Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsCommerce 2nd Term

Commerce 2nd Term

Uploaded by

Seyon Hunpegancommerce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Store Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeFrom EverandStore Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeNo ratings yet

- Ejercicio #4 de Llenado de Bill of LadingDocument4 pagesEjercicio #4 de Llenado de Bill of LadingKatherine Vallejos0% (1)

- RM Unit 1Document14 pagesRM Unit 1Hii HloNo ratings yet

- Civics Notes Market Around US: I. Tick The Correct OptionDocument8 pagesCivics Notes Market Around US: I. Tick The Correct OptionSHOOT NROCKSSSNo ratings yet

- 3RD Term SS1 Economics Note For StudentsDocument25 pages3RD Term SS1 Economics Note For Studentsinyamahchinonso100% (1)

- Wa0000.Document17 pagesWa0000.dhruv MehtaNo ratings yet

- Conept of RetailingDocument13 pagesConept of RetailingAniSh ThapaNo ratings yet

- Commerce ss1Document33 pagesCommerce ss1ElfieNo ratings yet

- Retail ManagementDocument19 pagesRetail ManagementAnonymous uxd1ydNo ratings yet

- Distribution ChannelDocument38 pagesDistribution ChannelSomalKantNo ratings yet

- Commerce NotesDocument3 pagesCommerce NotesManya GuptaNo ratings yet

- UNIT 1 Notes For Retail ManagementDocument19 pagesUNIT 1 Notes For Retail Managementmano nandhiniNo ratings yet

- Distribution Channel - BOSDocument11 pagesDistribution Channel - BOSShivam TomarNo ratings yet

- RM-Lecture Notes-Chapter-1Document14 pagesRM-Lecture Notes-Chapter-1hasseteyNo ratings yet

- Channel of Distribution - IIDocument18 pagesChannel of Distribution - IIsinhapalak1002No ratings yet

- Intro To Retailing ModifiedDocument14 pagesIntro To Retailing ModifiedVaishnavi KateelNo ratings yet

- Chapter 9 Marketing IntermediariesDocument15 pagesChapter 9 Marketing Intermediaries102Putri AgielNo ratings yet

- D.M. Academy Classes: Accountancy & Business Studies by - The Legacy GuptaDocument6 pagesD.M. Academy Classes: Accountancy & Business Studies by - The Legacy Guptalegacy guptaNo ratings yet

- Eco Note For Ss2 StudentsDocument21 pagesEco Note For Ss2 Studentsmerezemenike272No ratings yet

- Chapter 4 - Channels of DistributionDocument7 pagesChapter 4 - Channels of DistributionChierhy Jane BayudanNo ratings yet

- Economics 2nd TermDocument27 pagesEconomics 2nd TermDAYONo ratings yet

- Chapter No. 1: ContentDocument101 pagesChapter No. 1: ContentVipul AdateNo ratings yet

- Chap 7Document6 pagesChap 7Jenalyn floresNo ratings yet

- CH 10 INTERNAL TRADEDocument8 pagesCH 10 INTERNAL TRADEA mere potatoNo ratings yet

- Retail Management TutorialDocument4 pagesRetail Management TutorialrshaktivelNo ratings yet

- Midterm ModuleDocument7 pagesMidterm ModuleCantos, Andrea GailNo ratings yet

- Internal Trade 02Document11 pagesInternal Trade 02dp456040No ratings yet

- Introduction To RetailingDocument7 pagesIntroduction To RetailingShabana ShabzzNo ratings yet

- Class Xi SM BST CH-9 Internal TradeDocument7 pagesClass Xi SM BST CH-9 Internal TradeTanisha AggarwalNo ratings yet

- Internal TradeDocument17 pagesInternal TradeUmesh PanchalNo ratings yet

- 11 Business Studies Notes ch10 Internal Trade 02 PDFDocument11 pages11 Business Studies Notes ch10 Internal Trade 02 PDFPetrishiya wiggetNo ratings yet

- I Am Sharing 'Chapter-9 Internal Trade' With You - MergedDocument14 pagesI Am Sharing 'Chapter-9 Internal Trade' With You - MergedPAPA PTRNo ratings yet

- Channels of DistributionDocument15 pagesChannels of DistributionAbhishekNo ratings yet

- Retail Marketing CH 1Document6 pagesRetail Marketing CH 1yulianandualemNo ratings yet

- B S M, Docx Unit-3Document15 pagesB S M, Docx Unit-3Rashmi Ranjan PanigrahiNo ratings yet

- Retail MarketingDocument62 pagesRetail MarketingThambi dhurai.SNo ratings yet

- Ranjit Cadbury ProjectDocument68 pagesRanjit Cadbury ProjectharipratapsinghNo ratings yet

- Retail Management: Prepared by S. SYED MUTHALIFF., M.B.A.,M.Phil.Document18 pagesRetail Management: Prepared by S. SYED MUTHALIFF., M.B.A.,M.Phil.ThilagaNo ratings yet

- Unit 3 Retailing Wholesaler and Integrated Marketing CommunicationDocument7 pagesUnit 3 Retailing Wholesaler and Integrated Marketing CommunicationHariharan EKSNo ratings yet

- Ch3 Components of Marketing ChannelsDocument20 pagesCh3 Components of Marketing ChannelsIra MatarongNo ratings yet

- Marketing Management Chapter No. 4: PlaceDocument55 pagesMarketing Management Chapter No. 4: PlaceAmol RandiveNo ratings yet

