Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsDerivatives II

Derivatives II

Uploaded by

kuselvderivatives question paper

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- 2022be313-5-Au Portfolio AnalysisDocument5 pages2022be313-5-Au Portfolio AnalysisKhawaja HamzaNo ratings yet

- MBA Finance 1st Semester Final Previous QuestionDocument8 pagesMBA Finance 1st Semester Final Previous Questionmuhammad shahid ullahNo ratings yet

- Question PaperDocument36 pagesQuestion PaperSenthil Kumar Ganesan0% (1)

- 1725F63BDocument6 pages1725F63Bsoundar rajNo ratings yet

- Question Paper: Bms College of EngineeringDocument2 pagesQuestion Paper: Bms College of EngineeringShivaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument50 pagesThis Paper Is Not To Be Removed From The Examination HallsmilkshakezNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- Question PPRDocument1 pageQuestion PPRshikhagrawalNo ratings yet

- 2019 4th SemDocument19 pages2019 4th Semsauravnagpal309No ratings yet

- L-2/T-l/NAME Date: 09/0812017Document14 pagesL-2/T-l/NAME Date: 09/0812017partho RoyNo ratings yet

- Assignment 1Document2 pagesAssignment 1WINFRED KYALONo ratings yet

- BIBS ED 1st MOCK TEST - SET 2.Document3 pagesBIBS ED 1st MOCK TEST - SET 2.PS FITNESSNo ratings yet

- BIBS ED 1st MOCK TEST - SET 2Document3 pagesBIBS ED 1st MOCK TEST - SET 2PS FITNESSNo ratings yet

- T1502 Management Science & Economics 8.6.13Document2 pagesT1502 Management Science & Economics 8.6.13pramod.bNo ratings yet

- Ibo 06Document6 pagesIbo 06alam2823No ratings yet

- Riskmgt 0 Fin425 Sample Exam3Document2 pagesRiskmgt 0 Fin425 Sample Exam3Ibrahim KhatatbehNo ratings yet

- Mba 1723Document3 pagesMba 1723Saloni AnandNo ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- Kongu Engineering College, Perundurai, Erode - 638 052: M.B.A. Degree ExaminationDocument2 pagesKongu Engineering College, Perundurai, Erode - 638 052: M.B.A. Degree ExaminationNANDHINIPRIYA.GNo ratings yet

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- Business Economics-July 2017 PDFDocument2 pagesBusiness Economics-July 2017 PDFgmNo ratings yet

- 102 Economics (Major-I) Nlujaa 2008Document3 pages102 Economics (Major-I) Nlujaa 2008Sankalp ShandilyaNo ratings yet

- Ibo 06Document7 pagesIbo 06alam2823No ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsSagar KotakNo ratings yet

- R L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent ReDocument71 pagesR L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent Rerakhi962No ratings yet

- CFA630Document15 pagesCFA630Cfa Pankaj KandpalNo ratings yet

- Tutor Marked AssignmentDocument4 pagesTutor Marked AssignmentCSNo ratings yet

- 5012 - Cmse - Nov-2020Document12 pages5012 - Cmse - Nov-2020sunainaknoufal100% (1)

- MS3EF07 Investment Analysis and Portfolio ManagementDocument5 pagesMS3EF07 Investment Analysis and Portfolio ManagementAshutosh ShuklaNo ratings yet

- (WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 1Document6 pages(WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 1diablolcNo ratings yet

- ECDDDocument2 pagesECDDGauravNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4meetwithsanjayNo ratings yet

- Sem V Financial EconomicsDocument3 pagesSem V Financial EconomicsSuvam Roy ChowdhuriNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Economics)Document2 pagesAllama Iqbal Open University, Islamabad: (Department of Economics)murtaza5500No ratings yet

- 17E00312 Investment & Portfolio ManagementDocument4 pages17E00312 Investment & Portfolio ManagementBeedam BalajiNo ratings yet

- Assignment Test 1Document1 pageAssignment Test 1Amrish KumarNo ratings yet

- 761ab - Business Economics23-Mar-23Document2 pages761ab - Business Economics23-Mar-23vijay kumarNo ratings yet

- TYBvoc Equity & Derivatives Market University ExamDocument2 pagesTYBvoc Equity & Derivatives Market University ExamMilind PatilNo ratings yet

- Questions1 CDocument27 pagesQuestions1 Cthomas Ed HorasNo ratings yet

- MODEL I SAPM - 1,2,3 UnitsDocument2 pagesMODEL I SAPM - 1,2,3 UnitsSabha PathyNo ratings yet

- SOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本Document85 pagesSOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本cnmouldplasticNo ratings yet

