Professional Documents

Culture Documents

SPC GST (TDS TCS)

SPC GST (TDS TCS)

Uploaded by

Aritra BanerjeeCopyright:

Available Formats

You might also like

- TDS Certificate - Form 16A - Q 1 - 23Document3 pagesTDS Certificate - Form 16A - Q 1 - 23ADBHUT CHARAN DAS IskconNo ratings yet

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- GST TDS Mechanism - 21062017Document3 pagesGST TDS Mechanism - 21062017Deepak WadhwaNo ratings yet

- Tds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar SahaDocument2 pagesTds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar Sahajkmijkmi597No ratings yet

- TDS in GSTDocument3 pagesTDS in GSTacm001No ratings yet

- 51 GST Flyer - Chapter 47 - TDS On GSTDocument5 pages51 GST Flyer - Chapter 47 - TDS On GSTRanjanNo ratings yet

- Tds Under GSTDocument4 pagesTds Under GSTShaan MithagariNo ratings yet

- Chapter 14 TDS TCS Under GSTDocument17 pagesChapter 14 TDS TCS Under GSTDR. PREETI JINDALNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- 74822bos60500 cp13Document48 pages74822bos60500 cp13Looney ApacheNo ratings yet

- 74823bos60500 cp14Document32 pages74823bos60500 cp14Looney ApacheNo ratings yet

- Tax Deduction at SourceDocument6 pagesTax Deduction at SourceShiwang AgrawalNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- FAQsonTDS 230221 120909Document8 pagesFAQsonTDS 230221 120909Bharath UGNo ratings yet

- Paper18 - Set1 Rev AnsDocument15 pagesPaper18 - Set1 Rev AnsSanya GoelNo ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Chapter 8 Composition Scheme Under GSTDocument12 pagesChapter 8 Composition Scheme Under GSTDR. PREETI JINDALNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Adobe Scan 21-Feb-2024Document8 pagesAdobe Scan 21-Feb-2024rahatkokate7No ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Unit 3FDocument21 pagesUnit 3Fbasavaraj nayakNo ratings yet

- Taxation Sec B May 2024 17077203Document13 pagesTaxation Sec B May 2024 17077203Umang NagarNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- Payment of TaxDocument9 pagesPayment of TaxYashiNo ratings yet

- Chapter 7 Input Tax Credit Under GSTDocument28 pagesChapter 7 Input Tax Credit Under GSTDR. PREETI JINDALNo ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- Amendment Booklet NOV 21 - by CA Yachaa Mutha BhuratDocument46 pagesAmendment Booklet NOV 21 - by CA Yachaa Mutha BhuratSuraj BijlaniNo ratings yet

- CA - Inter GST Important Questions Answers Part 1 May2023Document16 pagesCA - Inter GST Important Questions Answers Part 1 May2023Vishal AgrawalNo ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- Goods and Service Tax NoDocument5 pagesGoods and Service Tax NonitinNo ratings yet

- Composition of LevyDocument6 pagesComposition of LevyYalini MeenakshiNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- 3B Apr To June 21Document2 pages3B Apr To June 21Sachin NandeNo ratings yet

- GST 5 (Levy and Collection of CGST and IGST)Document14 pagesGST 5 (Levy and Collection of CGST and IGST)amangt9988No ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- 46787bosfinal p8 Part1 Cp10Document47 pages46787bosfinal p8 Part1 Cp10virmani123No ratings yet

- Indirect Tax - Budget 2019Document43 pagesIndirect Tax - Budget 2019Brijesh PitrodaNo ratings yet

- GST Circular-Restriction in Availment of ITC-Rule 36Document3 pagesGST Circular-Restriction in Availment of ITC-Rule 36Tejas RajkotiaNo ratings yet

- Form GSTR 3bDocument2 pagesForm GSTR 3bEasy Renewable Pvt LtdNo ratings yet

- 31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRDocument11 pages31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRsakshi sharmaNo ratings yet

