herein referred

to as Licenses or Rights) granted by

the government to operate a public

service, including public utility as an

October 31,

Administrative Cost instead of Income Tax

2023

"Direct Cost of Services", for

purposes of computing the gross

income to determine the Optional

Standard Deduction (OSD) under

Section 34 (L) of the Tax Code of

1997, as amended by Section 3 of

Republic Act (RA) No. 9504

You might also like

- Epistemic Beliefs InventoryDocument4 pagesEpistemic Beliefs InventoryAlberto RojasNo ratings yet

- The Life and Ministry of Apostle PeterDocument113 pagesThe Life and Ministry of Apostle PeterDukejack100% (1)

- Karamat Sidi Ahmad Ibn Idris p59cDocument2 pagesKaramat Sidi Ahmad Ibn Idris p59cibnbadawiNo ratings yet

- Present Perfect SlidesDocument22 pagesPresent Perfect SlidesKinanti Ithuww VeraNo ratings yet

- November Compliance Calendar 2023Document4 pagesNovember Compliance Calendar 2023Astik Dubey ADNo ratings yet

- Indirect Tax Newsletter - July 2023Document15 pagesIndirect Tax Newsletter - July 2023ELP LawNo ratings yet

- Summary of All Notifications of GSTDocument126 pagesSummary of All Notifications of GSTKumar Sunny SrmfincorpNo ratings yet

- TdsCertificate 20240301102850Document3 pagesTdsCertificate 20240301102850pratik.upadhyay950No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToSOUMYAJIT BARINo ratings yet

- 16A For The Quarter-01 MEENAKSHI ISPATDocument3 pages16A For The Quarter-01 MEENAKSHI ISPATrenukm07No ratings yet

- FY2022 23 Form16 PF FormDocument3 pagesFY2022 23 Form16 PF FormJoydip MukhopadhyayNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- TDS CertificateDocument3 pagesTDS CertificateP D DeshpandeNo ratings yet

- TDS CertificateDocument3 pagesTDS Certificatejfcgfh8fc6No ratings yet

- ECRRSDocument3 pagesECRRSMaunik ParikhNo ratings yet

- HSRPM9590K Q3 2023-24Document3 pagesHSRPM9590K Q3 2023-24jishna mathewNo ratings yet

- Aacca3193k Q3 2024-25Document3 pagesAacca3193k Q3 2024-25Yogesh KanojiyaNo ratings yet

- Latest Updates in GST - NovDocument6 pagesLatest Updates in GST - NovVishwanath HollaNo ratings yet

- Aino Communique 114th Edition Apr 23Document12 pagesAino Communique 114th Edition Apr 23Swathi JainNo ratings yet

- 16A For The Quarter-01 MEENAXI BUILDINGDocument3 pages16A For The Quarter-01 MEENAXI BUILDINGrenukm07No ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- New Microsoft Word DocumentDocument8 pagesNew Microsoft Word DocumentMuhammad WaqarNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- Adobe Scan Jan 26, 2023Document25 pagesAdobe Scan Jan 26, 2023Rafael AbedesNo ratings yet

- Aqxpa3351p Q1 2024-25Document3 pagesAqxpa3351p Q1 2024-25amrithavinilNo ratings yet

- Suneetha HOFPS9571N Q4 2023-24Document3 pagesSuneetha HOFPS9571N Q4 2023-24Kr NagendraNo ratings yet

- Tds Report 310387Document3 pagesTds Report 310387HimmatNo ratings yet

- 16A For The Quarter-01 MR ROOFINGSDocument3 pages16A For The Quarter-01 MR ROOFINGSrenukm07No ratings yet

- Compliance ManualDocument19 pagesCompliance ManualBPDUTTANo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Ahypl9744k Q2 2024-25Document3 pagesAhypl9744k Q2 2024-25krishna lvNo ratings yet

- Ahnpp9921f Q4 2023-24Document3 pagesAhnpp9921f Q4 2023-24ps245702No ratings yet

- Mvat Trade Circular 11t 2023 For Upload 26jun2023Document28 pagesMvat Trade Circular 11t 2023 For Upload 26jun2023Shubham AgrawalNo ratings yet

- Fqlps2923a - Q4 - 2024-25 2Document3 pagesFqlps2923a - Q4 - 2024-25 2eng.dasharath1996No ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Form 16Document7 pagesForm 16Pandu YerraNo ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document13 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Wallaze EbdaoNo ratings yet

- Notification No 73 2022Document2 pagesNotification No 73 2022uslls visNo ratings yet

- AFSPH8459KDocument2 pagesAFSPH8459Kcontagious4No ratings yet

- Form 16: SLN Facility Management Private LimitedDocument10 pagesForm 16: SLN Facility Management Private LimitedChetan NarasannavarNo ratings yet

- Form 16: CGI Information Systems and Management Consultants Private LimitedDocument9 pagesForm 16: CGI Information Systems and Management Consultants Private LimitedNimish ShuklaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToCA Ramajayam JayachandranNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- XXXXXXXXXXXXX 2023-24 SignedDocument2 pagesXXXXXXXXXXXXX 2023-24 SignedpinkyyymehtaNo ratings yet

