Professional Documents

Culture Documents

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

Uploaded by

Tope JohnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors

Uploaded by

Tope JohnCopyright:

Available Formats

(https://www.iasplus.

com/en)

(https://www.iasplus.com/en)

IAS 8 — Accounting Policies, Changes in Accounting Estimates and Errors

Quick Article Links

Overview

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors is applied in selecting and applying accounting

policies, accounting for changes in estimates and reflecting corrections of prior period errors.

The standard requires compliance with any specific IFRS applying to a transaction, event or condition, and provides guid‐

ance on developing accounting policies for other items that result in relevant and reliable information. Changes in ac‐

counting policies and corrections of errors are generally retrospectively accounted for, whereas changes in accounting

estimates are generally accounted for on a prospective basis.

IAS 8 was reissued in December 2005 and applies to annual periods beginning on or after 1 January 2005.

History of IAS 8

October 1976 Exposure Draft E8 The Treatment in the Income Statement of

Unusual Items and Changes in Accounting Estimates and

Accounting Policies

February 1978 IAS 8 Unusual and Prior Period Items and Changes in Accounting

Policies

July 1992 Exposure Draft E46 Extraordinary Items, Fundamental Errors and

Changes in Accounting Policies

December 1993 IAS 8 (1993) Net Profit or Loss for the Period, Fundamental Errors

and Changes in Accounting Policies (revised as part of the 'Com‐

parability of Financial Statements' project)

1 January 1995 Effective date of IAS 8 (1993)

18 December 2003 Revised version of IAS 8 issued by the IASB

1 January 2005 Effective date of IAS 8 (2003)

31 October 2018 Amended by Definit ion of Material (Amendments to IAS 1 and IAS

(https://www.iasplus.com/en/news/2018/10/definition-8)

of-material)

1 January 2020 Effective date of October 2018 amendments

Related Interpretations

IAS 8(2003) supersedes SIC-2 (https://www.iasplus.com/en/standards/sic/sic-2) Consistency - Capit alis

ation of

Borrowing Costs

IAS 8(2003) supersedes SIC-18 (https://www.iasplus.com/en/standards/sic/sic-18) Consistency - Alternative

Methods.

Amendments under consideration by the IASB

Disclosure initiative – Principles of disclosure (https://www.iasplus.com/en/projects/major/principles-of-

disclosure)

Disclosure initiative — Changes in accounting policies and estimates

(https://www.iasplus.com/en/projects/major/ias-8)

Summary of IAS 8

Key definit ions [IAS 8.5]

Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in

preparing and presenting financial statements.

A change in accounting estimate is an adjustment of the carrying amount of an asset or liability, or related ex‐

pense, resulting from reassessing the expected future benefits and obligations associated with that asset or

liability.

International Financial Reporting Standardsare standards and interpretations adopted by the International

Accounting Standards Board (IASB). They comprise:

International Financial Reporting Standards (IFRSs)

International Accounting Standards (IASs)

Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC) or

the former Standing Interpretations Committee (SIC) and approved by the IASB.

Materiality. Information is material if omitting, misstating or obscuring it could reasonably be expected to influ‐

ence decisions that the primary users of general purpose financial statements make on the basis of those finan‐

cial statements, which provide financial information about a specific reporting entity.*

Prior period errors are omissions from, and misstatements in, an entity's financial statements for one or more

prior periods arising from a failure to use, or misuse of, reliable information that was available and could reason‐

ably be expected to have been obtained and taken into account in preparing those statements. Such errors re‐

sult from mathem atical mistakes, mistakes in applying accounting policies, oversights or misinterpretations of

facts, and fraud.

* Clarified by Definit ion of Material (Amendments to IAS 1 and IAS 8), effective 1 January 2020.

