Professional Documents

Culture Documents

ChallanForm

ChallanForm

Uploaded by

kuldip Singh0 ratings0% found this document useful (0 votes)

7 views1 pageGghs1

Original Title

23050500074332_ChallanForm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGghs1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageChallanForm

ChallanForm

Uploaded by

kuldip SinghGghs1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

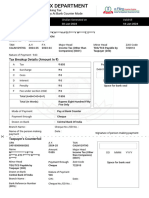

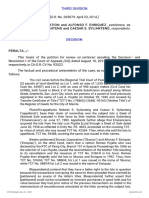

INCOME TAX DEPARTMENT

Challan Form For Making Tax

Payment Through Pay At Bank Counter Mode

CRN Challan Generated on Valid till

23050500074332 05-May-2023 20-May-2023

ITNS No. : 281

Name : G*** ***** **** ***** *****E K***N

e-mail ID :

Mobile No. : 99XXXXXX14

TAN A.Y. F.Y. Major Head Minor Head ZAO Code

JLDG04886A 2024-25 2023-24 Income Tax (Other than TDS/TCS Payable by 722005

Companies) (0021) Taxpayer (200)

Nature of Payment : 92A

Tax Breakup Details (Amount In ₹)

A Tax ₹ 5,000 For Use In Receiving Bank

B Surcharge ₹0 Debit to A/c / Cheque credited on

C Cess ₹0

D Interest ₹0 DD MMM YYYY

E Penalty ₹0 Space for bank seal

F Fee under section 234E ₹0

Total (A+B+C+D+E+F) ₹ 5,000

Total (In Words) Rupees Five Thousand

Only

Mode of Payment : Pay at Bank Counter

Payment through : Cheque

Drawn on Bank : State Bank Of India

Branch Name : Cheque No./DD No. :

Name of the person making Date :

Signature of person making payment

payment :

Taxpayer’s Counterfoil

CRN A.Y. TAN

23050500074332 2024-25 JLDG04886A

Name Amount Major Head

G*** ***** **** ***** *****E ₹ 5,000 Income Tax (Other DD MMM YYYY

K***N than Companies)

(0021)

Minor Head Payment through ZAO Code Space for bank seal

TDS/TCS Payable by Cheque 722005

Taxpayer (200)

Drawn on Bank Nature of Payment : 92A

State Bank Of India

Branch Name : CIN : Date :

Bank Reference Number Cheque No./DD No. :

(BRN) :

You might also like

- Temple-Trust DeedDocument18 pagesTemple-Trust DeedAnil kumar90% (39)

- ChallanFormDocument1 pageChallanFormArun JadhavNo ratings yet

- Tds Vinoba NagarDocument2 pagesTds Vinoba Nagardpmuftp2012No ratings yet

- ChallanFormDocument1 pageChallanFormvinodvadageri367No ratings yet

- Tds Pakka TalabDocument2 pagesTds Pakka Talabdpmuftp2012No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- Tds Challan Radha NagarDocument2 pagesTds Challan Radha Nagardpmuftp2012No ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormsyedaafreen.inNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormConsumer Cooperative Medicine JPCNo ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- ChallanFormDocument1 pageChallanForm15Suman SahaNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- 24062700105033_ChallanFormDocument1 page24062700105033_ChallanFormasinghas72No ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- ChallanFormDocument1 pageChallanFormiemjalaalNo ratings yet

- ChallanFormDocument1 pageChallanFormspmusrinivasaraoNo ratings yet

- ChallanFormDocument1 pageChallanFormhp agencyNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormSHIVAPPA HEBBALNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormtheniqcabcalltaxiNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormnews24into7into365No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormmanjuskkNo ratings yet

- ChallanFormDocument1 pageChallanFormSudhanshu MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormomNo ratings yet

- ChallanFormDocument1 pageChallanFormGaurav SardanaNo ratings yet

- TAX ChallanFormDocument1 pageTAX ChallanFormzaiddparkar1No ratings yet

- ChallanFormDocument1 pageChallanFormACAS LLPNo ratings yet

- ChallanFormDocument1 pageChallanFormAman GargNo ratings yet

- Income Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)Document1 pageIncome Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)DilleshNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- Devleena ESS PROF TX EChallanDocument2 pagesDevleena ESS PROF TX EChallanABHINEET KRISHNA VARSHNEYNo ratings yet