- RETAIL MANAGEMENT - by Anant Dhuri (MMS - Marketing Notes) PDFDocument58 pagesRETAIL MANAGEMENT - by Anant Dhuri (MMS - Marketing Notes) PDFAnant Dhuri78% (32)

- Domestic Retailing-The Part of A Nation's Retailing, That Represents The Systems of RetailDocument3 pagesDomestic Retailing-The Part of A Nation's Retailing, That Represents The Systems of RetailPavol PradeepNo ratings yet

- Unit 6 - Organization of Trade 1Document62 pagesUnit 6 - Organization of Trade 1NISHA NANDALNo ratings yet

- Retail Management NEP (OEC)Document92 pagesRetail Management NEP (OEC)khushi P HNo ratings yet

- Class11 BusinessStudies Unit10 NCERT TextBook EnglishEditionDocument26 pagesClass11 BusinessStudies Unit10 NCERT TextBook EnglishEditionSai KrishnaNo ratings yet

- Assignment: of Industrial Marketing IIDocument11 pagesAssignment: of Industrial Marketing IIYukihira SomaNo ratings yet

- Types of Wholesalers-Written ReportDocument12 pagesTypes of Wholesalers-Written ReportRico I. Panganiban Jr.No ratings yet

- Retail MarketingDocument43 pagesRetail MarketingThanveer AhamedNo ratings yet

- An Overview of RetailingDocument5 pagesAn Overview of RetailingAnu AmruthNo ratings yet

- RASCI Qualifications Pack 0105 - Team LeaderDocument32 pagesRASCI Qualifications Pack 0105 - Team LeaderNambram Amul KumarNo ratings yet

- Introduction To Retailing: Module - 1Document84 pagesIntroduction To Retailing: Module - 1Neha GodboleNo ratings yet

- CHP 10Document16 pagesCHP 10Janit BediNo ratings yet

- SSS2 First Term Marketing NotesDocument22 pagesSSS2 First Term Marketing NotesPreciousNo ratings yet

- Types of RetailersDocument46 pagesTypes of RetailersDr. Neelam Shrivastava (SAP Professor)0% (1)

- Retail Marketing - Unit I & 2Document28 pagesRetail Marketing - Unit I & 2Vijay KumarNo ratings yet

- Retail Module1Document29 pagesRetail Module1Shivam TiwariNo ratings yet

- Large Scale RetailingDocument3 pagesLarge Scale Retailingscb_bankersNo ratings yet

- Ch3 DM - Components of Marketing ChannelsDocument8 pagesCh3 DM - Components of Marketing ChannelsJireh CrisheigneNo ratings yet

- Chapter 02 0Document8 pagesChapter 02 0fernando_mart859243No ratings yet

- Marketing Project: Topic: Channel of DistributionDocument38 pagesMarketing Project: Topic: Channel of DistributionNadir SheikhNo ratings yet

- Tax REFERENCES AsdpnewDocument6 pagesTax REFERENCES AsdpnewSeyon HunpeganNo ratings yet

- AppendixDocument2 pagesAppendixSeyon HunpeganNo ratings yet

- Acc 324 L5Document7 pagesAcc 324 L5Seyon HunpeganNo ratings yet

- Lecture Notes On Information System 12.09.20Document4 pagesLecture Notes On Information System 12.09.20Seyon HunpeganNo ratings yet

- Bus 401 Biz DecisionDocument8 pagesBus 401 Biz DecisionSeyon HunpeganNo ratings yet

- AIS-Operating System ACC 409Document2 pagesAIS-Operating System ACC 409Seyon HunpeganNo ratings yet

- PLANNING AND CONTROL SYSTEM-may 2021Document10 pagesPLANNING AND CONTROL SYSTEM-may 2021Seyon HunpeganNo ratings yet

- Bus 401Document21 pagesBus 401Seyon HunpeganNo ratings yet

- Seyon c1Document13 pagesSeyon c1Seyon HunpeganNo ratings yet

- 4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileDocument13 pages4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileSeyon HunpeganNo ratings yet

- FocusStrategiesv1 1Document2 pagesFocusStrategiesv1 1Seyon HunpeganNo ratings yet

- Seyon c1Document46 pagesSeyon c1Seyon HunpeganNo ratings yet

- Fashion E-Commerce in The United StatesDocument87 pagesFashion E-Commerce in The United StatesPratyush BaruaNo ratings yet

- Concept and Introduction To FinanceDocument26 pagesConcept and Introduction To FinanceChicos tacosNo ratings yet

- Basics of Custom DutyDocument3 pagesBasics of Custom DutyKeshav JhaNo ratings yet

- INCOTERMS 2020-Structure, Explanation & LeveragingDocument57 pagesINCOTERMS 2020-Structure, Explanation & Leveragingchanchal maloo100% (1)

- UntitledDocument107 pagesUntitledFULCHAND DANGENo ratings yet

- Case StudyDocument5 pagesCase StudyJerrold Samonte0% (2)

- CLOSING CASE Trade in TextilesDocument4 pagesCLOSING CASE Trade in TextilesHaseeb KhAn NiAziNo ratings yet

- IFM 02 Exchange Rate SystemsDocument53 pagesIFM 02 Exchange Rate SystemsTanu GuptaNo ratings yet

- Mcom Project Sem 4Document85 pagesMcom Project Sem 439 MCOM - AC TINO ANIYANNo ratings yet

- Investment Decisions 99 16th OctDocument99 pagesInvestment Decisions 99 16th OctAshish DhawanNo ratings yet

- Typeform Invoice BTLWMgTYQCPq91RjvDocument1 pageTypeform Invoice BTLWMgTYQCPq91RjvAakash vermaNo ratings yet

