Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsTax Planning Strategies For Small Businesses

Tax Planning Strategies For Small Businesses

Uploaded by

anvithapremagowdaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Wendy Yvana Intro To Finance Unit 6Document11 pagesWendy Yvana Intro To Finance Unit 6pse100% (1)

- Voyage SoleilDocument3 pagesVoyage Soleiljacksonfegfefefsf100% (1)

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- Module 2 Strategic Tax ManagementDocument33 pagesModule 2 Strategic Tax ManagementAsh Padilla100% (1)

- Siib c1Document38 pagesSiib c1Santanu Das100% (1)

- Website BlogDocument7 pagesWebsite Blogkhalfan.rahimNo ratings yet

- Business Plan Sample For Tax ServicesDocument6 pagesBusiness Plan Sample For Tax ServicesafkndyfxwNo ratings yet

- Tax Planning FinalDocument16 pagesTax Planning FinalsikeNo ratings yet

- Tax Planning Strategies For Small BusinessesDocument1 pageTax Planning Strategies For Small BusinessescocojamelonNo ratings yet

- D@G Consulting Business PlanDocument15 pagesD@G Consulting Business PlanGARUIS MELINo ratings yet

- Company Tax Change in Limbo: Sneak PeekDocument6 pagesCompany Tax Change in Limbo: Sneak PeekAnonymous bxETEAczsNo ratings yet

- 1o Finance TipsDocument6 pages1o Finance Tipskuchbhi.kabhibhi2021No ratings yet

- Roxanne Project ICT 104Document13 pagesRoxanne Project ICT 104Temitope AdekoyaNo ratings yet

- Module 5Document3 pagesModule 5Angelie UmambacNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?su_pathriaNo ratings yet

- Corporate TaxDocument29 pagesCorporate Taxsu_pathriaNo ratings yet

- Green Modern Financial Management PresentationDocument17 pagesGreen Modern Financial Management PresentationsikeNo ratings yet

- Report On Importance of Accounting in BusinessDocument10 pagesReport On Importance of Accounting in BusinessMd. Mohiuddin RownakNo ratings yet

- Skrip LIDocument5 pagesSkrip LIsuhemiNo ratings yet

- Ifp 29 Tax PlanningDocument5 pagesIfp 29 Tax Planningsachin_chawlaNo ratings yet

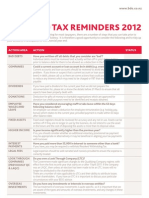

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Tax ConsiderationsDocument8 pagesTax Considerationspkgarg_iitkgpNo ratings yet

- Student Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesDocument25 pagesStudent Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesPriyanka AggarwalNo ratings yet

- AUS Tax StrategiesDocument22 pagesAUS Tax StrategiesNur Alahi100% (1)

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- The HMRC Tax Deferral Scheme For VATDocument1 pageThe HMRC Tax Deferral Scheme For VATAdam GaleNo ratings yet

- Small Business Owner S HandbookDocument18 pagesSmall Business Owner S HandbookAla'a AbdullaNo ratings yet

- Accounts Project Group 1Document11 pagesAccounts Project Group 1aryan sethiaNo ratings yet

- SomethingDocument6 pagesSomethingGanya BishnoiNo ratings yet

- Financial PlanDocument82 pagesFinancial PlanYASHA BAIDNo ratings yet

- Building An Effective EtaxplanDocument3 pagesBuilding An Effective EtaxplanverycoolingNo ratings yet

- Ifrs 13 ThesisDocument7 pagesIfrs 13 Thesisoabfziiig100% (2)

- Lecture 1Document31 pagesLecture 1api-275959008No ratings yet

- What Are Accounting TrendsDocument4 pagesWhat Are Accounting TrendsJena Kryztal TolentinoNo ratings yet

- Taxation Dissertation TopicsDocument7 pagesTaxation Dissertation TopicsInstantPaperWriterCanada100% (1)

- Tax Planning, Evasion, AvoidanceDocument16 pagesTax Planning, Evasion, AvoidanceDr. Nathan WafNo ratings yet

