Professional Documents

Culture Documents

None

None

Uploaded by

Donny EmanuelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

None

None

Uploaded by

Donny EmanuelCopyright:

Available Formats

Question:

✍ None

You can view the question in original Chegg URL page.

Expert answer: 0 0

✍ None

Step: 1

n

In this scenario, Splish Company sold 170 tool sets to Barr Hardware on March 10, 2020 , at a price of $50 each (costing $32 per set), with terms of ,

60

f.o.b. shipping point. The terms allow Barr to return any unused tool sets within 60 days of purchase, and Splish estimates that 10 sets will be returned.

Explanation

The cost of recovering the products is deemed immaterial, and Splish believes the returned tool sets can be resold at a profit. On March 25, 2020 , Barr

returned 6 tool sets and received a credit.

Step: 2

Answer :

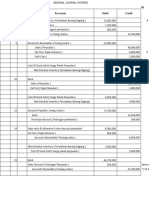

Journal entry :

No. Accounts Debit Credit

1 Cash 8500

Sales revenue 8500

(To record cash sales)

Cost of Goods sold 5440

Inventory 5440

(To record cost of goods sold)

2 Sales returns and allowances 300

Accounts payable 300

(To record sales returns)

Returned inventory 192

Cost of goods sold 192

(To record cost of goods sold returned)

3 Sales returns and allowances 200

Accounts payable 200

(Adjusting entry for sales returns)

Estimated inventory returns 128

Cost of Goods sold 128

(Adjusting entry for Cost of Goods sold)

Income Statement:

Sales revenue 8500

Less: sales returns and allowances 500

Net Sales 8000

Cost of goods sold (5,440-192-128) 5120

Gross Profit 2880

Balance Sheet:

Cash 8500

Returned Inventory 320

Accounts Payable 500

Explanation

. This scenario emphasizes the importance of accurate estimation, diligent monitoring, and appropriate accounting treatments to ensure the integrity of

financial reporting while navigating the nuances of customer returns within the realm of business operations.

Final Answer

In conclusion, the series of transactions between Splish Company and Barr Hardware exemplifies the complexity and intricacies involved in accounting for

sales with return provisions. The careful consideration of estimated returns, potential recovery costs, and the ability to resell returned items at a profit

underscores the need for accurate record-keeping and prudent financial management.

None

You might also like

- View Invoice - AppleDocument1 pageView Invoice - AppleCamelia BarbuNo ratings yet

- Reebok NFL Replica Jerseys Case Group IDocument30 pagesReebok NFL Replica Jerseys Case Group ISebastián Andrés Salinas Sepúlveda88% (8)

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Manual Solution CH 10 Analisis Laporan Keuangan K.R. SubramanyamDocument2 pagesManual Solution CH 10 Analisis Laporan Keuangan K.R. SubramanyamMeilani Intan PertiwiNo ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Management of Supermarket OperationsDocument33 pagesManagement of Supermarket OperationsAndoko LiminNo ratings yet

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- Accounting Chap 5Document6 pagesAccounting Chap 5Nguyễn Ngọc MaiNo ratings yet

- Jawaban Jurnal Umum P Dagang (11 Desember 2023)Document4 pagesJawaban Jurnal Umum P Dagang (11 Desember 2023)230210018No ratings yet

- Instructions:: E5.10 Prepare Multiple-Step and Single-Step Income StatementDocument16 pagesInstructions:: E5.10 Prepare Multiple-Step and Single-Step Income StatementKevin ChandraNo ratings yet

- Brief Exercise: Date AccountDocument11 pagesBrief Exercise: Date AccountSilvia HestyNo ratings yet

- Bayer Lamp CompanyDocument5 pagesBayer Lamp CompanyTrisha Mae CorpuzNo ratings yet

- CH 05Document16 pagesCH 05Idris100% (1)

- Chapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongDocument12 pagesChapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongMai Phương NguyễnNo ratings yet

- Chapter 7 Part 2Document23 pagesChapter 7 Part 2meahangela.labadan.23No ratings yet

- 2018 - Final Exam123key To StudentsDocument3 pages2018 - Final Exam123key To StudentsMinh ThưNo ratings yet

- Accounting Principles Manual Chapter 5 (Brief Exercises)Document5 pagesAccounting Principles Manual Chapter 5 (Brief Exercises)Dani SaputraNo ratings yet

- Akuntansi p5Document7 pagesAkuntansi p5Alche MistNo ratings yet

- Accounting 2 (FMI) 2024 DR - Mohiy Samy LectureDocument18 pagesAccounting 2 (FMI) 2024 DR - Mohiy Samy LectureAmr HassanNo ratings yet