- 6810 Question Paper Winter 2023Document2 pages6810 Question Paper Winter 2023karanNo ratings yet

- Handout 2-Economics - PAUDocument1 pageHandout 2-Economics - PAUAhmed Rizvan HasanNo ratings yet

- Bcomh Fibtpm Dse3 2021Document4 pagesBcomh Fibtpm Dse3 2021tsyrlwbyeNo ratings yet

- Financial Markets & Institutions Feb.23Document2 pagesFinancial Markets & Institutions Feb.23pratik9365No ratings yet

- BEC 3102 Principles of MicroEconomicsDocument3 pagesBEC 3102 Principles of MicroEconomicsKelvin MagiriNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsarpanmalewarNo ratings yet

- Managerial EconomicDocument6 pagesManagerial EconomicMaddyNo ratings yet

- TY-BFM Question BankDocument17 pagesTY-BFM Question BankManish SolankiNo ratings yet

- CM2ADocument4 pagesCM2AMike KanyataNo ratings yet

- Seat No.: All Questions Are CompulsoryDocument19 pagesSeat No.: All Questions Are CompulsoryNishant PatilNo ratings yet

- Two Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following InstructionsDocument4 pagesTwo Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following Instructions47 sarada pattnayakNo ratings yet

- Derivatives Dealers ModuleDocument9 pagesDerivatives Dealers ModulekedarisettivenkateshNo ratings yet

- Securities Laws and Compliances: Part-ADocument3 pagesSecurities Laws and Compliances: Part-AAishwarya RaghavanNo ratings yet

- Portfolio ManagementDocument4 pagesPortfolio ManagementSoniaNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Suppy PNo ratings yet

- FN1024 ZB - 2019Document7 pagesFN1024 ZB - 2019Ha PhuongNo ratings yet

- 2019 Past PaperDocument7 pages2019 Past Papersidath thiranjayaNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- Two Marks Slip Test For AcctsDocument1 pageTwo Marks Slip Test For AcctskuselvNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- Abstract and Key WordsDocument2 pagesAbstract and Key WordskuselvNo ratings yet

- 1.1. Introduction To Supply Chain and LogisticsDocument13 pages1.1. Introduction To Supply Chain and LogisticskuselvNo ratings yet

- 10 - Appendix-2Document18 pages10 - Appendix-2kuselvNo ratings yet

- 17 - Chapter 7Document37 pages17 - Chapter 7kuselvNo ratings yet

- Chapter 2Document19 pagesChapter 2kuselvNo ratings yet

- Appendix QuestionnaireDocument6 pagesAppendix QuestionnairekuselvNo ratings yet

- PramilaDocument6 pagesPramilakuselvNo ratings yet

- MSC M Van Der Wal PDFDocument102 pagesMSC M Van Der Wal PDFkuselvNo ratings yet

- Assessment of Construction Management Techniques in The Nigeria Construction IndustryDocument55 pagesAssessment of Construction Management Techniques in The Nigeria Construction Industrykuselv0% (1)

- Claudio Ferrari - University of Genova, ItalyDocument19 pagesClaudio Ferrari - University of Genova, ItalykuselvNo ratings yet

- APPENDIXDocument1 pageAPPENDIXkuselvNo ratings yet

- Factors To Consider in ProductDocument1 pageFactors To Consider in ProductkuselvNo ratings yet

- Honda CityDocument1 pageHonda CitykuselvNo ratings yet

Derivatives II

Derivatives II

Uploaded by

kuselv0 ratings0% found this document useful (0 votes)

9 views1 pagederivatives question paper

Original Title

derivatives II

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentderivatives question paper

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageDerivatives II

Derivatives II

Uploaded by

kuselvderivatives question paper

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

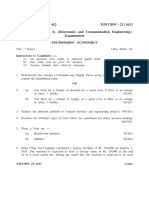

SKR ENGINEERING COLLEGE

DEPARTMENT OF MANAGEMENT STUDIES

Internal assessment-II

BA9261 - DERIVATIVES MANAGEMENT

Max mark: 100 Duration: 180 Min Date: 5.10.2010

Part-A Answer all (10*2=20)

1) Define Hedging.

2) What is option?

3) Define Futures Contract.

4) What is spread?

5) What is call option?

6) What is a currency option?

7) What is exercise price?

8) What is American style and European style of option?

9) What are the two assumptions of B-S model?

10) When is the expiry day for derivative products in NSE?

Part-B Answer all (16*5=80)

11(a) Explain hedging using futures with suitable examples.

(OR)

b) Explain the concept of option in context to: (i) Intrinsic value of option (ii) Time

value of option (iii) In-the-Money (iv) At-the-Money (v) Out-the-Money

12(a) Explain the factors influencing the options pricing.