- Tax Planning - BSMA 3D - Group 1Document27 pagesTax Planning - BSMA 3D - Group 1Joebet DebuyanNo ratings yet

- 1971 - Spring - Profit Planning or Management Accounting - 0Document4 pages1971 - Spring - Profit Planning or Management Accounting - 0Anonymous yd515BW6No ratings yet

- Applied EconomicsDocument9 pagesApplied EconomicsJoanna BelloNo ratings yet

- Document 1Document219 pagesDocument 1rutuja1462No ratings yet

- Ibon ReflectiveEssay Webinar8Document2 pagesIbon ReflectiveEssay Webinar8James Howell IbonNo ratings yet

- Tax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Document11 pagesTax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Manas MaheshwariNo ratings yet

- StrataxDocument40 pagesStrataxAsh PadillaNo ratings yet

- Capital V RevenueDocument18 pagesCapital V RevenueFaizan FaruqiNo ratings yet

- Incorporation Now Later or NeverDocument2 pagesIncorporation Now Later or NeverCoreyFerrierNo ratings yet

- Notes For The Cash JournalDocument4 pagesNotes For The Cash JournalJohn FritzNo ratings yet

- Tax Planning: Tax Planning To Reform New Organisation or Business With Free Trade AgreementDocument5 pagesTax Planning: Tax Planning To Reform New Organisation or Business With Free Trade Agreementabdulzaid9066No ratings yet

- Assignment 3Document2 pagesAssignment 3IshitaNo ratings yet

- Financial Statement Analysis CourseworkDocument8 pagesFinancial Statement Analysis Courseworkpqltufajd100% (2)

- Tax Strategies 2010 11Document25 pagesTax Strategies 2010 11Nisheeth SrivastavaNo ratings yet

- Economic and Legal Feasibility AnalysisDocument5 pagesEconomic and Legal Feasibility AnalysisJackson KasakuNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?SpUnky RohitNo ratings yet

- Accounting For ManagementDocument6 pagesAccounting For ManagementShrewd PrinceNo ratings yet

- Article Evaluation - Common Accounting Mistakes in Small BusinessesDocument14 pagesArticle Evaluation - Common Accounting Mistakes in Small Businessesjhell de la cruzNo ratings yet

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocument57 pagesPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sNo ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & AnalysisBijesh SiwachNo ratings yet

- Earning Management Group AssignmentDocument7 pagesEarning Management Group AssignmentcikyayaanosuNo ratings yet

- Corporate Accounting AssignmentDocument5 pagesCorporate Accounting AssignmentMd.Mahmudul HasanNo ratings yet

- Protect Your Business SpeechDocument19 pagesProtect Your Business SpeechIon GondobescuNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument58 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- RTP May 2019 EngDocument162 pagesRTP May 2019 EngVarun SahaniNo ratings yet

- AuditingDocument22 pagesAuditingawaisNo ratings yet

- GET Economics & Management Sciences Grades 7 - 9Document107 pagesGET Economics & Management Sciences Grades 7 - 9Goodwill Mahlatse100% (1)

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- Income Taxation Semi-Final ExaminationDocument12 pagesIncome Taxation Semi-Final ExaminationlalagunajoyNo ratings yet

- Cash Flow StatementDocument6 pagesCash Flow StatementAizia Sarceda Guzman80% (5)

- Chapter Four: Introduction To Cost and Managerial AccountingDocument38 pagesChapter Four: Introduction To Cost and Managerial AccountingSelam TsigieNo ratings yet

- Level I - Simple Business PlanDocument8 pagesLevel I - Simple Business PlanJerome BenipayoNo ratings yet

- Yuopta Fs 2022Document23 pagesYuopta Fs 2022Agatha MressaNo ratings yet

- The Relationship Between Accounting and TaxationDocument24 pagesThe Relationship Between Accounting and TaxationfatrNo ratings yet

- Acc 2Document2 pagesAcc 2Avox EverdeenNo ratings yet

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- Toaz - Info Acca f3 Exercise PRDocument86 pagesToaz - Info Acca f3 Exercise PRaungkyaw nyeinchanNo ratings yet

