Professional Documents

Culture Documents

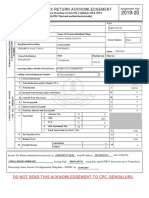

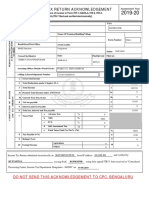

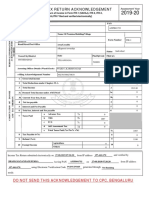

RAHUL BHALCHANDRA LONDHE - 04-Nov-2015 - 878755500

RAHUL BHALCHANDRA LONDHE - 04-Nov-2015 - 878755500

Uploaded by

rahulblondheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RAHUL BHALCHANDRA LONDHE - 04-Nov-2015 - 878755500

RAHUL BHALCHANDRA LONDHE - 04-Nov-2015 - 878755500

Uploaded by

rahulblondheCopyright:

Available Formats

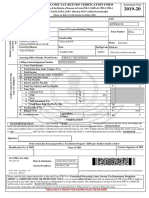

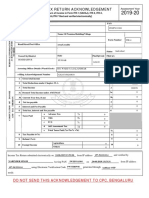

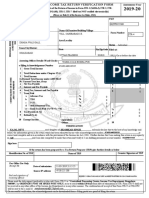

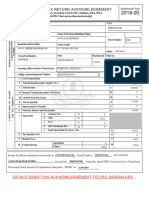

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-2A, ITR-3,

ITR-4S (SUGAM), ITR-4, ITR-5, ITR-7 transmitted electronically without digital signature] . 2015 - 16

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

RAHUL BHALCHANDRA LONDHE

AFPPL7644R

Flat/Door/Block No Name Of Premises/Building/Village Form No. which

has been ITR-4

Sr.no. 165 Building No 125/b10

electronically

transmitted

Road/Street/Post Office Area/Locality

Jayprakash Society Malwadi Hadapsar Individual

Status

Town/City/District State Pin Aadhaar Number

Pune

MAHARASHTRA 411028

Designation of AO (Ward / Circle) WARD 14(2), PUNE Original or Revised ORIGINAL

E-filing Acknowledgement Number 878755500041115 Date(DD-MM-YYYY) 04-11-2015

1 Gross Total Income 1 512849

2 Deductions under Chapter-VI-A 2 61389

3 Total Income 3 451460

a Current Year loss, if any 3a 0

4 Net Tax Payable 4 18690

5 Interest Payable 5 100

6 Total Tax and Interest Payable 6 18790

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 13677

c TCS 7c 0

d Self Assessment Tax 7d 5300

e Total Taxes Paid (7a+7b+7c +7d) 7e 18977

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 190

Agriculture

10 Exempt Income 10

Others

VERIFICATION

I, RAHUL BHALCHANDRA LONDHE son/ daughter of BHALCHANDRA LONDHE , holding Permanent Account Number AFPPL7644R

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2015-16. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 04-11-2015 Place NA

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 1.22.61.38

Date

Seal and signature of AFPPL7644R048787555000411152E34D4CB0569171BE7A7AD1C81F8B639BD11D588

receiving official

Please send the duly signed Form ITR-V to “Income Tax Department - CPC, Post Bag No - 1, Electronic City Post Office, Bengaluru - 560100,

Karnataka”, by ORDINARY POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V

shall not be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at

ITD-CPC will be sent to the e-mail address casanketkurhe@gmail.com

You might also like

- Bishop Coulston Roman Military Equipment From The Punic Wars To The Fall of RomeDocument345 pagesBishop Coulston Roman Military Equipment From The Punic Wars To The Fall of Romefevzisahin79100% (4)

- 1601352-BFP-046 - Recommended Operational Spare Parts For BFP - Rev.CDocument2 pages1601352-BFP-046 - Recommended Operational Spare Parts For BFP - Rev.CMena Kamel100% (1)

- Gramática AwáDocument422 pagesGramática AwáJaghu San100% (1)

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKarthikJacobNo ratings yet

- Itr-V CDBPS6088Q 2019-20 462928720110419Document1 pageItr-V CDBPS6088Q 2019-20 462928720110419rajNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Sumanyuu NNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- 2019 07 08 17 57 37 774 - 1562588857774 - XXXPD5098X - ItrvDocument1 page2019 07 08 17 57 37 774 - 1562588857774 - XXXPD5098X - ItrvAaditya PatelNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument13 pagesIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageEdukondalu BNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusayesha chandNo ratings yet

- 2019 09 27 06 24 49 469 - 1569545689469 - XXXPS6429X - Itrv PDFDocument1 page2019 09 27 06 24 49 469 - 1569545689469 - XXXPS6429X - Itrv PDFSse ikolaha SubstationNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruvishnu ksNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Karan VetNo ratings yet

- PDF 897511860260819Document1 pagePDF 897511860260819Kartik RajputNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruASHISANo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Anmol KhannaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurukrishna kasanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZIRWA ENTERPRISESNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusumitNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAadityaa PawarNo ratings yet

- 2019 08 20 19 55 00 478 - 1566311100478 - XXXPM8505X - Acknowledgement PDFDocument1 page2019 08 20 19 55 00 478 - 1566311100478 - XXXPM8505X - Acknowledgement PDFADIGARLA MALLAYYANo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- ACKDocument1 pageACKSAITEJA SOLVENT PURCHASENo ratings yet

- 2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Document1 page2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Ritesh MehtaNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururengarajan82No ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJayabrata sahooNo ratings yet

- 2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFDocument1 page2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFpramodNo ratings yet

- ANAIL RAMDASJI NAGDEVE 05-Aug-2013 736833470Document1 pageANAIL RAMDASJI NAGDEVE 05-Aug-2013 736833470Indian UnboxingNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSangita AjgaonkarNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- Balwinder Singh ITR 2Document1 pageBalwinder Singh ITR 2Pawan KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhNo ratings yet

