Professional Documents

Culture Documents

Research v.1

Research v.1

Uploaded by

Karl SaysonCopyright:

Available Formats

You might also like

- M. Decree .211 For 2003 EngDocument57 pagesM. Decree .211 For 2003 Engmohsafety55@yahoo.com78% (9)

- Provincial Assessor of Marinduque vs. Court of AppealsDocument4 pagesProvincial Assessor of Marinduque vs. Court of AppealsiwamawiNo ratings yet

- Local TaxationDocument9 pagesLocal TaxationSNLTNo ratings yet

- Third Division: The Provincial Assessor of Marinduque, Petitioner, Marcopper Mining Corporation, RespondentsDocument22 pagesThird Division: The Provincial Assessor of Marinduque, Petitioner, Marcopper Mining Corporation, RespondentsjankriezlNo ratings yet

- Dungo V LopenaDocument14 pagesDungo V LopenaJonathan DancelNo ratings yet

- City of Lapu-Lapu v. PEZA - TOODocument3 pagesCity of Lapu-Lapu v. PEZA - TOORalph Ryan TooNo ratings yet

- Imposition of Real Property Tax - IndividualDocument9 pagesImposition of Real Property Tax - IndividualAweRiceNo ratings yet

- Draft Revenue Code of Lian Batangas 04-17-23Document45 pagesDraft Revenue Code of Lian Batangas 04-17-23Mark Andrei GubacNo ratings yet

- DAO 2004-53 - Guidelines To Implement The Tax Incentives Provision Under Section 13 of RA 8749Document5 pagesDAO 2004-53 - Guidelines To Implement The Tax Incentives Provision Under Section 13 of RA 8749Pacific SpectrumNo ratings yet

- MCIAA Vs MARCOSDocument4 pagesMCIAA Vs MARCOSJep Echon TilosNo ratings yet

- Tax Case Digest Mactan Cebu International Airport Authority Vs Marcos Et Al GR No 120082Document3 pagesTax Case Digest Mactan Cebu International Airport Authority Vs Marcos Et Al GR No 120082txgkosaltpiocspppcNo ratings yet

- Real Property TaxDocument13 pagesReal Property TaxArgel Cosme100% (2)

- Prov Assessor of Agusan V Filipinas PlantationDocument2 pagesProv Assessor of Agusan V Filipinas PlantationRobert MantoNo ratings yet

- Finals For Envi Law - Atty. NolascoDocument30 pagesFinals For Envi Law - Atty. NolascoLucky AngelaNo ratings yet

- Provincial Assessor of Agusan Del Sur VS Filipinas Palm OilDocument2 pagesProvincial Assessor of Agusan Del Sur VS Filipinas Palm OilClaudine Christine A. Vicente67% (3)

- Module 1 - Applicable LGC ProvisionsDocument66 pagesModule 1 - Applicable LGC ProvisionsElmar Perez Blanco100% (1)

- Manila Electric Company vs. The City AssessorDocument8 pagesManila Electric Company vs. The City Assessormerren bloomNo ratings yet

- ACT26 - Ch02 Value Added TaxDocument26 pagesACT26 - Ch02 Value Added Taxarya starkNo ratings yet

- 11 Provincial Assessor of Marinduque vs. CADocument14 pages11 Provincial Assessor of Marinduque vs. CAbvsmdlNo ratings yet

- Gratuitous Permits and Desilting PermitsDocument6 pagesGratuitous Permits and Desilting Permitsirenev_1100% (1)

- Ch02 Value-Added TaxDocument22 pagesCh02 Value-Added TaxRenelyn FiloteoNo ratings yet

- Real Property Taxation UpdatedDocument39 pagesReal Property Taxation UpdatedEmille LlorenteNo ratings yet

- Republic Act 9003Document18 pagesRepublic Act 9003Nishit Acherzee PalashNo ratings yet

- Philippine Clean Air Act of 1999Document6 pagesPhilippine Clean Air Act of 1999jimart10No ratings yet

- Procurement and Safety Laws Pertaining To ECE Equipment/Services in The PhilippinesDocument33 pagesProcurement and Safety Laws Pertaining To ECE Equipment/Services in The PhilippinesRigel ZabateNo ratings yet

- Alabaster New Noise OrdinanceDocument3 pagesAlabaster New Noise OrdinanceCaleb TurrentineNo ratings yet

- Real Estate TaxationDocument6 pagesReal Estate TaxationShine Revilla - MontefalconNo ratings yet

- Chapter 1 General Environmental Quality Act, 1974 (Act 127)Document25 pagesChapter 1 General Environmental Quality Act, 1974 (Act 127)Echam HamidNo ratings yet

- R.A. 9514Document5 pagesR.A. 9514Katherine Olitoquit Baiño-FlordelizNo ratings yet

- Quarry LawsDocument6 pagesQuarry Lawsgta0523No ratings yet

- Decision: Panganiban, J.Document18 pagesDecision: Panganiban, J.Patrick GoNo ratings yet

