Professional Documents

Culture Documents

UBL Annual Report 2018-87

UBL Annual Report 2018-87

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-87

UBL Annual Report 2018-87

Uploaded by

IFRS LabCopyright:

Available Formats

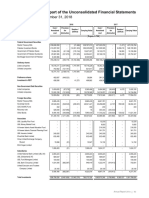

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

5.7 Non-banking assets acquired in satisfaction of claims

Non-banking assets acquired in satisfaction of claims are carried at revalued amounts less accumulated depreciation.

These assets are revalued by professionally qualified valuers with sufficient regularity to ensure that their net carrying value

does not differ materially from their fair value. A surplus arising on revaluation of property is credited to the 'surplus on

revaluation of non-banking assets' account and any deficit arising on revaluation is taken to profit and loss account directly.

Legal fees, transfer costs and direct costs of acquiring title to property are charged to the profit and loss account and not

capitalised.

5.8 Impairment

Impairment of available for sale equity investments

Available for sale equity investments are impaired when there has been a significant or prolonged decline in their fair value

below their cost. The determination of what is significant or prolonged requires judgment. In making this judgment, the Bank

evaluates, among other factors, the normal volatility in share price.

Impairment of investments in subsidiaries and associates

The Bank considers that a decline in the recoverable value of the investment in a subsidiary or an associate below its cost

may be evidence of impairment. Recoverable value is calculated as the higher of fair value less costs to sell and value in

use. An impairment loss is recognized when the recoverable value falls below the carrying value and is charged to the profit

and loss account. A subsequent reversal of an impairment loss, upto the cost of the investment in the subsidiary or the

associate, is credited to the profit and loss account.

Impairment in non-financial assets (excluding deferred tax)

The carrying amounts of non-financial assets are reviewed at each reporting date for impairment whenever events or

changes in circumstances indicate that the carrying amounts of these assets may not be recoverable. The recoverable

amount of an asset is the higher of its fair value less costs of disposal and its value in use. If such indication exists, and

where the carrying value exceeds the estimated recoverable amount, assets are written down to their recoverable amount.

The resulting impairment loss is charged to the profit and loss account except for an impairment loss on revalued assets,

which is adjusted against the related revaluation surplus to the extent that the impairment loss does not exceed the

revaluation surplus.

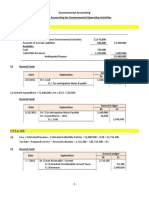

5.9 Taxation

5.9.1 Current

Provision for current taxation is based on taxable income for the year determined in accordance with the prevailing laws

and at the prevailing rates for taxation on income earned by the Bank. The amount of current tax payable is the best

estimate of the tax amount expected to be paid that reflects uncertainty related to income taxes, if any. It is measured using

tax rates enacted or substantively enacted at the reporting date. Current tax also includes any tax arising from dividends.

Current tax assets and liabilities are offset only if certain criteria are met.

5.9.2 Deferred

Deferred tax is recognized using the balance sheet method on all major temporary differences between the amounts

attributed to assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax

is calculated at the rates that are expected to apply to the period when the differences are expected to reverse, based on

tax rates that have been enacted or substantively enacted at the statement of financial position date.

Deferred tax assets are recognized only to the extent that it is probable that future taxable profits will be available against

which the assets can be utilized.

The carrying amount of deferred tax assets is reviewed at each statement of financial position date and reduced to the

extent that it is no longer probable that sufficient taxable profits will be available to allow all or part of the deferred tax asset

to be utilized.

Annual Report 2018 85

You might also like

- Literary Analysis - The NecklaceDocument5 pagesLiterary Analysis - The NecklaceDanny Hoi33% (3)

- Walter SchlossDocument40 pagesWalter SchlossB.C. Moon91% (11)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Raymart - Notes To FS 2018Document7 pagesRaymart - Notes To FS 2018gerald padua100% (3)

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- 19 - Us Gaap Vs Indian GaapDocument5 pages19 - Us Gaap Vs Indian GaapDeepti SinghNo ratings yet

- Notes To Fs - SeDocument8 pagesNotes To Fs - SeMilds LadaoNo ratings yet

- Mary Joy L. Amigos Rice Store Notes To The Financial StatementsDocument5 pagesMary Joy L. Amigos Rice Store Notes To The Financial StatementsLizanne GauranaNo ratings yet

- Significant Accounting PoliciesDocument4 pagesSignificant Accounting PoliciesVenkat Sai Kumar KothalaNo ratings yet

- Special Accounting ConsiderationsDocument9 pagesSpecial Accounting ConsiderationsIvy Claire SemenianoNo ratings yet

