Professional Documents

Culture Documents

UBL Annual Report 2018-137

UBL Annual Report 2018-137

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-137

UBL Annual Report 2018-137

Uploaded by

IFRS LabCopyright:

Available Formats

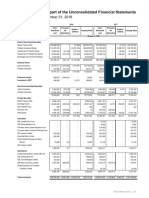

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

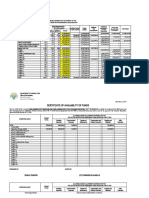

47.1.5 Concentration of Advances

The bank top 10 exposures on the basis of total (funded and non-funded exposures) aggregated to Rs 329,887 million

(2017: 244,079 million) are as following:

2018 2017

------- (Rupees in '000) -------

Funded 202,225,292 151,828,373

Non Funded 127,661,689 92,250,648

Total Exposure 329,886,981 244,079,021

The sanctioned limits against these top 10 expsoures aggregated to Rs 377,954 million (2017: Rs 320,645 million).

47.1.6 Advances - Province / Region-wise Disbursement & Utilization

2018

Utilization

Province / Region Disburse-

KPK including AJK including

ments Punjab Sindh Balochistan Islamabad

FATA Gilgit-Baltistan

---------------------------------------------------------------------------- (Rupees in '000) ---------------------------------------------------------------------------

Punjab 189,383,006 189,383,006 - - - - -

Sindh 182,227,010 - 182,227,010 - - - -

KPK including FATA 1,993,230 - - 1,993,230 - - -

Balochistan 316,817 - - - 316,817 - -

Islamabad 81,087,836 - - - - 81,087,836 -

AJK including Gilgit-Baltistan - - - - - - -

Total 455,007,899 189,383,006 182,227,010 1,993,230 316,817 81,087,836 -

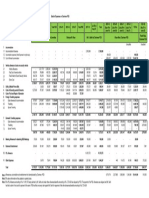

2017

Utilization

Province / Region Disburse-

KPK including AJK including

ments Punjab Sindh Balochistan Islamabad

FATA Gilgit-Baltistan

---------------------------------------------------------------------------- (Rupees in '000) ---------------------------------------------------------------------------

Punjab 133,494,133 133,494,133 - - - - -

Sindh 281,235,979 - 281,235,979 - - - -

KPK including FATA 1,025,076 - - 1,025,076 - - -

Balochistan 1,438,165 - - - 1,438,165 - -

Islamabad 18,292,432 - - - - 18,292,432 -

AJK including Gilgit-Baltistan 18,311 - - - - - 18,311

Total 435,504,096 133,494,133 281,235,979 1,025,076 1,438,165 18,292,432 18,311

47.2 Market Risk

Market risk is the risk that the fair value of a financial instrument will fluctuate due to movements in market prices. It results

from changes in interest rates, exchange rates and equity prices as well as from changes in the correlations between them.

Each of these components of market risk consists of a general market risk and a specific market risk that is driven by the

nature and composition of the portfolio.

Measuring and controlling market risk is usually carried out at a portfolio level. However, certain controls are applied, where

necessary, to individual risk types, to particular books and to specific exposures. Controls are also applied to prevent any

undue risk concentrations in trading books, taking into account variations in price, volatility, market depth and liquidity.

These controls include limits on exposure to individual market risk variables as well as limits on concentrations of tenors

and issuers.

