Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsShort Term Financial Planning

Short Term Financial Planning

Uploaded by

slunibha00Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Working Capital ManagementDocument7 pagesWorking Capital ManagementLumingNo ratings yet

- MIDTERM - LESSON 2 - Classifications of CreditDocument4 pagesMIDTERM - LESSON 2 - Classifications of CreditJc Quismundo63% (8)

- PayPal Merchant Account Details in 2021Document4 pagesPayPal Merchant Account Details in 2021shivam SinghNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewSurya SpadikamNo ratings yet

- Principles of Working Capital ManagementDocument21 pagesPrinciples of Working Capital ManagementNabinSundar Nayak100% (1)

- Lecture33-33 - 19401 - Working Capital ManagementDocument13 pagesLecture33-33 - 19401 - Working Capital Managementmootu2019No ratings yet

- Chapter 3 Planning For Working CapitalDocument5 pagesChapter 3 Planning For Working CapitalSantosh YadavNo ratings yet

- Operating and Cash Conversion CyclesDocument4 pagesOperating and Cash Conversion CyclesChristoper SalvinoNo ratings yet

- CHAPTER 22 Working Capital ManagementDocument25 pagesCHAPTER 22 Working Capital Managementlinda zyongweNo ratings yet

- Principles of Working CapitalDocument24 pagesPrinciples of Working CapitalAnuj VyasNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital Management9897856218No ratings yet

- CH - 27 - Working Capital ManagementDocument28 pagesCH - 27 - Working Capital ManagementGohil HiralNo ratings yet

- PAN African E-Network Project: Working Capital ManagementDocument101 pagesPAN African E-Network Project: Working Capital ManagementEng Abdulkadir MahamedNo ratings yet

- Principles of Working Capital ManagementDocument23 pagesPrinciples of Working Capital ManagementThiru MuruganNo ratings yet

- Working Capital Management: Dr. Ajay Kumar ChauhanDocument21 pagesWorking Capital Management: Dr. Ajay Kumar ChauhanAmit JhaNo ratings yet

- Chapte R: Principles of Working Capital ManagementDocument24 pagesChapte R: Principles of Working Capital Managementmylyf12No ratings yet

- Unit V: Working Capital ManagementDocument28 pagesUnit V: Working Capital ManagementDevyansh GuptaNo ratings yet

- Module - 4: Principles of Working Capital ManagementDocument15 pagesModule - 4: Principles of Working Capital ManagementChander KumarNo ratings yet

- Principles of Working Capital ManagementDocument24 pagesPrinciples of Working Capital ManagementdevrajkinjalNo ratings yet

- Working Capital Management 2Document78 pagesWorking Capital Management 2Roopan DoluiNo ratings yet

- Working Capital Management of L&TDocument18 pagesWorking Capital Management of L&TVishakh Nag100% (1)

- Chapter 9 10Document17 pagesChapter 9 10ainezerialc ngogupNo ratings yet

- Week1 CCCDocument2 pagesWeek1 CCCSelin AkbabaNo ratings yet

- Principles of Working Capital ManagementDocument63 pagesPrinciples of Working Capital ManagementPavan Koundinya100% (2)

- 4 Working Capital MGTDocument76 pages4 Working Capital MGTAnkita SharmaNo ratings yet

- PK14 NotesDocument22 pagesPK14 NotesContessa PetriniNo ratings yet

- Working CapitalDocument17 pagesWorking CapitalHanuman PrasadNo ratings yet

- 1) Cash Conversion CycleDocument2 pages1) Cash Conversion CyclesaramumtazNo ratings yet

- CMF FormulaDocument1 pageCMF FormulaElexie RollonNo ratings yet

- Working Capital ManagementDocument20 pagesWorking Capital ManagementHaardik GandhiNo ratings yet

- Unit - 5 (Working Capital)Document36 pagesUnit - 5 (Working Capital)DarsNo ratings yet

- WC MGMTDocument34 pagesWC MGMTVikas GargNo ratings yet

- Chapter 6Document59 pagesChapter 6getahunsurafel1No ratings yet

- Chapter 1 Working Capital ManagementDocument130 pagesChapter 1 Working Capital Managementmanthq21404caNo ratings yet

- Working Capital ManagementDocument26 pagesWorking Capital ManagementAshutosh GhadaiNo ratings yet

