Professional Documents

Culture Documents

ICICI Direct Go Fashions IPO Review

ICICI Direct Go Fashions IPO Review

Uploaded by

PriyankaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Direct Go Fashions IPO Review

ICICI Direct Go Fashions IPO Review

Uploaded by

PriyankaCopyright:

Available Formats

Go Fashion India Ltd (GOFASH)

Price Band: | 655-690 UNRATED

November 16, 2021

Market leader in women’s bottom-wear space…

About the Company: The company is a one stop shop for women’s bottom-wear

under the brand ‘Go Colors’. It is among the few apparel players in India to have

identified the market opportunity in women’s bottom-wear and acted as a ‘category

IPO Review

creator’ for the same.

IPO Details

Widespread distribution network consisting of 459 exclusive branded Issue Details

outlets (70% of revenue) and available in 1200+ LFS’ (22% of revenue) Issue Opens November 17, 2021

Strong operating metrics with one of the industry’s highest revenue/sq ft Issue Closes November 22, 2021

(~| 17000/sq ft. as on FY20) and healthy operating margins (~21% pre-Ind- Issue Size ~ | 1014 crore

AS 116). Capital efficient business model with RoE of ~18% as on FY20 Issue Type

Fresh Issue/ Offer for

sale

Key triggers/Highlights: Price Band | 655 - | 690

No of shares ~ 1.5 crore

The company is a one-stop-shop with bottom-wear sold across categories

such as ethnic wear, western wear, fusion wear, athleisure, denims and for Market Lot 21 shares

every occasion. As of September 30, 2021 the company sold bottom-wear Face Value 10.0

in 50 styles and more than 120 colours QIB (%) 75.0

Non-Institutional (%) 15.0

It generates healthy gross margins (~60%+) as round the year relevance of

product portfolio allows it to typically retail products at full price and with Retail (%) 10.0

discounts offered only in limited circumstances

Shareholding pattern (%)

The price range caters across all income segments at a range of | 225-1599

ICICI Securities – Retail Equity Research

and ASP at exclusives stores being ~ | 620 Pre-offer Post-offer

The company follows an asset light business model, with production Promoter 57.5 52.8

outsourced on a job work basis (73 suppliers, 42 job-workers). It manages Public 42.5 47.2

its entire supply chain from its 99100 square foot warehouse in Tirupur,

Tamil Nadu and is capable of handling complex SKU mixes

Objects of the issue

The branded women’s bottom-wear market is pegged at | 4473 crore (33% | crore

organised penetration) and the company has ~8% market share. The Funding roll out of 120 new

33.7

branded space is expected to grow at a CAGR of 21% by FY25 EBO's

Funding working capital

61.4

requirements

What should investors do? Go Fashions is the first company to launch a brand General corporate purposes -

exclusively dedicated to the women’s bottom-wear category. It is a play on the Fresh issue 125.0

unorganised to the modern retail shift. At the upper end of the price band, it is valued

at 9.4x, 14.6x EV/sales for FY20, FY21, respectively. Offer for sale 888.6

We assign UNRATED rating to the IPO Research Analyst

Bharat Chhoda

Key risk & concerns bharat.chhoda@icicisecurities.com

Dependence on single brand and category

Cheragh Sidhwa

High store network concentration in southern and western India cheragh.sidhwa@icicisecurities.com

Dependence on single warehouse for pan-India distribution

Key Financial Summary

| crore FY19 FY20 FY21 Q1FY22

Net Sales 285.2 392.0 250.7 31.0

EBITDA 80.0 126.5 46.3 -5.9

PAT 30.9 52.6 -3.5 -19.0

Diluted EPS 5.7 9.7 -0.7 -3.5

P/E (x) 120.4 70.8 -

EV/EBITDA (x) 45.9 29.2 78.8

Mcap/Sales (x) 13.1 9.5 14.9

RoCE (%) 22.6 29.3 5.9

RoE (%) 13.6 18.4 -1.3

Source: RHP, ICICI Direct Research

IPO Review | Go Fashion Ltd ICICI Direct Research

Company Background

Incorporated in 2010, Go Fashions is engaged in the development, design, sourcing,

marketing and retailing a range of women’s bottom-wear products under the brand,

‘Go Colors’. It is among the few apparel companies in India to have identified the

market opportunity in women’s bottom-wear and acted as a ‘category creator’ for

bottom-wear. It is the first company to launch a brand exclusively dedicated to the

women’s bottom-wear category and has leveraged this advantage to create a direct-

to-consumer brand with a diversified and differentiated product portfolio of

premium quality products at competitive prices.

