Professional Documents

Culture Documents

Ratio Analysis Review Questions

Ratio Analysis Review Questions

Uploaded by

Paul NdaliCopyright:

Available Formats

You might also like

- HW 3 - ACME RoadrunnerDocument7 pagesHW 3 - ACME Roadrunnerkartik lakhotiyaNo ratings yet

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- Financial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredDocument52 pagesFinancial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredVasileios Lymperopoulos100% (1)

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3Xiena67% (3)

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- Viva Term Finance & BankingDocument26 pagesViva Term Finance & BankingMinhaz Hossain Onik100% (2)

- Abc 2Document2 pagesAbc 2Kath LeynesNo ratings yet

- Essay Part 2Document58 pagesEssay Part 2Silvia alfonsNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- FS Analysis PDFDocument4 pagesFS Analysis PDFseraseraquexNo ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Other Solution Part 1 Ratio Case 1Document2 pagesOther Solution Part 1 Ratio Case 1Carla RománNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- AA367Document11 pagesAA367Meena DasNo ratings yet

- SEMI-FINAL EXAM QUESTIONNAIRE (Edited)Document17 pagesSEMI-FINAL EXAM QUESTIONNAIRE (Edited)Pia De LaraNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Exam 3Document22 pagesExam 3Darynn F. Linggon100% (2)

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- 1 Manelcom Inc.-With AnswersDocument7 pages1 Manelcom Inc.-With AnswersAmir Aboul FotouhNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- Chapter Two HandoutDocument24 pagesChapter Two HandoutNati AlexNo ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Ratio Excercise 2Document1 pageRatio Excercise 2Marwan AqrabNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Brewer Chapter 14 Alt ProbDocument8 pagesBrewer Chapter 14 Alt ProbAtif RehmanNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- FS AnalysisDocument1 pageFS AnalysisLark WarNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Accounting II FinalDocument6 pagesAccounting II FinalPak KhNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Intermediate Accounting 3: Name: Date: Professor: Section: ScoreDocument21 pagesIntermediate Accounting 3: Name: Date: Professor: Section: ScoreBella ChoiNo ratings yet

- Ratio GKB's Ratio Industry AveragesDocument3 pagesRatio GKB's Ratio Industry AveragesNidhi Ann FrancisNo ratings yet

- Quiz 1 INTACCDocument13 pagesQuiz 1 INTACCGellie BuenaventuraNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- IAS 41 Agriculture Supplementary NotesDocument16 pagesIAS 41 Agriculture Supplementary NotesPASTORYNo ratings yet

- Intermediate May 2019 b1Document19 pagesIntermediate May 2019 b1PASTORYNo ratings yet

- Intermediate May 2019 B6Document21 pagesIntermediate May 2019 B6PASTORYNo ratings yet

- Intermediate May 2019 B5Document23 pagesIntermediate May 2019 B5PASTORYNo ratings yet

- Corporate Dividend Policy (L-9)Document39 pagesCorporate Dividend Policy (L-9)Mega capitalmarketNo ratings yet

- Analysis of Dhaka Stock ExchangeDocument25 pagesAnalysis of Dhaka Stock ExchangeSaima Haque EmaNo ratings yet

- Avast - Rule 15 Letter - LTIP - RSUsDocument9 pagesAvast - Rule 15 Letter - LTIP - RSUsClay ClarkNo ratings yet

- How To Prepare For An Asset Management Interview - Online Version2 PDFDocument11 pagesHow To Prepare For An Asset Management Interview - Online Version2 PDFGuido FranchettiNo ratings yet

- Konquest - Knowledge Builder - 2021Document54 pagesKonquest - Knowledge Builder - 2021CRESCENDO 2k19No ratings yet

- Karen Shaw and Forrest Foster v. Agri-Mark, Inc., 50 F.3d 117, 2d Cir. (1995)Document5 pagesKaren Shaw and Forrest Foster v. Agri-Mark, Inc., 50 F.3d 117, 2d Cir. (1995)Scribd Government DocsNo ratings yet

