Professional Documents

Culture Documents

Cost Accounting Quicknotes

Cost Accounting Quicknotes

Uploaded by

juleslovefenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting Quicknotes

Cost Accounting Quicknotes

Uploaded by

juleslovefenCopyright:

Available Formats

COST ACCOUNTING

Involves the measuring, recording, and reporting of product costs.

Total

Goal: to determine the product cost Unit

Unit Cost basis of SP = Unit Cost + Markup

↑ SP, ↓ Demand

Selling Price (SP) influences the demand of the product Costing

↓ SP, not profitable

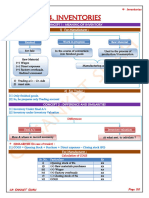

Cost Accounting Systems

Small volume

1. Job Order Unique / distinct products Ex. buildings, aircrafts, personalized jewelries

Heterogenous

Large volume

2. Process Costing Similar / identical products Mass Production (Ex. markers, paper, calculator, automobile)

Homogenous

RM/DM

RM/DM 𝑊𝐼𝑃

Inventory WIP UNIT COST =

DL # 𝑜𝑓 𝐺𝑜𝑜𝑑 𝑈𝑛𝑖𝑡𝑠

FG

OH

JOB ORDER COSTING

1. RM Inventory FORMULA: COGM / COGS

Upon purchase

Accounts Payable

DM Used

RM

2. Work-in-Process + DL

usage + OH

RM Inventory

TMC

3. Salaries Expense + WIP, beg

DL (AR x AH)

Salaries Payable - WIP, end

DL COGM

4. Work-in-Process + FG, beg

Salaries Expense - FG, end

COGS

5. Depreciation Expense

Utilities Expense

Rent Expense

Accumulated Depreciation Actual OH OH-A < OH-C Underapplied (+)

Utilities Payable

Rent Payable OH-A > OH-C Overapplied (-)

OH

6. OH Control

Depreciation Expense

Utilities Expense Actual OH

Rent Expense

7. Work-in-Process Standard Cost

OH Applied (SR x SH)

Normal Costing

8. Dec. 31

OH Applied

OH Control Immaterial / Insignificant COGS

Difference

WIP

Material / Significant FG

COGS

Actual

Costing Normal (if silent)

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

Spoiled Units

Cannot be sold at original price

No longer good units Unit Cost

Specific WIP ↑

due to exacting specification from customer

Normal charged to customer

w/n expectations

Common OH-C No effect

Spoilage internal failure

charged to all units

Abnormal Loss No effect

outside expectations

SPOILED GOODS

NRV of spoiled xx Total units xx

Cost of spoiled (xx) Spoiled units (xx)

Loss xx Good units xx

CASE 1: If the rework costs are charged to the entity/to all production/internal failure.

Total Cost of Goods* xx * include allowance to cost

Cost of Spoiled (xx)

Cost transferred to FG xx

Divide: Good units xx

Cost per unit xx

Note: Loss will be charged to manufacturing overhead

(MOH) and will be an actual overhead (OH).

CASE 2: Charged to customer/ “exacting specification”/specific job

Total Cost of Goods xx

NRV of Spoiled (xx)

Cost transferred to FG xx

Divide: Good units xx

Cost per unit xx

Note: Loss will be included in the costs

transferred to FG.

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

Defective Units

Can be sold at original SP

Still good units

Incur rework cost

Unit Cost

Specific WIP ↑

Normal

Defective / Rework Common OH-C

Abnormal Loss

Components of rework cost:

1. Direct material

2. Direct labor

3. Manufacturing overhead

CASE 1: If the rework costs are charged to the entity/to all production/internal failure.

Total cost of goods xx

Divide: Good units* xx *Good units = Total units

Cost per unit xx

Note: Rework costs will be charged to manufacturing

overhead (MOH) and will be an actual overhead (OH).

CASE 2: Charged to customer/ “exacting specification”/specific job

Total cost of goods xx

Rework costs xx

Cost transferred to FG xx

Divide: Good units xx

Cost per unit xx

Note: Rework costs will be included in the costs

transferred to FG.

