Professional Documents

Culture Documents

Frequently Asked Questions About Short-Term Finan

Frequently Asked Questions About Short-Term Finan

Uploaded by

yashnagra6452yOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Frequently Asked Questions About Short-Term Finan

Frequently Asked Questions About Short-Term Finan

Uploaded by

yashnagra6452yCopyright:

Available Formats

HOME READ WRITE ADVERTISE TOOLS LEARN

Subscribe to our newsletter & get $230k in SaaS credits &

discounts!

topics small-business-resources

industry

Expert

Frequently asked questions

about short-term finance

Guest Author

October 30, 2018

You should never take out any type of loan

without knowing everything about it. Here are

the common questions about short-term finance

that you need the answers for.

You have a lot of options available to you when it

comes to financing. For example, Max Funding,

one of the leading non-bank lender in Australia

offers different packages for you to check. Plus,

you have a choice between long-term and short-

term financing. Each of these comes with their

own pros and cons that you need to understand.

It’s particularly important that you do more

research when considering short-term finance.

Such loans often come with different acceptance

criteria than long-term loans. As a result, you need

to understand exactly what you’re signing up for.

So, where do you start?

This list of frequently asked questions will help

you to figure out what you stand to receive with

short-term finance.

Question 1 – What are the different types of

short-term finance?

Many types of finance fall under the short-term

banner. The following are the ones that business

owners are most likely to consider:

Short-term loans. This are perhaps the most

common solution. As the name implies, short-

term loans require you to repay the sum of the

loan within a short period of time. Typically,

this can be within one year. However, some

lenders, such as Max Funding, offer up to 36

months for repayment on some of their short-

term loans.

You may also find it easier to access a short-

term loan than you would a traditional

business loan. They have different acceptance

criteria that often make them available to

those who have bad credit.

Trade credit. A business may use this type of

finance to help them to pay for goods that

they’ve already received. Typically, they’ll

repay the loan within one month, usually upon

sale of the goods.

However, you may be able to secure trade

credit with a longer repayment period.

Businesses use these loans to help them

balance their cash flow. They’re particularly

useful for growing businesses that need to

expand their inventory but don’t have the

required capital.

Overdrafts. If you have a business bank

account, it’s likely that you’ve received an

offer to create an overdraft. An overdraft

allows you to draw money out of your account

even if you don’t have money in it. Overdrafts

have their limits and usually come with high

interest rates. However, you only pay these

rates if you dip into the overdraft.

They’re useful for businesses that anticipate

running into invoicing issues. They give you

some breathing space while you wait for

payments to clear.

Credit cards. This is another common form of

short-term finance. A business credit card

allows you to charge purchases against a line

of credit. You then make repayments based

on your agreement with your credit provider.

These repayments have interest attached,

again at a rate agreed with your provider.

Credit cards can prove useful in a pinch.

However, the high interest rates attached can

cause problems. This is especially the case if

you don’t repay than the bare minimum. Over

reliance on multiple credit cards can also put

you in severe financial difficulty.

Question 2 – When might I need short-term

financing?

Running a business comes with all sorts of risks.

There may be times when you struggle to balance

your cash flow, for whatever reason. These are

usually the occasions where you can benefit from

short-term finance.

You may use this solution in any of the following

circumstances:

You’ve experienced a sudden surge in demand

that means you need to buy more inventory.

Something’s gone wrong with your equipment

and you don’t have the funds needed to fix it.

Clients haven’t paid on time, which means that

you don’t have the cash you expected to have.

Furthermore, you may find that one of your

project’s experienced unexpected issues. Such

was the case with one Max Funding client. His

construction project ran into several obstacles

that he didn’t anticipate. This led to delays, which

inevitably increased costs.

He required an extra $200,000 to cover those

costs.

Max Funding helped the client to use his

construction project as security on short-term

finance. He received the money he needed to pay

the extra costs. Plus, he boosted his credit limit to

give him some more breathing space.

So, as a general rule, you’ll take out short-term

financing to deal with unexpected issues.

