Professional Documents

Culture Documents

Cash & Cash Equivalents: - For Ending Balance

Cash & Cash Equivalents: - For Ending Balance

Uploaded by

ETTORE JOHN DE VERAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash & Cash Equivalents: - For Ending Balance

Cash & Cash Equivalents: - For Ending Balance

Uploaded by

ETTORE JOHN DE VERACopyright:

Available Formats

Cash & Cash Equivalents Trade Receivables

Cash (Theories) 1. Accounts receivable

● IM: Face Value

● SM: Face Value

● Examples:

1. Cash on hand (i.e. bills and coins)

2. Cash in bank

3. Demand deposits - SM: Net Realizable Value

4. Checks that may be encashed immediately - NRV - deducting

5. Cash set aside for funds used in current operations 1. Sales Returns

Other Considerations 2. Sales Discounts

1. Bank Overdraft - classified as a CL, unless has 2 or more 3. Freight Charges

accounts in the same bank and one of them has a negative 4. Doubtful Accounts

balance 1.1 Bad Debts / Uncollectible Accounts

2. Compensating balance - part of cash only if not legally (1) Direct write-off method, or;

restricted (2) Allowance method

3. Postdated checks drawn, Stale checks and Undelivered

checks - included because the entity still has unrestricted use

over them until the check is ready for encashment

Cash Equivalents

● IM: Face Value

● SM: Face Value

● Examples:

1. 3-month Treasury bill

2. 90-day money market instruments

3. 3-month time deposits

Other Considerations

- GR: Equity Instruments excluded

- XPN: Redeemable Preference Shares acquired within - For ending balance:

3 months from its redemption date

For PROBLEM SOLVING:

Include:

1. Cash in Bank (unless restricted) - Estimation methods:

a. Undelivered Check

b. Checking Account

% of Sales % of Receivables Aging of

c. Payroll Receivables

d. Savings Deposit

Nature % of Credit Sales % of Gross Rec, Percentage table

e. Money Market Instrument within 3 months

f. Compensating Balance - if NOT Legally Restricted Write-off amount Ending balance Ending Balance

Impact

2. Cash on hand (debit amount)

3. Checkbook Balance

4. Cash Equivalents - maturing within 3 month Receivable Financing - raising funds by utilizing existing receivables

5. 1. Pledging and Assignment

Loans and Receivables

Receivables

- Financial assets arising from a contractual right to receive

cash

- Falls under 4 categories (PFRS 9)

1. FAAC

2. FAFVPL

3. FAFVOCI

- Loans and Receivables - non-derivative financial assets with

2. Factoring - absolute sale and transfer of ownership to a bank

fixed maturity

or financing entity

- The ff. occurs during factoring:

1. Accounts are derecognized

2. Gain or loss is recognized

3. Any service fees and interest charged is directly

deducted

4. Factor’s holdback - ade to secure the factor

from any possible uncollectible accounts

3. Discounting - transfer of endorsement of note by the payee in

favor of another party. The endorsement may be:

Types of Inventories

1. Goods in Transit

2. Consigned Goods

3. Pledge of Inventory

4. Lay-away Sales

5. Bill and Hold Sales

Measurement

- IM & SM - LCNRV

- NRV - Selling Price - Cost of Completion & Selling

Nontrade Receivables Costs

- Monetary items arising from lending transactions. - No impairment

- Normally long term - Cost of Inventories

- Should be stated at PV: 1. Cost of Purchase - PP, ID, non-recoverable taxes

a. Face value (short-term and interest bearing) 2. Cost of Conversion - DL, VOH and FOH

b. Discounted value (non-interest bearing and 3. Other Costs - bringing the inventories to their present

unreasonably low interest) location and condition

- Factors to consider: - VAT is:

1. Interest bearing on non - Excluded - VAT Taxpayer

2. Effective rate = or =/= to nominal rate - Included - non-VAT Taxpayer

a. Nominal rate/face rate/coupon - Excluded from Cost:

rate/contracted rate – stated rate in the note - Abnormal amounts of wasted materials

b. Effective rate/market rate/yield rate – rate - Storage costs, unless necessary

used in the market to discount to present value - Administrative OH

c. If ER > NR = discount - Selling Costs

d. If ER < NR = premium Deferred Settlement Terms

3. Timing and manner of payment - Purchase Price - Amount Paid

4. Maturity period - Recognized as interest expense over the period

5. Direct cost and fees made to originate the financing Service Providers

agreement - Cost of production

a. Origination costs – costs that are expended - Should not include profit margins or non-attributable overhead

by the lender in order to process a loan Accounting for Inventories

application but are not chargeable against the

borrower

i. Direct – deferred cost

ii. Indirect – expensed immediately

b. Origination fees – also costs to process a loan

application, except that it is chargeable against

the borrower. Accounted for as unearned

interest income.