Product portfolio includes churidars, leggings, dhotis, harems, patiala, palazzo,

culottes, pants, trousers and jeggings across multiple categories including ethnic

wear, fusion wear, western wear, lounge wear, athleisure. It caters to women across

all age groups and girls & physiques covering the entire spectrum of women’s

bottom-wear requirements, including daily wear, casual and work wear, festive and

occasion wear and loungewear.

The company offers customers the ability to ‘mix and match’ their top-wear with an

assortment of bottom-wear styles in multiple colours allowing to plan an outfit

according to the needs. The price range offered (| 225-1599) caters across all income

segments, which allows it to tap customers in tier II and tier III cities as well.

It has a multi-channel pan-India distribution network with enhanced focus on EBOs.

It operates 459 exclusive stores across 118 cities in 23 states and union territories

across India. Further, as of September 30, 2021, the company also retailed products

through 1270 large format stores such as Reliance Retail Central, Unlimited, Globus

Stores Pvt Ltd and Spencer's Retail. It also retails its products through multi branded

outlets and online marketplaces.

Exhibit 1: Revenue mix channel wise

5% 4%

EBO

22%

LFS

Online

69% MBO

Source: RHP, ICICI Direct Research

Exhibit 2: Number of touchpoints across formats as on Q1FY22

1600

1400

1200

No. of touchpoints

1000

800

1353

600

400

200 446

48 10

0

Q1FY22

EBO LFS MBO Online

Source: RHP, ICICI Direct Research

ICICI Securities | Retail Research 2

IPO Review | Go Fashion Ltd ICICI Direct Research

Exhibit 3: Product portfolio

Product-Type Product Portfolio Price Range (|)

Ethnic Wear Churidar, Patiala, kurti-pants, salwar, Silk Pant and dhoti 549-1049

Leggings, Cropped Jegging, Jeans, Cargo Pants, Trousers,

Western Wear 499-1499

Ponte Pants, Track Pants

Fusion Wear Jeggings, Palazzos, Pants and Harem Pants 699-1299

Athleisure Leggings, Track Pants and Joggers 549-999

Jeggings, Joggers, Jeans, Denim Palazzos, Pants, Denim

Denims 1049-1499

Culottes and Capris

Lounge Pants, Lounge Knit Pants, Lounge Capris and Lounge

Lounge Wear 449-749

Shorts.

Go Plus Churidars, Leggings, Jeggings, Pants and Palazzos 599-1599

Girl’s wear Leggings, Jeggings, Palazzos, Pants, Shorts and Harem Pants 225-999

Source: RHP, ICICI Direct Research

The company has strong store unit economics, which has allowed it to expand its

EBO network across regions including new EBOs in tier-III/IV cities, resulting in

frequency of store openings, being one every 12 days over the last three fiscals.

Ability to identify and determine the optimum location and size of a store and

marketing leverage of EBOs is critical in ensuring visibility among target customers.

This resulted in the company having one of the highest sales per square feet among

key women’s apparel companies.

Exhibit 4: Store operating metrics

Source: RHP, ICICI Direct Research

Exhibit 5: Stores spread across metro-tier IV cities

Source: RHP, ICICI Direct Research

ICICI Securities | Retail Research 3

IPO Review | Go Fashion Ltd ICICI Direct Research

Industry Overview

The women’s apparel market is estimated to be ~36% of the total apparel market

while the women’s bottom-wear market contributed 8.3% of women’s apparel

market (| 13547 crore). The women’s apparel market is expected to grow from

| 163291 crore (US$ 21.0 billion) in FY20 to | 253733 crore (US$33.8 billion) by FY25.

This market is projected to grow due to a) an increase in the number of working

women, b) a shift towards aspiration rather than need based buying c) design

innovation d) shift from purchasing sets to buying separates for mix and match of

clothing.

Exhibit 6: Overall women’s apparel market

300000

253733

250000

200000

163291

| crore

150000

101432

100000

50000

0

FY15 FY20 FY25E

Source: RHP, ICICI Direct Research

Women’s bottom-wear products comprise the ethnic, fusion and western categories.

Clothing today is modular. The concept of mix & match has become an important

part of self-styling for women. There is an increasing preference of women towards

buying contrasting tops and bottom-wear rather than buying full suit sets. With this

shift in consumer preference, the sale of ‘separates’ clothing has increased.

Exhibit 7: Overall women’s bottom-wear market in India

30000

24315

25000

20000

13547

| crore

15000

10000 7723

5000

0

FY15 FY20 FY25E

Source: RHP, ICICI Direct Research

The bottom-wear market has historically been unorganised with limited products,

lack of quality products, low pricing power and scope for expansion. However, with

growing westernisation, increasing disposable incomes and urbanisation,

consumers have become more fashion, brand and quality conscious and demand

quality branded products. The share of branded women’s bottom-wear rose from

19.7% in FY15 to 33% in FY20 at a CAGR of 24.1%. The branded women’s bottom-

wear market is expected to see continued high growth in future as well with its share

rising to 46.8% by FY25. The market for branded women's bottom-wear is

fragmented and comprises more than 40 brands. Go Colors was the first company

to launch a brand exclusively dedicated to the women’s bottom wear category and

has ~8% market share in the branded category.