- Withholding Tax Under GSTDocument2 pagesWithholding Tax Under GSTAbp PbaNo ratings yet

- Input Tax Credit Under GSTDocument52 pagesInput Tax Credit Under GSTkuldeep singhNo ratings yet

- Chand GSTR 3B 03 2024Document3 pagesChand GSTR 3B 03 2024CHAND DISTRIBUTORNo ratings yet

- GST - Audit OffencesDocument35 pagesGST - Audit OffencesApurva DharNo ratings yet

- CA Inter Payment of GST Notes @mission - CA - InterDocument36 pagesCA Inter Payment of GST Notes @mission - CA - InterKush BafnaNo ratings yet

- Levy and Collection of TaxDocument22 pagesLevy and Collection of Tax7013 Arpit DubeyNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- Payment OF Taxes Under GST: Submitted By: Submitted ToDocument10 pagesPayment OF Taxes Under GST: Submitted By: Submitted Toakshit sharmaNo ratings yet

- LEVY AND COLLECTION OF GST - AbhiDocument14 pagesLEVY AND COLLECTION OF GST - AbhiAbhishek Abhi100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Form PDF 337279780310722Document7 pagesForm PDF 337279780310722hitendraNo ratings yet

- Cricket Is LoveDocument7 pagesCricket Is LoveSuraj JaiswalNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSingireddy Srikanth ReddyNo ratings yet

- Due Dates Relating To Payroll India ESI, PT, PF, TDSDocument2 pagesDue Dates Relating To Payroll India ESI, PT, PF, TDSParama Hamsa KNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- 26as Ay 21-22Document4 pages26as Ay 21-22Madhu MohanNo ratings yet

- VARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMDocument6 pagesVARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMidealNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- Fqnrfy202223itall WORD PrintDocument1,642 pagesFqnrfy202223itall WORD PrintsysfqnrNo ratings yet

- Form PDF 648514400190719Document6 pagesForm PDF 648514400190719RebornNo ratings yet

- Rashmi RanaDocument2 pagesRashmi RanaRashmi RanaNo ratings yet

- 2023 06 20 10 25 36may 23 - 753008Document3 pages2023 06 20 10 25 36may 23 - 753008Biswamitra RathNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form PDF 992301420310723Document10 pagesForm PDF 992301420310723tax advisorNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Vikas VidhurNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)singam jasNo ratings yet

- Igkc TanDocument2 pagesIgkc TanJyoti prakash MohapatraNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- Dec - 21Document17 pagesDec - 21Amit KumarNo ratings yet

- Form PDF 475707440150723Document7 pagesForm PDF 475707440150723Pralay RautNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaNo ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Form PDF 129564520091221Document6 pagesForm PDF 129564520091221shivam kumarNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet

SPC GST (TDS TCS)

SPC GST (TDS TCS)

Uploaded by

Aritra BanerjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SPC GST (TDS TCS)

SPC GST (TDS TCS)

Uploaded by

Aritra BanerjeeCopyright:

Available Formats

13.

TDS & TCS

Content of Chapter 13

Concept 1. – Introduction

Concept 2 – TDS

Concept 3- TCS

Concept 1- Introduction

1.This concept of TDS ensures regular inflow of tax collection to the Government.

2.Also, with the integration of data furnished by the Supplier and Buyer on the GST

common portal, there exists an audit trail to ensure for harmony of taxes

paid by the supplier

Concept 2 – TDS

2.1 – Section 51

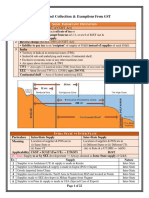

Sr Particulars Remarks

no

1. Deductors (section 51) 1.CG/SG department or establishment [Section 51(1)(a)

2. Local Authority [Section 51(1)(b)]

3. Governmental Agencies [Section 51(1)(c)]

4. Notified Persons/category of persons [Section 51(1)(d)]

2 Notified persons 1. Authority or a board or any other body set up by an Act of

(deductor) parliament or a State legislature or established by any Government

in which 51% or more participation by way of equity or control is

with the Government.

