Professional Documents

Culture Documents

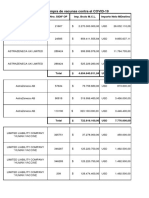

Admissible and Inadmissible Expenses

Admissible and Inadmissible Expenses

Uploaded by

jhansiaj06Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Admissible and Inadmissible Expenses

Admissible and Inadmissible Expenses

Uploaded by

jhansiaj06Copyright:

Available Formats

PROBLEMS AND SOLUTIONS

J. State whether the following payments are admissible or not while calculating the

business

income under the provisions of Income Tax Act. (2019)

Loss of stock due to theft by an employee Alo wable expensu

2. Service charged

3. Charities paid all

4. Provision for doubtful debts Diaallowed exp

5. Legal expenses to defined on existing title toa capital aSSet

6. Loss on sale of capital asset Lrnadtntsible

7. O/s GSTor sale tax of previous years paid duringthe year 30,000 Add ms be

8. Gift tax paid nodmikble

9. Professional tax paid Amabla

10. Penalty paid to customs authorities for importing prohibited goods from Austraia 180000

2. State whether the following payments are admissible or not whi•ecalculating the business

income under the provisions of IncomeTax Act. (2018)

1. Discount allowed AdMIT6Le

2. Annual isting fees paidtowardsstockexchange by acompany AdmD

3. LIC premium on director and his amíly member's lifee b l

A. Paymentof liense for obtaining íranchise ynamikkt

5. Depreciation of RS 40000is debited to P,& Laleof sri Ganesh temple which was con_trycted

linsidethe factory premises for the benefit ófèmplovees of the company Admis ble

6,. Interest on loan taken to pay income tax Sngd m

7. Commission of Rs. 50,000 paidto secure a business order macseble

8. Brokerage paid for raising aloan of Rs. 10,00,000 A£msible

3. State wheher the following payments are admissible or not while calculating the business

income under the provisions of Income Tax Act. (2018)

1. A cash payment of 18500 paid to asuppljer of,aw materials on a day which the books were

klosed on account of in-definite strike Admine

Depreciation of S0000 is debited to P& L adc of sri Ganesh temple which was construçted

inside the factory prenises for the benefit of employees of the company Adm iblo

Contribution made by company to staff welfare fund na miuible

Donation oNCF 25000 ngd misle

5. Bonusof R75000was paid to the employee after due date of filing retorn of income n a d i

6. Sales Tax /GST pid AJ m i e

7. Provision for income tax Snodm sCble

Pcmecible

S. Of the sales tax Drovision sales take of R 000 was paid befoe iling the retum of income

. Compensation of &200000 paid toanemployeefor premature temination of his service -fdrible

10,Interest on capital Snad misebLe

of the

4, According to income tax Act Advise an assesscee about admissibility or otherwise

following while computing income from business:

m bte

. Commission of? 40,000 paid to procure ordes for the business

2. Loss due to embezzlement by anemployee nad mssible

34,000 Fnadmielbl

B. Cash expendirure of &

VJAYA COLLEGE, JAYANAGAR, BENGALURU.

&. 7. 6. 5.

Penaltyfor 6. 5. 4.

alculate before A,B

BBookProfit From From Discount

Interest

00000and.

partners and the the

wable C following

following on

partners allowed

importing loan

salary taken

C |3,45,000 ascertainCases for

tion.or sharing ascertain

200000 and prohibitedprompt to

commission pay

and. profits remuneration remuneration

paymentafduesincome

o

mmission 2,60,000 23) goods

e

ation. cqually tax

is

1500000, payable payable

Snatmiible Snadmisib

carrying

000and 190,000 33) Ao

asS as

The on per per nse

the

partnef Sec, Sec,

busines_

l,00,000 |4) 40B, 40B, ble e

s

salarySA

ctively. Book

The

fhns150,000 Profit-8,00,000

net

150000,

profit

You might also like

- LVHM & Warnaco: Strategy & Financial Statement AnalysisDocument5 pagesLVHM & Warnaco: Strategy & Financial Statement AnalysisVanshika SinghNo ratings yet

