Professional Documents

Culture Documents

61b0a0056fbe6.1638965253.SIP Report 27092021

61b0a0056fbe6.1638965253.SIP Report 27092021

Uploaded by

delightadvertisementOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

61b0a0056fbe6.1638965253.SIP Report 27092021

61b0a0056fbe6.1638965253.SIP Report 27092021

Uploaded by

delightadvertisementCopyright:

Available Formats

Equity | Commodities | Currency Derivatives | Demat | NRI Services | Mutual Funds | Insurance | Bonds | Wealth Management | Investment Advisory

| Financial Planning | Company Fixed

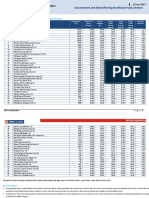

SIP Report Date: September 27, 2021

Investment value of ` 10,000 per month

1,20,000 3,60,000 6,00,000 12,00,000

Large Cap (% XIRR) Present Value (`)

Scheme Inception Date AUM (Rs Cr) NAV 1Y 3Y 5Y 10Y 1Y 3Y 5Y 10 Y

Axis Bluechip Fund-Reg(G) 05-Jan-2010 32,213 47.86 53.34 30.19 22.82 22.82 1,52,207 5,54,754 10,56,464 31,09,598

Mirae Asset Large Cap Fund-Reg 04-Apr-2008

(G) 29,425 80.22 54.20 29.63 20.68 18.73 1,52,698 5,50,586 10,03,235 32,15,574

BNP Paribas Large Cap Fund(G) 23-Sep-2004 1,212 142.16 48.83 28.47 19.77 16.40 1,49,625 5,42,132 9,81,403 28,36,240

ESG

SBI Magnum Equity ESG Fund- 01-Jan-1991

Reg(D) 4,251 166.47 55.62 29.86 20.41 16.36 1,53,501 5,52,303 9,96,828 28,30,157

Axis ESG Equity Fund-Reg(G) 12-Feb-2020 2,133 16.92 54.47 - - - 1,52,848 - - -

Focused

SBI Focused Equity Fund-Reg(G) 11-Oct-2004 19,429 241.46 68.19 34.01 23.67 19.74 1,60,552 5,83,487 10,78,300 33,95,158

Axis Focused 25 Fund-Reg(G) 29-Jun-2012 19,736 48.60 65.94 34.47 24.08 - 1,59,300 5,87,040 10,89,166 -

Sundaram Select Focus(G) 30-Jul-2002 1,398 278.93 54.42 28.28 20.07 15.44 1,52,821 5,40,724 9,88,415 26,94,209

Large & Mid Cap

Mirae Asset Emerging Bluechip- 09-Jul-2010

Reg(G) 20,615 98.50 65.93 38.70 26.31 25.61 1,59,294 6,20,095 11,48,728 46,65,059

Invesco India Growth Opp Fund 09-Aug-2007

(G) 4,153 53.31 53.08 28.66 19.92 17.27 1,52,056 5,43,519 9,85,054 29,72,737

Axis Growth Opp Fund-Reg(G) 22-Oct-2018 4,322 20.95 72.92 40.80 - - 1,63,162 6,09,044 - -

Flexi Cap

Axis Flexi Cap Fund-Reg(G) 17-Nov-2017 9,783 19.75 62.28 32.73 - - 1,57,256 5,73,704 - -

Kotak Flexicap Fund(G) 11-Sep-2009 38,626 53.57 49.35 27.38 18.82 17.85 1,49,926 5,34,230 9,59,023 30,65,855

Parag Parikh Flexi Cap Fund-Reg(G) 28-May-2013 14,590 50.28 69.07 41.73 28.63 - 1,61,039 6,44,568 12,13,970 -

Multi Cap

ICICI Pru Multicap Fund(G) 01-Oct-1994 6,381 447.51 64.05 30.28 19.45 16.83 1,58,247 5,55,397 9,73,824 29,02,695

Mahindra Manulife Multi Cap

11-May-2017 721 20.45 80.86 40.55 - - 1,67,509 6,34,924 - -

Badhat Yojana-Reg(G)

Invesco India Multicap Fund(G) 17-Mar-2008 1,573 80.69 68.69 35.24 21.57 19.45 1,60,828 5,92,937 10,25,226 33,43,334

