Professional Documents

Culture Documents

Ep60 2023

Ep60 2023

Uploaded by

Bogdan AlecsaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ep60 2023

Ep60 2023

Uploaded by

Bogdan AlecsaCopyright:

Available Formats

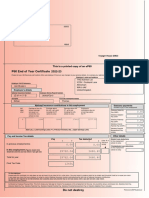

Tax Year to

P60 End of Year Certificate 5 April 2023

DO NOT DESTROY

National Insurance Number

Mr Bogdan Alecsa

SR600894C

93 ST Nicholas Road

LEAMINGTON SPA

CV31 1UN Works / Payroll Number

02173644

Employer's full name and address (including postcode)

University of Warwick Employer PAYE reference

190 U50

Coventry

CV4 7AL

National Insurance Contributions in this employment (Note: LEL = Lower Earnings Limit, UEL = Upper Earnings Limit, PT = Primary Threshold)

NIC Earnings at the Earnings above Earnings above Employee's

table LEL (where the LEL, up to the PT, up to contributions

letter earnings are and including and including due on all earnings

equal to or the PT the UEL above the PT

exceed the

LEL)

£ £ £ £ P

A 5863 5215 23432 2,972.31

Statutory Payments included in the pay 'in this employment' figure below

£ P £ P £ P £ P £ P

SMP SPP SSPP SAP SPBP

( Note: SMP - Statutory Maternity Pay, SPP - Statutory Paternity Pay, SSPP - Statutory Shared Parental Pay, SAP - Statutory Adoption Pay, SPBP - Statutory Parental Bereavement Pay )

Pay and Income Tax details

Tax deducted Student Loan Deductions

Pay (R = refund) (whole £'s only)

£ P £ P £

In this 34510.58 4596.00 * * Figures shown here should be used for

your tax return, if you get one

790

employment

Postgraduate Loan Deductions

In previous (whole £'s only)

2,171.90 224.60 £

employment(s)

Total for year 36682.48 4820.60

Certificate by Employer/Paying Office:

Final This form shows your total pay for Income Tax purposes in this employment for the

1257L year. Any overtime, bonus, commission etc, Statutory Sick Pay, Statutory Maternity Pay,

tax code

Statutory Paternity Pay, Statutory Shared Parental Pay, Statutory Parental

Bereavement Pay or Statutory Adoption Pay is included.

To the employee. Please keep this certificate in a safe place as you will need it if you have to fill in a tax return. You also need it to make a claim for tax credits and Universal Credit

or to renew your claim. It also helps you check that your employer is using the correct National Insurance number and deducting the right rate of National Insurance contributions. By law

you are required to tell HM Revenue and Customs about any income that is not fully taxed, even if you are not sent a tax return.

HM Revenue and Customs P60(Substitute)(SF)(SAP UK LTD)(2022-23)

You might also like

- Case Write Up 1Document4 pagesCase Write Up 1E learningNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Edexcel IGCSE Economics Official GlossaryDocument9 pagesEdexcel IGCSE Economics Official GlossaryAshley Lau100% (2)

- Do Not Destroy: P60 End of Year CertificateDocument1 pageDo Not Destroy: P60 End of Year Certificatevickythom10No ratings yet

- P60-Mircea AndreiDocument1 pageP60-Mircea AndreiAndrei AlbertoNo ratings yet

- NicolaiCommunicationView 2Document1 pageNicolaiCommunicationView 2dmorari93No ratings yet

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- SarahBrannigan P60 2024Document1 pageSarahBrannigan P60 2024sarahb662003No ratings yet

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- P60 Florin - Vaetus 26 04 2018Document1 pageP60 Florin - Vaetus 26 04 2018Florin VaetusNo ratings yet

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Tax Year To 5 April: P60 End of Year Certificate 2024Document1 pageTax Year To 5 April: P60 End of Year Certificate 2024wjrwzmt22wNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- P60_6945077Document1 pageP60_6945077Mihail FrunzeNo ratings yet

- P60 End of Year Certificate: Tax Year To 5 AprilDocument1 pageP60 End of Year Certificate: Tax Year To 5 April林陵No ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Nicolae Greurus - p60 (2023-24)Document1 pageNicolae Greurus - p60 (2023-24)danielagonciulea6No ratings yet

- Miller P60Document1 pageMiller P60alexanderpatrickfarrellNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- Instructions To Use Tax CalculatorDocument5 pagesInstructions To Use Tax Calculatormadhuri priyankaNo ratings yet

- Offer Letter JyotiDocument3 pagesOffer Letter Jyotitushar.phalswalNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- Tan Koon Aik PayslipDocument3 pagesTan Koon Aik PayslipDaniel GuanNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- P60 Single Sheet 2022 To 2023Document1 pageP60 Single Sheet 2022 To 2023Manuel Brites FerreiraNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- Financial Feasibility SampleDocument66 pagesFinancial Feasibility SampleKimmyNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Benny Septian - SS18092213 Apr 2019Document1 pageBenny Septian - SS18092213 Apr 2019Bank MuamalatNo ratings yet

- Nov 2019 PF ECR PolserDocument2 pagesNov 2019 PF ECR PolserMela RavalNo ratings yet

- x6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfDocument1 pagex6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfAdemuyiwa OlaniyiNo ratings yet

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoDocument2 pagesProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneNo ratings yet

- Salary Break CalculatorDocument1 pageSalary Break CalculatortrickyNo ratings yet

