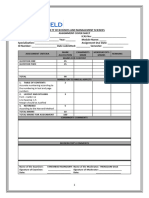

Professional Documents

Culture Documents

CV 2024 Utkrisht - Sethi

CV 2024 Utkrisht - Sethi

Uploaded by

Schneider SpellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CV 2024 Utkrisht - Sethi

CV 2024 Utkrisht - Sethi

Uploaded by

Schneider SpellCopyright:

Available Formats

Utkrisht Sethi

FMVA®, CMSA® & CFA All Levels Cleared

Committed to becoming a field specialist, striving to develop strategies that advance society while meeting organisational and personal objectives.

Passionate about driving positive change, seeking to align professional goals with societal impact, and contributing to organisational success.

utkrishtsethi15@gmail.com +91-8291474684 Delhi linkedin.com/in/utkrishtsethi

WORK EXPERIENCE SKILLS

Credit Suisse, India Financial Analysis Corporate Finance Equity Valuation

Financial Analyst (Product Controller)

05/2021 - 05/2022, Pune, India

Alternative Assets Fixed Income Corporate Valuation

Department - Product Control Analytics | Exceptions Management

Financial Modeling Derivatives Portfolio Management

Tasks/Accomplishments

Performed analysis of the daily trading P&L by understanding Bloomberg Microsoft Excel Financial Management

trading strategies, risk profile and market conditions.

Took ownership of valuation matters, including Independent Price

Verification, Valuation Adjustment and Fair Value Adjustment.

Leveraged technology (Machine Learning) and tools to deliver AWARDS & ACHIEVEMENTS

solutions that streamline daily and monthly P&L preparation.

Partnered with the business to evaluate and integrate new financial

Passed CFA Level 3 (02/2024)

products into the financial environment in a controlled manner.

Scholarship for CFA Level 1 & 3 (03/2023)

Trained members and worked closely with the Control team, to Awarded CFA scholarship for level 1 under University Affiliation Program (UAP) & for

correct the breaking trades by performing related valuations. level 3 under Access Scholarship Program (ASP).

Executed a groundbreaking method to streamline daily task,

Director's Award - Symbiosis, Pune (05/2021)

reducing the time taken from 7 minutes to 5 seconds.

Displayed meritorious academic performance in MBA.

Awarded three RAVE's (Recognizing and Valuing Excellence) in

one year for upholding and displaying exemplary performance.

CERTIFICATES

INTERNSHIPS & PROJECTS Investment Manager Selection (CFA Institute) (11/2023)

Covered principles related to manager universe, quantitative analysis & qualitative

Internship - DVS & Partners (Financial Advisor) analysis (investment due diligence & operational due diligence).

(05/2022 - 12/2022)

Performance Attribution (CFA Institute) (10/2023)

Providing wealth management & portfolio management related services to

the firm & its partners. Covered return attribution concepts like Brinson model (BHB & BF), calculation and

interpretation of allocation, selection, and interaction effects.

Internship - Credit Suisse (Product Control Analytics - VaR

Performance Evaluation: Risk Measurement & Data Integrity (CFA

Backtesting) (05/2020 - 06/2020)

Institute) (10/2023)

Performed daily analysis of Global Profit & Loss Account, VaR - Backtesting

Explored performance evaluation's role in investment management, its usefulness to

process and reported it to the respective global regulators.

clients, and ethical considerations in presentations.

Solstice Horizon Wealth Fund (Portfolio Simulation) Risk Measurement, Risk Attribution & Performance Appraisal

(02/2023 - 03/2023) (CFA Institute) (09/2023)

Performed portfolio simulation using mean variance optimization on 4 Explored distinctions between non-financial & financial risk; various classifications of

stocks and 4 indices to determine optimal weights for asset allocation. market risk, downside risk, drawdown, value at risk, etc.

IPO Gain/Loss Prediction Model (09/2022 - 09/2022) Essentials of Factor Investing (Robeco | CFA Institute) (04/2022)

Multiple regression model executed, to predict upcoming IPOs listing

gains/losses with approx. 79% accuracy. Capital Market & Securities Analyst® (Corporate Finance

Stockotine Screener BSE & NSE 2700+ (12/2021 - 03/2022) Institute) (03/2021)

Performed the valuation of swaps, futures, options, forwards, forward rate

Designed industry specific, real-time, and self-updating stock screener. agreement & swaptions, etc.