- Quiz Akuntansi OlgazfDocument18 pagesQuiz Akuntansi OlgazfOlga Zulmaniar FadjrinNo ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- St. Vincent'S College Incorporated College of Accounting EducationDocument8 pagesSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- Chapter 2 - Capital AllowancesDocument11 pagesChapter 2 - Capital AllowancesNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Brampton Financial ReviewDocument55 pagesBrampton Financial ReviewToronto StarNo ratings yet

- VAL Travel Management ConfigurationDocument25 pagesVAL Travel Management Configurationsapfico2k8No ratings yet

- Share-Based Payment: Indian Accounting Standard (Ind AS) 102Document90 pagesShare-Based Payment: Indian Accounting Standard (Ind AS) 102srinivasNo ratings yet

- Accounting in ConstructionDocument85 pagesAccounting in ConstructionYihun abrahamNo ratings yet

- Company Name Employee Provident Fund Calculator (EPF)Document2 pagesCompany Name Employee Provident Fund Calculator (EPF)Roosy RoosyNo ratings yet

- History of Bank of PunjabDocument32 pagesHistory of Bank of PunjabMahrukh AlTafNo ratings yet

- Trump Tax Case NY StateDocument23 pagesTrump Tax Case NY StateMichelle Lee100% (3)

- Adv AccountssumsDocument419 pagesAdv Accountssumsmasdram_91849140750% (2)

- Net Cash Flow From Operating Activities 1,222,000Document1 pageNet Cash Flow From Operating Activities 1,222,000Jen DeloyNo ratings yet

Tax Planning Strategies For Small Businesses

Tax Planning Strategies For Small Businesses

Uploaded by

anvithapremagowda0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

tax-planning-strategies-for-small-businesses

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesTax Planning Strategies For Small Businesses

Tax Planning Strategies For Small Businesses

Uploaded by

anvithapremagowdaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Brief Report Accounting & Marketing

Volume 12:04, 2023

ISSN: 2168-9601 Open Access

Tax Planning Strategies for Small Businesses

Buid Nega*

Department of Business Administration, Seoul National University of Science and Technology, Nowon-gu, Seoul 01811, Korea

business owners should consider establishing retirement plans for themselves

Introduction and their employees. Contributing to retirement plans not only helps secure the

owner's financial future but also provides tax benefits. Popular options include:

Small businesses face unique challenges when it comes to managing their Simplified Employee Pension (SEP) IRAs allow business owners to contribute

finances and taxes. Tax planning is crucial for these enterprises to ensure up to 25% of their net self-employment income or 20% of their net earnings

they can maximize profits and minimize liabilities. This article explores various from the business. Savings Incentive Match Plan for Employees (SIMPLE)

tax planning strategies tailored to small businesses, offering insights into IRAs are ideal for businesses with 100 or fewer employees, offering both

deductions, credits and compliance measures that can help small business employer and employee contributions. Traditional 401(k) plans allow business

owners navigate the complex world of taxation. Tax planning is an essential owners to contribute as both employers and employees, offering significant

component of financial management for small businesses. Proper tax planning tax-deferral opportunities [2].

can help these enterprises reduce their tax liabilities, increase cash flow and

ultimately improve their bottom line. With the ever-evolving tax laws and Contributions to these retirement plans are tax-deductible, helping business

regulations, staying informed about the latest tax strategies is vital for small owners reduce their taxable income while simultaneously saving for the future.

business owners. In this article, we will delve into various tax planning strategies Controlling expenses is essential for small businesses looking to optimize their

that small businesses can employ to ensure they are operating efficiently while tax position. Careful expense management can lead to deductions and credits

keeping their tax bills in check. One of the first tax planning decisions a small that reduce taxable income. It's important to keep detailed records and receipts

business owner must make is choosing the right legal structure or entity for for all business-related expenses. Common deductible expenses include office

their business. Common options include sole proprietorships, partnerships, supplies, travel, advertising, rent and utilities. Additionally, expenses related

LLCs, S corporations and C corporations. Each entity type has different tax to employee compensation, health benefits and retirement plan contributions

implications and selecting the right one can have a significant impact on the are often eligible for tax benefits. Small businesses must maintain meticulous

amount of taxes owed. records and adhere to tax compliance requirements. Neglecting proper record-

keeping and compliance can result in penalties and increased tax liabilities.

