Professional Documents

Culture Documents

UBL Annual Report 2018-86

UBL Annual Report 2018-86

Uploaded by

IFRS LabCopyright:

Available Formats

You might also like

- Seasonal PatternsDocument14 pagesSeasonal PatternsHồng NgọcNo ratings yet

- EU Approved Seafood Exporters SenegalDocument10 pagesEU Approved Seafood Exporters SenegalkairabafaNo ratings yet

- Raymart - Notes To FS 2018Document7 pagesRaymart - Notes To FS 2018gerald padua100% (3)

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-87Document1 pageUBL Annual Report 2018-87IFRS LabNo ratings yet

- Notes To The Annual Financial StatementsDocument31 pagesNotes To The Annual Financial StatementsshamielpeNo ratings yet

- Ikk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Document8 pagesIkk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Dondie EsguerraNo ratings yet

- NDDB AR 2016-17 Eng 0 Part47Document2 pagesNDDB AR 2016-17 Eng 0 Part47siva kumarNo ratings yet

- Maruti Suzuki India LTD.: 1. Property, Plant and EquipmentDocument6 pagesMaruti Suzuki India LTD.: 1. Property, Plant and EquipmentaasdffNo ratings yet

- UBL Annual Report 2018-85Document1 pageUBL Annual Report 2018-85IFRS LabNo ratings yet

- Tcevha 2015 Audited Fs and Notes 1 1Document12 pagesTcevha 2015 Audited Fs and Notes 1 1Rogerick LeabresNo ratings yet

- Accounting Standard of Mahindra and Mahindra LTDDocument9 pagesAccounting Standard of Mahindra and Mahindra LTDDheeraj shettyNo ratings yet

- Significant Accounting PoliciesDocument4 pagesSignificant Accounting PoliciesVenkat Sai Kumar KothalaNo ratings yet

- AS-10Document16 pagesAS-10dilipupadhyay1979No ratings yet

- AS-10Document16 pagesAS-10dilipupadhyay1979No ratings yet

- Accounting PoliciesDocument16 pagesAccounting Policiesanoopmurali007No ratings yet

- QuadrantDocument2 pagesQuadrantVibhor SinghNo ratings yet

- UBL Annual Report 2018-183Document1 pageUBL Annual Report 2018-183IFRS LabNo ratings yet

- Accounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsDocument1 pageAccounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsYin LiuNo ratings yet

- MaxisDocument2 pagesMaxisYaaga DharsiniNo ratings yet

- Schedule - Specimen of Statement of Significant Accounting PoliciesDocument16 pagesSchedule - Specimen of Statement of Significant Accounting Policiesav_meshramNo ratings yet

- 19 - Us Gaap Vs Indian GaapDocument5 pages19 - Us Gaap Vs Indian GaapDeepti SinghNo ratings yet

- Tata Motors Notes Forming Part of Financial StatementsDocument36 pagesTata Motors Notes Forming Part of Financial StatementsSwarup RanjanNo ratings yet

- Nykaa E Retail Mar 19Document23 pagesNykaa E Retail Mar 19NatNo ratings yet

- 805 CC101 AFM DD 2 Valuation of Tangible F.assetsDocument32 pages805 CC101 AFM DD 2 Valuation of Tangible F.assetsArchana N VyasNo ratings yet

- Good Will: J) Descried The Accounting Policies Relating To Intangible Asset Adopted by Worley ParksonsDocument5 pagesGood Will: J) Descried The Accounting Policies Relating To Intangible Asset Adopted by Worley ParksonsTriet NguyenNo ratings yet

- Schedule-17 Significant Accounting Policies 1. GeneralDocument4 pagesSchedule-17 Significant Accounting Policies 1. GeneralsgleenaNo ratings yet

- ASSIGNMENTDocument7 pagesASSIGNMENTRahulNo ratings yet

- Hire Purchase DocumentDocument15 pagesHire Purchase Documentchandra_wakarNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Innovation Software Export: Year Fixed Assets and DepreciationDocument6 pagesInnovation Software Export: Year Fixed Assets and DepreciationMohan BishtNo ratings yet

- UBL Annual Report 2018-178Document1 pageUBL Annual Report 2018-178IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- Accounting Policies ModelDocument7 pagesAccounting Policies ModelShalini GuptaNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- Notes To Fs - SeDocument8 pagesNotes To Fs - SeMilds LadaoNo ratings yet

