Professional Documents

Culture Documents

BOI Reporting Filing Dates-Published03.24.23 508C

BOI Reporting Filing Dates-Published03.24.23 508C

Uploaded by

amanogho.adidiCopyright:

Available Formats

You might also like

- Employment Law OutlineDocument35 pagesEmployment Law OutlineBrad Larkin100% (2)

- Xx1c 130e 5 Basic Weight Checklists and Loading Manual Hercules C 130Document29 pagesXx1c 130e 5 Basic Weight Checklists and Loading Manual Hercules C 130Meshal AlhaimodNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- BOI Informational Brochure 508CDocument3 pagesBOI Informational Brochure 508Cmark fakundinyNo ratings yet

- BOI FAQs QA 01.12.2024Document38 pagesBOI FAQs QA 01.12.2024abhishek.vynNo ratings yet

- What Beneficial Ownership Information Reporting Means To Small Business Owners.Document13 pagesWhat Beneficial Ownership Information Reporting Means To Small Business Owners.knightttttNo ratings yet

- FinCEN Launches Beneficial Ownership Information Registry - Winston & StrawnDocument5 pagesFinCEN Launches Beneficial Ownership Information Registry - Winston & StrawnknightttttNo ratings yet

- Information To Be Provided in The BOI ReportDocument3 pagesInformation To Be Provided in The BOI Reportfluenttax19No ratings yet

- Corporate Transparency ActDocument5 pagesCorporate Transparency ActassistantNo ratings yet

- BOIR Filing InstructionsDocument21 pagesBOIR Filing InstructionsTatiana SuarezNo ratings yet

- IND AS On Fixed AssetsDocument1 pageIND AS On Fixed Assetschandrakumar k pNo ratings yet

- FAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Document5 pagesFAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Nur Batrisyia BalqisNo ratings yet

- Duane Morris LLP - The New Corporate Transparency Act - What Are The Reporting and Filing Requirements For Your Business - 06.13.2023Document2 pagesDuane Morris LLP - The New Corporate Transparency Act - What Are The Reporting and Filing Requirements For Your Business - 06.13.2023assistantNo ratings yet

- 150.events After The Reporting PeriodDocument6 pages150.events After The Reporting PeriodMelanie SamsonaNo ratings yet

- PIC QA No 2022 01Document4 pagesPIC QA No 2022 01Ryan LipayNo ratings yet

- 2023.12.01 - Notice To Client - CTA - EletterheadDocument3 pages2023.12.01 - Notice To Client - CTA - EletterheadsramdasNo ratings yet

- CA Final Law Amendments - Nov 2022Document10 pagesCA Final Law Amendments - Nov 2022Rohit KumarNo ratings yet

- Primer: For Boi Registered CompaniesDocument13 pagesPrimer: For Boi Registered CompaniesSarah Jean TaliNo ratings yet

- Business Owners Guide1Document34 pagesBusiness Owners Guide1Shailendra KelaniNo ratings yet

- BVI LAWS On FATCA ReportingDocument1 pageBVI LAWS On FATCA ReportingMa. Angelica de GuzmanNo ratings yet

- Beneficial Interest (BI) : Beneficial Interest in A Share Includes, Directly or Indirectly, Through AnyDocument2 pagesBeneficial Interest (BI) : Beneficial Interest in A Share Includes, Directly or Indirectly, Through AnyUrvi KanodiaNo ratings yet

- The Sick Ind. CompaniesDocument7 pagesThe Sick Ind. CompaniesnddaymaNo ratings yet

- Act04 Lfta222n001 Capistrano, JoanaDocument1 pageAct04 Lfta222n001 Capistrano, JoanaJoana loize CapistranoNo ratings yet

- BOI Small Compliance Guide FINAL Sept 508CDocument56 pagesBOI Small Compliance Guide FINAL Sept 508CBenny PrasetiohadiNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- INTACC 3.2LN - Related Party, Events After The Reporting Period, Operating SegmentsDocument5 pagesINTACC 3.2LN - Related Party, Events After The Reporting Period, Operating SegmentsAlvin BaternaNo ratings yet