- Ôn Cô ThoaDocument12 pagesÔn Cô ThoaNgân KimNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Test Bank 1Document36 pagesAccounting What The Numbers Mean 11th Edition Marshall Test Bank 1amandawilkinsijckmdtxez100% (32)

- TextileDocument32 pagesTextilePrasanna KumarNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran AvulaNo ratings yet

- AR InvoiceDocument2 pagesAR InvoiceVinícius Pires CláudioNo ratings yet

- Book of Accounts and RegistriesDocument7 pagesBook of Accounts and RegistriesRonalyn Torino ParacuelesNo ratings yet

- Company Profile:: OverviewDocument10 pagesCompany Profile:: OverviewHK FreeNo ratings yet

- Commonwealth Bank StatementDocument5 pagesCommonwealth Bank StatementKate YehNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Mohan PudasainiNo ratings yet

- The Money GameDocument13 pagesThe Money GameMuneeb AliNo ratings yet

- Jhazelles Company Profile DraftDocument22 pagesJhazelles Company Profile DraftJauhari UsmanNo ratings yet

- ISE307 173 Major1 SolvedDocument8 pagesISE307 173 Major1 SolvedMmNo ratings yet

- Balance of PaymentDocument27 pagesBalance of PaymentAniket GuptaNo ratings yet

- Variable AbsorptionDocument24 pagesVariable AbsorptionHafizah MuhammadNo ratings yet

- Ci Thai RiceDocument4 pagesCi Thai RiceMakkah Madina riceNo ratings yet

- Reconciliation StatementsDocument26 pagesReconciliation StatementsPetrinaNo ratings yet

- Ca Dipesh Arora 9871140986, 8285040986Document113 pagesCa Dipesh Arora 9871140986, 8285040986dipeshNo ratings yet

- Forex Chaser Study GuideDocument17 pagesForex Chaser Study GuidePaul100% (2)

Commerce 2nd Term

Commerce 2nd Term

Uploaded by

Seyon Hunpegan0 ratings0% found this document useful (0 votes)

2 views11 pagescommerce

Original Title

commerce 2nd term

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcommerce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views11 pagesCommerce 2nd Term

Commerce 2nd Term

Uploaded by

Seyon Hunpegancommerce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 11

WEEK 1 KICKOFF TEST AND CLEANING OF THE COMPOUND

WEEK 2 HOME TRADE

Home Trade involves the exchange (i.e. buying and selling) of goods and services within a

country and sub-divided into wholesale trade and retail trade.

Characteristics of the Retailer/Retail Trade

1) The retailer sells in units or fractions.

2) The retailer stocks and sells a wide variety (range) of goods.

3) They sell directly to the ultimate consumers.

4) They buy in small quantities from the wholesaler or manufacturer.

5) The wares consists of fast selling products, mainly consumer goods.

6) A large number of small shops are involved.

7) They are the final link in the distribution chain

Function of Retailer/Retail Trade

To the manufacturer:

(i) He sells the goods produced by the manufacturer to the final consumer.

Factors to be considered in setting up a retail trade

(ii) He helps in informing the manufacturer about the likes and dislikes of the consumers either

directly or through the wholesalers.

(iii) He gives advice to the manufacturer

To the Wholesaler:

(I) He provides information about consumer needs and changes in market trends to the

wholesaler

(ii) He gives advice to the wholesaler

To the Consumer:

(I) Provision of a variety of goods

(ii) Granting of credit to credit –worthy customers

(iii) Provision of useful information and advice

(iv)Breaking the bulk i.e. selling in smallest quantities (units) to the consumer

(v) Provision of after – sales services e.g. installation, servicing etc.

Small scale retailers.

Itinerant Traders: The common feature of itinerant traders is that they move from place to place

to sell, thereby making goods handy for customers i.e. goods are brought to the consumer’s

doors. Examples of itinerant traders are hawkers, peddlers, gypsies etc.

Mobile shops: These are motor vans or Lorries used as shops with goods well-arranged. They

build up regular customers and are very convenient for consumers in remote areas. They

advertise by music, microphone announcement, public-address system, jingles etc.

Small Store or Single Shops: These are small stores found in front of residential houses or at

shopping complexes. They are conveniently located for customers and are found in both urban

and rural areas

WEEK 3 HOME TRADE

Large scale retailer.

Supermarket: This is a large scale retailing shop offering for sale, principally by self-service,

household goods like groceries, provisions, tinned foods, frozen food, vegetables, fresh fruits etc.

Mail order: This is a form of large scale retailing in which buying and selling is carried out

through the Post Office or through agents. The Mail Order firms contact prospective customers

by mail, receive their orders by mail and make delivery of goods to customers also by mail. It

involves the use of specially prepared catalogues that presents the retailer’s products both

visually and in writing

Modern trend in retailing.

Self-service: This is a method that allows customers to do their shopping in a shop with little or

no assistance from sales attendants. The goods are conspicuously displayed and arranged on the

shelves of shops with price tags. The customers goes about in the shop, examines the good

displayed, compares them, tries them on, where necessary, select those of his choice and gathers

them in a basket portray made available in the shop, The customer finally approaches the

checkout counter where he pays for the goods bought to the cashier, This arrangement saves time

because it avoid bargaining . Self –Service is associated with large scale retailer who have

enough space and the necessary equipment e.g. supermarket, departmental stores, hyper markets

etc.