- 09 - Provincial Assessor V CADocument3 pages09 - Provincial Assessor V CAKristine De LeonNo ratings yet

- Environmental Crimes Law - BrazilDocument10 pagesEnvironmental Crimes Law - BrazilmgiongoNo ratings yet

- Ra 9238 GRT Vat On BanksDocument8 pagesRa 9238 GRT Vat On Banksapi-247793055No ratings yet

- RPT CasesDocument13 pagesRPT CasesSNLTNo ratings yet

- Value Added Tax With AnswerDocument24 pagesValue Added Tax With AnswerKeith China Dela Cruz100% (1)

- Environmental Laws Prohibited ActsDocument12 pagesEnvironmental Laws Prohibited Actsfritzie abellaNo ratings yet

- R.A. No. 9238Document6 pagesR.A. No. 9238Jesselle De GuzmanNo ratings yet

- E Waste (M&H) Rules 2011Document24 pagesE Waste (M&H) Rules 2011Prem Shanker RawatNo ratings yet

- Tax2 - Real Property Tax ReviewerDocument5 pagesTax2 - Real Property Tax Reviewercardeguzman100% (1)

- PSA Sec13-15 ConstiProvDocument2 pagesPSA Sec13-15 ConstiProvjackyNo ratings yet

- Compiled Cases in PropertyDocument96 pagesCompiled Cases in PropertydianepndvlaNo ratings yet

- PD 552Document5 pagesPD 552Myrelle Da Jose SarioNo ratings yet

- Today Is Friday, October 03, 2014Document9 pagesToday Is Friday, October 03, 2014Bryan MagnayeNo ratings yet

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress Assembledkram kolNo ratings yet

- RR No. 28-2020Document4 pagesRR No. 28-2020Jayvee OlayresNo ratings yet

- PD 1442 - Development of GeothermalDocument3 pagesPD 1442 - Development of GeothermalSchuldich SchwarzNo ratings yet

- Special Penal Law 5th Ass LawsDocument13 pagesSpecial Penal Law 5th Ass LawsebenezermanzanormtNo ratings yet

- OR23-003 Greene County Zoning Ordinance Article 16 FinalDocument3 pagesOR23-003 Greene County Zoning Ordinance Article 16 FinalnewsNo ratings yet

- Environmental Science (Air Quality Management)Document8 pagesEnvironmental Science (Air Quality Management)jessiejohnfelixNo ratings yet

- MCIAA v. Marcos, G.R. No. 120082, September 11, 1996Document19 pagesMCIAA v. Marcos, G.R. No. 120082, September 11, 1996Kristanne Louise YuNo ratings yet

- Disposal of WastesDocument4 pagesDisposal of WastesSachin BokanNo ratings yet

- Disposal SiteDocument7 pagesDisposal SiteSiphumelele QithiNo ratings yet

- SECTION 44 - Lands of MaharashtraDocument14 pagesSECTION 44 - Lands of MaharashtraAmol RautNo ratings yet

- ORDINANCE Lgu PropertiesDocument3 pagesORDINANCE Lgu PropertiesColleen Rose Guantero100% (2)

- Mactan Cebu International Airport Authority vs. Hon. Ferdinand J. Marcos G.R. No. 120082 September 11, 1996 Davide, JR., J.Document1 pageMactan Cebu International Airport Authority vs. Hon. Ferdinand J. Marcos G.R. No. 120082 September 11, 1996 Davide, JR., J.Maraipol Trading Corp.No ratings yet

- A Model Environmental Code: The Dubai Environment LawFrom EverandA Model Environmental Code: The Dubai Environment LawNo ratings yet

- Act on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaFrom EverandAct on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaNo ratings yet

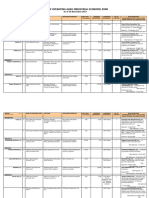

- List of Operating Agro-Industrial Economic Zone: Total No. 22Document4 pagesList of Operating Agro-Industrial Economic Zone: Total No. 22Karl SaysonNo ratings yet

- SR ADocument6 pagesSR AKarl SaysonNo ratings yet

- Aip 1Document4 pagesAip 1Karl SaysonNo ratings yet

- Aip 3Document4 pagesAip 3Karl SaysonNo ratings yet

- Sla LonDocument6 pagesSla LonKarl SaysonNo ratings yet

- IPL Finals Transcript PDFDocument64 pagesIPL Finals Transcript PDFKarl SaysonNo ratings yet

- Sayson, Karl Benedict N. Special Proceedings (Thurs, 7:30-9:30 P.M.) Feb. 27, 2020 Atty. TangarorangDocument6 pagesSayson, Karl Benedict N. Special Proceedings (Thurs, 7:30-9:30 P.M.) Feb. 27, 2020 Atty. TangarorangKarl SaysonNo ratings yet

- Mayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpDocument6 pagesMayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpKarl SaysonNo ratings yet

- Weekly Digests Format: Relaxing)Document1 pageWeekly Digests Format: Relaxing)Karl SaysonNo ratings yet

- Special Power of Attorney: Know All Men by These PresentsDocument2 pagesSpecial Power of Attorney: Know All Men by These PresentsKarl SaysonNo ratings yet

- Attributes of A Corporation: (ACS-P) A C S P No Par Value ShareDocument1 pageAttributes of A Corporation: (ACS-P) A C S P No Par Value ShareKarl SaysonNo ratings yet

- 14 Units 17 Units: Agency, Trust and Partnership Criminal Procedure Negotiable Instruments Credit TransactionsDocument1 page14 Units 17 Units: Agency, Trust and Partnership Criminal Procedure Negotiable Instruments Credit TransactionsKarl SaysonNo ratings yet

- Ra 8282: Social Security Law: Sss vs. Atlantic GulfDocument16 pagesRa 8282: Social Security Law: Sss vs. Atlantic GulfKarl SaysonNo ratings yet

- The Brothers KaramazovDocument2 pagesThe Brothers KaramazovKarl SaysonNo ratings yet

- (G.R. No. 122494. October 8, 1998) : vs. COURTDocument26 pages(G.R. No. 122494. October 8, 1998) : vs. COURTKarl SaysonNo ratings yet

- Leyte IV Electric Cooperative, Inc. v. LEYECO IV Employees Union-ALUDocument5 pagesLeyte IV Electric Cooperative, Inc. v. LEYECO IV Employees Union-ALUKarl SaysonNo ratings yet

- Fontana Development Corp. (FDC) v. Sascha VukasinovicDocument3 pagesFontana Development Corp. (FDC) v. Sascha VukasinovicKarl SaysonNo ratings yet

- Scope As It Includes Both Appriable and Non-Approriable Objects. The Moon and The Stars Are Things But They Are Not Appropriable So They Are Not Property. E.G. AirDocument1 pageScope As It Includes Both Appriable and Non-Approriable Objects. The Moon and The Stars Are Things But They Are Not Appropriable So They Are Not Property. E.G. AirKarl SaysonNo ratings yet

- De Buyser v. Director of Lands & Siary Valley Estates v. LucasanDocument1 pageDe Buyser v. Director of Lands & Siary Valley Estates v. LucasanKarl SaysonNo ratings yet

- Foreshore Lands / Submerged Areas Republic of The Philippines v. CA &moratoDocument16 pagesForeshore Lands / Submerged Areas Republic of The Philippines v. CA &moratoKarl SaysonNo ratings yet

- SIP Reflection Paper For The First Week.: Workplace LearningDocument2 pagesSIP Reflection Paper For The First Week.: Workplace LearningKarl SaysonNo ratings yet

- Literature Review Space Mining 3Document7 pagesLiterature Review Space Mining 3api-582787318No ratings yet

- Model Papers: (BA (SP) Hones in International Relations)Document3 pagesModel Papers: (BA (SP) Hones in International Relations)Kalum PalihawadanaNo ratings yet

- Aschehoug Et Al-2015-EcologyDocument7 pagesAschehoug Et Al-2015-EcologyPaula RojasNo ratings yet

- China Sanhe Thermal Power Plant Project (I) (II) : MongoliaDocument13 pagesChina Sanhe Thermal Power Plant Project (I) (II) : MongoliaMarioKeppleNo ratings yet

- Essay On Indian PhilosophyDocument1 pageEssay On Indian PhilosophyDhandev KammathNo ratings yet

- Khoironi 2019 IOP Conf. Ser. Earth Environ. Sci. 293 012002Document7 pagesKhoironi 2019 IOP Conf. Ser. Earth Environ. Sci. 293 012002Godfrey EmilioNo ratings yet

- Stem Cells of Aquatic Invertebrates As An Advanced Tool For Assessing Ecotoxicological ImpactsDocument23 pagesStem Cells of Aquatic Invertebrates As An Advanced Tool For Assessing Ecotoxicological ImpactsTiago TorresNo ratings yet

- Minirhizotron Imaging Reveals That Nodulation of Field-Grown Soybean Is Enhanced by Free-Air CO2 Enrichment Only When Combined With Drought StressDocument12 pagesMinirhizotron Imaging Reveals That Nodulation of Field-Grown Soybean Is Enhanced by Free-Air CO2 Enrichment Only When Combined With Drought StressCarlos FabioNo ratings yet

- Kalabagh Dam PDFDocument5 pagesKalabagh Dam PDFAbdul Qadeer Zhman100% (1)

- Evaluation of Satellite Rainfall Estimates in A Rugged Topographical Basin Over South Gojjam Basin, Ethiopia PDFDocument14 pagesEvaluation of Satellite Rainfall Estimates in A Rugged Topographical Basin Over South Gojjam Basin, Ethiopia PDFKonthoujam JamesNo ratings yet