- Financial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaDocument6 pagesFinancial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaGautamNo ratings yet

- LUYỆN TẬP BT CÓ CÔNG THỨC - TTCKDocument11 pagesLUYỆN TẬP BT CÓ CÔNG THỨC - TTCKLâm Thị Như ÝNo ratings yet

- Boys Will Be BoysDocument32 pagesBoys Will Be BoysmukwameNo ratings yet

- Cerulli Asset Management in Southeast Asia 2012 Info PacketDocument13 pagesCerulli Asset Management in Southeast Asia 2012 Info PacketHaMy TranNo ratings yet

- Zerodha Securities Pvt. LTD.: For Individuals Additional KYC Form For Opening A Demat AccountDocument9 pagesZerodha Securities Pvt. LTD.: For Individuals Additional KYC Form For Opening A Demat AccountAvinashInagadapaNo ratings yet

- Investment Environment & Management ProcessDocument10 pagesInvestment Environment & Management ProcessMd Shahbub Alam SonyNo ratings yet

- Dividend PolicyDocument34 pagesDividend PolicyasifibaNo ratings yet

- Module 4 - Decisions Under UncertaintyDocument19 pagesModule 4 - Decisions Under UncertaintyRussell Lito LingadNo ratings yet

- Security Analysis and Portfolio Management of Five Major Players in Banking SectorDocument130 pagesSecurity Analysis and Portfolio Management of Five Major Players in Banking SectorAzhar k.p100% (2)

- Concession Theory - The Corporation Is A Creature Without Existence Until It Has Received Imprimatur of The State Acting According To Law. 2Document5 pagesConcession Theory - The Corporation Is A Creature Without Existence Until It Has Received Imprimatur of The State Acting According To Law. 2Shane JardinicoNo ratings yet

- 1 - Introduction To The CourseDocument17 pages1 - Introduction To The CourseGioacchinoNo ratings yet

- MCQ'S CorpDocument12 pagesMCQ'S CorpFrances Ann Nacar0% (1)

- Books ListDocument3 pagesBooks Listviral1622No ratings yet

- CHAPTER 1 - Rainmaker PDFDocument35 pagesCHAPTER 1 - Rainmaker PDFMomentum PressNo ratings yet

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyNo ratings yet

- RBC Equity ResearchDocument18 pagesRBC Equity ResearchRio PrestonniNo ratings yet

- Lesson 3 Analysis and Interpretation NotesDocument8 pagesLesson 3 Analysis and Interpretation NotesoretshwanetsemosielengNo ratings yet

- Finance QuizDocument2 pagesFinance QuizSatyajitNo ratings yet

- Indian Securities Market 2014, SecuritiesDocument222 pagesIndian Securities Market 2014, SecuritiesPrashant SiroliyaNo ratings yet

- Xii Com Accountancy 40 MarksDocument5 pagesXii Com Accountancy 40 MarksprakharNo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Case Study InvestmentDocument6 pagesCase Study Investmentaroosha 2110No ratings yet

Ratio Analysis Review Questions

Ratio Analysis Review Questions

Uploaded by

Paul NdaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis Review Questions

Ratio Analysis Review Questions

Uploaded by

Paul NdaliCopyright:

Available Formats

FINANCIAL ACCOUNTING (B2)

REVIEW QUESTIONS ON FINANCIAL STATEMENT

ANALYSIS

Prepared By

Godson Mkaro [MSc in Finance & Investments, BSc in Computer Science (Hons), ATEC II, CPA (T)] &

Emmanuel Christopher [MBA (Finance), BCom Accounting (Hons), CPA (T)]

Phone: 0717/0769 348 616 |Email:info@covenantfinco.com |website: www.covenantfinco.com