Branding: This is a general term covering names, design, marks, symbols or description which

may be used by a producer to distinguish his goods from that of other organization. Branded

goods are therefore, goods sold under a refrigerated trade mark or trade name to distinguish one

manufacture products from similar products of other manufacturers. Examples of brand or trade

names are Elephant, Omo, and Ariel for detergents: Pepsodent, Close up, Colgate, MacLean for

toothpaste etc.

WEEK 4 HOME TRADE

Main characteristics of large scale and small scale retailers

Larger scale Features

1. Extensive Inventory: Large scale retailers typically carry a wide range of products, offering

extensive choices to customers in various categories.

2. Sophisticated Supply Chain: They often have sophisticated supply chain management

systems, enabling efficient handling of large volumes of goods from manufacturers to

consumers.

3. Brand Recognition: Large retailers frequently have established brand names and strong

market presence, leading to high brand recognition among consumers.

4. Economies of Scale: These retailers benefit from economies of scale, allowing them to

negotiate better deals with suppliers, reduce per-unit costs, and offer competitive prices to

customers.

5. Advanced Technology: Large-scale retailers leverage advanced technologies for inventory

management, point-of-sale systems, and customer relationship management, enhancing

overall operational efficiency.

Small scale Features

1. Personalized Service: Small retailers often provide more personalized and customer-

centric services due to their close interactions with customers.

2. Localized Focus: They have a localized focus, catering to the specific needs and

preferences of the community or neighborhood where they operate.

3. Flexibility: Small scale retailers can quickly adapt to changes in the market, customer

demands, and trends due to their flexibility and agility in decision-making.

4. Community Integration: Small retailers are often deeply integrated into the community,

fostering strong relationships with local customers and businesses.

5. Owner Involvement: In many cases, the owner is directly involved in the day-to-day

operations, leading to a hands-on approach and a strong connection with customers and

employees.

Reasons why retail business fail

1. Poor Management

2. Inadequate Market Research

3. Insufficient Capital

4. Ineffective Marketing Strategies

5. Inability to Adapt to Market Trends

6. Lack of Differentiation in Products or Services

WEEK 5 HOME TRADE

Whole sale trade: Wholesale trade (wholesaling) involves the buying of goods in large quantities

from the producers or manufacturing and re-selling in small quantities to retailer. Wholesaler is a

trader who purchases goods in large quantities from the manufacturing and sell in small

quantities to the retailers

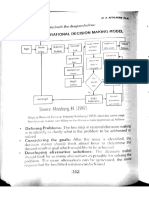

Channel of distribution

The channel of distribution describes the path through which goods moves from the products to

the consumer. The channel of distribution for goods could be any of the following:

Producer – Wholesaler – Retailers – Consumers

Producer – Wholesaler – Consumers

Producer – Retailers – Consumers

Factors to Be Considered before Choosing a Particular Channel Of distribution Of A

Commodity

1. The type of nature of the commodity e.g. whether it is a perishable good or durable

goods.

2. 2 Geographical consideration e.g the location of customers

3. The existing and potential demand for the commodity i.e the extent of demand for the

product.

4. How regular the demand for the product is

5. The number of retail outlets in an area

Function of agents

1. Facilitate Market Expansion

2. Enhance Efficiency in Distribution

3. Provide Market Information

4. Mitigate Risk and Uncertainty

5. Offer Specialized Expertise

6. Strengthen Relationships with Channel Members

WEEK 6 FOREIGN TRADE (INTERNATIONAL TRADE)

Foreign trade (international trade): International trade /foreign trade refers to the exchange of

goods and services across the border of two or more countries by their resident and government.

In other words, it is exchange of goods and services between people and different countries.

Types of foreign trade

1. Bilateral Trade: This takes place when one country agrees to (trade) exchanged goods and

services with another country e.g. Nigeria and Japan

2. Multilateral Trade: This is the buying and selling of goods and services among countries. It

occurs when each nation buys and sells with whatever country it wishes to track with e.g. Nigeria

has multilateral agreement with countries as America, Russia, China, Britain etc.

Advantages and disadvantages

Advantages of International Trade

1. It leads to interdependence among nations because no nation is self –sufficient

2. It is a source of revenue

3. Equitable re-distribution of natural resources

4. Employment opportunity

5. It fosters unity among countries

Disadvantages of International Trade

1. International trade leads to exploitation of poorer countries

2. It leads to dumping of goods

3. Visible imports

4. It does not encourage creativity

Week 7 Foreign trade (international trade)

Barriers of foreign trade

1. Currency differences: Differences in currency is a barrier because it involves two or more

currencies change in exchange rate and non-availability of foreign currencies hinder the flow of

goods.

2. Artificial barrier: Imposition of duties like tariff on imported goods create barrier strict

regulation and tariff limits the extent of foreign trade.

3. Distance: Distance between one country and another and the cost of freight all hinder foreign

trade.

4. Cultural problems: Customs and traditions various countries keep away businessman and have

negative impact on foreign trade.

5. Difference in language: language differences creates communication barrier

Division of foreign trade

Imports: These are goods and services procured and are being transferred from another countries.

a. Invisible Imports: These are services provided by other countries e.g. banking, insurance,

shipping, transportation etc.

b. Visible imports: these are exchange of tangible items from other countries.

Export Trade: Is the selling of a country’s products in abroad i.e. selling of one country product

toother countries. Export includes goods and services to other countries. Export can be visible or

invisible.

Visible Export: are tangible goods sold to other nations. Nigeria exports are agricultural product

and mineral resources. These are sold to overseas without being processed e.g. crude oil, cotton,

palm oil, etc.