- Bright Perspectives Solar Power Africa Policy PaperDocument98 pagesBright Perspectives Solar Power Africa Policy PaperRoger CkNo ratings yet

- Final Section 1 PDFDocument12 pagesFinal Section 1 PDFEva SmithNo ratings yet

- Waste IncinerationDocument111 pagesWaste Incinerationramirali100% (2)

- Wet Basin CalculationDocument10 pagesWet Basin CalculationAlif MohammadNo ratings yet

- Unit3 - Bio Diversity (I)Document40 pagesUnit3 - Bio Diversity (I)Sahith AddagallaNo ratings yet

- Region 2 Cagayan Valley AnalysisDocument2 pagesRegion 2 Cagayan Valley AnalysisJohn Mark BalaneNo ratings yet

- Stewart and Oke 2012Document22 pagesStewart and Oke 2012Thayssa NevesNo ratings yet

- BT Renewal Proposals AS ON 13.02.2022 PR DIV NRPTDocument15 pagesBT Renewal Proposals AS ON 13.02.2022 PR DIV NRPTK KARTHIKNo ratings yet

- Food ResourcesDocument14 pagesFood ResourcesNimmyNo ratings yet

- Safety Data Sheet: 1. IdentificationDocument7 pagesSafety Data Sheet: 1. IdentificationeadriesNo ratings yet

- Starchem: Safety Data SheetDocument2 pagesStarchem: Safety Data SheetUntuk KegiatanNo ratings yet

- Nitasha Sharma (Bca-1609) Ppt-Green TechnologyDocument12 pagesNitasha Sharma (Bca-1609) Ppt-Green TechnologyNitasha sharmaNo ratings yet

- The J'S Group Tree House at Villa Rosario Casinglot, Tagoloan Misamis Oriental 0997-106-6388Document6 pagesThe J'S Group Tree House at Villa Rosario Casinglot, Tagoloan Misamis Oriental 0997-106-6388Albjn MoralesNo ratings yet

- Dust-Sol DS-2.5 PM-1.0, PM-2.5 & PM-10 Dust SamplerDocument2 pagesDust-Sol DS-2.5 PM-1.0, PM-2.5 & PM-10 Dust SamplerJonathanNo ratings yet

- Kico Corneja - Made Janur Yasa - CNN HeroDocument3 pagesKico Corneja - Made Janur Yasa - CNN HeroKico Corneja100% (1)

- Technical Specification & Rincian Harga Sewage Treatment Plant (STP) Palma Hotel ProjectDocument6 pagesTechnical Specification & Rincian Harga Sewage Treatment Plant (STP) Palma Hotel ProjectrudiawanNo ratings yet

- Monitoring To Provide Evidence of Clean Room Performance Related To Air Cleanliness by Particle Concentration ISO 14622-2Document1 pageMonitoring To Provide Evidence of Clean Room Performance Related To Air Cleanliness by Particle Concentration ISO 14622-2Summiya JaveidNo ratings yet

- Romania - CountryDocument18 pagesRomania - CountryMaria Mirabela BenteNo ratings yet

- Eaeth Sub SystemDocument31 pagesEaeth Sub SystemPantz Revibes PastorNo ratings yet

- Esm 206Document59 pagesEsm 206Esse ObamrevwoNo ratings yet

Research v.1

Research v.1

Uploaded by

Karl SaysonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research v.1

Research v.1

Uploaded by

Karl SaysonCopyright:

Available Formats

Machinery and Equipment for Pollution Control and Environmental Protection

as Exempt from Real Property Taxes

Section 234. Exemptions from Real Property Tax. - The following are exempted from payment of

the real property tax:

a) Real property owned by the Republic of the Philippines or any of its political subdivisions

except when the beneficial use thereof has been granted, for consideration or otherwise, to

a taxable person;

b) Charitable institutions, churches, parsonages or convents appurtenant thereto, mosques,

nonprofit or religious cemeteries and all lands, buildings, and improvements actually,

directly, and exclusively used for religious, charitable or educational purposes;

c) All machineries and equipment that are actually, directly and exclusively used by local

water districts and government-owned or - controlled corporations engaged in the supply

and distribution of water and/or generation and transmission of electric power;

d) All real property owned by duly registered cooperatives as provided for under R. A. No.

6938; and

e) Machinery and equipment used for pollution control and environmental protection.

Except as provided herein, any exemption from payment of real property tax previously granted to,

or presently enjoyed by, all persons, whether natural or juridical, including all government-owned

or -controlled corporations are hereby withdrawn upon the effectivity of this Code.

As declared in Mactan Cebu International Airport Authority v. Marcos case 1, the exemption

granted under Sec. 234(e) of the Local Government Code (R.A. No. 7160) to machinery and

equipment used for pollution control and environmental protection is based on usage. The term usage

means direct, immediate and actual application of the property itself to the exempting purpose. As

provided under Section 199 of the same Code, actual use is the purpose for which the property is

principally or predominantly utilized by the person in possession thereof. It therefore contemplates

concrete, as distinguished from mere potential use. As such, the claim for exception under (e) should

be supported by evidence that the property sought to be exempt is actually, directly, exclusively used

for pollution control and environmental protection.

As provided under the Philippine Mining Act of 1995 (R.A. No. 7942), Sec. 3 (am), Pollution

control and infrastructure devices refers to infrastructure, machinery, equipment and/or improvements

used for impounding, treating or neutralizing, precipitating, filtering, conveying and cleansing mine

industrial waste and tailings as well as eliminating or reducing hazardous effects of solid particles,

chemicals, liquids or other harmful byproducts and gases emitted from any facility utilized in mining

operations for their disposal. Hence, pollution control device now also refers to infrastructure or

improvement, and not just to machinery or equipment.

Further, Section 199(o) of the same Code and as cited in the Provincial Assessor of

Marinduque case2, the word machinery Machinery" embraces machines, equipment, mechanical

contrivances, instruments, appliances or apparatus which may or may not be attached, permanently or

temporarily, to the real property. It includes the physical facilities for production, the installations and

appurtenant service facilities, those which are mobile, self-powered or self-propelled and those not

permanently attached to the real property which are actually, directly, and exclusively used to meet the

needs of the particular industry, business or activity and which by their very nature and purpose are

designed for, or necessary to its manufacturing.

1

G.R. No. 120082 (September 11, 1996) Mactan Cebu International Airport Authority v. Marcos

2

G.R. No. 170532 (April 30, 2009) Provincial Assessor of Marinduque v. Cour of Appeals and Marcopper Mining

Corporation

You might also like

- M. Decree .211 For 2003 EngDocument57 pagesM. Decree .211 For 2003 Engmohsafety55@yahoo.com78% (9)

- Provincial Assessor of Marinduque vs. Court of AppealsDocument4 pagesProvincial Assessor of Marinduque vs. Court of AppealsiwamawiNo ratings yet

- Local TaxationDocument9 pagesLocal TaxationSNLTNo ratings yet

- Third Division: The Provincial Assessor of Marinduque, Petitioner, Marcopper Mining Corporation, RespondentsDocument22 pagesThird Division: The Provincial Assessor of Marinduque, Petitioner, Marcopper Mining Corporation, RespondentsjankriezlNo ratings yet

- Dungo V LopenaDocument14 pagesDungo V LopenaJonathan DancelNo ratings yet

- City of Lapu-Lapu v. PEZA - TOODocument3 pagesCity of Lapu-Lapu v. PEZA - TOORalph Ryan TooNo ratings yet

- Imposition of Real Property Tax - IndividualDocument9 pagesImposition of Real Property Tax - IndividualAweRiceNo ratings yet

- Draft Revenue Code of Lian Batangas 04-17-23Document45 pagesDraft Revenue Code of Lian Batangas 04-17-23Mark Andrei GubacNo ratings yet

- DAO 2004-53 - Guidelines To Implement The Tax Incentives Provision Under Section 13 of RA 8749Document5 pagesDAO 2004-53 - Guidelines To Implement The Tax Incentives Provision Under Section 13 of RA 8749Pacific SpectrumNo ratings yet

- MCIAA Vs MARCOSDocument4 pagesMCIAA Vs MARCOSJep Echon TilosNo ratings yet

- Tax Case Digest Mactan Cebu International Airport Authority Vs Marcos Et Al GR No 120082Document3 pagesTax Case Digest Mactan Cebu International Airport Authority Vs Marcos Et Al GR No 120082txgkosaltpiocspppcNo ratings yet

- Real Property TaxDocument13 pagesReal Property TaxArgel Cosme100% (2)

- Prov Assessor of Agusan V Filipinas PlantationDocument2 pagesProv Assessor of Agusan V Filipinas PlantationRobert MantoNo ratings yet

- Finals For Envi Law - Atty. NolascoDocument30 pagesFinals For Envi Law - Atty. NolascoLucky AngelaNo ratings yet

- Provincial Assessor of Agusan Del Sur VS Filipinas Palm OilDocument2 pagesProvincial Assessor of Agusan Del Sur VS Filipinas Palm OilClaudine Christine A. Vicente67% (3)

- Module 1 - Applicable LGC ProvisionsDocument66 pagesModule 1 - Applicable LGC ProvisionsElmar Perez Blanco100% (1)

- Manila Electric Company vs. The City AssessorDocument8 pagesManila Electric Company vs. The City Assessormerren bloomNo ratings yet

- ACT26 - Ch02 Value Added TaxDocument26 pagesACT26 - Ch02 Value Added Taxarya starkNo ratings yet

