Professional Documents

Culture Documents

Tax, VAT & Others Regulatory Calendar SAZZAD W

Tax, VAT & Others Regulatory Calendar SAZZAD W

Uploaded by

Mehedi Hasan Munna0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageTax, VAT & Others Regulatory Calendar SAZZAD W

Tax, VAT & Others Regulatory Calendar SAZZAD W

Uploaded by

Mehedi Hasan MunnaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

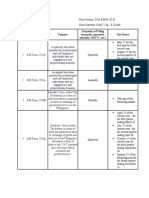

Summary of Tax & VAT Compliances Calender (ITA-'23 and VAT & SD Act-'12)

Prepared By Moinuddin Faruque, 01813-232477, Senior Officer- VAT, Tax & Accounts, Golden Son Ltd

Further makeover by: Sazzad Hossain, ITP, CSCA, CC - ISC2, CA (PL) - 01675237592; sazzadais@gmail.com

SL Time of Prepared Related To Timeline To Authority

No Submission Documents

1 Withholding Tax By 15th Day of DCT

Return U/S-177 Next Month

Monthly Tax

Return

2 Other Related Tax

Doc

3 TDS Challan By 15th Day of Next DCT

Month

4 VAT Return Mushak- By 15th Day of

Monthly 9.1 Next Month VAT

Monthly VAT

Commissionerate/

5 Other Related VAT Return

Local Circle office

Doc

6 VDS Challan By 7th day of Next Do

Tax period

7 VAT Payable By 15th day of Next Related VAT

Tax period Commissionerate

Advance 15th Day of

Income Tax September,

8 Quarterly Tax Challan U/S-154 DCT

(AIT) December, March &

June @ 25%

9 Annual Return

Within 30th Days of

10 Audited FS Schedule X RJSC

AGM

11 Form 238

12 Tax Return U/S 165 15th days of the

Corporate

Seventh Month

13 Audited FS Income Tax

Following the end of

Return

14 Other tax Documents Income Year

DCT

Annual TP Along with Tax

15 Yearly Return U/S 238

Return Return

Employee Tax Return Individual Tax Before 30th day of

16

U/S 180 Return November

Quarterly Financial Within 30th Days of

17 FDI Reporting Banker

Statement AGM

License Renewal i. e:

Trade License, Document

Before 30th Day of City Corporation/

18 IRC/ERC, Association Renewal

June Others

Of Member, Fire, Certification

Invironment, BIDA

You might also like

- 0605Document2 pages0605Kath Rivera60% (42)

- E Tax 20200504201259Document3 pagesE Tax 20200504201259monitganatra100% (1)

- Kieso17e ch13 Solutions ManualDocument89 pagesKieso17e ch13 Solutions ManualMoheeb HaddadNo ratings yet

- Cod DGT - Per - 25 - PJ - 2018Document2 pagesCod DGT - Per - 25 - PJ - 2018Desmanto HermanNo ratings yet

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanNo ratings yet

- Tax Alerts Act Wise Sep 10Document1 pageTax Alerts Act Wise Sep 10radhikaannapurna2010No ratings yet

- Reportorial RequirementsDocument3 pagesReportorial RequirementsMark Anthony P. TarroquinNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Introduction To GST Unit 1 8 Mark Questions.Document4 pagesIntroduction To GST Unit 1 8 Mark Questions.manoharchary157No ratings yet

- Tax On Personnel Under Job Order and Contract of ServicesDocument14 pagesTax On Personnel Under Job Order and Contract of ServicesghNo ratings yet

- Summary of Filing Deadlines of Internal Revenue TaxesDocument1 pageSummary of Filing Deadlines of Internal Revenue TaxesColleen GuimbalNo ratings yet

- Group 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnDocument4 pagesGroup 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnVan Joshua NunezNo ratings yet

- REPUBLIC OF THE PHILIPPINES FROM Rdo 27Document5 pagesREPUBLIC OF THE PHILIPPINES FROM Rdo 27ernestaguilar.valentinoNo ratings yet

- Bangladesh Taxation Overview 2Document7 pagesBangladesh Taxation Overview 2Reznov KovacicNo ratings yet

- Taxation Reviewer - REODocument202 pagesTaxation Reviewer - REOtmica7260No ratings yet

- 001 TMRAC Tax Compliance Guide Post Finance 2020 UpdatedDocument89 pages001 TMRAC Tax Compliance Guide Post Finance 2020 UpdatedHAMZA TAHIRNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment Systemmelanie venturaNo ratings yet