Value

IDFC Sterling Value Fund-Reg(G) 07-Mar-2008 3,990 84.62 85.20 39.77 22.65 18.40 1,69,860 6,28,684 10,52,357 31,58,804

ICICI Pru Value Discovery Fund(G) 16-Aug-2004 21,778 239.79 61.40 33.22 20.67 18.13 1,56,762 5,77,467 10,03,090 31,14,115

UTI Value Opp Fund-Reg(G) 20-Jul-2005 6,545 101.25 56.53 32.36 21.28 15.61 1,54,018 5,70,944 10,17,945 27,18,299

Midcap

Axis Midcap Fund-Reg(G) 18-Feb-2011 14,804 70.27 70.99 39.55 27.76 22.60 1,62,097 6,26,865 11,89,204 39,64,607

Kotak Emerging Equity Fund(G) 30-Mar-2007 15,709 70.86 67.98 39.17 24.32 22.14 1,60,431 6,23,894 10,95,299 38,67,183

Nippon India Growth Fund(G) 08-Oct-1995 11,322 2064.21 81.39 41.08 25.43 19.71 1,67,795 6,39,299 11,24,919 33,90,762

Small Cap

SBI Small Cap Fund-Reg(G) 09-Sep-2009 9,714 99.98 67.14 41.36 26.66 26.41 1,59,964 6,41,570 11,58,421 48,71,330

Axis Small Cap Fund-Reg(G) 29-Nov-2013 7,095 59.36 84.38 45.42 29.56 - 1,69,414 6,75,227 12,41,095 -

Nippon India Small Cap Fund(G) 16-Sep-2010 16,633 81.21 98.44 49.16 28.98 26.37 1,76,943 7,07,180 12,24,155 48,60,443

www.geplcapital.com Mutual Fund Desk: +91 22 6614 2789 mutualfunds@geplcapital.com

Equity | Commodities | Currency Derivatives | Demat | NRI Services | Mutual Funds | Insurance | Bonds | Wealth Management | Investment Advisory | Financial Planning | Company Fixed

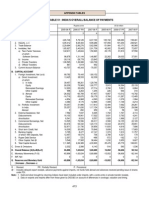

SIP Report Date: September 27, 2021

Investment value of ` 10,000 per month

1,20,000 3,60,000 6,00,000 12,00,000

ELSS

Scheme Inception AUM (Rs Cr) NAV 1Y 3Y 5Y 10Y 1Y 3Y 5Y 10 Y

Date

Axis Long Term Equity Fund-Reg 29-Dec-2009

(G) 33,871 77.70 65.53 34.29 23.91 20.92 1,59,068 5,85,599 10,84,725 36,20,343

Mirae Asset Tax Saver Fund-Reg 28-Dec-2015

(G) 9,401 31.44 61.17 36.50 25.36 - 1,56,630 6,02,735 11,22,965 -

DSP Tax Saver Fund-Reg(G) 18-Jan-2007

9,675 82.26 65.35 34.84 22.64 19.41 1,58,973 5,89,881 10,51,985 33,35,985

Financial Services

SBI Banking & Financial Services 26-Feb-2015

2,889 25.49 42.49 24.77 18.81 - 1,45,962 5,15,608 9,58,788 -

Fund-Reg(G)

Aditya Birla SL Banking & Finan- 14-Dec-2013

2,195 39.99 57.88 27.01 16.92 - 1,54,781 5,31,499 9,15,346 -

cial Services Fund-Reg(G)

ICICI Pru Banking & Fin Serv 22-Aug-2008

5,097 86.09 54.65 24.91 16.12 17.71 1,52,949 5,16,582 8,97,674 30,44,345

Fund(G)

Healthcare

Nippon India Pharma Fund(G) 05-Jun-2004 5,667 315.55 42.57 40.28 27.67 19.94 1,46,008 6,32,740 11,86,756 34,32,869

Mirae Asset Healthcare Fund-Reg 02-Jul-2018

1,901 23.95 46.75 44.48 - - 1,48,433 6,67,284 - -

(G)

Tata India Pharma & Healthcare 28-Dec-2015

610 18.20 38.97 37.43 24.81 - 1,43,910 6,10,030 11,08,447 -

Fund-Reg(G)

