Professional Documents

Culture Documents

UBL Annual Report 2018-139

UBL Annual Report 2018-139

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-139

UBL Annual Report 2018-139

Uploaded by

IFRS LabCopyright:

Available Formats

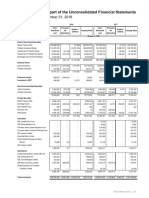

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

2018 2017

Foreign Foreign Net foreign Foreign Foreign

Off-balance Off-balance sheet Net foreign

Currency Currency currency Currency Currency

sheet items items currency exposure

Assets Liabilities exposure Assets Liabilities

--------------------------------------------------------------------------------------------- (Rupees in '000) ---------------------------------------------------------------------------------------------

Pakistan Rupee 1,528,881,285 1,332,249,233 (45,447,911) 151,184,141 1,663,524,378 1,474,785,303 (30,679,274) 158,059,801

US Dollar 188,482,131 105,377,856 (83,674,639) (570,364) 213,845,211 114,777,825 (98,381,371) 686,015

Pound Sterling 908,675 25,083,810 24,503,084 327,949 1,705,174 19,910,188 18,563,742 358,728

Japanese Yen 26,277 8,804 (12,606) 4,867 1,196,948 1,182,636 (11,770) 2,542

Euro 1,172,096 7,178,589 6,049,138 42,645 2,767,898 9,587,369 6,959,689 140,218

UAE Dirham 128,464,510 211,071,317 80,270,598 (2,336,209) 102,898,239 193,641,497 89,151,353 (1,591,905)

Bahraini Dinar 13,581,751 25,327,298 12,252,900 507,353 13,708,941 22,243,314 9,037,609 503,236

Qatari Riyal 24,428,228 28,332,023 4,809,866 906,071 26,105,618 29,677,810 4,230,555 658,363

Other Currencies 3,654,193 3,700,268 1,249,570 1,203,495 7,181,527 7,820,945 1,129,467 490,049

1,889,599,146 1,738,329,198 - 151,269,948 2,032,933,934 1,873,626,887 - 159,307,047

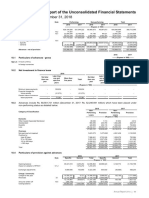

2018 2017

Banking Trading Banking Trading

book book book book

--------------------------------- (Rupees in '000) ---------------------------------

Impact of 1% change in foreign exchange rates on

- Profit and loss account

+1% change - - - -

-1% change - - - -

- Other comprehensive income

+1% change (15,664) - (7,572) -

-1% change 15,664 - 7,572 -

47.2.3 Equity Position Risk

Equity position risk is the risk that the fair value of a financial instrument will fluctuate due to changes in the prices of

individual stocks or the levels of equity indices. The Bank’s equity book comprises of held for trading (HFT) and available

for sale (AFS) portfolios. The objective of the HFT portfolio is to make short-term capital gains, whilst the AFS portfolio is

maintained with a medium term view of earning both capital gains and dividend income. Product program manuals have

been developed to provide guidelines on the objectives and policies, risks and mitigants, limits and controls for the equity

portfolios of the Bank.

2018 2017

Banking Trading Banking Trading

book book book book

--------------------------------- (Rupees in '000) ---------------------------------

Impact of 5% change in equity prices on,

Other comprehensive income

+5% change 860,010 - 938,862 -

-5% change (860,010) - (938,862) -

47.2.4 Yield / Interest Rate Risk in the Banking Book (IRRBB) - Basel II Specific

Interest rate risk is the risk that fair value of a financial instrument will fluctuate as a result of changes in interest rates,

including changes in the shape of yield curves. Interest rate risk is inherent in many of the Bank's businesses and arises

from mismatches between the contractual maturities or the re-pricing of on and off-balance sheet assets and liabilities. The

interest rate sensitivity profile is prepared on a quarterly basis based on the re-pricing or contractual maturities of assets

and liabilities.

Interest rate risk is monitored and managed by performing periodic gap analysis, sensitivity analysis and stress testing and

taking appropriate actions where required.

2018 2017

Banking Trading Banking Trading

book book book book

--------------------------------- (Rupees in '000) ---------------------------------

Impact of 1% change in interest rates on

- Profit and loss account

+1% change - 3,724,417 - 2,783,786

-1% change - (3,724,417) - (2,783,786)

- Other comprehensive income

+1% change 498,049 - - -

-1% change (498,049) - - -

Annual Report 2018 137

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- HomeworkDocument8 pagesHomeworkEnrique Feliciano Cornejo50% (2)

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- Bank of Baroda Financials 2021Document1 pageBank of Baroda Financials 2021Timothy KawumaNo ratings yet

- Section 1 Bharti Airtel - Performance at A Glance: ParticularsDocument1 pageSection 1 Bharti Airtel - Performance at A Glance: Particularsrajesh bathulaNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- Link From Other Wsheet: InputDocument31 pagesLink From Other Wsheet: Inputferry fadlyNo ratings yet

- OCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Document33 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Nathan MartinNo ratings yet

- OCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Document33 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009qtipxNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Goodwill Finance FM FinalDocument231 pagesGoodwill Finance FM Finalmeenal_smNo ratings yet