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

PROCESS COSTING

High volume, similar, identical, homogenous products

Assembly / Production line

Ex. Pfizer, Unilab, Toyota, Lenovo, SMC

Objective: to determine the Unit Cost SP Demand

Cost of Production Report (CPR) JEs:

1. Units to Accounts For (UTAF) 0% 100% 1. Work-in-Process

2. Units Accounted For (UAF) Units

UTAF Various Accounts

3. Equivalent Units of Production (EUP) UAF

Total Units

4. Cost per EUP Unit Cost 2. Finished Goods

@ the start

5. Cost Accounted For Work-in-Process

3. Cost of Goods Sold

0% 30% 100% Finished Goods

FIFO

WIP, beg

Methods

0% 30% 100%

WAVE

WIP, beg

Normal increases UC Discrete w/ inspection point

Spoilage Normal Spoilage

Abnormal Loss Continuous no inspection point

method of neglect

Formulas: as if the spoilage did not occur

1. UTAF N. Spoilage 0%

WIP, beg xx

Ab. Spoilage 100% Loss

Started xx

UTAF xx

2. UAF

FIFO: Materials EUP Conversion Cost EUP

WIP, beg xx 0% Ø (1 – WIP, beg %) xx

Transferred-Out

Started xx 100% xx 100% xx

Normal Spoilage xx 100% xx 100% xx

Abnormal Spoilage xx 100% xx 100% xx

WIP, end xx 100% xx (WIP, end %) xx

UAF xx xx xx

WAVE: Materials EUP Conversion Cost EUP

TO xx 100% xx 100% xx

Normal Spoilage xx 100% xx 100% xx

Abnormal Spoilage xx 100% xx 100% xx

WIP, end xx 100% xx (WIP, end %) xx

UAF xx xx xx

Shortcut for EUP by Sir RMV

4. Cost per EUP

100% % Complete

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐶𝑜𝑠𝑡 Materials Conversion

FIFO = 𝐸𝑈𝑃 Completed / Transferred-out xx xx

EI EUP (EI units x % complete) xx xx

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐶𝑜𝑠𝑡+𝑊𝐼𝑃,𝑏𝑒𝑔 𝑐𝑜𝑠𝑡

WAVE = N. Spoilage xx xx

𝐸𝑈𝑃

Ab. Spoilage xx xx

5. Cost Accounted For Weighted Average EUP xx xx

EUP x Cost Per EUP (Materials) BI EUP LY (BI units x % Complete) (xx) (xx)

+ EUP x Cost Per EUP (Conversion) FIFO EUP xx xx

Cost Accounted For

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

Formula to compute completed/transferred-out units:

Beginning inventory in units xxx

Started/transferred-in units xxx

Ending inventory in units (xxx)

Lost units (normal + abnormal) (xxx)

Completed/transferred-out units xxx

Formulas to compute started and completed units:

Started/transferred-in units xxx Completed/transferred-out units xxx

Ending inventory in units (xxx) Beginning inventory in units (xxx)

Lost units (xxx) Started & completed units xxx

Started & completed units xxx

Lost units: EUP SCHEDULE

Discrete: Normal/Abnormal

Direct materials

If the placement took place first, then 100%

If the inspection took place first, then 0%

Conversion costs

Lost units x % of inspection

Continuous Loss – method of neglect

Normal loss = 0% as to materials and conversion costs

Abnormal loss = 100% as to materials and conversion costs.

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

JOINT AND BY-PRODUCT COSTING

two or more different products are manufactured in the same production process

Example:

Company X Chairs, Tables, Cabinets

Common to

all products A (Chairs)

B (Tables) Main Products

Joint Cost C (Cabinets)

DM, DL, OH (WIP) Separable Cost

0% 30% X (By-Product) 100%

(Further

Saw dust Processing Cost)

Relatively (FPC)

Split-off point small value

Issue #1: How to allocate Joint Cost to the main products?

1. Physical Measure (# of units, kg, meters)

2. Sales Value at Split-off (# of units x SP @ S.O.)

(MV)

3. NRV @ Split-off (# of units x SP – CTS) @ S.O

4. Approximated / Estimated / Hypothetical NRV (# of units x Final SP – CTS – FPC) @ S.O

Issue #2: How to report by-products?