- Questions SsDocument7 pagesQuestions SsAngelli Lamique100% (2)

- Day Trading With The InstitutionsDocument102 pagesDay Trading With The Institutionslowtarhk50% (2)

- INCOME TAXATION - Fringe Benefit TaxDocument7 pagesINCOME TAXATION - Fringe Benefit TaxErlle AvllnsaNo ratings yet

- BC 405 PII Past PapersDocument22 pagesBC 405 PII Past PapersRaza Ali SoomroNo ratings yet

- BC 405 PII Past PapersDocument24 pagesBC 405 PII Past PapersArbaz KhanNo ratings yet

- Theories: B. 2 and 3 OnlyDocument5 pagesTheories: B. 2 and 3 OnlyLucille Mae EndigaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Individual b4 B PracticeDocument4 pagesIndividual b4 B Practicedavid.ellis1245No ratings yet

- Franchise AccountingDocument5 pagesFranchise Accountingnephtalie92% (12)

- Franchise Accounting PDF FreeDocument5 pagesFranchise Accounting PDF Freedes arellanoNo ratings yet

- Assessment of Partnership Firms: Illustration 01Document8 pagesAssessment of Partnership Firms: Illustration 01kreshmith2No ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- Practice Exam FinalsDocument2 pagesPractice Exam FinalsPauline Jasmine Sta AnaNo ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Unexpired Insurance: Furniture and FixtureDocument1 pageUnexpired Insurance: Furniture and FixtureFucio, Mark JeroldNo ratings yet

- Inclusions To Gross Income Illustrative ExamplesDocument5 pagesInclusions To Gross Income Illustrative ExamplesMary Rose CredoNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Baf1101 CatDocument7 pagesBaf1101 CatCy RusNo ratings yet

- Ty Sorn-T: (Time:Z%) Iours)Document4 pagesTy Sorn-T: (Time:Z%) Iours)shahisonal02No ratings yet

- Assessment of Companies: Worked Example 1Document6 pagesAssessment of Companies: Worked Example 1IQBALNo ratings yet

- Income Taxation ExamDocument2 pagesIncome Taxation ExamyezaqueraNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaDocument8 pagesProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- Unit 7Document4 pagesUnit 7christian guile figueroaNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- AP1: Cash and AccrualsDocument3 pagesAP1: Cash and AccrualsJelwin Enchong BautistaNo ratings yet

- Acc203 Tut On LiquidationDocument7 pagesAcc203 Tut On LiquidationShivanjani KumarNo ratings yet

- AfB1 Tutorial Questions For Week 3Document3 pagesAfB1 Tutorial Questions For Week 3zhaok0610No ratings yet

- Income From BusinessDocument23 pagesIncome From Businesskhushi shahNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- Taxation - I: (Please Turn Over)Document3 pagesTaxation - I: (Please Turn Over)Laskar REAZ100% (1)

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- IFRS - 2017 - Solved QPDocument15 pagesIFRS - 2017 - Solved QPSharan ReddyNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Invesrment Decision Problems Only QuestionsDocument7 pagesInvesrment Decision Problems Only QuestionsDivyasree DsNo ratings yet

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Document8 pagesSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNo ratings yet

- Fringe Benefits AnswersDocument5 pagesFringe Benefits AnswersJonnah Grace SimpalNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- May 2016 Ques & Answers Taxation-&-Fiscal-policy May 2016Document14 pagesMay 2016 Ques & Answers Taxation-&-Fiscal-policy May 2016Timore FrancisNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Artikel 20205729Document12 pagesArtikel 20205729Suci AyuNo ratings yet

- Important Government Schemes Ministry of Agriculturr Lyst8515Document17 pagesImportant Government Schemes Ministry of Agriculturr Lyst8515Prachi SinghNo ratings yet

- Monetary Economics-Unit 1Document62 pagesMonetary Economics-Unit 1Amanda RuthNo ratings yet