ICICI Securities | Retail Research 4

IPO Review | Go Fashion Ltd ICICI Direct Research

Exhibit 8: Branded, unbranded share of women’s bottom-wear industry

30000

25000 11378

Major brands in women space and SKU presence

20000

| crore

15000 4473

10000 1521

12937

5000 9074

6202

0

FY15 FY20 FY25E

Unbranded Branded

Source: RHP, ICICI Direct Research

Exhibit 9: Sales/sq ft for key players

Brand Store Size Range (Sq. ft.) Sales/sq.ft. range (yearly) (|)

Go Colors 150-500 12000-40000

Aurelia 800-1200 6000-9000

Biba 1000-1500 8500-12500

Fabindia 2500-3500 10500-15000

Soch 1200-3000 6500-16500

W 800-1200 7000-10500

Zara 15000-30000 20000-40500

Source: RHP, ICICI Direct Research

Exhibit 10: Revenue break-up across key formats

Revenue Source Revenue Share (% )

Go Colors TCNS FabIndia Soch Zara India

EBO 69.0 44.0 95.0 72.0 85.0

MBO 4.0 4.0 0.0 6.5 0.0

LFS 22.0 42.0 0.0 6.5 0.0

Online 5.0 10.0 5.0 15.0 15.0

Source: RHP, ICICI Direct Research

Exhibit 11: Historical rollout of EBOs

Brand 2015 2018 2021 CAGR % (FY18-21)

Go Colors 70 200 450 31

Aurelia 69 183 213 5

Biba 150 254 346 11

Fabindia 200 275 307 4

H&M NA 39 48 7

Levis 400 410 366 -4

M&S 44 62 92 14

Soch NA 100 131 9

Vero Moda 64 67 49 -10

W 166 281 301 2

Zara 16 20 21 2

Source: RHP, ICICI Direct Research

ICICI Securities | Retail Research 5

IPO Review | Go Fashion Ltd ICICI Direct Research

Investment Rationale

Continues to expand retail network with focus on EBOs

In the past, the company has expanded stores through a cluster-based expansion

model and intends to continue to expand its presence by setting up EBOs. It intends

to follow the COCO model that will ensure better operational control over the stores.

As part of its growth strategy, the company intends to expand its EBO network in

other regions across India. By having products be reasonably priced and essential, it

intends to increase its footprint and scale of operations across India. Bottom-wear

being a core essential category and having limited print or design is relatively

insulated from changes in fashion trends and is acceptable across the country. Of

the total fresh proceeds worth | 125 crore, ~ | 33 crore would be utilised towards

adding 120 new stores during FY23-24E. Given the cluster based approach of

establishing EBOs primarily in tier I cities, it will focus on establishing additional EBOs

on a similar model across tier II and tier III cities.

In-house expertise in developing, designing products

The company develops products in-house based on demand for such products and

the sale of similar products that it tracks and monitors through its ERP system. It

designs the products keeping in mind trends in fashion, fabric, textiles, stitch and

pricing. Its products are designed for every occasion including for daily wear, office

wear, festive, denim and lounge wear and are available in over 120 colours. It follows

a data-driven approach as part of the design process and has launched products that

focus on comfort and fit focused on its target customer segment and are based on

market research and feedback from the customers. Based on business intelligence

reports on its product-wise sales generated by the ERP system, the company is able

to determine future product launches. In the last three fiscals and in the three months

ended June 30, 2021, the company has launched over 20 products. The company

has a skilled team of in-house designers and merchandisers that focuses on creating

quality products with innovative designs and optimal fit & sizing. As of September

30, 2021, its in-house design team comprised 10 professionals who design the

products. The company also undertakes concept development and trend forecasting

to develop and design new styles and products and regularly participate in fairs or

exhibitions in India or abroad to understand the trends.

Leverage technology to bring cost efficiency, enhance

customer experience

The company intends to further improve operating efficiency and ensure efficient

supply chain management through global best practices. Among measures that it

intends to undertake include investing further in IT infrastructure to improve

productivity, time savings. It will look to expand and upgrade warehouse to optimise

inventory and supply management. It intends to strategically expand warehouse

operations and implement new technologies to further expand & improve customer

deliveries and enhance customer buying experience with faster dispatches.

Furthermore, it will also undertake data analytics that will allow it to better

understand customer preferences, improve sales and help scale up operations.

