Professional Documents

Culture Documents

Business Insurance

Business Insurance

Uploaded by

nagchand85Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Insurance

Business Insurance

Uploaded by

nagchand85Copyright:

Available Formats

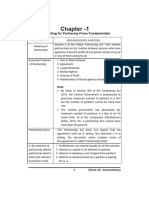

FTR DOCKET

Section 4

Basic Underwriting Guidelines

for Business Insurance

Click/Tap on the link below to land on page directly:

4.1 Partnership Insurance Underwriting

4.2 MWPA Insurance Underwriting

4.3 Keyman Insurance Underwriting

4.4 Hindu Undivided Family Underwriting

4.5 Employer-Employee Underwriting

Click/Tap on the icons

to navigate: Prev. Next

Index

Section Section

ENABLERS Strictly for internal Trainings 48

Section 4

Basic Underwriting Guidelines

for Business Insurance

4.1.1 Partnership Insurance

Category Partnership Guidelines

Type of Product Only Term Plans allowed

Only SPG Level Term cover (Variant 1) without Add-on

SPG Variant

cover, without ROP and Whole life Option allowed

For Cover amount > ₹ 25 Cr would be offered lower

Policy Term

duration (maximum cover upto age 65 years)

Nomination Nomination is not Allowed

Assignment is not allowed –

Assignment

except in the case of dissolution of partnership

Riders Riders are not allowed

• All partners need to apply for cover simultaneously.

Other

• Partnership Business should generate Profit

commensurate with Sum Proposed.

1. Copies of Original Partnership Deed

& Supplementary Partnership Deed.

2. Copies of Latest Audited P&L, BS for last 3 years.

Documentation 3. Statement showing capital account of partners.

4. Letter from Partnership firm authorizing the person

to sign on behalf of the firm.

5. AML-KYC documents of controlling beneficial owners

ENABLERS Strictly for internal Trainings 49

4.1 Business

Insurance UW

4.1.2 Married Woman’s Property Act 1874 Insurance

Category MWPA Guidelines

LA & Proposer The Life Assured & Proposer must be one and the same

Beneficiaries, once declared, cannot be changed.

The Beneficiaries may be:

Beneficiary

- Wife

- Any of his children

- Wife and any of his children

• MWPA Policies are considered as ‘Automatic Trust’,

hence the need for Trustee(s).

• A Trustee is the legal owner of the policy under the Act.

• The Policyholder must assign the Trustee(s) at

inception

Trustee • S/he receives the benefits on behalf of the

beneficiaries.

• A Trustee could be:

- Any individual, two or more people

- Any organization

- Wife and one/more adult children

• Trustee(s) can be changed during policy term

MWPA Addendum: Signed by Life Assured,

Documentation

Beneficiaries & Trustee(s) (mandatory)

Type of Plan(s) Term Plan, Traditional & ULIP

ENABLERS Strictly for internal Trainings 50

4.1 Business

Insurance UW

4.1.3 Keyman Insurance

Category Keyman Insurance Guidelines

1. Proposal form should be submitted, signed by a

person authorized by company.

2. Copies of memorandum and articles of association.

3. A resolution from the board of directors which should

state that they desire to have a policy on the life of the

key man to be named and they should state the

amount for which the policy is desired.

4. The resolution should also state the name of the

authorized signatory of the company, who must affix

rubber stamp of his designation in the company with

company’s name below his signature on the proposal

form.

Documentation

5. Key-man questionnaire signed by the persons

authorized by the entity -Annexure Key man

6. Copy of audited accounts, profit & loss account and

balance sheet of the entity for the last three years duly

certified by Chartered Accountant. Keyman cover

cannot be granted to loss making entities or Non-

profit organizations

7. KYC documents of the Controlling beneficial owners of

the entity

8. Form 16 for last 2 years or proof of remuneration of

the key man

ENABLERS Strictly for internal Trainings 51

4.1 Business

Insurance UW

4.1.3 Keyman Insurance (continued)

The permissible amount of Key Man insurance for a company will be the least of

the amounts arrived at on the basis of below 3 methods:

Method 1: Method 2: Method 3:

Sum Assured = Sum Assured = Sum Assured =

3 x Average 5 x Average net 10 x Annual

Gross Profit of profit of the compensation

the company for company for the Package of Key

the last 3 years last 3 years person

Note: If there is more than one key person in the company the total of the face

value of the policies on the life of all these key persons (from all insurance

companies) should not exceed the overall limit arrived at by methods 1 & 2

mentioned above.