- Pa12 Trần Khánh Vy Hw Ch5Document5 pagesPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhNo ratings yet

- Dokumen - Tips 4brief-Ex4Document4 pagesDokumen - Tips 4brief-Ex4Feby NurdianaNo ratings yet

- Accounting For Managers: Professor ZHOU NingDocument38 pagesAccounting For Managers: Professor ZHOU Ningdev4c-1No ratings yet

- ACTBFAR - Group Practice SetDocument3 pagesACTBFAR - Group Practice SetElle KongNo ratings yet

- Module 5 Lecture WorksheetDocument6 pagesModule 5 Lecture WorksheetcccNo ratings yet

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- Cost Accounting WorksheetDocument2 pagesCost Accounting WorksheetLEON JOAQUIN VALDEZNo ratings yet

- Exercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineDocument9 pagesExercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineAllie LinNo ratings yet

- At 5Document4 pagesAt 5Thùy NguyễnNo ratings yet

- CH 6 - SolutionDocument78 pagesCH 6 - SolutionMuhammad RehmanNo ratings yet

- CH 05 Financial AccountingDocument5 pagesCH 05 Financial AccountingkashifNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Single StepDocument1 pageSingle StepMerza DyanNo ratings yet

- Inventory (Questions) : Question No. H-1Document4 pagesInventory (Questions) : Question No. H-1manadish nawazNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Inter CA Costing Homework SolutionDocument82 pagesInter CA Costing Homework SolutionNo ProblemNo ratings yet

- Practice Set 4 AssetsDocument9 pagesPractice Set 4 AssetsAashiNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- EX1: Presented Here Are The Components in Sanders Company's Income Statement. DetermineDocument3 pagesEX1: Presented Here Are The Components in Sanders Company's Income Statement. DetermineViet Anh TranNo ratings yet

- NlktaDocument9 pagesNlktaYến Hoàng HảiNo ratings yet

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDocument10 pagesFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNo ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- CE2 Answer KeyDocument2 pagesCE2 Answer KeyHazel Joy DemaganteNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- FDNACCT Business Case - 3T1819 PDFDocument2 pagesFDNACCT Business Case - 3T1819 PDFRoy BonitezNo ratings yet

- No. 4-37 Page 146Document6 pagesNo. 4-37 Page 146Nemalai VitalNo ratings yet

- 7 Cycles of Accounting HakdogDocument23 pages7 Cycles of Accounting HakdogJamal DimaampaoNo ratings yet

- TASK 5 - AMOYAN - BSA-1CfarDocument15 pagesTASK 5 - AMOYAN - BSA-1CfarNicolle AmoyanNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- 31243mtestpaper Ipcc sr2 p3Document8 pages31243mtestpaper Ipcc sr2 p3Sundeep MogantiNo ratings yet

- Kisi KisiDocument14 pagesKisi KisiHairun NisaNo ratings yet

- EssayDocument5 pagesEssayDương NguyễnNo ratings yet

- DATEDocument1 pageDATEmajestictouchrepNo ratings yet

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- AssignmentDocument3 pagesAssignmentalmira garciaNo ratings yet

- 9 Stock ValuationDocument15 pages9 Stock ValuationDayaan ANo ratings yet

- Income Statement 10.7 SolutionsDocument4 pagesIncome Statement 10.7 SolutionsHarry ChaoNo ratings yet

- Accounting For Merchandising Operations: Pertemuan 7Document16 pagesAccounting For Merchandising Operations: Pertemuan 7Herry ArsevenNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 6 - Accounting For Merchandising BusinessDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 6 - Accounting For Merchandising BusinessJohn Carlos DoringoNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument7 pagesFundamentals of Accountancy Business and ManagementJayNo ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- Fair Value for Financial Reporting: Meeting the New FASB RequirementsFrom EverandFair Value for Financial Reporting: Meeting the New FASB RequirementsNo ratings yet

- Expert AnswerDocument3 pagesExpert AnswerDonny EmanuelNo ratings yet

- 35179798Document1 page35179798Donny EmanuelNo ratings yet

- DownloadDocument15 pagesDownloadDonny EmanuelNo ratings yet

- DownloadDocument3 pagesDownloadDonny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Readytoprint Chrome - Com 202428293729Document1 pageReadytoprint Chrome - Com 202428293729Donny EmanuelNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- X Tan BX X V E: NoneDocument1 pageX Tan BX X V E: NoneDonny EmanuelNo ratings yet

