Professional Documents

Culture Documents

UBL Annual Report 2018-70

UBL Annual Report 2018-70

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-70

UBL Annual Report 2018-70

Uploaded by

IFRS LabCopyright:

Available Formats

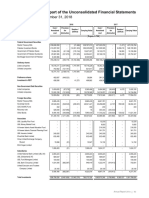

S.No.

Key Audit Matters How the matter was addressed in our audit

In addition to the above time based criteria the PRs The testing of controls included testing of:

require a subjective evaluation of the credit worthiness automated (IT system based) controls over

of borrowers to determine the classification of advances. correct classification of non-performing

The PRs also require the creation of general provision advances on time based criteria;

for the consumer portfolio. controls over monitoring of advances with

Provision against advances of overseas branches is higher risk of default and correct classification

made as per the requirements of the respective of non-performing advances on subjective

regulatory regimes. criteria;

The Bank has recognized a net provision against controls over accurate computation and

advances amounting to Rs. 11,337.236 million in the recording of provisions; and

unconsolidated profit and loss account in the current controls over the governance and approval

year. As at December 31, 2018, the Bank holds a process related to provisions, including

provision of Rs 60,335.610 million against advances. continuous reassessment by the

The determination of provision against advances based management.

on the above criteria remains a significant area of x In accordance with the regulatory requirement,

judgement and estimation. Because of the significance we sampled and tested at least sixty percent of

of the impact of these judgements / estimations and the the total advances portfolio and performed the

materiality of advances relative to the overall following substantive procedures for sample loan

unconsolidated statement of financial position of the accounts:

Bank, we considered the area of provision against verified repayments of advances / mark-up

advances as a key audit matter. installments and checked that non-performing

advances have been correctly classified and

categorized based on the number of days

overdue.

examined watch list accounts and, based on

review of the individual facts and

circumstances, discussions with management

and our assessment of financial conditions of

the borrowers, formed a judgement as to

whether classification of these accounts as

performing was appropriate.

x We checked the accuracy of specific provision

made against non-performing advances and of

general provision made against consumer finance

by recomputing the provision amount in

accordance with the criteria prescribed under the

PRs;

x Where the management has not identified

indicators displaying impairment, we reviewed the

credit history, account movement, financial ratios,

report on security maintained and challenged the

management’s assessment based on our review

of the credit file ; and

x We issued instructions to auditors of those

overseas branches which were selected for audit,

highlighting ‘Provision against advances’ as a

significant risk. The auditors of those branches

performed audit procedures to check compliance

with regulatory requirements and reported the

results thereof to us.

2 Valuation of investments

(Refer note 9 to the unconsolidated financial statements)

The carrying value of investments held by the Bank Our audit procedures to verify valuation of

amounted to Rs. 786,375.326 million, which constitutes investments, amongst others, included the following:

41.62% of the Bank’s total assets as at December 31, Assessed the design and tested the operating

2018. effectiveness of key controls in place relating to

valuation of investments;

68 United Bank Limited

You might also like

- Module 8 LIABILITIESDocument5 pagesModule 8 LIABILITIESNiño Mendoza MabatoNo ratings yet

- Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementFrom EverandAnalyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementRating: 5 out of 5 stars5/5 (5)

- UBL Annual Report 2018-162Document1 pageUBL Annual Report 2018-162IFRS LabNo ratings yet

- HBL Annual Report 2023Document4 pagesHBL Annual Report 2023azeem sandhuNo ratings yet

- Payal Elecon Company AllDocument27 pagesPayal Elecon Company AllJagrati LakhnaviNo ratings yet

- ICICI Bank FinancialDocument175 pagesICICI Bank FinancialRahul NishadNo ratings yet

- Interloop Financials 2023Document31 pagesInterloop Financials 2023Ghulam MustafaNo ratings yet

- Sales - Receiveable - Audit ProgramDocument15 pagesSales - Receiveable - Audit ProgramAsher khanNo ratings yet

- Business Planning Banking Sample Paper - AnswersDocument32 pagesBusiness Planning Banking Sample Paper - Answerscima2k15No ratings yet

- UBL Annual Report 2018-161Document1 pageUBL Annual Report 2018-161IFRS LabNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- Account Assertion Audit Procedure Money Market PaperDocument1 pageAccount Assertion Audit Procedure Money Market PaperTrisha Mae RodillasNo ratings yet

- OCC S New Fair Lending Guide May Portend Broader Changes 1675948989Document3 pagesOCC S New Fair Lending Guide May Portend Broader Changes 1675948989Stanford A. Stanford Sr.No ratings yet

- HBL ReportDocument34 pagesHBL ReportMansoor ArifNo ratings yet

- Audit Report 2021-2022Document18 pagesAudit Report 2021-2022Tanvir Ahmed ChowdhuryNo ratings yet