- Volatility Strategies ExplainedDocument19 pagesVolatility Strategies Explainedsandyk82No ratings yet

- CHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Document29 pagesCHAPTER 7 - MATHEMATICS of FINANCE, Seventh Edition by Robert L. Brown, Steve Kopp and Petr Zima (Z-Lib - Org) - 261-289Tisha YatolNo ratings yet

- NOTICE OF SD, SF-181, UCC 1, SECURITY AGREEMENT, AFV, & DISCHARGE TO JUDGE PAMELA WASHINGTONDocument123 pagesNOTICE OF SD, SF-181, UCC 1, SECURITY AGREEMENT, AFV, & DISCHARGE TO JUDGE PAMELA WASHINGTONMARK MENO©™No ratings yet

- Daftar Saham - 20240515Document38 pagesDaftar Saham - 20240515anggitasimanjuntak33No ratings yet

- MB ComDocument2 pagesMB Comsatyanand guptaNo ratings yet

- Provisional Certificate H402HHL0667970Document1 pageProvisional Certificate H402HHL0667970vindyttNo ratings yet

- Erdogan V Economics: A Scheme To Save The Lira Piles On The Risks InsteadDocument1 pageErdogan V Economics: A Scheme To Save The Lira Piles On The Risks InsteadRuslan AbduraxmanovNo ratings yet

- Commercial InvoiceDocument2 pagesCommercial InvoiceanhNo ratings yet

- Cfas - Cash and Cash EquivalentsDocument5 pagesCfas - Cash and Cash EquivalentsYna SarrondoNo ratings yet

- Aravali Institute of Management: Presentation OnDocument38 pagesAravali Institute of Management: Presentation OnRahul VyasNo ratings yet

- GLIBLCH1ShearmanSterling 2Document17 pagesGLIBLCH1ShearmanSterling 2Nattapong POkpaNo ratings yet

- Bank Regulation, Risk Management, and Compliance - Theory, Practice, and Key Problem Areas 1st Edition Alexander DillDocument43 pagesBank Regulation, Risk Management, and Compliance - Theory, Practice, and Key Problem Areas 1st Edition Alexander Dillmichelle.sanchez556100% (10)

- Economics II Assignment 1: Chapter 15 Measuring GDPDocument9 pagesEconomics II Assignment 1: Chapter 15 Measuring GDP許雅婷No ratings yet

- FYBA Open Book Test (History), 5101Document1 pageFYBA Open Book Test (History), 5101Shreyasi SNo ratings yet

- Mawdsley - From Billions To Trillions - Financing The SDGs in A World Beyond AidDocument5 pagesMawdsley - From Billions To Trillions - Financing The SDGs in A World Beyond AidCodruța Mihaela HăinealăNo ratings yet

- Exercises-for-Accounting-Equation-and-Double-entry-system (1)Document3 pagesExercises-for-Accounting-Equation-and-Double-entry-system (1)sheenacgacitaNo ratings yet

- Bid FormDocument1 pageBid FormAileen EstanislaoNo ratings yet

- Chapter 7 Managerial Economics Paul Keat SolutionDocument16 pagesChapter 7 Managerial Economics Paul Keat Solutionwcm007No ratings yet

- Iata PDFDocument9 pagesIata PDFRaul Hernan Villacorta GarciaNo ratings yet

- Tamiya Clod Buster ManualDocument28 pagesTamiya Clod Buster ManualDavid EveridgeNo ratings yet

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- invoiceDocument1 pageinvoiceroshankumarae2015No ratings yet

- Pump Storage 10Document5 pagesPump Storage 10bhathiya01No ratings yet

- Mapping Area & AgendaDocument59 pagesMapping Area & AgendaAzis RoisNo ratings yet

- Principles of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All ChapterDocument67 pagesPrinciples of Macroeconomics 5E 5E Edition Ben Bernanke Et Al All Chapterroscoe.carbonaro447100% (8)