Professional Documents

Culture Documents

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Uploaded by

d.pagkatoytoyCopyright:

Available Formats

You might also like

- Statement of Purpose SampleDocument39 pagesStatement of Purpose SampleHưng Dương Công76% (51)

- The Professional FlagmanDocument33 pagesThe Professional FlagmanChicago Transit Justice CoalitionNo ratings yet

- Prelim Departmental Exam Reviewer With Answer Key PDFDocument11 pagesPrelim Departmental Exam Reviewer With Answer Key PDFAndrea Marie Calma100% (1)

- Criminal Complaint Us 494 RW Sec. 34 of The Indian Penal code-Drafting-Criminal Template-1096Document3 pagesCriminal Complaint Us 494 RW Sec. 34 of The Indian Penal code-Drafting-Criminal Template-1096jonshon kripakaran100% (3)

- Basic Accounting Reviewer (Corpo)Document30 pagesBasic Accounting Reviewer (Corpo)Maestro Jay71% (7)

- Fabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesDocument17 pagesFabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesIva Milli Ayson100% (3)

- USALI 10th VS 11th EditionDocument7 pagesUSALI 10th VS 11th EditionvictoregomezNo ratings yet

- BSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFDocument14 pagesBSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFAnn Santos100% (1)

- Wrap Up Part 2 - Financial Accounting and ReportingDocument14 pagesWrap Up Part 2 - Financial Accounting and ReportingShaimer Cinto100% (1)

- IC TroubleshootingDocument64 pagesIC TroubleshootingKriti TyagiNo ratings yet

- Outputs of Dairy FarmingDocument29 pagesOutputs of Dairy FarmingRamya RachelNo ratings yet

- Cash and Accrual BasisDocument5 pagesCash and Accrual BasisLeisleiRago100% (1)

- Adjusting ProcessDocument13 pagesAdjusting ProcessEly IseijinNo ratings yet

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- Cpa Review School of The Philippines Manila: Accounting ProcessDocument3 pagesCpa Review School of The Philippines Manila: Accounting ProcessAlliah Mae ArbastoNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. BiliganNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. Biligan0% (1)

- Hand Out#: Far 01 Topic: Accounting Process Classification: TheoriesDocument3 pagesHand Out#: Far 01 Topic: Accounting Process Classification: TheoriesJolaica DiocolanoNo ratings yet

- 6951 Accounting ProcessDocument4 pages6951 Accounting Processjohn paulNo ratings yet

- TestbankDocument122 pagesTestbankJanine Lerum0% (1)

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BDocument6 pagesMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESNo ratings yet

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Acctg 111 - TPDocument4 pagesAcctg 111 - TPElizabeth Espinosa ManilagNo ratings yet

- Midterm 17 18 August 2019 QuestionsDocument12 pagesMidterm 17 18 August 2019 QuestionsMela ZylphireNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument6 pagesPhilippine School of Business Administration: Cpa ReviewYukiNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesDocument11 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesAngelaNo ratings yet

- Theory FarDocument10 pagesTheory FarLhea VillanuevaNo ratings yet

- Basic Accounting Reviewer Corpo PDFDocument30 pagesBasic Accounting Reviewer Corpo PDFanthony lañaNo ratings yet

- De - Fundamentals of AccountingDocument16 pagesDe - Fundamentals of Accountingcamilla100% (1)

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - ACCOUNTS RECEIVABLE QUIZDocument8 pagesACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - ACCOUNTS RECEIVABLE QUIZMarilou Arcillas PanisalesNo ratings yet

- University of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterDocument6 pagesUniversity of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterYu BabylanNo ratings yet

- Midterm Exam - Financial Accounting 3 With QuestionsDocument8 pagesMidterm Exam - Financial Accounting 3 With Questionsjanus lopezNo ratings yet

- Simulated Midterm Exam. Far1 PDFDocument11 pagesSimulated Midterm Exam. Far1 PDFDyosang BomiNo ratings yet

- 6801 - Accounting Process PDFDocument5 pages6801 - Accounting Process PDFSheila Mae PioquintoNo ratings yet

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- 6881 - Accounting ProcessDocument4 pages6881 - Accounting ProcessMaximusNo ratings yet

- ReceivablesDocument5 pagesReceivablesHanns Lexter PadillaNo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- ReviewerDocument43 pagesReviewergnim1520No ratings yet