- Date: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDDocument14 pagesDate: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDJayverdhan TiwariNo ratings yet

- General InformationDocument2 pagesGeneral InformationGhritachi PaulNo ratings yet

- Accounting Policy As Per FSDocument17 pagesAccounting Policy As Per FSShubham TiwariNo ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- EFU Accounting PoliciesDocument9 pagesEFU Accounting PoliciesJaved AkramNo ratings yet

- Accounting Policies of DaburDocument10 pagesAccounting Policies of DaburMkNo ratings yet

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- 08-OrmocCity2018 Part1-Notes To FSDocument33 pages08-OrmocCity2018 Part1-Notes To FSsandra bolokNo ratings yet

- Fama AssignmentDocument7 pagesFama AssignmentAdityaNo ratings yet

- Notes To The Financial Statements SampleDocument6 pagesNotes To The Financial Statements SampleKielRinonNo ratings yet

- 21 Financial Instruments s22 - FINALDocument95 pages21 Financial Instruments s22 - FINALAphelele GqadaNo ratings yet

- 9 - AirXDocument25 pages9 - AirXSalar AliNo ratings yet

- UBL AnalysisDocument19 pagesUBL Analysismuhammad akramNo ratings yet

- UBL Annual Report 2018-176Document1 pageUBL Annual Report 2018-176IFRS LabNo ratings yet

- Consolidated Financial Statements Indian GAAP Dec07Document15 pagesConsolidated Financial Statements Indian GAAP Dec07martynmvNo ratings yet

- IAS 36 Chapter TextDocument10 pagesIAS 36 Chapter Textkashan.ahmed1985No ratings yet

- Impairment of AssetDocument27 pagesImpairment of AssetSrabon BaruaNo ratings yet

- Policies - 09Document2 pagesPolicies - 09Ayeman AnwarNo ratings yet

- Principle of SelectionDocument16 pagesPrinciple of SelectionIsiyaku AdoNo ratings yet

- Leases in The Financial Statements of LessorsDocument1 pageLeases in The Financial Statements of LessorsdskrishnaNo ratings yet

- Historical Cost of Property, Plant and EquipmentDocument9 pagesHistorical Cost of Property, Plant and EquipmentChinchin Ilagan DatayloNo ratings yet

- Financial Strength of Southeast Bank LimitedDocument7 pagesFinancial Strength of Southeast Bank LimitedEasin Mohammad RomanNo ratings yet

- Accounting Standard 11Document5 pagesAccounting Standard 11Gmd NizamNo ratings yet

- Lobrigas - Week3 Ia3Document39 pagesLobrigas - Week3 Ia3Hensel SevillaNo ratings yet

- Module 4 - ImpairmentDocument5 pagesModule 4 - ImpairmentLuiNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- Indian Banking .. ..SECTORDocument30 pagesIndian Banking .. ..SECTORShakshi Arvind GuptaNo ratings yet

- TAXATIONDocument48 pagesTAXATIONJeffrey VergaraNo ratings yet

- Impact of Demonetization of Indian Economy StudyDocument11 pagesImpact of Demonetization of Indian Economy StudywachoNo ratings yet

- Katalog Rattan CirebonDocument19 pagesKatalog Rattan Cirebonmd marcommNo ratings yet

- Allowance - RavinathanDocument4 pagesAllowance - RavinathanRavi NathanNo ratings yet

- Accounting For Debentures & Preference Shares Question No 15Document33 pagesAccounting For Debentures & Preference Shares Question No 15binuNo ratings yet

- Ifrs Edition: Preview ofDocument28 pagesIfrs Edition: Preview ofwtf100% (1)

- Credit Rating Report Update 2020Document17 pagesCredit Rating Report Update 2020Zubair RazaNo ratings yet

- Abm G3Document32 pagesAbm G3Chrizelle Mariece Escalante KaguingNo ratings yet

- Ue 195Document1 pageUe 195Tejas ShawNo ratings yet

- Software Quality ConceptsDocument38 pagesSoftware Quality Conceptskiran reddyNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaNo ratings yet

- Us664891555 Customs DocumentDocument1 pageUs664891555 Customs Documents2118231No ratings yet