- FinMan-11 25Document92 pagesFinMan-11 25Jessa GalbadorNo ratings yet

- Working Capital ManagementDocument36 pagesWorking Capital ManagementVeeresh Madival VmNo ratings yet

- Working Capital ManageentDocument31 pagesWorking Capital ManageentNikhil ChopraNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- 82 Working Capital ManagementDocument25 pages82 Working Capital ManagementPrashant SharmaNo ratings yet

- Unit Two: Managing Cash and Marketable SecuritiesDocument31 pagesUnit Two: Managing Cash and Marketable SecuritiesmeseleNo ratings yet

- Businessfinance12 q3 Mod4 FINAL PDFDocument13 pagesBusinessfinance12 q3 Mod4 FINAL PDFJoyce Anne ManzanilloNo ratings yet

- WORKING CAPITAL ManagementDocument22 pagesWORKING CAPITAL ManagementPrajwal BhattNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementRiannezel A. NavidadNo ratings yet

- 2,,working Capital ManagementDocument19 pages2,,working Capital ManagementKelvin mwaiNo ratings yet

- FMP Lecture - Working CapitalDocument31 pagesFMP Lecture - Working CapitalFatima ZehraNo ratings yet

- Master in Business Administration Mba 308 - Financial ManagementDocument7 pagesMaster in Business Administration Mba 308 - Financial ManagementJhaydiel JacutanNo ratings yet

- Comparative Financial AnalysisDocument36 pagesComparative Financial AnalysisNIKNISHNo ratings yet

- FIN701 Finance: DIO (Average Inventory ÷ Cost of Goods Sold) X 365Document24 pagesFIN701 Finance: DIO (Average Inventory ÷ Cost of Goods Sold) X 365ankita chauhanNo ratings yet

- FM Midterm Chapter4Document13 pagesFM Midterm Chapter4Mayet RoseteNo ratings yet

- Management Advisory Services Working Capital ManagementDocument4 pagesManagement Advisory Services Working Capital ManagementAlexandra Nicole IsaacNo ratings yet

- Working Capital Management NOTESDocument10 pagesWorking Capital Management NOTESvalentine mutungaNo ratings yet

- Cash and Marketable Securities ManagementDocument5 pagesCash and Marketable Securities ManagementJack HererNo ratings yet

- Working Capital ManagementDocument66 pagesWorking Capital ManagementvaishalikatkadeNo ratings yet

- Working Capital ManagementDocument60 pagesWorking Capital ManagementLay TekchhayNo ratings yet

- Chapter 10Document30 pagesChapter 10Nowshad AyubNo ratings yet

- 2A Unit 6 Working Capital SlidesDocument104 pages2A Unit 6 Working Capital SlidesZiphozonkeNo ratings yet

- Working Capital ManagementDocument44 pagesWorking Capital ManagementPhaniraj Lenkalapally100% (1)

- Session 6 FINANCIAL PLANNING Working Capital ManagementDocument44 pagesSession 6 FINANCIAL PLANNING Working Capital ManagementXia AlliaNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Menu InformationDocument2 pagesMenu Informationslunibha00No ratings yet

- Cover LetterDocument1 pageCover Letterslunibha00No ratings yet

- Performance Management PolicyDocument2 pagesPerformance Management Policyslunibha00No ratings yet

- Assignment 3 Part 1Document1 pageAssignment 3 Part 1slunibha00No ratings yet

- Cover LtterDocument1 pageCover Ltterslunibha00No ratings yet

- Sop Nishant CheetriDocument5 pagesSop Nishant Cheetrislunibha00No ratings yet

- Dear University Admissions CommitteeDocument2 pagesDear University Admissions Committeeslunibha00No ratings yet

- Scholarship Reference LetterDocument1 pageScholarship Reference Letterslunibha00No ratings yet

- BB SMC-1Document25 pagesBB SMC-1Suleman Saleh88% (16)

- Unit 2 MFRBDocument31 pagesUnit 2 MFRBSweety TuladharNo ratings yet

- Chapter 3: Financial Statement Analysis and Financial ModelsDocument33 pagesChapter 3: Financial Statement Analysis and Financial ModelsKamrul HasanNo ratings yet

- 2014 07 17 Base ProspectusDocument126 pages2014 07 17 Base ProspectusVipin VipinNo ratings yet