- Notes To FSDocument28 pagesNotes To FSLouisse Homer NarcisoNo ratings yet

- 10 Handout 1Document13 pages10 Handout 1Charlotte AlcomendasNo ratings yet

- Companies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueDocument24 pagesCompanies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueMuhammad IrshadNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- Sec Reg ReportDocument5 pagesSec Reg ReportAndrew GallardoNo ratings yet

- 2.3. Ind AS 10Document22 pages2.3. Ind AS 10Ajay JangirNo ratings yet

- Corporations: Week 4-Notes AEC 209-Income TaxationDocument23 pagesCorporations: Week 4-Notes AEC 209-Income TaxationRena Decena ChavezNo ratings yet

- RA-03 SubDocument1 pageRA-03 SubFaizan SajjadNo ratings yet

- Topic 6 MFRS 110 3 Event - After - Reporting PeriodDocument14 pagesTopic 6 MFRS 110 3 Event - After - Reporting Perioddini sofia100% (1)

- Chapter 3 (Corporations) TaxationDocument16 pagesChapter 3 (Corporations) TaxationBradleeNo ratings yet

- RR 5-2021 - IT - As of 20210412 - EBQ - UnlockedDocument92 pagesRR 5-2021 - IT - As of 20210412 - EBQ - UnlockedTreb LemNo ratings yet

- Pfrs 1 - First Time Adoption To PfrsDocument27 pagesPfrs 1 - First Time Adoption To PfrsMa. Nicole AbremateaNo ratings yet

- Unit 1: 1. Company (Sec. 2 (17) ) : The Expression Company' Is Defined To MeanDocument26 pagesUnit 1: 1. Company (Sec. 2 (17) ) : The Expression Company' Is Defined To MeanAndrew BrownNo ratings yet

- 62297bos50449 Mod2 cp12Document188 pages62297bos50449 Mod2 cp12monicabhat96No ratings yet

- Luis Enrrique Romero Portillo: Affidavit of Unchanged StatusDocument1 pageLuis Enrrique Romero Portillo: Affidavit of Unchanged StatusL.E.R.P CRISTONo ratings yet

- LLC FormDocument3 pagesLLC FormLori HarwoodNo ratings yet

- 54233bos43539cp4 U5Document36 pages54233bos43539cp4 U5Akash KamathNo ratings yet

- VPI BIR Ruling DA-022-04Document5 pagesVPI BIR Ruling DA-022-04Sophia InoturanNo ratings yet

- The Companies Act: Audit Requirement and Other Matters Related To The AuditDocument8 pagesThe Companies Act: Audit Requirement and Other Matters Related To The AuditHussain MustunNo ratings yet

- COMPANY". This Concept Was Not There in Companies Act, 1956. Another Name of This ACT 2013"Document6 pagesCOMPANY". This Concept Was Not There in Companies Act, 1956. Another Name of This ACT 2013"Guru K PrasathNo ratings yet

- Ifrs at A Glance: IAS 10 Events After The ReportingDocument4 pagesIfrs at A Glance: IAS 10 Events After The ReportingJozelle Grace PadelNo ratings yet

- Events After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14Document14 pagesEvents After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14kshitijsaxenaNo ratings yet

- Preparing For Fatca Understanding Implications and RequirementsDocument25 pagesPreparing For Fatca Understanding Implications and RequirementsylshihNo ratings yet

- International Accounting Standard-10: Events After The Balance Sheet Date / Events After The Reporting PeriodDocument19 pagesInternational Accounting Standard-10: Events After The Balance Sheet Date / Events After The Reporting PeriodBasavaraj S PNo ratings yet