- BA Economics 4th Sem 2016, 2017, 2018 BatchDocument11 pagesBA Economics 4th Sem 2016, 2017, 2018 BatchRambo panditNo ratings yet

- Hfa Unit 2Document14 pagesHfa Unit 2Darshan PanchalNo ratings yet

- A Level Accounting QuestionsDocument391 pagesA Level Accounting QuestionsALI HAMEEDNo ratings yet

- Topic 9 - Investment PlanningDocument55 pagesTopic 9 - Investment PlanningArun GhatanNo ratings yet

- This Study Resource Was: Tarea 8: Compitiendo GlobalmenteDocument9 pagesThis Study Resource Was: Tarea 8: Compitiendo GlobalmenteBellapu Durga vara prasadNo ratings yet

- Group Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliDocument7 pagesGroup Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliNabil MuneerNo ratings yet

- Statement 932073059 20221025 112113 56Document1 pageStatement 932073059 20221025 112113 56hari tejaNo ratings yet

- Canada TurboTax - Tax Year 2023Document2 pagesCanada TurboTax - Tax Year 2023RomeoNo ratings yet

- Assignment of Slovakia CountryDocument25 pagesAssignment of Slovakia CountryAsad MemonNo ratings yet

- 8 Indian Agritech Start-Ups To Watch in 2021 - ComputerworldDocument7 pages8 Indian Agritech Start-Ups To Watch in 2021 - ComputerworldAbhishek RaghuwanshiNo ratings yet

- Moving Ahead Time of Use RatesDocument27 pagesMoving Ahead Time of Use RatesMICHEL MUÑOZNo ratings yet

- Products of UblDocument19 pagesProducts of UblAtiq MaliKNo ratings yet

- MR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleDocument2 pagesMR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleAubrien Fachi MusambakarumeNo ratings yet

- Brings Contributes Affects Has An Influence Can Result: BBS First Year English Model Question 2019Document39 pagesBrings Contributes Affects Has An Influence Can Result: BBS First Year English Model Question 2019anup chauhanNo ratings yet

- College Accounting 12th Edition Slater Test BankDocument38 pagesCollege Accounting 12th Edition Slater Test Bankrobertnelsonxrofbtjpmi100% (13)

UBL Annual Report 2018-86

UBL Annual Report 2018-86

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-86

UBL Annual Report 2018-86

Uploaded by

IFRS LabCopyright:

Available Formats

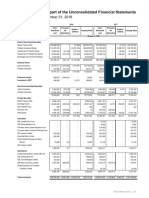

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

5.5.1 Finance Lease receivables

Leases, where the Bank transfers substantially all the risks and rewards incidental to ownership of an asset to the lessee

are classified as finance lease. A receivable is recognized at an amount equal to the present value of the minimum lease

payments including guaranteed residual value, if any. Finance lease receivables are included in advances.

5.5.2 Islamic financings and related assets

Receivables under Murabaha financing represent cost price plus an agreed mark-up on deferred sale arrangement. Mark-

up income is recognized on a straight line basis over the period of the instalments.

Ijarah financing represents arrangements whereby the Bank (being the owner of assets) transfers its usufruct to its

customers for an agreed period at an agreed consideration. Assets leased out under Ijarah are stated at cost less

accumulated depreciation and accumulated impairment losses, if any. These are depreciated over the term of the lease.

Ijarah income is recognized on an accrual basis.

Diminishing Musharaka is partnership agreement between the Bank and its customer for financing vehicle or plant and

machinery. The receivable is recorded to the extent of Bank's share in the purchase of asset. Income is recognized on

accrual basis.

5.6 Fixed assets and depreciation

5.6.1 Tangible

Property and equipment, other than land (which is not depreciated) and capital work-in-progress, are stated at cost or

revalued amount less accumulated depreciation and accumulated impairment losses, if any. Land is carried at revalued

amount less impairment losses while capital work-in-progress is stated at cost less impairment losses. The cost and the

accumulated depreciation of property and equipment of foreign branches include exchange differences arising on currency

translation at the year-end rates of exchange.

Depreciation is calculated so as to write off the depreciable amount of the assets over their expected useful lives at the

rates specified in note 11.2 to these unconsolidated financial statements. The depreciation charge for the year is calculated

on a straight line basis after taking into account the residual value, if any. The residual values and useful lives are reviewed

and adjusted, if appropriate, at each statement of financial position date.

Depreciation on additions is charged from the month the asset is available for use. No depreciation is charged in the month

of disposal.

Land and buildings are revalued by independent, professionally qualified valuers with sufficient regularity to ensure that

their net carrying amount does not differ materially from their fair value. An increase arising on revaluation is credited to the

surplus on revaluation of fixed assets account. A decrease arising on revaluation of fixed assets is adjusted against the

surplus of that asset or, if no surplus exists, is charged to the profit and loss account as an impairment of the asset. A

surplus arising subsequently on an impaired asset is reversed through the profit and loss account up to the extent of the

original impairment.

Surplus on revaluation of fixed assets (net of associated deferred tax) to the extent of the incremental depreciation charged

on the related assets is transferred to unappropriated profit.

Gains and losses on sale of fixed assets are included in the profit and loss account, except that the related surplus on

revaluation of fixed assets (net of deferred tax) is transferred directly to unappropriated profit.

Major renewals and improvements are capitalized and the assets so replaced, if any, are retired. Normal repairs and

maintenance are charged to the profit and loss account as and when incurred.

5.6.2 Intangible assets

Intangible assets are stated at cost less accumulated amortization and accumulated impairment losses, if any. The cost

and the accumulated amortization of intangible assets of foreign branches include exchange differences arising on

currency translation at the year-end rates of exchange. Amortization is calculated so as to write off the amortizable amount

of the assets over their expected useful lives at the rates specified in note 12.1 to these unconsolidated financial

statements. The amortization charge for the year is calculated on a straight line basis after taking into account the residual

value, if any. The residual values and useful lives are reviewed and adjusted, if appropriate, at each statement of financial

position date. Amortization on additions is charged from the month the asset is available for use. No amortization is

charged in the month of disposal.

Gains and losses on sale of intangible assets are included in the profit and loss account.

84 United Bank Limited

You might also like

- Seasonal PatternsDocument14 pagesSeasonal PatternsHồng NgọcNo ratings yet

- EU Approved Seafood Exporters SenegalDocument10 pagesEU Approved Seafood Exporters SenegalkairabafaNo ratings yet

- Raymart - Notes To FS 2018Document7 pagesRaymart - Notes To FS 2018gerald padua100% (3)

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-87Document1 pageUBL Annual Report 2018-87IFRS LabNo ratings yet

- Notes To The Annual Financial StatementsDocument31 pagesNotes To The Annual Financial StatementsshamielpeNo ratings yet

- Ikk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Document8 pagesIkk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Dondie EsguerraNo ratings yet

- NDDB AR 2016-17 Eng 0 Part47Document2 pagesNDDB AR 2016-17 Eng 0 Part47siva kumarNo ratings yet

- Maruti Suzuki India LTD.: 1. Property, Plant and EquipmentDocument6 pagesMaruti Suzuki India LTD.: 1. Property, Plant and EquipmentaasdffNo ratings yet

- UBL Annual Report 2018-85Document1 pageUBL Annual Report 2018-85IFRS LabNo ratings yet

- Tcevha 2015 Audited Fs and Notes 1 1Document12 pagesTcevha 2015 Audited Fs and Notes 1 1Rogerick LeabresNo ratings yet

- Accounting Standard of Mahindra and Mahindra LTDDocument9 pagesAccounting Standard of Mahindra and Mahindra LTDDheeraj shettyNo ratings yet

- Significant Accounting PoliciesDocument4 pagesSignificant Accounting PoliciesVenkat Sai Kumar KothalaNo ratings yet

- AS-10Document16 pagesAS-10dilipupadhyay1979No ratings yet

- AS-10Document16 pagesAS-10dilipupadhyay1979No ratings yet

- Accounting PoliciesDocument16 pagesAccounting Policiesanoopmurali007No ratings yet

- QuadrantDocument2 pagesQuadrantVibhor SinghNo ratings yet

- UBL Annual Report 2018-183Document1 pageUBL Annual Report 2018-183IFRS LabNo ratings yet

- Accounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsDocument1 pageAccounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsYin LiuNo ratings yet