Procedures for foreign trade

Market Research: Conduct thorough market research to identify potential opportunities and

challenges in the target foreign market.

Legal Compliance: Ensure compliance with the legal and regulatory requirements of both the

exporting and importing countries.

Product Adaptation: Modify products or services to meet the specific needs and preferences of

the target market.

Determine Incoterms: Clearly define International Commercial Terms (Incoterms) specifying

responsibilities and costs between the buyer and the seller.

Select Mode of Entry: Choose the appropriate mode of entry, whether through exporting,

licensing, joint ventures, or establishing a foreign subsidiary.

Establish Trade Terms: Negotiate and establish trade terms, including price, payment terms, and

delivery schedules, with the foreign buyer.

Documentation: Prepare and complete necessary documentation, including invoices, packing

lists, certificates of origin, and other required paperwork.

Customs Clearance: Ensure compliance with customs regulations and facilitate the smooth

clearance of goods through customs in both the exporting and importing countries.

Shipping and Logistics: Arrange for transportation, select shipping methods, and coordinate

logistics to move goods from the origin to the destination.

Payment Processing: Agree on payment terms and facilitate secure and efficient payment

processing methods, such as letters of credit or online payment systems.

Risk Management: Implement risk mitigation strategies, such as insurance, to protect against

potential risks during transportation or trade transactions.

After-Sales Service: Provide after-sales support to foreign customers, including addressing

inquiries, handling warranty claims, and maintaining customer satisfaction.

Balance of trade and balance of payment

Balance of Trade: The balance of trade is a subset of a country's balance of payments and

represents the difference between the value of a country's exports (goods and services sold to

other countries) and its imports (goods and services purchased from other countries) during a

specific period, usually a year. A positive balance of trade, or a trade surplus, occurs when a

country exports more than it imports. Conversely, a negative balance of trade, or a trade deficit,

occurs when a country imports more than it exports.

Balance of Payments: The balance of payments is a comprehensive record of all economic

transactions between a country and the rest of the world over a specific time period. It is divided

into two main components: the current account and the capital and financial account.

Current Account: This accounts for the trade of goods and services, income received or paid, and

unilateral transfers. A surplus in the current account implies that a country is exporting more

value than it is importing.

Capital and Financial Account: This accounts for capital transfers and the acquisition or disposal

of non-financial and financial assets. A surplus in this account means that a country is receiving

more foreign investment and loans than it is investing abroad.

WEEK 8 FOREIGN TRADE (INTERNATIONAL TRADE)

Tariffs and reasons for the imposition of tariff

A tariff is essentially a tax imposed on imported goods and services. It functions like a price

increase, making foreign products more expensive for domestic consumers. Governments utilize

tariffs for various reasons, which can be broadly categorized into:

a. Protect Domestic Industries: This is the most common reason, aiming to shield new or

struggling industries from cheaper foreign competition

b. Protect Jobs: Tariffs can be seen as a tool to safeguard jobs in specific sectors threatened

by foreign imports. The increased cost of imported goods, coupled with incentives for

domestic production, can lead to more jobs in the protected industries

c. National Security: Certain goods are deemed critical for national security, and

governments might impose tariffs on them to ensure domestic production capacity and

reduce reliance on foreign imports. This could involve sensitive technologies, strategic

resources, or essential military equipment.

d. Bargaining Chip: Tariffs can be used strategically in international trade negotiations. By

threatening or imposing tariffs, a government can put pressure on other countries to make

concessions or change their trade policies that are deemed unfavorable. Address Unfair

Trade Practices: If another country is suspected of engaging in unfair trade practices like

dumping (selling goods below cost) or subsidizing exports, tariffs can be imposed to

counter the advantage they gain. This aims to level the playing field and protect domestic

industries from such practices.

e. Environmental Protection: Tariffs can be used to discourage imports that are seen as

environmentally harmful or produced with unsustainable practices.

Tools for trade restriction and export promotion

1. Tariffs: Imposing taxes on imported goods to make them more expensive and less

competitive in the domestic market.

2. Quotas: Setting limits on the quantity of specific goods that can be imported, restricting

the total volume of imports.

3. Embargoes: Complete bans on the import or export of certain goods to or from specific

countries.

4. Licensing Requirements: Requiring licenses or permits for specific imports or exports,

controlling the entry or exit of certain products.

5. Subsidies and Domestic Support: Providing financial assistance or incentives to domestic

industries to make them more competitive compared to foreign counterparts.

6. Non-Tariff Barriers: Implementing various regulatory measures, such as product

standards, safety regulations, and licensing, to create obstacles for imports.

Tools for Export Promotion

1. Export Credit and Insurance: Offering financial support and insurance to domestic

companies to encourage them to explore foreign markets.

2. Export Subsidies: Providing financial incentives or subsidies to domestic companies to

make their products more competitive in international markets.

3. Trade Agreements: Forming agreements with other countries to reduce trade barriers and

facilitate the flow of goods and services across borders.

4. Export Processing Zones (EPZs): Establishing special economic zones with favorable

conditions for businesses engaged in export-oriented activities.

5. Market Research and Information: Providing support for market research and information

to help businesses identify and exploit export opportunities.

6. Trade Facilitation Measures: Streamlining customs procedures, reducing paperwork, and

improving logistics to make exporting easier and more efficient for businesses.

WEEK 9 FOREIGN TRADE (INTERNATIONAL TRADE)

Custom and Excise authority is an agency charged with the responsibilities of assessing and

collecting revenue due from import and export. It is a revenue collecting organ of the

government. The department of customs and excise under the ministry of internal affairs.