Annual Report 2018 135

You might also like

- Jeyashri Health Insurance DocumentDocument5 pagesJeyashri Health Insurance Documentsivakumar100% (1)

- Break A Leg STUDENT FILLABLE PDFDocument2 pagesBreak A Leg STUDENT FILLABLE PDFJoshua0% (1)

- DRAFT Cargo Insurance CertificateDocument1 pageDRAFT Cargo Insurance CertificateAdnan TariqNo ratings yet

- B. Insurance: Pcil Set 1Document24 pagesB. Insurance: Pcil Set 1Isaac WongNo ratings yet

- Black-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDocument8 pagesBlack-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDickson phiriNo ratings yet

- Insurance Contract Law NotesDocument10 pagesInsurance Contract Law NotesTay Min Si100% (2)

- 432B Case 2 Questions Mogen Inc Mar221Document1 page432B Case 2 Questions Mogen Inc Mar221wole1974No ratings yet

- UBL Annual Report 2018-100Document1 pageUBL Annual Report 2018-100IFRS LabNo ratings yet

- Tengah Bulan Driver Periode 1 - 15 Maret 2022Document4 pagesTengah Bulan Driver Periode 1 - 15 Maret 2022Asep Ali Muhamad RamdanNo ratings yet

- Barangay Centro CBRP-Monitoring-Report-with-Formulas 1Document7 pagesBarangay Centro CBRP-Monitoring-Report-with-Formulas 1Henry Kahal Orio Jr.No ratings yet

- Balance Gral Jun 2022 y 2021Document1 pageBalance Gral Jun 2022 y 2021quinterolerma8No ratings yet

- Claim Expense AUG 2020 W2Document187 pagesClaim Expense AUG 2020 W2HAN SUKARMANNo ratings yet

- Claim Expense AUG 2020 W3Document187 pagesClaim Expense AUG 2020 W3HAN SUKARMANNo ratings yet

- UBL Annual Report 2018-155Document1 pageUBL Annual Report 2018-155IFRS LabNo ratings yet

- Interest Income On Biogas Reconciliation With CAD For The Year Ended 30 June, 2019 IDCOL Biogas ProgramDocument9 pagesInterest Income On Biogas Reconciliation With CAD For The Year Ended 30 June, 2019 IDCOL Biogas ProgramNazmulNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- 5 A3 BLACKIN WHITE Month Wise Quantity Execution PlanDocument1 page5 A3 BLACKIN WHITE Month Wise Quantity Execution PlanKamlesh SarjanNo ratings yet

- 高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementDocument13 pages高顿财经ACCA acca.gaodun.cn: Advanced Performance ManagementIskandar BudionoNo ratings yet

- Regional Travelers 2020Document12 pagesRegional Travelers 2020Dranreb PaleroNo ratings yet

- CANELODocument11 pagesCANELOsonicholasfilesNo ratings yet

- Goods Control 2023Document234 pagesGoods Control 2023Ân TrươngNo ratings yet

- 01-Current Revenue Expenditure SideDocument4,993 pages01-Current Revenue Expenditure SidePPP NodeNo ratings yet

- Audit Report1Document2 pagesAudit Report1Manoj gurungNo ratings yet

- CTC Pt. Sgi - 2018Document9 pagesCTC Pt. Sgi - 2018Rama Triwardana PolaniNo ratings yet

- 2020 - ATI CNA Incentive Request TemplateDocument196 pages2020 - ATI CNA Incentive Request TemplateJapaninaNo ratings yet

- TDS Calculator - 2017-18Document9 pagesTDS Calculator - 2017-18rohithnatramNo ratings yet

- RegionalTravelers2018 PDFDocument20 pagesRegionalTravelers2018 PDFMadge FordNo ratings yet

- Paybill OfficialDocument63 pagesPaybill Officialmudassir awanNo ratings yet

- 2023 08 28 Budget Book 2022 23 ComposedDocument28 pages2023 08 28 Budget Book 2022 23 ComposedMirza shaharyar baigNo ratings yet

- Portfolio Activity Unit 2Document4 pagesPortfolio Activity Unit 2Kelvin kikanaeNo ratings yet

- Financial Statistics History: Capital AccountDocument37 pagesFinancial Statistics History: Capital AccountEsha ChaudharyNo ratings yet

- Form GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDocument4 pagesForm GSTR-3B (August'21) : Particulars Total Taxable Value Igst CGST Sgst/UtgstDost BhawanaNo ratings yet