Research Paper - Investing Strategies & Performance of Retail Financial Modelling & Valuations Analyst® (Corporate Finance

Investors vs Financial Advisors (03/2021 - 09/2021) Institute) (08/2020)

Focusing on the returns generated, asset allocation, risk perception and Performed financial valuations for different types of businesses/industries.

asset selection by Retail Investors & Financial Advisors.

CFA Ethical Decision Making (CFA Institute) (06/2020)

EDUCATION

Master of Business Administration (Finance)

VOLUNTEER EXPERIENCE

Symbiosis Institute of Management Studies, Pune CFA Practice Analysis Working Body Member

06/2019 - 04/2021, 7.86/10 CGPA

(01/2022 - 12/2022)

Reviewing CFA curricula such as LOS, readings and study tools.

Bachelor of Commerce (Honours) - Accounting &

Finance

Narsee Monjee Institute of Management Studies, INTERESTS

Mumbai

Travelling Simulations Aviation Badminton

05/2016 - 03/2019, 3.15/4 CGPA

You might also like

- QP PreparationDocument10 pagesQP Preparationpraveen gandiNo ratings yet

- Iimjobs Pragati BandiDocument1 pageIimjobs Pragati Bandisanandreas989898No ratings yet

- Resume of Niladri Chakraborty-5Document1 pageResume of Niladri Chakraborty-5Aakansha DNo ratings yet

- Resume CFA PDFDocument2 pagesResume CFA PDFgaurav mehraNo ratings yet

- Akashdeep Gill - CVDocument1 pageAkashdeep Gill - CVagrawalkunal2No ratings yet

- Sanchit Mehrotra: Work Experience SkillsDocument1 pageSanchit Mehrotra: Work Experience SkillsSanchit MehrotraNo ratings yet

- Resume Devesh Gupta FinalDocument1 pageResume Devesh Gupta Finaldevesh guptaNo ratings yet

- Priya Shah Resume 11.10.2023Document1 pagePriya Shah Resume 11.10.2023Group ShareNo ratings yet

- Resume Devesh Gupta Credit ManagerDocument1 pageResume Devesh Gupta Credit Managerdevesh guptaNo ratings yet

- Anant SinghDocument1 pageAnant Singhhimn99No ratings yet

- Syed Raheel Zubair CVDocument2 pagesSyed Raheel Zubair CVRaheelPUBGNo ratings yet

- Aruneshwar VermaDocument2 pagesAruneshwar Vermagaurav SinghNo ratings yet

- Manu Singh: Date of Birth: 5 December, 1991 Post Graduate Diploma in Management (PGDM)Document2 pagesManu Singh: Date of Birth: 5 December, 1991 Post Graduate Diploma in Management (PGDM)Vicky SurywanshiNo ratings yet

- Naukri MadhavVashisht (13y 0m)Document3 pagesNaukri MadhavVashisht (13y 0m)Naman VasalNo ratings yet

- Shailendra SinghDocument1 pageShailendra Singhsriram.srikanthNo ratings yet

- Resume Subham Kumar CitiDocument1 pageResume Subham Kumar Citisanket patilNo ratings yet

- BU7006 Semester 1 Assessment Brief Sep 2023 - 24Document12 pagesBU7006 Semester 1 Assessment Brief Sep 2023 - 24Rabia GulNo ratings yet

- Resume Subham KumarDocument1 pageResume Subham Kumarsanket patilNo ratings yet

- Resume Subham Kumar CitiDocument1 pageResume Subham Kumar Citisanket patilNo ratings yet

- Vibhu Agarwal CVDocument1 pageVibhu Agarwal CVrg24No ratings yet

- ResumeDocument1 pageResumeNandan JhaNo ratings yet

- Akshay's ResumeDocument1 pageAkshay's ResumeakshayNo ratings yet

- Academic Qualification: Male, 26 Years - B.E - M.B.ADocument1 pageAcademic Qualification: Male, 26 Years - B.E - M.B.ARajgopal BalabhadruniNo ratings yet

- Anay Aheshwari: Core Competencies Work ExperienceDocument2 pagesAnay Aheshwari: Core Competencies Work ExperienceAbraham JuleNo ratings yet

- Abhinav - CVDocument2 pagesAbhinav - CVAbhinav JainNo ratings yet

- Samarth's ResumeDocument1 pageSamarth's ResumeamanNo ratings yet

- GBP Course Handout AY2021-22 - HDocument30 pagesGBP Course Handout AY2021-22 - HShanthan ReddyNo ratings yet