- Kreston Sri Lanka Budget Proposals 2024Document18 pagesKreston Sri Lanka Budget Proposals 2024nipuna athukoralaNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Gjwpp7325e Q1 2024 25Document3 pagesGjwpp7325e Q1 2024 25Adarsh PandeyNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Circular 4 2023Document2 pagesCircular 4 2023pramodgvpbaNo ratings yet

- Igkc TanDocument2 pagesIgkc TanJyoti prakash MohapatraNo ratings yet

- Statecircular 291022Document6 pagesStatecircular 291022King KiteNo ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- Form No 16A of Vivekananda AcharyaDocument2 pagesForm No 16A of Vivekananda AcharyaVivekananda AcharyaNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSurbhiNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMUNNA SKNo ratings yet

- CalendarDocument83 pagesCalendarwaseem.sir4455No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- TDS CertificateDocument2 pagesTDS CertificateJyoti MeenaNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- A Comprehensive Review On Fresh State Rheological Properties of Extrusion Mortars Designed For 3D Printing ApplicationsDocument20 pagesA Comprehensive Review On Fresh State Rheological Properties of Extrusion Mortars Designed For 3D Printing ApplicationsAlfonzo SamudioNo ratings yet

- Paint DeptDocument3 pagesPaint DeptYanelfi GuzmanNo ratings yet

- Mec 3772RT Machine SpecificationDocument2 pagesMec 3772RT Machine SpecificationDushyant SharmaNo ratings yet

- Print Supple Admit Card - I-EMS - EUBDocument1 pagePrint Supple Admit Card - I-EMS - EUBMustak JuliatNo ratings yet

- ETI 22618 UT2 Question Bank 2022-23 240523Document19 pagesETI 22618 UT2 Question Bank 2022-23 240523Harshal MakodeNo ratings yet

- Diagnostic Test 2022 23 EnglishDocument14 pagesDiagnostic Test 2022 23 EnglishRona Janoras GonzalesNo ratings yet

- 3-Phase Distribution Transformers 11 or 33 kV/415-240V (Outdoor Type)Document2 pages3-Phase Distribution Transformers 11 or 33 kV/415-240V (Outdoor Type)Nanban VkyNo ratings yet

- حلول وترجمة مواضيع كتاب الطالب والأنشطة أنجليزي بكالوريا سوريا PDFDocument130 pagesحلول وترجمة مواضيع كتاب الطالب والأنشطة أنجليزي بكالوريا سوريا PDFlaura ..No ratings yet

- Cost TypesDocument3 pagesCost TypesAsif IqbalNo ratings yet

- Introduction of Guest SpeakerDocument2 pagesIntroduction of Guest SpeakerAldrin Jay BalangatanNo ratings yet

- Marco Island Veterans' Community Park Construction Document Proposal - 7-2-19Document14 pagesMarco Island Veterans' Community Park Construction Document Proposal - 7-2-19Omar Rodriguez OrtizNo ratings yet

- ANS Drugs - SANGALANG, AQ - #SGD - PANOSOJBA - C6 - AY2022-2023Document8 pagesANS Drugs - SANGALANG, AQ - #SGD - PANOSOJBA - C6 - AY2022-2023Jasper PanosoNo ratings yet

- Medsurg Careplan 3Document10 pagesMedsurg Careplan 3api-520874306No ratings yet

- Aspergers Boarding SchoolDocument4 pagesAspergers Boarding SchoolBrian HaraNo ratings yet

- Ratio - Analysis - Green - Park Project Report1Document99 pagesRatio - Analysis - Green - Park Project Report1Raju AmmuNo ratings yet

- Military Service: The Ministry of Aliyah and Immigrant AbsorptionDocument64 pagesMilitary Service: The Ministry of Aliyah and Immigrant AbsorptionKERVIN6831117No ratings yet

- Arvind Mill Case Analysis: Increasing No of Players Increases Bargaining Power of The SuppliersDocument5 pagesArvind Mill Case Analysis: Increasing No of Players Increases Bargaining Power of The SuppliersPritam D BiswasNo ratings yet

- Report in Inventory MNGMNTDocument17 pagesReport in Inventory MNGMNTEzel May ArelladoNo ratings yet

- Nahuatl Grammar Veracruz 2d Edition WolgemuthDocument169 pagesNahuatl Grammar Veracruz 2d Edition WolgemuthWilfrido Barajas100% (1)

- ENGG102 Students Notes - Week 10Document3 pagesENGG102 Students Notes - Week 10HoangViet NguyenNo ratings yet

- Drainage Handbook SpecificationsDocument57 pagesDrainage Handbook Specificationshussainelarabi100% (1)

- Management Information Systems 7th Edition Sousa Solutions Manual DownloadDocument15 pagesManagement Information Systems 7th Edition Sousa Solutions Manual DownloadLouis Held100% (27)

- Discourse MarkersDocument6 pagesDiscourse MarkersAlina HilimNo ratings yet

- 545 Znshine PDFDocument2 pages545 Znshine PDFDS INSTALAÇÕES ELÉTRICASNo ratings yet

- 29primary AngleClosure GlauDocument9 pages29primary AngleClosure GlauShari' Si WahyuNo ratings yet

- Jollibee V. Mcdonald'S in The PhilippinesDocument12 pagesJollibee V. Mcdonald'S in The PhilippinesCharls DNo ratings yet