- Placement DetailsDocument4 pagesPlacement DetailsSwami SrinivasNo ratings yet

- CF-Export-05-03-2024 21Document13 pagesCF-Export-05-03-2024 21v4d4f8hkc2No ratings yet

- UBL Annual Report 2018-96Document1 pageUBL Annual Report 2018-96IFRS LabNo ratings yet

- ABYIP FormatDocument4 pagesABYIP FormatLeonard VillanuevaNo ratings yet

- Actual Gaji & Lembur PSB Readymix April 2022Document8 pagesActual Gaji & Lembur PSB Readymix April 2022Adi PrasetyoNo ratings yet

- Adp W&S 2018-19Document39 pagesAdp W&S 2018-19Molai SyedNo ratings yet

- Solar Energy Corporation of India Schedule of Fixed Assets: (Amount in RS)Document22 pagesSolar Energy Corporation of India Schedule of Fixed Assets: (Amount in RS)mayoorNo ratings yet

- Audit Proforma 2019Document12 pagesAudit Proforma 2019Spandana pdicdsNo ratings yet

- LK Irs & Gua Jo Bulan Januari - Desember 2020Document77 pagesLK Irs & Gua Jo Bulan Januari - Desember 2020DesyanaNo ratings yet

- Financial Statistics HistoryDocument38 pagesFinancial Statistics HistoryOUSEPPACHAN JOSHYNo ratings yet

- Brief Tractor 07-11-2023Document4 pagesBrief Tractor 07-11-2023Hafiz Saddique MalikNo ratings yet

- The Ars - Cash Flow 2023Document70 pagesThe Ars - Cash Flow 2023Irwan syachNo ratings yet

- APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountDocument2 pagesAPR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountSrinivasan PNo ratings yet

- CG - 2018-2019 - Jayshree Jay KariaDocument2 pagesCG - 2018-2019 - Jayshree Jay KariaAnil kadamNo ratings yet

- Simulasi Perhitungan Andal v5Document48 pagesSimulasi Perhitungan Andal v5sepniNo ratings yet

- Sales Report 2020Document27 pagesSales Report 2020Endri GinantakaNo ratings yet

- Ap MisDocument6 pagesAp MisNARUTONo ratings yet

- PAYBILL OFFICERDocument22 pagesPAYBILL OFFICERmudassir awanNo ratings yet

- MyOnlineCA Tax Relief Calculator 2024 Version FinalDocument7 pagesMyOnlineCA Tax Relief Calculator 2024 Version FinalamarNo ratings yet

- UBL Annual Report 2018-99Document1 pageUBL Annual Report 2018-99IFRS LabNo ratings yet

- Income Tax Calculator FY 2022-23 (AY 2023-24) FormatDocument3 pagesIncome Tax Calculator FY 2022-23 (AY 2023-24) FormatAnkush SinghNo ratings yet

- Harkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedDocument4 pagesHarkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedPawan Kumar SinghNo ratings yet

- Computation Mumbai Bazaar 2022Document3 pagesComputation Mumbai Bazaar 2022Sanjeev RanjanNo ratings yet

- Chairman Expenses Q4 (2021-22) 02Document1 pageChairman Expenses Q4 (2021-22) 02Creator5858 SNo ratings yet

- PHE (Public Health Sindh)Document63 pagesPHE (Public Health Sindh)irfanzai456No ratings yet

- 2024-2026 Operating Budget ChangesDocument4 pages2024-2026 Operating Budget ChangesCityNewsTorontoNo ratings yet

- q1 - q4 - 2023 h63 Cash Position - New Format - 01Document1,323 pagesq1 - q4 - 2023 h63 Cash Position - New Format - 01Jojo RamosNo ratings yet

- 27-Local GovernmentDocument87 pages27-Local GovernmentIrfan RazaNo ratings yet

- CS2016 Dinesh GuptaDocument2 pagesCS2016 Dinesh Guptakashish guptaNo ratings yet