- DT NotesDocument16 pagesDT NotesSatyam ShrivastavaNo ratings yet

- NAS 10 ICAN Revision Classes IDocument9 pagesNAS 10 ICAN Revision Classes ISujan ShresthaNo ratings yet

- Income Tax: Basic Terms and Provisions Relating To Residential StatusDocument7 pagesIncome Tax: Basic Terms and Provisions Relating To Residential StatusAshika Khanna 1911165No ratings yet

- Insurance Circular Letter No. 037-18Document2 pagesInsurance Circular Letter No. 037-18Mary Mayne LamusaoNo ratings yet

- Income TaxDocument126 pagesIncome TaxIndranil RayNo ratings yet

- Tutorial Event After Reporting Period Week 7Document10 pagesTutorial Event After Reporting Period Week 7Anna RomanNo ratings yet

- IndiaDocument6 pagesIndiachandra bhumiNo ratings yet

- Roject Prepared During NternshipDocument11 pagesRoject Prepared During NternshipDivyam DhyaniNo ratings yet

- Dormant CompanyDocument4 pagesDormant Companysonakshi182No ratings yet

- Foreign Liability and Assets Return (Fla Return)Document2 pagesForeign Liability and Assets Return (Fla Return)rushi SatheNo ratings yet

- Pa Tax Brief - May 2020Document22 pagesPa Tax Brief - May 2020Teresita TibayanNo ratings yet

- Ind As 10Document13 pagesInd As 10mohd52No ratings yet

- Federal Accounting Handbook: Policies, Standards, Procedures, PracticesFrom EverandFederal Accounting Handbook: Policies, Standards, Procedures, PracticesNo ratings yet

- FP Parent Handbook 2023 24Document33 pagesFP Parent Handbook 2023 24amanogho.adidiNo ratings yet

- La1ed WS 682032 1 - 50 - 80006372Document1 pageLa1ed WS 682032 1 - 50 - 80006372amanogho.adidiNo ratings yet

- WIDERA CallTopicListe WP2023-2024 Dezember2023 1Document13 pagesWIDERA CallTopicListe WP2023-2024 Dezember2023 1amanogho.adidiNo ratings yet

- La1ed WS 682032 2 - 50 - 80006357Document1 pageLa1ed WS 682032 2 - 50 - 80006357amanogho.adidiNo ratings yet

- LA1ED WS 685004 1 - 50 - 8000638eDocument1 pageLA1ED WS 685004 1 - 50 - 8000638eamanogho.adidiNo ratings yet

- Wcms 877584Document8 pagesWcms 877584amanogho.adidiNo ratings yet

- Abv SpecDocument111 pagesAbv Specamanogho.adidiNo ratings yet

- Whirlpool RebateDocument3 pagesWhirlpool RebatePrasad ReddyNo ratings yet

- 1st Floor Office Suite, ST Ann's Mill, Kirkstall Road, Leeds, West Yorkshire, LS5 3AEDocument2 pages1st Floor Office Suite, ST Ann's Mill, Kirkstall Road, Leeds, West Yorkshire, LS5 3AERavi BhollahNo ratings yet

- Civil Appeal 146 of 2013Document4 pagesCivil Appeal 146 of 2013Philip MalangaNo ratings yet

- MOCK CALL (Applicant's Guide)Document4 pagesMOCK CALL (Applicant's Guide)Lee Robert OlivarNo ratings yet

- Florida Contractor AgreementDocument5 pagesFlorida Contractor Agreementklamsang555No ratings yet

- AM 22-09-01-SC - Code of Professional Responsibility and AccountabilityDocument36 pagesAM 22-09-01-SC - Code of Professional Responsibility and AccountabilityJake MacTavishNo ratings yet

- Oblicon (Articles 1305 - 1415)Document9 pagesOblicon (Articles 1305 - 1415)SIMPAO, Ma. Kristine Mae C.No ratings yet

- 03 - Bardillon v. Barangay Masili of Calamba, LagunaDocument2 pages03 - Bardillon v. Barangay Masili of Calamba, LagunaAngelicaNo ratings yet