Utilizing accounting software, hiring a qualified accountant, or outsourcing

Description financial management can help ensure that the business is meeting its

tax obligations. Effective tax planning for small businesses is a year-round

This structure is the simplest but provides no legal separation between endeavor. Waiting until the last minute to assess your tax situation can lead

the owner and the business. All profits and losses are reported on the owner's to missed opportunities for deductions and credits. Regularly reviewing

personal tax return. Partnerships are subject to pass-through taxation, where financials, consulting with tax professionals and adapting your tax strategy

profits and losses are passed through to the individual partners' tax returns. as your business evolves are essential for success. Small businesses should

An LLC offers flexibility in terms of taxation. It can be treated as a disregarded consider the importance of risk management as a part of their tax planning

entity, partnership, S corporation, or C corporation, depending on the owner's strategies. By identifying and mitigating potential financial risks, businesses

choice.S corporations provide pass-through taxation like partnerships, but with can avoid unexpected expenses or liabilities that may affect their tax situation.

certain restrictions. Owners can receive a salary and report additional income Ensure that your business has adequate insurance coverage, which can help

as dividends. C corporations are subject to double taxation, with the business protect your assets and income in the event of unforeseen events like natural

paying taxes on its income and shareholders paying taxes on their dividends [1]. disasters, accidents, or lawsuits. Some insurance premiums may also be tax-

This allows businesses to deduct the cost of certain assets, such as deductible [3].

equipment and machinery, in the year of purchase rather than depreciating Staying up to date with all local, state and federal regulations is crucial.

them over several years. Introduced by the Tax Cuts and Jobs Act, this Non-compliance can lead to fines and penalties, adversely impacting your

deduction allows eligible businesses to deduct up to 20% of their qualified financial stability. Developing a robust business continuity plan can help your

business income. Small businesses engaged in research and development business weather disruptions and continue to operate smoothly, minimizing any

activities may be eligible for a tax credit to offset their research expenses. This financial losses. Maintain an emergency fund to cover unexpected expenses

credit was introduced in response to the COVID-19 pandemic and provides or revenue shortfalls. This can prevent you from having to tap into personal

financial incentives for businesses to retain employees. This credit is available funds or take on debt, both of which can affect your tax planning. As small

to businesses that hire individuals from targeted groups, such as veterans and businesses grow, their tax planning strategies should evolve to accommodate

ex-felons. Taking advantage of these deductions and credits can significantly the changing financial landscape. Consider the following. Expanding your

reduce a small business's tax burden and free up cash for other purposes. Small business, whether through opening new locations, entering new markets,

or diversifying your product or service offerings, can have tax implications.

Assess the tax implications of growth strategies and ensure that they align with

*Address for Correspondence: Buid Nega, Department of Business

Administration, Seoul National University of Science and Technology, your business goals. If you're considering merging with or acquiring another

Nowon-gu, Seoul 01811, Korea; E-mail: negabuid212@gmail.com business or you're the target of such activities, you should consult with tax

professionals to understand the tax implications of the transaction. When the

Copyright: © 2023 Nega B. This is an open-access article distributed under the

time comes to exit your business, whether through sale, succession planning,

terms of the Creative Commons Attribution License, which permits unrestricted

use, distribution, and reproduction in any medium, provided the original author or other means, tax implications can be substantial. Proper exit planning

and source are credited. can help you maximize the value of your business and minimize taxes when

you exit. In the digital age, technology plays a crucial role in small business

Received: 01 July 2023, Manuscript No. Jamk-23-116575; Editor Assigned: 03

tax planning. Using accounting software, tax preparation tools and financial

July 2023, PreQC No. P-116575; Reviewed: 15 July 2023, QC No. Q-116575;

Revised: 22 July 2023, Manuscript No. R-116575; Published: 29 July 2023, DOI: management apps can streamline your financial processes and help you stay

10.37421/2168-9601.2023.12.436 organized [4].

