Professional Documents

Culture Documents

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

Uploaded by

kamalsinghaniya5305Copyright:

Available Formats

You might also like

- GMCVB Marketing Plan Y 2023Document95 pagesGMCVB Marketing Plan Y 2023avinaauthoringtools3No ratings yet

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- CA Foundation Accounts Q MTP 1 June 2024 Castudynotes ComDocument8 pagesCA Foundation Accounts Q MTP 1 June 2024 Castudynotes Comgokulthilagam362No ratings yet

- Navyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SDocument2 pagesNavyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SparthNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Accounts June 2024Document8 pagesAccounts June 2024rajdjpurohitNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Adobe Scan 05 Jan 2024Document2 pagesAdobe Scan 05 Jan 2024Harshit GargNo ratings yet

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocument3 pagesCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345No ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- 21Document10 pages21aroranavdishNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- CA Foundation Accounts Q MTP 2 Nov23 Castudynotes ComDocument6 pagesCA Foundation Accounts Q MTP 2 Nov23 Castudynotes Comhariniharini03904No ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Exam Type Question of Accountancy, Class XiDocument3 pagesExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- BRS SCANNER by Nahta PDFDocument24 pagesBRS SCANNER by Nahta PDFVaidika JainNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- Mid Term Accounts - SubjectiveDocument4 pagesMid Term Accounts - Subjectivekarishma prabagaranNo ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- Bank Reconciliation Statement Problems and Solutions I BRS I AK PDFDocument12 pagesBank Reconciliation Statement Problems and Solutions I BRS I AK PDFAdvance Knowledge88% (8)

- Test Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingGayathiri RNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation Statement20232024s5r14leungjacobNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- F005 Test 5 StudentsDocument6 pagesF005 Test 5 StudentsbhumikaaNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- Ill-Gotten Money and the Economy: Experiences from Malawi and NamibiaFrom EverandIll-Gotten Money and the Economy: Experiences from Malawi and NamibiaNo ratings yet

- Nes D2188Document6 pagesNes D2188prasannaNo ratings yet

- HP Scanjet Pro 2500 F1 Flatbed Scanner: DatasheetDocument2 pagesHP Scanjet Pro 2500 F1 Flatbed Scanner: DatasheetKarkittykatNo ratings yet

- Recognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyDocument89 pagesRecognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyMaria ClaraNo ratings yet

- Assessment of Digestive and GI FunctionDocument23 pagesAssessment of Digestive and GI FunctionSandeepNo ratings yet

- Before Reading: An Encyclopedia EntryDocument6 pagesBefore Reading: An Encyclopedia EntryĐào Nguyễn Duy TùngNo ratings yet

- Synopsis Car Showroom ManagementDocument18 pagesSynopsis Car Showroom ManagementRaj Bangalore50% (4)

- Martin Luther King Jr. - A True Historical Examination. (N.D.) - Retrieved OctoberDocument5 pagesMartin Luther King Jr. - A True Historical Examination. (N.D.) - Retrieved Octoberapi-336574490No ratings yet

- The Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldDocument474 pagesThe Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldSSI-Strategic Studies Institute-US Army War College100% (1)

- Crim Pro 2004-2010 Bar QuestionsDocument4 pagesCrim Pro 2004-2010 Bar QuestionsDennie Vieve IdeaNo ratings yet

- Kapandji TrunkDocument245 pagesKapandji TrunkVTZIOTZIAS90% (10)

- Resource AllocationDocument10 pagesResource AllocationZoe NyadziNo ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Chem 26.1 Lab Manual 2017 Edition (2019) PDFDocument63 pagesChem 26.1 Lab Manual 2017 Edition (2019) PDFBea JacintoNo ratings yet

- Uperpowered Estiary: Boleth To YclopsDocument6 pagesUperpowered Estiary: Boleth To YclopsMatheusEnder172No ratings yet