- April Blakeley Procedural Safeguard Tri-Fold BrochureDocument2 pagesApril Blakeley Procedural Safeguard Tri-Fold Brochureapi-617077329No ratings yet

- Barcenas Vs AlveroDocument14 pagesBarcenas Vs AlveroJannah Anne JavierNo ratings yet

- SALES - Dec. 11, 2022Document9 pagesSALES - Dec. 11, 2022Elmer SarabiaNo ratings yet

- XXX Audit XXXDocument20 pagesXXX Audit XXXmisssunshine112No ratings yet

- 10 First Planters Pawnshop Vs BIR CaseDocument2 pages10 First Planters Pawnshop Vs BIR CaseRenato C. Silvestre Jr.No ratings yet

- KWA AEG War Sport LVOA Series ManualDocument28 pagesKWA AEG War Sport LVOA Series ManualJuanma Galvez JimenezNo ratings yet

- Pidato Harlah NUDocument3 pagesPidato Harlah NULeni komariatul ulfaNo ratings yet

- 003 Pimentel Vs LEBDocument2 pages003 Pimentel Vs LEBMary Anne Turiano100% (1)

- Milimani Elc 23rd January 2023 To 27th January 2023Document47 pagesMilimani Elc 23rd January 2023 To 27th January 2023Absalom OsodoNo ratings yet

- QD PPT 1Document33 pagesQD PPT 1reymark daquiganNo ratings yet

- Cyber Law SynopsisDocument5 pagesCyber Law SynopsisDivyanshu BaraiyaNo ratings yet

- Initial - SL-SMDocument18 pagesInitial - SL-SMAnnabel LicudoNo ratings yet

- Dennis VS United StatesDocument1 pageDennis VS United StatesJeffrey Ahmed SampulnaNo ratings yet

- Case Diary GulabDocument15 pagesCase Diary GulabJai ShreeramNo ratings yet

- 2018 09 03 220829 LawDocument12 pages2018 09 03 220829 LawNelson JordanNo ratings yet

- District Registrar, Hyderabad V Canara BankDocument3 pagesDistrict Registrar, Hyderabad V Canara BankAshish UpadhyayaNo ratings yet

- Obw Great CrimesDocument10 pagesObw Great Crimestatyana.delNo ratings yet

- Chapter 3 - Legal, Ethical, and Professional Issues in Information SecurityDocument7 pagesChapter 3 - Legal, Ethical, and Professional Issues in Information SecurityAshura OsipNo ratings yet

- STATEMENT OF WORK Water TanksDocument7 pagesSTATEMENT OF WORK Water TanksiskidrowNo ratings yet

BOI Reporting Filing Dates-Published03.24.23 508C

BOI Reporting Filing Dates-Published03.24.23 508C

Uploaded by

amanogho.adidiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BOI Reporting Filing Dates-Published03.24.23 508C

BOI Reporting Filing Dates-Published03.24.23 508C

Uploaded by

amanogho.adidiCopyright:

Available Formats

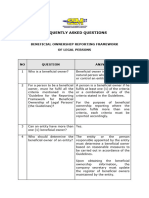

BENEFICIAL OWNERSHIP INFORMATION REPORT FILING DATES

FinCEN will begin accepting beneficial ownership information reports from reporting companies1

that are not exempt 2 on January 1, 2024, the effective date of the reporting requirement.

INITIAL REPORTS

Existing reporting companies New reporting companies

Created or registered to do Created or registered to do business in the United States on or after January 1, 2024.

business in the United States Reporting companies created or registered on or after January 1, 2024 and before

before January 1, 2024. January 1, 2025, have 90 calendar days after receiving actual or public notice that

Reports due by their company’s creation or registration is effective to file their initial BOI reports.

January 1, 2025. Reporting companies created or registered on or after January 1, 2025, will have

30 calendar days from receipt of actual or public notice that their creation or

registration is effective to file their initial BOI reports.