Question 3 – Should I apply online?

Many short-term finance providers allow you to

apply online.

This is perfectly safe as long as you check that

the website takes the proper precautions.

Check the URL first. You should see that it begins

with https://. The “s” is important because it tells

you that you have a secure connection. As a

result, you can feel safe sending personal

information.

If the “s” isn’t there, don’t send any personal

details to that website.

It’s also worth contacting the lender to ask if they

use SSL encryption. This technology encrypts the

information that you send so that only the

intended recipient can read it. You’ll usually find

mention of this technology in the provider’s

privacy policy. Be wary of applying online with any

providers that don’t use it.

Question 4 – Do I have to have good credit?

Short-term financers may take your credit score

into account. However, they’re often more flexible

than traditional lenders. That means you can often

access short-term financing if you have bad

credit.

The trade-off is that you’ll usually face higher

interest rates than you would with loans that

require you to have good credit. Still, this makes

short-term finance a potential solution for those

who have credit-related issues.

Question 5 – How much can I borrow?

This depends on the lender and the type of short-

term finance you require. Your circumstances also

play a role.

Some lenders, such as Max Funding, can offer

short-term finance of $1 million or more. Others

restrict you to a few thousand dollars.

Typically, the lender will determine your maximum

financing amount after reviewing your application.

Question 6 – How long does it take to apply

Again, this depends on the lender and the type of

finance.

However, you’ll often find that you can complete

an application online and get pre-approval in a

matter of minutes. It then might take a day or two

to receive full approval.

Question 7 – Can I change my mind?

As long as you haven’t signed a contract, you can

change your mind on any type of short-term

finance.

That makes it all the more important that you read

and understand the terms of the finance. In most

cases, you’re locked in after you put pen to paper.

However, some financers offer a grace period of

24 hours after you sign the contract. You may be

able to cancel the loan within this period. Check

with your lender to see if you have this option

open to you.

Question 8 – Can I take out multiple types of

short-term finance?

The answer to this depends on several factors.

These include your circumstances and your

lender’s criteria.

It’s certainly possible that you could, for example,

take out a short-term loan and get a business

credit card. However, it’s crucial that you

understand the potential implications. Using

several types of short-term finance at the same

time increases your repayment burden. It also

means you have to pay interest on several sums

of money.

Question 9 – How do I know the lender/financer

is legitimate?

Legitimate lenders have to obtain a license to

offer credit under the National Consumer Credit

Protection Act 2009. You can also check with the

Australian Securities and Investments Commission

(ASIC). Legitimate lenders usually carry ASIC

accreditation.

It’s also worth checking for mentions of the lender

in respected financial publications. You can also

check to see if they’re registered with the Better

Business Bureau. If they are, they’ll usually have a

rating attached to them. Finally, spend some time

researching what others have to say about the

lender.

Combine all of that and you should get a good

idea of whether a lender/financer is legitimate.

The final word

With these questions answered, you’re now in a

better position to determine which type of short-

term finance suits you. You should also be able to

see if the lender you’re considering can offer what

they claim.

Always consider your own circumstances before

using finance of any kind. After that, make sure

you choose the right lender.

Max Funding can help if you need short-term

finance. We offer:

Pre-approval within five minutes.

Flexible approval criteria

Tax-deductible interest.

Loan repayment periods of up to 36 months.

Financing for people with bad credit.

Low-doc loans.

Early repayment.

The ability to borrow anywhere between

$1,000 and $1 million.

You just need to apply from Max Funding to get

started.

What do you think?

Be the first to comment

Add a new comment

Type Your Comment

Post Comment

#Business Finance #Funding #Max Funding

#short-term finance

Guest Author

Dynamic Business has a range of highly

skilled and expert guest contributors, from a

wide range of businesses and industries.

View all posts

Get Tips, Business News

& How to Articles

Delivered Daily

Our mission is to help you get better at business by

helping you solve common business problems like

sales, marketing, finance and HR and by keeping you

up to date with business news, analysis and special

o!ers.

