Professional Documents

Culture Documents

Module No1 Investment Management

Module No1 Investment Management

Uploaded by

HdpCopyright:

Available Formats

You might also like

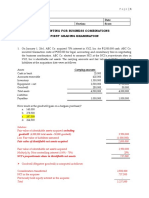

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Proposal For Daraz VA With Estimated BudgetingDocument8 pagesProposal For Daraz VA With Estimated BudgetingBILAL KHANNo ratings yet

- Investment Management NotesDocument75 pagesInvestment Management NotesArjun Nayak100% (3)

- Estimation Coffeteria & Gym - Fooqa SareDocument9 pagesEstimation Coffeteria & Gym - Fooqa SareEng Abdi Shakur Yusuf100% (1)

- Test Bank MGMT 126Document8 pagesTest Bank MGMT 126najihachangminNo ratings yet

- Chapter 1 Finance (Kusuma)Document20 pagesChapter 1 Finance (Kusuma)karan yadavNo ratings yet

- BM 141 NotesDocument13 pagesBM 141 NotesNicole TaysonNo ratings yet

- Finanace InvestmentDocument5 pagesFinanace Investmentnehaunjiya5No ratings yet

- Thank You ScribdDocument1 pageThank You ScribdJazzmin Rae BarbaNo ratings yet

- Assignment For Mba Students Portfolio ManagementDocument12 pagesAssignment For Mba Students Portfolio ManagementRajan ShrivastavaNo ratings yet

- Final ReportDocument53 pagesFinal ReportsaharsandyNo ratings yet

- Finance (MBA) 216Document90 pagesFinance (MBA) 216Naveen Kumar I MNo ratings yet

- What Is FinanceDocument8 pagesWhat Is FinanceGULBAZ MAHMOODNo ratings yet

- Introduction of PortfolioDocument80 pagesIntroduction of PortfolioShubham MoreNo ratings yet

- Sources of Long Term FinancingDocument13 pagesSources of Long Term FinancingEtsegenet TafesseNo ratings yet

- Investment AvenuesDocument45 pagesInvestment AvenuesGrishma Ruchit Jaganiya100% (3)

- Investment 1Document18 pagesInvestment 1Sujal BedekarNo ratings yet

- 4VPkGBzkpwLekXu - P8SrXBOR22XCK0Bs-Principles of FinanceDocument9 pages4VPkGBzkpwLekXu - P8SrXBOR22XCK0Bs-Principles of FinanceNilailaNo ratings yet

- Investment and Portfolio ManagementDocument14 pagesInvestment and Portfolio ManagementMary Lyn DuarteNo ratings yet

- Investment Pattern of PeoplesDocument17 pagesInvestment Pattern of PeoplesLogaNathanNo ratings yet

- Financial Management 1Document29 pagesFinancial Management 1Aŋoop KrīşħŋặNo ratings yet

- Week 1 - Papeer FinanceDocument11 pagesWeek 1 - Papeer FinanceKiran patilNo ratings yet

- Week 1 Module - Definition of Investment Portfolio ManagementDocument8 pagesWeek 1 Module - Definition of Investment Portfolio ManagementKrystal AquinoNo ratings yet

- FSM Revision Notes June 2021Document267 pagesFSM Revision Notes June 2021jacob michelNo ratings yet

- Bme 5 PrelimsDocument4 pagesBme 5 PrelimsIrish DionisioNo ratings yet

- Silo - Tips Chapter 1 Introduction of Investments and Portfolio ManagementDocument60 pagesSilo - Tips Chapter 1 Introduction of Investments and Portfolio ManagementReynalyn Layron ReyesNo ratings yet

- 09 Chapter1 PDFDocument60 pages09 Chapter1 PDFMonica MckinneyNo ratings yet

- Portofolio ManagmentDocument70 pagesPortofolio ManagmentS K Shubham KanojiaNo ratings yet

- 06 Chapter 1Document52 pages06 Chapter 1yezdiarwNo ratings yet

- Business Finance Prelim To Finals ReviewerDocument127 pagesBusiness Finance Prelim To Finals ReviewerMartin BaratetaNo ratings yet

- Project Final Chapss PRNTDocument78 pagesProject Final Chapss PRNTVignesh RvNo ratings yet

- Comprehensive Activity - Financial ManagementDocument2 pagesComprehensive Activity - Financial Managementmarkconda21No ratings yet

- Jyothi Full ProjectDocument94 pagesJyothi Full ProjectNaghul KrishnaNo ratings yet

- Chapter 1Document17 pagesChapter 1Tasebe GetachewNo ratings yet

- Quick RevisionDocument51 pagesQuick RevisionvishwajeetNo ratings yet

- Investment Law NotesDocument122 pagesInvestment Law Notesberthakwilasa32No ratings yet

- A Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDDocument31 pagesA Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDParameshwari ParamsNo ratings yet

- NJ Fundz Nism QuestionsDocument51 pagesNJ Fundz Nism QuestionsLatesh KolheNo ratings yet

- A Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDDocument31 pagesA Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDParameshwari ParamsNo ratings yet

- Business Finance 1 ÖZETDocument23 pagesBusiness Finance 1 ÖZETÖmer Faruk AYDINNo ratings yet

- FM 1-3Document53 pagesFM 1-3zeleke fayeNo ratings yet

- A Study On Profitability Analysis ProjectDocument72 pagesA Study On Profitability Analysis Projectharshith rajuNo ratings yet