- 11 Provincial Assessor of Marinduque vs. CADocument14 pages11 Provincial Assessor of Marinduque vs. CAbvsmdlNo ratings yet

- Gratuitous Permits and Desilting PermitsDocument6 pagesGratuitous Permits and Desilting Permitsirenev_1100% (1)

- Ch02 Value-Added TaxDocument22 pagesCh02 Value-Added TaxRenelyn FiloteoNo ratings yet

- Real Property Taxation UpdatedDocument39 pagesReal Property Taxation UpdatedEmille LlorenteNo ratings yet

- Republic Act 9003Document18 pagesRepublic Act 9003Nishit Acherzee PalashNo ratings yet

- Philippine Clean Air Act of 1999Document6 pagesPhilippine Clean Air Act of 1999jimart10No ratings yet

- Procurement and Safety Laws Pertaining To ECE Equipment/Services in The PhilippinesDocument33 pagesProcurement and Safety Laws Pertaining To ECE Equipment/Services in The PhilippinesRigel ZabateNo ratings yet

- Alabaster New Noise OrdinanceDocument3 pagesAlabaster New Noise OrdinanceCaleb TurrentineNo ratings yet

- Real Estate TaxationDocument6 pagesReal Estate TaxationShine Revilla - MontefalconNo ratings yet

- Chapter 1 General Environmental Quality Act, 1974 (Act 127)Document25 pagesChapter 1 General Environmental Quality Act, 1974 (Act 127)Echam HamidNo ratings yet

- R.A. 9514Document5 pagesR.A. 9514Katherine Olitoquit Baiño-FlordelizNo ratings yet

- Quarry LawsDocument6 pagesQuarry Lawsgta0523No ratings yet

- Decision: Panganiban, J.Document18 pagesDecision: Panganiban, J.Patrick GoNo ratings yet

- 09 - Provincial Assessor V CADocument3 pages09 - Provincial Assessor V CAKristine De LeonNo ratings yet

- Environmental Crimes Law - BrazilDocument10 pagesEnvironmental Crimes Law - BrazilmgiongoNo ratings yet

- Ra 9238 GRT Vat On BanksDocument8 pagesRa 9238 GRT Vat On Banksapi-247793055No ratings yet

- RPT CasesDocument13 pagesRPT CasesSNLTNo ratings yet

- Value Added Tax With AnswerDocument24 pagesValue Added Tax With AnswerKeith China Dela Cruz100% (1)

- Environmental Laws Prohibited ActsDocument12 pagesEnvironmental Laws Prohibited Actsfritzie abellaNo ratings yet

- R.A. No. 9238Document6 pagesR.A. No. 9238Jesselle De GuzmanNo ratings yet

- E Waste (M&H) Rules 2011Document24 pagesE Waste (M&H) Rules 2011Prem Shanker RawatNo ratings yet

- Tax2 - Real Property Tax ReviewerDocument5 pagesTax2 - Real Property Tax Reviewercardeguzman100% (1)

- PSA Sec13-15 ConstiProvDocument2 pagesPSA Sec13-15 ConstiProvjackyNo ratings yet

- Compiled Cases in PropertyDocument96 pagesCompiled Cases in PropertydianepndvlaNo ratings yet

- PD 552Document5 pagesPD 552Myrelle Da Jose SarioNo ratings yet

- Today Is Friday, October 03, 2014Document9 pagesToday Is Friday, October 03, 2014Bryan MagnayeNo ratings yet

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress Assembledkram kolNo ratings yet

- RR No. 28-2020Document4 pagesRR No. 28-2020Jayvee OlayresNo ratings yet

- PD 1442 - Development of GeothermalDocument3 pagesPD 1442 - Development of GeothermalSchuldich SchwarzNo ratings yet

- Special Penal Law 5th Ass LawsDocument13 pagesSpecial Penal Law 5th Ass LawsebenezermanzanormtNo ratings yet

- OR23-003 Greene County Zoning Ordinance Article 16 FinalDocument3 pagesOR23-003 Greene County Zoning Ordinance Article 16 FinalnewsNo ratings yet

- Environmental Science (Air Quality Management)Document8 pagesEnvironmental Science (Air Quality Management)jessiejohnfelixNo ratings yet

- MCIAA v. Marcos, G.R. No. 120082, September 11, 1996Document19 pagesMCIAA v. Marcos, G.R. No. 120082, September 11, 1996Kristanne Louise YuNo ratings yet

- Disposal of WastesDocument4 pagesDisposal of WastesSachin BokanNo ratings yet

- Disposal SiteDocument7 pagesDisposal SiteSiphumelele QithiNo ratings yet

- SECTION 44 - Lands of MaharashtraDocument14 pagesSECTION 44 - Lands of MaharashtraAmol RautNo ratings yet

- ORDINANCE Lgu PropertiesDocument3 pagesORDINANCE Lgu PropertiesColleen Rose Guantero100% (2)