- Annex E Changes in Equity 2020Document1 pageAnnex E Changes in Equity 2020EunicaNo ratings yet

- UBL Annual Report 2018-169Document1 pageUBL Annual Report 2018-169IFRS LabNo ratings yet

- GST Annual Return 2021 2022Document99 pagesGST Annual Return 2021 2022AUTHENTIC SURSEZNo ratings yet

- Office Units 2022Document316 pagesOffice Units 2022Remz NaynesNo ratings yet

- Almaty–Issyk-Kul Altnernative Road Economic Impact AssessmentFrom EverandAlmaty–Issyk-Kul Altnernative Road Economic Impact AssessmentNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-89Document1 pageUBL Annual Report 2018-89IFRS LabNo ratings yet

- Examination: Subject ST3 - General Insurance Specialist TechnicalDocument6 pagesExamination: Subject ST3 - General Insurance Specialist Technicaldickson phiriNo ratings yet

- ASI Insurance PDFDocument5 pagesASI Insurance PDFSARDER JERIN SARAHNo ratings yet

- Multiple Choice Financial DerivativesDocument14 pagesMultiple Choice Financial DerivativesAnkit BaranwalNo ratings yet

- Unit 8Document7 pagesUnit 8Kayla Marie CagoNo ratings yet

- India Insure - TerrorismDocument8 pagesIndia Insure - TerrorismsridharanNo ratings yet

- The Magic of Jeevan Saral: An Insight Into This Unique Plan of L.I.C. Golden Peacock Award Winner in 2004Document31 pagesThe Magic of Jeevan Saral: An Insight Into This Unique Plan of L.I.C. Golden Peacock Award Winner in 2004Nitesh ChauhanNo ratings yet

- Under WrittingDocument4 pagesUnder WrittingChazzy f ChazzyNo ratings yet

- StockDocument60 pagesStockPhan Tú AnhNo ratings yet

- CERTIFICATE No. CXW-3250556-1Document2 pagesCERTIFICATE No. CXW-3250556-1dannyNo ratings yet

- San Beda Insurance Code Bar ReviewerDocument26 pagesSan Beda Insurance Code Bar Reviewerเจียนคาร์โล การ์เซีย100% (2)

- Accounting For Financial InstrumentsDocument22 pagesAccounting For Financial InstrumentsSajid IqbalNo ratings yet

- Derivative Securities: FINA 3204Document27 pagesDerivative Securities: FINA 3204BillyNo ratings yet

- AINS 22 - Segment B Quiz (Qizlet)Document18 pagesAINS 22 - Segment B Quiz (Qizlet)Karly Alleyne100% (1)

- Ifrs 9 (Psak 71)Document21 pagesIfrs 9 (Psak 71)Revanty IryaniNo ratings yet

- CRG660 - Full SS 2022 To 2019Document51 pagesCRG660 - Full SS 2022 To 2019Wibi Ali HazaratNo ratings yet

- Elements of Marine Insurance ContractDocument6 pagesElements of Marine Insurance ContractSucharitaNo ratings yet

- Renewal Notice Sample For PNBDocument1 pageRenewal Notice Sample For PNBDeejay FarioNo ratings yet

- APGLI A.P.G.L.I. Age Limit Up To 58 YearsDocument3 pagesAPGLI A.P.G.L.I. Age Limit Up To 58 YearsSEKHARNo ratings yet

- Illustration 4 PDFDocument2 pagesIllustration 4 PDFsusman paulNo ratings yet

- Msc. Accounting and FinanceDocument18 pagesMsc. Accounting and FinancerytchluvNo ratings yet

- Libor Transition A Practical Guide PDFDocument31 pagesLibor Transition A Practical Guide PDFmartaNo ratings yet

- Insight Into Basics of General InsuranceDocument18 pagesInsight Into Basics of General Insurancepiyushkumarjha12No ratings yet