Professional Documents

Culture Documents

UBL Annual Report 2018-126

UBL Annual Report 2018-126

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-126

UBL Annual Report 2018-126

Uploaded by

IFRS LabCopyright:

Available Formats

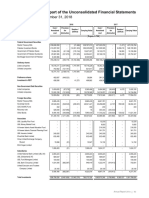

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

42. FAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value of quoted securities other than those classified as held to maturity, is based on quoted market price. Quoted

securities classified as held to maturity are carried at cost. The fair value of unquoted equity securities, other than

investments in associates and subsidiaries, is determined on the basis of the break-up value of these investments as per

their latest available audited financial statements.

The fair value of unquoted debt securities, fixed term loans, other assets, other liabilities, fixed term deposits and

borrowings cannot be calculated with sufficient reliability due to the absence of a current and active market for these assets

and liabilities and reliable data regarding market rates for similar instruments.

In the opinion of the management, the fair value of the remaining financial assets and liabilities are not significantly different

from their carrying values since these are either short-term in nature or, in the case of customer loans and deposits, are

frequently repriced.

42.1 The Bank measures fair values using the following fair value hierarchy that reflects the significance of the inputs used in

making the measurements:

Level 1: Fair value measurements using quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Fair value measurements using inputs other than quoted prices included within Level 1 that are observable for the

assets or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3: Fair value measurements using input for the asset or liability that are not based on observable market data (i.e.

unobservable inputs).

The table below analyses financial instruments measured at the end of the reporting period by the level in the fair value

hierarchy into which the fair value measurement is categorised:

2018

Carrying / Fair value

Notional value Level 1 Level 2 Level 3 Total

On balance sheet financial instruments -------------------------- (Rupees in '000) --------------------------

Financial assets measured at fair value

- Investments

Government Securities (T-bills, PIBs, GoP Sukuks

and Eurobonds) 392,484,077 - 392,484,077 - 392,484,077

Foreign Bonds - Sovereign 34,242,507 - 34,242,507 - 34,242,507

Foreign Bonds - others 6,839,803 - 6,839,803 - 6,839,803

Ordinary shares of listed companies 16,718,226 16,718,226 - - 16,718,226

Debt securities (TFCs , Sukuks) 948,128 - 948,128 - 948,128

Investment in REIT 499,863 499,863 - - 499,863

451,732,604 17,218,089 434,514,515 - 451,732,604

Financial assets not measured at fair value

- Investments (HTM, unlisted ordinary shares,

preference shares, subsidiaries and associates) 334,642,722 - - - -

786,375,326 17,218,089 434,514,515 - 451,732,604

Off-balance sheet financial instruments

Forward purchase and sale of foreign exchange contracts 583,708,769 - 1,628,749 - 1,628,749

Interest rate swaps 1,674,764 - (22,082) - (22,082)

FX options - purchased and sold 1,159,752 - - - -

Forward purchase of government securities 13,619,209 - (53,425) - (53,425)

Forward sale of government securities 2,326,880 - (672) - (672)

124 United Bank Limited

You might also like

- 4.5 Assignment Financing S S Air S Expansion Plans With A Bond IssueDocument5 pages4.5 Assignment Financing S S Air S Expansion Plans With A Bond IssueKevin TedryNo ratings yet

- Tugas ObligasiDocument15 pagesTugas Obligasiwahdah ulin nafisahNo ratings yet

- (Lehman Brothers) Quantitative Credit Research Quarterly - Quarter 3 2001Document44 pages(Lehman Brothers) Quantitative Credit Research Quarterly - Quarter 3 2001anuragNo ratings yet

- UBL Annual Report 2018-127Document1 pageUBL Annual Report 2018-127IFRS LabNo ratings yet

- UBL Annual Report 2018-138Document1 pageUBL Annual Report 2018-138IFRS LabNo ratings yet

- Den FY2021 Financial Report-11Document6 pagesDen FY2021 Financial Report-11PAVANKUMAR S BNo ratings yet

- CommerzMarketsLLC-Statement of Financial Condition JUN 2022Document15 pagesCommerzMarketsLLC-Statement of Financial Condition JUN 2022Катерина ЕгороваNo ratings yet

- Ulster County Financial Report For 2018Document143 pagesUlster County Financial Report For 2018Daily FreemanNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2020Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2020Syed FadiNo ratings yet

- Quarterly Report 20120331Document25 pagesQuarterly Report 20120331TshegofatsoTaunyaneNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2019Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2019Syed FadiNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- 2023-Q3 Md&a (LRC)Document26 pages2023-Q3 Md&a (LRC)Jasdeep ToorNo ratings yet

- Bảng cân đối kế toán Anh - Hoa 2Document3 pagesBảng cân đối kế toán Anh - Hoa 2Tran MyNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Gonzaga FamNo ratings yet