- MaxisDocument2 pagesMaxisYaaga DharsiniNo ratings yet

- Schedule - Specimen of Statement of Significant Accounting PoliciesDocument16 pagesSchedule - Specimen of Statement of Significant Accounting Policiesav_meshramNo ratings yet

- 19 - Us Gaap Vs Indian GaapDocument5 pages19 - Us Gaap Vs Indian GaapDeepti SinghNo ratings yet

- Tata Motors Notes Forming Part of Financial StatementsDocument36 pagesTata Motors Notes Forming Part of Financial StatementsSwarup RanjanNo ratings yet

- Nykaa E Retail Mar 19Document23 pagesNykaa E Retail Mar 19NatNo ratings yet

- 805 CC101 AFM DD 2 Valuation of Tangible F.assetsDocument32 pages805 CC101 AFM DD 2 Valuation of Tangible F.assetsArchana N VyasNo ratings yet

- Good Will: J) Descried The Accounting Policies Relating To Intangible Asset Adopted by Worley ParksonsDocument5 pagesGood Will: J) Descried The Accounting Policies Relating To Intangible Asset Adopted by Worley ParksonsTriet NguyenNo ratings yet

- Schedule-17 Significant Accounting Policies 1. GeneralDocument4 pagesSchedule-17 Significant Accounting Policies 1. GeneralsgleenaNo ratings yet

- ASSIGNMENTDocument7 pagesASSIGNMENTRahulNo ratings yet

- Hire Purchase DocumentDocument15 pagesHire Purchase Documentchandra_wakarNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Innovation Software Export: Year Fixed Assets and DepreciationDocument6 pagesInnovation Software Export: Year Fixed Assets and DepreciationMohan BishtNo ratings yet

- UBL Annual Report 2018-178Document1 pageUBL Annual Report 2018-178IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- Accounting Policies ModelDocument7 pagesAccounting Policies ModelShalini GuptaNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- Notes To Fs - SeDocument8 pagesNotes To Fs - SeMilds LadaoNo ratings yet

- Date: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDDocument14 pagesDate: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDJayverdhan TiwariNo ratings yet

- General InformationDocument2 pagesGeneral InformationGhritachi PaulNo ratings yet

- Accounting Policy As Per FSDocument17 pagesAccounting Policy As Per FSShubham TiwariNo ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- EFU Accounting PoliciesDocument9 pagesEFU Accounting PoliciesJaved AkramNo ratings yet

- Accounting Policies of DaburDocument10 pagesAccounting Policies of DaburMkNo ratings yet

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- 08-OrmocCity2018 Part1-Notes To FSDocument33 pages08-OrmocCity2018 Part1-Notes To FSsandra bolokNo ratings yet

- Fama AssignmentDocument7 pagesFama AssignmentAdityaNo ratings yet

- Notes To The Financial Statements SampleDocument6 pagesNotes To The Financial Statements SampleKielRinonNo ratings yet

- 21 Financial Instruments s22 - FINALDocument95 pages21 Financial Instruments s22 - FINALAphelele GqadaNo ratings yet

- 9 - AirXDocument25 pages9 - AirXSalar AliNo ratings yet

- UBL AnalysisDocument19 pagesUBL Analysismuhammad akramNo ratings yet

- UBL Annual Report 2018-176Document1 pageUBL Annual Report 2018-176IFRS LabNo ratings yet

- Consolidated Financial Statements Indian GAAP Dec07Document15 pagesConsolidated Financial Statements Indian GAAP Dec07martynmvNo ratings yet

- IAS 36 Chapter TextDocument10 pagesIAS 36 Chapter Textkashan.ahmed1985No ratings yet

- Impairment of AssetDocument27 pagesImpairment of AssetSrabon BaruaNo ratings yet

- Policies - 09Document2 pagesPolicies - 09Ayeman AnwarNo ratings yet

- Principle of SelectionDocument16 pagesPrinciple of SelectionIsiyaku AdoNo ratings yet

- Leases in The Financial Statements of LessorsDocument1 pageLeases in The Financial Statements of LessorsdskrishnaNo ratings yet

- Historical Cost of Property, Plant and EquipmentDocument9 pagesHistorical Cost of Property, Plant and EquipmentChinchin Ilagan DatayloNo ratings yet

