Professional Documents

Culture Documents

1 ZDS Bir 2316 2023

1 ZDS Bir 2316 2023

Uploaded by

Cheny RojoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 ZDS Bir 2316 2023

1 ZDS Bir 2316 2023

Uploaded by

Cheny RojoCopyright:

Available Formats

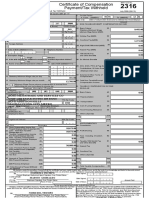

Republic of the

UseFor BCS/ Philippines Department of

Only Item: Finance Bureau of Internal

Revenue

BIR Form No.

Certificate of Compensation

2316

September 2021(ENCS)

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld

2316 9/21ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the Period 0 1

(YYYY) 2 0 2 3 From (MM/DD)

0 1 To (MM/DD)

1 2 1 2

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN

1 2 9 - 2 7 4 - 6 3 7 - 0 0 0 0 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

4 Employee's Name (Last Name,2First Name, Middle Name) 5 RDO Code

29 Basic Salary (including the exempt P250,000 & below) 0.00

or the Statutory Minimum Wage of the MWE

ACAIN, ATHENA P 0.00

6 Registered Address 6A ZIP Code 30 Holiday Pay (MWE)

31 Overtime Pay (MWE) 0.00

6B Local Home Address 6C ZIP Code

32 Night Shift Differential (MWE) 0.00

6D Foreign Address

33 Hazard Pay (MWE) 0.00

7 Date of Birth (MM/DD/YYYY) 8 Contact Number 34 13th Month Pay and Other Benefits

(maximum of P90,000) 90,000.00

35 De Minimis Benefits 16,000.00

9 Statutory Minimum Wage rate per day

36 SSS, GSIS, PHIC & PAG-IBIG

Contributions and Union Dues (Employee 77,265.00

10 Statutory Minimum Wage rate per month

share only)

37 Salaries and Other Forms of Compensation 0.00

11 Minimum Wage Earner (MWE) whose compensation is exempt from

withholding tax and not subject to income tax 38 Total Non-Taxable/Exempt Compensation

Part II - Employer Information (Present) Income (Sum of Items 29 to 37) 183,265.00

12 TIN

0 0 0 - 8 6 3 - 9 5 8 - 0 7 7 7 B. TAXABLE COMPENSATION INCOME REGULAR

13 Employer's Name

39 Basic Salary 615,069.00

DEPED DIVISION OF ZAMBOANGA DEL SUR

14 Registered Address 14A ZIP Code 40 Representation

PROVINCIAL GOVERNMENT COMPOUND 7 0 1 6

41 Transportation

15 Type of Employer Main Employer Secondary Employer

42 Cost of Living Allowance (COLA)

Part III - Employer Information (Previous)

16 TIN

- - - 43 Fixed Housing Allowance

17 Employer's Name 44 Others (specify)

44A 0.00

18 Registered Address

18A ZIP Code 44B

SUPPLEMENTARY

Part IVA - Summary 45 Commission

19 Gross Compensation Income from 869,712.21

Present Employer (Sum of Items 38 and 52)

46 Profit Sharing

20 Less: Total Non-Taxable/Exempt Compensation 183,265.00

Income from Present Employer (From Item 38)

47 Fees Including Director's Fees

21 Taxable Compensation Income from

Present Employer (Item 19 Less Item 20) (From 686,447.21

Item 52)

48 Taxable 13th Month Benefits 71,378.21

22 Add: Taxable Compensation Income

from Previous Employer, if applicable 0.00 49 Hazard Pay

23 Gross Taxable Compensation Income

(Sum of Items 21 and 22) 686,447.21 50 Overtime Pay

51 Others (specify)

24 Tax Due 79,789.44

51A

25 Amount of Taxes Withheld

25A Present Employer

79,789.44

51B

25B Previous Employer, if applicable 0.00 52 Total Taxable Compensation Income

26 Total Amount of Taxes Withheld as adjusted (Sum of Items 39 to 51B)

686,447.21

(Sum of Items 25A and 25B) 79,789.44

27 5% Tax Credit (PERA Act of 2008)