UPDATED REPORTS CORRECTED REPORTS

Required when there is a change to previously Required when previously reported information

reported information about the reporting was inaccurate when filed.

company itself or its beneficial owners.

Updated reports due within 30 calendar days Corrected reports due within 30 calendar days

after a change occurs. days after the reporting company becomes

aware or has reason to know of an inaccuracy.

More information can be found at www.fincen.gov/boi.

1 There are two types of reporting companies: domestic and foreign. A domestic reporting company is any entity that is a corporation, a limited liability company (LLC), or created by the

filing of a document with a secretary of state or any similar office under the law of a U.S. state or Indian tribe. A foreign reporting company is any entity that is a corporation, LLC, or other

entity that is formed under the law of a foreign country and registered to do business in any U.S. state or tribal jurisdiction by the filing of a document with a secretary of state or any similar

office under the law of a U.S. state or Indian tribe.

2 There are 23 categories of entities that are exempt from the definition of reporting company. Please review FinCEN’s final beneficial ownership information reporting rule, as well as

FinCEN’s reference materials published on www.fincen.gov/boi, for more details.

Financial Crimes Enforcement Network VERSION 2 - Published December 2023

You might also like

- Employment Law OutlineDocument35 pagesEmployment Law OutlineBrad Larkin100% (2)

- Xx1c 130e 5 Basic Weight Checklists and Loading Manual Hercules C 130Document29 pagesXx1c 130e 5 Basic Weight Checklists and Loading Manual Hercules C 130Meshal AlhaimodNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- BOI Informational Brochure 508CDocument3 pagesBOI Informational Brochure 508Cmark fakundinyNo ratings yet

- BOI FAQs QA 01.12.2024Document38 pagesBOI FAQs QA 01.12.2024abhishek.vynNo ratings yet

- What Beneficial Ownership Information Reporting Means To Small Business Owners.Document13 pagesWhat Beneficial Ownership Information Reporting Means To Small Business Owners.knightttttNo ratings yet

- FinCEN Launches Beneficial Ownership Information Registry - Winston & StrawnDocument5 pagesFinCEN Launches Beneficial Ownership Information Registry - Winston & StrawnknightttttNo ratings yet

- Information To Be Provided in The BOI ReportDocument3 pagesInformation To Be Provided in The BOI Reportfluenttax19No ratings yet

- Corporate Transparency ActDocument5 pagesCorporate Transparency ActassistantNo ratings yet

- BOIR Filing InstructionsDocument21 pagesBOIR Filing InstructionsTatiana SuarezNo ratings yet

- IND AS On Fixed AssetsDocument1 pageIND AS On Fixed Assetschandrakumar k pNo ratings yet

- FAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Document5 pagesFAQs On BO (06012020) (RDSD) (English) (Updated 26012021)Nur Batrisyia BalqisNo ratings yet

- Duane Morris LLP - The New Corporate Transparency Act - What Are The Reporting and Filing Requirements For Your Business - 06.13.2023Document2 pagesDuane Morris LLP - The New Corporate Transparency Act - What Are The Reporting and Filing Requirements For Your Business - 06.13.2023assistantNo ratings yet

- 150.events After The Reporting PeriodDocument6 pages150.events After The Reporting PeriodMelanie SamsonaNo ratings yet

- PIC QA No 2022 01Document4 pagesPIC QA No 2022 01Ryan LipayNo ratings yet

- 2023.12.01 - Notice To Client - CTA - EletterheadDocument3 pages2023.12.01 - Notice To Client - CTA - EletterheadsramdasNo ratings yet

- CA Final Law Amendments - Nov 2022Document10 pagesCA Final Law Amendments - Nov 2022Rohit KumarNo ratings yet

- Primer: For Boi Registered CompaniesDocument13 pagesPrimer: For Boi Registered CompaniesSarah Jean TaliNo ratings yet