Your business email Subscribe

DB Brand Accounts

DB Brand Account

How integrating business

processes creates time fo…

growth

Clare Loewenthal

September 4, 2023

DB Brand Account

Claim your spot at the

small business winners’…

circle

Precedent Productio…

June 8, 2023

DB Brand Account

Cushioning your business:

protecting your cashflow…

with debt resolution

EC Credit Control

systems

August 15, 2022

DB Brand Account

Choosing the right phone

system for your small…

business

Aircall

August 8, 2022

DB Brand Account

Exploring finance on

demand for your business

Shift

July 13, 2022

About Us

Dynamic Business has been helping business

owners and managers for 27 years

DB Contributors Network - Pitch a Story

Advertise Privacy Policy

Australian Business Grants

List your Product on DB LifeStyle

© Copyrights 2020 by Dynamic Business - All

rights reserved.

You might also like

- Unit 5 (Loans and Credit)Document4 pagesUnit 5 (Loans and Credit)Dewinta Stefanus67% (3)

- Finmarket Lecture 5Document13 pagesFinmarket Lecture 5Rosie PosieNo ratings yet

- RRLDocument13 pagesRRLady neriNo ratings yet

- Essential Guide To Financing Your StartDocument8 pagesEssential Guide To Financing Your Startgp.mishraNo ratings yet

- 31692the Basic Principles of Guaranteed Payday LoansDocument2 pages31692the Basic Principles of Guaranteed Payday Loanskordan3gzcNo ratings yet

- Short Term FinancingDocument8 pagesShort Term FinancingMaimai DuranoNo ratings yet

- A. Discuss The Advantages of Financing Capital Expenditures With DebtDocument5 pagesA. Discuss The Advantages of Financing Capital Expenditures With DebtMark SantosNo ratings yet

- Module 4 Lesson 1Document10 pagesModule 4 Lesson 1Kryzel PanteNo ratings yet

- 7 of The Most Common Reasons To Get A Business LoanDocument2 pages7 of The Most Common Reasons To Get A Business LoanFirdaus PanthakyNo ratings yet

- Debt Vs EquityDocument4 pagesDebt Vs EquityNooraghaNo ratings yet

- More Locations: Commercial BankDocument6 pagesMore Locations: Commercial BankAyushi KhuranaNo ratings yet

- Bac 308 AssignmentDocument7 pagesBac 308 AssignmentMutwiri MwikaNo ratings yet

- The Advantages of Borrowing Money Without SecurityDocument2 pagesThe Advantages of Borrowing Money Without SecurityAffordableCebuClassifiedsNo ratings yet

- Advantages and Disadvantages of Borrowing Money From Lending InstitutionDocument7 pagesAdvantages and Disadvantages of Borrowing Money From Lending InstitutionFEVY BOOTNo ratings yet

- Presentation in Engineering Management: Engr. Eleonor F. DilidiliDocument17 pagesPresentation in Engineering Management: Engr. Eleonor F. DilidiliLenidee San JoseNo ratings yet

- Meaning of Loan: Debt Assets Lender Borrower MoneyDocument10 pagesMeaning of Loan: Debt Assets Lender Borrower MoneybondhonbondNo ratings yet

- Emprestimo de DinheiroDocument4 pagesEmprestimo de DinheiroDom NemaNo ratings yet

- Acct 226Document4 pagesAcct 226freeNo ratings yet

- Comprehensive Credit Repair 10-18-07Document64 pagesComprehensive Credit Repair 10-18-07Carol100% (1)

- Fin 204Document2 pagesFin 204LaxandaNo ratings yet

- H/W Topic 6 4/11/19Document4 pagesH/W Topic 6 4/11/19sssda fffdfNo ratings yet

- Debt Financing or Equity FinancingDocument10 pagesDebt Financing or Equity Financingimran hossain ruman100% (1)

- Ten Commandments of Commercial LendingDocument4 pagesTen Commandments of Commercial LendingcapitalfinNo ratings yet