- FORM47Document2 pagesFORM47Rider AbhiNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Government of Andhra Pradesh: (APTC Form-47)Document2 pagesGovernment of Andhra Pradesh: (APTC Form-47)Y.rajuNo ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Gross Net Va Net GrossDocument4 pagesGross Net Va Net GrossMinh NguyenNo ratings yet

- Ep60 384 Ye43911 2022 20220406Document1 pageEp60 384 Ye43911 2022 20220406thomas.rohanNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- RAvindraDocument1 pageRAvindrapnmbbsrz1.acilNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedBHASKAR pNo ratings yet

- Small Charities Training Budgets Cash Flow Self Help Case StudyDocument10 pagesSmall Charities Training Budgets Cash Flow Self Help Case StudyXavier PokharelNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Pay Slip 37000140 - Apr - 2020 PDFDocument1 pagePay Slip 37000140 - Apr - 2020 PDFSumantrra ChattopadhyayNo ratings yet

- Salary Tax PlannerDocument7 pagesSalary Tax Plannerbecito6195No ratings yet

- Form47 1Document2 pagesForm47 1Myreddy VijayaNo ratings yet

- Q000686a 2019917 8550 0003598919Document1 pageQ000686a 2019917 8550 0003598919Thirangana WeerasingheNo ratings yet

- CS Executive Tax Laws Suggested Answers-1Document21 pagesCS Executive Tax Laws Suggested Answers-1nehaNo ratings yet

- Total Income StatementDocument2 pagesTotal Income StatementMohan Ganesh S/o A.MurugesanNo ratings yet

- Philab Holdings Corp.: Computation of Retirement ObligationDocument4 pagesPhilab Holdings Corp.: Computation of Retirement ObligationFSJVVNo ratings yet

- A PDFDocument58 pagesA PDFAkhilNo ratings yet

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- 6a259f20-e0b3-454d-84d7-b7f3e876c605 (1) (1) (1)Document3 pages6a259f20-e0b3-454d-84d7-b7f3e876c605 (1) (1) (1)UDAYBHAN YADAVNo ratings yet

- Ngakl1017779000 93712584 1693292121252 2023082944721253705Document2 pagesNgakl1017779000 93712584 1693292121252 2023082944721253705Mr. A. A. PandeNo ratings yet

- 2 PDFDocument1 page2 PDFsatyajit_manna_2No ratings yet

- SALARY REVISION - CALCULATIONDocument10 pagesSALARY REVISION - CALCULATIONchittaranjan93pintuNo ratings yet

- Sales AgentsDocument3 pagesSales AgentsDavidCruzNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- Cheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935Document6 pagesCheque Account Statement: Postnet Suite 86 P Bag X103 Mtubatuba 3935MarkNo ratings yet

- Project On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre DivisionDocument52 pagesProject On Effectiveness of Training Program OF Grasim Industries Limited Staple Fibre Divisiondave_sourabhNo ratings yet

- Intern Report - Sanima BankDocument11 pagesIntern Report - Sanima BankRajan ParajuliNo ratings yet

- Material Ledgers - Actual Costing - SAP Blogs PDFDocument21 pagesMaterial Ledgers - Actual Costing - SAP Blogs PDFsuryaNo ratings yet

- Adb Brief 127 Industrial Park Rating System IndiaDocument8 pagesAdb Brief 127 Industrial Park Rating System IndiaSiddhartha ShekharNo ratings yet

- Core Assets DefinitionDocument7 pagesCore Assets Definitionako akoNo ratings yet

- Abm 1-W6.M2.T1.L2Document5 pagesAbm 1-W6.M2.T1.L2mbiloloNo ratings yet

- Selection Process of Cavin Kare Pvt. LTDDocument69 pagesSelection Process of Cavin Kare Pvt. LTDYasir ShafiNo ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Notes On Cyber SecurityDocument9 pagesNotes On Cyber SecurityDeeksha SaxenaNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- CHAPTER 4 Entrepreneurial MindDocument8 pagesCHAPTER 4 Entrepreneurial MindXOLCHITNo ratings yet

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- ED - Structure - Supratim DeyDocument3 pagesED - Structure - Supratim DeyVinay KumarNo ratings yet

- Minesh Final MsDocument59 pagesMinesh Final MsAmey KoliNo ratings yet

- Course Detail 7th Sem Mkm. BBADocument8 pagesCourse Detail 7th Sem Mkm. BBAHari AdhikariNo ratings yet

- Maceda Law Realty Installment Buyer Protection Act: Own House CondominiumDocument4 pagesMaceda Law Realty Installment Buyer Protection Act: Own House CondominiumsherwinNo ratings yet

- Review Questions - OVWL 2023Document8 pagesReview Questions - OVWL 2023zitkonkuteNo ratings yet

- TCW Module 3 Pre FinalDocument21 pagesTCW Module 3 Pre FinalMark Jade BurlatNo ratings yet

- Developing and Managing Talent A Blueprint For Business Survival by Sultan KermallyDocument131 pagesDeveloping and Managing Talent A Blueprint For Business Survival by Sultan KermallyCarlos Ruxa100% (1)

- D2.2 SWOT AnalysisDocument16 pagesD2.2 SWOT AnalysisPALACIOS HERRERA JORGE LUISNo ratings yet

- Risk Management PlanDocument3 pagesRisk Management Planit argentinaNo ratings yet

- WB - Paper-17 CMA FINALDocument131 pagesWB - Paper-17 CMA FINALvijaykumartaxNo ratings yet

- Suli LK TW Iii 2017Document91 pagesSuli LK TW Iii 2017J KNo ratings yet

- 1001 (1) c3Document1 page1001 (1) c3I am CanapeeNo ratings yet