FMCG

BNP Paribas India Consumption 10-Sep-2018

Fund-Reg(G) 839 19.86 55.40 32.08 - - 1,53,378 5,68,809 - -

Mirae Asset Great Consumer 29-Mar-2011

Fund-Reg(G) 1,488 55.58 59.22 30.20 21.46 18.78 1,55,538 5,54,780 10,22,346 32,24,481

ICICI Pru FMCG Fund(G) 31-Mar-1999

875 336.08 49.40 21.51 16.05 14.84 1,49,953 4,92,971 8,96,194 26,07,994

Infrastructure

Invesco India Infrastructure Fund(G) 24-Oct-2007 261 30.33 80.48 37.85 23.30 18.19 1,67,299 6,13,323 10,68,729 31,23,534

Tata Infrastructure Fund-Reg(G) 31-Dec-2004 718 88.54 77.65 34.49 19.99 15.26 1,65,756 5,87,131 9,86,646 26,67,314

ICICI Pru Infrastructure Fund(G) 31-Aug-2005 1,632 79.36 89.30 35.09 20.00 14.59 1,72,068 5,91,792 9,86,875 25,73,490

Technology

ICICI Pru Technology Fund(G) 03-Mar-2000 5,037 163.09 118.24 66.84 44.71 28.50 1,87,303 8,72,249 17,61,930 54,53,873

Aditya Birla SL Digital India Fund(G) 15-Jan-2000 2,288 139.17 104.31 61.13 42.06 27.13 1,80,042 8,16,464 16,59,209 50,65,573

SBI Technology Opp Fund-Reg(G) 03-Jul-1999 1,465 154.50 98.64 54.47 38.06 24.79 1,77,048 7,54,384 15,13,864 44,62,011

Global Funds

ICICI Pru US Bluechip Equity Fund

06-Jul-2012 1,809 45.02 24.29 24.07 20.80 - 1,35,174 5,10,691 10,06,203 -

(G)

Motilal Oswal Nasdaq 100 ETF 29-Mar-2011 5,125 109.51 31.47 37.66 31.30 25.61 1,39,480 6,11,845 12,93,185 46,64,632

PGIM India Global Equity Opp

14-May-2010 1,516 39.22 28.26 38.56 30.10 16.80 1,37,565 6,19,017 12,57,031 28,97,917

Fund(G)

www.geplcapital.com Mutual Fund Desk: +91 22 6614 2789 mutualfunds@geplcapital.com

Equity | Commodities | Currency Derivatives | Demat | NRI Services | Mutual Funds | Insurance | Bonds | Wealth Management | Investment Advisory | Financial Planning | Company Fixed

SIP Report Date: September 27, 2021

Investment value of ` 10,000 per month

1,20,000 3,60,000 6,00,000 12,00,000

Index Funds

Scheme Inception AUM (Rs Cr) NAV 1Y 3Y 5Y 10Y 1Y 3Y 5Y 10 Y

Date

HDFC Index Fund-NIFTY 50 Plan

17-Jul-2002 3,705 164.10 54.65 29.70 20.77 15.76 1,52,948 5,51,110 10,05,507 27,40,631

(G)

HDFC Index Fund-Sensex(G) 17-Jul-2002 2,556 537.16 53.04 29.46 21.28 16.07 1,52,032 5,49,339 10,17,887 27,85,966

ICICI Pru Nifty Next 50 Index

25-Jun-2010 1,535 38.13 60.37 29.29 17.94 16.49 1,56,182 5,48,113 9,38,608 28,50,462

Fund(G)

Gold Funds

Kotak Gold Fund(G) 25-Mar-2011 1,019 19.13 -6.86 8.93 10.32 6.53 1,15,517 4,11,847 7,77,856 16,78,267

ICICI Pru Regular Gold Savings

11-Oct-2011 548 15.22 -7.16 8.28 9.64 6.36 1,15,318 4,07,872 7,64,697 16,45,458

Fund(FOF)(G)

Nippon India ETF Gold BeES 08-Mar-2007 6,006 40.44 -7.30 8.39 9.88 6.62 1,15,228 4,08,540 7,69,291 16,86,223