S.O / Production Sale

always measured at NRV

By-Product Invty Cash

Significant / Material recognized @ point of production

WIP (↓ JC) By-P Invty

By-Product (inventory)

Insignificant / Immaterial recognized @ point of sale

no entry Cash

Other Inc.

Addition to sales revenue of the main product

Alternative Presentation for Other Income

Reduction from cost of sales

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

JUST-IN-TIME & BACKFLUSH COSTING

JIT inventory management system; produce as needed

Traditional: manufacture warehouse order deliver

Benefits: reduces inventory storage cost & obsolescence

A JIT system requires an attitude that places emphasis on the following:

Cooperation with a value chain perspective

Respect for people at all levels

Quality at the source

Simplification or just enough resources

Continuous improvement

A long-term perspective

A JIT system also incorporates the following practices:

Just-in-time purchasing

Focused factories

Cellular manufacturing

Just-in-time production

Just-in-time distribution

Simplified accounting

Process oriented performance measurements

Backflush Costing simplified accounting

trigger points (points wherein we make JEs)

Traditional JE (4 TP) Backflush (3 Trigger Points) 2 Trigger Points 1 Trigger Point

1. RM 1. MIP (RIP) V1 1. MIP 4. COGS

AP Purchase AP Purchase AP Purchase AP Sale

CC-Applied

2. WIP Production

3. FG 4. COGS

Var. Accts MIP Completion MIP Sale

CC-Applied CC-Applied

3. FG 4. COGS V2 3. FG

Completion Sale

WIP FG AP Purchase

CC-Applied

4. COGS Sale 4. COGS Dec. 31

Sale

FG FG CC-Applied

CC-Control

Diff COGS

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

ACTIVITY-BASED COSTING

allocates overhead to multiple activity cost pools and assigns the activity cost pools to products and services by

means of cost drivers.

A cost driver is any factor or activity that has a direct cause-effect relationship with the resources consumed.

Recall: Manufacturing Cost

Factory

DM

✔

DL 5hrs

OH rent, dep’n, taxes, insurance A B

₱100,000

300 units

𝑇𝑜𝑡𝑎𝑙 𝑂𝐻

OH Rate = 𝐶𝑜𝑠𝑡 𝐷𝑟𝑖𝑣𝑒𝑟

(Units produced, MH, LH)

Example:

A B Total A B

Units Produced 100 200 300 DM 2,000 4,000

Machine Hours 40 60 100 DL 5,000 10,000

DM ₱2,000 ₱4,000 OH 24,000 36,000

DL ₱5,000 ₱10,000 31,000 50,000

OH ₱60,000 ÷ 100 ÷200

÷ 100 UC 310 250

600/hr

Traditional Costing

OH Product

1 OH Rate

Activity-Based Costing more accurate cost allocation method

Products Activities Resources (MH, LH)

Steps:

1. Identify Activities

2. Identify Cost Driver per activity

3. Compute OH rate per activity (multiple OH rate)

4. Allocate OH to proceeds

Activity-Based Management (ABM)

Process of identifying value-adding activities necessary to produce a product; maximize ↓ Costs,

Nonvalue-adding activities do not add value to products; minimize ↑ Profitability

Activity Levels:

1. Unit Level activities performed for each unit of production.

2. Batch Level activities performed for each batch of products rather than each unit.

3. Product Level activities performed in support of an entire product line.

4. Factory/Facility Level activities required to support an entire production process.

5. Organizational Level

Quality Cost: High-quality products; ↓ defects / spoilages; ↑ profitability

1. Prevention Cost - cost to avoid defects during production

- Ex. Training workers, proper maintenance

2. Appraisal Cost - identification of defects before shipment

- Ex. Inspection cost / point

3. Internal Failure Cost - actual removal of defects before shipment

- Rework Cost

4. External Failure Cost - already been shipped with defects

- Ex. warranty, replacement

Reference: Sir Brad’s Lecture + Pinnacle Handout Compiled by: CPM

You might also like

- Cost Accounting Summary NotesDocument10 pagesCost Accounting Summary NotesCarlene Ugay100% (1)