2. Society established by the Central Government or the State

Government or a Local Authority under the Societies Registration

Act, 1860;

3.Public sector undertakings

3 Deductee Suppliers whose total value of supply of taxable G or S under a

contract exceeds ` 2,50,000 exclusive of tax & cess as per the

invoice

4 Rate of TDS TDS-1% +1% [CGST + SGST] on net value of taxable supplies

5 Threshold limit ` 2,50,000

CA Pooja Kamdar Date Swapnil Patni Classes 447

6 Deduct TDS The deductors have to deduct tax at the rate of 2% from the

payment made or credited to the supplier

7 Value of Supply Amount indicated in the invoice excluding GST, Taxes and Cess

8 (i)

Categories of persons 1.When goods and/or services are supplied from a public sector

not liable to deduct undertaking (PSU) to another PSU, whether or not a distinct

TDS person

(ii) 22 When supply of goods and/or services takes place between one

person to another person specified in clauses (a), (b), (c) and (d)

of section 51(1) of the CGST Act.

9 Deposit of TDS with By 10th of the succeeding month.

the Govt.

10 TDS certificate Form GSTR7A

11 Return to be filed by GSTR-7 (covered in chapter of Returns)

Deductor

12 Default by Deductor TDS + Penal Interest u/s 50

not deposited TDS to

the Govt

13 For deductee 1) TDS amount to be reflected in E-cash ledger

2) The deductee can claim credit of the tax deducted, in his

electronic cash ledger. This provision enables the Government to

cross check whether the amount deducted by the deductor is

correct and that there is no mis -match between the amount

reflected in the electronic cash ledger and the amount shown in

the return filed by deductor.

Note: The deductor or the deductee can claim refund of excess deduction or

erroneous deduction. The provisions of section 54 relating to refunds would

apply in such cases.(will be learnt in the final)

Concept 2.2 – No TDS

When the location of the supplier and the place of supply is a State/Union territory which

is different from the State/Union territory of registration of the recipient, there will be no

TDS

1) Supplier, place of supply and recipient are in the same state.

It would be intra-State supply and TDS (Central plus State tax) shall be deducted. It

would be possible for the supplier (i.e. the deductee) to take credit of TDS in his

electronic cash ledger.

2)Supplier as well as the place of supply are in different states.

In such cases, integrated tax would be levied. TDS to be deducted would be TDS

CA Pooja Kamdar Date Swapnil Patni Classes 448

13. TDS & TCS

(Integrated tax) and it would be possible for the supplier (i.e. the deductee) to take

credit of TDS in his electronic cash ledger.

3)Supplier as well as the place of supply are in State A and the recipient is located

in State B.

The supply would be intra-State supply and Central tax and State tax would be levied.

In such case, transfer of TDS (Central tax + State tax of State B) to the cash ledger of

the supplier (Central tax + State tax of State A) would be difficult. So, in such cases,

TDS would not be deducted.

Thus, when both the supplier as well as the place of supply are different from that of

the recipient, no tax deduction at source would be made

Location of supplier Place of supply Registration of TDS u/s 51

Recipient

State A State A State A Yes

State A State A State B No

State A State B State B Yes

UT1 UT1 UT1 Yes

UT1 UT2 UT2 Yes

UT1 UT1 UT2 No

Concept 2.3 – Registration

1) Deductor/any person required to deduct TDS shall apply for registration

electronically on common portal.

2) PO within 3 working days from application shall grant registration.

3) If PO feels that person is no longer required to deduct TDS he may cancel

registration.

Example

e.g.Supplier makes a supply worth ` 20 lakh to a recipient and the GST at the rate of

18% is required to be paid. The recipient, while making the payment of ` 20 lakh to the

supplier, shall deduct 2% [CGST 1% + SGST 1%] viz ` 4 lakh as TDS.