- Resume Puja PDocument1 pageResume Puja PFarzeen NPNo ratings yet

- Sample Resume For Students With Previous ExperienceDocument3 pagesSample Resume For Students With Previous ExperienceAakash AakashNo ratings yet

- Financial Modeling 5 Jan 2023Document5 pagesFinancial Modeling 5 Jan 2023Archit SharmaNo ratings yet

- Thejas's Resume PDFDocument1 pageThejas's Resume PDFvivek tiwariNo ratings yet

- Profile Sujawal JaggaDocument2 pagesProfile Sujawal JaggaFortune CA0% (1)

- Mba Shubhi Kapoor PDFDocument1 pageMba Shubhi Kapoor PDFVaibhav GuptaNo ratings yet

- Scoman 2: Study Guide For Course Summer 2020Document2 pagesScoman 2: Study Guide For Course Summer 2020Gracelle Mae OrallerNo ratings yet

- Keshav Khandelwal - ResumeDocument1 pageKeshav Khandelwal - Resumedeepak.sharmaNo ratings yet

- Benson Varghese - ResumeDocument2 pagesBenson Varghese - ResumebenvarrNo ratings yet

- Financial Modeling Brochure - F 2021Document5 pagesFinancial Modeling Brochure - F 2021Ayush UpadhyayNo ratings yet

- Resume-Akhil Loharuka PDFDocument3 pagesResume-Akhil Loharuka PDFYamini SharmaNo ratings yet

- Arnab SenDocument18 pagesArnab SenArnab SenNo ratings yet

- Resume Devesh Gupta GrowthDocument1 pageResume Devesh Gupta Growthdevesh guptaNo ratings yet

- Vaibhav Rohatgi ResumeDocument2 pagesVaibhav Rohatgi ResumesarveshNo ratings yet

- Rabi-Rajak ResumeDocument1 pageRabi-Rajak ResumeMNR SolutionsNo ratings yet

- ShubhamBindal LBSIMDocument1 pageShubhamBindal LBSIMShubham BindalNo ratings yet

- Viraj Rathod: Education SkillsDocument1 pageViraj Rathod: Education Skillscvam04No ratings yet

- Tejendrasinh Gohil: TH THDocument7 pagesTejendrasinh Gohil: TH THSureshArigelaNo ratings yet

- Vikalp ResumeDocument1 pageVikalp ResumeAshley CorreaNo ratings yet

- Kavish Jalan CV - 2018Document2 pagesKavish Jalan CV - 2018Jaimaruti PolychemNo ratings yet

- Business Valuation Standards I Corporate ProfessionalsDocument5 pagesBusiness Valuation Standards I Corporate ProfessionalsBrexa ManagementNo ratings yet

- Rajgopal BalabhadruniDocument2 pagesRajgopal BalabhadruniRajgopal BalabhadruniNo ratings yet

- Sandhiya's Resume-2Document1 pageSandhiya's Resume-2selac87827No ratings yet

- Chief Financial Officer Programme: Indian Institute of Management CalcuttaDocument14 pagesChief Financial Officer Programme: Indian Institute of Management CalcuttaBharat VyasNo ratings yet

- Resume - Rajan PalanDocument3 pagesResume - Rajan PalanShrikant RamNo ratings yet

- Career Summary Recruitment (BFSI, Analytics, IT & Non-IT), Leadership Hiring, Training &Document2 pagesCareer Summary Recruitment (BFSI, Analytics, IT & Non-IT), Leadership Hiring, Training &VipinNo ratings yet

- End-Sem Report - Tushit - 2013B3A8376H PDFDocument16 pagesEnd-Sem Report - Tushit - 2013B3A8376H PDFTushit ThakkarNo ratings yet

- Kinjal Pankaj ThakerDocument3 pagesKinjal Pankaj Thakerapi-280321399No ratings yet

- Abhinav MadanDocument3 pagesAbhinav MadanvinaydevangNo ratings yet

- Ashwat Poojary - Symphoni HRDocument5 pagesAshwat Poojary - Symphoni HRMeenu SharmaNo ratings yet

- Carrier Objective: Keeping Track of All Payments and ExpendituresDocument2 pagesCarrier Objective: Keeping Track of All Payments and ExpendituresAbhishek MNNo ratings yet

- Benefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideFrom EverandBenefits Realisation Management: The Benefit Manager's Desktop Step-by-Step GuideNo ratings yet