FINANCIAL ACCOUNTING REVIEW QUESTIONS ON FINANCIAL STATEMENT ANALYSIS

10.1. Review Questions on Ratio Analysis

QUESTION01

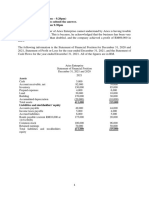

XYZ LTD's STATEMENT OF FINANCIAL POSITIN AS AT 31 st December 2015

ASSETS

Fixed Assets 142,000

Current Asset

Stock 28,000

Debtors 36,000

Bank 24,000

Total Current Assets 88,000

Total Assets 230,000

LIABILITIES AND OWNERS EQUITY

Share Capital:

100,000 Ordinary Share Capital @ $1 each, issued and fully paid 100,000

10% 50,000 Preference Shares @ $1 each and fully paid 50,000

Revenue Reserves 20,000

170,000

Long term Liabilities:

12% $1 Debenture 30,000

Current Liabilities:

Creditor 18,000

Taxation 12,000 30,000

Total Liabilities and OE 230,000

XYZ LTDS STATEMENT OF PROFIT/LOSS AND OTHER COMPREHENSIVE INCOME 31st Dec 2015

Sales 532,000

Opening stock 20,000

Add purchases 480,000

Cost of goods available for sale 500,000

Closing stock 28,000

Sostof sales 472,000

Gross profit 60,000

Administrative Expenses 28,000

Selling & Distribution Expense 9,000

Financial Expenses ( include debenture capital) 4,000 41,000

Net profit 19,000

Taxation 12,000

Profit after tax 7,000

Preference dividend(gross) 5,000

PAT and preference dividends 2,000

Phone: 0717/0769 348 616 |Email:info@covenantfinco.com |website: www.covenantfinco.com 1

FINANCIAL ACCOUNTING REVIEW QUESTIONS ON FINANCIAL STATEMENT ANALYSIS

Additional information

• The market price for ordinary share is 1.20

• Dividend declared per share is 1% of the nominal value of the share

• Out of total sales, credit sales were 448,000

Required:

Calculate all possible ratios for the following categories

i. Profitability

ii. Liquidity

iii. Efficiency

iv. Gearing or capital structure

v. Market based ratios

QUESTION 02

a) NASACO Ltd. was completely destroyed by fire and all accounting and financial

information was burnt. However, on going through the Director of Finance’s briefcase

which was salvaged by the owner, the following key data for the accounts for the year

ended June 30, 2005 were found:

i) Current ratio 1.75

ii) Liquid Ratio 1.25

iii) Stock Turnover (Cost of Sales / Closing Stock) 9

iv) Gross Profit Ratio – 25% of sales

v) Debt Collection Period – 1 1 months

2

vi) Reserves and Profit and Loss to Capital – 2

vii) Turnover to Fixed Assets – 1.2

viii) Capital Gearing Ratio – 0.6

ix) Fixed Assets to Net Worth – 1.25

x) Sales for the year Shs. 1,200,000,000

REQUIRED: Reconstruct the Balance Sheet of NASACO Ltd., as at June 30, 2005 using the above

information. (12 Marks)

a) Business A and Business B are both engaged in retailing, but seem to take a different

approach to this trade according to information available. This information consists of

ratios, as shown in the table below:

Business A Business B

Current Ratio 2:1 1.5:1

Quick Ratio 1.7:1 0.7:1

Return on Capital Employed (ROCE) 20% 17%

Return on Owners’ Equity (ROE) 30% 18%

Phone: 0717/0769 348 616 |Email:info@covenantfinco.com |website: www.covenantfinco.com 2

FINANCIAL ACCOUNTING REVIEW QUESTIONS ON FINANCIAL STATEMENT ANALYSIS

Debtors’ Turnover (days) 63 days 21 days

Creditors’ Turnover (days) 50 days 45 days

Gross Profit Margin 40% 15%

Net Profit Margin 10% 10%

Stock Turnover (days) 52 days 25 days

REQUIRED: Describe what this information indicates about the differences in approach between the

two businesses. If one prides itself on personal services to its clients and one of them on competitive

prices, which do you think is which and why?