• Key person shareholding is less than or equal to 51%.

• Family (includes spouse and minor child) shareholding is less than or equal

to 70%.

• Cases with different shareholding pattern will be considered on case-to-case

basis

ENABLERS Strictly for internal Trainings 52

4.1 Business

Insurance UW

4.1.3 Keyman Insurance (continued)

The companies that are recently established where audited Profit & Loss

Accounts for three years are not available:

No. of years for which audited

Maximum Sum Assured

accounts are available

2 Years 2 Times Average Net Profit

1 Year Equal to Net Profit

Less than 1 Year Nil

4.1.4 HUF Insurance

Category HUF Guidelines

Proposal Form with HUF as Proposer

PAN of HUF mandatory

Documentation Income Proof/ITRs of HUF

(if total premium paid is more than ₹ 5 Lakhs)

HUF addendum signed by HUF Karta, to contain

Declaration & details of Coparcener(s) &/or members

Premium Premium to be paid from HUF Account

Medicals For clubbed SUC (Individual Cover and HUF Cover)

ENABLERS Strictly for internal Trainings 53

4.1 Business

Insurance UW

4.1.5 Employer Employee

Category Employer Employee Insurance Guidelines

Partners cannot take EEIS for themselves,

employees of the partnership firm can be covered.

Employees of proprietorship can be covered under EEIS

but not the proprietor.

Eligibility

Director of a company can be covered,

provided he is receiving regular salary from company

Employer must have atleast 10 permanent employees

1. Board Resolution (signed by all directors/partners):

Decision to buy Insurance for employees as per

mentioned in resolution, with mention of authorized

signatory to sign all documents on behalf of employer

2. Employer-Employee Annexure (signed by authorized

signatory): with information of the Employer

3. Assignment Form: Assignment is compulsory with

proposal under EEIS. Please tick on the type of

assignment in the assignment form and provide

necessary details.

Employer’s

Documentation

KYC of Witness of assignment is mandatory

4. Memorandum & Articles of Association & Company

Registration Certificate

5. Shareholding Pattern

6. Audited Accounts: Last 3 years P&L, BS

7. ITR: Last 3 years

8. PAN of company

ENABLERS Strictly for internal Trainings 54

4.1 Business

Insurance UW

Category Employer Employee Insurance Guidelines

1. Proof of Employment: Depending on income (any of

the below)

• Last 2 years Form 16 showing income

Employee’s • Bank Account Statement of last 6 months

Documentation (showing salary credit for employees joined in

current FY)

• Last 3 months’ salary slip with employee no., PF

no., month etc

Term Plan, Traditional & ULIP.

Type of Plans

Plans with inbuilt waiver of premium are not allowed

Only SPG Level Term cover (Variant 1) & Increasing Level

SPG Variant (Variant 4) allowed along with all Add-On covers except

WOP and ROP

Cover will not be offered beyond the age of 65, except in

case of a closely held company where policy is assigned in

insured`s name is made post retirement or age 65

Policy Term (whichever is earlier), such companies can be considered

for higher duration covers i.e. 99 years age subject to

“absolute immediate assignment of policy in the name of

LA” (only upto ₹ 25 Cr, higher covers -> reinsurer decision)