- Easypaisa Money Transfer To Any Mobile NumberDocument2 pagesEasypaisa Money Transfer To Any Mobile NumberBryan WalkerNo ratings yet

- ACC 3501: Advanced Group AccountingDocument8 pagesACC 3501: Advanced Group AccountingatikahNo ratings yet

- MEC Activities TimelineDocument13 pagesMEC Activities TimelineFranz Xavier GarciaNo ratings yet

- E TicketsDocument4 pagesE TicketsPayroll TeamNo ratings yet

- Alchemist Jan 2010Document24 pagesAlchemist Jan 2010rsaittreyaNo ratings yet

- Banking LawDocument24 pagesBanking LawRaja SoodNo ratings yet

- CFA Level I 权益知识点汇总: 1.1 Fulfill different entities' requirementsDocument26 pagesCFA Level I 权益知识点汇总: 1.1 Fulfill different entities' requirementsIves LeeNo ratings yet

- General Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionDocument7 pagesGeneral Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionFozle Rabby 182-11-5893No ratings yet

- Spring 2009 Mgt201 3 VuabidDocument5 pagesSpring 2009 Mgt201 3 Vuabidsaeedsjaan100% (3)

- Kajal Sip 1Document48 pagesKajal Sip 1Kajal NagraleNo ratings yet

- Fmi S14Document66 pagesFmi S14Arpit JainNo ratings yet

- Invoice: Anugerah Makmur Tour and TravelDocument1 pageInvoice: Anugerah Makmur Tour and TravelArwin BacharNo ratings yet

- AccountingDocument10 pagesAccountingRuffa Mae CabangunayNo ratings yet

- Brown and Yellow Scrapbook Brainstorm PresentationDocument31 pagesBrown and Yellow Scrapbook Brainstorm PresentationReanne GuintoNo ratings yet

- 05112019193330stmbl45qgoend7fz26 Estatement 102019 2203Document10 pages05112019193330stmbl45qgoend7fz26 Estatement 102019 2203Manoj EmmidesettyNo ratings yet

- Finaco1 Module 2 AssignmentDocument10 pagesFinaco1 Module 2 AssignmentbLaXe AssassinNo ratings yet

- Chapter 6 Special Situations - ModuleDocument3 pagesChapter 6 Special Situations - ModuleJoannah maeNo ratings yet

- Summary of Accounts: Contacting UsDocument3 pagesSummary of Accounts: Contacting Ussiva AwaraNo ratings yet

- Chapter 2 RevisedDocument16 pagesChapter 2 RevisedDante M Suarez Jr.No ratings yet

- Chapter 13Document30 pagesChapter 13REEMA BNo ratings yet

- Intermediate Accounting 1 - MODULE 8: Content StandardsDocument4 pagesIntermediate Accounting 1 - MODULE 8: Content StandardsGee-Anne GonzalesNo ratings yet

- Past Due Rent Payment PlanDocument3 pagesPast Due Rent Payment PlanRia KudoNo ratings yet

- Corporate Banking 101Document55 pagesCorporate Banking 101MuskanDodejaNo ratings yet

- Current Assets Current LiabilitiesDocument6 pagesCurrent Assets Current LiabilitiesneetaNo ratings yet

Short Term Financial Planning

Short Term Financial Planning

Uploaded by

slunibha000 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

short-term-financial-planning

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesShort Term Financial Planning

Short Term Financial Planning

Uploaded by

slunibha00Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

1 Concept of short term financial management

Short term financial management covers all decisions of an

organization involving cash flows in the short run with emphasis on the

management of investment in current assets and their financing. It

focuses on coordinated control of the firms CA and CL.

2. Concept of Net Working Capital (NWC)

NWC is the difference between the firms CA and CL.

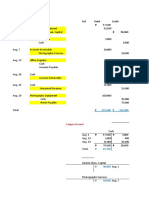

3. The operating cycle and cash cycle

The time duration required to convert raw materials into finished goods

and hen realize cash by selling them is called operating cycle. Or

working capital cycle.