The value for TDS purpose shall not include 18% GST. The TDS, so deducted, shall be

deposited in the account of Government by 10th of the succeeding month.

The TDS so deposited in the Government account shall be reflected in the electronic

cash ledger of the supplier (i.e. deductee) who would be able to use the same for

payment of tax or any other amount.

CA Pooja Kamdar Date Swapnil Patni Classes 449

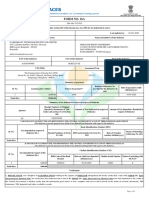

Contents of TDS certificate

The content of Form GSTR 7A (TDS Certificate) are given below:

1. TDS Certificate No.

2. GSTIN of deductor

3. Name of deductor

4. GSTIN of deductee

5. (a) Legal name of the deductee

(b) Trade name, if any

6. Tax period in which tax deducted and accounted for in GSTR-7

7. Details of supplies

8. Amount of tax deducted

Concept 3 - TCS

Eco

G/S G/S

C- Commission Customer

Actual supplier

(ECO – Displays goods or services actually supplied by other persons)

3.1 About TCS

Sr Particulars Remarks

no

1. Who is liable to ECO (not being an agent) who collects consideration on

collect TCS behalf of supplier [Excluding supply covered u/s 9(5)]

2 Rate of TCS i)0.5% of net value of intra-state taxable supplies

ii) 1% of net value of inter-state taxable supplies

e.g Suppose a certain product is sold at ` 1,120 [including

GST@12%] through an Operator by a supplier. The

operator would collect tax @ 1% of the net value of ` 1,000

i.e. ` 10 in case of inter-State supplies.

3 Net value of Supply Value of –Returns Taxable supplies of G/S [Excluding

supplies covered u/s 9(5)]

4 Threshold limit Nil

5 Deposit of TCS by By 10th of the next month

ECO to Govt e.g. TCS collected in month of July must be remitted by

CA Pooja Kamdar Date Swapnil Patni Classes 450

13. TDS & TCS

10th Aug

6 Filing of monthly Monthly – GSTR-8

and annual Annually GSTR-9B

statement by ECO

7 No TCS 1) on supply of services notified under section 9(5) of the

CGST Act, 2017.

2)on exempt supplies

3) on supplies on which the recipient is required to

pay tax on reverse charge basis

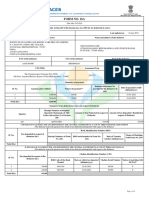

3.2 Registration

1) Deductor/any person required to deduct TCS shall apply for registration

electronically on common portal.

2) PO within 3 working days from application shall grant registration.

3) If PO feels that person is no longer required to deduct TCS he may cancel

registration

3.3 Notice to the operator seeking details

1) An officer not below the rank of Deputy Commissioner can issue notice to an

operator, asking him to furnish details relating to volume of the

goods/services supplied, stock of goods lying in warehouses/godowns etc.

2) The operator is required to furnish such details within 15 working days.

3) In case an operator fails to furnish the information, besides being liable for

penal action under section 122 12, it shall also be liable for penalty up to `

25,000

3.4 Some examples

Eg1-Mr. X is a supplier selling his own products through a web site hosted by

him. Does he fall under the definition of an “electronic commerce operator”?

Whether he is required to collect TCS on such supplies?

CA Pooja Kamdar Date Swapnil Patni Classes 451

Eg2-If Mr. A purchase goods from different vendors and in turn Mr. A, is selling them

on his own website under his own billing, Is TCS required to be collected on such

supplies?

Electronic Commerce Operator

means

Any person who

owns

Digital/ electronic

facility/ platform

operates

for electronic

commerce

manages

CA Pooja Kamdar Date Swapnil Patni Classes 452

13. TDS & TCS

Applicability of TDS

Type of supply liable to TCS

CA Pooja Kamdar Date Swapnil Patni Classes 453

Questions

1. Whether the rate of tax of 1% notified under section 52 is CGST or SGST or a

combination of both CGST and SGST?