Enhancing sales through online channel

The company continues to focus on further strengthening its online sales channels

to benefit from evolving customer trends in the market. The company is planning to

make investments in digital channels to build an omni-channel engagement

experience for its customers and have a dedicated team for its e-commerce

operations. The company also intends to leverage its existing capabilities to increase

its online presence by improving and upgrading its own website. The company’s

focus will be to target customer acquisition to drive sales through own website and

online marketplaces. In addition, it intends to invest in content generation to engage

with a younger audience. The company will continue to focus on analytic

technologies to create personalised journeys for customers. Through these

measures, it aims to expand revenue generating channels as well as become a

digitally relevant brand for Indian women in the bottom-wear segment.

ICICI Securities | Retail Research 6

IPO Review | Go Fashion Ltd ICICI Direct Research

Key Risk

Dependence on single brand, category

All the products of the company are sold under a single brand, ‘Go Colors’ and cater

to only the women’s bottom-wear category. An inability to effectively market its

products and brand, or any deterioration in public perception of its brand, could

affect customer footfall and consequently adversely impact the business, financial

condition, cash flows and results of operations.

High store network concentration in southern, western India

The company has a pan-India network of EBOs across 23 states and union territories

in India as of September 30, 2021 with a significant number of its stores located in

southern and western India. It operated 315 stores in southern and western India,

which comprised 68.63% of its total network of stores. The concentration of its

operations in these states heightens the exposure to adverse developments related

to competition and other changes, which may adversely affect its business

prospects, financial conditions and results of operations. In the event of a regional

slowdown in economic activity in these regions, or any other developments

including political or civil unrest, disruption or sustained economic downturn that

reduce the demand for its products in these regions, could adversely affect its

business, financial condition and results of operations.

Inability to protect its trademarks including brand ‘Go Colors’

The company has six trademarks pertaining to its brand name, all of which are

applied for but are pending registration under the Trade Marks Act, 1999. It has

applied seeking registration of these trademarks. The application for registration of

the trademark ‘GO COLORS’, under class 25, has been opposed by a third-party on

various grounds seeking, among other things, refusal of the application to register

the trademark. In the absence of the trademark registration for the trademarks

pertaining to its brand name, such as, ‘GO COLORS’ the company may be unable to

initiate an infringement action against any third party. In the event such a trademark

is not approved or, if registered in the name of a third-party, it could result in

significant monetary loss or prevent it from selling its products under its brand name.

Dependence on outsourcing in absence of own manufacturing

facilities

The Company does not currently own any manufacturing facilities and engages job

workers for manufacturing all its products. It may be unable to obtain sufficient

quantities or desired quality of products from job workers in a timely manner or at

acceptable prices, which may adversely affect its business, financial condition and

results of operations.

Dependence on single warehouse for pan-India distribution

The company’s warehouse is currently located in southern India. Any significant

disruption due to social, political or economic factors or natural calamities or civil

disruptions, impacting the region may adversely affect operations. Further, its

warehouse may be subject to operating risks, such as performance below expected

levels of efficiency, labour disputes, natural disasters, industrial accidents and

statutory and regulatory restrictions. The company is planning a geographical

expansion across India but in the event that it is unable to make available its products

in a prompt manner and within the requisite timelines or if there is a lapse in

coordination across stores located countrywide, its business, financial condition and

prospects may be adversely affected.

ICICI Securities | Retail Research 7

IPO Review | Go Fashion Ltd ICICI Direct Research

Financial summary

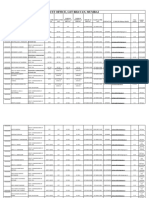

Exhibit 12: Profit and loss statement | crore Exhibit 13: Cash flow statement | crore

(Year-end March) FY19 FY20 FY21 Q1FY22 (Year-end March) FY19 FY20 FY21 Q1FY22

Net Sales 285.2 392.0 251 31.0 Profit Before Tax 42.2 68.3 -3.1 -18.4

Growth (%) 37.4 (36.1) Add: Depreciation 32.1 46.6 60.5 16.0

Add: Finance Cost 11.4 16.5 20.6 5.7

Total Raw Material Cost 94.5 130.0 92.2 11.1

Others 6.1 -0.7 -51.1 0.7

Gross Margins (%) 66.88 66.85 63.2 64.2

Net (Increase)/decrease in WC -41.8 -53.2 63.1 -29.0

Employee Expenses 42.0 62.0 61.5 15.9

Tax paid -16.7 -20.2 0.0 0.0

% to sales 14.7 15.8 24.5 51.3 CF from operating activities 33.29 57.21 89.85 -24.86

Other Expenses 68.8 73.6 50.7 9.9 (Inc)/dec in Fixed Assets -26.1 -28.1 -9.9 -1.2