- 6939 - Cash and Accruals BasisDocument5 pages6939 - Cash and Accruals BasisAljur SalamedaNo ratings yet

- Financial Accounting and Reporting IDocument5 pagesFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Bsa SM 1 1 Set ADocument10 pagesBsa SM 1 1 Set ARicaRhayaMangahasNo ratings yet

- Exercise 1Document3 pagesExercise 1CZARINA COMPLENo ratings yet

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- Cash and AccrualDocument3 pagesCash and AccrualHarvey Dienne Quiambao100% (2)

- BASACC1 Midterm Comprehensive HWDocument5 pagesBASACC1 Midterm Comprehensive HWDufuxwerr WerrNo ratings yet

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- Chaper 15 & 20Document14 pagesChaper 15 & 20ansari.sl01No ratings yet

- Preliminary-Examinations AccountingDocument16 pagesPreliminary-Examinations AccountingIc Sherenne ValeNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: CompletionDocument14 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Completionericacadago100% (1)

- Midterm Mock Exam Questionnaire (With Answers)Document15 pagesMidterm Mock Exam Questionnaire (With Answers)Ella Mae Magbato100% (1)

- GENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableDocument7 pagesGENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableEdison San JuanNo ratings yet

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- Ta WP CebuDocument48 pagesTa WP CebuPatricia ByunNo ratings yet

- ReceivablesDocument7 pagesReceivablesstraw berryNo ratings yet

- (Cpar2016) Far-6181 (Accounting Process)Document3 pages(Cpar2016) Far-6181 (Accounting Process)Irene ArantxaNo ratings yet

- Third Quarter Exam - FABM 1Document4 pagesThird Quarter Exam - FABM 1Raul Soriano Cabanting100% (6)

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- 2nd Tri Midterm Exam v2Document16 pages2nd Tri Midterm Exam v2yelenaNo ratings yet

- Answers With ExplanationDocument10 pagesAnswers With Explanationdebate ddNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- FINAL PREBOAR1Document35 pagesFINAL PREBOAR1d.pagkatoytoyNo ratings yet

- act 6J03_comp1_1stsem05-06Document13 pagesact 6J03_comp1_1stsem05-06d.pagkatoytoyNo ratings yet

- ch 7 answers 09Document5 pagesch 7 answers 09d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4Document8 pagesPfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4d.pagkatoytoyNo ratings yet

- act 6J03_comp2_1stsem05-06Document11 pagesact 6J03_comp2_1stsem05-06d.pagkatoytoyNo ratings yet

- ch 3 answers 09Document9 pagesch 3 answers 09d.pagkatoytoyNo ratings yet

- ch 6 answers 09Document6 pagesch 6 answers 09d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10 and Pfrs 11Document1 pagePfrs 9, Pfrs 10 and Pfrs 11d.pagkatoytoyNo ratings yet

- Pfrs 11, Pfrs 12, Pfrs 13Document6 pagesPfrs 11, Pfrs 12, Pfrs 13d.pagkatoytoyNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Audit of CoE, CB, AB, SES and PPE - SW10Document8 pagesAudit of CoE, CB, AB, SES and PPE - SW10d.pagkatoytoyNo ratings yet

- PAS 28 - Investment in Associate,, Equity Method, Cost Method, DividendsDocument3 pagesPAS 28 - Investment in Associate,, Equity Method, Cost Method, Dividendsd.pagkatoytoyNo ratings yet

- Audit of Financial Statements - SW9Document12 pagesAudit of Financial Statements - SW9d.pagkatoytoyNo ratings yet

- Audit of Intangible AssetDocument3 pagesAudit of Intangible Assetd.pagkatoytoyNo ratings yet

- Group 3 Midterm Case Studies EnronDocument14 pagesGroup 3 Midterm Case Studies EnronWiln Jinelyn NovecioNo ratings yet

- Ede ReportDocument15 pagesEde ReportSaraswathi SudharsanNo ratings yet

- Drug Discovery Complete NotesDocument5 pagesDrug Discovery Complete NotesSadiqa ForensicNo ratings yet

- Alves Doa - Way Intl 102723Document5 pagesAlves Doa - Way Intl 102723michaelgracias700No ratings yet

- Taverna - Georgina HaydenDocument403 pagesTaverna - Georgina Haydenelena8kartsiouliNo ratings yet

- UNIT-III Transmission Line ParametersDocument69 pagesUNIT-III Transmission Line ParametersManish MadhuNo ratings yet

