Professional Documents

Culture Documents

UBL Annual Report 2018-133

UBL Annual Report 2018-133

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-133

UBL Annual Report 2018-133

Uploaded by

IFRS LabCopyright:

Available Formats

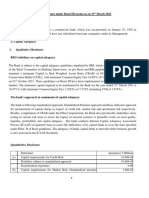

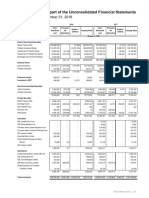

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

2018 2017

46. CAPITAL ADEQUACY, LEVERAGE RATIO & LIQUIDITY REQUIREMENTS ------- (Rupees in '000) -------

Minimum Capital Requirement (MCR):

Paid-up capital (net of losses) 12,241,798 12,241,798

Capital Adequacy Ratio (CAR):

Eligible Common Equity Tier 1 (CET 1) Capital 109,026,135 110,649,879

Eligible Additional Tier 1 (ADT 1) Capital 8,875,000 -

Total Eligible Tier 1 Capital 117,901,135 110,649,879

Eligible Tier 2 Capital 38,449,649 40,892,332

Total Eligible Capital (Tier 1 + Tier 2) 156,350,784 151,542,211

Risk Weighted Assets (RWAs):

Credit Risk 729,807,059 666,405,810

Market Risk 9,991,738 174,331,695

Operational Risk 141,621,143 140,304,148

Total 881,419,940 981,041,653

Common Equity Tier 1 Capital Adequacy Ratio 12.37% 11.28%

Tier 1 Capital Adequacy Ratio 13.38% 11.28%

Total Capital Adequacy Ratio 17.74% 15.45%

The SBP through its BSD Circular No. 07 dated April 15, 2009 has prescribed the minimum paid-up capital (net of

accumulated losses) for Banks to be raised to Rs.10,000 million by the year ending December 31, 2015. The paid-up

capital of the Bank for the year ended December 31, 2018 stood at Rs.12,241.798 million (2017: Rs.12,241.798 million)

and is in compliance with SBP requirements. Banks are also required to maintain a minimum Capital Adequacy Ratio

(CAR) of 10.0% plus capital conservation buffer of 1.90% of the risk weighted exposures of the Bank. Further, under Basel

III instructions, Banks are also required to maintain a Common Equity Tier 1 (CET 1) ratio and Tier 1 ratio of 6.0% and

7.5%, respectively, as at December 31, 2018. As at December 31, 2018 the Bank is fully compliant with prescribed ratios

as the Bank’s CAR is 17.74% whereas CET 1 and Tier 1 ratios stood at 12.37% and 13.38% respectively. The Bank and

its individually regulated operations have complied with all capital requirements throughout the year.

Furthermore, under the SBP’s Framework for Domestic Systematically Important Banks (D-SIBs) introduced vide BPRD

Circular No. 04 of 2018 dated April 13, 2018, UBL has been designated as a D-SIB. Under this framework, the Bank is

required to meet the Higher Loss Absorbency capital charge of 1.5%, in the form of Additional CET 1 capital, on a

standalone as well as consolidated level. The additional capital requirement shall be effective from the end of March 2019.

Under the current capital adequacy regulations, credit risk and market risk exposures are measured using the Standardized

Approach and operational risk is measured using the Basic Indicator Approach. Credit risk mitigants are also applied

against the Bank’s exposures based on eligible collateral under comprehensive approach.

2018 2017

------- (Rupees in '000) -------

Leverage Ratio (LR):

Eligible Tier-1 Capital 117,901,135 110,649,879

Total Exposures 2,423,130,058 2,880,164,756

Leverage Ratio 4.87% 3.84%

Liquidity Coverage Ratio (LCR):

Total High Quality Liquid Assets 404,144,218 414,579,250

Total Net Cash Outflow 212,338,866 255,636,947

Liquidity Coverage Ratio 190.33% 162.18%

Net Stable Funding Ratio (NSFR):

Total Available Stable Funding 1,489,318,075 1,128,634,708

Total Required Stable Funding 1,181,920,887 1,086,955,065

Net Stable Funding Ratio 126.01% 103.83%

46.1 The full disclosures on the CAPITAL ADEQUACY, LEVERAGE RATIO & LIQUIDITY REQUIREMENTS as per SBP

instructions issued from time to time are placed on the website. The link to the full disclosure is available at

http://www.ubldirect.com/Corporate/InvestorRelations/CapitalAdequacyStatements.aspx