Your answer should include a discussion on profitability, liquidity, efficiency and gearing of the two

businesses. (8 Marks) (Total:20 Marks)

QUESTION 03

APEX Co achieved a turnover of TZS 16 million in the year that has just ended and expects a turnover

growth of 8.4% in the next year. Cost of sales in the year has just ended was TZS 10.88 Million and other

expenses were TZS 1.44 Million. The financial statement of APEX CO. for the year that has just ended is

as follows:

Statement of financial position

AMOUNT(TZS Mil)

Assets

Non- Current Assets 22.0

Current Assets

Inventory 2.4

Trade Receivables 2.2

Total Assets 26.6

Equity and Liabilities

Equity Finance

Ordinary shares 5.0

Reserves 7.5

Long term loan 10.0

Trade payable 1.9

Overdraft 2.2

Total Equity and Liabilities 26.6

The long-term bank loan has a fixed annual interest of 8% per year. APEX CO. pays taxation at annual

rate of 40% per year .the following accounting ratios have been forecasted for the next three years :

Gross profit margin 30%

Operating profit margin 20%

Dividend payout 50%

Inventory turnover 110 days

Phone: 0717/0769 348 616 |Email:info@covenantfinco.com |website: www.covenantfinco.com 3

FINANCIAL ACCOUNTING REVIEW QUESTIONS ON FINANCIAL STATEMENT ANALYSIS

Trade receivables period 65 days

Trade payables period 75 days

Overdraft interest in the next year is expected to be TZS 140,000. No change is expected in the in the

level of non-current assets and depreciation should be ignored.

REQUIRED

(a) Prepare the following forecasted statements for APEX CO.:

(ί) A statement of income for the next year (7 marks)

(ί ί) A statement of financial position at the end of the year (7 marks)

(b) Analyze and discuss the working capital financial policy of APEX CO ( 6 marks)

QUESTION 04

(a) Liquidity is one of the useful aspect in analyzing various financial statements of entities

Required: State importance of understanding liquidity of an entity to different users of financial

statements, giving examples of different ratios of liquidity that can be computed.

(b) Sanjiro products plc has a current ratio on 30th September 2015 of 2:1, before the following

transactions were completed

• Sold a building for cash

• Exchanged old equipment for new equipment (no cash was involved)

• Declared a cash dividend on a preferred stock

• Sold merchandise on account (at profit)

• Retired loan notes that would have matured in 2023

• Issued a stock dividend to common stockholders

• Paid cash for a patent

• Temporarily invested cash in government bonds

• Purchased inventory for cash

• Written off an account receivable as uncollectible, amount is less than the balance for

uncollectible account

• Paid the cash dividend on preferred stock that was declared earlier

• Purchased a computer and gave a two-year promissory notes

• Collected accounts receivable

• Borrowed from the bank on a 120-day promissory note

• Discounted a customer’s note, interest expense was involved

Required

Considering each transaction independently of others;

(i) Indicate whether amount of working capital will increase, decrease or be unaffected

by each of the above transactions.

(ii) Indicate whether current ratio will increase, decrease or be unaffected by each of the

above transactions.

(Use tabular format to present your answer, one table can suffice answering both parts (i) and (ii)

Phone: 0717/0769 348 616 |Email:info@covenantfinco.com |website: www.covenantfinco.com 4

You might also like

- HW 3 - ACME RoadrunnerDocument7 pagesHW 3 - ACME Roadrunnerkartik lakhotiyaNo ratings yet

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- Financial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredDocument52 pagesFinancial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredVasileios Lymperopoulos100% (1)

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3Xiena67% (3)

- Financial Management - 1 PDFDocument85 pagesFinancial Management - 1 PDFKingNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- Viva Term Finance & BankingDocument26 pagesViva Term Finance & BankingMinhaz Hossain Onik100% (2)