(OR)

12(b) Discuss the B-S option pricing model in detail.

13(a) Explain the payoff profile of call and put option with an example.

(OR)

13(b) Compare and contrast between forward, futures and option contracts.

14(a) Discuss any four bullish and bearish and neutral option strategies with

examples. (OR)

14(b) Explain the Binomial pricing model with an illustration.

15(a) The stock price of Reliance industries in spot market is Rs 450 and two-month

option contract is of Rs.450. The price of the option is Rs 20 per share. At what price

the option will be at-the-money, In-the-Money and Out-the-Money of the option is

both call as well as put option? (OR)

15(b) Explain the marking to market term used in futures trading and its

mechanism with suitable examples.

You might also like

- 2022be313-5-Au Portfolio AnalysisDocument5 pages2022be313-5-Au Portfolio AnalysisKhawaja HamzaNo ratings yet

- MBA Finance 1st Semester Final Previous QuestionDocument8 pagesMBA Finance 1st Semester Final Previous Questionmuhammad shahid ullahNo ratings yet

- Question PaperDocument36 pagesQuestion PaperSenthil Kumar Ganesan0% (1)

- 1725F63BDocument6 pages1725F63Bsoundar rajNo ratings yet

- Question Paper: Bms College of EngineeringDocument2 pagesQuestion Paper: Bms College of EngineeringShivaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument50 pagesThis Paper Is Not To Be Removed From The Examination HallsmilkshakezNo ratings yet

- CT8 Iai QP 1009Document5 pagesCT8 Iai QP 1009Mike KanyataNo ratings yet

- Question PPRDocument1 pageQuestion PPRshikhagrawalNo ratings yet

- 2019 4th SemDocument19 pages2019 4th Semsauravnagpal309No ratings yet

- L-2/T-l/NAME Date: 09/0812017Document14 pagesL-2/T-l/NAME Date: 09/0812017partho RoyNo ratings yet

- Assignment 1Document2 pagesAssignment 1WINFRED KYALONo ratings yet

- BIBS ED 1st MOCK TEST - SET 2.Document3 pagesBIBS ED 1st MOCK TEST - SET 2.PS FITNESSNo ratings yet

- BIBS ED 1st MOCK TEST - SET 2Document3 pagesBIBS ED 1st MOCK TEST - SET 2PS FITNESSNo ratings yet

- T1502 Management Science & Economics 8.6.13Document2 pagesT1502 Management Science & Economics 8.6.13pramod.bNo ratings yet

- Ibo 06Document6 pagesIbo 06alam2823No ratings yet

- Riskmgt 0 Fin425 Sample Exam3Document2 pagesRiskmgt 0 Fin425 Sample Exam3Ibrahim KhatatbehNo ratings yet

- Mba 1723Document3 pagesMba 1723Saloni AnandNo ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- Kongu Engineering College, Perundurai, Erode - 638 052: M.B.A. Degree ExaminationDocument2 pagesKongu Engineering College, Perundurai, Erode - 638 052: M.B.A. Degree ExaminationNANDHINIPRIYA.GNo ratings yet

- FM423 Practice Exam IDocument8 pagesFM423 Practice Exam IruonanNo ratings yet

- Business Economics-July 2017 PDFDocument2 pagesBusiness Economics-July 2017 PDFgmNo ratings yet

- 102 Economics (Major-I) Nlujaa 2008Document3 pages102 Economics (Major-I) Nlujaa 2008Sankalp ShandilyaNo ratings yet

- Ibo 06Document7 pagesIbo 06alam2823No ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsSagar KotakNo ratings yet

- R L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent ReDocument71 pagesR L F C: Ptudelhi - Vice@yahoo - Co.in Regional Learning & Facilitation Cent Rerakhi962No ratings yet

- CFA630Document15 pagesCFA630Cfa Pankaj KandpalNo ratings yet

- Tutor Marked AssignmentDocument4 pagesTutor Marked AssignmentCSNo ratings yet

- 5012 - Cmse - Nov-2020Document12 pages5012 - Cmse - Nov-2020sunainaknoufal100% (1)

- MS3EF07 Investment Analysis and Portfolio ManagementDocument5 pagesMS3EF07 Investment Analysis and Portfolio ManagementAshutosh ShuklaNo ratings yet

- (WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 1Document6 pages(WWW - Entrance-Exam - Net) - Institute of Actuaries of India-Subject ST6 - Finance and Investment B Sample Paper 1diablolcNo ratings yet

- ECDDDocument2 pagesECDDGauravNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4meetwithsanjayNo ratings yet