• Total Insurance cover on life, will not exceed the

eligible individual life cover, based on employee’s

salary earned from the employer

Financial UW

• PPC of Life Assured has to be justified

• Employer cannot pay more than 50% of net annual

income of Employee towards EEIS premium

No specific restriction for EEIS,

General UW

normal UW guidelines will apply

Employer as policyholder, to be signed by authorized

Proposal Form

signatory of the company

Premium Premium Payment from Employer’s Account

ENABLERS Strictly for internal Trainings 55

You might also like

- RECOMMERCEDocument25 pagesRECOMMERCEAishwarya NairNo ratings yet

- Walt DisneyDocument56 pagesWalt DisneyDaniela Denisse Anthawer Luna100% (6)

- Business Plan Rusenyi Coffee Growers - Final - Version - FinalDocument53 pagesBusiness Plan Rusenyi Coffee Growers - Final - Version - FinalReneNo ratings yet

- Tata Aia Keyman Insurance - L&C ApprovedDocument3 pagesTata Aia Keyman Insurance - L&C ApprovedajaybsinghNo ratings yet

- Shareholders AgreementDocument24 pagesShareholders AgreementMariaNo ratings yet

- Presentation 1Document33 pagesPresentation 1khushio4No ratings yet

- IllustrationDocument1 pageIllustrationshalinimani19No ratings yet

- Keyman InsuranceDocument4 pagesKeyman InsuranceAnonymous gCE3zvINo ratings yet

- Ilovepdf MergedDocument162 pagesIlovepdf Mergeddkhanna874No ratings yet

- Sbi Life Shield Used As A Keyman How To SubscribeDocument3 pagesSbi Life Shield Used As A Keyman How To SubscribeDADINMNo ratings yet

- Member's Booklet - WorkSave Pension Plan - W12105 (1120)Document32 pagesMember's Booklet - WorkSave Pension Plan - W12105 (1120)nazy1983No ratings yet

- Illustration (3) - 3Document1 pageIllustration (3) - 3Navneet PandeyNo ratings yet

- Partnership InsuranceDocument9 pagesPartnership InsuranceChari TawaNo ratings yet

- Introduction To Shareholder'S Agreements: What?Document24 pagesIntroduction To Shareholder'S Agreements: What?MuhaiyoNo ratings yet

- Partnership Act RajsirasignmentDocument36 pagesPartnership Act RajsirasignmentAmaresh Priyadarshi MahapatraNo ratings yet

- Shareholding AgreementDocument5 pagesShareholding AgreementSameer RajguruNo ratings yet

- Theory Notes Part IDocument31 pagesTheory Notes Part ISuraj PatelNo ratings yet

- Indian Partnership Act, 1932: IntroductionDocument14 pagesIndian Partnership Act, 1932: IntroductionChandni ShawNo ratings yet

- Online Course + Applicable State Reporting Fees XCEL SolutionsDocument1 pageOnline Course + Applicable State Reporting Fees XCEL Solutionsbs2hf9ppmpNo ratings yet

- Ae100 Finals Lecture Partnership and CorporationDocument98 pagesAe100 Finals Lecture Partnership and Corporationwords of Ace.No ratings yet

- Chapter-15 Partnership Accounts PDFDocument20 pagesChapter-15 Partnership Accounts PDFTarushi Yadav , 51BNo ratings yet

- Module II - Partnership Basic ConsiderationDocument10 pagesModule II - Partnership Basic ConsiderationJoji OlavidesNo ratings yet

- IllustrationDocument1 pageIllustrationkrish4c4No ratings yet

- SharesDocument6 pagesSharesgoyalb06062004No ratings yet

- Things You Need To Know About Vesting: StartupsDocument4 pagesThings You Need To Know About Vesting: StartupsINKNo ratings yet

- Admission of Partner FA - III1644397784Document31 pagesAdmission of Partner FA - III1644397784satishNo ratings yet

- Epolicy - 1022684495Document61 pagesEpolicy - 1022684495Kurt MarfilNo ratings yet

- MWP & KeymanDocument11 pagesMWP & KeymanEnnsignn Advisory Services P LtdNo ratings yet

- HDFCLife Click2Retire BrochureDocument16 pagesHDFCLife Click2Retire BrochurenidhinNo ratings yet