Direct origination costs – origination fees = net deferred costs or net

unearned interest income

Impairment of Nontrade Receivables

- Assessing factors

1. Significant financial difficulty of the debtor, issuer or

obligor

2. Default or delinquency in interest or principal payments

3. The creditor granting the debtor a concession that the

creditor would not otherwise consider

4. Probability that the borrower will enter bankruptcy or

other financial reorganization or restructuring

5. Disappearance of an active market for that financial

asset because of financial difficulties

6. Indication that there is a measurable decrease in the

estimated future cash flows from the group of financial

assets

**Carrying Amount - PV of Estimated Future Cash Flows = Impairment Loss

- Either: (1) Direct deduction; or (2) Allowance accounts with the loss

recognized in P/L

- Reversals of impairment are allowed and a ‘gain on reversal of

impairment’ is recorded.

Cost Formulas

- Restriction: New recoverable amount should not be more

than the would have been carrying amount if the impairment

was not originally recognized

Inventories (PAS 2)

- Defines as assets:

a. Finished Goods

b. Work in Process

c. Raw Materials and Manufacturing Supplies Recognition as Expense

- All inventory, except: - Write-down of inventories to NRV and all losses of inventories

a. Financial Instruments - Reversal of write-down - recognized as a reduction in the

b. Biological Assets related to Agricultural activity and amount of inventories recognized as an expense.

Agricultural produce at the point of harvest Inventory Estimation

- Measurement does not apply to inventories held by:

You might also like

- Audit - Cash and Cash Equivalents PDFDocument15 pagesAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- MScFE 560 FM - Compiled - Notes - M2 PDFDocument21 pagesMScFE 560 FM - Compiled - Notes - M2 PDFtylerNo ratings yet

- DHFL Annual Report Fy 2018 19 PDFDocument332 pagesDHFL Annual Report Fy 2018 19 PDFmayurbuddyNo ratings yet

- Reviewer Fundamentals of Accounting 2Document3 pagesReviewer Fundamentals of Accounting 2Astro LunaNo ratings yet

- INTACC - Chapter 1Document4 pagesINTACC - Chapter 1MeriiiNo ratings yet

- Audit of Receivables Lecture NotesDocument10 pagesAudit of Receivables Lecture NotesDebs Fanoga100% (1)

- Audit of ReceivablesDocument4 pagesAudit of ReceivablesClarisse AnnNo ratings yet

- Summary of Cash and Cash EquivalentsDocument4 pagesSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesMa. Trixcy De VeraNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- AttachmentDocument14 pagesAttachmentAngelo Jose BalalongNo ratings yet

- NU - Audit of Cash and Cash EquivalentsDocument14 pagesNU - Audit of Cash and Cash EquivalentsDawn QuimatNo ratings yet

- Auditing Problems: Audit of ReceivablesDocument4 pagesAuditing Problems: Audit of ReceivablesLaong laanNo ratings yet

- 1 Page Summary Internal ControlsDocument2 pages1 Page Summary Internal ControlsFahim zaibNo ratings yet

- CAF 09 - Controls Sheet By: Muhammad Asif, FCADocument2 pagesCAF 09 - Controls Sheet By: Muhammad Asif, FCAsidra awanNo ratings yet

- AP Lesson 2Document13 pagesAP Lesson 2Joanne RomaNo ratings yet

- Audit Final To PrintDocument6 pagesAudit Final To PrintKHathy AsoiralNo ratings yet

- FABM REVIEWER 2nd QUARTERDocument5 pagesFABM REVIEWER 2nd QUARTERMikaella Adriana GoNo ratings yet

- Topic 26 Internal Control Sales Cycle PDFDocument6 pagesTopic 26 Internal Control Sales Cycle PDFGlen JavellanaNo ratings yet

- Chapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewDocument20 pagesChapter 2: AUDIT OF CASH (Receipts and Disbursements) Audit of Cash and Cash Chapter 2 Equivalents Chapter OverviewAngel RosalesNo ratings yet

- Intermediate AccountingDocument4 pagesIntermediate AccountingjenNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate Accountingjaninasachadelacruz0119No ratings yet