Selection and application of accounting policies

When a Standard or an Interpretation specifically applies to a transaction, other event or condition, the accounting policy

or policies applied to that item must be determined by applying the Standard or Interpretation and considering any rele‐

vant Implementation Guidance issued by the IASB for the Standard or Interpretation. [IAS 8.7]

In the absence of a Standard or an Interpretation that specifically applies to a transaction, other event or condition, man‐

agement must use its judgement in developing and applying an accounting policy that results in information that is rele‐

vant and reliable. [IAS 8.10]. In making that judgement, management must refer to, and consider the applicability of, the

following sources in descending order:

the requirements and guidance in IASB standards and interpretations dealing with similar and related issues;

and

the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in

the Framework. [IAS 8.11]

Management may also consider the most recent pronouncements of other standard-setting bodies that use a similar

conceptual framework to develop accounting standards, other accounting literature and accepted industry practices, to

the extent that these do not conflict with the sources in paragraph 11. [IAS 8.12]

Consistency of accounting policies

An entity shall select and apply its accounting policies consistently for similar transactions, other events and conditions,

unless a Standard or an Interpretation specifically requires or permits categ

orisation of items for which different policies

may be appropriate. If a Standard or an Interpretation requires or permits such categ orisation, an appropriate accounting

policy shall be selected and applied consistently to each category. [IAS 8.13]

Changes in accounting policies

An entity is permitted to change an accounting policy only if the change:

is required by a standard or interpretation; or

results in the financial statements providing reliable and more relevant information about the effects of transac‐

tions, other events or conditions on the entity's financial position, financial performance, or cash flows. [IAS

8.14]

Note that changes in accounting policies do not include applying an accounting policy to a kind of transaction or event

that did not occur previously or were immaterial. [IAS 8.16]

If a change in accounting policy is required by a new IASB standard or interpretation, the change is accounted for as re‐

quired by that new pronouncement or, if the new pronouncement does not include specific transition provisions, then the

change in accounting policy is applied retrospectively. [IAS 8.19]

Retrospective application means adjusting the opening balance of each affected component of equity for the earliest

prior period presented and the other comparative amounts disclosed for each prior period presented as if the new ac‐

counting policy had always been applied. [IAS 8.22]

However, if it is impracticable to determine either the period-specific effects or the cumulative effect of the

change for one or more prior periods presented, the entity shall apply the new accounting policy to the carrying

amounts of assets and liabilities as at the beginning of the earliest period for which retrospective application is

practicable, which may be the current period, and shall make a corresponding adjustment to the opening bal‐

ance of each affected component of equity for that period. [IAS 8.24]

Also, if it is impracticable to determine the cumulative effect, at the beginning of the current period, of applying a

new accounting policy to all prior periods, the entity shall adjust the comparative information to apply the new

accounting policy prospectively from the earliest date practicable. [IAS 8.25]

Disclosures relating to changes in accounting policies

Disclosures relating to changes in accounting policy caused by a new standard or interpretation include: [IAS 8.28]

the title of the standard or interpretation causing the change

the nature of the change in accounting policy

a description of the transitional provisions, including those that might have an effect on future periods

for the current period and each prior period presented, to the extent practicable, the amount of the adjustment:

for each financial statement line item affected, and

for basic and diluted earnings per share (only if the entity is applying IAS 33)

the amount of the adjustment relating to periods before those presented, to the extent practicable

if retrospective application is impracticable, an explanation and description of how the change in accounting

policy was applied.

Financial statements of subsequent periods need not repeat these disclosures.

Disclosures relating to voluntary changes in accounting policy include: [IAS 8.29]

the nature of the change in accounting policy

the reasons why applying the new accounting policy provides reliable and more relevant information

for the current period and each prior period presented, to the extent practicable, the amount of the adjustment:

for each financial statement line item affected, and

for basic and diluted earnings per share (only if the entity is applying IAS 33)

the amount of the adjustment relating to periods before those presented, to the extent practicable

if retrospective application is impracticable, an explanation and description of how the change in accounting

policy was applied.

Financial statements of subsequent periods need not repeat these disclosures.

If an entity has not applied a new standard or interpretation that has been issued but is not yet effective, the entity must

disclose that fact and any and known or reasonably estimable information relevant to assessing the possible impact

that the new pronouncement will have in the year it is applied. [IAS 8.30]

Changes in accounting estimates

The effect of a change in an accounting estimate shall be recognised prospectively by including it in profit or loss in: [IAS

8.36]

the period of the change, if the change affects that period only, or

the period of the change and future periods, if the change affects both.

However, to the extent that a change in an accounting estimate gives rise to changes in assets and liabilities, or relates

to an item of equity, it is recognised by adjusting the carrying amount of the related asset, liability, or equity item in the

period of the change. [IAS 8.37]

Disclosures relating to changes in accounting estimates

Disclose:

the nature and amount of a change in an accounting estimate that has an effect in the current period or is ex‐

pected to have an effect in future periods

if the amount of the effect in future periods is not disclosed because estimating it is impracticable, an entity

shall disclose that fact. [IAS 8.39-40]

Errors

The general principle in IAS 8 is that an entity must correct all material prior period errors retrospectively in the first set

of financial statements authorised for issue after their discovery by: [IAS 8.42]

restating the comparative amounts for the prior period(s) presented in which the error occurred; or

if the error occurred before the earliest prior period presented, restating the opening balances of assets, liabili‐

ties and equity for the earliest prior period presented.

However, if it is impracticable to determine the period-specific effects of an error on comparative information for one or

more prior periods presented, the entity must restate the opening balances of assets, liabilities, and equity for the earli‐

est period for which retrospective restatement is practicable (which may be the current period). [IAS 8.44]

Further, if it is impracticable to determine the cumulative effect, at the beginning of the current period, of an error on all

prior periods, the entity must restate the comparative information to correct the error prospectively from the earliest

date practicable. [IAS 8.45]

Disclosures relating to prior period errors

Disclosures relating to prior period errors include: [IAS 8.49]

the nature of the prior period error

for each prior period presented, to the extent practicable, the amount of the correction:

for each financial statement line item affected, and

for basic and diluted earnings per share (only if the entity is applying IAS 33)

the amount of the correction at the beginning of the earliest prior period presented

if retrospective restatement is impracticable, an explanation and description of how the error has been

corrected.

Financial statements of subsequent periods need not repeat these disclosures.

Like 267

Contact us (https://www.iasplus.com/en/footer/contact-us)

About (https://www.iasplus.com/en/footer/about)

Legal (https://www.iasplus.com/en/footer/legal)

Privacy (https://www.iasplus.com/en/footer/privacy)

Cookies (https://www.iasplus.com/en/footer/cookies)

FAQs (https://www.iasplus.com/en/footer/faqs)

© 2022. See Legal (http://www.iasplus.com/en/footer/legal) for more information. Deloitte refers to one or

more of Deloitte Touche Tohmatsu Limited ("DTTL"), its global network of member firms and their related

entities. DTTL (also referred to as "Deloitte Global") and each of its member firms are legally separate and

independent entities. DTTL does not provide services to clients. Please see www.deloitte.com/about

(http://www.deloitte.com/about) to learn more.

You might also like

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Yardi KRC Manual Refund APDocument3 pagesYardi KRC Manual Refund APVikas OberoiNo ratings yet

- 6sgp 2005 Dec QDocument7 pages6sgp 2005 Dec Qapi-19836745No ratings yet

- Ias 9Document5 pagesIas 9Giulia TabaraNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument4 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsBagudu Bilal GamboNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsLeen LurNo ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument4 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsJay FajardoNo ratings yet

- Ias 8Document7 pagesIas 8Jan Joshua Paolo GarceNo ratings yet

- Intermedate AssgniDocument5 pagesIntermedate AssgnishimelisNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsJorreyGarciaOplasNo ratings yet

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFDocument20 pagesIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanNo ratings yet

- Summary of IAS 8Document10 pagesSummary of IAS 8pradyp15No ratings yet

- PAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument5 pagesPAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsROB101512No ratings yet

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsMarc Eric RedondoNo ratings yet

- Assign Accounting StandardsDocument39 pagesAssign Accounting StandardsTrisha Valero FerolinoNo ratings yet

- BetapplicationletterDocument5 pagesBetapplicationlettershimelisNo ratings yet

- Wa0033.Document38 pagesWa0033.Baqar BaigNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument27 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and ErrorsMK RKNo ratings yet

- Module 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesModule 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Key Definitions (IAS 8.5) Accounting PoliciesDocument6 pagesKey Definitions (IAS 8.5) Accounting Policiessimply PrettyNo ratings yet

- PAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesPAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDivine Grace BravoNo ratings yet

- 8 Policy, Estimate, ErrorDocument16 pages8 Policy, Estimate, ErrorChelsea Anne VidalloNo ratings yet

- Summary of IAS 8Document1 pageSummary of IAS 8Tin BatacNo ratings yet

- Ias 8Document35 pagesIas 8saif700No ratings yet

- Chapter 18 Policies Estimates and ErrorsDocument28 pagesChapter 18 Policies Estimates and ErrorsHammad Ahmad100% (1)

- Accounting Policies, Changes in Estimates and ErrorsDocument91 pagesAccounting Policies, Changes in Estimates and Errorsnishania pillayNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument18 pagesAccounting Policies, Changes in Accounting Estimates and ErrorscindhyNo ratings yet

- MFRS 108Document22 pagesMFRS 108Yeo Chioujin0% (1)

- IPAS 8 - Accounting Policies Changes in Accounting Estimates and ErrorsDocument22 pagesIPAS 8 - Accounting Policies Changes in Accounting Estimates and ErrorsJhea LirasanNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Nepal Accounting Standards On Accounting Policies, Changes in Accounting Estimates & ErrorsDocument25 pagesNepal Accounting Standards On Accounting Policies, Changes in Accounting Estimates & Errorsshama_rana20036778No ratings yet

- Indian Accounting Standard (Ind AS) 8: Accounting Policies, Changes in Accounting Estimates and ErrorsDocument19 pagesIndian Accounting Standard (Ind AS) 8: Accounting Policies, Changes in Accounting Estimates and ErrorsAnkush GoelNo ratings yet

- Exp Posure D Draft: A Accounti Ing Stan Ndard (A AS) 5 (Re Evised)Document15 pagesExp Posure D Draft: A Accounti Ing Stan Ndard (A AS) 5 (Re Evised)ratiNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument20 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMa Precylla Cerraine FloresNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- FRS108Document8 pagesFRS108Aritz EpitNo ratings yet

- Indian Accounting Standard (Ind AS) 8 - Taxguru - inDocument11 pagesIndian Accounting Standard (Ind AS) 8 - Taxguru - inaaosarlbNo ratings yet

- Amendments To PAS 8 - PrefaceDocument13 pagesAmendments To PAS 8 - PrefacejolanreidNo ratings yet

- Summary of IAS 8Document5 pagesSummary of IAS 8Mae Gamit LaglivaNo ratings yet

- Ias 8 EnglezaDocument9 pagesIas 8 EnglezaTatiana LupuNo ratings yet

- Accounting Policies Ias 8Document9 pagesAccounting Policies Ias 8mulualemNo ratings yet

- Accounting Policies, Accounting Estimates and Errors (IAS8)Document11 pagesAccounting Policies, Accounting Estimates and Errors (IAS8)Mo HachimNo ratings yet

- Chapte 3Document13 pagesChapte 3Mary Ann Alegria MorenoNo ratings yet

- Accounting Policy and Estimate IAS 8Document6 pagesAccounting Policy and Estimate IAS 8OLAWALE AFOLABI TIMOTHYNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument25 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAshish agrawalNo ratings yet

- Ias No.8Document41 pagesIas No.8rafikaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument14 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsSuresh Reddy SannapureddyNo ratings yet

- Ias 8Document9 pagesIas 8Muhammad SaeedNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMaruf HossainNo ratings yet

- Chapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsDocument12 pagesChapter 5 PAS 8 Accounting Policies, Changes in Accouting Estimates and ErrorsSimon RavanaNo ratings yet

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Document27 pagesPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNo ratings yet

