Professional Documents

Culture Documents

Model

Model

Uploaded by

skycoca120 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageModel

Model

Uploaded by

skycoca12Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

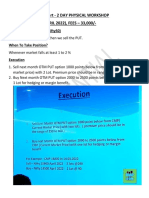

The Unicorn Model

I. Elements to a trade setup

- logic : internal liquidity -> external liquidity

(fvgs) (swing points)

- narrative : daily bias

- context : H1 market structure

- entry : M5 breaker + FVG

II. Hunting times

- we need an economic red folder to participate in the session (liquidity

injection) no news = no trade

- we only trade after the 9:30 opening bell (or after 9:45/10:00 if there

are news after the open)

- NFP protocol : finish the week on wednesday at the latest, no trade

thursday to friday

- FOMC protocol : wait for FOMC news driver to engage in the marketplace,

PM session trading is allowed on thursday

III. Risk parameters

- 1 trade a day & 2 trades a week maximum

- 0.5% risk

- fixed 2R for TP in harmony with the draw on liquidity

- TP or SL no in between

IV. Details

- trade only 1 market (ES)

- specialize in the NY open (AM session)

- only take trades in the same direction as the daily orderflow

- journal every trade (saturdays are for reviewing the week that was and

sundays are to plan the week to be)

You might also like

- Business PlanDocument3 pagesBusiness PlanJumoke Olaniyan67% (9)

- The MEJT System: A New Tool for Day Trading the S&P 500 IndexFrom EverandThe MEJT System: A New Tool for Day Trading the S&P 500 IndexRating: 4 out of 5 stars4/5 (1)

- FX GOAT SessionsDocument6 pagesFX GOAT Sessionsjames johnNo ratings yet

- How To Find A+ SetupsDocument3 pagesHow To Find A+ SetupsSudip SharmaNo ratings yet

- Forex One Minute Strategy Workbook - CompressedDocument22 pagesForex One Minute Strategy Workbook - CompressedBrayan GiraldoNo ratings yet

- Key Info (ICT)Document1 pageKey Info (ICT)Planet TravisNo ratings yet

- Forex Trading PlanDocument2 pagesForex Trading PlanDustin Plaas100% (2)

- NFP ReportDocument12 pagesNFP ReportSharizal ShafeiNo ratings yet

- Class Notes - Swapnil Joshi - Nov - 22Document4 pagesClass Notes - Swapnil Joshi - Nov - 22Chandra ReddyNo ratings yet

- INDICEDocument8 pagesINDICEGabixqNo ratings yet

- 7 Good Times To Enter ForexDocument15 pages7 Good Times To Enter Forexjayjonbeach100% (2)

- All Credit To ICT I'm Only A Learner of These MethodologiesDocument10 pagesAll Credit To ICT I'm Only A Learner of These MethodologiesMonkey D. SosaNo ratings yet

- Trade SetupsDocument25 pagesTrade Setupsarpitbrahamne3No ratings yet

- Trade Plan by TimCavDocument4 pagesTrade Plan by TimCavIsuru MadurangaNo ratings yet

- Bank NiftyDocument1 pageBank NiftyGopikumar ManoharanNo ratings yet

- Business Plan and Rules: Fundamental AnalysisDocument1 pageBusiness Plan and Rules: Fundamental AnalysisMohamed Saabkey HaajiNo ratings yet

- Forex Trading SystemDocument2 pagesForex Trading SystemBelenyesi DavidNo ratings yet

- What Is Premarket Trading and Post Market TradingDocument1 pageWhat Is Premarket Trading and Post Market Tradingcbcb gdfgsdfNo ratings yet

- RM RulesDocument5 pagesRM RulesAKIN KAYODENo ratings yet

- Conclusion of Ict StrategyDocument18 pagesConclusion of Ict StrategymultithingsdzNo ratings yet

- Key Info (ICT)Document1 pageKey Info (ICT)abhishekchouhab123No ratings yet

- 15 June 2020 Nifty MONDocument24 pages15 June 2020 Nifty MONVarun VasurendranNo ratings yet

- Creating A European Market System Under Mifid Niamh Moloney, Lse Hkex and The Market Structure Revolution' March 2012Document31 pagesCreating A European Market System Under Mifid Niamh Moloney, Lse Hkex and The Market Structure Revolution' March 2012fankozaNo ratings yet