- Pile Cutting / Hacking (Sub-Structure Work)Document2 pagesPile Cutting / Hacking (Sub-Structure Work)Rahmat HariNo ratings yet

- ELECTRICAL MACHINES-II-ELECTRICAL-5th-2021-22Document2 pagesELECTRICAL MACHINES-II-ELECTRICAL-5th-2021-22sameer mohantyNo ratings yet

- Case - The Tao of Timbuk2Document2 pagesCase - The Tao of Timbuk2Saikat Mukherjeee100% (1)

- Lecture 2.2 Merge Sort AlgorithmsDocument59 pagesLecture 2.2 Merge Sort AlgorithmsPablo ChanNo ratings yet

- ITSS - Workshop.Exercise01 PT04Document18 pagesITSS - Workshop.Exercise01 PT04Madhusudhan RNo ratings yet

- Example ReportDocument4 pagesExample ReportFirzanNo ratings yet

- Lab 8Document5 pagesLab 8Ravin BoodhanNo ratings yet

- Zebra Rfid LabelDocument4 pagesZebra Rfid LabeldishaNo ratings yet

- Kore Wa Zombie Desuka Volume 01Document252 pagesKore Wa Zombie Desuka Volume 01randydodson1993No ratings yet

- MKTG 5th Canadian EditionDocument418 pagesMKTG 5th Canadian EditionArturo VeranoNo ratings yet

- Project ReportDocument12 pagesProject ReportSasi DharNo ratings yet

- Metaphor AgerosegelelectroforeseDocument2 pagesMetaphor AgerosegelelectroforeseSuus.veluwenkampNo ratings yet

- La Investigacion en El Iese Research at Iese - CompressDocument27 pagesLa Investigacion en El Iese Research at Iese - CompressSangría PanchitaNo ratings yet

- Microcatchment: NegarimDocument11 pagesMicrocatchment: Negarimhaithamelramlawi7503100% (1)

- The Structure of The Long BoneDocument3 pagesThe Structure of The Long BonesharneNo ratings yet

- SDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsDocument4 pagesSDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsmilandivacNo ratings yet

- Feasibility Study About The Establishment of An Ice Cream Car BusinessDocument9 pagesFeasibility Study About The Establishment of An Ice Cream Car BusinesshebaNo ratings yet

- UNIT-1: Linear Wave ShapingDocument24 pagesUNIT-1: Linear Wave Shapingmahender1987No ratings yet

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Uploaded by

d.pagkatoytoyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Single Enry, Accrual Basis, Cash Basis, Correction of Errors

Uploaded by

d.pagkatoytoyCopyright:

Available Formats

DE LA SALLE LIPA

College of Business, Economics, Accountancy and Management

Accountancy Department

Theory of Accounts – Reviewer

____________________________________________________________________________________________________________

COVERAGE:

Other Topics: Single Entry System

Accrual Basis & Cash Basis of Accounting

Correction of Errors

Direction: Read and select the best answer for the following questions.

___1. Under this method of recording transactions, there is complete set of accounting records, journal, special journal, subsidiary ledger and other

important records. Under this method, transactions are recorded in terms of equal debits and credits.

a. Double-entry system

b. Single-entry system

c. Triple-entry system

d. No-entry system

___2. Under this method of recording transactions, the accounting records are incomplete. At most, these is only cashbook, summarizing receipts

and disbursements,

a. Double-entry system

b. Single-entry system

c. Triple-entry system

d. No-entry system

___3. Under this basis of accounting, income is recognized when earned regardless of collection and expense is recognized when incurred

regardless of payment.

a. Simple basis

b. Modified basis

c. Accrual basis

d. cash basis

___4. Under this basis of accounting, income is recognized when cash is collected regardless of when earned and expense is recognized when paid

regardless of when incurred.

a. Simple basis

b. Modified basis

c. Accrual basis

d. cash basis

___5. Total net income over the life of an entity is

a. Higher under the cash basis that under the accrual basis

b. Lower under the cash basis that under the accrual basis

c. The same under the cash basis as under the accrual basis

d. Not susceptible to measurement

___6. Under the cash basis of accounting

a. Revenue is recorded when earned.

b. Accounts receivable would appear in the statement of financial position.

c. Depreciation of assets having an economic life of more than one year is not recognized.

d. The matching principle is ignored.