% to sales 24.1 18.8 20.2 32.0 Others 20.8 9.6 -37.3 40.4

Total Operating Expenditure 205.3 265.5 204.3 36.9 CF from investing activities -5.30 -18.47 -47.26 39.19

EBITDA 80.0 126.5 46.3 (5.9) Inc / (Dec) in Equity/prefrence share 0.0 0.0 0.0 0.0

EBITDA Margin 28.0 32.3 18.5 (19.1) Inc / (Dec) in Loan 0.0 0.0 0.0 0.0

Interest 11.4 16.5 20.6 5.7 Others -30.9 -49.3 -29.5 -19.2

Depreciation 32.1 46.6 60.5 16.0 CF from financing activities -30.9 -49.3 -29.5 -19.2

Net Cash flow -2.9 -10.5 13.1 -4.9

Other Income 5.7 4.8 31.6 9.3

Opening Cash 13.5 10.6 0.1 13.2

Exceptional Expense - - -

Closing Cash 10.60 0.10 13.20 8.30

PBT 42.2 68.3 (3.1) (18.4)

Source: Company, ICICI Direct Research

Total Tax 11.3 15.7 0.4 0.6

Profit After Tax 30.9 52.6 (3.5) (19.00)

Source: Company, ICICI Direct Research

Exhibit 14: Balance sheet | crore Exhibit 15: Key ratios | crore

(Year-end March) FY19 FY20 FY21 Q1FY22 (Year-end March) FY19 FY20 FY21 Q1FY22

Equity Capital 30.0 30.0 30.0 30.0 Per share data (|)

Preference shares 49.0 49.0 49.0 49.0 Diluted EPS 5.7 9.7 -0.7 -3.5

Reserve and Surplus 149.3 207.3 203.9 184.9 Cash EPS 11.7 18.4 10.5 -0.5

BV 42.3 53.0 52.4 48.9

Total Shareholders funds 228.3 286.3 282.9 263.9

Cash Per Share 12.4 7.7 15.9 7.5

Minority interest

Operating Ratios (% )

Total Debt 8.3 2.8 10.4 0.0

EBITDA margins 28.0 32.3 18.5 -19.1

Non Current Liabilities 146.3 208.2 224.0 231.2 PBT margins 14.8 17.4 -1.3 -59.3

Source of Funds 382.90 497.30 517.38 495.15 Net Profit margins 10.8 13.4 -1.4 -61.3

Inventory days 88.9 98.6 117.9

Net Fixed Assets 47.3 60.3 58.4 57.8 Debtor days 51.3 51.8 68.6

Capital WIP 2.0 8.1 8.6 8.1 Creditor days 17.7 9.7 15.6

Intangible assets 0.5 0.7 0.5 0.4 Return Ratios (% ) .

Right of use assets 137.7 194.7 200.6 205.1 RoE 13.6 18.4 -1.3

Investments & bank balance 56.5 41.3 72.9 32.4 RoCE 22.6 29.3 5.9

Valuation Ratios (x)

Inventory 69.5 105.9 80.9 102.7

P/E 120.4 70.8 -

Cash 10.6 0.1 13.2 8.3

EV / EBITDA 45.9 29.2 78.8

Debtors 40.1 55.6 47.1 38.7

EV / Sales 12.9 9.4 14.6

Loans & Advances & Other CA 18.7 25.3 34.0 44.4

Market Cap / Revenues 13.1 9.5 14.9

Total Current Assets 138.8 186.9 175.3 194.0 Price to Book Value 16.3 13.0 13.2

Creditors 13.8 10.5 10.7 11.8 Solvency Ratios

Provisions & Other CL 7.4 11.4 20.3 23.7 Debt / Equity 0.0 0.0 0.0

Total Current Liabilities 21.2 21.9 31.0 35.5 Debt/EBITDA 0.1 0.0 0.2

Net Current Assets 117.6 165.0 144.3 158.5 Current Ratio 6.5 8.5 5.7

LT L& A, Other Assets 21.3 27.2 32.1 32.8 Quick Ratio 3.3 3.7 3.0

Other Assets 0.0 0.0 0.0 0.0 Source: Company, ICICI Direct Research

Application of Funds 382.91 497.31 517.38 495.15

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 8

IPO Review | Go Fashion Ltd ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to

companies that are coming out with their initial public offerings and then categorises them as Subscribe, Subscribe

for the long term and Avoid.