- Business and Consumer Loan: What Is The Difference Between Bonds and Loans?Document10 pagesBusiness and Consumer Loan: What Is The Difference Between Bonds and Loans?Dandreb SardanNo ratings yet

- Dissertation On Payday LoansDocument6 pagesDissertation On Payday LoansBuyingCollegePapersSingapore100% (1)

- Fueling Your Business: A Guide To Financing Your Small BusinessDocument10 pagesFueling Your Business: A Guide To Financing Your Small BusinessCHOUCoLaTe GAMINGNo ratings yet

- Secured Personal Loans - Need To Know Before ApplyDocument7 pagesSecured Personal Loans - Need To Know Before ApplyKAZI THASMIA KABIRNo ratings yet

- An Introduction To Business Finance: How Much Do You Need?Document4 pagesAn Introduction To Business Finance: How Much Do You Need?Wazeem AkramNo ratings yet

- Secrets About Payday Loans New Orleans You Can Learn From TVDocument3 pagesSecrets About Payday Loans New Orleans You Can Learn From TVwychankn7eNo ratings yet

- Harvard Business ReviewDocument6 pagesHarvard Business ReviewbalachmalikNo ratings yet

- Five Steps For CreditDocument2 pagesFive Steps For CreditjohnribarNo ratings yet

- Equity Financing Small Business AdministrationDocument8 pagesEquity Financing Small Business AdministrationrajuNo ratings yet

- The Financial Kaleidoscope - May 2018Document8 pagesThe Financial Kaleidoscope - May 2018Deepthi PNo ratings yet

- Week 5 AssignmentDocument2 pagesWeek 5 AssignmentEliza FrancisNo ratings yet

- 2 Assignment: Department of Business AdministrationDocument14 pages2 Assignment: Department of Business AdministrationFarhan KhanNo ratings yet

- Financing ConceptsDocument5 pagesFinancing ConceptsSoothing BlendNo ratings yet

- Loan EquirementDocument3 pagesLoan Equirementrigsdriller94No ratings yet

- 4 Types of Short-Term LoansDocument2 pages4 Types of Short-Term LoansQQ Loan MalaysiaNo ratings yet

- 3 Dec.... 3 ArticlesDocument5 pages3 Dec.... 3 Articlesavinash sharmaNo ratings yet

- Ten Sources of CapitalDocument6 pagesTen Sources of CapitalbhushanakNo ratings yet

- QuizDocument2 pagesQuizCris TineNo ratings yet

- Sources of FinanceDocument3 pagesSources of Financealok19886No ratings yet

- 06 MoneyDocument4 pages06 Moneywhwei91No ratings yet

- Sources of Business Finance (Raising Capital For Enterprise)Document17 pagesSources of Business Finance (Raising Capital For Enterprise)Abiola NerdNo ratings yet

- Financial Literacy CourseDocument29 pagesFinancial Literacy CourseAsfandyar KhanNo ratings yet

- Personal Loan Products: New Car LoansDocument18 pagesPersonal Loan Products: New Car LoanssuvarnarathodNo ratings yet

- Rationale For Bad Credit Lenders As A SolutionDocument32 pagesRationale For Bad Credit Lenders As A SolutionR.S.Tiwari0% (1)

- Summer 2013 CDocument12 pagesSummer 2013 Capi-309082881No ratings yet

- Ten Cre Linkedin PostsDocument11 pagesTen Cre Linkedin PostsJim JobNo ratings yet

- How Do Small Business Loans Work?Document3 pagesHow Do Small Business Loans Work?Soumyajit Das MazumdarNo ratings yet

- Personal Loan ProjectDocument7 pagesPersonal Loan ProjectSudhakar GuntukaNo ratings yet

- Bessemer Guide To Venture DebtDocument14 pagesBessemer Guide To Venture Debtarnoldlee1No ratings yet

- Short-Term Financing: After Studying This Chapter, You Will Be Able ToDocument13 pagesShort-Term Financing: After Studying This Chapter, You Will Be Able ToMohammad Salim HossainNo ratings yet