- UBL Annual Report 2018-115Document1 pageUBL Annual Report 2018-115IFRS LabNo ratings yet

- UBL Annual Report 2018-155Document1 pageUBL Annual Report 2018-155IFRS LabNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Book1 RevisedDocument2 pagesBook1 RevisedBelieve Sithole Ndangana MunasheNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocument4 pagesIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDocument12 pagesP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanNo ratings yet

- Saudi Aramco 9m 2019 Summary Financials PDFDocument4 pagesSaudi Aramco 9m 2019 Summary Financials PDFakshay_kapNo ratings yet

- LK Irs & Gua Jo Bulan Januari - Desember 2020Document77 pagesLK Irs & Gua Jo Bulan Januari - Desember 2020DesyanaNo ratings yet

- Revised Alfalah Solar Financing - Mr. JahanzaibDocument3 pagesRevised Alfalah Solar Financing - Mr. JahanzaibChaudhary Muhammad Suban TasirNo ratings yet

- UBL Annual Report 2018-94Document1 pageUBL Annual Report 2018-94IFRS LabNo ratings yet

- Interim Financial Statements For Quarter Ended 30th Chaitra 2080 98558b97dcDocument20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2080 98558b97dcghanshyamdhami302No ratings yet

- Financial Analysis Assessment TemplateDocument4 pagesFinancial Analysis Assessment Templateshades13579No ratings yet

- Government of Pakistan Pakistan Bureau of Statistics Karachi SUMMARY (Revised) July, 2020Document1 pageGovernment of Pakistan Pakistan Bureau of Statistics Karachi SUMMARY (Revised) July, 2020Mohsin RazaNo ratings yet

- Area 12 Appraisal CalculationsDocument6 pagesArea 12 Appraisal Calculationslusayo06No ratings yet

- UBL Annual Report 2018-144Document1 pageUBL Annual Report 2018-144IFRS LabNo ratings yet

- Bank of China Limited SEHK 3988 FinancialsDocument47 pagesBank of China Limited SEHK 3988 FinancialsJaime Vara De ReyNo ratings yet

- UBL Annual Report 2018-101Document1 pageUBL Annual Report 2018-101IFRS LabNo ratings yet

- Talwalkars Better Value Fitness Limited BSE 533200 FinancialsDocument36 pagesTalwalkars Better Value Fitness Limited BSE 533200 FinancialsraushanatscribdNo ratings yet

- Tesla Inc NasdaqGS TSLA FinancialsDocument36 pagesTesla Inc NasdaqGS TSLA FinancialsSuyash KelaNo ratings yet

- Earnings Quality Score % 84 72: PT Kalbe Farma TBKDocument5 pagesEarnings Quality Score % 84 72: PT Kalbe Farma TBKHari HikmawanNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaNo ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- Q4 - Interim Financial StatementsDocument20 pagesQ4 - Interim Financial Statementsshresthanikhil078No ratings yet

- FibDocument39 pagesFibHana MokhlessNo ratings yet

- Cashflow Projection ChacabriDocument1 pageCashflow Projection ChacabriBrian Okuku OwinohNo ratings yet

- 5b. Kunci LaporanDocument4 pages5b. Kunci LaporanDiyah Noviana RNo ratings yet

- Cloud Kitchen - ViseshamDocument34 pagesCloud Kitchen - ViseshamadiarunaaNo ratings yet

- Optimaxon Financial Plan - Cash Flow ForecastDocument2 pagesOptimaxon Financial Plan - Cash Flow ForecastAudience Connect ServicesNo ratings yet

- Flujo de Caja AaplDocument9 pagesFlujo de Caja AaplPablo Alejandro JaldinNo ratings yet

- Sample CogsDocument5 pagesSample Cogsroxan sugueNo ratings yet

- SPW - Cash - Flow - CopyDocument21 pagesSPW - Cash - Flow - CopyKulkarni AbhiramNo ratings yet

- Seedly Financials 2017 To 2020Document4 pagesSeedly Financials 2017 To 2020AzliGhaniNo ratings yet

- UBL Annual Report 2018-129Document1 pageUBL Annual Report 2018-129IFRS LabNo ratings yet

- Industrial and Commercial Bank of China Limited SEHK 1398 FinancialsDocument49 pagesIndustrial and Commercial Bank of China Limited SEHK 1398 FinancialsJaime Vara De ReyNo ratings yet

- EBL Q1 FS2023 UnauditedDocument2 pagesEBL Q1 FS2023 UnauditedAnwar Hossain ReponNo ratings yet

- 50 50 Financial Projections Using Trend AnalysisDocument8 pages50 50 Financial Projections Using Trend AnalysisDhiraj RawatNo ratings yet

- 2021.2 Financial Results Presentation MaterialsDocument31 pages2021.2 Financial Results Presentation Materialslofevi5003No ratings yet

- HB 2023 Q4 Financial ReportDocument17 pagesHB 2023 Q4 Financial ReportNg Yew MengNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- 20240709072407_668c751710959Document49 pages20240709072407_668c751710959Lenra MusongNo ratings yet