Subscribe: Apply for the IPO

Avoid: Do not apply for the IPO

Subscribe only for long term: Apply for the IPO only from a long term investment perspective (>two years)

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 9

IPO Review | Go Fashion Ltd ICICI Direct Research

ANALYST CERTIFICATION

I/We, Bharat Chhoda, MBA, Cheragh Sidhwa, MBA, Research Analysts authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the

subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed that above mentioned

Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc. as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities Limited has been appointed as one of the Book Running Lead Managers to the initial public offer of Go Fashion (India) Ltd. This report is prepared on the basis of publicly available information

ICICI Securities | Retail Research 10

You might also like

- Cmfas m1b Part 2 (80 Question)Document15 pagesCmfas m1b Part 2 (80 Question)Megan Pang0% (1)

- Diagrama Electrico Toyota Tacoma 2009 PDFDocument81 pagesDiagrama Electrico Toyota Tacoma 2009 PDFMainor ReyesNo ratings yet

- Exercise #1: Transactions of Bud's Computer Are As FollowsDocument19 pagesExercise #1: Transactions of Bud's Computer Are As FollowsMejias, Janrey80% (10)

- V2 Retail LTD - IC Report - DSPLDocument20 pagesV2 Retail LTD - IC Report - DSPLSiva KumarNo ratings yet

- Godrej Agrovet IC Jan18Document49 pagesGodrej Agrovet IC Jan18S KNo ratings yet

- GoColors IPO Note AngelOneDocument7 pagesGoColors IPO Note AngelOnedjfreakyNo ratings yet

- Credo Brands Marketing Limited - IPO NoteDocument9 pagesCredo Brands Marketing Limited - IPO NotedeepaksinghbishtNo ratings yet

- VMART Retail IC Sep20Document28 pagesVMART Retail IC Sep20Khush GosraniNo ratings yet

- Rossari Biotech LTD: SubscribeDocument9 pagesRossari Biotech LTD: SubscribeDavid BassNo ratings yet

- Metro Brands LTD: Leading Player in A High Growth MarketDocument21 pagesMetro Brands LTD: Leading Player in A High Growth MarketKunal SoniNo ratings yet

- India Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankDocument19 pagesIndia Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankGugaNo ratings yet

- Research Report Pidilite Industries LTDDocument7 pagesResearch Report Pidilite Industries LTDAnirudh PatilNo ratings yet

- Aditya Birla Fashion Initiating CoverageDocument13 pagesAditya Birla Fashion Initiating Coveragekrishna_buntyNo ratings yet

- Trent Nov07 19Document9 pagesTrent Nov07 19Ravi KNo ratings yet

- Sona BLW Precision Forgings LTD.: Equitas Small Finance Bank Equitas Small Finance BankDocument22 pagesSona BLW Precision Forgings LTD.: Equitas Small Finance Bank Equitas Small Finance BankrajpvikNo ratings yet

- Isec DOMS Initiating Coverage Mar24Document36 pagesIsec DOMS Initiating Coverage Mar24Variable SeperableNo ratings yet

- Adani Wilmar IPO Note Angel OneDocument7 pagesAdani Wilmar IPO Note Angel OneRevant SatiNo ratings yet

- Zone 2 XIMB Page Industries 1Document12 pagesZone 2 XIMB Page Industries 1Hitesh AsnaniNo ratings yet

- ADTimes 2020 ABFRLDocument9 pagesADTimes 2020 ABFRLgargshashankNo ratings yet

- Fullerton Relaxo 27 July 2012Document9 pagesFullerton Relaxo 27 July 2012Sibina ANo ratings yet

- Nuvama On Cantabil Retail India Visit Note High Growth at An AffordableDocument18 pagesNuvama On Cantabil Retail India Visit Note High Growth at An Affordabletakemederato1No ratings yet

- Uniparts India IPO Notes ICICI DirectDocument12 pagesUniparts India IPO Notes ICICI DirectPrashant ChourasiyaNo ratings yet

- 338 - AUM - Metro Brands Ltd. - IPO NoteDocument4 pages338 - AUM - Metro Brands Ltd. - IPO NoteKunal SoniNo ratings yet

- Asianpaintppt 191211182449Document19 pagesAsianpaintppt 191211182449Meena MalcheNo ratings yet

- Golden Midcap Portfolio: June 1, 2021Document7 pagesGolden Midcap Portfolio: June 1, 2021Ram KumarNo ratings yet

- IDirect IndigoPaints IPOReviewDocument16 pagesIDirect IndigoPaints IPOReviewbhaskarkakatiNo ratings yet

- Arvind Fashions IC ICICI Sec 19jun19Document23 pagesArvind Fashions IC ICICI Sec 19jun19chetankvoraNo ratings yet

- PC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344Document70 pagesPC - Innerwear Industry Report (Phillip Capital India PVT LTD) 20211006143344PriyankaNo ratings yet

- IDirect MrsBectorsFood IPOReviewDocument14 pagesIDirect MrsBectorsFood IPOReviewAkshay keerNo ratings yet

- BajconDocument22 pagesBajcon354Prakriti SharmaNo ratings yet

- V.I.P. Industries LTD.: On Acquisition SpreeDocument3 pagesV.I.P. Industries LTD.: On Acquisition SpreeShikha Shikha SNo ratings yet