2. Is every e-commerce operator required to collect tax on behalf of actual supplier?

3. State whether the provisions pertaining to tax collected at source under section 52 of

CGST Act, will be applicable, if Fitan Ltd. sells watch on its own through

its own website?

4. There is no onus of filing any monthly & annual statements by ECO. Examine the

technical veracity of the statement by explaining relevant provisions.

5. State whether the provisions pertaining to tax collected at source under section 52 of

CGST Act, will be applicable, if ABC limited who is dealer of Royul brand sells watches

through Slipkart, an electronic commerce operator?

Answers

1. The rate of TCS as notified under CGST Act is payable under CGST and the equal rate

of TCS is expected under the SGST Act also, in effect aggregating to 1%.

2. Yes, every e-commerce operator is required to collect tax where consideration

with respect to the supply is being collected by the e-commerce operator.

However, no TCS is required to be collected in the following cases:-

(i) on supply of services notified under section 9(5) of the CGST Act, 2017.

(ii) on exempt supplies

(iii) on supplies on which the recipient is required to pay tax on reverse charge basis.

3. As per Section 52, every electronic commerce operator not being an agent, shall

collect an amount calculated at such rate not exceeding one per cent., as may be

notified by the Government on the recommendations of the Council, of the net value of

taxable supplies made through it by other suppliers where the consideration with

respect to such supplies is to be collected by the operator.

Hence, if the person sells on his own, provisions pertaining to tax collected at source

(TCS) won’t be applicable.

4. The given statement is invalid. An electronic statement has to be filed by the ECO

containing details of the outward supplies of goods and/ or services effected through

it, including the supplies returned through it and the amount collected by it as TCS

during the month within 10 days after the end of the each month in which supplies are

made.

CA Pooja Kamdar Date Swapnil Patni Classes 454

13. TDS & TCS

Additionally, the ECO is also mandated to file an Annual Statement on or before 31st

day of December following the end of the financial year.

The Commissioner has been empowered to extend the due date for furnishing of

monthly and annual statement by the person collecting tax at source.

5. As per Section 52, every electronic commerce operator not being an agent, shall

collect an amount calculated at such rate not exceeding one per cent., as may be

notified by the Government on the recommendations of the Council, of the net value of

taxable supplies made through it by other suppliers where the consideration with

respect to such supplies is to be collected by the operator. If ABC limited who is dealer

of Royul brand sells watches through Slipkart, then the provision of TCS will be

applicable to Slipkart.

CA Pooja Kamdar Date Swapnil Patni Classes 455

Rapid fire Quiz

1. Is it correct or not that public sector undertakings is liable to deduct TDS from

payments made to the suppliers of taxable goods?

2. What is the implication of TDS in case services are supplied from a public sector

undertaking (PSU) to another PSU?

3. Mr. X contends that tax is liable to be deducted if total value of supply of taxable

goods under a contract is ` 2,50,000 exclusive of tax. Is his contention valid in law

or not?

4. What is the implication of TDS in case supplier, place of supply and recipient

are in the same state?

5. What is the implication of TDS in case location of supplier is in State A and place

of supply as well as registration of recipient are in State B?

6. What is the implication of TDS if supplier as well as the place of supply are in

State A and the recipient is located in State B. ?

7. What is the rate of TCS under CGST?

8. Is it valid that services by way of transportation of passengers by motor cycle is

to be included while computing net value of taxable supplies?

CA Pooja Kamdar Date Swapnil Patni Classes 456

13. TDS & TCS

CROSSWORD PUZZLE

ACROSS

1. TDS is not attracted if services are supplied from a PSU to another ----------

.(Acronym)

3. Value of supply shall------------ tax & cess for the purpose of TDS under

Section 51 of CGST Act, 2017.

5. The amount of tax deducted at source should be deposited to the

Government account by 10th of the succeeding-----------.

8. Net value of taxable supplies shall mean the aggregate value of taxable

supplies of goods and/or services, other than services notified under subsection

(5) of section 9, made during any month by all registered persons through the

operator reduced by the aggregate value of taxable supplies-------------- to the

suppliers during the said month.