Nega B. J Account Mark, Volume 12:04, 2023

These tools offer features like automatic expense tracking, payroll

management, tax calculations and reporting. They not only save you time but Conflict of Interest

also reduce the risk of errors, ensuring that you claim all eligible deductions and

credits. While small business owners can handle many aspects of tax planning The authors declare that there is no conflict of interest associated with

on their own, it's often beneficial to seek professional assistance. Enlisting the this manuscript.

services of a certified public accountant (CPA) or a tax advisor can provide

valuable expertise in navigating complex tax regulations, identifying tax-saving

opportunities and ensuring compliance. CPAs and tax advisors can help you

References

create a customized tax strategy tailored to your business's unique needs and 1. Prins, J. E. J., Dennis Broeders and H. M. Griffioen. "iGovernment: A new

goals. They can also provide insights into the latest tax code changes and perspective on the future of government digitisation." Comput Law Secur Rev 28

ensure that you're taking full advantage of all available deductions and credits [5]. (2012): 273-282.

2. Almeida, Heitor, Murillo Campello and Michael S. Weisbach. "The cash flow

Conclusion sensitivity of cash." J Finance 59 (2004): 1777-1804.

3. Atawnah, Nader, Balasingham Balachandran, Huu Nhan Duong and Edward J.

Small businesses face unique challenges when it comes to managing Podolski. "Does exposure to foreign competition affect stock liquidity? Evidence

their finances and taxes. However, with the right tax planning strategies, they from industry-level import data." J Financial Mark 39 (2018): 44-67.

can maximize profits and minimize liabilities. Key considerations include entity 4. Caldara, Dario and Matteo Iacoviello. "Measuring geopolitical risk." Am Econ Rev

selection, accounting methods, deductions and credits, retirement plans, 112 (2022): 1194-1225.

strategic expense management, compliance and year-round tax planning.

5. Chen, Shuping, Xia Chen, Qiang Cheng and Terry Shevlin. "Are family firms more

Ultimately, small business owners who prioritize tax planning and stay informed

tax aggressive than non-family firms?." J Financ Econ 95 (2010): 41-61.

about changes in tax laws and regulations can position their enterprises for

success and financial stability. In an ever-changing tax landscape, being

proactive in tax planning can make all the difference between a thriving small

business and one burdened by unnecessary tax liabilities.

Acknowledgement

How to cite this article: Nega, Buid. “Tax Planning Strategies for Small

None. Businesses.” J Account Mark 12 (2023): 436.

Page 2 of 2

You might also like

- Wendy Yvana Intro To Finance Unit 6Document11 pagesWendy Yvana Intro To Finance Unit 6pse100% (1)

- Voyage SoleilDocument3 pagesVoyage Soleiljacksonfegfefefsf100% (1)

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- Module 2 Strategic Tax ManagementDocument33 pagesModule 2 Strategic Tax ManagementAsh Padilla100% (1)

- Siib c1Document38 pagesSiib c1Santanu Das100% (1)

- Website BlogDocument7 pagesWebsite Blogkhalfan.rahimNo ratings yet

- Business Plan Sample For Tax ServicesDocument6 pagesBusiness Plan Sample For Tax ServicesafkndyfxwNo ratings yet

- Tax Planning FinalDocument16 pagesTax Planning FinalsikeNo ratings yet

- Tax Planning Strategies For Small BusinessesDocument1 pageTax Planning Strategies For Small BusinessescocojamelonNo ratings yet

- D@G Consulting Business PlanDocument15 pagesD@G Consulting Business PlanGARUIS MELINo ratings yet

- Company Tax Change in Limbo: Sneak PeekDocument6 pagesCompany Tax Change in Limbo: Sneak PeekAnonymous bxETEAczsNo ratings yet

- 1o Finance TipsDocument6 pages1o Finance Tipskuchbhi.kabhibhi2021No ratings yet

- Roxanne Project ICT 104Document13 pagesRoxanne Project ICT 104Temitope AdekoyaNo ratings yet

- Module 5Document3 pagesModule 5Angelie UmambacNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?su_pathriaNo ratings yet