Operating cycle= ICP+RCP (days)

Where, ICP= inventory conversion period [ the length of time required

for conversion of raw materials into finished goods and sales]=

days∈ year

inventory

cost of goods sold per day

OR Inventory

turn [ITR=COGS÷Avg inventory]

ratio

RCP= receivable conversion period[also called days sales outstanding

(DSO) or average collection period(ACP) and it is the length of time

required for the collection of accounts receivable from credit customers

average receivables

after products have been sold off.= RCP= credit sales per day =OR=

days ∈ year

turn [RTR=credit sales ÷ account receivable]

receivable

ratio

4. Cash conversion cycle (CCC) it represents the net time intervals in

days between actual cash expenditure of the firm and ultimate recovery

of cash.

CCC= ICP+RCP-PDP where,

PDP= payable deferral period=the average length of time required for

average payable

payment of credit purchases and accruals. = PDP= cost of goods sold per day

account payable

OR credit purchase per day

5. Shortening the Cash Conversion Cycle( CCC)

By reducing inventory conversion period (ICP) resulted from

quick conversion of raw materials and quick sale of finished

goods.

By reducing receivable conversion period (RCP) resulted from

speeding up the collections.

By increasing the payable deferral period (PDP) resulted from

slowing down the payments.

6. Calculation of amount of financing to support CCC

Amount of required financing= daily cash required or investment or

COGS per day × CCC

Or = daily investment in operating cycle ×CCC

COGS∨sales

7. Investment in account receivables= 360

× RCP

COGS∨sales yearly (qtyxcostxdays∈ year )

8. Working capital turnover = working capital financing

You might also like

- Working Capital ManagementDocument7 pagesWorking Capital ManagementLumingNo ratings yet

- MIDTERM - LESSON 2 - Classifications of CreditDocument4 pagesMIDTERM - LESSON 2 - Classifications of CreditJc Quismundo63% (8)

- PayPal Merchant Account Details in 2021Document4 pagesPayPal Merchant Account Details in 2021shivam SinghNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewSurya SpadikamNo ratings yet

- Principles of Working Capital ManagementDocument21 pagesPrinciples of Working Capital ManagementNabinSundar Nayak100% (1)

- Lecture33-33 - 19401 - Working Capital ManagementDocument13 pagesLecture33-33 - 19401 - Working Capital Managementmootu2019No ratings yet

- Chapter 3 Planning For Working CapitalDocument5 pagesChapter 3 Planning For Working CapitalSantosh YadavNo ratings yet

- Operating and Cash Conversion CyclesDocument4 pagesOperating and Cash Conversion CyclesChristoper SalvinoNo ratings yet

- CHAPTER 22 Working Capital ManagementDocument25 pagesCHAPTER 22 Working Capital Managementlinda zyongweNo ratings yet

- Principles of Working CapitalDocument24 pagesPrinciples of Working CapitalAnuj VyasNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital Management9897856218No ratings yet

- CH - 27 - Working Capital ManagementDocument28 pagesCH - 27 - Working Capital ManagementGohil HiralNo ratings yet

- PAN African E-Network Project: Working Capital ManagementDocument101 pagesPAN African E-Network Project: Working Capital ManagementEng Abdulkadir MahamedNo ratings yet

- Principles of Working Capital ManagementDocument23 pagesPrinciples of Working Capital ManagementThiru MuruganNo ratings yet

- Working Capital Management: Dr. Ajay Kumar ChauhanDocument21 pagesWorking Capital Management: Dr. Ajay Kumar ChauhanAmit JhaNo ratings yet

- Chapte R: Principles of Working Capital ManagementDocument24 pagesChapte R: Principles of Working Capital Managementmylyf12No ratings yet

- Unit V: Working Capital ManagementDocument28 pagesUnit V: Working Capital ManagementDevyansh GuptaNo ratings yet

- Module - 4: Principles of Working Capital ManagementDocument15 pagesModule - 4: Principles of Working Capital ManagementChander KumarNo ratings yet

- Principles of Working Capital ManagementDocument24 pagesPrinciples of Working Capital ManagementdevrajkinjalNo ratings yet

- Working Capital Management 2Document78 pagesWorking Capital Management 2Roopan DoluiNo ratings yet

- Working Capital Management of L&TDocument18 pagesWorking Capital Management of L&TVishakh Nag100% (1)

- Chapter 9 10Document17 pagesChapter 9 10ainezerialc ngogupNo ratings yet

- Week1 CCCDocument2 pagesWeek1 CCCSelin AkbabaNo ratings yet

- Principles of Working Capital ManagementDocument63 pagesPrinciples of Working Capital ManagementPavan Koundinya100% (2)