___7. Which of the following regarding accrual versus cash basis accounting is true?

a. The FRSc believes that the cash basis is appropriate for some smaller entities, especially those in the service industry.

b. The cash basis is less useful in predicting the time and amounts of future cash flows of an entity.

c. Application of the cash basis results in an income statement reporting revenue and expenses.

d. The cash basis requires a comp0lete set of double entry records.

___8. Under the accrual basis of accounting, cash receipts and disbursements may

a. Precede, coincide with, or follow the period in which revenue and expenses are recognized.

b. Precede or coincide with but never follow the period in which revenue and expenses are recognized.

c. coincide with or follow but never precede the period in which revenue and expenses are recognized.

d. Only coincide with the period in which revenue and expenses are recognized.

DLSL CPA Board Operation – Theory of Accounts Page 1 of 3

___9. As compare to its cash basis net income for the current year, an entity’s accrual basis net income is increased when it

a. Declared a cash dividend in the prior year that is paid in the current year.

b. Wrote off more accounts receivable that it reported as uncollectible accounts expense in the current year.

c. Had lower accrued expenses on December 31 of the current year than on January 1.

d. Sold used equipment for cash at a gain in the current year.

___10. It is a basis of accounting which is a mixture of cash basis and accrual basis where revenue is reported in the year of cash receipts, prepaid

expenses are deferred but accruals are not recognized, expenditures having benefits of more than one year are capitalized as assets and

depreciated.

a. cash basis

b. Accrual basis

c. Modified cash basis

d. Pure cash basis

___11. These are omissions from and misstatements in the financial statements for one or more periods arising from a failure to use or misuse

reliable information.

a. change in accounting policy

b. change in accounting estimate

c. prior period error

d. change in reporting entity

___12. What is the treatment of prior period error?

a. It should be corrected prospectively in the current year profit or loss.

b. It should be corrected retrospectively by restating the beginning retained earnings.

c. It should be ignored.

d. It should be corrected in the statement of cash flows.

___13. Prior period error should be reported in

a. Income statement of the current year

b. Income statement on the year of error

c. Statement of changes in equity of the current year

d. Statement of changes in equity of the year of error

___14. Prior period errors are omissions from and misstatements in the financial statements for one or more periods arising from a failure to use or

misuse of reliable information that:

a. Was available when financial statements for those periods were authorized for issue.

b. could reasonably be expected to have been obtained and taken into accounting in the preparation and presentation of those financial

statements.

c. Either A or B

d. Both A and B

___15. The following shall be disclosed about prior period errors, except

a. The nature o the prior period error.

b. The amount of correction at the beginning of the earliest prior period presented.

c. If retrospective restatement is impracticable for a particular prior period, the circumstances that led to the existence of that condition and

a description of how and from when the error has been corrected.

d. The comparative amount of error to that of competitor.

___16. These are errors which only affect real or permanent accounts.

a. Statement of financial position errors

b. Income statement errors

c. Mixed errors

d. counter-balancing errors

___17. These are errors which only affect nominal or temporary accounts.

a. Statement of financial position errors

b. Income statement errors

c. Mixed errors

d. counter-balancing errors

___18. These are errors which affect both real and nominal accounts.

a. Statement of financial position errors

b. Income statement errors

c. Mixed errors

d. counter-balancing errors

___19. These are errors which when not detected within the subsequent financial in which the errors were committed, are automatically corrected as

natural part of the accounting process.

a. counter-balancing errors

b. noncounterbalancing errors

DLSL CPA Board Operation – Theory of Accounts Page 2 of 3

c. income statement errors

d. Statement of financial position errors

___20. Also called as permanent errors, there errors do not automatically offset in the next accounting reporting period.

a. counter-balancing errors

b. noncounterbalancing errors

c. income statement errors

d. Statement of financial position errors

___21. The following are counterbalancing errors, except

a. Overstatement or understatement of inventory, whether beginning or ending

b. Overstatement or understatement of accruals, whether beginning or ending

c. Overstatement or understatement of prepayments and deferrals, whether beginning or ending

d. Nonrecording of depreciation, amortization and bad debt expense

___22. These are entries that are made in the accounting records to correct an improper treatment of an event, information, or transaction in a prior

period.

a. correcting entry

b. adjusting entry

c. closing entry

d. reversing entry

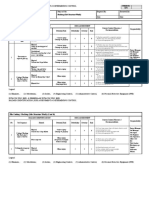

___23. Indicate the effects of the following errors by writing Over for overstated, Under for understated and NE for no

effect.