- Sem V Financial EconomicsDocument3 pagesSem V Financial EconomicsSuvam Roy ChowdhuriNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Economics)Document2 pagesAllama Iqbal Open University, Islamabad: (Department of Economics)murtaza5500No ratings yet

- 17E00312 Investment & Portfolio ManagementDocument4 pages17E00312 Investment & Portfolio ManagementBeedam BalajiNo ratings yet

- Assignment Test 1Document1 pageAssignment Test 1Amrish KumarNo ratings yet

- 761ab - Business Economics23-Mar-23Document2 pages761ab - Business Economics23-Mar-23vijay kumarNo ratings yet

- TYBvoc Equity & Derivatives Market University ExamDocument2 pagesTYBvoc Equity & Derivatives Market University ExamMilind PatilNo ratings yet

- Questions1 CDocument27 pagesQuestions1 Cthomas Ed HorasNo ratings yet

- MODEL I SAPM - 1,2,3 UnitsDocument2 pagesMODEL I SAPM - 1,2,3 UnitsSabha PathyNo ratings yet

- SOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本Document85 pagesSOA-All-COURSE-8V-Exams-For-QFIC-Fall-2014 - 副本cnmouldplasticNo ratings yet

- 6810 Question Paper Winter 2023Document2 pages6810 Question Paper Winter 2023karanNo ratings yet

- Handout 2-Economics - PAUDocument1 pageHandout 2-Economics - PAUAhmed Rizvan HasanNo ratings yet

- Bcomh Fibtpm Dse3 2021Document4 pagesBcomh Fibtpm Dse3 2021tsyrlwbyeNo ratings yet

- Financial Markets & Institutions Feb.23Document2 pagesFinancial Markets & Institutions Feb.23pratik9365No ratings yet

- BEC 3102 Principles of MicroEconomicsDocument3 pagesBEC 3102 Principles of MicroEconomicsKelvin MagiriNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsarpanmalewarNo ratings yet

- Managerial EconomicDocument6 pagesManagerial EconomicMaddyNo ratings yet

- TY-BFM Question BankDocument17 pagesTY-BFM Question BankManish SolankiNo ratings yet

- CM2ADocument4 pagesCM2AMike KanyataNo ratings yet

- Seat No.: All Questions Are CompulsoryDocument19 pagesSeat No.: All Questions Are CompulsoryNishant PatilNo ratings yet

- Two Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following InstructionsDocument4 pagesTwo Year M. Com. Semester 1 Examination: The Students Are Required To Strictly Adhere To The Following Instructions47 sarada pattnayakNo ratings yet

- Derivatives Dealers ModuleDocument9 pagesDerivatives Dealers ModulekedarisettivenkateshNo ratings yet

- Securities Laws and Compliances: Part-ADocument3 pagesSecurities Laws and Compliances: Part-AAishwarya RaghavanNo ratings yet

- Portfolio ManagementDocument4 pagesPortfolio ManagementSoniaNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Suppy PNo ratings yet

- FN1024 ZB - 2019Document7 pagesFN1024 ZB - 2019Ha PhuongNo ratings yet

- 2019 Past PaperDocument7 pages2019 Past Papersidath thiranjayaNo ratings yet

- Unit IVDocument14 pagesUnit IVkuselvNo ratings yet

- Two Marks Slip Test For AcctsDocument1 pageTwo Marks Slip Test For AcctskuselvNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- Abstract and Key WordsDocument2 pagesAbstract and Key WordskuselvNo ratings yet

- 1.1. Introduction To Supply Chain and LogisticsDocument13 pages1.1. Introduction To Supply Chain and LogisticskuselvNo ratings yet

- 10 - Appendix-2Document18 pages10 - Appendix-2kuselvNo ratings yet

- 17 - Chapter 7Document37 pages17 - Chapter 7kuselvNo ratings yet

- Chapter 2Document19 pagesChapter 2kuselvNo ratings yet

- Appendix QuestionnaireDocument6 pagesAppendix QuestionnairekuselvNo ratings yet

- PramilaDocument6 pagesPramilakuselvNo ratings yet

- MSC M Van Der Wal PDFDocument102 pagesMSC M Van Der Wal PDFkuselvNo ratings yet

- Assessment of Construction Management Techniques in The Nigeria Construction IndustryDocument55 pagesAssessment of Construction Management Techniques in The Nigeria Construction Industrykuselv0% (1)

- Claudio Ferrari - University of Genova, ItalyDocument19 pagesClaudio Ferrari - University of Genova, ItalykuselvNo ratings yet

- APPENDIXDocument1 pageAPPENDIXkuselvNo ratings yet

- Factors To Consider in ProductDocument1 pageFactors To Consider in ProductkuselvNo ratings yet

- Honda CityDocument1 pageHonda CitykuselvNo ratings yet