- MCO 106 UNIT-1 Business Finance 2023Document14 pagesMCO 106 UNIT-1 Business Finance 2023daogafugNo ratings yet

- (Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementDocument9 pages(Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementMark Dhel VillaramaNo ratings yet

- INVESTMENT AlternativesDocument69 pagesINVESTMENT Alternativesdhvanichauhan476No ratings yet

- FMSM Revision Notes - Db4fd5fe b925 4e33 A94e 810a57d49c83Document236 pagesFMSM Revision Notes - Db4fd5fe b925 4e33 A94e 810a57d49c83jacob michelNo ratings yet

- Introduction of Corporate Finance 1.1 Corporate FinanceDocument4 pagesIntroduction of Corporate Finance 1.1 Corporate FinanceRupal DalalNo ratings yet

- IAPM Unit-1Document10 pagesIAPM Unit-1Anubhav MishraNo ratings yet

- IntroductionIst and 2nd WeeksDocument10 pagesIntroductionIst and 2nd Weekskhan officialNo ratings yet

- FIN101PRELIMSDocument6 pagesFIN101PRELIMSEmily ResuentoNo ratings yet

- Chapter No 1: - Introduction: 1.1 InvestmentDocument64 pagesChapter No 1: - Introduction: 1.1 InvestmentvatsalNo ratings yet

- Inventory Management SWATHIDocument96 pagesInventory Management SWATHISakhamuri Ram'sNo ratings yet

- Investment Management2 PDFDocument170 pagesInvestment Management2 PDFThomas nyadeNo ratings yet

- Treasury Management (M)Document9 pagesTreasury Management (M)Keisia Kate FabioNo ratings yet

- COMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakDocument73 pagesCOMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakRajendra Babu DaraNo ratings yet

- Report On Wealth ManagementDocument34 pagesReport On Wealth Managementarun883765No ratings yet

- International Journal of Business and Management Invention (IJBMI)Document5 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Investment PortfolioDocument23 pagesInvestment PortfolioProfessional Service100% (1)

- 06 Chapter1Document33 pages06 Chapter1touffiqNo ratings yet

- Natinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section RegularDocument18 pagesNatinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section Regularcn comNo ratings yet

- Chapter 2Document7 pagesChapter 2Prakash SinghNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- How to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementFrom EverandHow to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementNo ratings yet

- An Economist Sells Bagels A Case Study in Profit Maximization PDFDocument43 pagesAn Economist Sells Bagels A Case Study in Profit Maximization PDFMax GrecoNo ratings yet

- Chapter 7 Co-BrandingDocument30 pagesChapter 7 Co-BrandingHoNo ratings yet

- General Banking Activities of Jamuna BankDocument52 pagesGeneral Banking Activities of Jamuna BankFatin Arefin0% (1)

- Intercompany Transactions PDFDocument22 pagesIntercompany Transactions PDFmouse.lenova mouse100% (1)

- Methodological Brief - EnG v.2 - 2Document44 pagesMethodological Brief - EnG v.2 - 2Ayah S. YassinNo ratings yet

- The Business Model of Flipkart: March 2018 December 2018 January 2019Document11 pagesThe Business Model of Flipkart: March 2018 December 2018 January 2019Suryateja ChallaNo ratings yet

- Lata Internship Report 1 1Document45 pagesLata Internship Report 1 1FahimNo ratings yet

- Floor Plan Lending PrimerDocument73 pagesFloor Plan Lending PrimerCari Mangalindan MacaalayNo ratings yet

- Reverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomeDocument9 pagesReverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomePitaloka RanNo ratings yet

- Ismt LTD (2019-2020)Document150 pagesIsmt LTD (2019-2020)Nimit BhimjiyaniNo ratings yet

- Accounts and Finance Short TermsDocument59 pagesAccounts and Finance Short TermsBelalHossainNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- IDX Fact Book 2009Document166 pagesIDX Fact Book 2009Mhd FadilNo ratings yet

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocument33 pagesTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99No ratings yet

- International Financial Management: AnswerDocument18 pagesInternational Financial Management: AnswerNithyananda PatelNo ratings yet

- Power PricingDocument83 pagesPower PricingSrikanth Reddy SanguNo ratings yet

- Southwest Airlines Case Study AnswersDocument6 pagesSouthwest Airlines Case Study AnswersRamesh Mandava50% (4)

- Case Study On Alibabas TaobaoDocument8 pagesCase Study On Alibabas TaobaoChen ChengNo ratings yet

- Portfolio Analysis of Micro Finance Portfolio Management and Security AnalysisDocument12 pagesPortfolio Analysis of Micro Finance Portfolio Management and Security AnalysisBasanta BhetwalNo ratings yet

- A Study On The Challenges HR Managers Face TodayDocument10 pagesA Study On The Challenges HR Managers Face TodayJAY MARK TANONo ratings yet

- Role of Maharashtra Centre For Entrepreneurship Development (Mced) in Developing Self Employment and EntrepreneurshipDocument3 pagesRole of Maharashtra Centre For Entrepreneurship Development (Mced) in Developing Self Employment and EntrepreneurshipInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Compute For The Unit Contribution MarginDocument9 pagesCompute For The Unit Contribution Marginmusic niNo ratings yet

- Homework Chap 9Document4 pagesHomework Chap 9aleuvoNo ratings yet

- Maxis Bill Presentment - St...Document1 pageMaxis Bill Presentment - St...Kratos Vs DanteNo ratings yet

- Chapter 3 Evaluating A Company S External Environment: Basic QuestionsDocument2 pagesChapter 3 Evaluating A Company S External Environment: Basic QuestionsAlma CoronadoNo ratings yet

- Lesson 3 - Word CardsDocument1 pageLesson 3 - Word Cardsapi-240816434No ratings yet

Module No1 Investment Management

Module No1 Investment Management

Uploaded by

HdpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module No1 Investment Management

Module No1 Investment Management

Uploaded by

HdpCopyright:

Available Formats

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

MODULE NO:- 1 CONCEPT OF INVESTMENT

INTRODUCTION OF INVESTMENT:- An investment is an asset or item acquired with the goal

of generating income or appreciation. Appreciation refers to an increase in the value of an asset

over time. When an individual purchases a good as an investment, the intent is not to consume

the good but rather to use it in the future to create wealth.

MEANING:- An investment always concerns the outlay of some resource today—time, effort,

money, or an asset—in hopes of a greater payoff in the future than what was originally put in.

For example, an investor may purchase a monetary asset now with the idea that the asset will

provide income in the future or will later be sold at a higher price for a profit.

*An investment involves putting capital to use today in order to increase its value over time.

*An investment requires putting capital to work, in the form of time, money, effort, etc., in hopes

of a greater payoff in the future than what was originally put in.

*An investment can refer to any medium or mechanism used for generating future income,

including bonds, stocks, real estate property, or alternative investments.

*Investments usually do not come with guarantees of appreciation; it is possible to end up with

less money than with what you started.

INVESTMENT ATTRIBUTES : Every investor has certain specific objectives to achievethrough

his long term/short term investment. Such objectives may be monetary/financial orpersonal in

character. The objectives include safety and security of the funds invested(principal amount),

profitability (through interest, dividend and capital appreciation) and liquidity (convertibility into

cash as and when required). These objectives are universal in character as every investor will

like to have a fair balance of these three financial objectives. An investor will not like to take

undue risk about his principal amount even when the interest rate offered is extremely attractive.

These objectives or factors are known as investment attributes.

There are personal objectives which are given due consideration by every investor while

selecting suitable avenues for investment. Personal objectives may be like provision for old age

and sickness, provision for house construction, provision for education and marriage of children

and finally provision for dependents including wife, parents or physically handicapped member

of the family. Investment avenue selected should be suitable for achieving both the objectives

(financial and personal) decided. Merits and demerits of various investment avenues need to be

considered in the context of such investment objectives.

(1) Period of Investment : Period of investment is one major consideration while selecting

avenue for investment. Such period may be short (upto one year), medium (one to three years)

or long (more than three years). Return/rate of interest is normally more in the case of longer

term investment while it is less in the shorter period investment. The period of investment

relates to liquidity. An investor has to decide when he needs money back and adjust the period

accordingly. LIC policy is an investment for a very long period. Balance in the savings bank

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

account is a short term investment with highest liquidity but lowest rate of return.

(2) Risk in Investment : Risk is another factor which needs careful consideration while selecting

the avenue for investment. Risk is a normal feature of every investment as an investor has to

part with his money immediately and has to collect it back with some benefit in due course. The

risk may be more in some investment avenues and less in others. The risk in the investment

may be related to non-payment of principal amount or interest thereon. In addition, liquidity risk,

inflation risk, market risk, business risk, political risk, etc. are some more risks connected with

the investment made. The risk in investment depends on various factors. For example, the risk

is more, if the period of maturity is longer. Similarly, the risk is less in the case of debt

instrument (e.g., debenture) and more in the case of ownership instrument (e.g., equity share).

In addition, the risk is less if the borrower is creditworthy or the agency issuing security is

creditworthy. It is always desirable to select an investment avenue where the risk involved is

minimum/comparatively less. Thus, the objective of an investor should be to minimise the risk

and to maximise the return out of the investment made.

ECONOMIC VERSES FINANCIAL INVESTMENT

Economic Investment

This investment refers to the money spent on the purchase of new or replacing the capital

assets of a company. The capital assets here are all things necessary for the production of

goods or services. A few examples of such investments are retail stores, factories, equipment

and much more. Investments in raw materials will also fall under economic investments.

Financial Investment

Financial investment is a much broader concept, and we can say that economic investment is a

part of it. This type of investment involves the purchase of an asset with the goal of financial

gain. This investment could be made in the new asset or in any old assets.

A company makes a financial investment in assets that it expects to make a profit on for a

number of years. This investment could be in financial assets, including stocks, bonds, and

more, or in tangible assets such as land, buildings, machinery, and more.

COMPARISON CHART

BASIS OF COMPARISON FINANCE ECONOMIC

Meaning Finance refers to that branch of Economics is the science

economics which is concerned which studies the behavior of

with the procurement, human beings, as a link

management and utilization of between ends (wants) and

funds in an effective manner. limited means (resources) to

fulfill them, having alternative

uses.

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

What is it? An offshoot of Economics that Branch of knowledge that

deals with arrangement and deals with production,

administration of money. consumption, distribution and

exchange of commodities for

money.

Based on Time value of money Money value of time

Concerned with Optimization of funds to increase Decision making regarding the

wealth. way resources are to be used,

to attain maximum

satisfaction.

Determines How the funds are actively and How humans make decisions,

optimally managed and utilized? when there is scarcity of

resources?

Aim Maximization of wealth Optimization of scarce

resources.

Explains Reasons for trade surplus and Reasons for fluctuation in the

deficit, affecting the economy as a rate of interest, inflow and

whole. outflow of cash, etc.

INVESTMENT VERSES SPECULATION

Meaning of Investment:- Investment refers to the acquisition of the asset, in the expectation of

generating income. In a wider sense, it refers to the sacrifice of present money or other

resources for the benefits that will arise in future. The two main element of investment is time

and risk

Nowadays, there is a range of investment options available in the market as you can deposit

money in the bank account, or you can acquire property, or purchase shares of the company, or

invest your money in government bonds or contribute in the funds like EPF or PPF.

Meaning of Speculation:- Speculation relies upon future expectations of market changes.

Examiners or speculators attempt to get profited from the high points and low points of market

variances. In any case, this approach is unsure, and the likelihood of misfortune is high. Market

variances are the premise of speculations.

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

Basis of Investment Speculation

comparison

Defination Money allocation for an asset purchase. Short-term bets on financial

assets to gain quickly.

Aim The investor’s main objective is to achieve The speculator seeks to

small recurring returns in the long term, achieve small profits in the

such as the payment of dividends. short term.

Time Generally, the investor keeps the assets in Speculators usually change

his portfolio for a long time, years and assets in the short term, in

even a lifetime. minutes, hours, or a few days.

Analysis Thorough analysis of fundamental factors, Technical analysis mainly

including company ratios, competitive and combined with fundamental

industry conditions, and technical factors and market sentiment.

throughout the asset’s history.

Income certainty Stable Erratic

Risks Moderate risk. The lower the risk, the High risk. The higher the risk,

lower the return. the higher the potential gains.

CHARACTERISTICS OF GOOD INVESTMENT

A. Objective fulfillment:- An investment should fulfill the objective of the savers. Every

individual has a definite objective in making an investment. When the investment objective is

contrasted with the uncertainty involved with investments, the fulfillment of the objectives

through the chosen investment avenue could become complex.

B. Safety:- The first and foremost concern of any ordinary investor is that his investment

should be safe. That is he should get back the principal at the end of the maturity period of the

investment. There is no absolute safety in any investment, except probably with investment in

government securities or such instruments where the repayment of interest and principal is

guaranteed by the government.

C. Return:- The return from any investment is expectedly consistent with the extent of risk

assumed by the investor. Risk and return go together. Higher the risk, higher the chances of

getting higher return. An investment in a low risk - high safety investment such as investment in

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

government securities will obviously get the investor only low returns.

D. Liquidity:- Given a choice, investors would prefer a liquid investment than a higher return

investment. Because the investment climate and market conditions may change or investor

may be confronted by an urgent unforeseen commitment for which he might need funds, and if

he can dispose of his investment without suffering unduly in terms of loss of returns, he would

prefer the liquid investment.

E. Hedge against inflation:- The purchasing power of money deteriorates heavily in a country

which is not efficient or not well endowed, in relation to another country. Investors, who save for

the long term, look for hedge against inflation so that their investments are not unduly eroded;

rather they look for a capital gain which neutralizes the erosion in purchasing power and still

gives a return.

F. Concealabilty:- If not from the taxman, investors would like to keep their investments rather

confidential from their own kith and kin so that the investments made for their old age/

uncertain future does not become a hunting ground for their own lives. Safeguarding of financial

instruments representing the investments may be easier than investment made in real estate.

Moreover, the real estate may be prone to encroachment and other such hazards.

G. Tax shield:- Investment decisions are highly influenced by the tax system in the country.

Investors look for front-end tax incentives while making an investment and also rear-end tax

reliefs while reaping the benefit of their investments. As against tax incentives and reliefs, if

investors were to pay taxes on the income earned from investments, they look for higher return

in such investments so that their after tax income is comparable to the pre-tax equivalent level

with some other income which is free of tax, but is more risky.

INVESTMENT PROCESS:-

An Investment Process is a systematic approach that individuals or organisations follow to

make informed decisions about allocating their funds. The goal of an Investment Process is to

maximise returns while managing risks effectively. It provides a structured framework, guiding

Investors in selecting appropriate assets, diversifying portfolios, and adapting strategies to

achieve specific financial objectives, ensuring long-term financial stability and growth.

Steps involved in Investment Process

Step 1: Setting financial goals

Setting clear financial goals is the cornerstone of any successful Investment journey. Short-term

goals like purchasing a car and long-term objectives such as retirement planning must be

defined and prioritised. These goals act as guiding stars, shaping your Investment strategies

and providing direction.

Step 2: Assessing risk tolerance

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

Understanding your risk tolerance is pivotal in making Investment decisions. It refers to your

ability to endure fluctuations in the value of your Investments. Assessing your risk tolerance

involves evaluating your comfort level with market uncertainties.

This step ensures that your Investments align with your temperament, making your financial

journey not just profitable but also emotionally secure.

Step 3: Creating a budget and emergency fund

A strong financial foundation starts with disciplined budgeting and building an emergency fund.

Budgeting helps in tracking income and expenses, ensuring surplus funds for Investments.

Simultaneously, having an emergency fund safeguards Investments from unexpected events

such as medical emergencies or sudden job loss.

The emergency fund acts as a safety net, preventing the need to liquidate Investments during

crises, thus preserving long-term goals. Creating a budget cultivates financial discipline,

enabling systematic Investments, while an emergency fund provides:

1) Financial security

2) Reinforcement in your ability to stay invested during market fluctuations

3) Surety that your Investments stay on course to meet your goals

Step 4: Diversifying Investment portfolio

Diversification is the golden rule of Investments. It refers to spreading Investments across

different asset classes, such as stocks, bonds, mutual funds, and real estate. This strategy

mitigates risks by reducing the impact of poor performance in any single Investment.

Diversifying ensures that a downturn in one sector doesn’t your entire portfolio, balancing

potential losses.

Step 5: Conducting research and analysis

Informed decisions are the bedrock of successful investing. Conducting thorough research and

analysis is imperative before making Investment choices. Fundamental analysis delves into a

company's financial health, while technical analysis studies market trends. Staying updated on

economic indicators and market dynamics enables anticipation of trends.

Continuous analysis aids in tracking Investments, ensuring they align with goals. With

comprehensive knowledge, Investors can navigate the ever-changing market landscape, making

well-informed decisions that pave the way for sustainable financial growth.

Step 6: Making informed Investment decisions

Regularly monitoring Investment performance is essential, ensuring they align with your goals.

Adapting strategies to market changes and evolving life goals is critical.

Whether it’s seeking expert advice or using online tools, informed decisions are the result of

meticulous evaluation and adaptation. By staying vigilant and flexible, Investors can respond to

market dynamics, ensuring that their Investments remain aligned with their objectives, even

amidst economic fluctuations, securing their financial future.

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

Step 7: Regularly reviewing and rebalancing the portfolio

Investment strategies need periodic review and adjustment. Regular portfolio reviews help

gauge performance against goals. Rebalancing involves adjusting asset allocation to maintain

the desired risk and return levels. Life events like marriage or nearing retirement may

necessitate changes in the Investment approach.

This step ensures that Investments remain relevant, aligning with evolving goals, ultimately

securing a stable and prosperous financial future.

Conclusion

In conclusion, mastering the Investment Process is not just about making money; it's about

creating a secure financial future. By following the seven steps outlined in this blog, readers can

navigate the complex world of Investments with confidence. Empowered with knowledge and a

systematic approach, individuals can work towards achieving their financial dreams and

aspirations. Remember, Investment is not just about numbers; it is about building a foundation

for a prosperous and financially secure life.

FINANCIAL INSTRUMENT:-

Financial instruments are assets that can be traded, or they can also be seen as packages of

capital that may be traded. Most types of financial instruments provide efficient flow and

transfer of capital throughout the world’s investors. These assets can be in the form of cash, a

contractual right to deliver or receive cash or another type of financial instrument, or evidence of

one’s ownership in some entity.

Money Market Instruments

Money market instruments are financial instruments that help companies, corporations, and

government bodies to raise short-term debt for their needs. The borrowers meet their short-

term needs at a low cost and the lenders benefit from interest rates and liquidity. Money market

instruments include bonds, treasury bills, certificates of deposit, commercial paper, etc.

Types of Money Market Instruments in India

1. Treasury Bills:- Treasury Bills are one of the most popular money market instruments. They

have varying short-term maturities. The Government of India issues it at a discount for 14 days

to 364 days.

These instruments are issued at a discount and repaid at par at the time of maturity. Also, a

company, firm, or person can purchase TB’s. And are issued in lots of Rs. 25,000 for 14 days &

91 days and Rs. 1,00,000 for 364 days.

2. Commercial Bills:- Commercial bills, also a money market instrument, works more like the bill

of exchange. Businesses issue them to meet their short-term money requirements.

These instruments provide much better liquidity. As the same can be transferred from one

person to another in case of immediate cash requirements.

3. Certificate of Deposit:- Certificate of Deposit (CD’s) is a negotiable term deposit accepted by

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

commercial banks. It is usually issued through a promissory note.

CD’s can be issued to individuals, corporations, trusts, etc. Also, the CD’s can be issued by

scheduled commercial banks at a discount. And the duration of these varies between 3 months

to 1 year. The same, when issued by a financial institution, is issued for a minimum of 1 year

and a maximum of 3 years.

4. Commercial Paper:- Corporates issue CP’s to meet their short-term working capital

requirements. Hence serves as an alternative to borrowing from a bank. Also, the period of

commercial paper ranges from 15 days to 1 year.

The Reserve Bank of India lays down the policies related to the issue of CP’s. As a result, a

company requires RBI’s prior approval to issue a CP in the market. Also, CP has to be issued at

a discount to face value. And the market decides the discount rate.

Denomination and the size of CP:

Minimum size – Rs. 25 lakhs

Maximum size – 100% of the issuer’s working capital

5. Call Money:- It is a segment of the market where scheduled commercial banks lend or borrow

on short notice (say a period of 14 days). In order to manage day-to-day cash flows.

The interest rates in the market are market-driven and hence highly sensitive to demand and

supply. Also, historically, interest rates tend to fluctuate by a large % at certain times.

Features Of Money Market Instruments

1. High liquidity

The money market offers short-term securities that are highly liquid. Their high liquidity makes

them cash equivalents; that is, they can be traded for cash anytime. Several renowned financial

institutions and dealers issue these securities to take loans or generate funds.

2. Secure investment

Risk is inevitable, however in the case of the money market, the risk is significantly reduced due

to low tenure. Also, only companies and corporations with high credibility and goodwill issue

short-term securities and bonds. Hence, the risk of default is low as compared to higher tenure

instruments.

3. Fixed returns

Money market instruments in India are available at a discount on face value. Therefore, the

return on securities and bonds is pre-decided. You can be rest assured while investing in the

money market, as it promises fixed returns if held till maturity. The money market offers short-

term securities that are highly liquid. Their high liquidity makes them cash equivalents; that is,

they can be traded for cash anytime. Several renowned financial institutions and dealers issue

these securities to take loans or generate funds.

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

Instruments of Capital Market

Below are the 10 major instruments of capital market. Let’s look at individually.

1. Stocks

Stocks or Equity instruments represent ownership in a company. They represent the residual

claim on the assets and profits of a corporation after all debts have been paid. The holders of

these stocks, called shareholders, are entitled to dividends when declared by the company and

may vote for key decisions such as board members.

2. Equities

Equities are the instruments of capital market that involve buying and selling shares. They

represent ownership in a company and enable individuals to share in the profits or losses

generated by the company. By owning equities, investors may receive a dividend income from

companies when they declare dividends and any potential capital appreciation.

Investors can purchase equities directly from the companies offering them or through stock

exchanges.

3. Bonds

Bonds function as tools for issuers to secure funds from investors by offering them a debt-

based investment opportunity. These instruments guarantee periodic interest payments and the

repayment of the principal amount upon maturity, all at a predetermined interest rate. The value

of bonds can fluctuate in the secondary market, influenced by various factors such as credit

ratings, changes in the economy, and other pertinent considerations.

In this type of capital market instrument, investors can take part in this market by buying and

selling bonds, considering these factors and potential returns.

4. Derivatives

Investors can efficiently and profitably reach their financial goals by using derivatives. Financial

derivatives derive their value from an underlying asset, like stocks, commodities, or currencies.

They are mainly used to hedge against price fluctuations in the underlying asset and to

speculate on future market trends.

5. Commodities

Commodities serve as tangible capital market instruments that encompass essential raw

materials and primary goods of commerce. These include agricultural products, steel, other

metals, energy sources such as coal and oil, and livestock. Commodities are traded on a

regulated exchange through futures contracts that require the buyer to purchase the commodity

at a fixed price in the future.

6. Mutual Funds

Mutual funds are an ideal choice for people who want to invest but lack the expertise or time to

manage their portfolio of stocks and bonds. It involves pooling together money from various

investors with similar investment objectives and investing in various securities such as equities,

Content developed by kavyashree c.v Assistant Professor in Commerce Department

SAHYADRI INSTITUTE OF COMMERCE FIRST GRADE COLLEGE CHIKKAMAGALURU

debt instruments etc. The performance of these funds depends on the type of fund, its asset

composition, the market conditions, etc.

7. Exchange Traded Funds (ETFs)

ETFs are like mutual funds that track an index, commodity or basket of assets like an index fund,

but they trade like a stock on an exchange throughout the day. ETFs have become increasingly

popular over recent years due to their low cost, tax efficiency, and diversity. They are an easy

way to diversify a portfolio and take advantage of different market sectors without purchasing

multiple stocks.

8. Initial Public Offerings (IPOs)

An IPO signifies when a privately-held company transforms into a publicly-traded entity, making

its shares available for the general public to purchase for the first time. Companies utilize IPOs

to raise capital from public investors and list their shares on a stock exchange.

9. Real Estate Investment Trusts (REITs)

REITs serve as a capital market intrument that amass funds from investors to invest in real

estate properties that generate income. They allow individuals to invest in real estate without

directly owning physical properties. REITs distribute a significant portion of their income as

dividends to investors.

The appeal of REITs lies in their liquidity, providing the flexibility to buy or sell shares,

diversification benefits, and the potential for regular income, making them an attractive

investment option.

10. Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, akin to individual stocks. Their objective

is to mirror the performance of a specific index, sector, or asset class. This capital market

instrument offer advantages such as diversification across multiple securities, flexibility in daily

trading, and transparency in tracking underlying assets.

Content developed by kavyashree c.v Assistant Professor in Commerce Department

You might also like

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Proposal For Daraz VA With Estimated BudgetingDocument8 pagesProposal For Daraz VA With Estimated BudgetingBILAL KHANNo ratings yet

- Investment Management NotesDocument75 pagesInvestment Management NotesArjun Nayak100% (3)

- Estimation Coffeteria & Gym - Fooqa SareDocument9 pagesEstimation Coffeteria & Gym - Fooqa SareEng Abdi Shakur Yusuf100% (1)

- Test Bank MGMT 126Document8 pagesTest Bank MGMT 126najihachangminNo ratings yet

- Chapter 1 Finance (Kusuma)Document20 pagesChapter 1 Finance (Kusuma)karan yadavNo ratings yet

- BM 141 NotesDocument13 pagesBM 141 NotesNicole TaysonNo ratings yet

- Finanace InvestmentDocument5 pagesFinanace Investmentnehaunjiya5No ratings yet

- Thank You ScribdDocument1 pageThank You ScribdJazzmin Rae BarbaNo ratings yet

- Assignment For Mba Students Portfolio ManagementDocument12 pagesAssignment For Mba Students Portfolio ManagementRajan ShrivastavaNo ratings yet

- Final ReportDocument53 pagesFinal ReportsaharsandyNo ratings yet

- Finance (MBA) 216Document90 pagesFinance (MBA) 216Naveen Kumar I MNo ratings yet

- What Is FinanceDocument8 pagesWhat Is FinanceGULBAZ MAHMOODNo ratings yet

- Introduction of PortfolioDocument80 pagesIntroduction of PortfolioShubham MoreNo ratings yet

- Sources of Long Term FinancingDocument13 pagesSources of Long Term FinancingEtsegenet TafesseNo ratings yet

- Investment AvenuesDocument45 pagesInvestment AvenuesGrishma Ruchit Jaganiya100% (3)

- Investment 1Document18 pagesInvestment 1Sujal BedekarNo ratings yet

- 4VPkGBzkpwLekXu - P8SrXBOR22XCK0Bs-Principles of FinanceDocument9 pages4VPkGBzkpwLekXu - P8SrXBOR22XCK0Bs-Principles of FinanceNilailaNo ratings yet

- Investment and Portfolio ManagementDocument14 pagesInvestment and Portfolio ManagementMary Lyn DuarteNo ratings yet

- Investment Pattern of PeoplesDocument17 pagesInvestment Pattern of PeoplesLogaNathanNo ratings yet

- Financial Management 1Document29 pagesFinancial Management 1Aŋoop KrīşħŋặNo ratings yet

- Week 1 - Papeer FinanceDocument11 pagesWeek 1 - Papeer FinanceKiran patilNo ratings yet

- Week 1 Module - Definition of Investment Portfolio ManagementDocument8 pagesWeek 1 Module - Definition of Investment Portfolio ManagementKrystal AquinoNo ratings yet

- FSM Revision Notes June 2021Document267 pagesFSM Revision Notes June 2021jacob michelNo ratings yet

- Bme 5 PrelimsDocument4 pagesBme 5 PrelimsIrish DionisioNo ratings yet

- Silo - Tips Chapter 1 Introduction of Investments and Portfolio ManagementDocument60 pagesSilo - Tips Chapter 1 Introduction of Investments and Portfolio ManagementReynalyn Layron ReyesNo ratings yet

- 09 Chapter1 PDFDocument60 pages09 Chapter1 PDFMonica MckinneyNo ratings yet

- Portofolio ManagmentDocument70 pagesPortofolio ManagmentS K Shubham KanojiaNo ratings yet

- 06 Chapter 1Document52 pages06 Chapter 1yezdiarwNo ratings yet

- Business Finance Prelim To Finals ReviewerDocument127 pagesBusiness Finance Prelim To Finals ReviewerMartin BaratetaNo ratings yet

- Project Final Chapss PRNTDocument78 pagesProject Final Chapss PRNTVignesh RvNo ratings yet

- Comprehensive Activity - Financial ManagementDocument2 pagesComprehensive Activity - Financial Managementmarkconda21No ratings yet

- Jyothi Full ProjectDocument94 pagesJyothi Full ProjectNaghul KrishnaNo ratings yet

- Chapter 1Document17 pagesChapter 1Tasebe GetachewNo ratings yet

- Quick RevisionDocument51 pagesQuick RevisionvishwajeetNo ratings yet

- Investment Law NotesDocument122 pagesInvestment Law Notesberthakwilasa32No ratings yet

- A Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDDocument31 pagesA Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDParameshwari ParamsNo ratings yet

- NJ Fundz Nism QuestionsDocument51 pagesNJ Fundz Nism QuestionsLatesh KolheNo ratings yet

- A Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDDocument31 pagesA Study On Investor Behaviour Towards Investment Decision With Special Reference To Myfino Payment World (P) LTDParameshwari ParamsNo ratings yet

- Business Finance 1 ÖZETDocument23 pagesBusiness Finance 1 ÖZETÖmer Faruk AYDINNo ratings yet

- FM 1-3Document53 pagesFM 1-3zeleke fayeNo ratings yet

- A Study On Profitability Analysis ProjectDocument72 pagesA Study On Profitability Analysis Projectharshith rajuNo ratings yet

- MCO 106 UNIT-1 Business Finance 2023Document14 pagesMCO 106 UNIT-1 Business Finance 2023daogafugNo ratings yet

- (Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementDocument9 pages(Week 2) Lesson 1:: Lesson Number: Topic: Introduction To Financial ManagementMark Dhel VillaramaNo ratings yet

- INVESTMENT AlternativesDocument69 pagesINVESTMENT Alternativesdhvanichauhan476No ratings yet

- FMSM Revision Notes - Db4fd5fe b925 4e33 A94e 810a57d49c83Document236 pagesFMSM Revision Notes - Db4fd5fe b925 4e33 A94e 810a57d49c83jacob michelNo ratings yet

- Introduction of Corporate Finance 1.1 Corporate FinanceDocument4 pagesIntroduction of Corporate Finance 1.1 Corporate FinanceRupal DalalNo ratings yet

- IAPM Unit-1Document10 pagesIAPM Unit-1Anubhav MishraNo ratings yet

- IntroductionIst and 2nd WeeksDocument10 pagesIntroductionIst and 2nd Weekskhan officialNo ratings yet

- FIN101PRELIMSDocument6 pagesFIN101PRELIMSEmily ResuentoNo ratings yet

- Chapter No 1: - Introduction: 1.1 InvestmentDocument64 pagesChapter No 1: - Introduction: 1.1 InvestmentvatsalNo ratings yet

- Inventory Management SWATHIDocument96 pagesInventory Management SWATHISakhamuri Ram'sNo ratings yet

- Investment Management2 PDFDocument170 pagesInvestment Management2 PDFThomas nyadeNo ratings yet

- Treasury Management (M)Document9 pagesTreasury Management (M)Keisia Kate FabioNo ratings yet

- COMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakDocument73 pagesCOMPARATIVE ANALYSIS OF SELECT STOCKS LISTED ON BOTH BSE AND NSE - KotakRajendra Babu DaraNo ratings yet

- Report On Wealth ManagementDocument34 pagesReport On Wealth Managementarun883765No ratings yet

- International Journal of Business and Management Invention (IJBMI)Document5 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Investment PortfolioDocument23 pagesInvestment PortfolioProfessional Service100% (1)

- 06 Chapter1Document33 pages06 Chapter1touffiqNo ratings yet

- Natinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section RegularDocument18 pagesNatinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section Regularcn comNo ratings yet

- Chapter 2Document7 pagesChapter 2Prakash SinghNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- How to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementFrom EverandHow to Create and Maintain a Diversified Investment Portfolio: A Comprehensive Guide on Investment and Portfolio ManagementNo ratings yet

- An Economist Sells Bagels A Case Study in Profit Maximization PDFDocument43 pagesAn Economist Sells Bagels A Case Study in Profit Maximization PDFMax GrecoNo ratings yet

- Chapter 7 Co-BrandingDocument30 pagesChapter 7 Co-BrandingHoNo ratings yet

- General Banking Activities of Jamuna BankDocument52 pagesGeneral Banking Activities of Jamuna BankFatin Arefin0% (1)

- Intercompany Transactions PDFDocument22 pagesIntercompany Transactions PDFmouse.lenova mouse100% (1)

- Methodological Brief - EnG v.2 - 2Document44 pagesMethodological Brief - EnG v.2 - 2Ayah S. YassinNo ratings yet

- The Business Model of Flipkart: March 2018 December 2018 January 2019Document11 pagesThe Business Model of Flipkart: March 2018 December 2018 January 2019Suryateja ChallaNo ratings yet

- Lata Internship Report 1 1Document45 pagesLata Internship Report 1 1FahimNo ratings yet

- Floor Plan Lending PrimerDocument73 pagesFloor Plan Lending PrimerCari Mangalindan MacaalayNo ratings yet

- Reverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomeDocument9 pagesReverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomePitaloka RanNo ratings yet

- Ismt LTD (2019-2020)Document150 pagesIsmt LTD (2019-2020)Nimit BhimjiyaniNo ratings yet

- Accounts and Finance Short TermsDocument59 pagesAccounts and Finance Short TermsBelalHossainNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- IDX Fact Book 2009Document166 pagesIDX Fact Book 2009Mhd FadilNo ratings yet

- Trade Data Structure and Basics of Trade Analytics: Biswajit NagDocument33 pagesTrade Data Structure and Basics of Trade Analytics: Biswajit Nagyashd99No ratings yet

- International Financial Management: AnswerDocument18 pagesInternational Financial Management: AnswerNithyananda PatelNo ratings yet

- Power PricingDocument83 pagesPower PricingSrikanth Reddy SanguNo ratings yet

- Southwest Airlines Case Study AnswersDocument6 pagesSouthwest Airlines Case Study AnswersRamesh Mandava50% (4)

- Case Study On Alibabas TaobaoDocument8 pagesCase Study On Alibabas TaobaoChen ChengNo ratings yet

- Portfolio Analysis of Micro Finance Portfolio Management and Security AnalysisDocument12 pagesPortfolio Analysis of Micro Finance Portfolio Management and Security AnalysisBasanta BhetwalNo ratings yet

- A Study On The Challenges HR Managers Face TodayDocument10 pagesA Study On The Challenges HR Managers Face TodayJAY MARK TANONo ratings yet

- Role of Maharashtra Centre For Entrepreneurship Development (Mced) in Developing Self Employment and EntrepreneurshipDocument3 pagesRole of Maharashtra Centre For Entrepreneurship Development (Mced) in Developing Self Employment and EntrepreneurshipInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Compute For The Unit Contribution MarginDocument9 pagesCompute For The Unit Contribution Marginmusic niNo ratings yet

- Homework Chap 9Document4 pagesHomework Chap 9aleuvoNo ratings yet

- Maxis Bill Presentment - St...Document1 pageMaxis Bill Presentment - St...Kratos Vs DanteNo ratings yet

- Chapter 3 Evaluating A Company S External Environment: Basic QuestionsDocument2 pagesChapter 3 Evaluating A Company S External Environment: Basic QuestionsAlma CoronadoNo ratings yet

- Lesson 3 - Word CardsDocument1 pageLesson 3 - Word Cardsapi-240816434No ratings yet