Customs and excise authority collect the following during:

Import duties: they are taxes imposed on surplus goods and services that come from other

countries into a particular country, it is also known as traffic and they belong to what we all

customs duties.

Exporter duties: these are taxes imposed on surplus goods and services of a country that are sent

to other countries.

Excise duties: are taxes imposed on locally made goods. They may be based on either or specific.

Functions of customs and excise

1. Prevention of smuggling: smugglers are prevented from bringing or taking goods in or out of

the country.

2. Collection of data on import and export: it is the duty of custom authority to compile

statistics on import and export.

3. Generation of revenue: the department is also charged with the responsibility of generating

revenue for the government form of import and export duties.

4. Collection of taxes: it collects taxes on imported, exported and locally produced goods.

5. Supervision of bonded warehouse: it monitors and supervises bonded warehouse where

goods are stored until the duties are paid.

Nigeria export promotion council

Export trade: is the selling of goods/service of a country abroad. It includes goods and service

sold to other countries. Nigeria export products are cocoa, crude oil, rubber, cassava, etc.

Export can be visible and invisible. Visible export are tangible goods and invisible are service

rendered abroad.

Functions Of Nigeria Export Promotion Council

1. Export Funding: it provide financial facilities to export e.g. insurance and credit guarantee

schemes.

2. Exporting developing activities: it introduces measure to increase the volume and quality of

goods to be exported

3. Provision of trade information: information is provided through publication of trade journal

and export directives.

4. Training activities: it organizes seminars and workshops on export management for people

engaging in international trade.

5. Publicity function: the council prepares and issues not publication containing information

about activities of the council.

6. Activities relating to export marketing: it gives information about Nigeria exporting

international market and how to improve its marketability.

7. Export document preparation etc.

Nigeria airport authority

he Nigeria Airport Authority is a statutory body or public co – operation charged with the

responsibility of managing, maintaining, running, administrating and controlling all airports e.g.

Murtala Mohammed Airport Ikeja, Aminu Kano Airport Kano etc. are international airports in

Nigeria while Calabar airport are examples of local airports.

Functions of the N.A.A

1. Control of airway: it controls domestic and international airline.

2. Maintenance of all facilities: it provides repairs are maintenance facilities to damaged

aircrafts.

3. Provision of warehouse: the authority provides warehouse for storage of goods and luggage

before loading and off-loading.

4. Housing of security agents: it provides office accommodation for customs, immigration,

police and other agents work at the airport.

5. Revenue collection: the airport authority takes ‘charges of collecting airport taxes from

airlines shop operators in the airport etc.

6. Ensure passenger security: the airport ensures passenger safety by providing security.

Nigeria port authority

Nigeria port authority is organ of federal government charged with the responsibilities for

producing facilities and controlling sea port in a country. They provide facilities at the port to

ensure effective and efficient sea transportation. The facilities are boats, harbors, wharf, trailers,

forklifts etc. Nigeria has seaport in apapa Lagos, port-Harcourt, Warri, calabar, sapele etc.

Functions of Nigeria port authority {NPA}.

1. Provision of facilities: the port provides facilities like graner- berth, fork-lifts and

navigational aids.

2. Maintenance and improvement of ports: the authority is responsible for the improvement of

ports including dredging of channels of the port for easy passage of ship.

3. Provision and maintenance of security: it provides security to monitor movement of ships,

cargos and people within and around the nation’s port

4. The port authority provides office accommodation for officials of immigration customs and

shipping companies that work in the ports.

5. Revenue collection: the ports collects harbour and dock dues,

6. Provision of warehouse: the port provide warehouse where cargoes are stored before they are

loaded and after unloading from vessels.

You might also like

- Store Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeFrom EverandStore Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeNo ratings yet

- Ejercicio #4 de Llenado de Bill of LadingDocument4 pagesEjercicio #4 de Llenado de Bill of LadingKatherine Vallejos0% (1)

- RM Unit 1Document14 pagesRM Unit 1Hii HloNo ratings yet

- Civics Notes Market Around US: I. Tick The Correct OptionDocument8 pagesCivics Notes Market Around US: I. Tick The Correct OptionSHOOT NROCKSSSNo ratings yet

- 3RD Term SS1 Economics Note For StudentsDocument25 pages3RD Term SS1 Economics Note For Studentsinyamahchinonso100% (1)

- Wa0000.Document17 pagesWa0000.dhruv MehtaNo ratings yet

- Conept of RetailingDocument13 pagesConept of RetailingAniSh ThapaNo ratings yet

- Commerce ss1Document33 pagesCommerce ss1ElfieNo ratings yet

- Retail ManagementDocument19 pagesRetail ManagementAnonymous uxd1ydNo ratings yet

- Distribution ChannelDocument38 pagesDistribution ChannelSomalKantNo ratings yet

- Commerce NotesDocument3 pagesCommerce NotesManya GuptaNo ratings yet

- UNIT 1 Notes For Retail ManagementDocument19 pagesUNIT 1 Notes For Retail Managementmano nandhiniNo ratings yet

- Distribution Channel - BOSDocument11 pagesDistribution Channel - BOSShivam TomarNo ratings yet

- RM-Lecture Notes-Chapter-1Document14 pagesRM-Lecture Notes-Chapter-1hasseteyNo ratings yet

- Channel of Distribution - IIDocument18 pagesChannel of Distribution - IIsinhapalak1002No ratings yet

- Intro To Retailing ModifiedDocument14 pagesIntro To Retailing ModifiedVaishnavi KateelNo ratings yet