28 Total Taxes Withheld (Sum of Items 26 and 27) 79,789.44

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

53 ZENAIDA E. MAGO Date Signed

Present Employer/Authorized Agent Signature over Printed Name

CONFORME: ATHENA P ACAIN

54 Date Signed

Employee Signature over Printed Name Amount paid, if CTC

CTC/Valid ID No. Place of

Date Issued

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are reported under BIR Form No. 1604-C which has been filed with the Bureau of

Internal Revenue. I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

(BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

55 ZENAIDA E. MAGO the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

Present Employer/Authorized Agent Signature over Printed Name Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

(Head of Accounting/Human Resource or Authorized Representative) of Revenue Regulations (RR) No. 3-2002, as amended.

56

ATHENA P ACAIN

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

Employee Signature over Printed Name

You might also like

- Business Communication and Character 11Th Edition Amy Newman Full ChapterDocument67 pagesBusiness Communication and Character 11Th Edition Amy Newman Full Chapterhelena.williams785100% (7)

- New QuoteDocument13 pagesNew QuoteAnkita ReddyNo ratings yet

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Marketing Strategic Plan: Teacher Jose Eduardo Lievano CastiblancoDocument29 pagesMarketing Strategic Plan: Teacher Jose Eduardo Lievano Castiblancoborrasnicolas100% (1)

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDocument1 pageCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 2316 (1) 1 Sangrades, SchechinaDocument1 page2316 (1) 1 Sangrades, SchechinaLeo GasminNo ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Maricar CoronelDocument1 pageCertificate of Compensation Payment/Tax Withheld: Maricar CoronelAmy P. DalidaNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJexterNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- BIR GovernmentDocument15 pagesBIR GovernmentEdgar Miralles Inales ManriquezNo ratings yet

- BIR ITR 2306 - CastilloDocument1 pageBIR ITR 2306 - CastilloBernadine CastilloNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2 Zds Tax Module Cy 2023 ViewerDocument498 pages2 Zds Tax Module Cy 2023 ViewerCheny RojoNo ratings yet

- Job Order April 2024Document4 pagesJob Order April 2024Cheny RojoNo ratings yet

- Ribbons g5Document1 pageRibbons g5Cheny RojoNo ratings yet

- NFOT 2024 Guidelines Sining Revised As of 10jan2024 1Document83 pagesNFOT 2024 Guidelines Sining Revised As of 10jan2024 1Cheny RojoNo ratings yet

- Parent ConsentDocument3 pagesParent ConsentCheny RojoNo ratings yet

- Daily Time Record Daily Time RecordDocument1 pageDaily Time Record Daily Time RecordCheny RojoNo ratings yet

- NSBI Data Gathering Forms SY 2023 2024 - v3.0 As of March 03 2024 FinalDocument14 pagesNSBI Data Gathering Forms SY 2023 2024 - v3.0 As of March 03 2024 FinalCheny RojoNo ratings yet

- Medical Certificate: To Whom It May ConcernDocument2 pagesMedical Certificate: To Whom It May ConcernCheny RojoNo ratings yet

- Second Grading Test 2Document35 pagesSecond Grading Test 2Cheny RojoNo ratings yet

- Mean Percentage Score TemplateDocument7 pagesMean Percentage Score TemplateCheny RojoNo ratings yet

- Parent ConsentDocument3 pagesParent ConsentCheny RojoNo ratings yet

- ProgDocument3 pagesProgCheny RojoNo ratings yet

- SashDocument6 pagesSashCheny RojoNo ratings yet

- Ang Panunumpa NG ScoutDocument31 pagesAng Panunumpa NG ScoutCheny RojoNo ratings yet