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNo ratings yet

- Ias 8 Accounting Policies Changes in Accounting Estimates and Errors SummaryDocument5 pagesIas 8 Accounting Policies Changes in Accounting Estimates and Errors SummaryWilmar AbriolNo ratings yet

- Accounting Policies and ErrorsDocument32 pagesAccounting Policies and ErrorsTia Li100% (1)

- IPSAS 3 Change EstimationDocument33 pagesIPSAS 3 Change EstimationYoga SujokoNo ratings yet

- Audit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018From EverandAudit and Accounting Guide: Entities With Oil and Gas Producing Activities, 2018No ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- 4-Pertemuan 4 - Perencanaan AuditDocument11 pages4-Pertemuan 4 - Perencanaan AuditMelida Afifah SiregarNo ratings yet

- Accounting For Property, Plant and Equipment - ACCA Global - 1621239130982Document13 pagesAccounting For Property, Plant and Equipment - ACCA Global - 1621239130982Farhan Osman ahmedNo ratings yet

- Oracle Financial Services Software LTD.: TradeDocument3 pagesOracle Financial Services Software LTD.: TradeAKSHAT SINGHNo ratings yet

- 29833ICAI Official Directory 2013 14Document278 pages29833ICAI Official Directory 2013 14Charu Panchal BediNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsSharmaine manobanNo ratings yet

- 3 - Part 3 - ETHICS Section 300Document9 pages3 - Part 3 - ETHICS Section 300Maybelle BernalNo ratings yet

- PHD Thesis in Accounting and FinanceDocument6 pagesPHD Thesis in Accounting and Financeijofwkiig100% (2)

- Accountancy - Part 1 - Class 12 PDFDocument264 pagesAccountancy - Part 1 - Class 12 PDFCode 1No ratings yet

- Mid-Term Exam (Set A) : RequiredDocument14 pagesMid-Term Exam (Set A) : RequiredSharjaaahNo ratings yet

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNo ratings yet

- Institusionalisasi Internal Audit Capability Model Pada Aparat Pengawasan Intern Pemerintah (Studi Kasus Di Kementerian Luar Negeri)Document16 pagesInstitusionalisasi Internal Audit Capability Model Pada Aparat Pengawasan Intern Pemerintah (Studi Kasus Di Kementerian Luar Negeri)satrio pickNo ratings yet

- AUD339 (NOTES CP5) - Audit Planning & Fieldwork 2Document28 pagesAUD339 (NOTES CP5) - Audit Planning & Fieldwork 2pinocchiooNo ratings yet

- Chapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document29 pagesChapter 23 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chart of AccountsDocument55 pagesChart of AccountsSyed Shakir AliNo ratings yet

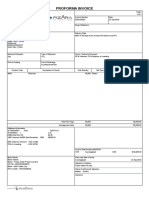

- 002 Proforma Invoice PDFDocument1 page002 Proforma Invoice PDFnadeem2510No ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Acc Quizzes ZZZDocument22 pagesAcc Quizzes ZZZagspurealNo ratings yet

- Expense Template Non VatDocument2 pagesExpense Template Non Vatzazira19No ratings yet

- 634 2031 1 PBDocument8 pages634 2031 1 PBCamila EsellerNo ratings yet

- Summary of Ias 36 Impairment of AssetsDocument3 pagesSummary of Ias 36 Impairment of AssetsenzoNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- F2.1-Management Accounting (Answ) August 2023Document19 pagesF2.1-Management Accounting (Answ) August 2023jbah saimon baptisteNo ratings yet

- Annual Report 2019 Financial Statements and Notes PDFDocument124 pagesAnnual Report 2019 Financial Statements and Notes PDFArti AtkaleNo ratings yet

- Types of AuditDocument58 pagesTypes of Auditvinay sainiNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Module 2 - Partnership Operations and Financial ReportingDocument85 pagesModule 2 - Partnership Operations and Financial ReportingxxxNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Cost and Management Accounting Students' Manual: Colin DruryDocument158 pagesCost and Management Accounting Students' Manual: Colin DruryPANASHE MARTIN MASANGUDZA100% (2)