- Standard, Actual Costing, Normal CostingDocument11 pagesStandard, Actual Costing, Normal Costinghababammar660No ratings yet

- Chapter 2 Cost ClassificationsDocument18 pagesChapter 2 Cost Classificationsmarizemeyer2No ratings yet

- COST Job Order Costing Rob NotesDocument3 pagesCOST Job Order Costing Rob NotesEvelyn LabhananNo ratings yet

- Job Order CostingDocument4 pagesJob Order Costingguliramsam5No ratings yet

- MS ReviewerDocument12 pagesMS ReviewerMarvi Ned Xigrid CruzNo ratings yet

- 1-Cost ConceptsDocument1 page1-Cost ConceptsDana Beatrice RoqueNo ratings yet

- DM DL OH: $ Direct Materials $ Direct Labor $ Overhead Cost Flow DiagramDocument18 pagesDM DL OH: $ Direct Materials $ Direct Labor $ Overhead Cost Flow DiagramAbdulaziz AlzahraniNo ratings yet

- I. Cost Terminology: ElementDocument52 pagesI. Cost Terminology: ElementJomar PenaNo ratings yet

- Tutorial 8 - Basic Cost Concepts and Normal Costing: All Expenses Are Costs But Not All Costs Are ExpensesDocument12 pagesTutorial 8 - Basic Cost Concepts and Normal Costing: All Expenses Are Costs But Not All Costs Are ExpensesLingNo ratings yet

- Formula Sheet Cost ConceptsDocument2 pagesFormula Sheet Cost ConceptsErika Anne JaurigueNo ratings yet

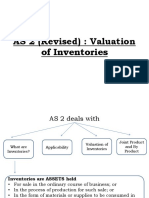

- As - 2: Valuation of InventoriesDocument18 pagesAs - 2: Valuation of InventoriesrajuNo ratings yet

- Sir Pro OrderDocument309 pagesSir Pro OrderTaruna PNo ratings yet

- Session 5 Job CostingDocument58 pagesSession 5 Job CostingJoeyNo ratings yet

- ACC2203 HandoutsDocument17 pagesACC2203 HandoutsbeaudecoupeNo ratings yet

- FR RevisionDocument378 pagesFR Revisionarkarminkhant734No ratings yet

- Analisa CostingDocument32 pagesAnalisa CostingpicalnitaNo ratings yet

- (Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)Document20 pages(Finished Goods/stock in Trade) (Work - In-Progress) (Raw Material, Stores and Spares, Etc.)razorNo ratings yet

- FR Shield - Ind As 2 - InventoriesDocument4 pagesFR Shield - Ind As 2 - InventoriesTanvi jain100% (1)

- CA IPCC As - 2,7,9,10 Accounts As by Rohan SirDocument38 pagesCA IPCC As - 2,7,9,10 Accounts As by Rohan SirJoya AhasanNo ratings yet

- Job Order Cost System MindmapDocument1 pageJob Order Cost System MindmapFemy DemetriaNo ratings yet

- Job Order Cost System MindmapDocument1 pageJob Order Cost System MindmapFemy DemetriaNo ratings yet

- As 2Document4 pagesAs 2abhishekkapse654No ratings yet

- AS 2 Valuation of InventoriesDocument18 pagesAS 2 Valuation of InventoriesRENU PALINo ratings yet

- FormulasDocument12 pagesFormulasMathivanan NatarajNo ratings yet

- Chapter 5 - Job Order CostingDocument20 pagesChapter 5 - Job Order CostingviraNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- Inventories NotesDocument2 pagesInventories NotesMikaela LacabaNo ratings yet

- Ind As 2: Inventories: (I) MeaningDocument6 pagesInd As 2: Inventories: (I) MeaningDinesh KumarNo ratings yet

- Management Accounting 2: MANG2005 Overhead Allocation & Income Effect of Costing SystemsDocument33 pagesManagement Accounting 2: MANG2005 Overhead Allocation & Income Effect of Costing Systems万博熠No ratings yet