- EFU Accounting PoliciesDocument9 pagesEFU Accounting PoliciesJaved AkramNo ratings yet

- Ikk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Document8 pagesIkk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Dondie EsguerraNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- Nykaa E Retail Mar 19Document23 pagesNykaa E Retail Mar 19NatNo ratings yet

- Definition .: The Philippine Securities and Exchange Commission deDocument15 pagesDefinition .: The Philippine Securities and Exchange Commission demiya girlNo ratings yet

- Tcevha 2015 Audited Fs and Notes 1 1Document12 pagesTcevha 2015 Audited Fs and Notes 1 1Rogerick LeabresNo ratings yet

- NDDB AR 2016-17 Eng 0 Part47Document2 pagesNDDB AR 2016-17 Eng 0 Part47siva kumarNo ratings yet

- Accounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsDocument1 pageAccounting Policies Continued Inventory: Financial Statements Notes To The Financial StatementsYin LiuNo ratings yet

- Notes To Accounts CompanyDocument9 pagesNotes To Accounts CompanyMy NameNo ratings yet

- Accounting Policies 31.3.2020Document3 pagesAccounting Policies 31.3.2020Sheenu KapoorNo ratings yet

- Notes To The Annual Financial StatementsDocument31 pagesNotes To The Annual Financial StatementsshamielpeNo ratings yet

- Maruti Suzuki India LTD.: 1. Property, Plant and EquipmentDocument6 pagesMaruti Suzuki India LTD.: 1. Property, Plant and EquipmentaasdffNo ratings yet

- Notes To The Financial Statements SampleDocument6 pagesNotes To The Financial Statements SampleKielRinonNo ratings yet

- Schedule - Specimen of Statement of Significant Accounting PoliciesDocument16 pagesSchedule - Specimen of Statement of Significant Accounting Policiesav_meshramNo ratings yet

- MaxisDocument2 pagesMaxisYaaga DharsiniNo ratings yet

- UBL Annual Report 2018-86Document1 pageUBL Annual Report 2018-86IFRS LabNo ratings yet

- UBL Annual Report 2018-85Document1 pageUBL Annual Report 2018-85IFRS LabNo ratings yet

- Ifrs VS Us GaapDocument118 pagesIfrs VS Us GaapAhmed SabirNo ratings yet

- CPA Official IFRS 9& CGU AnsDocument2 pagesCPA Official IFRS 9& CGU AnsKambi OfficialNo ratings yet

- Acctg 311N - First Trinal 1Document11 pagesAcctg 311N - First Trinal 1Raenessa FranciscoNo ratings yet

- Shiwan IDocument3 pagesShiwan IAmit PrabhuNo ratings yet

- Principle of SelectionDocument16 pagesPrinciple of SelectionIsiyaku AdoNo ratings yet

- Module 4 - ImpairmentDocument5 pagesModule 4 - ImpairmentLuiNo ratings yet

- 2.7 Intangible Assets (A) GoodwillDocument8 pages2.7 Intangible Assets (A) GoodwillLolita IsakhanyanNo ratings yet

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDocument5 pagesTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesPia DagmanNo ratings yet

- QuadrantDocument2 pagesQuadrantVibhor SinghNo ratings yet

- The Evocative Essential Oil and Scented Candles: 2.1 Basis of Preparation of Financial StatementsDocument12 pagesThe Evocative Essential Oil and Scented Candles: 2.1 Basis of Preparation of Financial StatementsExequiel AmbasingNo ratings yet

- Issues ReportDocument58 pagesIssues ReportfariaNo ratings yet

- #14 PFRS 9 (Financial Instruments-Summary)Document5 pages#14 PFRS 9 (Financial Instruments-Summary)Zaaavnn Vannnnn100% (1)

- Ias - IfrsDocument7 pagesIas - IfrsFalguni PurohitNo ratings yet

- Probiotec Annual Report 2021 6Document8 pagesProbiotec Annual Report 2021 6楊敬宇No ratings yet

- BPP Revision Kit Sample Answers 1Document8 pagesBPP Revision Kit Sample Answers 1Kian TuckNo ratings yet

- Chapter 5Document48 pagesChapter 5HelloWorldNowNo ratings yet

- Accounting Revision Notes (CA Companions)Document8 pagesAccounting Revision Notes (CA Companions)Habib Ullah KhanNo ratings yet

- Factsheet IAS12 Income TaxesDocument14 pagesFactsheet IAS12 Income TaxesMira EbreoNo ratings yet