- Financial Strength of Southeast Bank LimitedDocument7 pagesFinancial Strength of Southeast Bank LimitedEasin Mohammad RomanNo ratings yet

- Accounting Standard 11Document5 pagesAccounting Standard 11Gmd NizamNo ratings yet

- Lobrigas - Week3 Ia3Document39 pagesLobrigas - Week3 Ia3Hensel SevillaNo ratings yet

- Module 4 - ImpairmentDocument5 pagesModule 4 - ImpairmentLuiNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- Indian Banking .. ..SECTORDocument30 pagesIndian Banking .. ..SECTORShakshi Arvind GuptaNo ratings yet

- TAXATIONDocument48 pagesTAXATIONJeffrey VergaraNo ratings yet

- Impact of Demonetization of Indian Economy StudyDocument11 pagesImpact of Demonetization of Indian Economy StudywachoNo ratings yet

- Katalog Rattan CirebonDocument19 pagesKatalog Rattan Cirebonmd marcommNo ratings yet

- Allowance - RavinathanDocument4 pagesAllowance - RavinathanRavi NathanNo ratings yet

- Accounting For Debentures & Preference Shares Question No 15Document33 pagesAccounting For Debentures & Preference Shares Question No 15binuNo ratings yet

- Ifrs Edition: Preview ofDocument28 pagesIfrs Edition: Preview ofwtf100% (1)

- Credit Rating Report Update 2020Document17 pagesCredit Rating Report Update 2020Zubair RazaNo ratings yet

- Abm G3Document32 pagesAbm G3Chrizelle Mariece Escalante KaguingNo ratings yet

- Ue 195Document1 pageUe 195Tejas ShawNo ratings yet

- Software Quality ConceptsDocument38 pagesSoftware Quality Conceptskiran reddyNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaNo ratings yet

- Us664891555 Customs DocumentDocument1 pageUs664891555 Customs Documents2118231No ratings yet

- BA Economics 4th Sem 2016, 2017, 2018 BatchDocument11 pagesBA Economics 4th Sem 2016, 2017, 2018 BatchRambo panditNo ratings yet

- Hfa Unit 2Document14 pagesHfa Unit 2Darshan PanchalNo ratings yet

- A Level Accounting QuestionsDocument391 pagesA Level Accounting QuestionsALI HAMEEDNo ratings yet

- Topic 9 - Investment PlanningDocument55 pagesTopic 9 - Investment PlanningArun GhatanNo ratings yet

- This Study Resource Was: Tarea 8: Compitiendo GlobalmenteDocument9 pagesThis Study Resource Was: Tarea 8: Compitiendo GlobalmenteBellapu Durga vara prasadNo ratings yet

- Group Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliDocument7 pagesGroup Assignment Supply Chain Management. Nabeel Munir, Muhammad Amin, Faizan Mustaq, Arslan AliNabil MuneerNo ratings yet

- Statement 932073059 20221025 112113 56Document1 pageStatement 932073059 20221025 112113 56hari tejaNo ratings yet

- Canada TurboTax - Tax Year 2023Document2 pagesCanada TurboTax - Tax Year 2023RomeoNo ratings yet

- Assignment of Slovakia CountryDocument25 pagesAssignment of Slovakia CountryAsad MemonNo ratings yet

- 8 Indian Agritech Start-Ups To Watch in 2021 - ComputerworldDocument7 pages8 Indian Agritech Start-Ups To Watch in 2021 - ComputerworldAbhishek RaghuwanshiNo ratings yet

- Moving Ahead Time of Use RatesDocument27 pagesMoving Ahead Time of Use RatesMICHEL MUÑOZNo ratings yet

- Products of UblDocument19 pagesProducts of UblAtiq MaliKNo ratings yet

- MR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleDocument2 pagesMR K T Majakwara Tillen Court 3 Bouquet and Verona RosettenvilleAubrien Fachi MusambakarumeNo ratings yet

- Brings Contributes Affects Has An Influence Can Result: BBS First Year English Model Question 2019Document39 pagesBrings Contributes Affects Has An Influence Can Result: BBS First Year English Model Question 2019anup chauhanNo ratings yet

- College Accounting 12th Edition Slater Test BankDocument38 pagesCollege Accounting 12th Edition Slater Test Bankrobertnelsonxrofbtjpmi100% (13)