Source: ACEMF; NAV as on 24th September 2021

Disclaimer: This document has been prepared by GEPL Capital and its group companies has used information which is publically available including any information developed internally. GEPL Capital however does not warrant the accuracy, reasonableness and / or completeness of any information. Information gathered & material used

in this document is believed to be from reliable sources and software. The opinion expressed or estimates made are as per the best judgment as applicable at that point of time and are subject to change without any notice. This material is not a research report as per the SEBI (Research Analyst) Regulations, 2014. Mutual Fund invest-

ments are subject to market risks, read all scheme related documents carefully before investing.

www.geplcapital.com Mutual Fund Desk: +91 22 6614 2789 mutualfunds@geplcapital.com

You might also like

- UTIMCO Feb2023Document36 pagesUTIMCO Feb2023Manish Singh100% (3)

- Database - CRM UploadDocument24 pagesDatabase - CRM Uploadterraeagle.sophiyaNo ratings yet

- Case Study On Kotak Mahindra and ING Vysya Bank AmalgamationDocument19 pagesCase Study On Kotak Mahindra and ING Vysya Bank AmalgamationRoshni Anna Antony100% (4)

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DNo ratings yet

- Allocation Analysis-13-11-2023-08-08-56Document49 pagesAllocation Analysis-13-11-2023-08-08-56fortune144370No ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesPraful ThakreNo ratings yet

- Suresh Rathi Securities PVT LTD.: Ronak JajooDocument17 pagesSuresh Rathi Securities PVT LTD.: Ronak JajooRonak JajooNo ratings yet

- Staywealthy Investment Services: Portfolio Valuation SummaryDocument2 pagesStaywealthy Investment Services: Portfolio Valuation SummaryGauri TripathiNo ratings yet

- MF DoneDocument10 pagesMF DoneVIREN GOHILNo ratings yet

- April 19Document52 pagesApril 19sahithi reddyNo ratings yet

- HDFCsec MFReckonerFeb2022Document11 pagesHDFCsec MFReckonerFeb2022Sanjib DekaNo ratings yet

- 01 Adm 05695 RumaDas 20220328 Portfolio DetailedDocument26 pages01 Adm 05695 RumaDas 20220328 Portfolio DetailedAnirNo ratings yet

- PortfolioSummary RAJARATNAM SABAPATHYDocument6 pagesPortfolioSummary RAJARATNAM SABAPATHYDurga DeviNo ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranNo ratings yet

- Company Comparable Analysis Peers DC AdvisoryDocument23 pagesCompany Comparable Analysis Peers DC AdvisoryShuchita AgarwalNo ratings yet

- NJ Star Funds Jan-Mar 2022Document4 pagesNJ Star Funds Jan-Mar 2022Suresh TrivediNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- HDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023Document16 pagesHDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023ashoksoftNo ratings yet

- Star Oct Dec 23 1Document6 pagesStar Oct Dec 23 1aeikhanpurNo ratings yet

- Equity - AutoDocument7 pagesEquity - Automsmanish29No ratings yet

- Provisional Financial - Mar 2021Document8 pagesProvisional Financial - Mar 2021Anamika NandiNo ratings yet

- Categorywise Best-Worst Performing Funds: Category: Equity - ELSSDocument1 pageCategorywise Best-Worst Performing Funds: Category: Equity - ELSSRajkumar GNo ratings yet

- Prudent Investment Insights 31st July 2020 1597474493863Document33 pagesPrudent Investment Insights 31st July 2020 1597474493863bimalishaNo ratings yet

- Gilt Funds Traling Returns From 2015Document2 pagesGilt Funds Traling Returns From 2015Sandeep BorseNo ratings yet

- MF CurrDocument2 pagesMF Curraparna tiwariNo ratings yet

- Bop PDFDocument1 pageBop PDFLoknadh ReddyNo ratings yet

- Aqu Vol19 IssueIDocument2 pagesAqu Vol19 IssueIcool.prerna00No ratings yet

- ICICI Gold Arbitrage September 2020Document3 pagesICICI Gold Arbitrage September 2020Aryata BhansaliNo ratings yet

- Top Mutual FundsDocument6 pagesTop Mutual FundsPubg UpdateNo ratings yet

- Letchoose Farm Corporation Financial Highlights (Insert FS)Document31 pagesLetchoose Farm Corporation Financial Highlights (Insert FS)Cking CunananNo ratings yet