9. ------------------ sector undertakings are notified to deduct tax at source from

payments made to the suppliers.

CA Pooja Kamdar Date Swapnil Patni Classes 457

DOWN

2. TDS would be deducted if supplier, place of supply and recipient are in the-------

------ State.

4. The TDS deductees are the suppliers whose total value of supply of taxable

goods under a contract exceeds ` 2,50,000 ------------of tax & cess as per the

invoice.

6. Every Electronic Commerce Operator (ECO), not being an agent, has been

mandated to collect tax at source (TCS) on net value of taxable supplies made

------------it by suppliers.

7. The TCS amount collected by the ECO has to be remitted to the Government

Treasury within------days after the end of the month in which the collection

was made.

For Answers Scan the QR

CA Pooja Kamdar Date Swapnil Patni Classes 458

You might also like

- TDS Certificate - Form 16A - Q 1 - 23Document3 pagesTDS Certificate - Form 16A - Q 1 - 23ADBHUT CHARAN DAS IskconNo ratings yet

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- GST TDS Mechanism - 21062017Document3 pagesGST TDS Mechanism - 21062017Deepak WadhwaNo ratings yet

- Tds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar SahaDocument2 pagesTds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar Sahajkmijkmi597No ratings yet

- TDS in GSTDocument3 pagesTDS in GSTacm001No ratings yet

- 51 GST Flyer - Chapter 47 - TDS On GSTDocument5 pages51 GST Flyer - Chapter 47 - TDS On GSTRanjanNo ratings yet

- Tds Under GSTDocument4 pagesTds Under GSTShaan MithagariNo ratings yet

- Chapter 14 TDS TCS Under GSTDocument17 pagesChapter 14 TDS TCS Under GSTDR. PREETI JINDALNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- 74822bos60500 cp13Document48 pages74822bos60500 cp13Looney ApacheNo ratings yet

- 74823bos60500 cp14Document32 pages74823bos60500 cp14Looney ApacheNo ratings yet

- Tax Deduction at SourceDocument6 pagesTax Deduction at SourceShiwang AgrawalNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- FAQsonTDS 230221 120909Document8 pagesFAQsonTDS 230221 120909Bharath UGNo ratings yet

- Paper18 - Set1 Rev AnsDocument15 pagesPaper18 - Set1 Rev AnsSanya GoelNo ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Chapter 8 Composition Scheme Under GSTDocument12 pagesChapter 8 Composition Scheme Under GSTDR. PREETI JINDALNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Adobe Scan 21-Feb-2024Document8 pagesAdobe Scan 21-Feb-2024rahatkokate7No ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Unit 3FDocument21 pagesUnit 3Fbasavaraj nayakNo ratings yet

- Taxation Sec B May 2024 17077203Document13 pagesTaxation Sec B May 2024 17077203Umang NagarNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- Payment of TaxDocument9 pagesPayment of TaxYashiNo ratings yet

- Chapter 7 Input Tax Credit Under GSTDocument28 pagesChapter 7 Input Tax Credit Under GSTDR. PREETI JINDALNo ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- Amendment Booklet NOV 21 - by CA Yachaa Mutha BhuratDocument46 pagesAmendment Booklet NOV 21 - by CA Yachaa Mutha BhuratSuraj BijlaniNo ratings yet

- CA - Inter GST Important Questions Answers Part 1 May2023Document16 pagesCA - Inter GST Important Questions Answers Part 1 May2023Vishal AgrawalNo ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- Goods and Service Tax NoDocument5 pagesGoods and Service Tax NonitinNo ratings yet

- Composition of LevyDocument6 pagesComposition of LevyYalini MeenakshiNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- 3B Apr To June 21Document2 pages3B Apr To June 21Sachin NandeNo ratings yet