- GST Returns Assessment and Penal ProvisionsDocument9 pagesGST Returns Assessment and Penal ProvisionsAishuNo ratings yet

- VAT NotesDocument23 pagesVAT Notescz82h7z84tNo ratings yet

- Assignmen GST 5Document10 pagesAssignmen GST 5BhavnaNo ratings yet

- GST Registration Process and ReturnsDocument7 pagesGST Registration Process and ReturnsAkshay KumarNo ratings yet

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- Old Form 0605 PDFDocument2 pagesOld Form 0605 PDFeugene badere50% (2)

- Payment Form: 12 - DecemberDocument2 pagesPayment Form: 12 - DecemberElbert Natal100% (1)

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument28 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of Indiaatanu karmakarNo ratings yet

- 2020 With PenaltiesDocument1 page2020 With PenaltiesKashato BabyNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Relationship Between Tax Compliance and Tax Dispute (Including TP Documentation)Document37 pagesRelationship Between Tax Compliance and Tax Dispute (Including TP Documentation)ryu255No ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- New Business Registration (BIR)Document27 pagesNew Business Registration (BIR)CrizziaNo ratings yet

- Guidelines On Compliances and DocumentationDocument4 pagesGuidelines On Compliances and DocumentationJfm A Dazlac100% (1)

- Compliance Calendar 2022Document2 pagesCompliance Calendar 2022bhujabaliNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

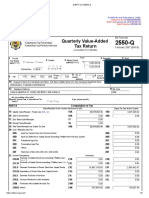

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnjoshuaNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- 20 Tasks For GST and Income Tax Need To Be Taken Care Before / After Year EndDocument4 pages20 Tasks For GST and Income Tax Need To Be Taken Care Before / After Year Endkrsh1950No ratings yet

- Bir FormDocument3 pagesBir FormChelsea Anne VidalloNo ratings yet

- Session 5 TDSDocument67 pagesSession 5 TDSsinthiakarim17No ratings yet

- 0605 SLSP Non FilingDocument1 page0605 SLSP Non FilingbertlaxinaNo ratings yet

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocument2 pagesFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoNo ratings yet

- Certificate of RegistrationDocument2 pagesCertificate of RegistrationEnrry SebastianNo ratings yet

- It 000154590025 2024 04Document1 pageIt 000154590025 2024 04MUHAMMAD TABRAIZNo ratings yet

- Chapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedDocument26 pagesChapter IX of CGST Act Read With CGST Rules, 2017 & Notifications PrescribedManali PingaleNo ratings yet

- Due Date Calendar Oct 22Document1 pageDue Date Calendar Oct 22Kushal DabhadkarNo ratings yet

- Taxable Income: Credit", As FollowsDocument13 pagesTaxable Income: Credit", As FollowsSuzette VillalinoNo ratings yet

- Final Withholding Taxation and Capital Gains TaxationDocument10 pagesFinal Withholding Taxation and Capital Gains TaxationKatrina MaglaquiNo ratings yet

- GST Returns NotesDocument5 pagesGST Returns NotesvishnureachmeNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- Income Tax Payment Challan: PSID #: 172780977Document1 pageIncome Tax Payment Challan: PSID #: 172780977fast fbrNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- It 000154519556 2024 04Document1 pageIt 000154519556 2024 04MUHAMMAD TABRAIZNo ratings yet

- GST Returns - Types, Forms, Due Dates & PenaltiesDocument7 pagesGST Returns - Types, Forms, Due Dates & PenaltiesRaj ArlaNo ratings yet

- GST A Social Reform Towards New Transparent IndiaDocument2 pagesGST A Social Reform Towards New Transparent IndiakishorejiNo ratings yet

- Adobe Scan 15 Dec 2023Document1 pageAdobe Scan 15 Dec 2023gandhipl74No ratings yet

- Tax FormsDocument4 pagesTax FormsJennie KimNo ratings yet

- Itr Ay 2022-23 Naveen KumarDocument1 pageItr Ay 2022-23 Naveen Kumarprateek gangwaniNo ratings yet

- ACK129478560310723Document1 pageACK129478560310723qazipilotNo ratings yet

- Tax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesDocument2 pagesTax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesArvin GarciaNo ratings yet

- PSIDAUG3Document1 pagePSIDAUG3Kashif NiaziNo ratings yet

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersDocument44 pagesIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1 - With TradersMehedi Hasan MunnaNo ratings yet