Annual Report 2018 131

You might also like

- Solution For Case 10 Valuation of Common StockDocument8 pagesSolution For Case 10 Valuation of Common StockHello100% (1)

- Overview If Railway AccountsDocument40 pagesOverview If Railway AccountsKannan ChakrapaniNo ratings yet

- Group 3 - Deutsche Bank and The Road To Basel IIIDocument14 pagesGroup 3 - Deutsche Bank and The Road To Basel IIIAmit Meshram0% (1)

- Barclays PLC Pillar 3 ReportDocument13 pagesBarclays PLC Pillar 3 ReporttaohausNo ratings yet

- Capital Adequacy Presentation 1Document16 pagesCapital Adequacy Presentation 1Nafiz Imran DiptoNo ratings yet

- 2016 Pillar III DisclosureDocument13 pages2016 Pillar III Disclosureahsan habibNo ratings yet

- Assignment Basal Norm Analysis (Dhanlaxmi Bank)Document18 pagesAssignment Basal Norm Analysis (Dhanlaxmi Bank)amisha saxenaNo ratings yet

- Pillar 3 Report 2021 - 931174233Document62 pagesPillar 3 Report 2021 - 931174233Sophiya RanaNo ratings yet

- Basel Disclosure Ashad2080Document4 pagesBasel Disclosure Ashad2080Na Bee NaNo ratings yet

- Capital-and-Liquidity-disclosures - 2018Document26 pagesCapital-and-Liquidity-disclosures - 2018zaid saadNo ratings yet

- Basel IIDocument3 pagesBasel IIaNo ratings yet

- Disclosure BLR QTR Sept 2019 - Revised-21042020Document2 pagesDisclosure BLR QTR Sept 2019 - Revised-21042020Joynul AbedinNo ratings yet

- Basel Iii Pillar Iii: Market Discipline OF Uttara Bank LimitedDocument20 pagesBasel Iii Pillar Iii: Market Discipline OF Uttara Bank LimitedrakhalbanglaNo ratings yet

- Arab Bank SwitzerlandDocument7 pagesArab Bank Switzerlandumar sohailNo ratings yet

- 2022 BD Pillar 3 DisclosureDocument15 pages2022 BD Pillar 3 DisclosuremmozupurNo ratings yet

- Karnataka Bank LimitedDocument9 pagesKarnataka Bank LimitedDhanusha RajuNo ratings yet

- PT Bank Central Asia TBK and Subsidiaries Leverage Ratio - Basel IIIDocument3 pagesPT Bank Central Asia TBK and Subsidiaries Leverage Ratio - Basel IIIDwi UdayanaNo ratings yet

- ICICI - Piramal EnterprisesDocument16 pagesICICI - Piramal EnterprisessehgalgauravNo ratings yet

- Disclosure Under Basel III For 31st March 2021Document54 pagesDisclosure Under Basel III For 31st March 2021Nithin YadavNo ratings yet

- Calculation of CAR After 20% PayoutDocument1 pageCalculation of CAR After 20% PayoutUmair IqbalNo ratings yet

- Capital Adequacy RatioDocument3 pagesCapital Adequacy RatioShaista MalikNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)Sohail AhmedNo ratings yet

- Chapter-Two Result and Findings: 4.1 Presentation and Analysis of DataDocument15 pagesChapter-Two Result and Findings: 4.1 Presentation and Analysis of Dataanujkhanal100No ratings yet

- Welcome To The Presentation: On Stress Testing of National Housing Finance LimitedDocument55 pagesWelcome To The Presentation: On Stress Testing of National Housing Finance LimitedOtoshi AhmedNo ratings yet

- Public Disclosure March 2021Document3 pagesPublic Disclosure March 2021manjusri lalNo ratings yet

- Basel III Pillar III Disclosures December 31 2021Document14 pagesBasel III Pillar III Disclosures December 31 2021Pankaj MaryeNo ratings yet

- Sesssion 5 17-Oct-2020Document44 pagesSesssion 5 17-Oct-2020Uzma UzmaNo ratings yet