- SIP Performance For Select Schemes Leaflet (As On 29th April 2022)Document4 pagesSIP Performance For Select Schemes Leaflet (As On 29th April 2022)Akash BNo ratings yet

- KBC Knowledge Series - Top Ten SchemesDocument2 pagesKBC Knowledge Series - Top Ten SchemesktiindiaNo ratings yet

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchDocument5 pagesChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RNo ratings yet

- Portfolio ReportDocument10 pagesPortfolio Reportsudeshna palitNo ratings yet

- 6 PesDocument2 pages6 PessidraNo ratings yet

- Table 6.1 National Savings Schemes (Net Investment)Document2 pagesTable 6.1 National Savings Schemes (Net Investment)sidraNo ratings yet

- AIL Share Holding As of Sep 30, 2010Document1 pageAIL Share Holding As of Sep 30, 2010Prateek DhingraNo ratings yet

- CF 01Document2 pagesCF 01John Alex SelorioNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Pix Transmission Report FinalDocument10 pagesPix Transmission Report Finalmyupdates100No ratings yet

- 52 Week High Low NAV Equity FundDocument4 pages52 Week High Low NAV Equity FundWealth Maker BuddyNo ratings yet

- SIP 10-15-20 Years Performance July 2021Document2 pagesSIP 10-15-20 Years Performance July 2021ABCNo ratings yet

- Top Performing Mutual Funds 22 06 2024Document2 pagesTop Performing Mutual Funds 22 06 2024Sunny AhujaNo ratings yet

- JM Daily - 23 Aug - DebtDocument373 pagesJM Daily - 23 Aug - DebtPravin SinghNo ratings yet

- Gilt Funds Trailing Returns From 2019Document2 pagesGilt Funds Trailing Returns From 2019Sandeep BorseNo ratings yet

- ValueResearchFundcard KotakGiltInvestmentRegular 2010nov24Document6 pagesValueResearchFundcard KotakGiltInvestmentRegular 2010nov24zankurNo ratings yet

- A4 Growealth Survey Oct 2020 PDFDocument1 pageA4 Growealth Survey Oct 2020 PDFAlois KudzaiNo ratings yet

- Top Stories:: WED 03 NOV 2021Document10 pagesTop Stories:: WED 03 NOV 2021JajahinaNo ratings yet

- Peer Group Focused 3 1Document1 pagePeer Group Focused 3 1Jinesh JadavNo ratings yet

- ValueResearchFundcard RelianceGrowth 2010dec30Document6 pagesValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNo ratings yet

- WWW - Centralbankofindia.co - In: Central OfficeDocument28 pagesWWW - Centralbankofindia.co - In: Central Officesriram TPNo ratings yet

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceDocument23 pagesCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaNo ratings yet

- Top Stories:: SMC, Eagle: SMC Eyeing To Acquire Eagle Coling The Shots: What To Do Since The Worst Is Not Yet Over?Document5 pagesTop Stories:: SMC, Eagle: SMC Eyeing To Acquire Eagle Coling The Shots: What To Do Since The Worst Is Not Yet Over?Edmond Baccay PanteNo ratings yet

- Schwab Jan2023 SMART SupplementDocument1 pageSchwab Jan2023 SMART SupplementManish SinghNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página877franzmartiniiNo ratings yet

- Recommendation of Advisory CommitteeDocument1 pageRecommendation of Advisory Committeemadhumay23No ratings yet

- Mutual Fund Holding Report - Feb23 - 13032023 - IDBIDocument54 pagesMutual Fund Holding Report - Feb23 - 13032023 - IDBIAnkit PandeNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Vocational-Skill Devlopment Assignment TopicDocument4 pagesVocational-Skill Devlopment Assignment TopicdelightadvertisementNo ratings yet

- Assignment of Business Management IInd SemDocument1 pageAssignment of Business Management IInd SemdelightadvertisementNo ratings yet

- Assignment For All - EnglishDocument2 pagesAssignment For All - EnglishdelightadvertisementNo ratings yet

- Final Report (Yashee)Document90 pagesFinal Report (Yashee)delightadvertisementNo ratings yet