- Lecture 2 - Receivables (Students' Copy - Diy) - 5Document297 pagesLecture 2 - Receivables (Students' Copy - Diy) - 5JOSCEL SYJONGTIANNo ratings yet

- 13 Cash and ReceivablesDocument14 pages13 Cash and ReceivablesHesham AhmedNo ratings yet

- FAR1 - Cash and Cash Equivalents + ReceivablesDocument3 pagesFAR1 - Cash and Cash Equivalents + ReceivablesHoney MuliNo ratings yet

- Business Finance ReviewerDocument4 pagesBusiness Finance ReviewerJanna rae BionganNo ratings yet

- C10 Lecture NotesDocument3 pagesC10 Lecture NotesJonathan NavalloNo ratings yet

- Cash and Cash Equivalents: If Silent, Our Stale CheckDocument2 pagesCash and Cash Equivalents: If Silent, Our Stale CheckJustine CruzNo ratings yet

- Pre2 Notesl Leo CcbrpocDocument15 pagesPre2 Notesl Leo CcbrpocCarla Jane Mirasol ApolinarioNo ratings yet

- CASH AND CASH EQUIVALENTS ReviewerDocument2 pagesCASH AND CASH EQUIVALENTS ReviewerhelloangelodavidNo ratings yet

- FINACC1 - Cash and Cash Equivalents + ReceivablesDocument3 pagesFINACC1 - Cash and Cash Equivalents + ReceivablesJerico DungcaNo ratings yet

- Day 6 Cash and Receivables 2024 FinalDocument18 pagesDay 6 Cash and Receivables 2024 FinalKit KatNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- Module 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Document6 pagesModule 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Cale Robert RascoNo ratings yet

- Forms of Receivable FinancingDocument3 pagesForms of Receivable FinancingClar AgramonNo ratings yet

- Cash and Cash EquivalentDocument3 pagesCash and Cash EquivalentGiyah UsiNo ratings yet

- Cash and Cash Equivalents Lecture NotesDocument2 pagesCash and Cash Equivalents Lecture Notesyna kyleneNo ratings yet

- Accounting For Cash and Cash Equivalents - PDF Filename UTF-8''AccountingDocument2 pagesAccounting For Cash and Cash Equivalents - PDF Filename UTF-8''AccountingFrancis RaagasNo ratings yet

- Funacc RebyuwerDocument4 pagesFunacc RebyuwerBea ManalotoNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- Pre 2 Auditing Concepts and Applications Module 1 and 2Document3 pagesPre 2 Auditing Concepts and Applications Module 1 and 2Anjilla Amor RubiaNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Updates in Financial Reporting Standards: Northeastern CollegeDocument3 pagesUpdates in Financial Reporting Standards: Northeastern CollegeJobelle Grace SorianoNo ratings yet

- Current LiabilitiesDocument2 pagesCurrent LiabilitiesPrio DebnathNo ratings yet

- BF Reviewer LastDocument4 pagesBF Reviewer LastKarl JardinNo ratings yet

- Igcse Accounting TheoryDocument32 pagesIgcse Accounting Theorykuanhuining202104No ratings yet

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2stephbatac241No ratings yet

- Cash & Cash Equivalents, LECTURE &EXERCISESDocument16 pagesCash & Cash Equivalents, LECTURE &EXERCISESNMCartNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- BA 114.1 - Module2 - Receivables - Handout PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Handout PDFKurt OrfanelNo ratings yet

- Auditing Problems Usl PDFDocument226 pagesAuditing Problems Usl PDFmusic niNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Other Assets: Audit ObjectivesDocument5 pagesOther Assets: Audit ObjectivesIvoryBriginoNo ratings yet

- 05 Fa-I Chapter 5Document8 pages05 Fa-I Chapter 5History and EventNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument7 pagesAudit of The Capital Acquisition and Repayment Cyclerezkifadila2No ratings yet

- Chapter 21 - Audit of The Capital Acquisition and Repayment CycleDocument5 pagesChapter 21 - Audit of The Capital Acquisition and Repayment CycleRaymond GuillartesNo ratings yet

- BC - Chapter 1Document8 pagesBC - Chapter 1Jana May Faustino MedranoNo ratings yet

- GoalDocument2 pagesGoalVarun JainNo ratings yet

- LAS BF Q3 Week 5 IGLDocument2 pagesLAS BF Q3 Week 5 IGLdaisymae.buenaventuraNo ratings yet