- Ambc 7sec-Amda-1tkrmb-1193125-13-334909 PDFDocument135 pagesAmbc 7sec-Amda-1tkrmb-1193125-13-334909 PDFpeterlee100No ratings yet

- CG 20230504-085925Document9 pagesCG 20230504-085925Meet MahidaNo ratings yet

- Press Release - Oct2020 AUM FINALDocument2 pagesPress Release - Oct2020 AUM FINALKevin ParkerNo ratings yet

- Notes To The Financial Statements7Document3 pagesNotes To The Financial Statements7LokiNo ratings yet

- 2017 q1 Pro Forma FinancialDocument9 pages2017 q1 Pro Forma FinancialMahoy SamNo ratings yet

- Statement of Impact of IAS 39 On Consolidated Financial Statements of SBPDocument5 pagesStatement of Impact of IAS 39 On Consolidated Financial Statements of SBPGillani BuildersNo ratings yet

- RSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022Document69 pagesRSM IFRS Listed Exploration and Mining Limited - Annual Report - 31122022AlfiNo ratings yet

- Module - 3 - Capital GainDocument50 pagesModule - 3 - Capital GaindevayudthdeyytNo ratings yet

- Unconsolidated Financial Statements2022 - Q4Document79 pagesUnconsolidated Financial Statements2022 - Q4i-ka-hayashiNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Week 1 IntroductionDocument28 pagesWeek 1 IntroductionAbhijit ChokshiNo ratings yet

- Unit 4 - Income From Capital GainsDocument10 pagesUnit 4 - Income From Capital GainsAvin P RNo ratings yet

- 01 ELMS Activity 1Document2 pages01 ELMS Activity 1Emperor SavageNo ratings yet

- University of Central Punjab: Project Appraisal & Credit ManagementDocument6 pagesUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtNo ratings yet

- BREIT Prospectus With Previous SupplementsDocument683 pagesBREIT Prospectus With Previous SupplementsKura ChihotaNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report August 31 2022Document12 pagesPPFCF PPFAS Monthly Portfolio Report August 31 2022yaarthNo ratings yet

- Notes To FSaDocument7 pagesNotes To FSaDonnie Ray DistajoNo ratings yet

- Financialstatement UnauditedDocument12 pagesFinancialstatement UnauditedbrianNo ratings yet

- Audited Financial Statements 201912 PublicationDocument1 pageAudited Financial Statements 201912 PublicationfogempabafaustinaNo ratings yet

- Administration and Other Fiduciary Fees Revenue Is PrimarilyDocument20 pagesAdministration and Other Fiduciary Fees Revenue Is PrimarilyORION OMAR MENDOZA SALHUANo ratings yet

- Vitrox q22018Document14 pagesVitrox q22018Dennis AngNo ratings yet

- Airtel BalancesheetDocument17 pagesAirtel BalancesheetISHA AGGARWALNo ratings yet

- 1Q 2014 Op Supp Final 7-21-14Document19 pages1Q 2014 Op Supp Final 7-21-14bomby0No ratings yet

- Final Cia SubmissionDocument44 pagesFinal Cia SubmissionGarvit GuptaNo ratings yet

- Reconciliation q4 Fy23Document5 pagesReconciliation q4 Fy23Shady FathyNo ratings yet

- Ca - FS23 697 707Document11 pagesCa - FS23 697 707thelilskywalkerNo ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document8 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- UBL Annual Report 2018-115Document1 pageUBL Annual Report 2018-115IFRS LabNo ratings yet

- Basel IIDocument3 pagesBasel IIaNo ratings yet

- CY 2020 Pre Post Trial BalanceDocument5 pagesCY 2020 Pre Post Trial Balancesunthatburns00No ratings yet

- GTS Post Trade AnalysisDocument7 pagesGTS Post Trade AnalysisKen RudominerNo ratings yet

- The BSE Limited The National Stock Exchange of India LTDDocument3 pagesThe BSE Limited The National Stock Exchange of India LTDVivek AnandNo ratings yet

- Capital-and-Liquidity-disclosures - 2018Document26 pagesCapital-and-Liquidity-disclosures - 2018zaid saadNo ratings yet

- Guaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024Document89 pagesGuaranty Trust Holding Company PLC - Quarter 1 - Financial Statement For 2024 Financial Statements May 2024frederick aivborayeNo ratings yet

- Financial Structure and Financial Costs: Note 15Document16 pagesFinancial Structure and Financial Costs: Note 15Ons MnejjaNo ratings yet

- Financial Year Ended270820211623Document6 pagesFinancial Year Ended270820211623SOMNATH DHEMARENo ratings yet

- PCC Se Financial Statements 2014 Ifrs PDFDocument5 pagesPCC Se Financial Statements 2014 Ifrs PDFAbabo damasaNo ratings yet

- Capital Adequacy and Liquidity Disclosures Unconsolidated2021Document14 pagesCapital Adequacy and Liquidity Disclosures Unconsolidated2021Syed FadiNo ratings yet