- Ethos LTD ReportDocument19 pagesEthos LTD ReportRavi KiranNo ratings yet

- Monarch Network Capital Initiating Coverage On Landmark Cars WithDocument37 pagesMonarch Network Capital Initiating Coverage On Landmark Cars WithDusk TilldownNo ratings yet

- Arvind LTDDocument10 pagesArvind LTDNitesh KumarNo ratings yet

- FRA Group Assignment 2 - Academic Group A12Document15 pagesFRA Group Assignment 2 - Academic Group A12somechnitjNo ratings yet

- Assignment 3Document20 pagesAssignment 3joel royNo ratings yet

- ADTimes 2021 ABFRLDocument9 pagesADTimes 2021 ABFRLDIBYAJYOTI BISWALNo ratings yet

- Initiating Coverage by MOSL February 2014Document46 pagesInitiating Coverage by MOSL February 2014Parul ChaudharyNo ratings yet

- Initiating Coverage: Rvind TDDocument19 pagesInitiating Coverage: Rvind TDV KeshavdevNo ratings yet

- IFB IndustriesDocument5 pagesIFB IndustriesPrashanth SagarNo ratings yet

- MI Summit 5.0 - Caselet Submission - TemplateDocument5 pagesMI Summit 5.0 - Caselet Submission - Templateharigaraputran GothandaramanNo ratings yet

- Golden Midcap Portfolio: UpdateDocument7 pagesGolden Midcap Portfolio: UpdateKshitij MathurNo ratings yet

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Azad Engineering LimitedDocument9 pagesAzad Engineering LimitedNagasundaram ENo ratings yet

- Vedant Fashions: Connecting To The Roots With Style!Document50 pagesVedant Fashions: Connecting To The Roots With Style!amsukdNo ratings yet

- Rossari Biotech IC Mar21Document42 pagesRossari Biotech IC Mar21Vipul Braj Bhartia100% (1)

- Campus Activewear Limited IPO: NeutralDocument7 pagesCampus Activewear Limited IPO: NeutralAkash PawarNo ratings yet

- CFA RC Team-Eternals UFE Mongolia-1Document21 pagesCFA RC Team-Eternals UFE Mongolia-1oyunnominNo ratings yet

- Adani Wilmar Limited IpoDocument19 pagesAdani Wilmar Limited IpoTejesh GoudNo ratings yet

- Indegene LTD - 638503546302422983Document9 pagesIndegene LTD - 638503546302422983digiowlmedialabNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: September 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: September 2020ASIFNo ratings yet

- Issue Highlights: Rossari Biotech LimitedDocument16 pagesIssue Highlights: Rossari Biotech LimitedJaackson SabastianNo ratings yet

- BP Equities - Cello World Ltd. - IPO Note - Subscribe - For - Listing - Gains - 27th October - 2023Document5 pagesBP Equities - Cello World Ltd. - IPO Note - Subscribe - For - Listing - Gains - 27th October - 2023palakNo ratings yet

- 5 30 2007 (Edelweiss) Page Industries-Initiatin - Edw01610Document9 pages5 30 2007 (Edelweiss) Page Industries-Initiatin - Edw01610api-3740729No ratings yet

- Sapm Company AnalysisDocument6 pagesSapm Company AnalysisShrishti GoyalNo ratings yet

- Aditya Birla Fashion and Retail (Abfrl) - : .... Reimagining A New FutureDocument29 pagesAditya Birla Fashion and Retail (Abfrl) - : .... Reimagining A New FutureJay PrajapatiNo ratings yet

- Insecticides India LTD - Investor Presentation Aug 2018Document30 pagesInsecticides India LTD - Investor Presentation Aug 2018taha zafarNo ratings yet

- Rossari BiotechDocument49 pagesRossari BiotechBorn StarNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: APRIL 2020Document7 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: APRIL 2020gamesaalertsNo ratings yet

- DOMs IPONote 121223Document10 pagesDOMs IPONote 121223Satvinder SinghNo ratings yet

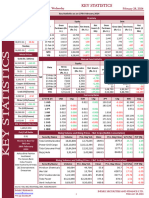

- Indsec - IC ReportDocument19 pagesIndsec - IC ReportPriyankaNo ratings yet

- Indsec Securities & Finance Ltd. Research Division - Indsec Key Statistics 28th February 2024 - 27 - Feb - 2024Document5 pagesIndsec Securities & Finance Ltd. Research Division - Indsec Key Statistics 28th February 2024 - 27 - Feb - 2024PriyankaNo ratings yet

- Page Industries Limited AR 2023-03-31 EnglishDocument176 pagesPage Industries Limited AR 2023-03-31 EnglishPriyankaNo ratings yet