- GST 5 (Levy and Collection of CGST and IGST)Document14 pagesGST 5 (Levy and Collection of CGST and IGST)amangt9988No ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- 46787bosfinal p8 Part1 Cp10Document47 pages46787bosfinal p8 Part1 Cp10virmani123No ratings yet

- Indirect Tax - Budget 2019Document43 pagesIndirect Tax - Budget 2019Brijesh PitrodaNo ratings yet

- GST Circular-Restriction in Availment of ITC-Rule 36Document3 pagesGST Circular-Restriction in Availment of ITC-Rule 36Tejas RajkotiaNo ratings yet

- Form GSTR 3bDocument2 pagesForm GSTR 3bEasy Renewable Pvt LtdNo ratings yet

- 31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRDocument11 pages31jan24 Draft Reply To Notice For IGST CGST SGST Issue ARRsakshi sharmaNo ratings yet

- Withholding Tax Under GSTDocument2 pagesWithholding Tax Under GSTAbp PbaNo ratings yet

- Input Tax Credit Under GSTDocument52 pagesInput Tax Credit Under GSTkuldeep singhNo ratings yet

- Chand GSTR 3B 03 2024Document3 pagesChand GSTR 3B 03 2024CHAND DISTRIBUTORNo ratings yet

- GST - Audit OffencesDocument35 pagesGST - Audit OffencesApurva DharNo ratings yet

- CA Inter Payment of GST Notes @mission - CA - InterDocument36 pagesCA Inter Payment of GST Notes @mission - CA - InterKush BafnaNo ratings yet

- Levy and Collection of TaxDocument22 pagesLevy and Collection of Tax7013 Arpit DubeyNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- Payment OF Taxes Under GST: Submitted By: Submitted ToDocument10 pagesPayment OF Taxes Under GST: Submitted By: Submitted Toakshit sharmaNo ratings yet

- LEVY AND COLLECTION OF GST - AbhiDocument14 pagesLEVY AND COLLECTION OF GST - AbhiAbhishek Abhi100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Form PDF 337279780310722Document7 pagesForm PDF 337279780310722hitendraNo ratings yet

- Cricket Is LoveDocument7 pagesCricket Is LoveSuraj JaiswalNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSingireddy Srikanth ReddyNo ratings yet

- Due Dates Relating To Payroll India ESI, PT, PF, TDSDocument2 pagesDue Dates Relating To Payroll India ESI, PT, PF, TDSParama Hamsa KNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- QwertabacbDocument3 pagesQwertabacbNDKKMDBNo ratings yet

- 26as Ay 21-22Document4 pages26as Ay 21-22Madhu MohanNo ratings yet

- VARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMDocument6 pagesVARIOUS FORMs OBJECTIVE QUESTIONs CMA FINAL DT DEC 2021 EXAMidealNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- Fqnrfy202223itall WORD PrintDocument1,642 pagesFqnrfy202223itall WORD PrintsysfqnrNo ratings yet

- Form PDF 648514400190719Document6 pagesForm PDF 648514400190719RebornNo ratings yet

- Rashmi RanaDocument2 pagesRashmi RanaRashmi RanaNo ratings yet

- 2023 06 20 10 25 36may 23 - 753008Document3 pages2023 06 20 10 25 36may 23 - 753008Biswamitra RathNo ratings yet

- Tds TcsDocument20 pagesTds TcsnaysarNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form PDF 992301420310723Document10 pagesForm PDF 992301420310723tax advisorNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Vikas VidhurNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)singam jasNo ratings yet

- Igkc TanDocument2 pagesIgkc TanJyoti prakash MohapatraNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- Dec - 21Document17 pagesDec - 21Amit KumarNo ratings yet

- Form PDF 475707440150723Document7 pagesForm PDF 475707440150723Pralay RautNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaNo ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tosahil choudharyNo ratings yet

- Form PDF 129564520091221Document6 pagesForm PDF 129564520091221shivam kumarNo ratings yet

- Suraj Sir 1Document8 pagesSuraj Sir 1Avinash YadavNo ratings yet