- The Wexford Carol (Arr Victor C Johnson)Document13 pagesThe Wexford Carol (Arr Victor C Johnson)Macdara de BurcaNo ratings yet

- Rev JSRR 45765Document2 pagesRev JSRR 45765Amit BNo ratings yet

- Hispanic Tradition in Philippine ArtsDocument14 pagesHispanic Tradition in Philippine ArtsRoger Pascual Cuaresma100% (1)

- Prince Ganai NuclearDocument30 pagesPrince Ganai Nuclearprince_ganaiNo ratings yet

- The Madmullah of Somaliland 1916 1921Document386 pagesThe Madmullah of Somaliland 1916 1921Khadar Hayaan Freelancer100% (1)

- Squirrels of Indian SubcontinentDocument14 pagesSquirrels of Indian SubcontinentAkshay MotiNo ratings yet

- Final Artifact Management Theory IIDocument11 pagesFinal Artifact Management Theory IIapi-651643566No ratings yet

- CAN LIN ProtocolDocument60 pagesCAN LIN ProtocolBrady BriffaNo ratings yet

- Student Assesment PDFDocument1 pageStudent Assesment PDFBelaNo ratings yet

- Industry ProfileDocument9 pagesIndustry ProfilesarathNo ratings yet

- MSP432 Chapter2 v1Document59 pagesMSP432 Chapter2 v1Akshat TulsaniNo ratings yet

- Neuromusic IIIDocument3 pagesNeuromusic IIIJudit VallejoNo ratings yet

- Palm Oil MillDocument52 pagesPalm Oil MillengrsurifNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet

- Skullcandy Case Study - Part OneDocument8 pagesSkullcandy Case Study - Part OneUthmanNo ratings yet

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

Uploaded by

kamalsinghaniya5305Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

01-11-2023 - 08.00pm - Accounts - Bank Reconciliation Statement Assignment

Uploaded by

kamalsinghaniya5305Copyright:

Available Formats

www.escholars.

in

CA Foundation

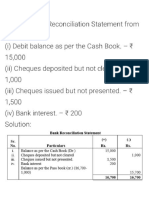

Bank Reconciliation Statement

Test Paper

Time Allowed: 45 Mins Maximum Marks: 30

Date: - 01-11-2023

Q. Questions Marks

No.

1. (i) Why do we need reconciliation? 4

(ii) What is a bank overdraft?

2. From the following information, prepare Bank Reconciliation Statement and adjusted 8

cash book as on 31st March, 2022:

(i) Balance (Debit) as per Cash Book as on 31st March, 2022 Rs. 19850.

(ii) Out of the total cheques issued amounting to Rs. 17500, cheques of Rs. 3,000

were debited by Bank in March, 2022, cheques of RS. 7540 were debited in april,

2022 and the rest have not been presented yet.

(iv) Out of the total cheques deposited amounting to Rs. 5,000, cheques of Rs. 1,500

were credited by bank in March, 2022, and balance cheques were credited in

April,2022.

(v) Bank had debited Rs. 100 as bank charges and had credited Rs. 200 as interest.

(vi) A cheque paid to S Ltd. for Rs. 3,400 had been entered in the Cash

Book as Rs. 4,300.

(vii) Amount directly deposited in the bank of Rs, 4570 and a bill has been

dishonoured of rs 13450 was discounted on 1550 discount charges.

3. (i) On 31st March, 2023 the bank passbook of Raman showed a balance of Rs. 30,000 8

to her credit.

(ii) Before that date, he had issued cheques amounting to Rs. 16,000 out of which

cheques amounting to Rs. 6,200 have so far been presented for payment.

(iii) A cheque of Rs. 5840 deposited by him into the bank on 26th March, 2023 is not

yet credited in the passbook.

(iv) He had also received a cheque of Rs. 2500 which although entered by him in the

bank column of cash book, was omitted to be paid into the bank.

(v) On 30th March, 2023 a cheque of Rs. 8750 received by him was paid into bank

but the same was omitted to be entered in the cash book.