ERRORS 12/31/2011 12/31/2011 12/31/2011 12/31/2011 12/31/2012 12/31/2012 12/31/2012 12/31/2012

Total Asset Total Capital/ Net income Total Asset Total Capital / Net Income

Liability Retained Liability Retained

Earnings Earnings

Overstated

Inventory on

12/31/2011

Understated

inventory on

12/31/2012

Understated

Prepaid on

12/31/2011

Overstated

Prepaid on

12/31/2012

Overstated

unearned

revenue on

12/31/2011

Understated

unearned

revenue on

12/31/2012

Overstated

accrued

revenue on

12/31/2011

Understated

accrued

revenue on

12/31/2012

Understated

accrued

expense on

12/31/2011

Overstated

accrued

expense on

12/31/2012

Under

depreciation

on year 2011

Over

depreciation

on year 2012

DLSL CPA Board Operation – Theory of Accounts Page 3 of 3

You might also like

- Statement of Purpose SampleDocument39 pagesStatement of Purpose SampleHưng Dương Công76% (51)

- The Professional FlagmanDocument33 pagesThe Professional FlagmanChicago Transit Justice CoalitionNo ratings yet

- Prelim Departmental Exam Reviewer With Answer Key PDFDocument11 pagesPrelim Departmental Exam Reviewer With Answer Key PDFAndrea Marie Calma100% (1)

- Criminal Complaint Us 494 RW Sec. 34 of The Indian Penal code-Drafting-Criminal Template-1096Document3 pagesCriminal Complaint Us 494 RW Sec. 34 of The Indian Penal code-Drafting-Criminal Template-1096jonshon kripakaran100% (3)

- Basic Accounting Reviewer (Corpo)Document30 pagesBasic Accounting Reviewer (Corpo)Maestro Jay71% (7)

- Fabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesDocument17 pagesFabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesIva Milli Ayson100% (3)

- USALI 10th VS 11th EditionDocument7 pagesUSALI 10th VS 11th EditionvictoregomezNo ratings yet

- BSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFDocument14 pagesBSA 1101 Fundamentals of Accounting 1 and 2 Prelim PDFAnn Santos100% (1)

- Wrap Up Part 2 - Financial Accounting and ReportingDocument14 pagesWrap Up Part 2 - Financial Accounting and ReportingShaimer Cinto100% (1)

- IC TroubleshootingDocument64 pagesIC TroubleshootingKriti TyagiNo ratings yet

- Outputs of Dairy FarmingDocument29 pagesOutputs of Dairy FarmingRamya RachelNo ratings yet

- Cash and Accrual BasisDocument5 pagesCash and Accrual BasisLeisleiRago100% (1)

- Adjusting ProcessDocument13 pagesAdjusting ProcessEly IseijinNo ratings yet

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- Cpa Review School of The Philippines Manila: Accounting ProcessDocument3 pagesCpa Review School of The Philippines Manila: Accounting ProcessAlliah Mae ArbastoNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. BiliganNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. Biligan0% (1)

- Hand Out#: Far 01 Topic: Accounting Process Classification: TheoriesDocument3 pagesHand Out#: Far 01 Topic: Accounting Process Classification: TheoriesJolaica DiocolanoNo ratings yet

- 6951 Accounting ProcessDocument4 pages6951 Accounting Processjohn paulNo ratings yet

- TestbankDocument122 pagesTestbankJanine Lerum0% (1)

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BDocument6 pagesMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESNo ratings yet

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Acctg 111 - TPDocument4 pagesAcctg 111 - TPElizabeth Espinosa ManilagNo ratings yet

- Midterm 17 18 August 2019 QuestionsDocument12 pagesMidterm 17 18 August 2019 QuestionsMela ZylphireNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument6 pagesPhilippine School of Business Administration: Cpa ReviewYukiNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesDocument11 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Adjusting Journal EntriesAngelaNo ratings yet

- Theory FarDocument10 pagesTheory FarLhea VillanuevaNo ratings yet

- Basic Accounting Reviewer Corpo PDFDocument30 pagesBasic Accounting Reviewer Corpo PDFanthony lañaNo ratings yet

- De - Fundamentals of AccountingDocument16 pagesDe - Fundamentals of Accountingcamilla100% (1)

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - ACCOUNTS RECEIVABLE QUIZDocument8 pagesACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - ACCOUNTS RECEIVABLE QUIZMarilou Arcillas PanisalesNo ratings yet