- Indsec - IC ReportDocument19 pagesIndsec - IC ReportPriyankaNo ratings yet

- DRHP - Page IndustriesDocument186 pagesDRHP - Page IndustriesPriyankaNo ratings yet

- Offline - Primary/ Secondary Packaging 161 15%-20%Document2 pagesOffline - Primary/ Secondary Packaging 161 15%-20%PriyankaNo ratings yet

- Pictogram Sourcebook: Organized by SectorDocument43 pagesPictogram Sourcebook: Organized by SectorPriyankaNo ratings yet

- NEPRA Annual ReportDocument32 pagesNEPRA Annual ReportPriyankaNo ratings yet

- Rating Chart Ppt-CreativeDocument14 pagesRating Chart Ppt-CreativePriyankaNo ratings yet

- Sop - Pibo'S: ULB Endorsement Agreement of WMA With PWPFDocument2 pagesSop - Pibo'S: ULB Endorsement Agreement of WMA With PWPFPriyankaNo ratings yet

- Particulars: EPR Application For BrandownersDocument4 pagesParticulars: EPR Application For BrandownersPriyankaNo ratings yet

- Ch10 - SessionDocument122 pagesCh10 - SessionKow RyderNo ratings yet

- Company Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceDocument5 pagesCompany Name: Apollo Tyres Industry: Automobile (Mid Cap) Market Capital: Stock PriceNavi FisNo ratings yet

- Module For Operations Management and TQM Part 5Document7 pagesModule For Operations Management and TQM Part 5Karyll JustoNo ratings yet

- BSCassignmentDocument4 pagesBSCassignmentBagas Wahyu LaksonoNo ratings yet

- IGP - Coffee All 10 - 035921Document11 pagesIGP - Coffee All 10 - 035921Mary Rose Pegalan SunotNo ratings yet

- Labor Project Final Term PaperDocument11 pagesLabor Project Final Term PaperEdris Abdella NuureNo ratings yet

- Lipton Brand ManagementDocument34 pagesLipton Brand ManagementHassan Ali TayyabNo ratings yet

- Examples of Working CapitalDocument2 pagesExamples of Working CapitalMandar JoshiNo ratings yet

- DCF Group 5Document18 pagesDCF Group 5Ravi Kumar100% (1)

- Varun BeveragesDocument10 pagesVarun Beveragesramsharma692000No ratings yet

- Advertising Strategy MaiharDocument65 pagesAdvertising Strategy Maiharvickram jainNo ratings yet

- Mumbai CST OfficeDocument8 pagesMumbai CST Officeyogesh shingareNo ratings yet

- 04meg 02Document5 pages04meg 02Joney GargNo ratings yet

- Misrak Fruit Juice Processing Enterprise Haramaya, Ethiopia Prepared ByDocument19 pagesMisrak Fruit Juice Processing Enterprise Haramaya, Ethiopia Prepared Byygebre38No ratings yet

- Business Plan-GROUP 4Document8 pagesBusiness Plan-GROUP 4Christine Joy Mendigorin100% (2)

- VAHAN 4.0 (Online Appointment)Document1 pageVAHAN 4.0 (Online Appointment)Ashutosh PendkarNo ratings yet

- An16076a VTDocument1 pageAn16076a VTEle BleNo ratings yet

- History of Pepsico ColaDocument4 pagesHistory of Pepsico ColaMadiha NayyerNo ratings yet

- Duty Drawback Refund and AbatementDocument30 pagesDuty Drawback Refund and AbatementRoebie Marie DimacaliNo ratings yet

- Sale of Goods Law - A Case StudyDocument13 pagesSale of Goods Law - A Case Studyoni siddikNo ratings yet

- FYBCOM SEM-II - Functions & DerivativeDocument1 pageFYBCOM SEM-II - Functions & DerivativeSufiyan MominNo ratings yet

- The Impact of Market Orders PDFDocument21 pagesThe Impact of Market Orders PDFSeverin SaubertNo ratings yet

- Vijay Dave July-2021Document3 pagesVijay Dave July-2021SBMG & AssociatesNo ratings yet

- Higher NationalsDocument17 pagesHigher Nationalsashwani singhaniaNo ratings yet

- Exercise 1: How Much? Do The Calculations. Write The Answers in Two WaysDocument3 pagesExercise 1: How Much? Do The Calculations. Write The Answers in Two WaysKamilatti ChoudjayNo ratings yet

- Accounting Files - Accounts ReceivableDocument3 pagesAccounting Files - Accounts ReceivableAyesha RGNo ratings yet

- Bank Guarantee: Uses, Eligibility & Process, AdvantagesDocument9 pagesBank Guarantee: Uses, Eligibility & Process, AdvantagesRajesh KumarNo ratings yet