- Bava Bro PDFDocument1 pageBava Bro PDFSomasundara ReddyNo ratings yet

- Indian Income Tax Return Acknowledgement: mises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: mises/Building/Villagenilabh007No ratings yet

- Itr-V Avapn7956m 2019-20 370567540270620Document1 pageItr-V Avapn7956m 2019-20 370567540270620kaysenterprises636No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagehemakumarsNo ratings yet

- 2019 07 31 23 05 02 491 - 1564594502491 - XXXPS2437X - Acknowledgement PDFDocument1 page2019 07 31 23 05 02 491 - 1564594502491 - XXXPS2437X - Acknowledgement PDFsosale prasannaNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Itr V 18-19Document1 pageItr V 18-19Abhishek Kumar GuptaNo ratings yet

- Kajal Devi Itr 19 20 PDFDocument2 pagesKajal Devi Itr 19 20 PDFRajesh KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSubhendu NathNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- 2020 03 02 21 11 48 509 - 1583163708509 - XXXPS0578X - ItrvDocument1 page2020 03 02 21 11 48 509 - 1583163708509 - XXXPS0578X - Itrvlaw classNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurudibyan dasNo ratings yet

- PDF 531439100260619Document1 pagePDF 531439100260619Animesh JainNo ratings yet

- 2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFDocument1 page2019 06 24 15 21 22 990 - 1561369882990 - XXXPA6889X - Acknowledgement PDFSiva KumariNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- 2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFDocument1 page2019 07 19 20 32 28 808 - 1563548548808 - XXXPS0222X - Acknowledgement PDFsampreethpNo ratings yet

- 13IPST068 Fabian PerezDocument7 pages13IPST068 Fabian Perezquisi123No ratings yet

- M4164-C 06-15 - Etrinsa Technical Manual - MN031r2hq PDFDocument142 pagesM4164-C 06-15 - Etrinsa Technical Manual - MN031r2hq PDFMaria Lavinia IordacheNo ratings yet

- Anatomy of Frontal Sinus & RecessDocument50 pagesAnatomy of Frontal Sinus & Recessanoop_aiims1No ratings yet

- Homelessness Listening Exercise: A. Watch The Video and Answer The Exercises With The Information Given. UnderstandingDocument2 pagesHomelessness Listening Exercise: A. Watch The Video and Answer The Exercises With The Information Given. Understandingryu ikiNo ratings yet

- Don Quijote Unit Summative AssessmentDocument1 pageDon Quijote Unit Summative AssessmentMaria MontoyaNo ratings yet

- Business ApplicationsDocument19 pagesBusiness ApplicationsAdair VinNo ratings yet

- Harmonization of Strategic PlansDocument47 pagesHarmonization of Strategic PlansLisette Senoc-GarciaNo ratings yet

- Lesson 9 Final PDFDocument120 pagesLesson 9 Final PDFFire RobloxNo ratings yet

- IOT Based Waste Monitoring SystemDocument25 pagesIOT Based Waste Monitoring SystemMayur ShimpiNo ratings yet

- AfunimawobeDocument14 pagesAfunimawobeAbdulsala100% (3)

- Lock Out-Tag OutDocument40 pagesLock Out-Tag OutMurali DharNo ratings yet

- Save The TigerDocument5 pagesSave The TigerChiranjit Saha100% (1)

- General Physics 1 Reviewer PDFDocument29 pagesGeneral Physics 1 Reviewer PDFJhon Robert ClavoNo ratings yet

- EXD2010 EX200: Compact Ex D Electro-Hydraulic Positioning and Monitoring SystemDocument8 pagesEXD2010 EX200: Compact Ex D Electro-Hydraulic Positioning and Monitoring SystemKelvin Anthony OssaiNo ratings yet

- Obesidade 2023Document69 pagesObesidade 2023Belinha DonattiNo ratings yet

- Lenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENDocument1 pageLenovo Tab-M10-Plus-3Gen Folio Case Datasheet ENSavoNo ratings yet

- 2008 Bullentin Rel. 2-DataDocument5 pages2008 Bullentin Rel. 2-DataKalai SelvanNo ratings yet

- WR WQ Pub Design Criteria Ch5Document10 pagesWR WQ Pub Design Criteria Ch5Teena AlawadNo ratings yet

- UT4000A Patient MonitorDocument5 pagesUT4000A Patient MonitorJuan Pablo MatadamazNo ratings yet

- DM Unit-IvDocument134 pagesDM Unit-IvDwaarakesh RameshNo ratings yet

- LPP - orDocument12 pagesLPP - orbharat_v79No ratings yet

- Stat Fax 3300 Chemistry AnalyzerDocument2 pagesStat Fax 3300 Chemistry AnalyzermohamedNo ratings yet

- India Email IdsDocument3,365 pagesIndia Email IdsGandhi ManadalapuNo ratings yet

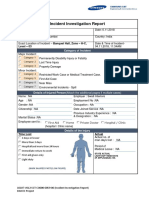

- Incident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsDocument4 pagesIncident Investigation Report - Fire Incedent - 04-11-2018 Swati InteriorsMobin Thomas AbrahamNo ratings yet

- climateChangeStat2015 PDFDocument294 pagesclimateChangeStat2015 PDFPallaviNo ratings yet

- Abhishek Shukla Project Reporton (Power Purchase)Document57 pagesAbhishek Shukla Project Reporton (Power Purchase)beast singhNo ratings yet

- Assignment Name: Identifying Characteristics of Some Family With 5 ExamplesDocument4 pagesAssignment Name: Identifying Characteristics of Some Family With 5 ExamplesAbdullah Al MamunNo ratings yet