- Session 21 - Action Plan For Daily Income Trader (Template)Document4 pagesSession 21 - Action Plan For Daily Income Trader (Template)Sri Chowdary0% (1)

- Step by Step Guide To Start Forex Himanshu PatwaDocument9 pagesStep by Step Guide To Start Forex Himanshu Patwabcrussia500No ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentBoss TassNo ratings yet

- NFP Day Trading Report-2Document6 pagesNFP Day Trading Report-2Etelka IvanicsNo ratings yet

- Trader Profile and Trading PlanDocument2 pagesTrader Profile and Trading PlanBenitaNo ratings yet

- GU Homework8 11to22 July 2022Document11 pagesGU Homework8 11to22 July 2022Alvaro MartinezNo ratings yet

- London Forex Rush ManualDocument56 pagesLondon Forex Rush ManualBogdanC-tin100% (3)

- TWP - CourseDocument81 pagesTWP - CoursevasseNo ratings yet

- Trade Pilipinas Trading Plan Sample 1Document7 pagesTrade Pilipinas Trading Plan Sample 1Carl ManzanoNo ratings yet

- Big Ben Trading StrategyDocument4 pagesBig Ben Trading StrategyMario CruzNo ratings yet

- Trading Compiled-VypernosDocument6 pagesTrading Compiled-VypernosLuca SchianoNo ratings yet

- Can I Trade News - FTMODocument4 pagesCan I Trade News - FTMOCMR CNo ratings yet

- Super Scalper 2.0Document20 pagesSuper Scalper 2.0Steve Marshall100% (1)

- AnalysDocument130 pagesAnalysvt inkNo ratings yet

- My Trade Mistakes#2Document2 pagesMy Trade Mistakes#2jim kangNo ratings yet

- The Trading One ThingDocument2 pagesThe Trading One ThingIburahim DeoNo ratings yet

- 10 June 2020 NiftyDocument15 pages10 June 2020 NiftyVarun VasurendranNo ratings yet

- Rangkuman Bab 12 Market EfficiencyDocument4 pagesRangkuman Bab 12 Market Efficiencyindah oliviaNo ratings yet

- Advanced Guide To Forex News TradingDocument9 pagesAdvanced Guide To Forex News TradingSatheesh KrishNo ratings yet

- PIPS30 Ultimate Forex GuideDocument76 pagesPIPS30 Ultimate Forex GuideadelowokanpelumijuliusNo ratings yet

- Trading The News Guide AdvancedDocument9 pagesTrading The News Guide AdvancedLiviuNo ratings yet

- TMS-II Preview NotesDocument4 pagesTMS-II Preview NotesParesh ShahNo ratings yet

- My MP ThreadDocument52 pagesMy MP ThreadksathisNo ratings yet

- Lesson 1: What Is ForexDocument49 pagesLesson 1: What Is ForexAgus RianNo ratings yet

- Welcome To Momentum Trading SetupDocument12 pagesWelcome To Momentum Trading SetupSunny Deshmukh0% (1)

- 305 Pips A DayDocument11 pages305 Pips A DayLestijono Last100% (1)

- My Trading Plan-1Document2 pagesMy Trading Plan-1angwererandy8No ratings yet

- BOC - WorkshopDocument21 pagesBOC - WorkshopVedanth MudholkarNo ratings yet

- Time To TradeDocument1 pageTime To TradesimonomuemuNo ratings yet

- Liquidity Trading PlanDocument13 pagesLiquidity Trading Plansurisigma25No ratings yet

- My First Trade of 2022Document4 pagesMy First Trade of 2022redwaanmo19No ratings yet

- Notes On - ICT Forex - Trading The Key Swing PointsDocument10 pagesNotes On - ICT Forex - Trading The Key Swing Pointssaiful100% (1)

- Advanced Guide To Forex News TradingDocument7 pagesAdvanced Guide To Forex News TradingHenry AgusiNo ratings yet

- Forex Toolkit One Minute News StrategyDocument2 pagesForex Toolkit One Minute News StrategyFx ToolkitNo ratings yet

- Usdcad Full PT IDocument38 pagesUsdcad Full PT IMonkey D. SosaNo ratings yet

- Ashare StrategyDocument18 pagesAshare StrategyHeisen LukeNo ratings yet