- Declaration3520115189692 - LahoreDocument5 pagesDeclaration3520115189692 - LahoreFarhan AliNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptSqaure PodNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- Form 16a - TDS - Blank 16aDocument1 pageForm 16a - TDS - Blank 16aJayNo ratings yet

- View Tax Payment Details: Reference Number: 29973456Document2 pagesView Tax Payment Details: Reference Number: 29973456arjuntyagi22No ratings yet

- App 7000034 TXN 172882049 TMPLT 995Document2 pagesApp 7000034 TXN 172882049 TMPLT 995tamil maran.uNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- BWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerDocument1 pageBWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerbuyindianlocalsNo ratings yet

- Ongole Municipal Corporation: ReceiptDocument1 pageOngole Municipal Corporation: ReceiptKAMMAPALEM SACHIVALAYAMNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- RoyalDocument2 pagesRoyallc2023asnNo ratings yet

- Property Tax Receipt - 2022Document1 pageProperty Tax Receipt - 2022Bablu DexterNo ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- It 000153098310 2024 03Document1 pageIt 000153098310 2024 03MUHAMMAD TABRAIZNo ratings yet

- It 000156923859 2023 00Document1 pageIt 000156923859 2023 00xabimoviesNo ratings yet

- TCS ChallanReceipt Oct-23Document1 pageTCS ChallanReceipt Oct-23ss_mirganjNo ratings yet

- It 000156777657 2024 06Document1 pageIt 000156777657 2024 06Zeshan SajidNo ratings yet

- Disbursement Voucher: Mode of Payment Payee AddressDocument5 pagesDisbursement Voucher: Mode of Payment Payee AddressDENNIS SAGUIDNo ratings yet

- It 000156777207 2024 06Document1 pageIt 000156777207 2024 06Zeshan SajidNo ratings yet

- Facebook India Online Services Private Limited - Aabcf5150g - q4 - Ay202021 - 16aDocument2 pagesFacebook India Online Services Private Limited - Aabcf5150g - q4 - Ay202021 - 16aJAYDIPVDNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Result 6th GurusarDocument2 pagesResult 6th Gurusarkuldip SinghNo ratings yet

- SikhCelebrations Guru Nanak Dev Jis Gurpurab PresentationDocument12 pagesSikhCelebrations Guru Nanak Dev Jis Gurpurab Presentationkuldip SinghNo ratings yet

- Invoice 17197Document1 pageInvoice 17197kuldip SinghNo ratings yet

- Opioid Withdrawal ClinicalKeyDocument14 pagesOpioid Withdrawal ClinicalKeykuldip SinghNo ratings yet

- Acct Statement - XX5415 - 27012024Document6 pagesAcct Statement - XX5415 - 27012024kuldip SinghNo ratings yet

- Central Board of Secondary Education Secondary School Examination (Class X) - 2017Document2 pagesCentral Board of Secondary Education Secondary School Examination (Class X) - 2017kuldip SinghNo ratings yet

- Affi,: T FGR'Document10 pagesAffi,: T FGR'kuldip SinghNo ratings yet

- Fer.: F : IlffiaaDocument6 pagesFer.: F : Ilffiaakuldip SinghNo ratings yet

- Ranjana RaniDocument21 pagesRanjana Ranikuldip SinghNo ratings yet

- B (FXNK DK: $nfxnkfgek DH KBKBK W (Bked Fog'On (J/H Hhnko) (E/Tb KBDocument6 pagesB (FXNK DK: $nfxnkfgek DH KBKBK W (Bked Fog'On (J/H Hhnko) (E/Tb KBkuldip SinghNo ratings yet

- Meeting Epunjab Session 2017-18Document1 pageMeeting Epunjab Session 2017-18kuldip SinghNo ratings yet

- WFP ADDITIONAL JhsDocument10 pagesWFP ADDITIONAL JhsMC MirandaNo ratings yet

- Teddy Te - S Forms BookDocument77 pagesTeddy Te - S Forms BookCamille AngelicaNo ratings yet

- Department Order No.2021-007Document60 pagesDepartment Order No.2021-007EDH100% (1)

- Assault As TortDocument8 pagesAssault As TortAbhijit PatilNo ratings yet

- Internship Report FinalDocument85 pagesInternship Report FinalDevashish TiwariNo ratings yet