- Co Op Bank Group Full 2022 FinancialsDocument1 pageCo Op Bank Group Full 2022 Financialscarolm790No ratings yet

- StatementDocument12 pagesStatementsupertraderNo ratings yet

- Annual-Report-13-14 AOP PDFDocument38 pagesAnnual-Report-13-14 AOP PDFkhurram_66No ratings yet

- Corporate Finance LectureDocument124 pagesCorporate Finance LectureMuhammad Kashif ZafarNo ratings yet

- Icici Prudential Pension Funds Management Company LimitedDocument44 pagesIcici Prudential Pension Funds Management Company LimitedSpl FriendsNo ratings yet

- Financial Reporting Case: What Is It Worth?: Property of STIDocument2 pagesFinancial Reporting Case: What Is It Worth?: Property of STIJoannie Cercado RabiaNo ratings yet

- Audited Financial Statements June 2018 PDFDocument68 pagesAudited Financial Statements June 2018 PDFmirza ahmedNo ratings yet

- Afya 2021Document80 pagesAfya 2021Ayushika SinghNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-89Document1 pageUBL Annual Report 2018-89IFRS LabNo ratings yet

- Greater Consumption of Alcohol Leads To More Motor Vehicle Accidents And, Thus, Imposes Costs On People Who Do Not Drink and DriveDocument7 pagesGreater Consumption of Alcohol Leads To More Motor Vehicle Accidents And, Thus, Imposes Costs On People Who Do Not Drink and DriveHồ PhụngNo ratings yet

- Accelya Kale SolutionsDocument14 pagesAccelya Kale SolutionsKalpeshNo ratings yet

- Agoncillo Vs Javier 38 Phil. 424Document2 pagesAgoncillo Vs Javier 38 Phil. 424John Lyndon RayosNo ratings yet

- Maruti Suzuki FS AnalysisDocument14 pagesMaruti Suzuki FS AnalysisChirag AggarwalNo ratings yet

- SecuritisationDocument43 pagesSecuritisationRonak KotichaNo ratings yet

- Literature Review of Ratio Analysis PDFDocument5 pagesLiterature Review of Ratio Analysis PDFea86yezd100% (1)

- FINAL SLIDE - Financial Distress Among UNIMAS StudentsDocument48 pagesFINAL SLIDE - Financial Distress Among UNIMAS StudentsChristinus NgNo ratings yet

- DebentureDocument5 pagesDebentureShweta RawatNo ratings yet

- fcs340 Document HousingmarketassignmentDocument9 pagesfcs340 Document Housingmarketassignmentapi-468161460No ratings yet

- SUDAN Investment Prospectus 2021Document59 pagesSUDAN Investment Prospectus 2021Mustafa SaeedNo ratings yet

- David Einhorn Speech To Value InvestorsDocument10 pagesDavid Einhorn Speech To Value InvestorsJohn CarneyNo ratings yet

- Chapter 4 Revenues and Other ReceiptsDocument10 pagesChapter 4 Revenues and Other ReceiptsKyree VladeNo ratings yet

- Promissory NoteDocument2 pagesPromissory NoteYngwie EnriquezNo ratings yet

- DepedDocument25 pagesDepedCharles Allen TanglaoNo ratings yet

- 2022 Assignment Brief 2 Assignment QuestionsDocument5 pages2022 Assignment Brief 2 Assignment Questionscanva zysyaNo ratings yet

- SILIVERU SHIVAKUMAR A Study On Rural Banking - SBIDocument19 pagesSILIVERU SHIVAKUMAR A Study On Rural Banking - SBIkizieNo ratings yet

- Analysis of Financial Statements PDFDocument14 pagesAnalysis of Financial Statements PDFMuhammad Akmal HossainNo ratings yet

- Circular No 14Document4 pagesCircular No 14Muhammad Ali JinnahNo ratings yet

- Credit Transactions ReviewerDocument18 pagesCredit Transactions ReviewerMonique AcostaNo ratings yet

- 62) de Barreto v. Villanueva WDocument2 pages62) de Barreto v. Villanueva WRain HofileñaNo ratings yet

- FIN 600 - Financial Analysis InfoDocument37 pagesFIN 600 - Financial Analysis InfoVipulNo ratings yet

- Business Mathematics Week 2Document37 pagesBusiness Mathematics Week 2Jewel Joy PudaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- Treasury Presentation To TBACQ12021Document47 pagesTreasury Presentation To TBACQ120215ty5No ratings yet

- Module 2 - Time Value of MoneyDocument61 pagesModule 2 - Time Value of MoneyNarayanan Subramanian100% (1)

- MITCDocument4 pagesMITCDesi Adda Official 2.0No ratings yet

- Guerrero Irene Notary October 2010 Sig Ver4Document2 pagesGuerrero Irene Notary October 2010 Sig Ver4Edward MaeweatherNo ratings yet