- Barclays Bank UK PLC Pillar 3 ReportDocument10 pagesBarclays Bank UK PLC Pillar 3 ReporttaohausNo ratings yet

- Market Discipline Disclosures On Risk Based Capital (Basel II) For The Year-2014Document13 pagesMarket Discipline Disclosures On Risk Based Capital (Basel II) For The Year-2014Tasneef ChowdhuryNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Vaibhav BFDocument9 pagesVaibhav BFVaibhav GuptaNo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- FIM-CAR-NIBL-July-2019-Pillar 2 Added PDFDocument10 pagesFIM-CAR-NIBL-July-2019-Pillar 2 Added PDFPrakriti ShresthaNo ratings yet

- FE (201312) Paper II - Answer PDFDocument12 pagesFE (201312) Paper II - Answer PDFgaryNo ratings yet

- Highlightsof Financial Statements: Millat Tractors LTDDocument17 pagesHighlightsof Financial Statements: Millat Tractors LTDraja farhanNo ratings yet

- FA Assignment - CEAT Tyres and JK TyresDocument2 pagesFA Assignment - CEAT Tyres and JK TyresSaichinNo ratings yet

- RBL Disclosure43841Document13 pagesRBL Disclosure43841Masud Khan ShakilNo ratings yet

- Pillar 3 Disclosures: Key Indicators at Group Consolidated Level - Crédit Agricole Group (KM1)Document9 pagesPillar 3 Disclosures: Key Indicators at Group Consolidated Level - Crédit Agricole Group (KM1)thelilskywalkerNo ratings yet

- 040221-FINAL P3D-DFs DEC 2020 DTD 04FEB2020Document12 pages040221-FINAL P3D-DFs DEC 2020 DTD 04FEB2020Neradabilli EswarNo ratings yet

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- Unit-2, Regulations of Depository InstitutionsDocument6 pagesUnit-2, Regulations of Depository InstitutionsUmesh LagejuNo ratings yet

- FCFE CalculationDocument23 pagesFCFE CalculationIqbal YusufNo ratings yet

- Indusind Q2FY23 RU LKPDocument12 pagesIndusind Q2FY23 RU LKPPramukNo ratings yet

- Disclosure As Per Basel - Nic Asia - Poush 2080Document25 pagesDisclosure As Per Basel - Nic Asia - Poush 2080Biren DahalNo ratings yet

- Vibgyor CV 2020Document4 pagesVibgyor CV 2020nr994724No ratings yet

- Axis Bank - LKP - 29.10.2020 PDFDocument12 pagesAxis Bank - LKP - 29.10.2020 PDFVimal SharmaNo ratings yet

- Risk Management in The Banking SectorDocument47 pagesRisk Management in The Banking SectorGaurEeshNo ratings yet

- BNP Paribas Substantial Equity Hybrid Fund - Regular Plan - RegularDocument1 pageBNP Paribas Substantial Equity Hybrid Fund - Regular Plan - Regularpdk jyotNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- Solved Problem 14.1: The Above Is Obtained Using The Following StepsDocument3 pagesSolved Problem 14.1: The Above Is Obtained Using The Following StepsArjun Jaideep BhatnagarNo ratings yet

- Training The Street DCFDocument2 pagesTraining The Street DCFantoine.deloisonNo ratings yet

- Cms Info Systems Limited: All You Need To Know AboutDocument8 pagesCms Info Systems Limited: All You Need To Know AboutPanktiNo ratings yet

- 2021 Annual ReportDocument64 pages2021 Annual ReportBBNo ratings yet

- Ratio AnalysisDocument66 pagesRatio AnalysisRenny WidyastutiNo ratings yet

- Practice Question Carey, Solvency, Liquidity and Other RegulationDocument17 pagesPractice Question Carey, Solvency, Liquidity and Other RegulationBlack Mamba100% (2)

- CFA560Document20 pagesCFA560goyalabhiNo ratings yet

- 1Q24 Quarterly Financial ReportDocument38 pages1Q24 Quarterly Financial ReportArnau R.S.14No ratings yet