- Business Owners Guide1Document34 pagesBusiness Owners Guide1Shailendra KelaniNo ratings yet

- BVI LAWS On FATCA ReportingDocument1 pageBVI LAWS On FATCA ReportingMa. Angelica de GuzmanNo ratings yet

- Beneficial Interest (BI) : Beneficial Interest in A Share Includes, Directly or Indirectly, Through AnyDocument2 pagesBeneficial Interest (BI) : Beneficial Interest in A Share Includes, Directly or Indirectly, Through AnyUrvi KanodiaNo ratings yet

- The Sick Ind. CompaniesDocument7 pagesThe Sick Ind. CompaniesnddaymaNo ratings yet

- Act04 Lfta222n001 Capistrano, JoanaDocument1 pageAct04 Lfta222n001 Capistrano, JoanaJoana loize CapistranoNo ratings yet

- BOI Small Compliance Guide FINAL Sept 508CDocument56 pagesBOI Small Compliance Guide FINAL Sept 508CBenny PrasetiohadiNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- INTACC 3.2LN - Related Party, Events After The Reporting Period, Operating SegmentsDocument5 pagesINTACC 3.2LN - Related Party, Events After The Reporting Period, Operating SegmentsAlvin BaternaNo ratings yet

- Notes To FSDocument28 pagesNotes To FSLouisse Homer NarcisoNo ratings yet

- 10 Handout 1Document13 pages10 Handout 1Charlotte AlcomendasNo ratings yet

- Companies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueDocument24 pagesCompanies Act 2017 Significant Amendments, May 2020: Smart Decisions. Lasting ValueMuhammad IrshadNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- Sec Reg ReportDocument5 pagesSec Reg ReportAndrew GallardoNo ratings yet

- 2.3. Ind AS 10Document22 pages2.3. Ind AS 10Ajay JangirNo ratings yet

- Corporations: Week 4-Notes AEC 209-Income TaxationDocument23 pagesCorporations: Week 4-Notes AEC 209-Income TaxationRena Decena ChavezNo ratings yet

- RA-03 SubDocument1 pageRA-03 SubFaizan SajjadNo ratings yet

- Topic 6 MFRS 110 3 Event - After - Reporting PeriodDocument14 pagesTopic 6 MFRS 110 3 Event - After - Reporting Perioddini sofia100% (1)

- Chapter 3 (Corporations) TaxationDocument16 pagesChapter 3 (Corporations) TaxationBradleeNo ratings yet

- RR 5-2021 - IT - As of 20210412 - EBQ - UnlockedDocument92 pagesRR 5-2021 - IT - As of 20210412 - EBQ - UnlockedTreb LemNo ratings yet

- Pfrs 1 - First Time Adoption To PfrsDocument27 pagesPfrs 1 - First Time Adoption To PfrsMa. Nicole AbremateaNo ratings yet

- Unit 1: 1. Company (Sec. 2 (17) ) : The Expression Company' Is Defined To MeanDocument26 pagesUnit 1: 1. Company (Sec. 2 (17) ) : The Expression Company' Is Defined To MeanAndrew BrownNo ratings yet

- 62297bos50449 Mod2 cp12Document188 pages62297bos50449 Mod2 cp12monicabhat96No ratings yet

- Luis Enrrique Romero Portillo: Affidavit of Unchanged StatusDocument1 pageLuis Enrrique Romero Portillo: Affidavit of Unchanged StatusL.E.R.P CRISTONo ratings yet

- LLC FormDocument3 pagesLLC FormLori HarwoodNo ratings yet

- 54233bos43539cp4 U5Document36 pages54233bos43539cp4 U5Akash KamathNo ratings yet

- VPI BIR Ruling DA-022-04Document5 pagesVPI BIR Ruling DA-022-04Sophia InoturanNo ratings yet

- The Companies Act: Audit Requirement and Other Matters Related To The AuditDocument8 pagesThe Companies Act: Audit Requirement and Other Matters Related To The AuditHussain MustunNo ratings yet