- Chapter 9 Marketing IntermediariesDocument15 pagesChapter 9 Marketing Intermediaries102Putri AgielNo ratings yet

- D.M. Academy Classes: Accountancy & Business Studies by - The Legacy GuptaDocument6 pagesD.M. Academy Classes: Accountancy & Business Studies by - The Legacy Guptalegacy guptaNo ratings yet

- Eco Note For Ss2 StudentsDocument21 pagesEco Note For Ss2 Studentsmerezemenike272No ratings yet

- Chapter 4 - Channels of DistributionDocument7 pagesChapter 4 - Channels of DistributionChierhy Jane BayudanNo ratings yet

- Economics 2nd TermDocument27 pagesEconomics 2nd TermDAYONo ratings yet

- Chapter No. 1: ContentDocument101 pagesChapter No. 1: ContentVipul AdateNo ratings yet

- Chap 7Document6 pagesChap 7Jenalyn floresNo ratings yet

- CH 10 INTERNAL TRADEDocument8 pagesCH 10 INTERNAL TRADEA mere potatoNo ratings yet

- Retail Management TutorialDocument4 pagesRetail Management TutorialrshaktivelNo ratings yet

- Midterm ModuleDocument7 pagesMidterm ModuleCantos, Andrea GailNo ratings yet

- Internal Trade 02Document11 pagesInternal Trade 02dp456040No ratings yet

- Introduction To RetailingDocument7 pagesIntroduction To RetailingShabana ShabzzNo ratings yet

- Class Xi SM BST CH-9 Internal TradeDocument7 pagesClass Xi SM BST CH-9 Internal TradeTanisha AggarwalNo ratings yet

- Internal TradeDocument17 pagesInternal TradeUmesh PanchalNo ratings yet

- 11 Business Studies Notes ch10 Internal Trade 02 PDFDocument11 pages11 Business Studies Notes ch10 Internal Trade 02 PDFPetrishiya wiggetNo ratings yet

- I Am Sharing 'Chapter-9 Internal Trade' With You - MergedDocument14 pagesI Am Sharing 'Chapter-9 Internal Trade' With You - MergedPAPA PTRNo ratings yet

- Channels of DistributionDocument15 pagesChannels of DistributionAbhishekNo ratings yet

- Retail Marketing CH 1Document6 pagesRetail Marketing CH 1yulianandualemNo ratings yet

- B S M, Docx Unit-3Document15 pagesB S M, Docx Unit-3Rashmi Ranjan PanigrahiNo ratings yet

- Retail MarketingDocument62 pagesRetail MarketingThambi dhurai.SNo ratings yet

- Ranjit Cadbury ProjectDocument68 pagesRanjit Cadbury ProjectharipratapsinghNo ratings yet

- Retail Management: Prepared by S. SYED MUTHALIFF., M.B.A.,M.Phil.Document18 pagesRetail Management: Prepared by S. SYED MUTHALIFF., M.B.A.,M.Phil.ThilagaNo ratings yet

- Unit 3 Retailing Wholesaler and Integrated Marketing CommunicationDocument7 pagesUnit 3 Retailing Wholesaler and Integrated Marketing CommunicationHariharan EKSNo ratings yet

- Ch3 Components of Marketing ChannelsDocument20 pagesCh3 Components of Marketing ChannelsIra MatarongNo ratings yet

- Marketing Management Chapter No. 4: PlaceDocument55 pagesMarketing Management Chapter No. 4: PlaceAmol RandiveNo ratings yet

- RETAIL MANAGEMENT - by Anant Dhuri (MMS - Marketing Notes) PDFDocument58 pagesRETAIL MANAGEMENT - by Anant Dhuri (MMS - Marketing Notes) PDFAnant Dhuri78% (32)

- Domestic Retailing-The Part of A Nation's Retailing, That Represents The Systems of RetailDocument3 pagesDomestic Retailing-The Part of A Nation's Retailing, That Represents The Systems of RetailPavol PradeepNo ratings yet

- Unit 6 - Organization of Trade 1Document62 pagesUnit 6 - Organization of Trade 1NISHA NANDALNo ratings yet

- Retail Management NEP (OEC)Document92 pagesRetail Management NEP (OEC)khushi P HNo ratings yet

- Class11 BusinessStudies Unit10 NCERT TextBook EnglishEditionDocument26 pagesClass11 BusinessStudies Unit10 NCERT TextBook EnglishEditionSai KrishnaNo ratings yet

- Assignment: of Industrial Marketing IIDocument11 pagesAssignment: of Industrial Marketing IIYukihira SomaNo ratings yet

- Types of Wholesalers-Written ReportDocument12 pagesTypes of Wholesalers-Written ReportRico I. Panganiban Jr.No ratings yet

- Retail MarketingDocument43 pagesRetail MarketingThanveer AhamedNo ratings yet

- An Overview of RetailingDocument5 pagesAn Overview of RetailingAnu AmruthNo ratings yet

- RASCI Qualifications Pack 0105 - Team LeaderDocument32 pagesRASCI Qualifications Pack 0105 - Team LeaderNambram Amul KumarNo ratings yet

- Introduction To Retailing: Module - 1Document84 pagesIntroduction To Retailing: Module - 1Neha GodboleNo ratings yet

- CHP 10Document16 pagesCHP 10Janit BediNo ratings yet

- SSS2 First Term Marketing NotesDocument22 pagesSSS2 First Term Marketing NotesPreciousNo ratings yet

- Types of RetailersDocument46 pagesTypes of RetailersDr. Neelam Shrivastava (SAP Professor)0% (1)