- University of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterDocument6 pagesUniversity of ST La Salle College of Business and Accountancy Bacolod City Accounting 1 - HM Midterm Exam AY 2015-2016, 1 SemesterYu BabylanNo ratings yet

- Midterm Exam - Financial Accounting 3 With QuestionsDocument8 pagesMidterm Exam - Financial Accounting 3 With Questionsjanus lopezNo ratings yet

- Simulated Midterm Exam. Far1 PDFDocument11 pagesSimulated Midterm Exam. Far1 PDFDyosang BomiNo ratings yet

- 6801 - Accounting Process PDFDocument5 pages6801 - Accounting Process PDFSheila Mae PioquintoNo ratings yet

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- 6881 - Accounting ProcessDocument4 pages6881 - Accounting ProcessMaximusNo ratings yet

- ReceivablesDocument5 pagesReceivablesHanns Lexter PadillaNo ratings yet

- Q3 Module 1Document15 pagesQ3 Module 1shamrockjusayNo ratings yet

- ReviewerDocument43 pagesReviewergnim1520No ratings yet

- 6939 - Cash and Accruals BasisDocument5 pages6939 - Cash and Accruals BasisAljur SalamedaNo ratings yet

- Financial Accounting and Reporting IDocument5 pagesFinancial Accounting and Reporting IKim Cristian Maaño50% (2)

- Bsa SM 1 1 Set ADocument10 pagesBsa SM 1 1 Set ARicaRhayaMangahasNo ratings yet

- Exercise 1Document3 pagesExercise 1CZARINA COMPLENo ratings yet

- FAR Review Course Pre-Board - FinalDocument17 pagesFAR Review Course Pre-Board - FinalROMAR A. PIGA100% (1)

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- Cash and AccrualDocument3 pagesCash and AccrualHarvey Dienne Quiambao100% (2)

- BASACC1 Midterm Comprehensive HWDocument5 pagesBASACC1 Midterm Comprehensive HWDufuxwerr WerrNo ratings yet

- FAR Review Course Pre-Board - Answer KeyDocument17 pagesFAR Review Course Pre-Board - Answer KeyROMAR A. PIGANo ratings yet

- Chaper 15 & 20Document14 pagesChaper 15 & 20ansari.sl01No ratings yet

- Preliminary-Examinations AccountingDocument16 pagesPreliminary-Examinations AccountingIc Sherenne ValeNo ratings yet

- Fundamentals of Accounting I ACCOUNTING CYCLE: CompletionDocument14 pagesFundamentals of Accounting I ACCOUNTING CYCLE: Completionericacadago100% (1)

- Midterm Mock Exam Questionnaire (With Answers)Document15 pagesMidterm Mock Exam Questionnaire (With Answers)Ella Mae Magbato100% (1)

- GENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableDocument7 pagesGENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableEdison San JuanNo ratings yet

- Exam Type With Answer KeyDocument7 pagesExam Type With Answer KeyAngelieNo ratings yet

- Ta WP CebuDocument48 pagesTa WP CebuPatricia ByunNo ratings yet

- ReceivablesDocument7 pagesReceivablesstraw berryNo ratings yet

- (Cpar2016) Far-6181 (Accounting Process)Document3 pages(Cpar2016) Far-6181 (Accounting Process)Irene ArantxaNo ratings yet

- Third Quarter Exam - FABM 1Document4 pagesThird Quarter Exam - FABM 1Raul Soriano Cabanting100% (6)

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- 2nd Tri Midterm Exam v2Document16 pages2nd Tri Midterm Exam v2yelenaNo ratings yet

- Answers With ExplanationDocument10 pagesAnswers With Explanationdebate ddNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- FINAL PREBOAR1Document35 pagesFINAL PREBOAR1d.pagkatoytoyNo ratings yet

- act 6J03_comp1_1stsem05-06Document13 pagesact 6J03_comp1_1stsem05-06d.pagkatoytoyNo ratings yet

- ch 7 answers 09Document5 pagesch 7 answers 09d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4Document8 pagesPfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4d.pagkatoytoyNo ratings yet

- act 6J03_comp2_1stsem05-06Document11 pagesact 6J03_comp2_1stsem05-06d.pagkatoytoyNo ratings yet