(vi) There was a credit of Rs. 150 for interest on current account and a debit of Rs. 25

for bank charges.

Draw up a bank reconciliation statement

4. On comparing the Cash Book of Nirmal with the Pass Book , following discrepancies 10

were noted :

Balance as per pass book (dr) 145500

(i) Out of 61,000 pain in by cheques into the bank on 25th, March cheques amounting

to 17800 were collected on 5th April,

(ii) Out of cheques drawn amounting to 15,600 on 28th March a cheque for 7850 was

presented on 3rd April.

(iii) A cheque for 3400 entered in Cash Book but omitted to be banked on 31st March.

(iv) A cheque for 1,200 deposited into bank omitted to be recorded in Cash Book and

was collected by the bank 29th March.

(v) A bill receivable for 3040 previously discounted (discount ₹ 40) with the bank

had been dishonoured but advice was received on 3rd April.

888 888 0402 support@escholars.in 1

www.escholars.in

(vi) A cheque 20,000 was retired/pair by the bank under a rebate of 300 but the full

amount of the bill was credited in the bank column of the Cash Boook.

(vii) A cheque of ₹ 9500 wrongly credited in the Pass Book on 29th March was

reversed on 2nd April.

(viii) Bank had wrongly debited 10,000 in the account on 31st March and reversed it

on 10th April. 2019

888 888 0402 support@escholars.in 2

You might also like

- GMCVB Marketing Plan Y 2023Document95 pagesGMCVB Marketing Plan Y 2023avinaauthoringtools3No ratings yet

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- CA Foundation Accounts Q MTP 1 June 2024 Castudynotes ComDocument8 pagesCA Foundation Accounts Q MTP 1 June 2024 Castudynotes Comgokulthilagam362No ratings yet

- Navyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SDocument2 pagesNavyug Commerce Institute Lakhanpur Kanpur Topic-B.R.SparthNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Accounts June 2024Document8 pagesAccounts June 2024rajdjpurohitNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Adobe Scan 05 Jan 2024Document2 pagesAdobe Scan 05 Jan 2024Harshit GargNo ratings yet

- Ca Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 MinutesDocument3 pagesCa Foundation Accounts Test Paper: Maximum Marks: 40 Time Allowed: 1hr. Allowed: 1hr. 15 Minutesvanshikha.agarwal345No ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- 21Document10 pages21aroranavdishNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- CA Foundation Accounts Q MTP 2 Nov23 Castudynotes ComDocument6 pagesCA Foundation Accounts Q MTP 2 Nov23 Castudynotes Comhariniharini03904No ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- 3.CA Foundation Test 3Document5 pages3.CA Foundation Test 3Nived Narayan PNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Exam Type Question of Accountancy, Class XiDocument3 pagesExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- BRS SCANNER by Nahta PDFDocument24 pagesBRS SCANNER by Nahta PDFVaidika JainNo ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Test 4Document6 pagesTest 4Jayant MittalNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- Mid Term Accounts - SubjectiveDocument4 pagesMid Term Accounts - Subjectivekarishma prabagaranNo ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- Bank Reconciliation Statement Problems and Solutions I BRS I AK PDFDocument12 pagesBank Reconciliation Statement Problems and Solutions I BRS I AK PDFAdvance Knowledge88% (8)

- Test Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingGayathiri RNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation Statement20232024s5r14leungjacobNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- 06 BRS - Practice QuestionsDocument1 page06 BRS - Practice QuestionsNeelanjana RayNo ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- Foundation Accounts Suggested Nov20Document25 pagesFoundation Accounts Suggested Nov20dhanushd0613No ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- 5664accountancy XIDocument9 pages5664accountancy XIAryan VishwakarmaNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- F005 Test 5 StudentsDocument6 pagesF005 Test 5 StudentsbhumikaaNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- Ill-Gotten Money and the Economy: Experiences from Malawi and NamibiaFrom EverandIll-Gotten Money and the Economy: Experiences from Malawi and NamibiaNo ratings yet