- OpTransactionHistoryTpr18 05 2023Document24 pagesOpTransactionHistoryTpr18 05 2023SHRI SIDDHIYINAYAKNo ratings yet

- Latest Payout (21-12-22)Document24 pagesLatest Payout (21-12-22)shraddha22kaleNo ratings yet

- Fund Factsheets Individual March31Document60 pagesFund Factsheets Individual March31Chandrasekar ChandramohanNo ratings yet

- Kotak Mahindra BankDocument7 pagesKotak Mahindra BankRajendra VermaNo ratings yet

- Com - Kotakgeneralinsurance CRIPC 2252851900 G4LAHM355375 EngineNumberDocument10 pagesCom - Kotakgeneralinsurance CRIPC 2252851900 G4LAHM355375 EngineNumberParul SinghNo ratings yet

- Asam Ajay KumarDocument1 pageAsam Ajay KumarPrudhvi ChargeNo ratings yet

- Urgent Legal Notice To Kotak - 30102021 - 211030 - 182306Document4 pagesUrgent Legal Notice To Kotak - 30102021 - 211030 - 182306spahujNo ratings yet

- Kotak Bank Company ProfileDocument17 pagesKotak Bank Company Profilemohammed khayyumNo ratings yet

- Complete June Current Affairs - NotesDocument109 pagesComplete June Current Affairs - NotesARMAN YADAVNo ratings yet

- Integrated Report Fy2021Document114 pagesIntegrated Report Fy2021Raghav SawhneyNo ratings yet

- Kotak Mahindra BankDocument4 pagesKotak Mahindra BankPriyanka Garg0% (1)

- Key Pointers For The RDM Role - TIEDDocument3 pagesKey Pointers For The RDM Role - TIEDNalla Thambi100% (1)

- Airtel Payment BankDocument8 pagesAirtel Payment Bankaniket.k.farkade0407No ratings yet

- Financial Performance of Icici Prudential Life Insurance Company and Kotak Mahindra Life Insurance Company: A Comparative StudyDocument5 pagesFinancial Performance of Icici Prudential Life Insurance Company and Kotak Mahindra Life Insurance Company: A Comparative StudygyandeepbhagawatiNo ratings yet

- Weekly Payment ProofDocument34 pagesWeekly Payment ProofVIKASH KHICHARNo ratings yet

- New Code ListDocument7 pagesNew Code ListHARI KRISHAN PALNo ratings yet

- Uday Kotak-1Document15 pagesUday Kotak-1BHAVESH KERAINo ratings yet

- OpTransactionHistoryUX329 06 2023Document18 pagesOpTransactionHistoryUX329 06 2023nihaNo ratings yet

- 13 - Kotak Mahindra Bank - Banking IndustryDocument3 pages13 - Kotak Mahindra Bank - Banking IndustryDivyanshu JoshiNo ratings yet

- Tracer CircularDocument13 pagesTracer CircularMANISH KUMARNo ratings yet

- Accidental Death Benefit Rider7 PDFDocument10 pagesAccidental Death Benefit Rider7 PDFShivaprasad PatilNo ratings yet

- Kotak BankDocument78 pagesKotak BankRupesh ShingareNo ratings yet

- Roll No. 19P0310314Document27 pagesRoll No. 19P0310314Priya KudnekarNo ratings yet

- Kotak Mahindra Bank Financial AnalysisDocument25 pagesKotak Mahindra Bank Financial Analysisheena siddiquiNo ratings yet

- Corporate Level Strategies: Dr. Nishikant C. Warbhuwan Ph. D. Mba (HRM) Be (It)Document166 pagesCorporate Level Strategies: Dr. Nishikant C. Warbhuwan Ph. D. Mba (HRM) Be (It)Salil BoranaNo ratings yet

- 6 - Examdays - Monthly CA Capsule - February 2021Document92 pages6 - Examdays - Monthly CA Capsule - February 2021Sandeep NegiNo ratings yet

- NSE FnO Lot Size - F&O Stocks List With Lot SizeDocument7 pagesNSE FnO Lot Size - F&O Stocks List With Lot Sizepatsan007No ratings yet

- Employee Handbook Final SmallDocument66 pagesEmployee Handbook Final SmallCricket KheloNo ratings yet