- Pascua v. Court of AppealsDocument12 pagesPascua v. Court of AppealsRea Rose TampusNo ratings yet

- 1.nationality of CorporationDocument10 pages1.nationality of CorporationMark John Borreros CabanNo ratings yet

- causelistALL2021 10 25Document129 pagescauselistALL2021 10 25Aksharva HomesNo ratings yet

- Tamil Nadu Public Service Commission Scheme and Syllabus Combined Civil Services Examination-Iv (GROUP-IV and VAO)Document13 pagesTamil Nadu Public Service Commission Scheme and Syllabus Combined Civil Services Examination-Iv (GROUP-IV and VAO)R. Ramya KrishnanNo ratings yet

- Spec Pro Case DoctrinesDocument4 pagesSpec Pro Case DoctrinesRalph Christian UsonNo ratings yet

- Code of Civil Procedure Suits of Civil NatureDocument15 pagesCode of Civil Procedure Suits of Civil NatureJitesh JadhavNo ratings yet

- 11 Philippine Asset Growth Two, Inc. v. Fastech Synergy Philippines, IncDocument31 pages11 Philippine Asset Growth Two, Inc. v. Fastech Synergy Philippines, Inc149890No ratings yet

- 03 Estate of Hemady v. Luzon SuretyDocument2 pages03 Estate of Hemady v. Luzon SuretyNN DDLNo ratings yet

- Final - TariffOrderUPStateDISOCMsFY2021 22 (29 07 2021) DigitallySigned pdf729202113115PMDocument627 pagesFinal - TariffOrderUPStateDISOCMsFY2021 22 (29 07 2021) DigitallySigned pdf729202113115PMDirector Distribution UPPCLNo ratings yet

- 304-B BAIL APPLICATION Neeraj Srivastava Moti LalDocument14 pages304-B BAIL APPLICATION Neeraj Srivastava Moti LalNeeraj kumar SrivastavaNo ratings yet

- Dissertation Topics On Immigration LawDocument8 pagesDissertation Topics On Immigration LawCustomPapersSingapore100% (1)

- Chapter 1: Basic Concepts of CyberlawDocument15 pagesChapter 1: Basic Concepts of CyberlawTong Kai QianNo ratings yet

- Jefferson Parish Sheriff LegalsDocument3 pagesJefferson Parish Sheriff Legalstheadvocate.comNo ratings yet

- 21 Tala Realty v. Banco FilipinoDocument1 page21 Tala Realty v. Banco FilipinoMona Liza Sulla PerezNo ratings yet

- Document 27Document1 pageDocument 27catnethameedaNo ratings yet

- Revised Draft Agreement For Service - MDR (29.01.2022)Document8 pagesRevised Draft Agreement For Service - MDR (29.01.2022)Saurav yadavNo ratings yet

- Affidavit of Site InspectionDocument3 pagesAffidavit of Site InspectionArjelyNo ratings yet

- Petitioners Vs Vs Respondents: Third DivisionDocument11 pagesPetitioners Vs Vs Respondents: Third DivisionMilane Anne CunananNo ratings yet

- Domestic and International Franchising, Master Franchising, and Regulation of Franchise Agreements in India: OverviewDocument30 pagesDomestic and International Franchising, Master Franchising, and Regulation of Franchise Agreements in India: Overviewabhinav jainNo ratings yet

- Batiquin vs. Court of Appeals G.R. No. 118231. July 5, 1996 FULL TEXTDocument4 pagesBatiquin vs. Court of Appeals G.R. No. 118231. July 5, 1996 FULL TEXTJeng PionNo ratings yet

- Jurisprudence (Personality)Document16 pagesJurisprudence (Personality)Madan JhaNo ratings yet

- Application FormDocument3 pagesApplication FormMangesh JoshiNo ratings yet

- Second Visit of Enhanced Monitoring of Police Overall Wellness (Empow) in Ilocos Sur PpoDocument10 pagesSecond Visit of Enhanced Monitoring of Police Overall Wellness (Empow) in Ilocos Sur PpoMyleen Escobar-CubarNo ratings yet

- Compulsory Land Acquisition by Local Government Authorities in Tanzania - Policy and PracticeDocument71 pagesCompulsory Land Acquisition by Local Government Authorities in Tanzania - Policy and PracticeCHARLES MARERE KITALYANo ratings yet