- Balkrishna Industries LTD: Investor Presentation February 2020Document30 pagesBalkrishna Industries LTD: Investor Presentation February 2020PIBM MBA-FINANCENo ratings yet

- Tarea Razones RentabilidadDocument12 pagesTarea Razones RentabilidadEmilio BazaNo ratings yet

- NAFT Financial ProjectionsDocument66 pagesNAFT Financial ProjectionsanonNo ratings yet

- Capital Budget MOPU Discounted After TaxDocument3 pagesCapital Budget MOPU Discounted After TaxBudi PrasetyoNo ratings yet

- For Fiscal Year Ending On 31 December 2017Document4 pagesFor Fiscal Year Ending On 31 December 2017Quỳnh NhưNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- Financial Section 2017: For The Year Ended March 31, 2017Document104 pagesFinancial Section 2017: For The Year Ended March 31, 2017Car Și PolicarNo ratings yet

- Speed Changers, Drives & Gears World Summary: Market Values & Financials by CountryFrom EverandSpeed Changers, Drives & Gears World Summary: Market Values & Financials by CountryNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Railway Demand Forecasting and Service Planning ProcessesDocument29 pagesRailway Demand Forecasting and Service Planning Processesharshad_patki4351No ratings yet

- Investor Presentation - Q1 FY17 (Company Update)Document67 pagesInvestor Presentation - Q1 FY17 (Company Update)Shyam SunderNo ratings yet

- Chapter 1 An Overview of The Changing Financial-Services SectorDocument11 pagesChapter 1 An Overview of The Changing Financial-Services SectorMiza MuhammadNo ratings yet

- Lecture Notes Cash & Cash Equivalent: Page 1 of 7Document7 pagesLecture Notes Cash & Cash Equivalent: Page 1 of 7Dalia DelrosarioNo ratings yet

- 11 - NikeDocument41 pages11 - NikePranali SanasNo ratings yet

- Security Analysis and Portfolio ManagementDocument8 pagesSecurity Analysis and Portfolio Managementnaved katuaNo ratings yet

- MM Dir 2016Document76 pagesMM Dir 2016Mila FaradilahNo ratings yet

- KctochiDocument5 pagesKctochitradingpithistoryNo ratings yet

- Investment Week - Matrix Article - 21 March 2011Document2 pagesInvestment Week - Matrix Article - 21 March 2011Eden Rock Capital ManagementNo ratings yet

- Valuation Considerations For Distressed Securities: BY: Rick Martin & Elpida TzilianosDocument38 pagesValuation Considerations For Distressed Securities: BY: Rick Martin & Elpida TzilianosThorHollisNo ratings yet

- SantuBabaTricks AppDocument41 pagesSantuBabaTricks AppSriheri DeshpandeNo ratings yet

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- Feasibility StudyDocument87 pagesFeasibility StudyTri Nguyen100% (1)

- Instructions 1. Indicate The Effect of Each Transaction and The Balances After Each Transaction, Using The FollowingDocument3 pagesInstructions 1. Indicate The Effect of Each Transaction and The Balances After Each Transaction, Using The FollowingAdinda NurningtyasNo ratings yet

- Company Overview: Incorporated On 23 January, 2004, HDFC Sales Is 100% Subsidiary of HDFC LTDDocument12 pagesCompany Overview: Incorporated On 23 January, 2004, HDFC Sales Is 100% Subsidiary of HDFC LTDsubhen13No ratings yet

- Capital Structure TheoriesDocument2 pagesCapital Structure TheoriesTHEOPHILUS ATO FLETCHERNo ratings yet

- Report 2Document28 pagesReport 2Jordan McKinleyNo ratings yet

- Chapter 17 - Earnings Per Share and Retained Earnings PDFDocument59 pagesChapter 17 - Earnings Per Share and Retained Earnings PDFDaniela MacaveiuNo ratings yet

- A Comparative Study of Risk and Return of PNB and HDFC Bank PDFDocument14 pagesA Comparative Study of Risk and Return of PNB and HDFC Bank PDFManoj MondalNo ratings yet

- Business Finance: Golden West CollegesDocument11 pagesBusiness Finance: Golden West CollegesAple BalisiNo ratings yet

- Graham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The FieldDocument53 pagesGraham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The Fielder4sall100% (1)

- Option Pricing Using Binomial TreesDocument19 pagesOption Pricing Using Binomial TreesDhaka SylhetNo ratings yet

- DocumentDocument24 pagesDocumentMa. Flora Mae B LeponNo ratings yet

- Ae 18 Financial MarketsDocument4 pagesAe 18 Financial Marketsnglc srzNo ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- F650 CaseDocument44 pagesF650 CaseRohan SinghNo ratings yet

- M What Is A Stock SymbolDocument4 pagesM What Is A Stock SymbolDanica BalinasNo ratings yet

- Unit 5 Capital Budgeting (SPPU Uni Sub Prof Notes)Document29 pagesUnit 5 Capital Budgeting (SPPU Uni Sub Prof Notes)ShrunaliNo ratings yet