- Abc 2Document2 pagesAbc 2Kath LeynesNo ratings yet

- Essay Part 2Document58 pagesEssay Part 2Silvia alfonsNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- FS Analysis PDFDocument4 pagesFS Analysis PDFseraseraquexNo ratings yet

- ACTIVITY # 1 - Financial Statement Analysis and RatioDocument2 pagesACTIVITY # 1 - Financial Statement Analysis and RatioSabrinaNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Republic CompanyDocument2 pagesRepublic CompanyLy CostalesNo ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Other Solution Part 1 Ratio Case 1Document2 pagesOther Solution Part 1 Ratio Case 1Carla RománNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- AA367Document11 pagesAA367Meena DasNo ratings yet

- SEMI-FINAL EXAM QUESTIONNAIRE (Edited)Document17 pagesSEMI-FINAL EXAM QUESTIONNAIRE (Edited)Pia De LaraNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Exam 3Document22 pagesExam 3Darynn F. Linggon100% (2)

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Midterm Fin 254 Summer 2020Document5 pagesMidterm Fin 254 Summer 2020Salauddin Imran MumitNo ratings yet

- 1 Manelcom Inc.-With AnswersDocument7 pages1 Manelcom Inc.-With AnswersAmir Aboul FotouhNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- MA A-3 Ratio AnalysisDocument3 pagesMA A-3 Ratio AnalysisShilpa AroraNo ratings yet

- Chapter Two HandoutDocument24 pagesChapter Two HandoutNati AlexNo ratings yet

- ACCT10002 Tutorial 1 Exercises, 2020 SM1Document5 pagesACCT10002 Tutorial 1 Exercises, 2020 SM1JING NIENo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Worksheet-4 On CFSDocument6 pagesWorksheet-4 On CFSNavya KhemkaNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Test 2 Financial - Analysis (Bervie Rondonuwu)Document5 pagesTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- Assignment - Doc-401 FIM - 24042016113313Document10 pagesAssignment - Doc-401 FIM - 24042016113313Ahmed RaajNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- ACMA Unit 5 Problems - CFS PDFDocument3 pagesACMA Unit 5 Problems - CFS PDFPrabhat SinghNo ratings yet

- Ratio Excercise 2Document1 pageRatio Excercise 2Marwan AqrabNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Brewer Chapter 14 Alt ProbDocument8 pagesBrewer Chapter 14 Alt ProbAtif RehmanNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- FS AnalysisDocument1 pageFS AnalysisLark WarNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Accounting II FinalDocument6 pagesAccounting II FinalPak KhNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Intermediate Accounting 3: Name: Date: Professor: Section: ScoreDocument21 pagesIntermediate Accounting 3: Name: Date: Professor: Section: ScoreBella ChoiNo ratings yet

- Ratio GKB's Ratio Industry AveragesDocument3 pagesRatio GKB's Ratio Industry AveragesNidhi Ann FrancisNo ratings yet

- Quiz 1 INTACCDocument13 pagesQuiz 1 INTACCGellie BuenaventuraNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- IAS 41 Agriculture Supplementary NotesDocument16 pagesIAS 41 Agriculture Supplementary NotesPASTORYNo ratings yet

- Intermediate May 2019 b1Document19 pagesIntermediate May 2019 b1PASTORYNo ratings yet

- Intermediate May 2019 B6Document21 pagesIntermediate May 2019 B6PASTORYNo ratings yet

- Intermediate May 2019 B5Document23 pagesIntermediate May 2019 B5PASTORYNo ratings yet

- Corporate Dividend Policy (L-9)Document39 pagesCorporate Dividend Policy (L-9)Mega capitalmarketNo ratings yet

- Analysis of Dhaka Stock ExchangeDocument25 pagesAnalysis of Dhaka Stock ExchangeSaima Haque EmaNo ratings yet