- Chapter 3 WorkbookDocument4 pagesChapter 3 WorkbookGianJoshuaDayritNo ratings yet

- Fundamental Cost Concepts: (Part 2)Document30 pagesFundamental Cost Concepts: (Part 2)amirulNo ratings yet

- Chapter 4 OverheadDocument21 pagesChapter 4 OverheadMUHAMMAD ZAIM HAMZI MUHAMMAD ZINNo ratings yet

- PPA 4 InventoriesDocument8 pagesPPA 4 Inventoriesbullalulla840No ratings yet

- Cos T: Sec 1 Cost ElementsDocument20 pagesCos T: Sec 1 Cost ElementsSuhaib SghaireenNo ratings yet

- Far Notes For QualiDocument10 pagesFar Notes For QualiMergierose DalgoNo ratings yet

- Cost Accounting (Midterm Period)Document13 pagesCost Accounting (Midterm Period)MAG MAGNo ratings yet

- Inventory ValuationDocument16 pagesInventory ValuationKillari PadmasriNo ratings yet

- Basics in FinanceDocument7 pagesBasics in FinanceAshraf S. Youssef100% (1)

- Cost NotesDocument49 pagesCost NotesHarriniNo ratings yet

- CH 4Document16 pagesCH 4Euis Muliawaty NNo ratings yet

- GICE Govt Purchase IPIRATED IncomeDocument3 pagesGICE Govt Purchase IPIRATED IncomeChristy Boyd TurnerNo ratings yet

- 9410 - Job Order CostingDocument7 pages9410 - Job Order CostingMarshmallowNo ratings yet

- 13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFDocument6 pages13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFSrinishaNo ratings yet

- NOTE CHAPTER 9 - Absorption Costing & Marginal CostingDocument18 pagesNOTE CHAPTER 9 - Absorption Costing & Marginal CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- Chapter 5Document42 pagesChapter 5bhagyeshparekh.caNo ratings yet

- Job CostingDocument9 pagesJob CostingParikshit KunduNo ratings yet

- Review Session 01 MA Topics 1-6 AfterDocument32 pagesReview Session 01 MA Topics 1-6 AftermisalNo ratings yet

- Review Session 01 MA Topics 1-6 BeforeDocument32 pagesReview Session 01 MA Topics 1-6 BeforemisalNo ratings yet

- Costing Revision Notes (1 Day Before Exam)Document47 pagesCosting Revision Notes (1 Day Before Exam)nagaraj9032230429No ratings yet

- Bba Project 3.0Document8 pagesBba Project 3.0Mr UniqueNo ratings yet

- Finance For Non-Finance Demand Supply Mgrs 2020021718Document39 pagesFinance For Non-Finance Demand Supply Mgrs 2020021718lngcivilNo ratings yet

- Capitalization: Capital Vs Operating LeaseDocument2 pagesCapitalization: Capital Vs Operating Leasejohnsmith12312312312No ratings yet

- BFD Class NotesDocument20 pagesBFD Class NotesAnas KhanNo ratings yet

- Costacc 8Document1 pageCostacc 8parkjenaa09No ratings yet

- AS 2 Valuation of InventoriesDocument11 pagesAS 2 Valuation of InventoriesBharatbhusan RoutNo ratings yet

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- Capital AllowancesDocument5 pagesCapital AllowancesjaviperumalNo ratings yet

- AS 2 (Revised) : Valuation of InventoriesDocument13 pagesAS 2 (Revised) : Valuation of InventoriesAkshay PatilNo ratings yet

- Oakajee Structure Plan ReportDocument72 pagesOakajee Structure Plan ReportHiddenDNo ratings yet

- The History and Current Applications of The Circular Economy ConceptDocument9 pagesThe History and Current Applications of The Circular Economy ConceptPaula Bertolino Sanvezzo100% (1)

- C. Math Practice SheetDocument2 pagesC. Math Practice SheetMalancha BooksNo ratings yet

- Implementation of Eco-Industrial Park Initiative For Sustainable Industrial Zones in Vietnam 2019 ReportDocument68 pagesImplementation of Eco-Industrial Park Initiative For Sustainable Industrial Zones in Vietnam 2019 Reportduchoang100% (1)