- What Is Asset ManagementDocument7 pagesWhat Is Asset ManagementAhyessa GetesNo ratings yet

- Personal Debt Vs Corp DebtDocument1 pagePersonal Debt Vs Corp DebtAlaissaNo ratings yet

- Consumer Guide To Rate LocksDocument5 pagesConsumer Guide To Rate LocksJarred AlexandrovNo ratings yet

- 12 Business Combination Pt2Document1 page12 Business Combination Pt2Mel paloma0% (1)

- 10 Years Treasury NoteDocument2 pages10 Years Treasury NoteGna OngNo ratings yet

- Elliott Management's BMC PresentationDocument36 pagesElliott Management's BMC PresentationDealBookNo ratings yet

- Companies Act 1956Document14 pagesCompanies Act 1956buviaroNo ratings yet

- Tolentino Vs Secretary of Finance 235 Scra 630 Case DigestDocument1 pageTolentino Vs Secretary of Finance 235 Scra 630 Case DigestFermari John ManalangNo ratings yet

- Counsel's Report On FEC Complaint Against Chris McDanielDocument28 pagesCounsel's Report On FEC Complaint Against Chris McDanielJonathan AllenNo ratings yet

- SB - Kishore and Tarun PDFDocument1 pageSB - Kishore and Tarun PDFsheetalNo ratings yet

- Press Release - Asian Paints Q2-FY21 ResultsDocument2 pagesPress Release - Asian Paints Q2-FY21 ResultsVishvajit PatilNo ratings yet

- POA Key TermsDocument23 pagesPOA Key TermsAnonymous LC5kFdtcNo ratings yet

- Pestel Analysis - Banking SectorDocument16 pagesPestel Analysis - Banking SectorAkankshya Bishwal50% (2)

- Hotspot ListDocument285 pagesHotspot Listsargent9914No ratings yet

- Accounting Quizzes Answer KeyDocument11 pagesAccounting Quizzes Answer KeyRae SlaughterNo ratings yet

- IRDA Mock Test 5Document13 pagesIRDA Mock Test 5psNo ratings yet

- City of BaltimoreDocument4 pagesCity of BaltimoreAnonymous Feglbx5No ratings yet

- Stock Market Research Paper 5Document13 pagesStock Market Research Paper 5api-549214190No ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Stock TradingDocument3 pagesStock Tradingadewoleo56No ratings yet

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosNo ratings yet

- TIN Application - Statement of Estimate (Entity)Document5 pagesTIN Application - Statement of Estimate (Entity)Christian Nicolaus MbiseNo ratings yet

- SBP Green Banking Policy C8-AnnexDocument44 pagesSBP Green Banking Policy C8-AnnexaliNo ratings yet

- Your Results For: "Multiple Choice Questions"Document21 pagesYour Results For: "Multiple Choice Questions"Jearick Reario AtazanNo ratings yet

- Business ImplementationDocument47 pagesBusiness ImplementationAllan Ella Manjares82% (11)

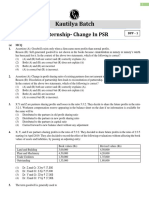

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- Star Champion Rockstar Shelter-4Document28 pagesStar Champion Rockstar Shelter-4markamonlinecenter000No ratings yet

- Innovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Document21 pagesInnovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Narinder BhasinNo ratings yet

- Prudential Bank V Panis 153 SCRA 390 1987Document6 pagesPrudential Bank V Panis 153 SCRA 390 1987Bonito BulanNo ratings yet

- NPS-103 - Death Withdrawal FormDocument5 pagesNPS-103 - Death Withdrawal FormSubahan ShaikNo ratings yet

- 10 D HL and Murrey Math ExcelDocument10 pages10 D HL and Murrey Math ExcelNihilisticDelusionNo ratings yet

- Real Property TaxationDocument125 pagesReal Property TaxationLaw_Portal100% (5)

- Reckoning Date of ValuationDocument25 pagesReckoning Date of ValuationRobert LavinaNo ratings yet