- Avast - Rule 15 Letter - LTIP - RSUsDocument9 pagesAvast - Rule 15 Letter - LTIP - RSUsClay ClarkNo ratings yet

- How To Prepare For An Asset Management Interview - Online Version2 PDFDocument11 pagesHow To Prepare For An Asset Management Interview - Online Version2 PDFGuido FranchettiNo ratings yet

- Konquest - Knowledge Builder - 2021Document54 pagesKonquest - Knowledge Builder - 2021CRESCENDO 2k19No ratings yet

- Karen Shaw and Forrest Foster v. Agri-Mark, Inc., 50 F.3d 117, 2d Cir. (1995)Document5 pagesKaren Shaw and Forrest Foster v. Agri-Mark, Inc., 50 F.3d 117, 2d Cir. (1995)Scribd Government DocsNo ratings yet

- Financial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaDocument6 pagesFinancial Market, Institutions and Services: Submitted To: Prof. Vinay DuttaGautamNo ratings yet

- LUYỆN TẬP BT CÓ CÔNG THỨC - TTCKDocument11 pagesLUYỆN TẬP BT CÓ CÔNG THỨC - TTCKLâm Thị Như ÝNo ratings yet

- Boys Will Be BoysDocument32 pagesBoys Will Be BoysmukwameNo ratings yet

- Cerulli Asset Management in Southeast Asia 2012 Info PacketDocument13 pagesCerulli Asset Management in Southeast Asia 2012 Info PacketHaMy TranNo ratings yet

- Zerodha Securities Pvt. LTD.: For Individuals Additional KYC Form For Opening A Demat AccountDocument9 pagesZerodha Securities Pvt. LTD.: For Individuals Additional KYC Form For Opening A Demat AccountAvinashInagadapaNo ratings yet

- Investment Environment & Management ProcessDocument10 pagesInvestment Environment & Management ProcessMd Shahbub Alam SonyNo ratings yet

- Dividend PolicyDocument34 pagesDividend PolicyasifibaNo ratings yet

- Module 4 - Decisions Under UncertaintyDocument19 pagesModule 4 - Decisions Under UncertaintyRussell Lito LingadNo ratings yet

- Security Analysis and Portfolio Management of Five Major Players in Banking SectorDocument130 pagesSecurity Analysis and Portfolio Management of Five Major Players in Banking SectorAzhar k.p100% (2)

- Concession Theory - The Corporation Is A Creature Without Existence Until It Has Received Imprimatur of The State Acting According To Law. 2Document5 pagesConcession Theory - The Corporation Is A Creature Without Existence Until It Has Received Imprimatur of The State Acting According To Law. 2Shane JardinicoNo ratings yet

- 1 - Introduction To The CourseDocument17 pages1 - Introduction To The CourseGioacchinoNo ratings yet

- MCQ'S CorpDocument12 pagesMCQ'S CorpFrances Ann Nacar0% (1)

- Books ListDocument3 pagesBooks Listviral1622No ratings yet

- CHAPTER 1 - Rainmaker PDFDocument35 pagesCHAPTER 1 - Rainmaker PDFMomentum PressNo ratings yet

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyNo ratings yet

- RBC Equity ResearchDocument18 pagesRBC Equity ResearchRio PrestonniNo ratings yet

- Lesson 3 Analysis and Interpretation NotesDocument8 pagesLesson 3 Analysis and Interpretation NotesoretshwanetsemosielengNo ratings yet

- Finance QuizDocument2 pagesFinance QuizSatyajitNo ratings yet

- Indian Securities Market 2014, SecuritiesDocument222 pagesIndian Securities Market 2014, SecuritiesPrashant SiroliyaNo ratings yet

- Xii Com Accountancy 40 MarksDocument5 pagesXii Com Accountancy 40 MarksprakharNo ratings yet

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Case Study InvestmentDocument6 pagesCase Study Investmentaroosha 2110No ratings yet