- Mactan Cebu International Airport Authority vs. Hon. Ferdinand J. Marcos G.R. No. 120082 September 11, 1996 Davide, JR., J.Document1 pageMactan Cebu International Airport Authority vs. Hon. Ferdinand J. Marcos G.R. No. 120082 September 11, 1996 Davide, JR., J.Maraipol Trading Corp.No ratings yet

- A Model Environmental Code: The Dubai Environment LawFrom EverandA Model Environmental Code: The Dubai Environment LawNo ratings yet

- Act on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaFrom EverandAct on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaNo ratings yet

- List of Operating Agro-Industrial Economic Zone: Total No. 22Document4 pagesList of Operating Agro-Industrial Economic Zone: Total No. 22Karl SaysonNo ratings yet

- SR ADocument6 pagesSR AKarl SaysonNo ratings yet

- Aip 1Document4 pagesAip 1Karl SaysonNo ratings yet

- Aip 3Document4 pagesAip 3Karl SaysonNo ratings yet

- Sla LonDocument6 pagesSla LonKarl SaysonNo ratings yet

- IPL Finals Transcript PDFDocument64 pagesIPL Finals Transcript PDFKarl SaysonNo ratings yet

- Sayson, Karl Benedict N. Special Proceedings (Thurs, 7:30-9:30 P.M.) Feb. 27, 2020 Atty. TangarorangDocument6 pagesSayson, Karl Benedict N. Special Proceedings (Thurs, 7:30-9:30 P.M.) Feb. 27, 2020 Atty. TangarorangKarl SaysonNo ratings yet

- Mayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpDocument6 pagesMayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpKarl SaysonNo ratings yet

- Weekly Digests Format: Relaxing)Document1 pageWeekly Digests Format: Relaxing)Karl SaysonNo ratings yet

- Special Power of Attorney: Know All Men by These PresentsDocument2 pagesSpecial Power of Attorney: Know All Men by These PresentsKarl SaysonNo ratings yet

- Attributes of A Corporation: (ACS-P) A C S P No Par Value ShareDocument1 pageAttributes of A Corporation: (ACS-P) A C S P No Par Value ShareKarl SaysonNo ratings yet

- 14 Units 17 Units: Agency, Trust and Partnership Criminal Procedure Negotiable Instruments Credit TransactionsDocument1 page14 Units 17 Units: Agency, Trust and Partnership Criminal Procedure Negotiable Instruments Credit TransactionsKarl SaysonNo ratings yet

- Ra 8282: Social Security Law: Sss vs. Atlantic GulfDocument16 pagesRa 8282: Social Security Law: Sss vs. Atlantic GulfKarl SaysonNo ratings yet

- The Brothers KaramazovDocument2 pagesThe Brothers KaramazovKarl SaysonNo ratings yet

- (G.R. No. 122494. October 8, 1998) : vs. COURTDocument26 pages(G.R. No. 122494. October 8, 1998) : vs. COURTKarl SaysonNo ratings yet

- Leyte IV Electric Cooperative, Inc. v. LEYECO IV Employees Union-ALUDocument5 pagesLeyte IV Electric Cooperative, Inc. v. LEYECO IV Employees Union-ALUKarl SaysonNo ratings yet

- Fontana Development Corp. (FDC) v. Sascha VukasinovicDocument3 pagesFontana Development Corp. (FDC) v. Sascha VukasinovicKarl SaysonNo ratings yet

- Scope As It Includes Both Appriable and Non-Approriable Objects. The Moon and The Stars Are Things But They Are Not Appropriable So They Are Not Property. E.G. AirDocument1 pageScope As It Includes Both Appriable and Non-Approriable Objects. The Moon and The Stars Are Things But They Are Not Appropriable So They Are Not Property. E.G. AirKarl SaysonNo ratings yet

- De Buyser v. Director of Lands & Siary Valley Estates v. LucasanDocument1 pageDe Buyser v. Director of Lands & Siary Valley Estates v. LucasanKarl SaysonNo ratings yet

- Foreshore Lands / Submerged Areas Republic of The Philippines v. CA &moratoDocument16 pagesForeshore Lands / Submerged Areas Republic of The Philippines v. CA &moratoKarl SaysonNo ratings yet

- SIP Reflection Paper For The First Week.: Workplace LearningDocument2 pagesSIP Reflection Paper For The First Week.: Workplace LearningKarl SaysonNo ratings yet

- Literature Review Space Mining 3Document7 pagesLiterature Review Space Mining 3api-582787318No ratings yet

- Model Papers: (BA (SP) Hones in International Relations)Document3 pagesModel Papers: (BA (SP) Hones in International Relations)Kalum PalihawadanaNo ratings yet

- Aschehoug Et Al-2015-EcologyDocument7 pagesAschehoug Et Al-2015-EcologyPaula RojasNo ratings yet