- Script For The Opening Program of The BSP and GSP BackyardDocument2 pagesScript For The Opening Program of The BSP and GSP BackyardCheny Rojo100% (1)

- Richard Laureano ResumeDocument2 pagesRichard Laureano Resumeapi-726195881No ratings yet

- TDS UK Spenax Rings and Fasteners Jun13Document1 pageTDS UK Spenax Rings and Fasteners Jun13Peter TNo ratings yet

- CivPro Atty. Custodio Case DigestsDocument12 pagesCivPro Atty. Custodio Case DigestsRachel CayangaoNo ratings yet

- EFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce DDocument253 pagesEFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce Dcity9848835243 cyberNo ratings yet

- 2021 Minutes 14th Regular Session - July 19, 2021Document6 pages2021 Minutes 14th Regular Session - July 19, 2021Nico & Hope SoNo ratings yet

- Interesting Design ServicesDocument21 pagesInteresting Design ServicesMad MateNo ratings yet

- Dineshdurai 1Document2 pagesDineshdurai 1kldineshNo ratings yet

- Difference Between Traditional Marketing Concept and Modern Marketing ConceptDocument3 pagesDifference Between Traditional Marketing Concept and Modern Marketing Conceptrollon.moaNo ratings yet

- DumpsCafe Microsoft-PL-900 Demo FreeDocument19 pagesDumpsCafe Microsoft-PL-900 Demo FreeJenny smithNo ratings yet

- Anuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorDocument44 pagesAnuraj Nakarmi: Effect of Sales Promotion On Consumer BehaviorravenNo ratings yet

- SITXCCS501 Manage Quality Customer Service - Student Guide: HospitalityDocument12 pagesSITXCCS501 Manage Quality Customer Service - Student Guide: HospitalitydeviNo ratings yet

- Resource Allocation MethodsDocument3 pagesResource Allocation MethodsFASIHANo ratings yet

- Questions - AleenaDocument2 pagesQuestions - AleenaAlina IsrarNo ratings yet

- Еduсаtiоn of Patriotism in the Russian Lаnguаgе Lеssоns in Pеdаgоgiсаl UniversitiesDocument4 pagesЕduсаtiоn of Patriotism in the Russian Lаnguаgе Lеssоns in Pеdаgоgiсаl UniversitiesResearch ParkNo ratings yet

- International Business: Guided by Prof. Nikhil RaoDocument16 pagesInternational Business: Guided by Prof. Nikhil RaoDelrioNo ratings yet

- Wk. 10 - Aggregating Multiple Products in A Single OrderDocument10 pagesWk. 10 - Aggregating Multiple Products in A Single Orderpapa wawaNo ratings yet

- SWASTIKDocument23 pagesSWASTIKSIW - OEMNo ratings yet

- Office Space Lease ContractDocument1 pageOffice Space Lease Contractادزسر بانديكو هادولهNo ratings yet

- Introduction To TrustDocument2 pagesIntroduction To Trustyeo8joanne100% (1)

- Dcache Book 2.6Document245 pagesDcache Book 2.6waltrapillasaNo ratings yet

- Artificial Intelligence & It's Applications in Banking SectorDocument61 pagesArtificial Intelligence & It's Applications in Banking SectorClassic PrintersNo ratings yet

- RDF Vs XML ReportsDocument3 pagesRDF Vs XML Reportsnaresh2219642No ratings yet

- Executive MBA in Dubai BrochureDocument16 pagesExecutive MBA in Dubai BrochureAbdulNo ratings yet

- Shoes Bill MohitDocument2 pagesShoes Bill MohitmohitNo ratings yet

- Accounting Theory 2Document2 pagesAccounting Theory 2Glenda TaniaNo ratings yet

- Mobile Payment Systems SeminarDocument26 pagesMobile Payment Systems Seminarkrishnaganth kichaaNo ratings yet

- Material Handling Equipment SteelDocument114 pagesMaterial Handling Equipment SteelZahir Khira100% (1)