- Corporate TaxDocument29 pagesCorporate Taxsu_pathriaNo ratings yet

- Green Modern Financial Management PresentationDocument17 pagesGreen Modern Financial Management PresentationsikeNo ratings yet

- Report On Importance of Accounting in BusinessDocument10 pagesReport On Importance of Accounting in BusinessMd. Mohiuddin RownakNo ratings yet

- Skrip LIDocument5 pagesSkrip LIsuhemiNo ratings yet

- Ifp 29 Tax PlanningDocument5 pagesIfp 29 Tax Planningsachin_chawlaNo ratings yet

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Tax ConsiderationsDocument8 pagesTax Considerationspkgarg_iitkgpNo ratings yet

- Student Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesDocument25 pagesStudent Name: Mac Guiver Castro Sánchez Student ID: VTI18197 BSBFIM601 Manage FinancesPriyanka AggarwalNo ratings yet

- AUS Tax StrategiesDocument22 pagesAUS Tax StrategiesNur Alahi100% (1)

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- The HMRC Tax Deferral Scheme For VATDocument1 pageThe HMRC Tax Deferral Scheme For VATAdam GaleNo ratings yet

- Small Business Owner S HandbookDocument18 pagesSmall Business Owner S HandbookAla'a AbdullaNo ratings yet

- Accounts Project Group 1Document11 pagesAccounts Project Group 1aryan sethiaNo ratings yet

- SomethingDocument6 pagesSomethingGanya BishnoiNo ratings yet

- Financial PlanDocument82 pagesFinancial PlanYASHA BAIDNo ratings yet

- Building An Effective EtaxplanDocument3 pagesBuilding An Effective EtaxplanverycoolingNo ratings yet

- Ifrs 13 ThesisDocument7 pagesIfrs 13 Thesisoabfziiig100% (2)

- Lecture 1Document31 pagesLecture 1api-275959008No ratings yet

- What Are Accounting TrendsDocument4 pagesWhat Are Accounting TrendsJena Kryztal TolentinoNo ratings yet

- Taxation Dissertation TopicsDocument7 pagesTaxation Dissertation TopicsInstantPaperWriterCanada100% (1)

- Tax Planning, Evasion, AvoidanceDocument16 pagesTax Planning, Evasion, AvoidanceDr. Nathan WafNo ratings yet

- Tax Planning - BSMA 3D - Group 1Document27 pagesTax Planning - BSMA 3D - Group 1Joebet DebuyanNo ratings yet

- 1971 - Spring - Profit Planning or Management Accounting - 0Document4 pages1971 - Spring - Profit Planning or Management Accounting - 0Anonymous yd515BW6No ratings yet

- Applied EconomicsDocument9 pagesApplied EconomicsJoanna BelloNo ratings yet

- Document 1Document219 pagesDocument 1rutuja1462No ratings yet

- Ibon ReflectiveEssay Webinar8Document2 pagesIbon ReflectiveEssay Webinar8James Howell IbonNo ratings yet

- Tax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Document11 pagesTax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Manas MaheshwariNo ratings yet

- StrataxDocument40 pagesStrataxAsh PadillaNo ratings yet

- Capital V RevenueDocument18 pagesCapital V RevenueFaizan FaruqiNo ratings yet

- Incorporation Now Later or NeverDocument2 pagesIncorporation Now Later or NeverCoreyFerrierNo ratings yet

- Notes For The Cash JournalDocument4 pagesNotes For The Cash JournalJohn FritzNo ratings yet

- Tax Planning: Tax Planning To Reform New Organisation or Business With Free Trade AgreementDocument5 pagesTax Planning: Tax Planning To Reform New Organisation or Business With Free Trade Agreementabdulzaid9066No ratings yet

- Assignment 3Document2 pagesAssignment 3IshitaNo ratings yet

- Financial Statement Analysis CourseworkDocument8 pagesFinancial Statement Analysis Courseworkpqltufajd100% (2)

- Tax Strategies 2010 11Document25 pagesTax Strategies 2010 11Nisheeth SrivastavaNo ratings yet

- Economic and Legal Feasibility AnalysisDocument5 pagesEconomic and Legal Feasibility AnalysisJackson KasakuNo ratings yet