- China Sanhe Thermal Power Plant Project (I) (II) : MongoliaDocument13 pagesChina Sanhe Thermal Power Plant Project (I) (II) : MongoliaMarioKeppleNo ratings yet

- Essay On Indian PhilosophyDocument1 pageEssay On Indian PhilosophyDhandev KammathNo ratings yet

- Khoironi 2019 IOP Conf. Ser. Earth Environ. Sci. 293 012002Document7 pagesKhoironi 2019 IOP Conf. Ser. Earth Environ. Sci. 293 012002Godfrey EmilioNo ratings yet

- Stem Cells of Aquatic Invertebrates As An Advanced Tool For Assessing Ecotoxicological ImpactsDocument23 pagesStem Cells of Aquatic Invertebrates As An Advanced Tool For Assessing Ecotoxicological ImpactsTiago TorresNo ratings yet

- Minirhizotron Imaging Reveals That Nodulation of Field-Grown Soybean Is Enhanced by Free-Air CO2 Enrichment Only When Combined With Drought StressDocument12 pagesMinirhizotron Imaging Reveals That Nodulation of Field-Grown Soybean Is Enhanced by Free-Air CO2 Enrichment Only When Combined With Drought StressCarlos FabioNo ratings yet

- Kalabagh Dam PDFDocument5 pagesKalabagh Dam PDFAbdul Qadeer Zhman100% (1)

- Evaluation of Satellite Rainfall Estimates in A Rugged Topographical Basin Over South Gojjam Basin, Ethiopia PDFDocument14 pagesEvaluation of Satellite Rainfall Estimates in A Rugged Topographical Basin Over South Gojjam Basin, Ethiopia PDFKonthoujam JamesNo ratings yet

- Bright Perspectives Solar Power Africa Policy PaperDocument98 pagesBright Perspectives Solar Power Africa Policy PaperRoger CkNo ratings yet

- Final Section 1 PDFDocument12 pagesFinal Section 1 PDFEva SmithNo ratings yet

- Waste IncinerationDocument111 pagesWaste Incinerationramirali100% (2)

- Wet Basin CalculationDocument10 pagesWet Basin CalculationAlif MohammadNo ratings yet

- Unit3 - Bio Diversity (I)Document40 pagesUnit3 - Bio Diversity (I)Sahith AddagallaNo ratings yet

- Region 2 Cagayan Valley AnalysisDocument2 pagesRegion 2 Cagayan Valley AnalysisJohn Mark BalaneNo ratings yet

- Stewart and Oke 2012Document22 pagesStewart and Oke 2012Thayssa NevesNo ratings yet

- BT Renewal Proposals AS ON 13.02.2022 PR DIV NRPTDocument15 pagesBT Renewal Proposals AS ON 13.02.2022 PR DIV NRPTK KARTHIKNo ratings yet

- Food ResourcesDocument14 pagesFood ResourcesNimmyNo ratings yet

- Safety Data Sheet: 1. IdentificationDocument7 pagesSafety Data Sheet: 1. IdentificationeadriesNo ratings yet

- Starchem: Safety Data SheetDocument2 pagesStarchem: Safety Data SheetUntuk KegiatanNo ratings yet

- Nitasha Sharma (Bca-1609) Ppt-Green TechnologyDocument12 pagesNitasha Sharma (Bca-1609) Ppt-Green TechnologyNitasha sharmaNo ratings yet

- The J'S Group Tree House at Villa Rosario Casinglot, Tagoloan Misamis Oriental 0997-106-6388Document6 pagesThe J'S Group Tree House at Villa Rosario Casinglot, Tagoloan Misamis Oriental 0997-106-6388Albjn MoralesNo ratings yet

- Dust-Sol DS-2.5 PM-1.0, PM-2.5 & PM-10 Dust SamplerDocument2 pagesDust-Sol DS-2.5 PM-1.0, PM-2.5 & PM-10 Dust SamplerJonathanNo ratings yet

- Kico Corneja - Made Janur Yasa - CNN HeroDocument3 pagesKico Corneja - Made Janur Yasa - CNN HeroKico Corneja100% (1)

- Technical Specification & Rincian Harga Sewage Treatment Plant (STP) Palma Hotel ProjectDocument6 pagesTechnical Specification & Rincian Harga Sewage Treatment Plant (STP) Palma Hotel ProjectrudiawanNo ratings yet

- Monitoring To Provide Evidence of Clean Room Performance Related To Air Cleanliness by Particle Concentration ISO 14622-2Document1 pageMonitoring To Provide Evidence of Clean Room Performance Related To Air Cleanliness by Particle Concentration ISO 14622-2Summiya JaveidNo ratings yet

- Romania - CountryDocument18 pagesRomania - CountryMaria Mirabela BenteNo ratings yet

- Eaeth Sub SystemDocument31 pagesEaeth Sub SystemPantz Revibes PastorNo ratings yet

- Esm 206Document59 pagesEsm 206Esse ObamrevwoNo ratings yet