- Retail Marketing - Unit I & 2Document28 pagesRetail Marketing - Unit I & 2Vijay KumarNo ratings yet

- Retail Module1Document29 pagesRetail Module1Shivam TiwariNo ratings yet

- Large Scale RetailingDocument3 pagesLarge Scale Retailingscb_bankersNo ratings yet

- Ch3 DM - Components of Marketing ChannelsDocument8 pagesCh3 DM - Components of Marketing ChannelsJireh CrisheigneNo ratings yet

- Chapter 02 0Document8 pagesChapter 02 0fernando_mart859243No ratings yet

- Marketing Project: Topic: Channel of DistributionDocument38 pagesMarketing Project: Topic: Channel of DistributionNadir SheikhNo ratings yet

- Tax REFERENCES AsdpnewDocument6 pagesTax REFERENCES AsdpnewSeyon HunpeganNo ratings yet

- AppendixDocument2 pagesAppendixSeyon HunpeganNo ratings yet

- Acc 324 L5Document7 pagesAcc 324 L5Seyon HunpeganNo ratings yet

- Lecture Notes On Information System 12.09.20Document4 pagesLecture Notes On Information System 12.09.20Seyon HunpeganNo ratings yet

- Bus 401 Biz DecisionDocument8 pagesBus 401 Biz DecisionSeyon HunpeganNo ratings yet

- AIS-Operating System ACC 409Document2 pagesAIS-Operating System ACC 409Seyon HunpeganNo ratings yet

- PLANNING AND CONTROL SYSTEM-may 2021Document10 pagesPLANNING AND CONTROL SYSTEM-may 2021Seyon HunpeganNo ratings yet

- Bus 401Document21 pagesBus 401Seyon HunpeganNo ratings yet

- Seyon c1Document13 pagesSeyon c1Seyon HunpeganNo ratings yet

- 4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileDocument13 pages4 GPFS Reports of 18 Local Governments 2018 Accounts Ojuolape FileSeyon HunpeganNo ratings yet

- FocusStrategiesv1 1Document2 pagesFocusStrategiesv1 1Seyon HunpeganNo ratings yet

- Seyon c1Document46 pagesSeyon c1Seyon HunpeganNo ratings yet

- Fashion E-Commerce in The United StatesDocument87 pagesFashion E-Commerce in The United StatesPratyush BaruaNo ratings yet

- Concept and Introduction To FinanceDocument26 pagesConcept and Introduction To FinanceChicos tacosNo ratings yet

- Basics of Custom DutyDocument3 pagesBasics of Custom DutyKeshav JhaNo ratings yet

- INCOTERMS 2020-Structure, Explanation & LeveragingDocument57 pagesINCOTERMS 2020-Structure, Explanation & Leveragingchanchal maloo100% (1)

- UntitledDocument107 pagesUntitledFULCHAND DANGENo ratings yet

- Case StudyDocument5 pagesCase StudyJerrold Samonte0% (2)

- CLOSING CASE Trade in TextilesDocument4 pagesCLOSING CASE Trade in TextilesHaseeb KhAn NiAziNo ratings yet

- IFM 02 Exchange Rate SystemsDocument53 pagesIFM 02 Exchange Rate SystemsTanu GuptaNo ratings yet

- Mcom Project Sem 4Document85 pagesMcom Project Sem 439 MCOM - AC TINO ANIYANNo ratings yet

- Investment Decisions 99 16th OctDocument99 pagesInvestment Decisions 99 16th OctAshish DhawanNo ratings yet

- Typeform Invoice BTLWMgTYQCPq91RjvDocument1 pageTypeform Invoice BTLWMgTYQCPq91RjvAakash vermaNo ratings yet

- Ôn Cô ThoaDocument12 pagesÔn Cô ThoaNgân KimNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Test Bank 1Document36 pagesAccounting What The Numbers Mean 11th Edition Marshall Test Bank 1amandawilkinsijckmdtxez100% (32)

- TextileDocument32 pagesTextilePrasanna KumarNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran AvulaNo ratings yet

- AR InvoiceDocument2 pagesAR InvoiceVinícius Pires CláudioNo ratings yet

- Book of Accounts and RegistriesDocument7 pagesBook of Accounts and RegistriesRonalyn Torino ParacuelesNo ratings yet

- Company Profile:: OverviewDocument10 pagesCompany Profile:: OverviewHK FreeNo ratings yet

- Commonwealth Bank StatementDocument5 pagesCommonwealth Bank StatementKate YehNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Mohan PudasainiNo ratings yet

- The Money GameDocument13 pagesThe Money GameMuneeb AliNo ratings yet

- Jhazelles Company Profile DraftDocument22 pagesJhazelles Company Profile DraftJauhari UsmanNo ratings yet

- ISE307 173 Major1 SolvedDocument8 pagesISE307 173 Major1 SolvedMmNo ratings yet

- Balance of PaymentDocument27 pagesBalance of PaymentAniket GuptaNo ratings yet

- Variable AbsorptionDocument24 pagesVariable AbsorptionHafizah MuhammadNo ratings yet

- Ci Thai RiceDocument4 pagesCi Thai RiceMakkah Madina riceNo ratings yet

- Reconciliation StatementsDocument26 pagesReconciliation StatementsPetrinaNo ratings yet

- Ca Dipesh Arora 9871140986, 8285040986Document113 pagesCa Dipesh Arora 9871140986, 8285040986dipeshNo ratings yet

- Forex Chaser Study GuideDocument17 pagesForex Chaser Study GuidePaul100% (2)