- 4 Working Capital MGTDocument76 pages4 Working Capital MGTAnkita SharmaNo ratings yet

- PK14 NotesDocument22 pagesPK14 NotesContessa PetriniNo ratings yet

- Working CapitalDocument17 pagesWorking CapitalHanuman PrasadNo ratings yet

- 1) Cash Conversion CycleDocument2 pages1) Cash Conversion CyclesaramumtazNo ratings yet

- CMF FormulaDocument1 pageCMF FormulaElexie RollonNo ratings yet

- Working Capital ManagementDocument20 pagesWorking Capital ManagementHaardik GandhiNo ratings yet

- Unit - 5 (Working Capital)Document36 pagesUnit - 5 (Working Capital)DarsNo ratings yet

- WC MGMTDocument34 pagesWC MGMTVikas GargNo ratings yet

- Chapter 6Document59 pagesChapter 6getahunsurafel1No ratings yet

- Chapter 1 Working Capital ManagementDocument130 pagesChapter 1 Working Capital Managementmanthq21404caNo ratings yet

- Working Capital ManagementDocument26 pagesWorking Capital ManagementAshutosh GhadaiNo ratings yet

- FinMan-11 25Document92 pagesFinMan-11 25Jessa GalbadorNo ratings yet

- Working Capital ManagementDocument36 pagesWorking Capital ManagementVeeresh Madival VmNo ratings yet

- Working Capital ManageentDocument31 pagesWorking Capital ManageentNikhil ChopraNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- 82 Working Capital ManagementDocument25 pages82 Working Capital ManagementPrashant SharmaNo ratings yet

- Unit Two: Managing Cash and Marketable SecuritiesDocument31 pagesUnit Two: Managing Cash and Marketable SecuritiesmeseleNo ratings yet

- Businessfinance12 q3 Mod4 FINAL PDFDocument13 pagesBusinessfinance12 q3 Mod4 FINAL PDFJoyce Anne ManzanilloNo ratings yet

- WORKING CAPITAL ManagementDocument22 pagesWORKING CAPITAL ManagementPrajwal BhattNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementRiannezel A. NavidadNo ratings yet

- 2,,working Capital ManagementDocument19 pages2,,working Capital ManagementKelvin mwaiNo ratings yet

- FMP Lecture - Working CapitalDocument31 pagesFMP Lecture - Working CapitalFatima ZehraNo ratings yet

- Master in Business Administration Mba 308 - Financial ManagementDocument7 pagesMaster in Business Administration Mba 308 - Financial ManagementJhaydiel JacutanNo ratings yet

- Comparative Financial AnalysisDocument36 pagesComparative Financial AnalysisNIKNISHNo ratings yet

- FIN701 Finance: DIO (Average Inventory ÷ Cost of Goods Sold) X 365Document24 pagesFIN701 Finance: DIO (Average Inventory ÷ Cost of Goods Sold) X 365ankita chauhanNo ratings yet

- FM Midterm Chapter4Document13 pagesFM Midterm Chapter4Mayet RoseteNo ratings yet

- Management Advisory Services Working Capital ManagementDocument4 pagesManagement Advisory Services Working Capital ManagementAlexandra Nicole IsaacNo ratings yet

- Working Capital Management NOTESDocument10 pagesWorking Capital Management NOTESvalentine mutungaNo ratings yet

- Cash and Marketable Securities ManagementDocument5 pagesCash and Marketable Securities ManagementJack HererNo ratings yet

- Working Capital ManagementDocument66 pagesWorking Capital ManagementvaishalikatkadeNo ratings yet

- Working Capital ManagementDocument60 pagesWorking Capital ManagementLay TekchhayNo ratings yet

- Chapter 10Document30 pagesChapter 10Nowshad AyubNo ratings yet

- 2A Unit 6 Working Capital SlidesDocument104 pages2A Unit 6 Working Capital SlidesZiphozonkeNo ratings yet

- Working Capital ManagementDocument44 pagesWorking Capital ManagementPhaniraj Lenkalapally100% (1)

- Session 6 FINANCIAL PLANNING Working Capital ManagementDocument44 pagesSession 6 FINANCIAL PLANNING Working Capital ManagementXia AlliaNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Menu InformationDocument2 pagesMenu Informationslunibha00No ratings yet