- Industrial Symbiosis Literature and TaxonomyDocument27 pagesIndustrial Symbiosis Literature and TaxonomyMichael BianchiNo ratings yet

- Cleaner Logistics and Supply Chain: Swapnil Lahane, Ravi KantDocument12 pagesCleaner Logistics and Supply Chain: Swapnil Lahane, Ravi KantSIDDHARTH PARIHARNo ratings yet

- Ap Micro Chapter 5Document37 pagesAp Micro Chapter 5henryliguansenNo ratings yet

- Circular Economy in China The Environmental Dimension of The Harmonious SocietyDocument12 pagesCircular Economy in China The Environmental Dimension of The Harmonious SocietyHa My NguyenNo ratings yet

- Eco Business ParkDocument10 pagesEco Business ParkJavier HerrerosNo ratings yet

- Tejal ProjectDocument81 pagesTejal ProjectUPENDRA NISHADNo ratings yet

- Explanation in Hierarchy of Isocost LineDocument2 pagesExplanation in Hierarchy of Isocost Line2023-105224No ratings yet

- Sustainable M5 Ktunotes - inDocument46 pagesSustainable M5 Ktunotes - inZohaib Hasan KhanNo ratings yet

- Just-in-Time Production: December 2019Document11 pagesJust-in-Time Production: December 2019himanshu vyasNo ratings yet

- Lean ProductionDocument14 pagesLean Productionisabelpanganiban681No ratings yet

- Chinese Steel Industry Energy and Environmnt-USTBDocument36 pagesChinese Steel Industry Energy and Environmnt-USTBvahidssNo ratings yet

- Industrial Ecology OverviewDocument11 pagesIndustrial Ecology OverviewJacqueline PortellaNo ratings yet

- Emerging Supplier Selection Criteria in The Contex SCMDocument16 pagesEmerging Supplier Selection Criteria in The Contex SCMMr AyieNo ratings yet

- Absorption and Variable CostingDocument1 pageAbsorption and Variable Costingqrrzyz7whgNo ratings yet

- Industrial Ecology by Waqas Ali TunioDocument16 pagesIndustrial Ecology by Waqas Ali TuniowaqasalitunioNo ratings yet

- Masi Et Al - Towards A More Circular Economy Exploring The Awareness Practices and Barriers From A Focal Firm PerspectiveDocument13 pagesMasi Et Al - Towards A More Circular Economy Exploring The Awareness Practices and Barriers From A Focal Firm PerspectiveDiana Toro HernandezNo ratings yet

- Makalah 46752Document280 pagesMakalah 46752novi wulanNo ratings yet

- Quiz 3Document2 pagesQuiz 3kaamayegiid69No ratings yet

- MCQs On Costing - PracticeDocument7 pagesMCQs On Costing - PracticethegreatnamanpatelNo ratings yet

- Issues Product DesignDocument19 pagesIssues Product DesignFarah AbdillahNo ratings yet

- Sustainable Growth: Combining Ecological Issues Into Strategic PlanningDocument8 pagesSustainable Growth: Combining Ecological Issues Into Strategic Planninghernawati hernaNo ratings yet

- Sustainable Economic Development PDFDocument326 pagesSustainable Economic Development PDFMohammad ShofieNo ratings yet

- CAF 03 - CMA All Tests by Sir Jawad Mehmood (S24)Document50 pagesCAF 03 - CMA All Tests by Sir Jawad Mehmood (S24)manzoorabdullah585No ratings yet

- 7300C Industrial Ecology and Life Cycle AnalysisDocument5 pages7300C Industrial Ecology and Life Cycle AnalysisIrfan Aditya DharmaNo ratings yet

- Lecture 1 - Industrial EcologyDocument56 pagesLecture 1 - Industrial EcologyIgnatius Yan RosarioNo ratings yet

- Green, Randles (2006) - Industrial Ecology and Spaces of InnovationDocument340 pagesGreen, Randles (2006) - Industrial Ecology and Spaces of InnovationmoncalejoNo ratings yet