- IFRS AND IAS of AuditDocument11 pagesIFRS AND IAS of AuditAvinash KumarNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102023Document28 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102023mnbvcxzqwerNo ratings yet

- Accounting Policies BataDocument5 pagesAccounting Policies BataHarini SundarNo ratings yet

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- Subsequent To Acquisition Date RevisedDocument2 pagesSubsequent To Acquisition Date RevisedAlyssaNo ratings yet

- Important Notes For Consolidation and Business CombinationDocument10 pagesImportant Notes For Consolidation and Business CombinationSajib Kumar DasNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Notes To FS EncodingDocument11 pagesNotes To FS EncodingPappi JANo ratings yet

- Lecture Notes On Trade and Other ReceivablesDocument5 pagesLecture Notes On Trade and Other Receivablesjudel ArielNo ratings yet

- Significant Accounting PoliciesDocument4 pagesSignificant Accounting PoliciesAdarsh NethwewalaNo ratings yet

- Lecture Notes On Trade and Other Receivables PDFDocument5 pagesLecture Notes On Trade and Other Receivables PDFjudel ArielNo ratings yet

- Sa Aug11 Ifrs9Document7 pagesSa Aug11 Ifrs9Parwez KurmallyNo ratings yet

- Master NoteDocument9 pagesMaster NoteCA Paramesh HemanathNo ratings yet

- NOTES On PFRS 9 Financial InstrumentsDocument11 pagesNOTES On PFRS 9 Financial Instrumentsjsus22100% (1)

- Tata Motors Notes Forming Part of Financial StatementsDocument36 pagesTata Motors Notes Forming Part of Financial StatementsSwarup RanjanNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- Installment Sales OldDocument3 pagesInstallment Sales OldThea Grace Bianan0% (1)

- FM II - Chapter 03, Financial Planning & ForecastingDocument14 pagesFM II - Chapter 03, Financial Planning & ForecastingHace AdisNo ratings yet

- Investors Guide To ImpactDocument21 pagesInvestors Guide To ImpactRobertNo ratings yet

- R Logue DanielsDocument10 pagesR Logue DanielsCalWonkNo ratings yet

- FINALE Accounts ManagementDocument36 pagesFINALE Accounts ManagementGel GarabilesNo ratings yet

- Balance of Payments TableDocument3 pagesBalance of Payments TableteetickNo ratings yet

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingRONALD SSEKYANZINo ratings yet

- B LawDocument240 pagesB LawShaheer MalikNo ratings yet

- Lesson-Exemplar-Entrep 1Document9 pagesLesson-Exemplar-Entrep 1Wilbert VenzonNo ratings yet

- TSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994Document6 pagesTSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994aroelmathNo ratings yet

- CNG Filling StationDocument32 pagesCNG Filling Stationpradip_kumar0% (1)

- Solutions To Ch04Document14 pagesSolutions To Ch04hala elgedNo ratings yet

- Resume Weiting Hu 230606Document3 pagesResume Weiting Hu 230606api-634550315No ratings yet

- Socio Economic OffencesDocument24 pagesSocio Economic OffencesRohit Vijaya ChandraNo ratings yet

- Presentation - Large Cap Multiples 1Document16 pagesPresentation - Large Cap Multiples 1Fernando PrietoNo ratings yet

- Tutorial 2 PFPDocument9 pagesTutorial 2 PFPWinjie PangNo ratings yet

- 241 Scope of Quasi-Banking FunctionsDocument4 pages241 Scope of Quasi-Banking FunctionsEzra SienesNo ratings yet

- Agricultural Contracts in Mindanao: The Case of Banana and PineappleDocument36 pagesAgricultural Contracts in Mindanao: The Case of Banana and PineappleMelchor LaribaNo ratings yet

- Tax 2 AssignmentDocument6 pagesTax 2 AssignmentKim EcarmaNo ratings yet

- G.R. No. 147036-37Document21 pagesG.R. No. 147036-37Your Public ProfileNo ratings yet

- Ap9208 Cash 1Document4 pagesAp9208 Cash 1Onids AbayaNo ratings yet

- T. Co M: R EadingDocument15 pagesT. Co M: R Eadingarun1974No ratings yet

- Arab Sudanese Bank: Sudanese Private Ccompany LTDDocument30 pagesArab Sudanese Bank: Sudanese Private Ccompany LTDShadow PrinceNo ratings yet

- Course Part4 Demat Basics PDFDocument7 pagesCourse Part4 Demat Basics PDFKirankumarNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- Acknowledgement S: St. Xaviers College, KolkataDocument63 pagesAcknowledgement S: St. Xaviers College, KolkataanianirudhkhatriNo ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet