Professional Documents

Culture Documents

Financial Literacy VAC Project-1

Financial Literacy VAC Project-1

Uploaded by

Pratibha MishraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Literacy VAC Project-1

Financial Literacy VAC Project-1

Uploaded by

Pratibha MishraCopyright:

Available Formats

Name - Pratibha Mishra

Roll No. - 20222937

B.A. (H) Economics (1st year)

Q. Prepare 5 savings plans and evaluate them on the factors mentioned below:

● Risk

● Liquidity

● Rate of return

● Inflation

● Restrictions and fees

____________________________________________________________________________

Assuming the monthly income as 1,00,000. Computing returns after 15 years.

1. First Plan

Channels Amount (Monthly) Returns

Systematic Investment Plan 40,000 2,05,73,821 (12.2%)

(SIP)

Public Provident Fund (PPF) 12,500 40,68,209 (7.1%)

Savings Account 20,000 45,50,802 (3%)

Life Insurance 5000 -

Health Insurance 2000 -

Other Expenses 20,500 -

Total 1,00,000

❖ This is not a high risk plan.

❖ Liquidity is high.

❖ The rate of return would be average if not high.

❖ A fee of 100 rupees is to be paid if SIP exceeds the value of 10,000.

❖ There is an emergency fund in this plan.

2. Second Plan

Channels Amount (Monthly) Returns

SIP 45,000 1,33,81,071 (6.1%)

PPF 10,000 2,71,214 (7.1%)

Fixed Deposit 20,000 61,57,112 (6.6%)

Life Insurance 6000 -

Health Insurance 3000 -

Other Expenses 16000 -

Total 1,00,000

❖ This is a high risk plan as a big part of the income is invested in SIP.

❖ The overall liquidity is moderate.

❖ The rate of return would be high.

❖ Inflation could prove to be an undesirable situation.

3. Third Plan

Channels Amount (Monthly) Returns

SIP 30,000 1,35,09,182 (10.84%)

PPF 7000 1,89,850 (7.1 %)

Fixed Deposit 25,000 76,96,391 (6.6%)

Savings Account 20,000 45,50,802 (3%)

Health Insurance 5000 -

Life Insurance 3000 -

Other Expenses 10,000 -

Total 1,00,000

❖ This is a moderately risky plan.

❖ Liquidity is moderate.

❖ Rate of return is less.

❖ Moving hand-in-hand with inflation.

4. Fourth Plan

Channels Amount (Monthly) Returns

SIP 40,000 2,05,73,821 (12.2%)

PPF 6000 1,62,728 (7.1%)

Government Bond (SBI 30,000 1,04,50,354 (8%)

Magnum Gilt Fund)

Health Insurance 2000 -

Life Insurance 2000 -

Other Expenses 20,000 -

Total 1,00,000

❖ This is a risky plan.

❖ Liquidity is almost none.

❖ Rate of return is high.

❖ This plan enables to stay hand-in-hand with Inflation.

5. Fifth Plan

Channels Amount (Monthly) Returns

SIP 35,000 1,58,20,045 (10.84%)

PPF 10,500 2,84,775 (7.1%)

Savings Account 20,000 45,50,802 (3%)

Government Bonds 20,000 69,66,903 (8%)

Health Insurance 1000 -

Life Insurance 2000 -

Other Expenses 11,500 -

Total 1,00,000

❖ This is a moderately risky plan.

❖ Liquidity is less.

❖ Rate of return is also moderate.

❖ This plan stays behind inflation.

You might also like

- 1.PDF Insolvency Law 10th EditionDocument733 pages1.PDF Insolvency Law 10th Editionliam.dalwai100% (2)

- FMP Assignement Key - Cases Fall 10Document16 pagesFMP Assignement Key - Cases Fall 10ahsan_anwar_1No ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- AC2101 SemGrp4 Team5 UpdatedDocument42 pagesAC2101 SemGrp4 Team5 UpdatedKwang Yi JuinNo ratings yet

- Servicer's Survival Guide 2012Document364 pagesServicer's Survival Guide 2012bob doleNo ratings yet

- Wealth Management: Group AssignmentDocument11 pagesWealth Management: Group Assignmentsimran guptaNo ratings yet

- Variable Life Insurance ProposalDocument6 pagesVariable Life Insurance ProposalJocelyn CelynNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- Financial Plan Report: ABC Yadnya Academy Pvt. Ltd. DD MMM YyyyDocument24 pagesFinancial Plan Report: ABC Yadnya Academy Pvt. Ltd. DD MMM YyyyAravind MauryaNo ratings yet

- Sample Financial Plan ReportDocument24 pagesSample Financial Plan ReportKarthik GundaNo ratings yet

- Variable Life Insurance ProposalDocument12 pagesVariable Life Insurance ProposalRoumel GalvezNo ratings yet

- Variable Life Insurance ProposalDocument6 pagesVariable Life Insurance ProposalJocelyn CelynNo ratings yet

- UTI Retirement Benefit Pension Fund - UTI Mutual FundDocument32 pagesUTI Retirement Benefit Pension Fund - UTI Mutual FundRinku MishraNo ratings yet

- Wilma Dapog Flexilink 1mDocument10 pagesWilma Dapog Flexilink 1mTweetie Borja DapogNo ratings yet

- E2d5b985fe2f809a1645591333765 1645591531613 1645591533097Document2 pagesE2d5b985fe2f809a1645591333765 1645591531613 1645591533097klassociates.vatNo ratings yet

- FY21 Budget Presentation To CouncilDocument25 pagesFY21 Budget Presentation To CouncilNewsChannel 9 StaffNo ratings yet

- U01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Document10 pagesU01 Apps PHSunSMART PHSunSMARTFiles SymbiosysFiles Generated OutputSIPDF 098692O090520182219005228644 1525875549108Jaymar Odtojan AbaloNo ratings yet

- JackieLunaSamplePolicy PDFDocument1 pageJackieLunaSamplePolicy PDFDom De Ocampo DaigoNo ratings yet

- Male 31 Maxi350KDocument7 pagesMale 31 Maxi350KJenno serranoNo ratings yet

- EightDocument1 pageEightNaveen PeramalasettyNo ratings yet

- Variable Life Insurance ProposalDocument6 pagesVariable Life Insurance ProposalJocelyn CelynNo ratings yet

- HLV CalculationDocument5 pagesHLV CalculationPhuntru PhiNo ratings yet

- Chapter 15 - Answer-2Document7 pagesChapter 15 - Answer-2Matthew Robert DesiderioNo ratings yet

- WM Final Disha Saxena Jn180269Document13 pagesWM Final Disha Saxena Jn180269Disha SaxenaNo ratings yet

- Module 1 - Time Value of Money Handout For LMS 2020Document8 pagesModule 1 - Time Value of Money Handout For LMS 2020sandeshNo ratings yet

- FinanceDocument9 pagesFinancecrystalNo ratings yet

- Assignment 1 - Fin 645Document5 pagesAssignment 1 - Fin 645Ushanthini NithanthanNo ratings yet

- VIVENCIA PRIME All RidersDocument12 pagesVIVENCIA PRIME All RidersRalph RUzzelNo ratings yet

- Budget Workshop 3 FY 2022Document41 pagesBudget Workshop 3 FY 2022Dan LehrNo ratings yet

- Actuary 101 - Some Basic Concepts: Texpers 20 Annual Conference March 31, 2009 Mark RandallDocument24 pagesActuary 101 - Some Basic Concepts: Texpers 20 Annual Conference March 31, 2009 Mark RandallRusdy S. NugrahaNo ratings yet

- I-Medik RIDER Suite: Your One Stop Medical Protection SolutionDocument83 pagesI-Medik RIDER Suite: Your One Stop Medical Protection SolutionainafaqeeraNo ratings yet

- Diamond LeafletDocument6 pagesDiamond Leafletjinna kvpNo ratings yet

- BANK3011 Week 13 Tutorial QuestionsDocument2 pagesBANK3011 Week 13 Tutorial QuestionsJamie ChanNo ratings yet

- Aviva UK: One Aviva Twice The ValueDocument17 pagesAviva UK: One Aviva Twice The ValueAviva GroupNo ratings yet

- City of Naples 2021 Pension Note Issuance AGM - 05192021Document5 pagesCity of Naples 2021 Pension Note Issuance AGM - 05192021Omar Rodriguez OrtizNo ratings yet

- Lesson 2 Other Long Term InvestmentsDocument12 pagesLesson 2 Other Long Term InvestmentsMeeka CalimagNo ratings yet

- Variable Life Insurance ProposalDocument6 pagesVariable Life Insurance ProposalJayson BorlagdatanNo ratings yet

- Kaycee Tolentino 1 Year Old Child Educ Funding ProposalDocument2 pagesKaycee Tolentino 1 Year Old Child Educ Funding ProposalRheianne Dela IslaNo ratings yet

- Some Semanth Fin CalDocument3 pagesSome Semanth Fin Calpoiluyt buytrNo ratings yet

- Bonds PayableDocument14 pagesBonds PayableCarl Yry BitengNo ratings yet

- Bonds PayableDocument7 pagesBonds PayableCarl Yry BitengNo ratings yet

- Financial Institutions Management - Chapter 5 Solutions PDFDocument6 pagesFinancial Institutions Management - Chapter 5 Solutions PDFJarrod RodriguesNo ratings yet

- Deductions - For StudentsDocument29 pagesDeductions - For Studentsdevkinger1212No ratings yet

- SunlifeDocument11 pagesSunlifeAsisclo CastanedaNo ratings yet

- Austin ISD FY2012 Preliminary Budget PresentationDocument33 pagesAustin ISD FY2012 Preliminary Budget PresentationKUTNewsNo ratings yet

- Flattening The Curves: Todd MattinaDocument4 pagesFlattening The Curves: Todd MattinaThea LandichoNo ratings yet

- Ramios N Mlprime 04112021083721Document18 pagesRamios N Mlprime 04112021083721Elaina DuarteNo ratings yet

- Insurance NeedDocument7 pagesInsurance NeedIshan AgarwalNo ratings yet

- Sun MaxiLink PrimeDocument8 pagesSun MaxiLink PrimeEric CorbezaNo ratings yet

- Interest Rates..Document13 pagesInterest Rates..arkobagchi32No ratings yet

- A#8 MLPDocument10 pagesA#8 MLPScribdTranslationsNo ratings yet

- 2021 Report To The Community - Booklet - Financial Highlights PageDocument1 page2021 Report To The Community - Booklet - Financial Highlights PageCoyNo ratings yet

- Capital Structure With Taxes and Bankruptcy CostsDocument7 pagesCapital Structure With Taxes and Bankruptcy Costsjoey131413141314No ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 16 & 19PRA MBANo ratings yet

- 201 Group-55 FIN435Document8 pages201 Group-55 FIN435Nahida Akter JannatNo ratings yet

- Apollo Munich Health OnDocument5 pagesApollo Munich Health OnKeshu sambitNo ratings yet

- Divi Thilina: (Terms & Conditions Applied)Document1 pageDivi Thilina: (Terms & Conditions Applied)KetharanathanSaravananNo ratings yet

- 1 Year OldDocument2 pages1 Year OldRheianne Dela IslaNo ratings yet

- H01 - 06 - DM 6 Pages PDFDocument6 pagesH01 - 06 - DM 6 Pages PDFNgoc Ha TranNo ratings yet

- Maf253 - SS - July 2021Document11 pagesMaf253 - SS - July 2021Shazrul FadzlyNo ratings yet

- Navigating the Global Storm: A Policy Brief on the Global Financial CrisisFrom EverandNavigating the Global Storm: A Policy Brief on the Global Financial CrisisNo ratings yet

- HSBC Switch Terms-And-Conditions-Cass-OfferDocument3 pagesHSBC Switch Terms-And-Conditions-Cass-OfferVladimir VukovicNo ratings yet

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicoleNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingNelhey DllgNo ratings yet

- Fiche de Paie Ahmed BoudinarDocument1 pageFiche de Paie Ahmed Boudinarjorta4400No ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Balance StatementDocument5 pagesBalance StatementVitor BinghamNo ratings yet

- Statement 1687884970915Document20 pagesStatement 1687884970915Praveen kumarNo ratings yet

- e-StatementBRImo 432301001713539 Mar2024 20240228 161143Document6 pagese-StatementBRImo 432301001713539 Mar2024 20240228 161143cv.jayabersama2007No ratings yet

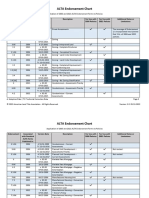

- ALTA Endorsement Chart V 02.0 05-12-2022Document11 pagesALTA Endorsement Chart V 02.0 05-12-2022Robert CastilloNo ratings yet

- Barclays BankDocument4 pagesBarclays BanktsundereadamsNo ratings yet

- Corporate Finance 2 SyllabusDocument11 pagesCorporate Finance 2 SyllabusMai NguyenNo ratings yet

- Texas Certified Lienholders ListDocument62 pagesTexas Certified Lienholders ListJose CeceñaNo ratings yet

- Tutorial - Unit 2 - BMDocument7 pagesTutorial - Unit 2 - BMBrianna GetfieldNo ratings yet

- 2022-03-10 Item 6aDocument4 pages2022-03-10 Item 6a视频精选全球No ratings yet

- Boa 2010Document4 pagesBoa 2010Taulant HoxhaNo ratings yet

- Federal Urdu University of Arts, Science and Technology, IslamabadDocument4 pagesFederal Urdu University of Arts, Science and Technology, IslamabadQasim Jahangir WaraichNo ratings yet

- Dispute ResultsDocument24 pagesDispute Resultsrichard winfreyNo ratings yet

- Lesson 23 Illustrating Simple and Compound InterestDocument12 pagesLesson 23 Illustrating Simple and Compound InterestANGELIE FERNANDEZNo ratings yet

- Sebenta PE Vasco TamenDocument33 pagesSebenta PE Vasco TamennovasbechatgptNo ratings yet

- Internship Report 1Document24 pagesInternship Report 1Girma Uniqe100% (1)

- BK Holiday Package Form 4Document4 pagesBK Holiday Package Form 4TabithaNo ratings yet

- Personal Finance Course. Mock Exam 2023.without AnswerDocument3 pagesPersonal Finance Course. Mock Exam 2023.without Answernguyen tungNo ratings yet

- Nl55ingb0537136142 - 20 06 2023 - 20 09 2023Document37 pagesNl55ingb0537136142 - 20 06 2023 - 20 09 2023ObsaharawweNo ratings yet

- Unclaimed Deposits in Dormant Accounts in UcbsDocument3 pagesUnclaimed Deposits in Dormant Accounts in UcbspraveenaNo ratings yet

- Internship Report On "Credit Cards of South East Bank LTD.": Submitted ToDocument26 pagesInternship Report On "Credit Cards of South East Bank LTD.": Submitted ToTushar ShahiNo ratings yet

- 92mdcreditdebitcar8 PDFDocument1 page92mdcreditdebitcar8 PDFland2legacy.inNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument13 pagesModule 1 - Cash and Cash EquivalentsAlliah Mae RaizNo ratings yet

- Ejf 101Document29 pagesEjf 101Geraldine Faith EcongNo ratings yet