- Cover LetterDocument1 pageCover Letterslunibha00No ratings yet

- Performance Management PolicyDocument2 pagesPerformance Management Policyslunibha00No ratings yet

- Assignment 3 Part 1Document1 pageAssignment 3 Part 1slunibha00No ratings yet

- Cover LtterDocument1 pageCover Ltterslunibha00No ratings yet

- Sop Nishant CheetriDocument5 pagesSop Nishant Cheetrislunibha00No ratings yet

- Dear University Admissions CommitteeDocument2 pagesDear University Admissions Committeeslunibha00No ratings yet

- Scholarship Reference LetterDocument1 pageScholarship Reference Letterslunibha00No ratings yet

- BB SMC-1Document25 pagesBB SMC-1Suleman Saleh88% (16)

- Unit 2 MFRBDocument31 pagesUnit 2 MFRBSweety TuladharNo ratings yet

- Chapter 3: Financial Statement Analysis and Financial ModelsDocument33 pagesChapter 3: Financial Statement Analysis and Financial ModelsKamrul HasanNo ratings yet

- 2014 07 17 Base ProspectusDocument126 pages2014 07 17 Base ProspectusVipin VipinNo ratings yet

- Easypaisa Money Transfer To Any Mobile NumberDocument2 pagesEasypaisa Money Transfer To Any Mobile NumberBryan WalkerNo ratings yet

- ACC 3501: Advanced Group AccountingDocument8 pagesACC 3501: Advanced Group AccountingatikahNo ratings yet

- MEC Activities TimelineDocument13 pagesMEC Activities TimelineFranz Xavier GarciaNo ratings yet

- E TicketsDocument4 pagesE TicketsPayroll TeamNo ratings yet

- Alchemist Jan 2010Document24 pagesAlchemist Jan 2010rsaittreyaNo ratings yet

- Banking LawDocument24 pagesBanking LawRaja SoodNo ratings yet

- CFA Level I 权益知识点汇总: 1.1 Fulfill different entities' requirementsDocument26 pagesCFA Level I 权益知识点汇总: 1.1 Fulfill different entities' requirementsIves LeeNo ratings yet

- General Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionDocument7 pagesGeneral Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionFozle Rabby 182-11-5893No ratings yet

- Spring 2009 Mgt201 3 VuabidDocument5 pagesSpring 2009 Mgt201 3 Vuabidsaeedsjaan100% (3)

- Kajal Sip 1Document48 pagesKajal Sip 1Kajal NagraleNo ratings yet

- Fmi S14Document66 pagesFmi S14Arpit JainNo ratings yet

- Invoice: Anugerah Makmur Tour and TravelDocument1 pageInvoice: Anugerah Makmur Tour and TravelArwin BacharNo ratings yet

- AccountingDocument10 pagesAccountingRuffa Mae CabangunayNo ratings yet

- Brown and Yellow Scrapbook Brainstorm PresentationDocument31 pagesBrown and Yellow Scrapbook Brainstorm PresentationReanne GuintoNo ratings yet

- 05112019193330stmbl45qgoend7fz26 Estatement 102019 2203Document10 pages05112019193330stmbl45qgoend7fz26 Estatement 102019 2203Manoj EmmidesettyNo ratings yet

- Finaco1 Module 2 AssignmentDocument10 pagesFinaco1 Module 2 AssignmentbLaXe AssassinNo ratings yet

- Chapter 6 Special Situations - ModuleDocument3 pagesChapter 6 Special Situations - ModuleJoannah maeNo ratings yet

- Summary of Accounts: Contacting UsDocument3 pagesSummary of Accounts: Contacting Ussiva AwaraNo ratings yet

- Chapter 2 RevisedDocument16 pagesChapter 2 RevisedDante M Suarez Jr.No ratings yet

- Chapter 13Document30 pagesChapter 13REEMA BNo ratings yet

- Intermediate Accounting 1 - MODULE 8: Content StandardsDocument4 pagesIntermediate Accounting 1 - MODULE 8: Content StandardsGee-Anne GonzalesNo ratings yet

- Past Due Rent Payment PlanDocument3 pagesPast Due Rent Payment PlanRia KudoNo ratings yet

- Corporate Banking 101Document55 pagesCorporate Banking 101MuskanDodejaNo ratings yet

- Current Assets Current LiabilitiesDocument6 pagesCurrent Assets Current LiabilitiesneetaNo ratings yet