- COMPANY". This Concept Was Not There in Companies Act, 1956. Another Name of This ACT 2013"Document6 pagesCOMPANY". This Concept Was Not There in Companies Act, 1956. Another Name of This ACT 2013"Guru K PrasathNo ratings yet

- Ifrs at A Glance: IAS 10 Events After The ReportingDocument4 pagesIfrs at A Glance: IAS 10 Events After The ReportingJozelle Grace PadelNo ratings yet

- Events After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14Document14 pagesEvents After The Reporting Date: Accounting Standard For Local Bodies (ASLB) 14kshitijsaxenaNo ratings yet

- Preparing For Fatca Understanding Implications and RequirementsDocument25 pagesPreparing For Fatca Understanding Implications and RequirementsylshihNo ratings yet

- International Accounting Standard-10: Events After The Balance Sheet Date / Events After The Reporting PeriodDocument19 pagesInternational Accounting Standard-10: Events After The Balance Sheet Date / Events After The Reporting PeriodBasavaraj S PNo ratings yet

- DT NotesDocument16 pagesDT NotesSatyam ShrivastavaNo ratings yet

- NAS 10 ICAN Revision Classes IDocument9 pagesNAS 10 ICAN Revision Classes ISujan ShresthaNo ratings yet

- Income Tax: Basic Terms and Provisions Relating To Residential StatusDocument7 pagesIncome Tax: Basic Terms and Provisions Relating To Residential StatusAshika Khanna 1911165No ratings yet

- Insurance Circular Letter No. 037-18Document2 pagesInsurance Circular Letter No. 037-18Mary Mayne LamusaoNo ratings yet

- Income TaxDocument126 pagesIncome TaxIndranil RayNo ratings yet

- Tutorial Event After Reporting Period Week 7Document10 pagesTutorial Event After Reporting Period Week 7Anna RomanNo ratings yet

- IndiaDocument6 pagesIndiachandra bhumiNo ratings yet

- Roject Prepared During NternshipDocument11 pagesRoject Prepared During NternshipDivyam DhyaniNo ratings yet

- Dormant CompanyDocument4 pagesDormant Companysonakshi182No ratings yet

- Foreign Liability and Assets Return (Fla Return)Document2 pagesForeign Liability and Assets Return (Fla Return)rushi SatheNo ratings yet

- Pa Tax Brief - May 2020Document22 pagesPa Tax Brief - May 2020Teresita TibayanNo ratings yet

- Ind As 10Document13 pagesInd As 10mohd52No ratings yet

- Federal Accounting Handbook: Policies, Standards, Procedures, PracticesFrom EverandFederal Accounting Handbook: Policies, Standards, Procedures, PracticesNo ratings yet

- FP Parent Handbook 2023 24Document33 pagesFP Parent Handbook 2023 24amanogho.adidiNo ratings yet

- La1ed WS 682032 1 - 50 - 80006372Document1 pageLa1ed WS 682032 1 - 50 - 80006372amanogho.adidiNo ratings yet

- WIDERA CallTopicListe WP2023-2024 Dezember2023 1Document13 pagesWIDERA CallTopicListe WP2023-2024 Dezember2023 1amanogho.adidiNo ratings yet

- La1ed WS 682032 2 - 50 - 80006357Document1 pageLa1ed WS 682032 2 - 50 - 80006357amanogho.adidiNo ratings yet

- LA1ED WS 685004 1 - 50 - 8000638eDocument1 pageLA1ED WS 685004 1 - 50 - 8000638eamanogho.adidiNo ratings yet