- Accounting Methods For GoodwillDocument4 pagesAccounting Methods For GoodwillaskmeeNo ratings yet

- RCMF - Loan Against InsuranceDocument8 pagesRCMF - Loan Against InsuranceAnuj KumarNo ratings yet

- Digisave TermsDocument8 pagesDigisave TermsfavourobinaujuwaNo ratings yet

- EFU Life Assurance Ltd. Illustration of Benefits For 'Prosperity For Life' Prepared For: Mr. ARSHAD ALIDocument3 pagesEFU Life Assurance Ltd. Illustration of Benefits For 'Prosperity For Life' Prepared For: Mr. ARSHAD ALIMonyee SindhuNo ratings yet

- Welcome To The Presentation: Sanzida Begum ID: 17002Document11 pagesWelcome To The Presentation: Sanzida Begum ID: 17002Sanzida BegumNo ratings yet

- AFAR - Part 1Document18 pagesAFAR - Part 1Myrna LaquitanNo ratings yet

- Free Term Insurance Buying GuideDocument14 pagesFree Term Insurance Buying Guiderajm791No ratings yet

- Business Taxation: Topic: Assessment of Partnership FirmsDocument19 pagesBusiness Taxation: Topic: Assessment of Partnership FirmsHarsha ReddyNo ratings yet

- The Law of Corporate Finance & Securities RegulationDocument26 pagesThe Law of Corporate Finance & Securities Regulationchandni.ambaniandassociatesNo ratings yet

- Xii Accounts NOTESDocument13 pagesXii Accounts NOTESNavin PatidarNo ratings yet

- Features of ICICI Pru Saral Jeevan BimaDocument2 pagesFeatures of ICICI Pru Saral Jeevan BimaKriti KaNo ratings yet

- 12 Accountancy Eng SM 2024 PDFDocument464 pages12 Accountancy Eng SM 2024 PDFShivansh JaiswalNo ratings yet

- QAISERDocument3 pagesQAISERsohailNo ratings yet

- ULOa DiscussionDocument27 pagesULOa DiscussionKristine Joy EbradoNo ratings yet

- IllustrationDocument1 pageIllustrationAbhijeet DhobleNo ratings yet

- Module 5 - Share Capital & BorrowingsDocument7 pagesModule 5 - Share Capital & BorrowingsAlishaNo ratings yet

- Mod-Pc-2005en-F 21Document24 pagesMod-Pc-2005en-F 21jerryq2007No ratings yet

- NOTES - LESSON 2 Forms of Business OrganisationDocument9 pagesNOTES - LESSON 2 Forms of Business OrganisationVV DreamsNo ratings yet

- BBA331: Financial Management CIA 1.1: Company: Tata SteelDocument11 pagesBBA331: Financial Management CIA 1.1: Company: Tata SteelRaj AgarwalNo ratings yet

- Underwriting of Shares and Debentures.Document26 pagesUnderwriting of Shares and Debentures.DeathRayShot -No ratings yet

- Financial Accounting 9Th Edition Hoggett Solutions Manual Full Chapter PDFDocument68 pagesFinancial Accounting 9Th Edition Hoggett Solutions Manual Full Chapter PDFDawnZimmermanxwcq100% (11)

- Employer Employee SchemeDocument22 pagesEmployer Employee SchemeMaruthi RaoNo ratings yet

- Nayve, Kimberly IDocument113 pagesNayve, Kimberly IKim Nayve50% (10)

- IndiaFirst Smart Save Plan BrochureDocument16 pagesIndiaFirst Smart Save Plan BrochureVishal SharmaNo ratings yet

- ASSIGNMENTDocument11 pagesASSIGNMENTxyzNo ratings yet

- Partnership Agreement: Name AddressDocument4 pagesPartnership Agreement: Name AddressJaa Rok100% (1)

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- CHAPTER 12 Partnerships Basic Considerations and FormationsDocument9 pagesCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNo ratings yet