- Intermediate Accounting 1Document49 pagesIntermediate Accounting 1Harry EvangelistaNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- ITGC Assessment ExampleDocument7 pagesITGC Assessment ExampleETTORE JOHN DE VERANo ratings yet

- Integs2024 RFBT NotesDocument39 pagesIntegs2024 RFBT NotesETTORE JOHN DE VERANo ratings yet

- De Vera, Asynchronous Exam AnswersDocument3 pagesDe Vera, Asynchronous Exam AnswersETTORE JOHN DE VERANo ratings yet

- BURMET 2 Performance Task 1Document17 pagesBURMET 2 Performance Task 1ETTORE JOHN DE VERANo ratings yet

- AnCasa Hotel Kuala LumpurDocument2 pagesAnCasa Hotel Kuala Lumpurratnamsoloman25No ratings yet

- Risk Management of Islamic Microfinance (IMF) Product by Financial Institutions in MalaysiaDocument8 pagesRisk Management of Islamic Microfinance (IMF) Product by Financial Institutions in Malaysiasajid bhattiNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- F9 QuestionsDocument3 pagesF9 QuestionsRiz WanNo ratings yet

- BOI - New LetterDocument5 pagesBOI - New Lettersandip_banerjeeNo ratings yet

- Company ProfileDocument8 pagesCompany ProfilejanardhanvnNo ratings yet

- White Paper Auriga Smart AtmsDocument2 pagesWhite Paper Auriga Smart AtmsirwinohNo ratings yet

- Credit Mandiri BankDocument8 pagesCredit Mandiri BankVie ViEnNo ratings yet

- Builder - Tom CartierDocument112 pagesBuilder - Tom CartierzhuorancaiNo ratings yet

- Chris Gildea ResumeDocument2 pagesChris Gildea Resumeapi-34165897No ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Books & Study Material Recommended For SBI PO Exam - Engistan JobsDocument3 pagesBooks & Study Material Recommended For SBI PO Exam - Engistan JobsdfdfdjNo ratings yet

- ListDocument4 pagesListgeralda pierrelusNo ratings yet

- AcctgDocument2 pagesAcctgJona FranciscoNo ratings yet

- 05 Maths Ncert CH 01 The Fish Tale QuesDocument5 pages05 Maths Ncert CH 01 The Fish Tale QuesHemantNo ratings yet

- Statement Nov 23 XXXXXXXX1574Document14 pagesStatement Nov 23 XXXXXXXX1574Arun SinghNo ratings yet

- Indiapost Blue Book FinalDocument135 pagesIndiapost Blue Book Finalজ্যোতিৰ্ময় বসুমতাৰীNo ratings yet

- Exercises of Cash Liquidity ManagementDocument8 pagesExercises of Cash Liquidity ManagementTâm ThuNo ratings yet

- BNI Mobile Banking: Histori TransaksiDocument7 pagesBNI Mobile Banking: Histori TransaksiIrvan KurniawanNo ratings yet

- A Study On Customer Satisfaction Towards Banking Services Provided by SBI in Reference With Coimbatore CityDocument11 pagesA Study On Customer Satisfaction Towards Banking Services Provided by SBI in Reference With Coimbatore CityAmit KumarNo ratings yet

- Advanced Macroeconomics I: 1. Recent Developments and The State of MacroDocument17 pagesAdvanced Macroeconomics I: 1. Recent Developments and The State of MacroRodneyNo ratings yet

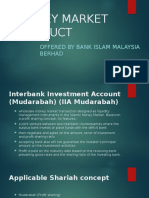

- Money Market BimbDocument9 pagesMoney Market BimbAncoi Ariff CyrilNo ratings yet

- Research Division: Federal Reserve Bank of St. LouisDocument25 pagesResearch Division: Federal Reserve Bank of St. LouisTBP_Think_TankNo ratings yet

- Swinburne Financial Matrix All Regions-Dec 2021Document5 pagesSwinburne Financial Matrix All Regions-Dec 2021Ehab EtmanNo ratings yet

- FRP Templates Guidelines (For RBS)Document10 pagesFRP Templates Guidelines (For RBS)Ma Lourdes T Cahatian100% (1)

- 2.2 Iifcl t3 8.8 20 Years (Sebi)Document127 pages2.2 Iifcl t3 8.8 20 Years (Sebi)Kashmira RNo ratings yet

- XacBank Annual Report 2019Document31 pagesXacBank Annual Report 2019ЭрхмээNo ratings yet

- Attachment PDFDocument6 pagesAttachment PDFYILDRANo ratings yet