- Nes D2188Document6 pagesNes D2188prasannaNo ratings yet

- HP Scanjet Pro 2500 F1 Flatbed Scanner: DatasheetDocument2 pagesHP Scanjet Pro 2500 F1 Flatbed Scanner: DatasheetKarkittykatNo ratings yet

- Recognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyDocument89 pagesRecognition, Signaling, and Repair of DNA Double-Strand Breaks Produced by Ionizing Radiation in Mammalian Cells - The Molecular ChoreographyMaria ClaraNo ratings yet

- Assessment of Digestive and GI FunctionDocument23 pagesAssessment of Digestive and GI FunctionSandeepNo ratings yet

- Before Reading: An Encyclopedia EntryDocument6 pagesBefore Reading: An Encyclopedia EntryĐào Nguyễn Duy TùngNo ratings yet

- Synopsis Car Showroom ManagementDocument18 pagesSynopsis Car Showroom ManagementRaj Bangalore50% (4)

- Martin Luther King Jr. - A True Historical Examination. (N.D.) - Retrieved OctoberDocument5 pagesMartin Luther King Jr. - A True Historical Examination. (N.D.) - Retrieved Octoberapi-336574490No ratings yet

- The Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldDocument474 pagesThe Russian Military Today and Tomorrow: Essays in Memory of Mary FitzgeraldSSI-Strategic Studies Institute-US Army War College100% (1)

- Crim Pro 2004-2010 Bar QuestionsDocument4 pagesCrim Pro 2004-2010 Bar QuestionsDennie Vieve IdeaNo ratings yet

- Kapandji TrunkDocument245 pagesKapandji TrunkVTZIOTZIAS90% (10)

- Resource AllocationDocument10 pagesResource AllocationZoe NyadziNo ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Chem 26.1 Lab Manual 2017 Edition (2019) PDFDocument63 pagesChem 26.1 Lab Manual 2017 Edition (2019) PDFBea JacintoNo ratings yet

- Uperpowered Estiary: Boleth To YclopsDocument6 pagesUperpowered Estiary: Boleth To YclopsMatheusEnder172No ratings yet

- The Wexford Carol (Arr Victor C Johnson)Document13 pagesThe Wexford Carol (Arr Victor C Johnson)Macdara de BurcaNo ratings yet

- Rev JSRR 45765Document2 pagesRev JSRR 45765Amit BNo ratings yet

- Hispanic Tradition in Philippine ArtsDocument14 pagesHispanic Tradition in Philippine ArtsRoger Pascual Cuaresma100% (1)

- Prince Ganai NuclearDocument30 pagesPrince Ganai Nuclearprince_ganaiNo ratings yet

- The Madmullah of Somaliland 1916 1921Document386 pagesThe Madmullah of Somaliland 1916 1921Khadar Hayaan Freelancer100% (1)

- Squirrels of Indian SubcontinentDocument14 pagesSquirrels of Indian SubcontinentAkshay MotiNo ratings yet

- Final Artifact Management Theory IIDocument11 pagesFinal Artifact Management Theory IIapi-651643566No ratings yet

- CAN LIN ProtocolDocument60 pagesCAN LIN ProtocolBrady BriffaNo ratings yet

- Student Assesment PDFDocument1 pageStudent Assesment PDFBelaNo ratings yet

- Industry ProfileDocument9 pagesIndustry ProfilesarathNo ratings yet

- MSP432 Chapter2 v1Document59 pagesMSP432 Chapter2 v1Akshat TulsaniNo ratings yet

- Neuromusic IIIDocument3 pagesNeuromusic IIIJudit VallejoNo ratings yet

- Palm Oil MillDocument52 pagesPalm Oil MillengrsurifNo ratings yet

- Architecture in EthDocument4 pagesArchitecture in Ethmelakumikias2No ratings yet

- Skullcandy Case Study - Part OneDocument8 pagesSkullcandy Case Study - Part OneUthmanNo ratings yet