- Screenshot - 2024 03 04 13 40 34 329 - Com - Android.chrome EditDocument12 pagesScreenshot - 2024 03 04 13 40 34 329 - Com - Android.chrome EditDonny EmanuelNo ratings yet

- Chrome - Screenshot - Feb 29, 2024 8 - 57 - 06 PM GMT+07 - 00Document1 pageChrome - Screenshot - Feb 29, 2024 8 - 57 - 06 PM GMT+07 - 00Donny EmanuelNo ratings yet

- ZDIHUXCDODocument13 pagesZDIHUXCDODonny EmanuelNo ratings yet

- A Study On Export Procedures & Documentation at Itc BPL Pondi Uniersity Project ReportDocument109 pagesA Study On Export Procedures & Documentation at Itc BPL Pondi Uniersity Project Reportphani raja kumarNo ratings yet

- Building Brand Architecture Report Ebay Vs AmazonDocument5 pagesBuilding Brand Architecture Report Ebay Vs AmazonritxNo ratings yet

- Shrinath Desai Pune, Maharashtra, IndiaDocument2 pagesShrinath Desai Pune, Maharashtra, IndiaAyisha PatnaikNo ratings yet

- Games Customers Play: - Ramesh DorairajDocument11 pagesGames Customers Play: - Ramesh DorairajAntariksh SenguptaNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Test BankDocument59 pagesFinancial Accounting Canadian 6th Edition Libby Test Bankissacedric5j5ja7No ratings yet

- KING'S OWN INSTITUTEICT 274 E-Commerce: (Document Subtitle)Document6 pagesKING'S OWN INSTITUTEICT 274 E-Commerce: (Document Subtitle)maleeha shahzadNo ratings yet

- Catering CompanyDocument58 pagesCatering CompanyMd nahidulNo ratings yet

- Zara Competitive AnalysisDocument3 pagesZara Competitive AnalysisBhumika DhanasriNo ratings yet

- SLM-BBA-Supply Chain and Logistics ManagementDocument13 pagesSLM-BBA-Supply Chain and Logistics ManagementmuhammedfayispvkNo ratings yet

- DocumentDocument5 pagesDocumentRica RegorisNo ratings yet

- Case Study nr.1 CAFEROMA Limba Moderna UTMDocument4 pagesCase Study nr.1 CAFEROMA Limba Moderna UTMDoina LekaNo ratings yet

- FABM1 - 1st QuarterDocument9 pagesFABM1 - 1st QuarterRaquel Sibal Rodriguez100% (2)

- Premium Garden Products PGP Supplies Gardening Enthusiasts and Commercial GardenDocument1 pagePremium Garden Products PGP Supplies Gardening Enthusiasts and Commercial GardenAmit PandeyNo ratings yet

- Solution 6-37Document3 pagesSolution 6-37Tszkwan YuNo ratings yet

- CAPSIM Capstone Strategy 2016Document21 pagesCAPSIM Capstone Strategy 2016Khanh MaiNo ratings yet

- Project On Hospitality Industry: Customer Relationship ManagementDocument36 pagesProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariNo ratings yet

- Business Definition: Business Definition Into Business Entity Definition and Business Activity DefinitionDocument10 pagesBusiness Definition: Business Definition Into Business Entity Definition and Business Activity Definitionmuhammad riazNo ratings yet

- Local Food Marketing As A Development Opportunity For Small UK Agri-Food BusinessesDocument10 pagesLocal Food Marketing As A Development Opportunity For Small UK Agri-Food BusinessesdedenNo ratings yet

- Lesson 2 - The Statement of Comprehensive Income - ActivityDocument3 pagesLesson 2 - The Statement of Comprehensive Income - ActivityEmeldinand Padilla Motas0% (2)

- Quiz GSCMDocument3 pagesQuiz GSCMGurlal SinghNo ratings yet

- Dealership Evaluation Form PART-ADocument5 pagesDealership Evaluation Form PART-AManiNo ratings yet

- Perfetti's Distribution Strategy: Presented by Bhakta Ram RanaDocument23 pagesPerfetti's Distribution Strategy: Presented by Bhakta Ram RanaBhakta ram0% (1)

- Boss VentureDocument25 pagesBoss VentureZainol JukiNo ratings yet

- Term Paper On Price DiscriminationDocument6 pagesTerm Paper On Price Discriminationc5r0xg9z100% (1)

- Q & A Business Reg - ShopeeDocument4 pagesQ & A Business Reg - ShopeeNetty LunariaNo ratings yet

- TupperwareDocument6 pagesTupperwareSunil PatleNo ratings yet