- Financial Sector Performance and System Stability: 8.1 OverviewDocument52 pagesFinancial Sector Performance and System Stability: 8.1 OverviewdevNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- Risk Management Framework For Electronic Gold Receipts (EGR)Document16 pagesRisk Management Framework For Electronic Gold Receipts (EGR)navesib226 ngopycomNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- Basel III Fundamental Review of The Trading BookDocument20 pagesBasel III Fundamental Review of The Trading Book0123456789raNo ratings yet

- Monetary Policy Research Paper Stanley Fischer Nov2021Document25 pagesMonetary Policy Research Paper Stanley Fischer Nov2021sagita fNo ratings yet

- Yellen Responses To Toomey QfrsDocument8 pagesYellen Responses To Toomey QfrsForkLogNo ratings yet

- CSB Bank LTD - IPO Note - Nov'19Document10 pagesCSB Bank LTD - IPO Note - Nov'19puchooNo ratings yet

- Bispap 143Document190 pagesBispap 143qhycvhx8jmNo ratings yet

- Global Money Notes #5: What Excess Reserves?Document18 pagesGlobal Money Notes #5: What Excess Reserves?AA IIINo ratings yet

- How To Develop A Strong Risk CultureDocument23 pagesHow To Develop A Strong Risk Culturegfvt23No ratings yet

- Mergers AcquisitionsDocument16 pagesMergers AcquisitionsTarun DahiyaNo ratings yet

- Corporate LoansDocument19 pagesCorporate Loansmsumit555No ratings yet

- Muiruri, Paul Munene - PHD Business Administration (Finance) - 2015Document161 pagesMuiruri, Paul Munene - PHD Business Administration (Finance) - 2015Sigei LeonardNo ratings yet

- Implementation of Basel II and Basel IIIDocument11 pagesImplementation of Basel II and Basel IIIMd MirazNo ratings yet

- Micro and Macro Prudential RegulationDocument15 pagesMicro and Macro Prudential RegulationYujia JinNo ratings yet

- Bayerische Landesbank: Global Detailed FormatDocument23 pagesBayerische Landesbank: Global Detailed FormatRawaaNo ratings yet

- Mishkin Fmi09 PPT 18Document69 pagesMishkin Fmi09 PPT 18lashia.williams69No ratings yet

- d457 NoteDocument25 pagesd457 NoteAtul KapurNo ratings yet

- Basel III - An Easy To Understand SummaryDocument18 pagesBasel III - An Easy To Understand SummaryDhiwakar Sb100% (2)

- An Essay On Bank Regulation and Basel IIDocument15 pagesAn Essay On Bank Regulation and Basel IIBhanumati BhunjunNo ratings yet

- Don Coxe Basic Points Two Days After Hallowe'en 101310Document51 pagesDon Coxe Basic Points Two Days After Hallowe'en 101310B_U_C_KNo ratings yet

- ABN AMRO Presentation Morgan Stanley Conference March 2016Document27 pagesABN AMRO Presentation Morgan Stanley Conference March 2016steefhNo ratings yet

- Bpi Rise Bonds Preliminary Offering CircularDocument200 pagesBpi Rise Bonds Preliminary Offering CircularRenneth Ena OdeNo ratings yet

- Banking & Financial InstitutionsDocument36 pagesBanking & Financial InstitutionsSumant SharmaNo ratings yet

- Liquidity Risk, Credit Risk, Market Risk and Bank CapitalDocument39 pagesLiquidity Risk, Credit Risk, Market Risk and Bank Capitalmadnansajid8765No ratings yet

- Capital Adequacy NormsDocument21 pagesCapital Adequacy NormsAayush ChimankarNo ratings yet

- Basel 3Document287 pagesBasel 3boniadityaNo ratings yet

- Regulatory ToolboxDocument40 pagesRegulatory ToolboxAtul KapurNo ratings yet

- IFS International BankingDocument39 pagesIFS International BankingVrinda GargNo ratings yet

- Questions With Bullet Point AnswersDocument33 pagesQuestions With Bullet Point AnswersSomnath MukherjeeNo ratings yet

- Capital StructureDocument75 pagesCapital StructureSantosh ChhetriNo ratings yet

- Basel Committee On Banking SupervisionDocument20 pagesBasel Committee On Banking Supervisionsh_chandraNo ratings yet