- Annual Report 2017Document154 pagesAnnual Report 2017reservasgoldcarNo ratings yet

- Accounts TitleDocument1 pageAccounts TitlenovyNo ratings yet

- Sidbi Ar 2021 22Document91 pagesSidbi Ar 2021 22kumar sivaNo ratings yet

- Bank Branch Statutory AuditDocument73 pagesBank Branch Statutory AuditRolando VasquezNo ratings yet

- 4-June 2017Document16 pages4-June 2017vasilikiNo ratings yet

- Compilationof Audit ReportDocument19 pagesCompilationof Audit Reportrehantex98No ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- REVIEWER2 - Introduction To Audit of Historical Financial InformationDocument8 pagesREVIEWER2 - Introduction To Audit of Historical Financial InformationErine ContranoNo ratings yet

- BankAsia AIR 2019 FinancialDocument123 pagesBankAsia AIR 2019 Financialmd fahadNo ratings yet

- Arab Bank Group Financial Statements 2021 eDocument112 pagesArab Bank Group Financial Statements 2021 etl3tNo ratings yet

- 2 Task Perfomance - AuditingDocument2 pages2 Task Perfomance - AuditingMillania ThanaNo ratings yet

- Hindustan Unilever LTDocument28 pagesHindustan Unilever LTPushpraj SinghNo ratings yet

- Chrysaor Holdings LTD PDFDocument107 pagesChrysaor Holdings LTD PDFSohini ChatterjeeNo ratings yet

- Chapter 1Document9 pagesChapter 1Nicale JeenNo ratings yet

- Ar-18 7Document5 pagesAr-18 7jawad anwarNo ratings yet

- Auditing AssignmentDocument7 pagesAuditing AssignmentYusef ShaqeelNo ratings yet

- Business Processes - Part 2Document17 pagesBusiness Processes - Part 2Malinda NayanajithNo ratings yet

- UBL Annual Report 2018-71Document1 pageUBL Annual Report 2018-71IFRS LabNo ratings yet

- Lecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsDocument8 pagesLecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsMaeNo ratings yet

- Auditing TheoryDocument2 pagesAuditing TheoryHanna Mary RamoNo ratings yet

- Illustrative KAMs - Aviation IndustryDocument5 pagesIllustrative KAMs - Aviation IndustryBilal AhmedNo ratings yet

- Watanya Insurance 2020Document66 pagesWatanya Insurance 2020reman.sa.exoNo ratings yet

- AuditofLiabilities PDFDocument6 pagesAuditofLiabilities PDFEricka Mher IsletaNo ratings yet

- CFAP 6 Winter 2021Document10 pagesCFAP 6 Winter 2021os96529No ratings yet

- Substantive Procedures For ReceivablesDocument3 pagesSubstantive Procedures For ReceivablesChristian PerezNo ratings yet

- ReceivablesDocument12 pagesReceivablesRizalene AgustinNo ratings yet

- Introduction To Audit and Audit Standard Setting ProcessDocument8 pagesIntroduction To Audit and Audit Standard Setting ProcessIrish SanchezNo ratings yet

- Trade-Payable DiscussionsDocument7 pagesTrade-Payable DiscussionsShena RieNo ratings yet

- 08 - Advances, Deposits, Prepayments and Other ReceivablesDocument4 pages08 - Advances, Deposits, Prepayments and Other ReceivablesAqib SheikhNo ratings yet

- OceanaGold FS Q4 2023Document42 pagesOceanaGold FS Q4 2023Luisa Garny AlegreNo ratings yet

- CA Final Paper - 3 Advanced Auditing and Professional Ethics MTPDocument10 pagesCA Final Paper - 3 Advanced Auditing and Professional Ethics MTPkomalchandwani.dnlNo ratings yet

- 01 112212 081 11821091237 23052024 114824amDocument81 pages01 112212 081 11821091237 23052024 114824amhassnain4252No ratings yet

- Audit of FS Review of FS Agreed-Upon Procedure Compilation of FSDocument2 pagesAudit of FS Review of FS Agreed-Upon Procedure Compilation of FSJuliana ChengNo ratings yet

- Standalone Financial StatementsDocument68 pagesStandalone Financial StatementsMaaz ShamsherNo ratings yet

- Overview of Audit Process and Pre-Engagement ActivitiesDocument5 pagesOverview of Audit Process and Pre-Engagement ActivitiesJoyce Ann CortezNo ratings yet

- TataSteel-IR23_Standalone-FinancialsDocument120 pagesTataSteel-IR23_Standalone-FinancialsJose HernandesNo ratings yet

- SFG Consolidated FY2022.4Q FinalDocument291 pagesSFG Consolidated FY2022.4Q FinalSi Joon RyuNo ratings yet