- XII Accountancy Notes All Chapters MR - Mohan H BaksaniDocument176 pagesXII Accountancy Notes All Chapters MR - Mohan H BaksaniALAY SINGHNo ratings yet

- 3 ChapDocument4 pages3 ChapSuhani AngelNo ratings yet

- IllustrationDocument1 pageIllustrationmon.rohithNo ratings yet

- GPA Policy 22-23Document6 pagesGPA Policy 22-237gs7gnc48tNo ratings yet

- Accounts Project Rough Draft by Vansh RupareliaDocument18 pagesAccounts Project Rough Draft by Vansh RupareliaVansh RupareliaNo ratings yet

- A K Mishra Faculty Iibf: Indian Institute of Banking & FinanceDocument39 pagesA K Mishra Faculty Iibf: Indian Institute of Banking & Financemithilesh tabhaneNo ratings yet

- Secondary Data CollectionDocument18 pagesSecondary Data CollectionShriya ParateNo ratings yet

- August InvoiceDocument1 pageAugust Invoicecindyshweta95No ratings yet

- How To Calculate Markup PercentageDocument4 pagesHow To Calculate Markup Percentage7761430No ratings yet

- Adnan LeeDocument16 pagesAdnan LeeGEORGENo ratings yet

- AIRs LM Business-Finance Q1 Module-3Document20 pagesAIRs LM Business-Finance Q1 Module-3Oliver N AnchetaNo ratings yet

- Chapter 8-Economic Impact of British Rule in IndiaDocument7 pagesChapter 8-Economic Impact of British Rule in IndiaRoshan SharmaNo ratings yet

- C A S E 28 Inner-City Paint Corporation (Revised)Document9 pagesC A S E 28 Inner-City Paint Corporation (Revised)Masud RanaNo ratings yet

- Assignment in Financial ManagementDocument6 pagesAssignment in Financial ManagementEricaNo ratings yet

- Chapter 1: PartnershipDocument121 pagesChapter 1: PartnershipGab IgnacioNo ratings yet

- Filling of Key Posts in HIMSR: HR ManagerDocument4 pagesFilling of Key Posts in HIMSR: HR ManagerAfif AyubNo ratings yet

- Update March 08Document25 pagesUpdate March 08api-27370939100% (2)

- House Journal of University of Petroleum & Energy StudiesDocument28 pagesHouse Journal of University of Petroleum & Energy StudiesUniversity Of Petroleum And Energy StudiesNo ratings yet

- Curriculum Vitae - RichardDocument4 pagesCurriculum Vitae - RichardJose Luis Huallpatinco CcasaNo ratings yet

- Investment Portfolio - Overview, Types, and How To BuildDocument5 pagesInvestment Portfolio - Overview, Types, and How To Buildpaynow580No ratings yet

- Ankita ItcDocument24 pagesAnkita ItcankitajituNo ratings yet

- Total Quality ManagementDocument4 pagesTotal Quality ManagementJunaid ZulifqarNo ratings yet

- Wca SQP GSVDocument4 pagesWca SQP GSVFerdous Khan RubelNo ratings yet

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Compensation and Benefits MCQDocument15 pagesCompensation and Benefits MCQsam NathNo ratings yet

- Account Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceDocument1 pageAccount Activity: Transaction Date Post Date Transaction Reference No. Description Debit Credit BalanceAtiq_2909No ratings yet

- International Marketing PlanDocument17 pagesInternational Marketing PlanMac CorleoneNo ratings yet

- Departmental AccountingDocument10 pagesDepartmental AccountingRobert HensonNo ratings yet

- Public Procurement Disposal Act 22 23Document50 pagesPublic Procurement Disposal Act 22 23Tadiwanashe MarengoNo ratings yet

- RWC Alcan ApplicationDocument29 pagesRWC Alcan ApplicationAsimNo ratings yet

- Work ReportDocument25 pagesWork ReportOKALEBO SAMUELNo ratings yet

- How Did George Soros Get RichDocument2 pagesHow Did George Soros Get RichAnanda rizky syifa nabilahNo ratings yet