- Training Effectiveness Measurement for Large Scale Programs - Demystified!: A 4-tier Practical Model for Technical Training ManagersFrom EverandTraining Effectiveness Measurement for Large Scale Programs - Demystified!: A 4-tier Practical Model for Technical Training ManagersNo ratings yet

- Black Book The Comparative Study On The Investors Perception Towards Stock Market and Mutual Fund - EditedDocument41 pagesBlack Book The Comparative Study On The Investors Perception Towards Stock Market and Mutual Fund - EditedRiya PaiNo ratings yet

- Acc731 - Written Assignment 1Document5 pagesAcc731 - Written Assignment 1tiisetsomalepe920No ratings yet

- Fin 552 Individual AssignmentDocument14 pagesFin 552 Individual Assignment2022978231No ratings yet

- Reading 50 Fixed-Income Cash Flows and TypesDocument10 pagesReading 50 Fixed-Income Cash Flows and TypesTNHNo ratings yet

- MBF Mid ExamDocument3 pagesMBF Mid ExamEfrem Wondale100% (2)

- IBF301 - Ch004 - FA2021 Đang Phản BiệnDocument37 pagesIBF301 - Ch004 - FA2021 Đang Phản BiệnGiang PhanNo ratings yet

- 01 MergedDocument199 pages01 MergedfifaNo ratings yet

- How To Find and Invest in Penny StocksDocument3 pagesHow To Find and Invest in Penny StocksJonhmark Aniñon100% (1)

- Dollar General Investment ThesisDocument5 pagesDollar General Investment Thesistoniawallacelittlerock100% (1)

- Septian Pajrin Mukti - InvestmentDocument2 pagesSeptian Pajrin Mukti - InvestmentSeptian Pajrin MuktiNo ratings yet

- MODULE 1 Business FinanceDocument13 pagesMODULE 1 Business FinanceWinshei CaguladaNo ratings yet

- Investment Versus Speculation: Results To Be Expected by The Intelligent InvestorDocument13 pagesInvestment Versus Speculation: Results To Be Expected by The Intelligent InvestorAnmol KangNo ratings yet

- Beta in FinanceDocument47 pagesBeta in FinanceRitika IsraneyNo ratings yet

- L 2 3 TN Private Equity PDFDocument20 pagesL 2 3 TN Private Equity PDFfabriNo ratings yet

- Markowitz Theory of PortfolioDocument6 pagesMarkowitz Theory of PortfolioRebel X HamzaNo ratings yet

- 5.4. Risk and Return Trade-Off: Unit 5: Basic Long-Term Financial ConceptsDocument4 pages5.4. Risk and Return Trade-Off: Unit 5: Basic Long-Term Financial ConceptsTin CabosNo ratings yet

- Best Option Trading Strategies For Indian Markets PDF - Google SearchDocument5 pagesBest Option Trading Strategies For Indian Markets PDF - Google Searchsantanu_13100% (4)

- Vanguard S&P 500 ETFDocument2 pagesVanguard S&P 500 ETFHeyu PermanaNo ratings yet

- Portfolio Management ConceptDocument2 pagesPortfolio Management ConceptPranay Kumar SahuNo ratings yet

- Psychedelic Stock Index Etf: HorizonsDocument4 pagesPsychedelic Stock Index Etf: HorizonsananNo ratings yet

- Alternative InvestmentsDocument62 pagesAlternative Investmentsdimplle parmaniNo ratings yet

- Citibank - FX TradingDocument2 pagesCitibank - FX TradingNIKILNo ratings yet

- Mosl Project CompleteDocument55 pagesMosl Project CompleteMOHD AMAANNo ratings yet

- 10 V3 - 20201026 - CFA一级押题 - 组合管理 - 泽才教育Document29 pages10 V3 - 20201026 - CFA一级押题 - 组合管理 - 泽才教育Bowen ZhangNo ratings yet

- PE Quiz 1Document94 pagesPE Quiz 1Abhi JainNo ratings yet

- A Visual Guide To The ETF UniverseDocument4 pagesA Visual Guide To The ETF UniverseNomad LifeNo ratings yet

- CHAPTER 3 Securities MarketDocument45 pagesCHAPTER 3 Securities MarketNana ShahhhNo ratings yet

- Planet MicroCap Review Q3 2022Document120 pagesPlanet MicroCap Review Q3 2022Planet MicroCap Review MagazineNo ratings yet

- Contact Us: An Investment in Knowledge Pays The Best InterestDocument6 pagesContact Us: An Investment in Knowledge Pays The Best InterestJaisankar KailasamNo ratings yet