- ch 3 answers 09Document9 pagesch 3 answers 09d.pagkatoytoyNo ratings yet

- ch 6 answers 09Document6 pagesch 6 answers 09d.pagkatoytoyNo ratings yet

- Pfrs 9, Pfrs 10 and Pfrs 11Document1 pagePfrs 9, Pfrs 10 and Pfrs 11d.pagkatoytoyNo ratings yet

- Pfrs 11, Pfrs 12, Pfrs 13Document6 pagesPfrs 11, Pfrs 12, Pfrs 13d.pagkatoytoyNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Audit of CoE, CB, AB, SES and PPE - SW10Document8 pagesAudit of CoE, CB, AB, SES and PPE - SW10d.pagkatoytoyNo ratings yet

- PAS 28 - Investment in Associate,, Equity Method, Cost Method, DividendsDocument3 pagesPAS 28 - Investment in Associate,, Equity Method, Cost Method, Dividendsd.pagkatoytoyNo ratings yet

- Audit of Financial Statements - SW9Document12 pagesAudit of Financial Statements - SW9d.pagkatoytoyNo ratings yet

- Audit of Intangible AssetDocument3 pagesAudit of Intangible Assetd.pagkatoytoyNo ratings yet

- Group 3 Midterm Case Studies EnronDocument14 pagesGroup 3 Midterm Case Studies EnronWiln Jinelyn NovecioNo ratings yet

- Ede ReportDocument15 pagesEde ReportSaraswathi SudharsanNo ratings yet

- Drug Discovery Complete NotesDocument5 pagesDrug Discovery Complete NotesSadiqa ForensicNo ratings yet

- Alves Doa - Way Intl 102723Document5 pagesAlves Doa - Way Intl 102723michaelgracias700No ratings yet

- Taverna - Georgina HaydenDocument403 pagesTaverna - Georgina Haydenelena8kartsiouliNo ratings yet

- UNIT-III Transmission Line ParametersDocument69 pagesUNIT-III Transmission Line ParametersManish MadhuNo ratings yet

- Pile Cutting / Hacking (Sub-Structure Work)Document2 pagesPile Cutting / Hacking (Sub-Structure Work)Rahmat HariNo ratings yet

- ELECTRICAL MACHINES-II-ELECTRICAL-5th-2021-22Document2 pagesELECTRICAL MACHINES-II-ELECTRICAL-5th-2021-22sameer mohantyNo ratings yet

- Case - The Tao of Timbuk2Document2 pagesCase - The Tao of Timbuk2Saikat Mukherjeee100% (1)

- Lecture 2.2 Merge Sort AlgorithmsDocument59 pagesLecture 2.2 Merge Sort AlgorithmsPablo ChanNo ratings yet

- ITSS - Workshop.Exercise01 PT04Document18 pagesITSS - Workshop.Exercise01 PT04Madhusudhan RNo ratings yet

- Example ReportDocument4 pagesExample ReportFirzanNo ratings yet

- Lab 8Document5 pagesLab 8Ravin BoodhanNo ratings yet

- Zebra Rfid LabelDocument4 pagesZebra Rfid LabeldishaNo ratings yet

- Kore Wa Zombie Desuka Volume 01Document252 pagesKore Wa Zombie Desuka Volume 01randydodson1993No ratings yet

- MKTG 5th Canadian EditionDocument418 pagesMKTG 5th Canadian EditionArturo VeranoNo ratings yet

- Project ReportDocument12 pagesProject ReportSasi DharNo ratings yet

- Metaphor AgerosegelelectroforeseDocument2 pagesMetaphor AgerosegelelectroforeseSuus.veluwenkampNo ratings yet

- La Investigacion en El Iese Research at Iese - CompressDocument27 pagesLa Investigacion en El Iese Research at Iese - CompressSangría PanchitaNo ratings yet

- Microcatchment: NegarimDocument11 pagesMicrocatchment: Negarimhaithamelramlawi7503100% (1)

- The Structure of The Long BoneDocument3 pagesThe Structure of The Long BonesharneNo ratings yet

- SDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsDocument4 pagesSDS (Safety Data Sheet) For LRV Vehicle Cleaning and OMSF Facilities Expired SheetsmilandivacNo ratings yet

- Feasibility Study About The Establishment of An Ice Cream Car BusinessDocument9 pagesFeasibility Study About The Establishment of An Ice Cream Car BusinesshebaNo ratings yet

- UNIT-1: Linear Wave ShapingDocument24 pagesUNIT-1: Linear Wave Shapingmahender1987No ratings yet