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Document137 pagesIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Mehedi Hasan MunnaNo ratings yet

- IVAS - DLV - BP User Guide For Reset PasswordDocument6 pagesIVAS - DLV - BP User Guide For Reset PasswordMehedi Hasan MunnaNo ratings yet

- IVAS - DLV - BP User Guide For Invoice Data For PurchaseSales Valued More Than Taka Two Lakh Using Form Mushak-6.10Document23 pagesIVAS - DLV - BP User Guide For Invoice Data For PurchaseSales Valued More Than Taka Two Lakh Using Form Mushak-6.10Mehedi Hasan MunnaNo ratings yet

- Ias 38, 10, 37 Ifrs 15Document83 pagesIas 38, 10, 37 Ifrs 15Mehedi Hasan MunnaNo ratings yet

- Tugas Chapter 10 - Adelia Ana Bella - 1613120001 - AKL2Document3 pagesTugas Chapter 10 - Adelia Ana Bella - 1613120001 - AKL2Meko N TNo ratings yet

- Master Budget QuizDocument1 pageMaster Budget QuizAbegail RafolsNo ratings yet

- The National Budget and Local BudgetDocument42 pagesThe National Budget and Local BudgetCherry Virtucio100% (1)

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Form No. 11A: (Now Redundant) Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Document2 pagesForm No. 11A: (Now Redundant) Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Dinesh KhandelwalNo ratings yet

- Anduril Industries IncentivesDocument5 pagesAnduril Industries IncentivesZachary HansenNo ratings yet

- Income Tax Revision QuestionsDocument13 pagesIncome Tax Revision QuestionsMbeiza MariamNo ratings yet

- Financial Engineering Class Sesi 1 Ver 2.0Document16 pagesFinancial Engineering Class Sesi 1 Ver 2.0Davis FojemNo ratings yet

- Honda Motors CH 3Document6 pagesHonda Motors CH 3Craft DealNo ratings yet

- Departmental Accounting PresentationDocument15 pagesDepartmental Accounting PresentationSurabhi AgrawalNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneySocio Fact'sNo ratings yet

- Problems Problem 1: True or FalseDocument4 pagesProblems Problem 1: True or Falsejessamae gundanNo ratings yet

- Lyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsDocument14 pagesLyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsYolly DiazNo ratings yet

- Topics On Income TaxationDocument4 pagesTopics On Income TaxationJessa Lopez GarciaNo ratings yet

- Income Statement & Ratio AnalysisDocument16 pagesIncome Statement & Ratio AnalysisababsenNo ratings yet

- 07 Franchise AccountingDocument5 pages07 Franchise AccountingAllegria AlamoNo ratings yet

- STD XII Class Note 1 NATIONAL INCOME 2021 22Document19 pagesSTD XII Class Note 1 NATIONAL INCOME 2021 22BE SANATANINo ratings yet

- AF2108 Week 1-4 StudentDocument6 pagesAF2108 Week 1-4 Studentw.leeNo ratings yet

- Phillips PLL 6e Chap03Document39 pagesPhillips PLL 6e Chap03snsahaNo ratings yet

- Employment IncomeDocument2 pagesEmployment IncomeFarhanah AfendiNo ratings yet

- Presumptive Taxation For Business and ProfessionDocument17 pagesPresumptive Taxation For Business and ProfessionRupeshNo ratings yet

- Taxability On Sale of Agriculture Land Under Income Tax LawDocument3 pagesTaxability On Sale of Agriculture Land Under Income Tax LawthevatsalsoniNo ratings yet

- Evolution of Taxation in The PhilippinesDocument10 pagesEvolution of Taxation in The PhilippinesCarlos Baul David100% (1)

- Oman - Corporate SummaryDocument12 pagesOman - Corporate SummarymujeebmuscatNo ratings yet

- Adjustments: Accounting For Service and Merchandising Entities ACC11Document12 pagesAdjustments: Accounting For Service and Merchandising Entities ACC11Rose LaureanoNo ratings yet

- Basis PeriodDocument9 pagesBasis PeriodaishahNo ratings yet

- Tutorial 6 (Week 7) QUESTIONDocument7 pagesTutorial 6 (Week 7) QUESTIONJahmesNo ratings yet

- Ma 3103 Business ValuationDocument28 pagesMa 3103 Business ValuationJacinta Fatima ChingNo ratings yet