- G10349 RG Audit Assurance Alert CAS 701 Key Audit Matters December 2018 PDFDocument16 pagesG10349 RG Audit Assurance Alert CAS 701 Key Audit Matters December 2018 PDFJosephNo ratings yet

- Auditing Full Version Sir Jaypee Tinipid Version1Document17 pagesAuditing Full Version Sir Jaypee Tinipid Version1Lovely Rose ArpiaNo ratings yet

- Preparation For An AuditDocument37 pagesPreparation For An AuditHarikrishnaNo ratings yet

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDenny June CraususNo ratings yet

- Audit of Other Items of Statement of Financial PositionDocument13 pagesAudit of Other Items of Statement of Financial PositionArlyn Pearl PradoNo ratings yet

- MBL Annual Report ACC 2022-17-05-23Document168 pagesMBL Annual Report ACC 2022-17-05-23Shorov ChowduryNo ratings yet

- Lecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020Document7 pagesLecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020MaeNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- Definition and Explanation of Financial Statement AnalysisDocument7 pagesDefinition and Explanation of Financial Statement Analysismedbest11No ratings yet

- FSR Guide 2021Document166 pagesFSR Guide 2021OlegNo ratings yet

- Chart OutlineDocument29 pagesChart OutlineKasem AhmedNo ratings yet

- Karvy Fraud Shivansh - 3438Document7 pagesKarvy Fraud Shivansh - 34383438SHIVANSH AggarwalNo ratings yet

- Ch.13 Managing Small Business FinanceDocument5 pagesCh.13 Managing Small Business FinanceBaesick MoviesNo ratings yet

- Ratios NoteDocument24 pagesRatios Noteamit singhNo ratings yet

- NEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Document20 pagesNEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Heleniya RenukaNo ratings yet

- 4corporate AccountingDocument2 pages4corporate AccountingShariaNo ratings yet

- BF Q3 StudentsDocument5 pagesBF Q3 StudentsCarmen Dana SuarezNo ratings yet

- Financial RatiosDocument35 pagesFinancial RatiosLetsah Bright100% (1)

- Mutual Funds in NepalDocument13 pagesMutual Funds in NepalRupesh NyaupaneNo ratings yet

- Insider TradingDocument6 pagesInsider TradingashhNo ratings yet

- Audited Consolodated and Separate Annual Financial Statements For The Year End 31 December 2020Document279 pagesAudited Consolodated and Separate Annual Financial Statements For The Year End 31 December 2020Devesh SinghNo ratings yet

- Practice Quiz - Chapter 1 - Alan Melville, International Financial Reporting, 8 - eDocument5 pagesPractice Quiz - Chapter 1 - Alan Melville, International Financial Reporting, 8 - emarywalnyimNo ratings yet

- Narayana Murthy Committee Report, 2003Document5 pagesNarayana Murthy Committee Report, 2003shanky017275% (4)

- The Accounting CycleDocument8 pagesThe Accounting CycleKathyrine Claire EdrolinNo ratings yet

- Module 3Document4 pagesModule 3Trúc LyNo ratings yet

- Fam PPT 2Document40 pagesFam PPT 2Varun RaiNo ratings yet

- Manaois FinMan ESSAYDocument2 pagesManaois FinMan ESSAYNCP Shem ManaoisNo ratings yet

- 4.SRC Rule 68Document104 pages4.SRC Rule 68francklineNo ratings yet

- Finmar Quiz 1Document2 pagesFinmar Quiz 1ob118463No ratings yet

- IFRSs For SMEs in The Kenyan ContextDocument6 pagesIFRSs For SMEs in The Kenyan ContextTerrence100% (1)

- Tutorial Meeting 1Document6 pagesTutorial Meeting 1Ve DekNo ratings yet

- FCMH#16Document4 pagesFCMH#16culxNo ratings yet

- Part 1 ReviewerDocument18 pagesPart 1 ReviewerexoloneloveNo ratings yet

- Chapter-5: Statement of Cash FlowDocument43 pagesChapter-5: Statement of Cash FlowBAM ZAHARDNo ratings yet

- Revised Chapter 2 Financial Statements and Corporate FinanceDocument17 pagesRevised Chapter 2 Financial Statements and Corporate FinanceLegend Game100% (1)

- Anita Rana - Synopsis - WC Icici RejectedDocument15 pagesAnita Rana - Synopsis - WC Icici RejectedPramod ShawNo ratings yet

- Consolidated Financial Statements HY 2019 - Solutions 30Document41 pagesConsolidated Financial Statements HY 2019 - Solutions 30Musariri TalentNo ratings yet

- FMG2 ReportDocument28 pagesFMG2 ReportCherry Velle TangogNo ratings yet