- Preface: What Is The Tax Planning ?Document29 pagesPreface: What Is The Tax Planning ?SpUnky RohitNo ratings yet

- Accounting For ManagementDocument6 pagesAccounting For ManagementShrewd PrinceNo ratings yet

- Article Evaluation - Common Accounting Mistakes in Small BusinessesDocument14 pagesArticle Evaluation - Common Accounting Mistakes in Small Businessesjhell de la cruzNo ratings yet

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocument57 pagesPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sNo ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & AnalysisBijesh SiwachNo ratings yet

- Earning Management Group AssignmentDocument7 pagesEarning Management Group AssignmentcikyayaanosuNo ratings yet

- Corporate Accounting AssignmentDocument5 pagesCorporate Accounting AssignmentMd.Mahmudul HasanNo ratings yet

- Protect Your Business SpeechDocument19 pagesProtect Your Business SpeechIon GondobescuNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument58 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- RTP May 2019 EngDocument162 pagesRTP May 2019 EngVarun SahaniNo ratings yet

- AuditingDocument22 pagesAuditingawaisNo ratings yet

- GET Economics & Management Sciences Grades 7 - 9Document107 pagesGET Economics & Management Sciences Grades 7 - 9Goodwill Mahlatse100% (1)

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Document4 pagesMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNo ratings yet

- Income Taxation Semi-Final ExaminationDocument12 pagesIncome Taxation Semi-Final ExaminationlalagunajoyNo ratings yet

- Cash Flow StatementDocument6 pagesCash Flow StatementAizia Sarceda Guzman80% (5)

- Chapter Four: Introduction To Cost and Managerial AccountingDocument38 pagesChapter Four: Introduction To Cost and Managerial AccountingSelam TsigieNo ratings yet

- Level I - Simple Business PlanDocument8 pagesLevel I - Simple Business PlanJerome BenipayoNo ratings yet

- Yuopta Fs 2022Document23 pagesYuopta Fs 2022Agatha MressaNo ratings yet

- The Relationship Between Accounting and TaxationDocument24 pagesThe Relationship Between Accounting and TaxationfatrNo ratings yet

- Acc 2Document2 pagesAcc 2Avox EverdeenNo ratings yet

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- Toaz - Info Acca f3 Exercise PRDocument86 pagesToaz - Info Acca f3 Exercise PRaungkyaw nyeinchanNo ratings yet

- Quiz Akuntansi OlgazfDocument18 pagesQuiz Akuntansi OlgazfOlga Zulmaniar FadjrinNo ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- St. Vincent'S College Incorporated College of Accounting EducationDocument8 pagesSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNo ratings yet

- Direct Material CostDocument29 pagesDirect Material CostRaj DharodNo ratings yet

- Chapter 2 - Capital AllowancesDocument11 pagesChapter 2 - Capital AllowancesNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Brampton Financial ReviewDocument55 pagesBrampton Financial ReviewToronto StarNo ratings yet

- VAL Travel Management ConfigurationDocument25 pagesVAL Travel Management Configurationsapfico2k8No ratings yet

- Share-Based Payment: Indian Accounting Standard (Ind AS) 102Document90 pagesShare-Based Payment: Indian Accounting Standard (Ind AS) 102srinivasNo ratings yet

- Accounting in ConstructionDocument85 pagesAccounting in ConstructionYihun abrahamNo ratings yet

- Company Name Employee Provident Fund Calculator (EPF)Document2 pagesCompany Name Employee Provident Fund Calculator (EPF)Roosy RoosyNo ratings yet

- History of Bank of PunjabDocument32 pagesHistory of Bank of PunjabMahrukh AlTafNo ratings yet

- Trump Tax Case NY StateDocument23 pagesTrump Tax Case NY StateMichelle Lee100% (3)

- Adv AccountssumsDocument419 pagesAdv Accountssumsmasdram_91849140750% (2)

- Net Cash Flow From Operating Activities 1,222,000Document1 pageNet Cash Flow From Operating Activities 1,222,000Jen DeloyNo ratings yet