- Wcms 877584Document8 pagesWcms 877584amanogho.adidiNo ratings yet

- Abv SpecDocument111 pagesAbv Specamanogho.adidiNo ratings yet

- Whirlpool RebateDocument3 pagesWhirlpool RebatePrasad ReddyNo ratings yet

- 1st Floor Office Suite, ST Ann's Mill, Kirkstall Road, Leeds, West Yorkshire, LS5 3AEDocument2 pages1st Floor Office Suite, ST Ann's Mill, Kirkstall Road, Leeds, West Yorkshire, LS5 3AERavi BhollahNo ratings yet

- Civil Appeal 146 of 2013Document4 pagesCivil Appeal 146 of 2013Philip MalangaNo ratings yet

- MOCK CALL (Applicant's Guide)Document4 pagesMOCK CALL (Applicant's Guide)Lee Robert OlivarNo ratings yet

- Florida Contractor AgreementDocument5 pagesFlorida Contractor Agreementklamsang555No ratings yet

- AM 22-09-01-SC - Code of Professional Responsibility and AccountabilityDocument36 pagesAM 22-09-01-SC - Code of Professional Responsibility and AccountabilityJake MacTavishNo ratings yet

- Oblicon (Articles 1305 - 1415)Document9 pagesOblicon (Articles 1305 - 1415)SIMPAO, Ma. Kristine Mae C.No ratings yet

- 03 - Bardillon v. Barangay Masili of Calamba, LagunaDocument2 pages03 - Bardillon v. Barangay Masili of Calamba, LagunaAngelicaNo ratings yet

- April Blakeley Procedural Safeguard Tri-Fold BrochureDocument2 pagesApril Blakeley Procedural Safeguard Tri-Fold Brochureapi-617077329No ratings yet

- Barcenas Vs AlveroDocument14 pagesBarcenas Vs AlveroJannah Anne JavierNo ratings yet

- SALES - Dec. 11, 2022Document9 pagesSALES - Dec. 11, 2022Elmer SarabiaNo ratings yet

- XXX Audit XXXDocument20 pagesXXX Audit XXXmisssunshine112No ratings yet

- 10 First Planters Pawnshop Vs BIR CaseDocument2 pages10 First Planters Pawnshop Vs BIR CaseRenato C. Silvestre Jr.No ratings yet

- KWA AEG War Sport LVOA Series ManualDocument28 pagesKWA AEG War Sport LVOA Series ManualJuanma Galvez JimenezNo ratings yet

- Pidato Harlah NUDocument3 pagesPidato Harlah NULeni komariatul ulfaNo ratings yet

- 003 Pimentel Vs LEBDocument2 pages003 Pimentel Vs LEBMary Anne Turiano100% (1)

- Milimani Elc 23rd January 2023 To 27th January 2023Document47 pagesMilimani Elc 23rd January 2023 To 27th January 2023Absalom OsodoNo ratings yet

- QD PPT 1Document33 pagesQD PPT 1reymark daquiganNo ratings yet

- Cyber Law SynopsisDocument5 pagesCyber Law SynopsisDivyanshu BaraiyaNo ratings yet

- Initial - SL-SMDocument18 pagesInitial - SL-SMAnnabel LicudoNo ratings yet

- Dennis VS United StatesDocument1 pageDennis VS United StatesJeffrey Ahmed SampulnaNo ratings yet

- Case Diary GulabDocument15 pagesCase Diary GulabJai ShreeramNo ratings yet

- 2018 09 03 220829 LawDocument12 pages2018 09 03 220829 LawNelson JordanNo ratings yet

- District Registrar, Hyderabad V Canara BankDocument3 pagesDistrict Registrar, Hyderabad V Canara BankAshish UpadhyayaNo ratings yet

- Obw Great CrimesDocument10 pagesObw Great Crimestatyana.delNo ratings yet

- Chapter 3 - Legal, Ethical, and Professional Issues in Information SecurityDocument7 pagesChapter 3 - Legal, Ethical, and Professional Issues in Information SecurityAshura OsipNo ratings yet

- STATEMENT OF WORK Water TanksDocument7 pagesSTATEMENT OF WORK Water TanksiskidrowNo ratings yet